by Mark Schniepp

November 3, 2017

Key Elements of the New Tax Reform Plan

So as of November 3, here are the key components of the House Ways and Means Committee’s tax reform proposal, before any further revisionist intervention from the full House or Senate:

The maximum corporate tax rate would be cut from 35 to 20 percent. Many business expenses would no longer be deductible, except expenses on R&D, low income housing, and some other miscellaneous expenses. Depreciable asset expenses can be deducted entirely.

The maximum corporate tax rate would be cut from 35 to 20 percent. Many business expenses would no longer be deductible, except expenses on R&D, low income housing, and some other miscellaneous expenses. Depreciable asset expenses can be deducted entirely.

There are 3 proposed tax brackets for individuals: 12, 25 and 35 percent instead of the seven that now exist.

The AMT (alternative minimum tax) would be eliminated. The standard deduction for middle class families would be doubled.

The estate tax would be gradually reduced and entirely repealed in 6 years.

The inherited wealth exemption would double from $5.5 million to $11 million.

Tax credits for children will increase from $1,000 to $1,600.

Itemized deductions would be eliminated, except for charitable expenses and the mortgage interest deduction which would be capped for newly purchased homes up to $500K.

Also property tax deductions would be retained but only up to a maximum of $10,000.

State and local taxes would no longer be deductible.

There would be no changes to pre-tax 401(k) contributions.

There is a new 25 percent tax rate for sole proprietorships, partnerships, and S corporations that currently pay taxes at the individual rate of their owners. These type of businesses represent about 95 percent of all businesses in the U.S. and produce most of the corporate tax revenue for the U.S. government.

How Will this Impact You?

If you own a home in coastal California and you’ve purchased it in the last 4 years or so, your property taxes are likely in excess of $10,000 annually. So you will not receive the full benefit of the property tax deduction. However, the standard deduction roughly doubles from $6,350 to $12,000 for individuals and $12,700 to $24,000 for married couples.

If you are a business owner, you are very likely to see a smaller tax obligation. And if a large part of your business expenditure is for research and development of the business, or equipment, software or the purchase of a building, then your tax liability will go even lower because those expenditures will be deductible on top of the low 20 percent maximum rate.

Do We Need Tax Reform?

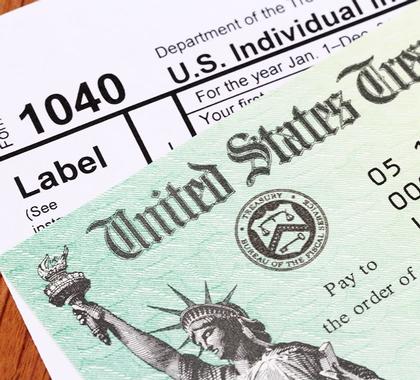

The hieroglyphical tax code that we all have to navigate through each year to determine both our personal and our business’ tax obligation is constantly changing and seemingly growing more complex. For anyone that has filed a tax return beyond the standard 1040 form, their answer is a very likely yes. We desperately need tax code simplification.

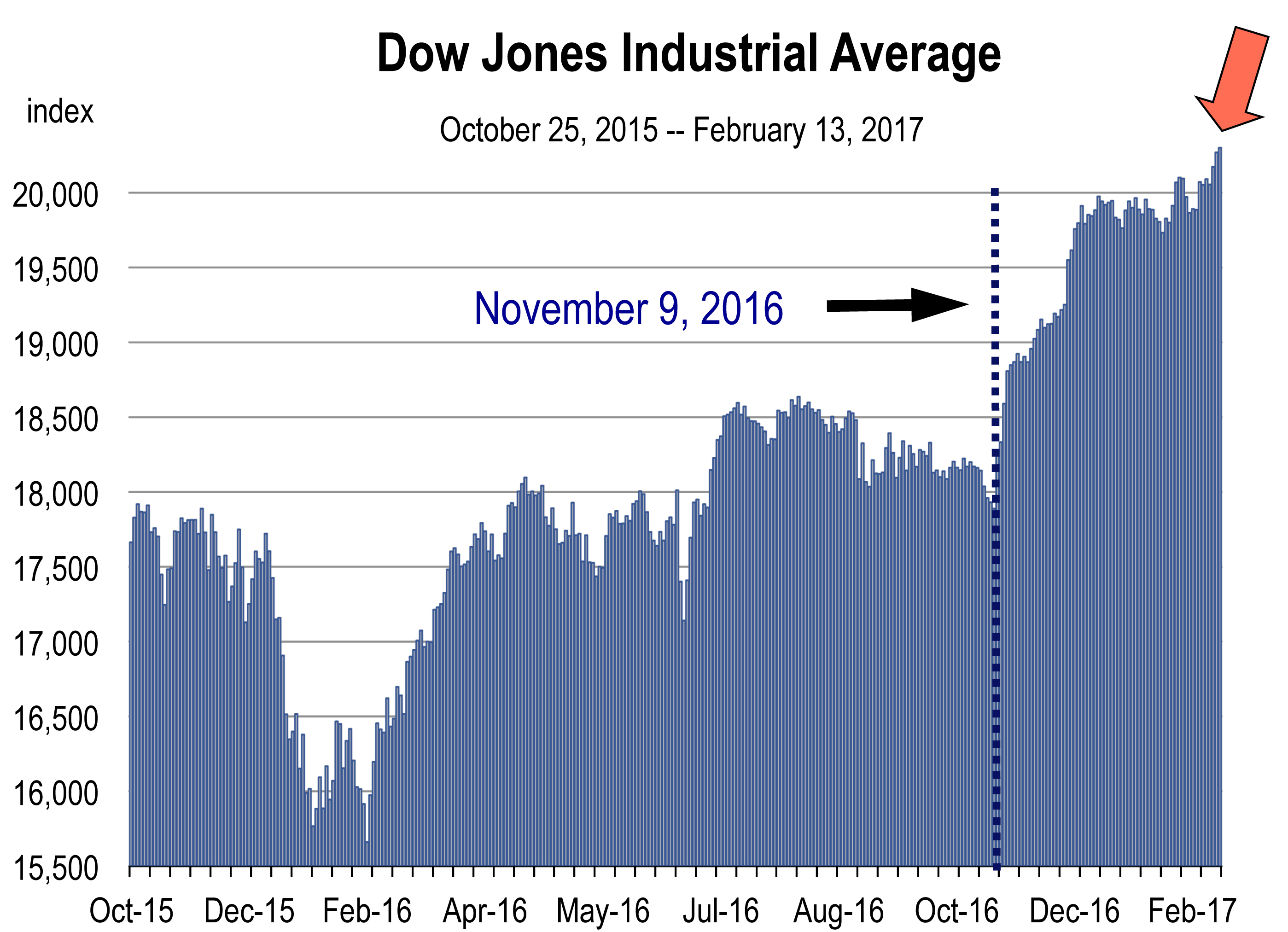

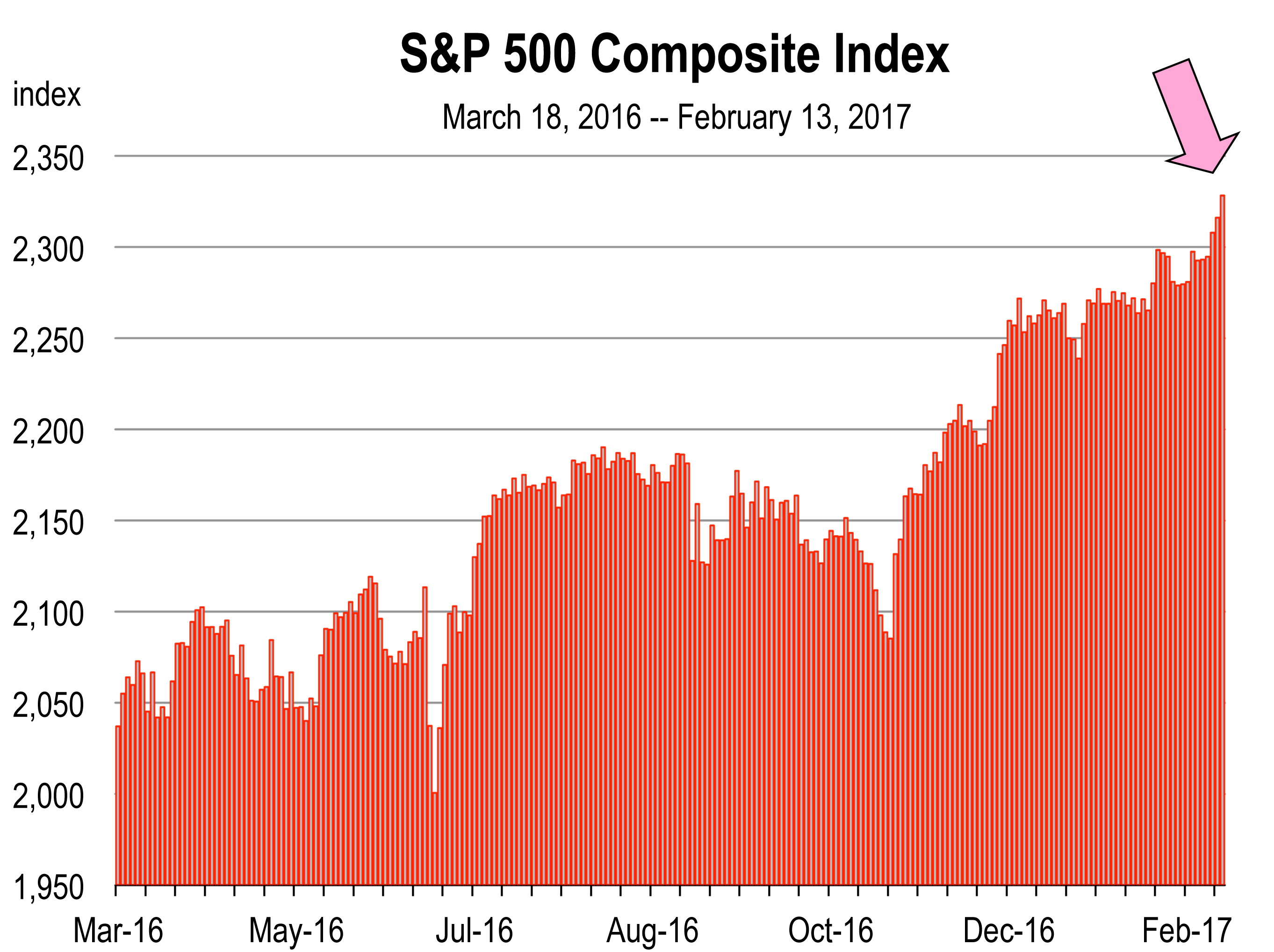

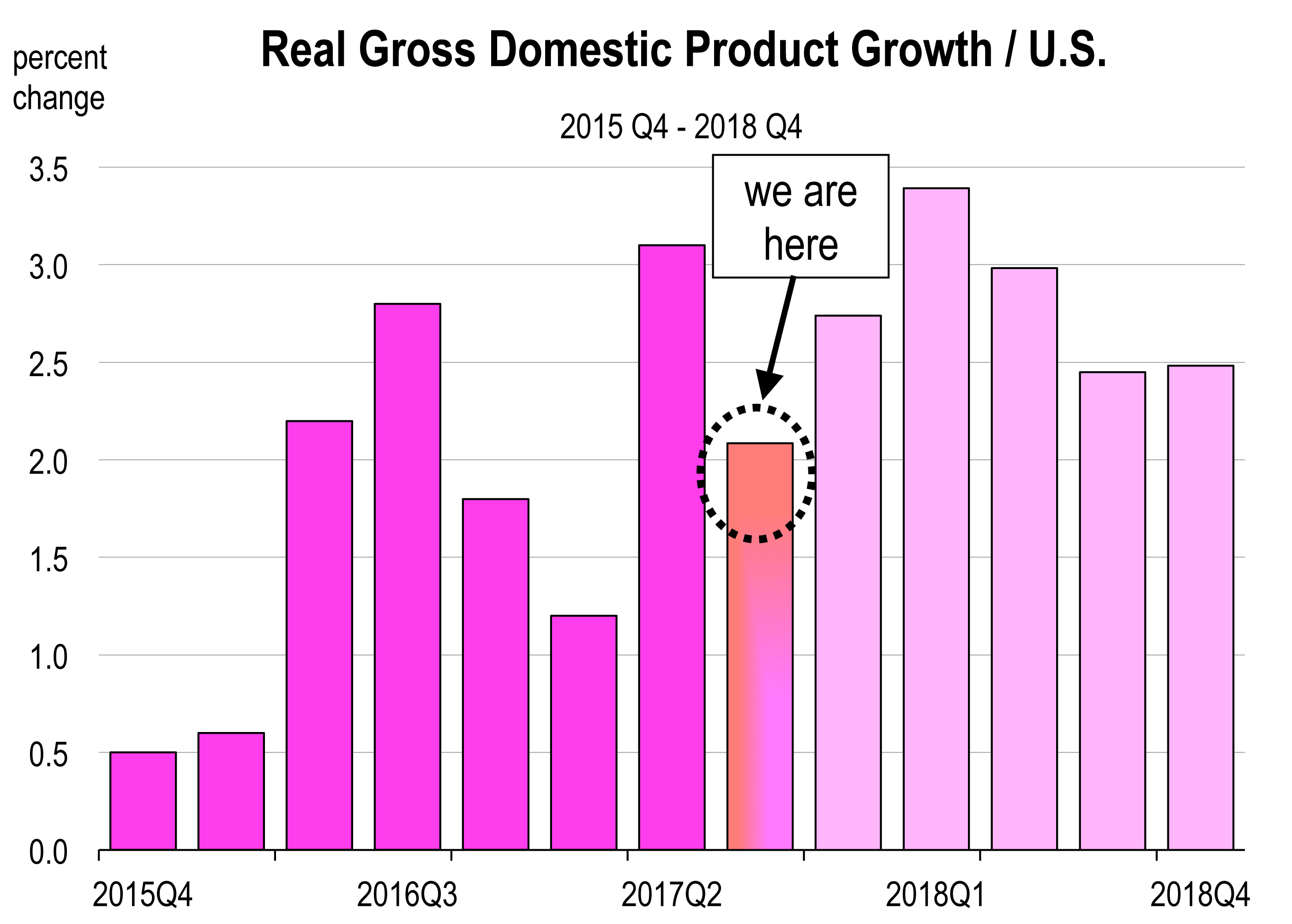

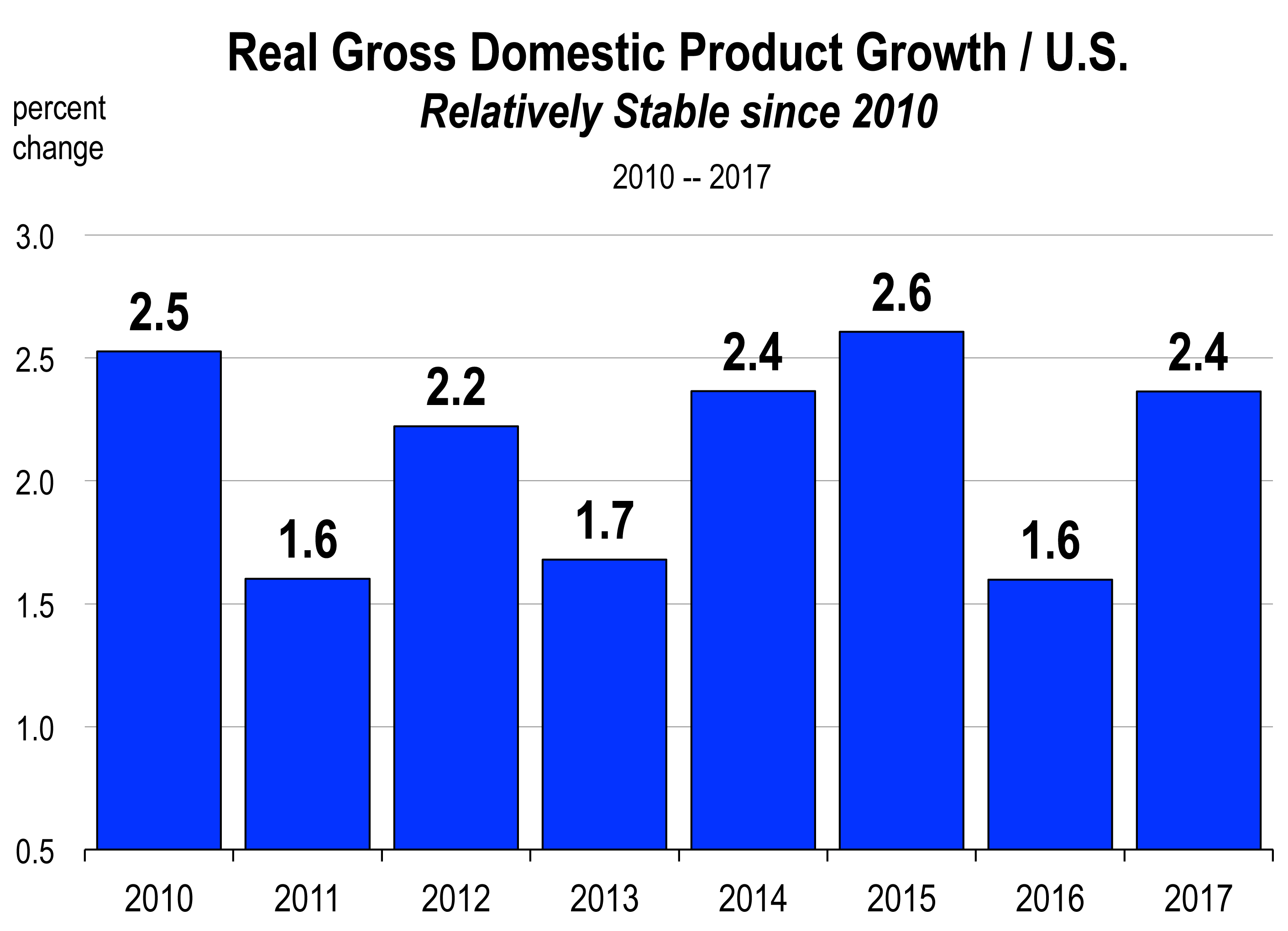

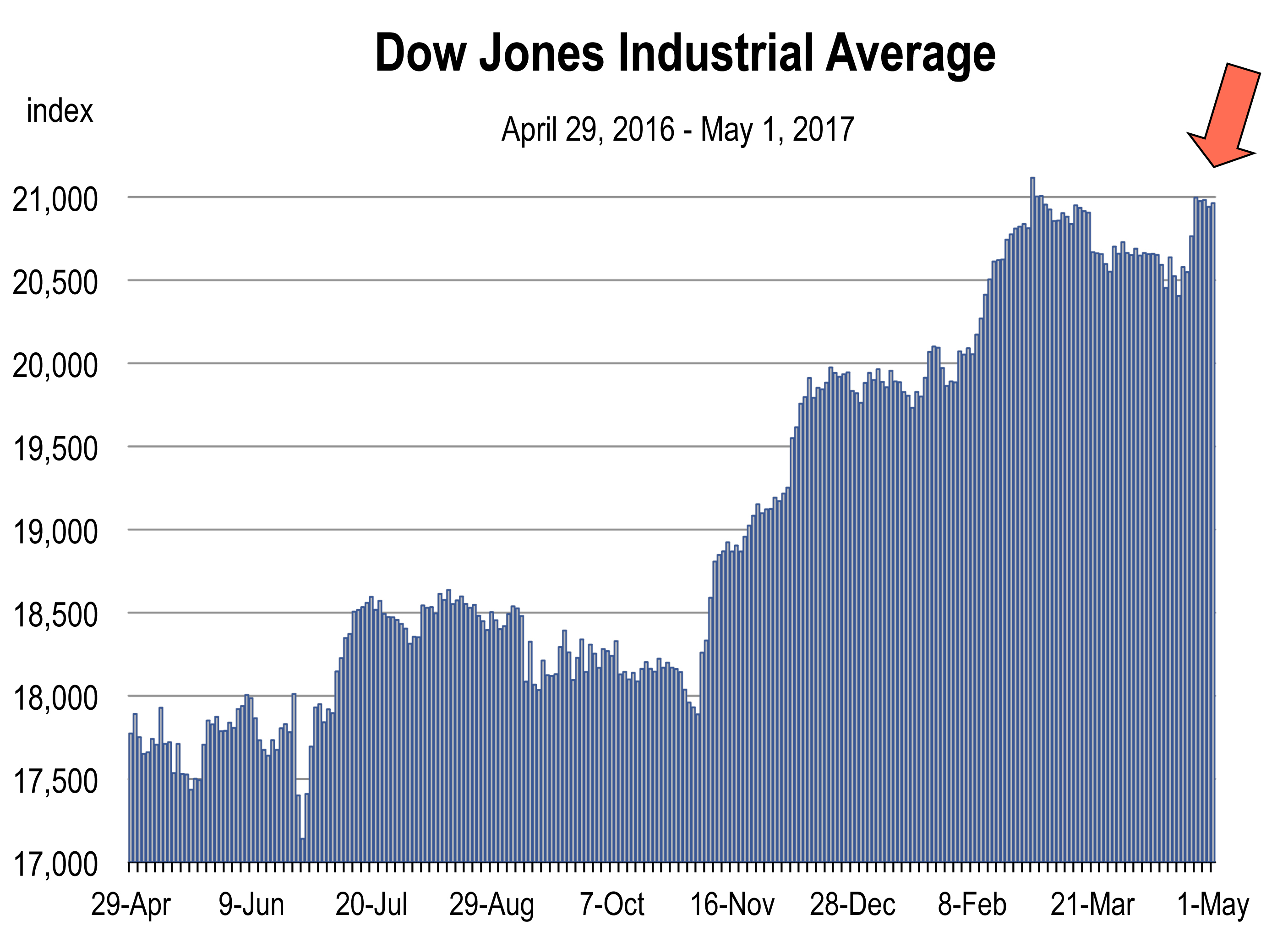

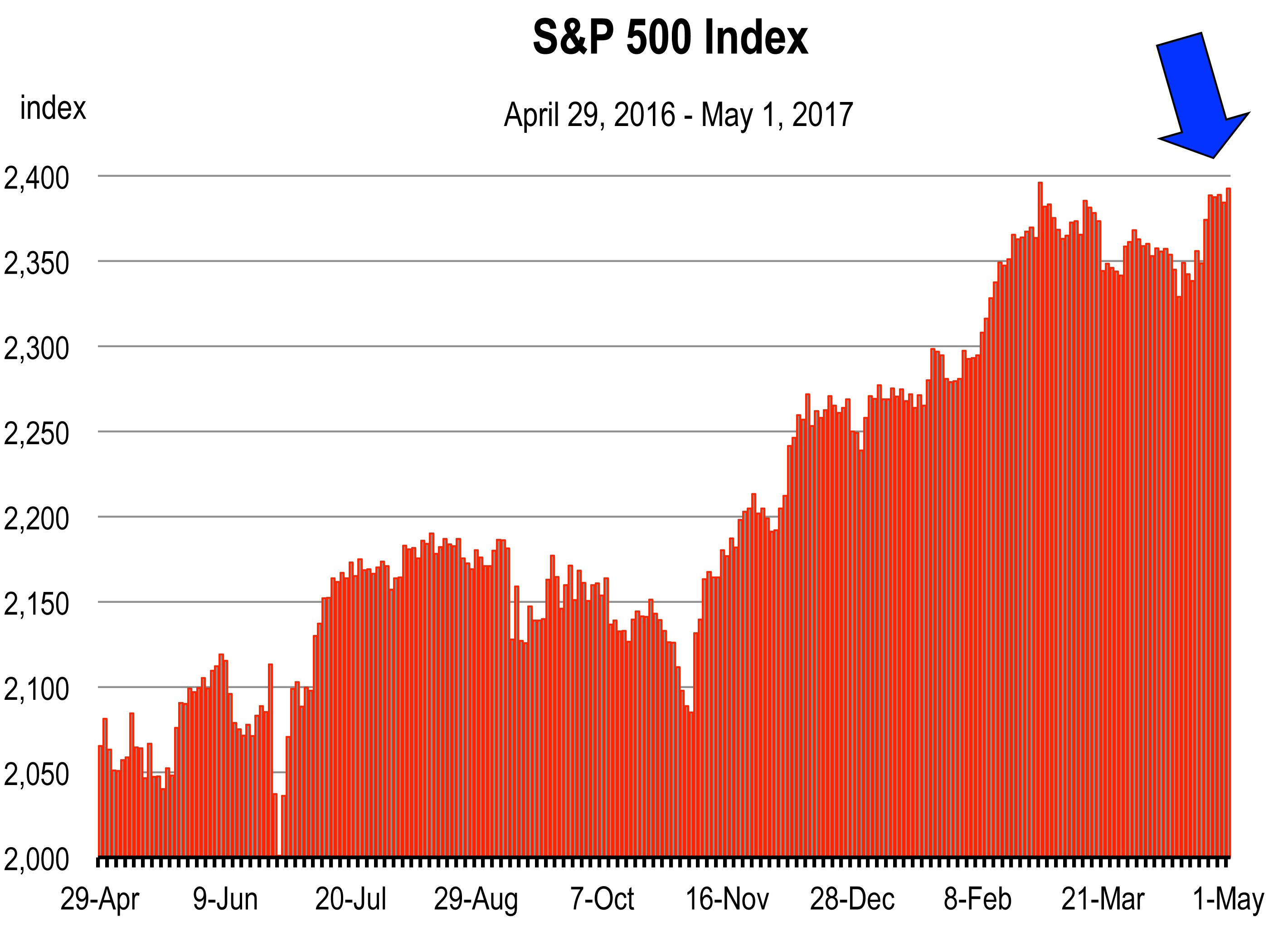

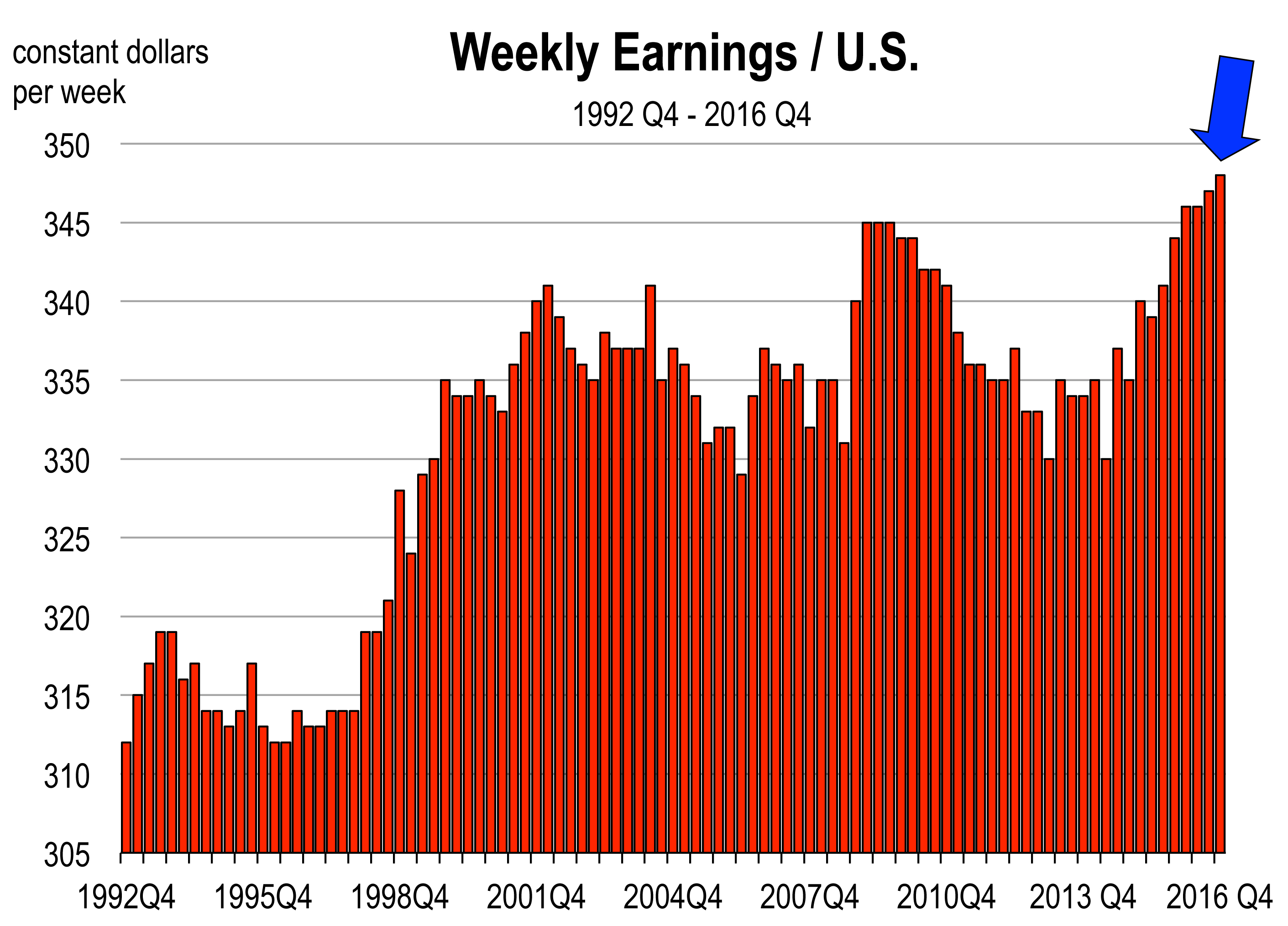

Does the economy need a tax cut? Well, growth has remained strong even as the administration and the Republican-led Congress have struggled to enact economic programs. And despite all the campaign rhetoric about jobs and businesses going overseas because of high corporate taxes, the economy has remained ruggedly resilient, the unemployment rate is the lowest in 17 years, real wages are rising, and GDP growth is accelerating.

Tax reform is always welcome, but do we need a tax cut to stimulate economic growth? No, not right now.

Conclusion

For me, any tax reform that is an actual reduction in my taxes is a good thing. I would much rather control the expenditure of my own income than I trust the federal or state government to do. So any tax cut is welcomed, providing it actually does reduce my taxes.

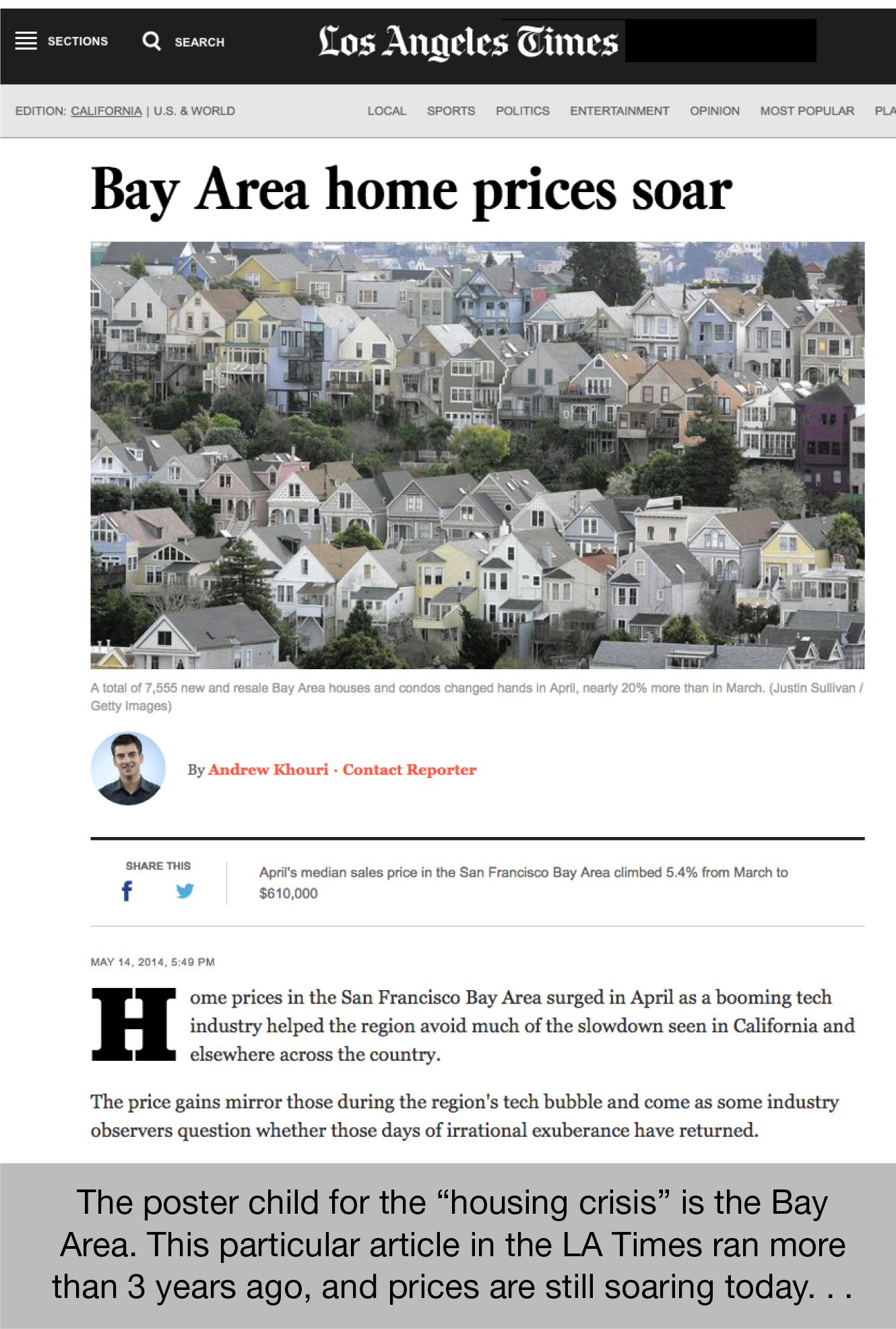

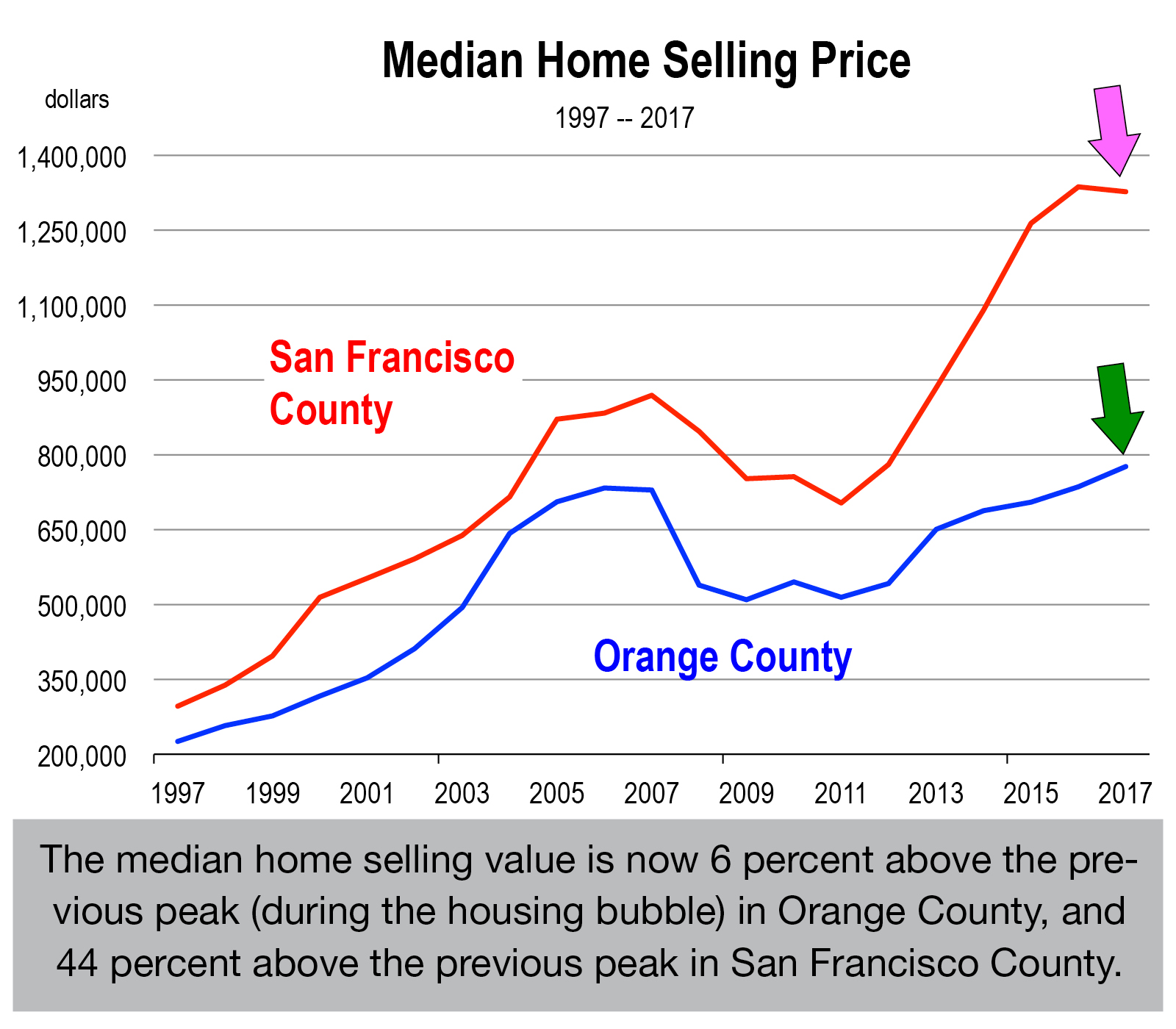

As Californians, some of us will face a higher tax bill due to the fact that we won’t be able to deduct all our property tax payments. This is especially true if you purchased a home recently in the Bay Area, or coastal Southern California. Moreover, the state income tax payment is non-deductible and California income taxes are higher than anywhere else.

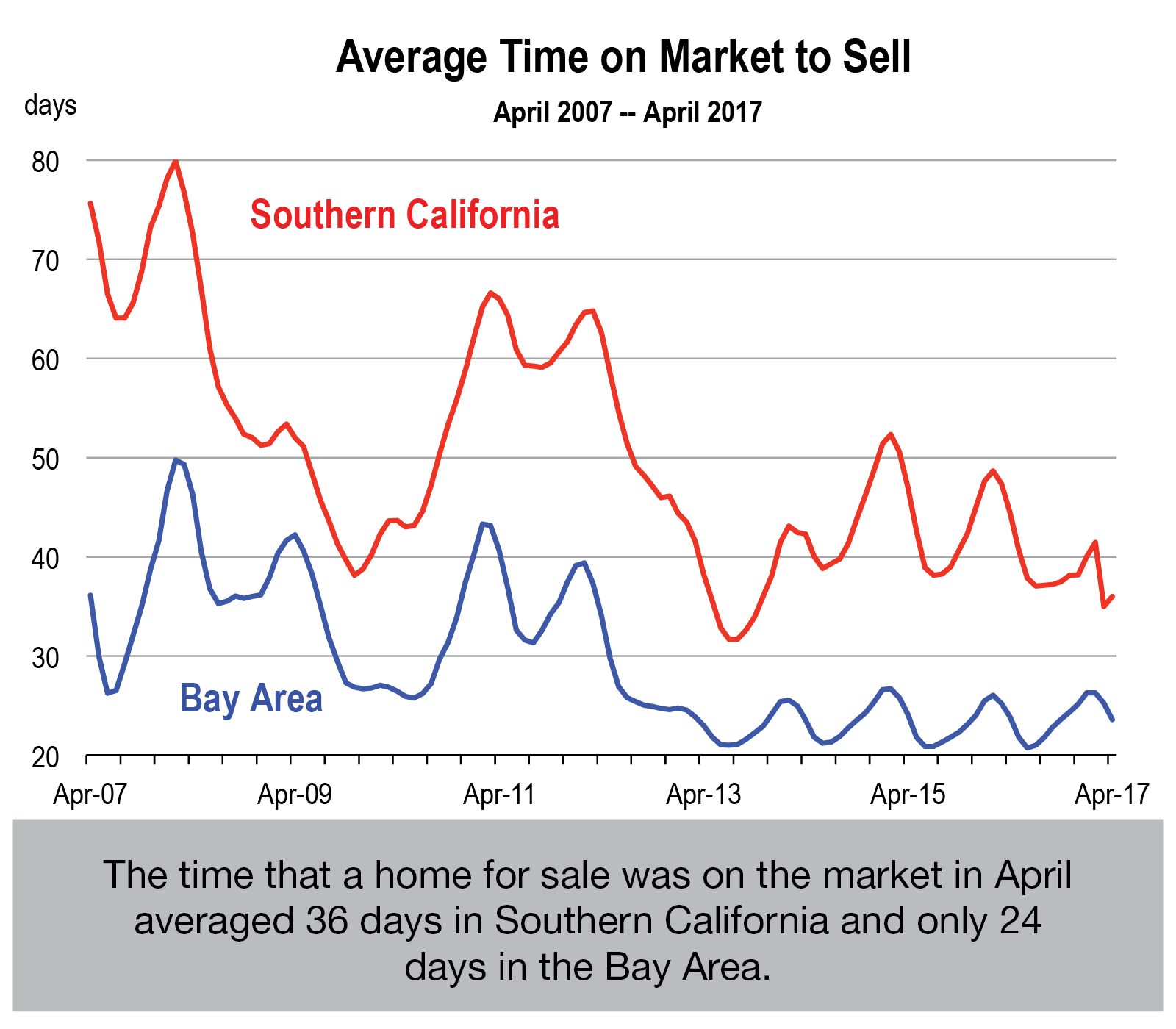

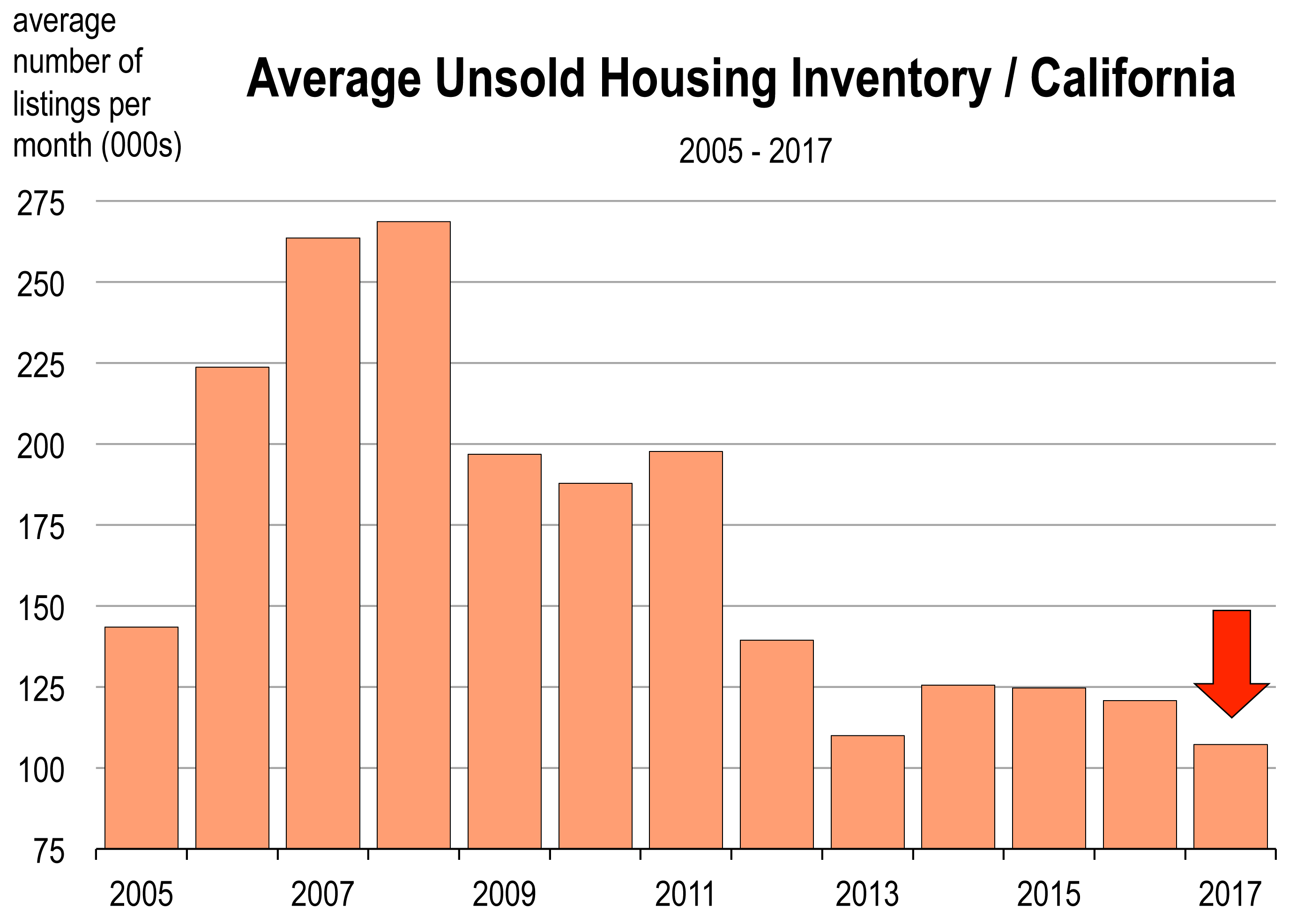

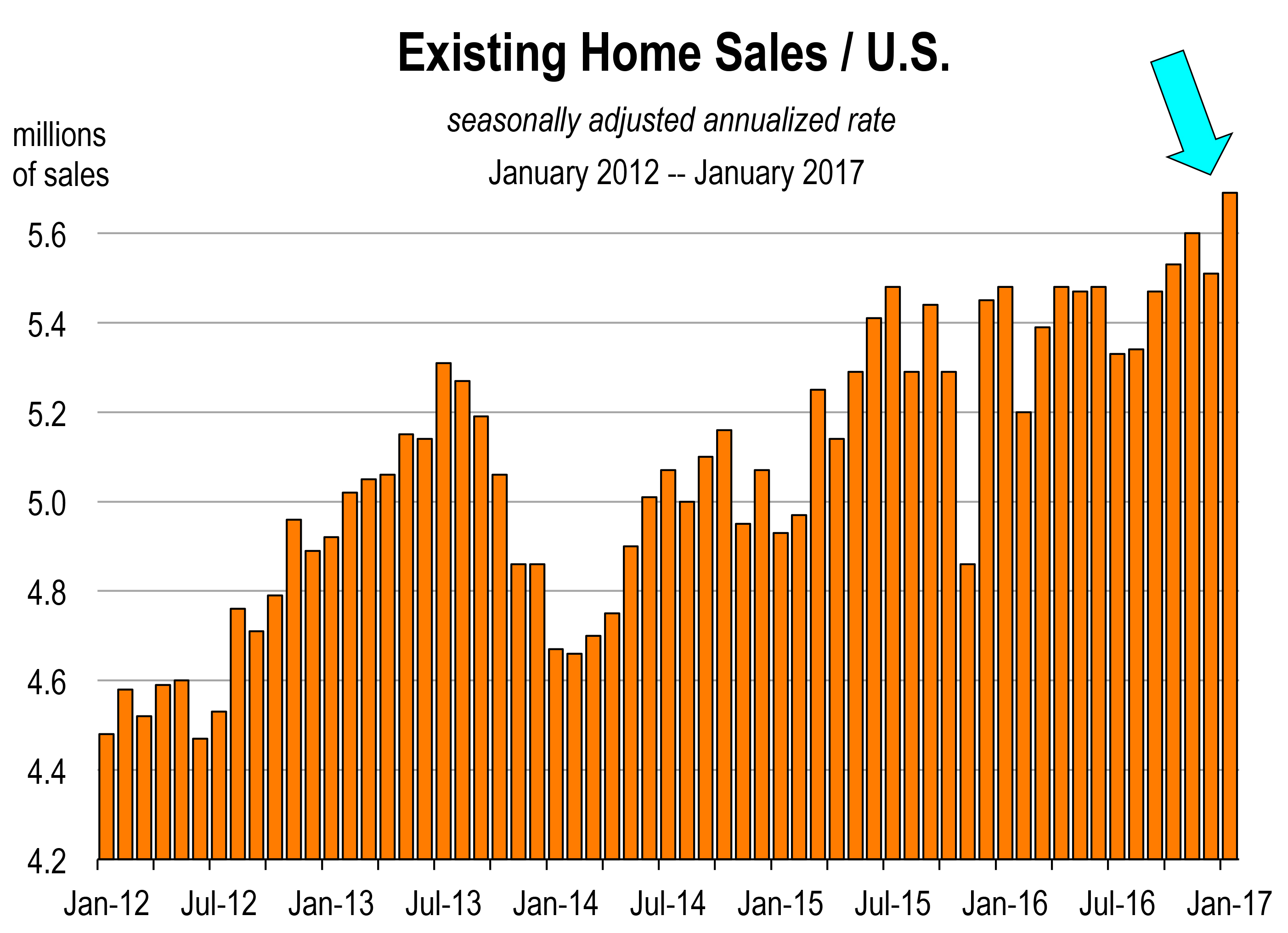

Also, the home mortgage deduction on new purchases will be capped for many new home owners in the higher housing cost areas of the state. This includes Santa Barbara and Goleta, coastal Ventura and Oxnard, the Conejo Valley, most of LA and Orange County, and coastal San Luis Obispo County. A reduced mortgage rate deduction will impact the decision to buy a home in California, so fewer home sales next year are likely. Realtors are naturally against this.

If you already own your home, you’re not going to be affected by the limits on the mortgage deduction. If your household income is above $250,000, then the elimination of the state income tax deduction will hurt you, but as an offset, you’re likely to benefit from the business tax reforms.

The Tax Foundation in Washington D.C. has evaluated the plan and according to them, households from the full range of incomes would benefit with at least a modest tax reduction.

Critics say this plan will hurt the poor. This is nonsense simply because the poor do not pay any state or federal income taxes. The bottom 35 percent of Americans will not get any extra benefits, because they already have a $0 federal tax liability.

Might this plan increase the deficit? Yes, it likely will. But I see the deficit as it’s own issue which does not have to be addressed when discussing tax reform. Why? Because there is always expenditure reform which many people erroneously assume is unreformable. The Senate must consider expenditure reform if they hope to pass tax reform with a 51 vote majority. Otherwise, the plan is dead.

Upcoming Presentation:

Santa Barbara Executive Roundtable

“Anticipating and Bracing for the Next Recession…”

Panel discussion with Mark Schniepp, Brian Johnson, Keith Berry, and Justin Anderson

November 9, 2017

University Club, Santa Barbara, 8 AM

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

An estimated $20 to $30 billion in economic losses are the immediate impacts resulting from business interruptions, such as idle hotels, closed stores, shutdown refineries, workplaces closed and people unable to go to work, Disneyland, SeaWorld, and Universal Studios—all closed. Spending was therefore curtailed on energy, home buying, car buying, and tourism. There is an estimated 50% to 70% loss of Florida’s citrus crop, valued at $1 billion. The estimate for third quarter GDP is predicted to be ½ percent lower because of the hurricanes. So perhaps a rate of between 1.8% and 2.3% is anticipated.

An estimated $20 to $30 billion in economic losses are the immediate impacts resulting from business interruptions, such as idle hotels, closed stores, shutdown refineries, workplaces closed and people unable to go to work, Disneyland, SeaWorld, and Universal Studios—all closed. Spending was therefore curtailed on energy, home buying, car buying, and tourism. There is an estimated 50% to 70% loss of Florida’s citrus crop, valued at $1 billion. The estimate for third quarter GDP is predicted to be ½ percent lower because of the hurricanes. So perhaps a rate of between 1.8% and 2.3% is anticipated.

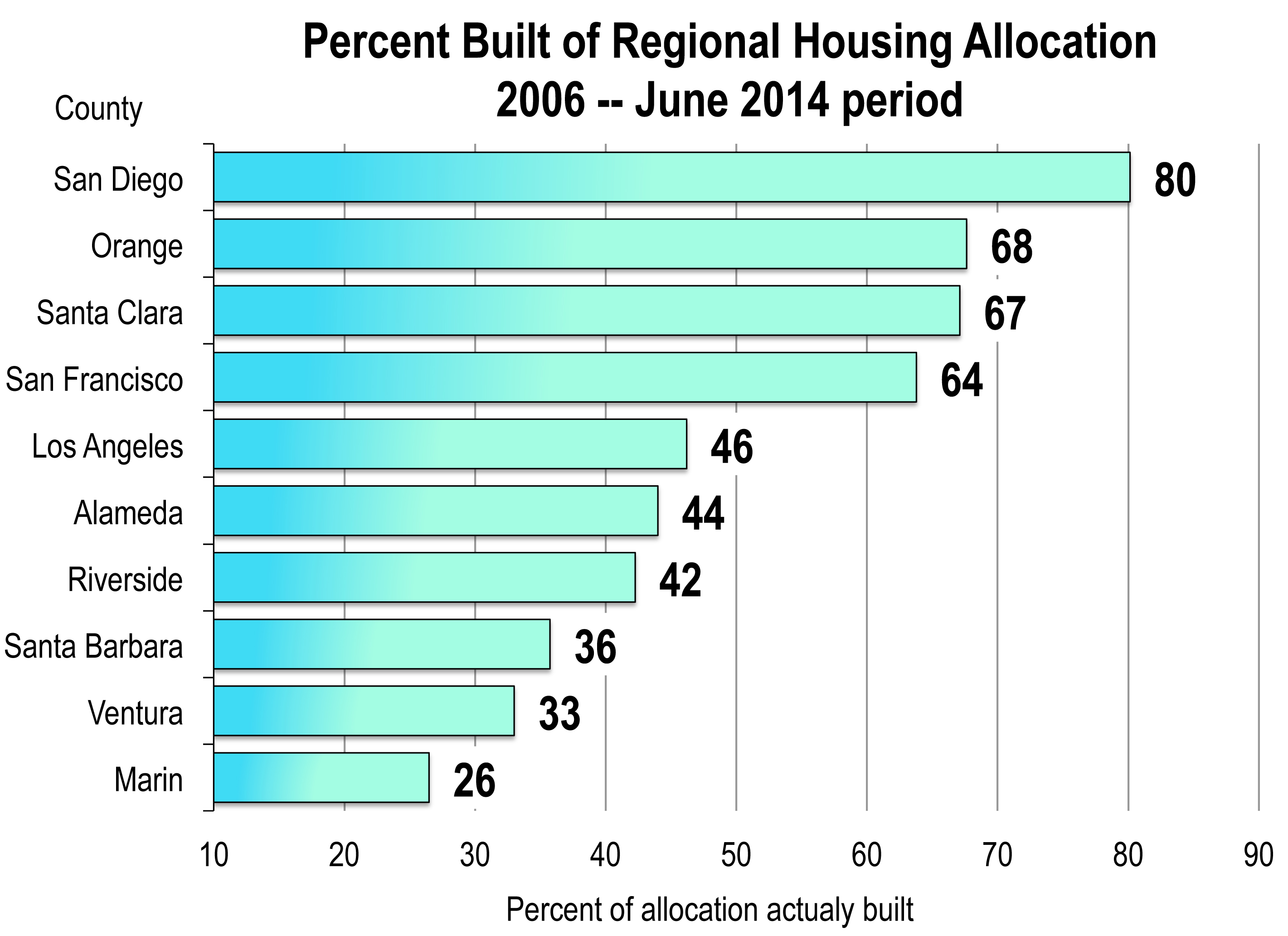

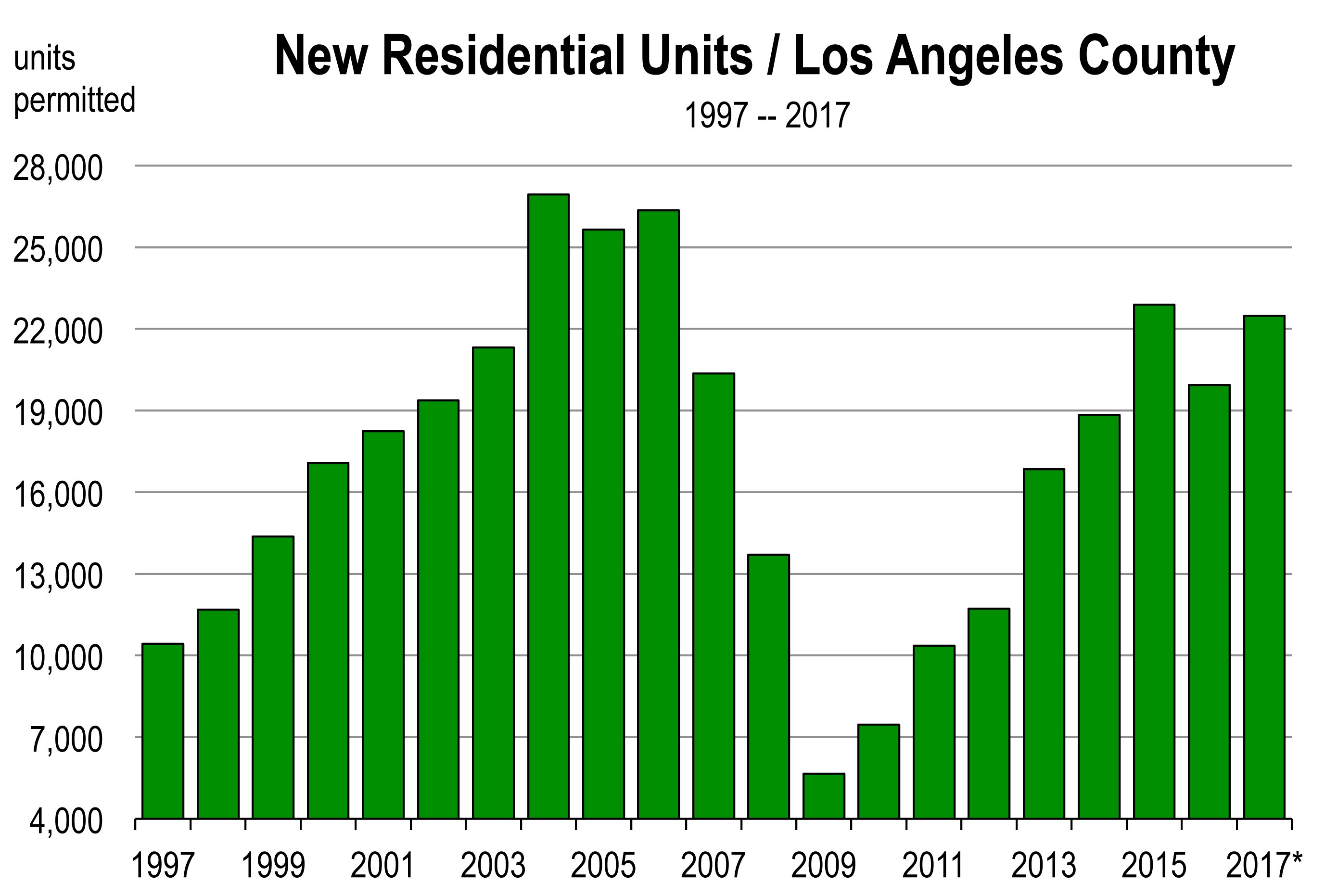

For the 2014 to 2021 planning period, the RHNA allocation for Southern California is 412,000 housing units, of which 180,000 are in Los Angeles County and 19,000 are in Ventura County. Permitted housing in L.A. County is currently on a pace that could meet the RHNA allocation. However, Ventura County is way behind.

For the 2014 to 2021 planning period, the RHNA allocation for Southern California is 412,000 housing units, of which 180,000 are in Los Angeles County and 19,000 are in Ventura County. Permitted housing in L.A. County is currently on a pace that could meet the RHNA allocation. However, Ventura County is way behind.

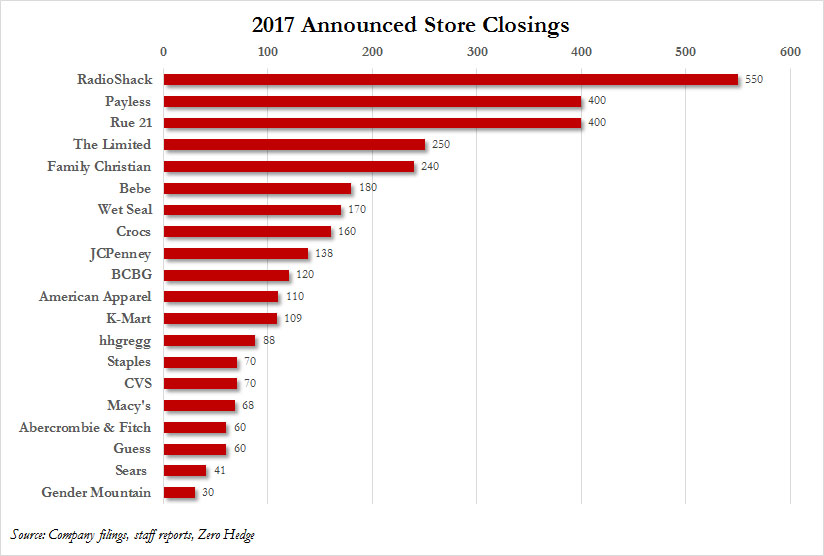

Macy’s closed 68 stores this year. An estimated 4,000 employees have been impacted. Another 34 stores are planned to close in the next 4 years. At the end of this month, JC Penny will begin to close 138 stores, and liquidation sales are underway at many of these stores now on the chopping block.

Macy’s closed 68 stores this year. An estimated 4,000 employees have been impacted. Another 34 stores are planned to close in the next 4 years. At the end of this month, JC Penny will begin to close 138 stores, and liquidation sales are underway at many of these stores now on the chopping block.

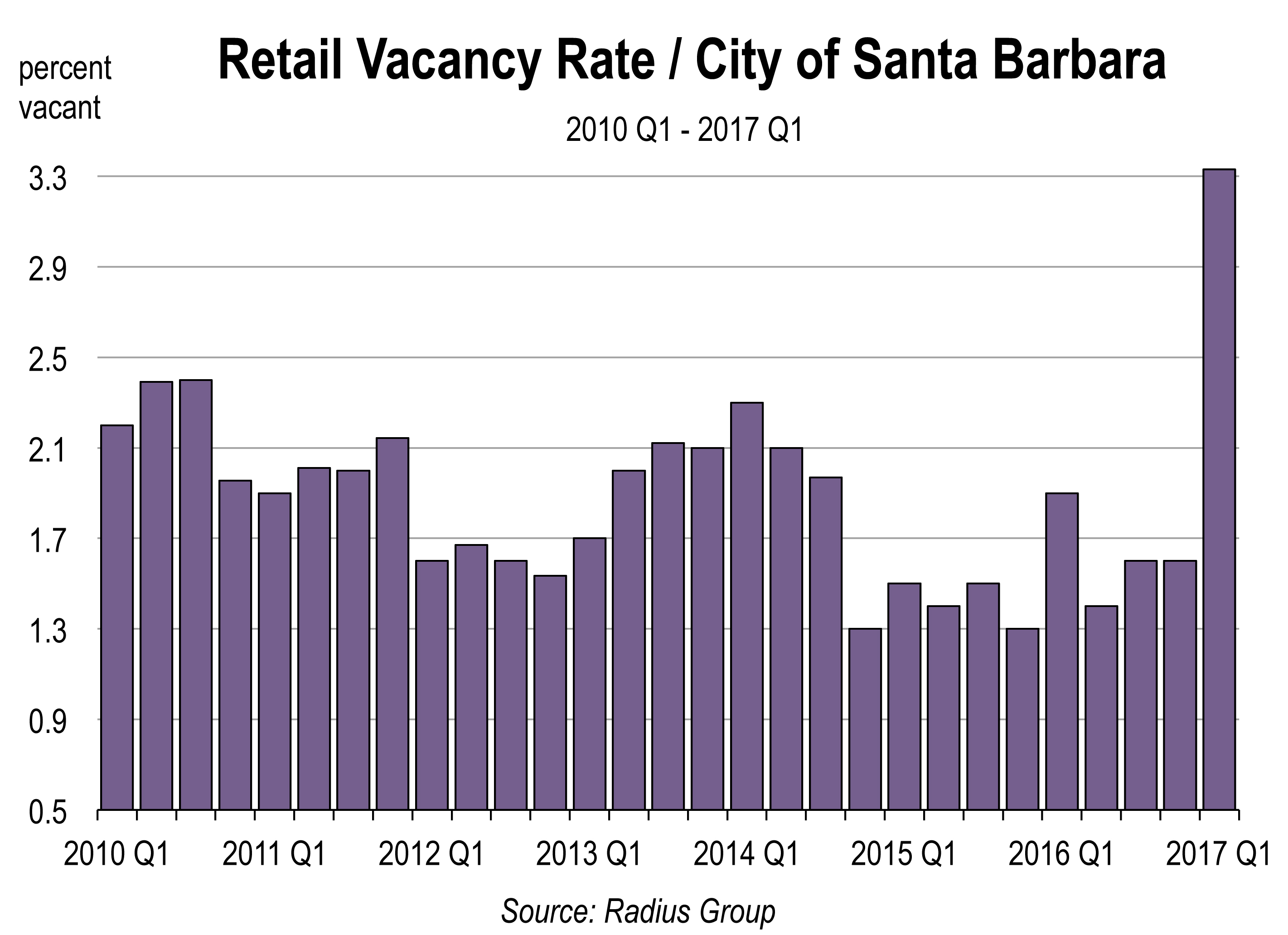

And speaking of Santa Barbara, there have been a spate of recent retail and restaurant closures on State Street, resulting in the highest level of downtown retail vacancy since the mid 1990s, according to the Radius Group.

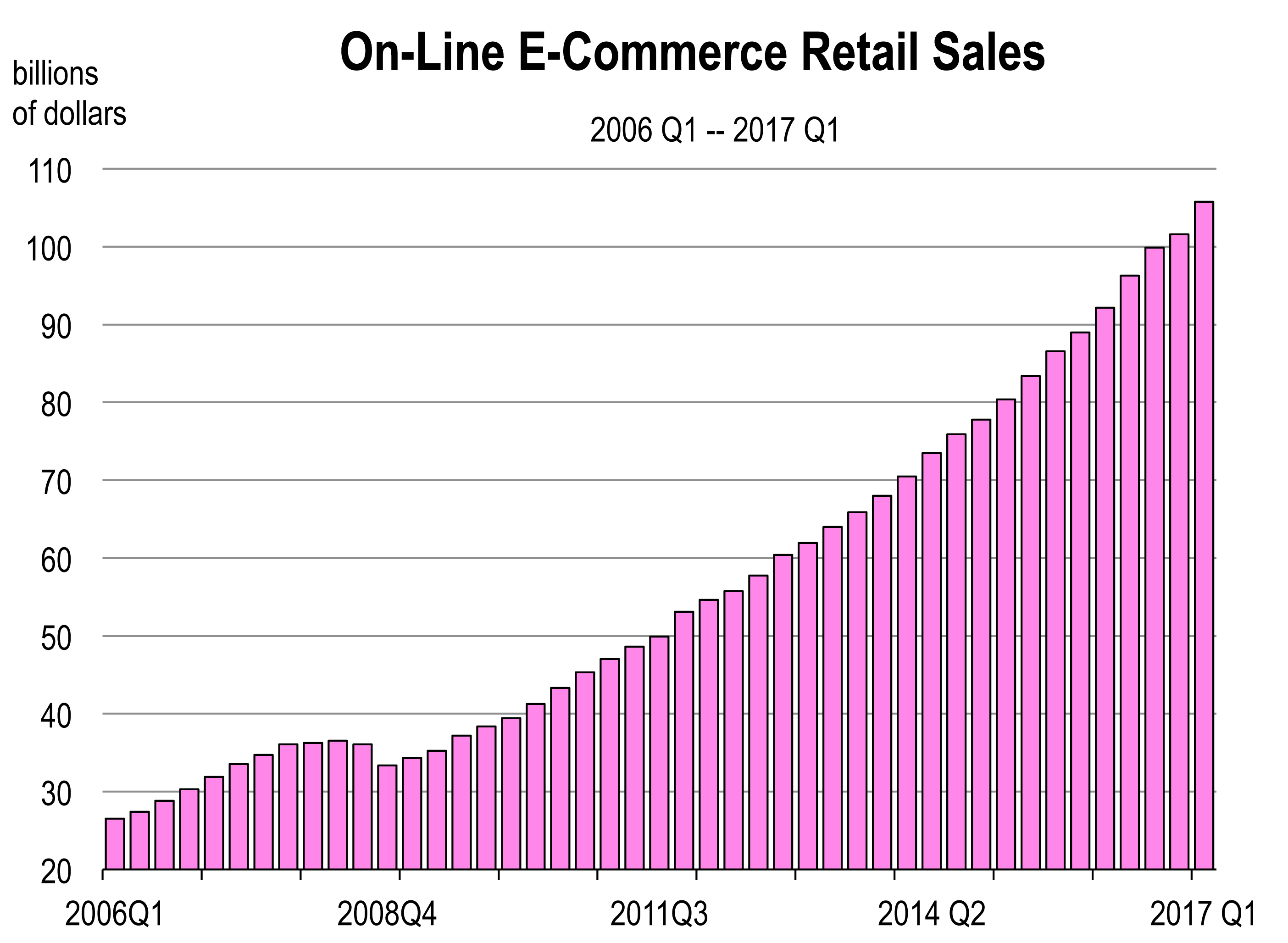

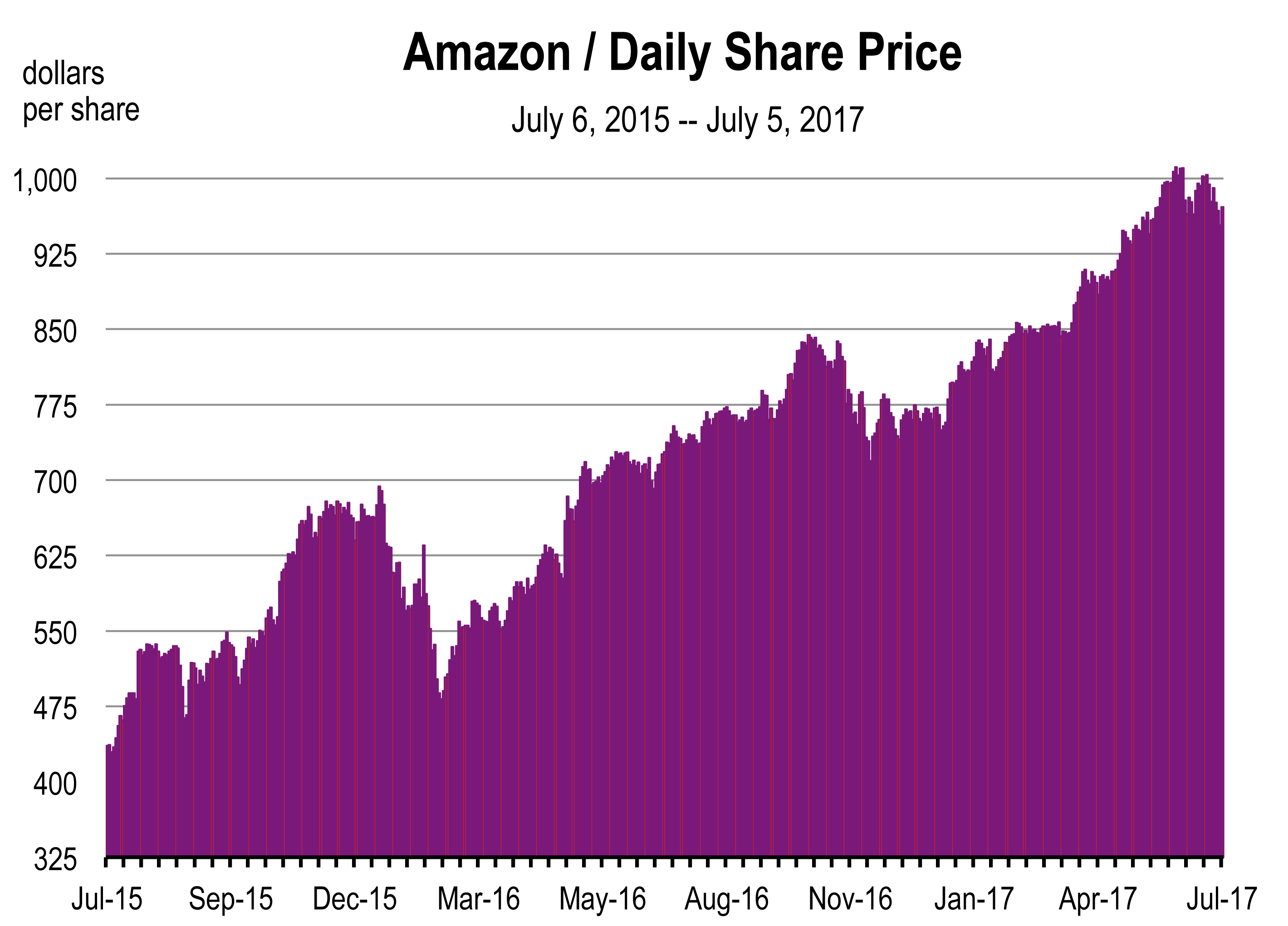

And speaking of Santa Barbara, there have been a spate of recent retail and restaurant closures on State Street, resulting in the highest level of downtown retail vacancy since the mid 1990s, according to the Radius Group. But the biggest factor is the widespread and pervasive migration to online stores for many goods, even clothing.

But the biggest factor is the widespread and pervasive migration to online stores for many goods, even clothing. What’s Ahead for Retail?

What’s Ahead for Retail?

Summer 2017

Summer 2017

Supply Conditions

Supply Conditions

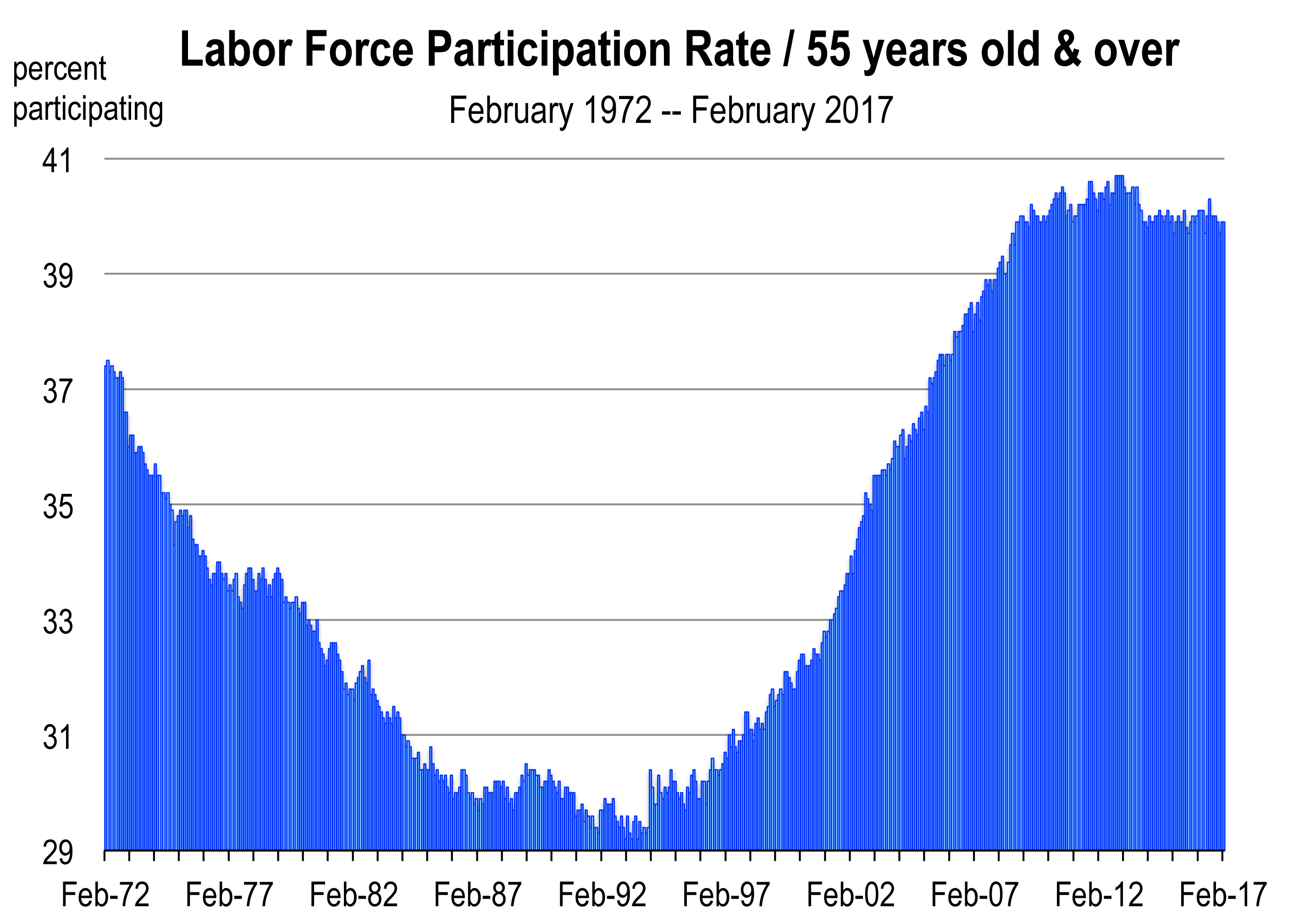

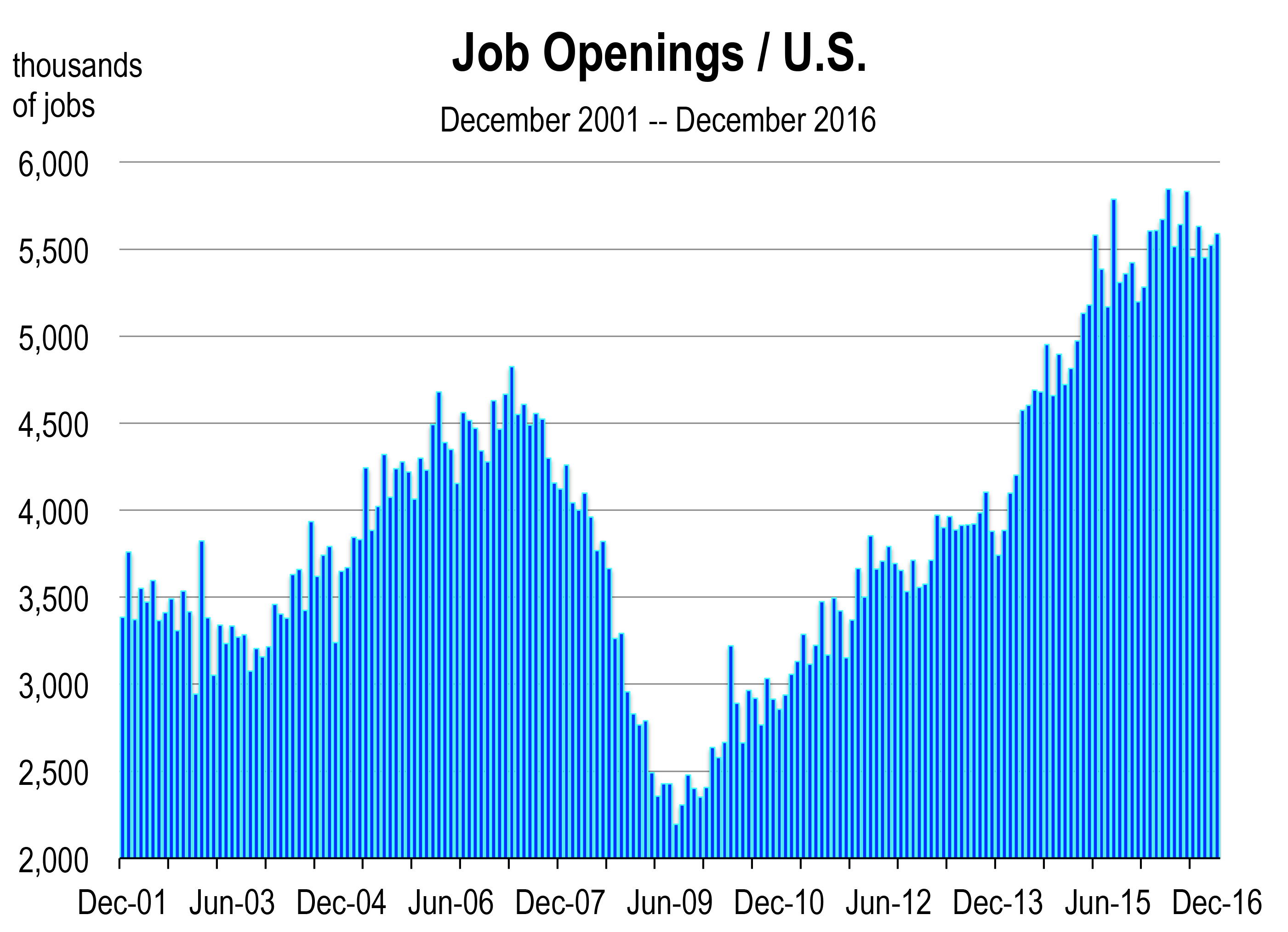

articipation rate and pessimistically but erroneously site the high rate of discouraged workers in the economy because as they will claim: job prospects are not that great.

articipation rate and pessimistically but erroneously site the high rate of discouraged workers in the economy because as they will claim: job prospects are not that great. It’s the millennial generation that is having the more difficult time obtaining employment, and this is only true if they have not adequately prepared with a college degree or a skill that is needed in today’s workforce.

It’s the millennial generation that is having the more difficult time obtaining employment, and this is only true if they have not adequately prepared with a college degree or a skill that is needed in today’s workforce. Job openings in the STEM fields take twice as long to fill, due to a dearth of candidates meeting these qualifications.

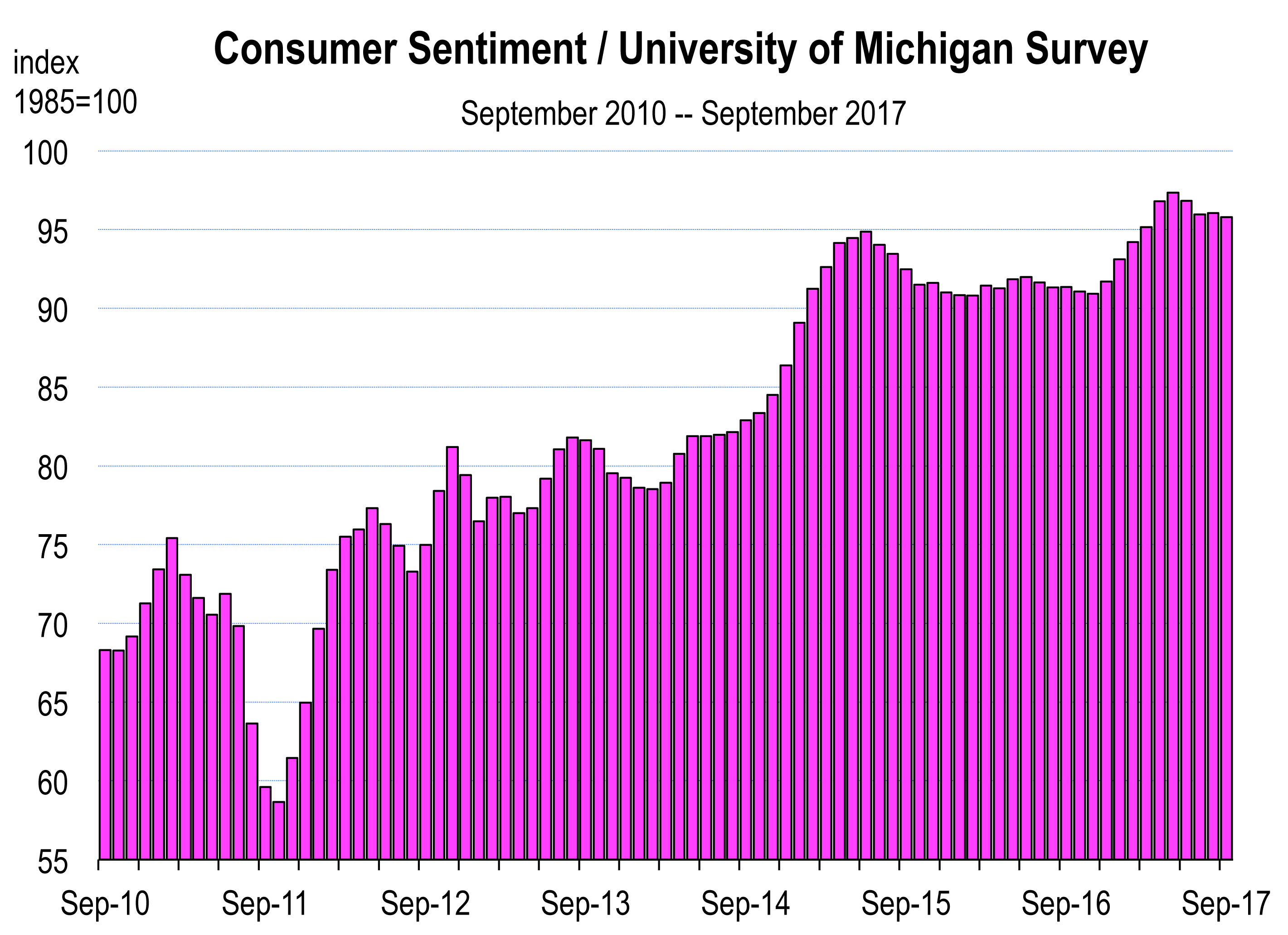

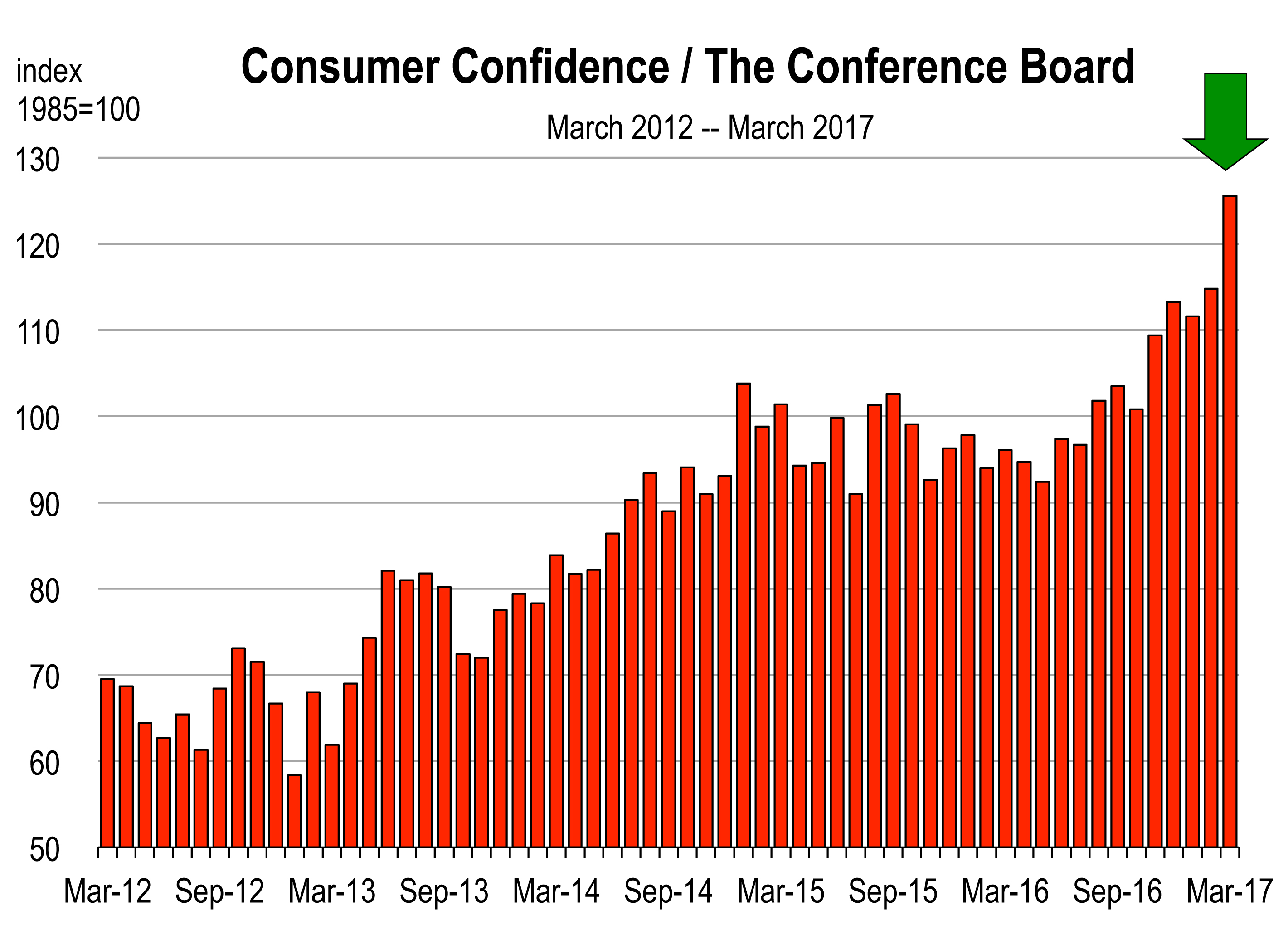

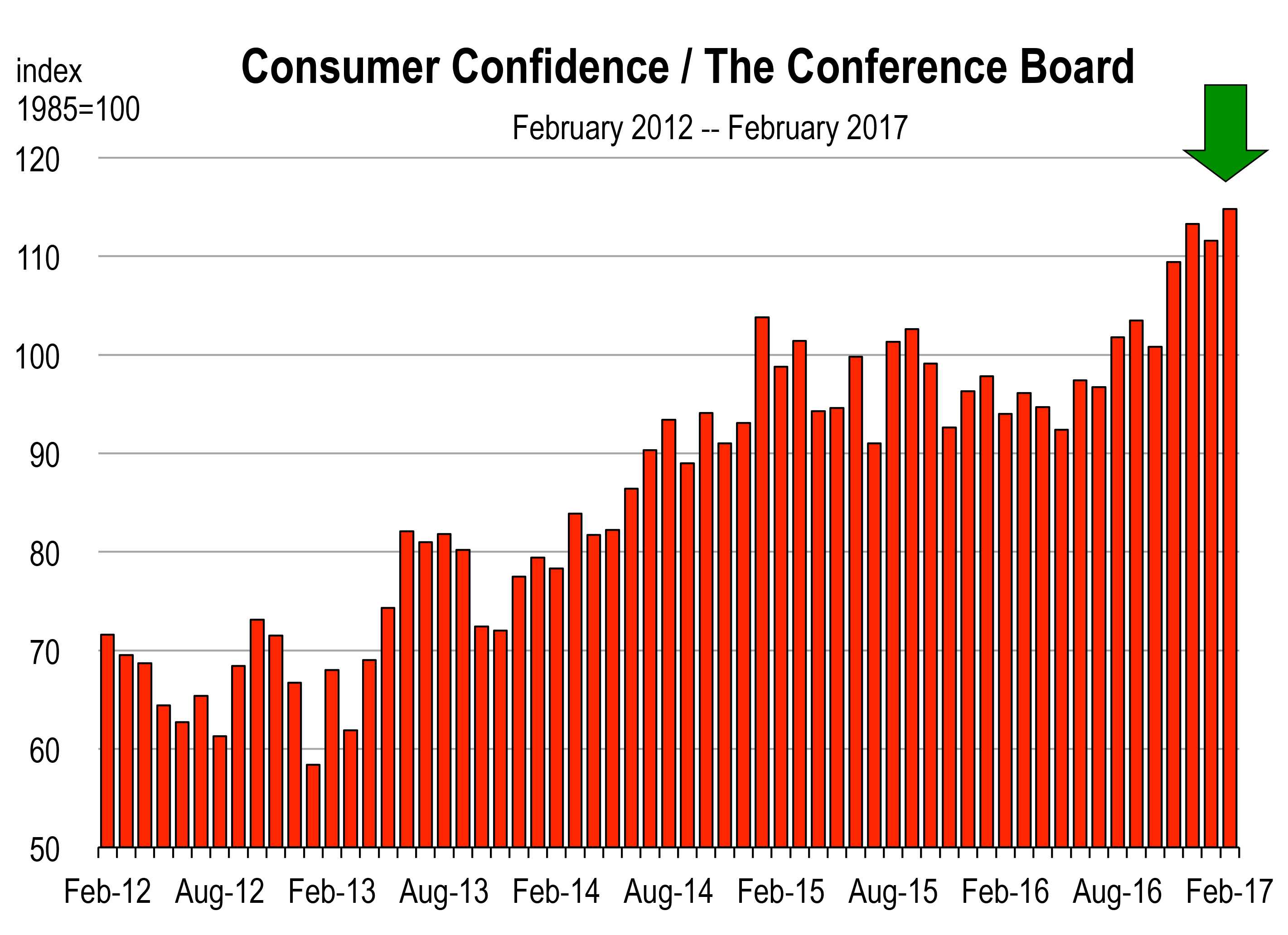

Job openings in the STEM fields take twice as long to fill, due to a dearth of candidates meeting these qualifications. Confidence has strengthened considerably, building on its sharp gains in November and December.

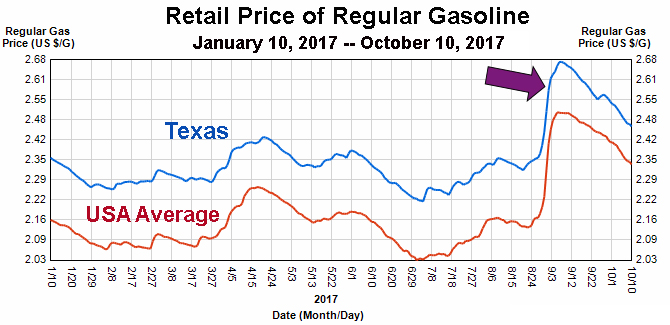

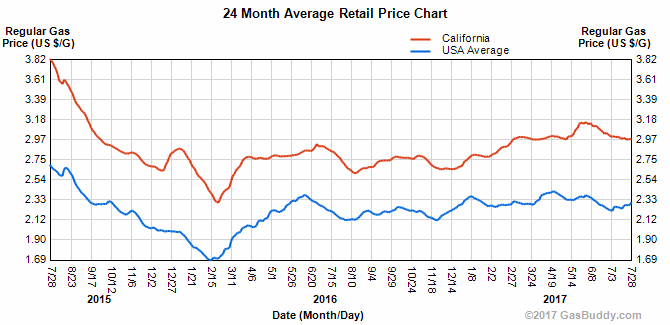

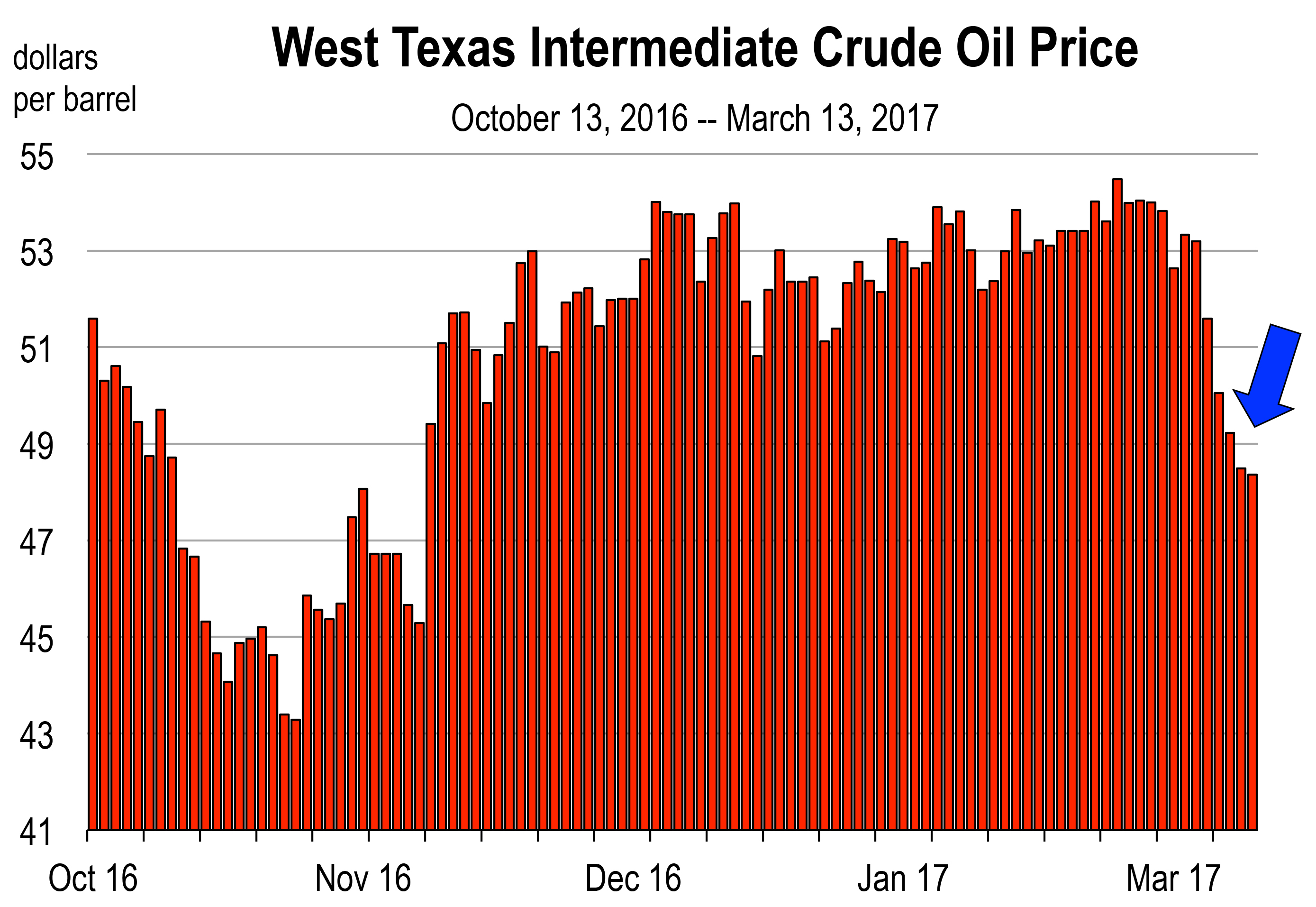

Confidence has strengthened considerably, building on its sharp gains in November and December. This will ultimately translate into lower gasoline prices which have recently spiked up to an average price of $3.01 in California. Despite OPEC’s effort to restrict crude oil supply in the world, U.S. inventories are rising and drilling activity remains optimistic.

This will ultimately translate into lower gasoline prices which have recently spiked up to an average price of $3.01 in California. Despite OPEC’s effort to restrict crude oil supply in the world, U.S. inventories are rising and drilling activity remains optimistic. Nationwide, the median selling value rose 7.1 percent year over year in January. In California, the median price has risen 4.8 percent.

Nationwide, the median selling value rose 7.1 percent year over year in January. In California, the median price has risen 4.8 percent. Total passenger enplanements and deplanements are at all time record levels at both San Francisco International and Los Angeles International Airports. Ditto John Wayne, Sacramento International and Lindbergh Field.

Total passenger enplanements and deplanements are at all time record levels at both San Francisco International and Los Angeles International Airports. Ditto John Wayne, Sacramento International and Lindbergh Field. The travel industry has experienced a series of renaissance years during this economic expansion. Both vacation and business travel is soaring in California. Transient lodging occupancy is at its highest level ever recorded.

The travel industry has experienced a series of renaissance years during this economic expansion. Both vacation and business travel is soaring in California. Transient lodging occupancy is at its highest level ever recorded.