by Mark Schniepp

June 2017

Summer 2017

Summer 2017

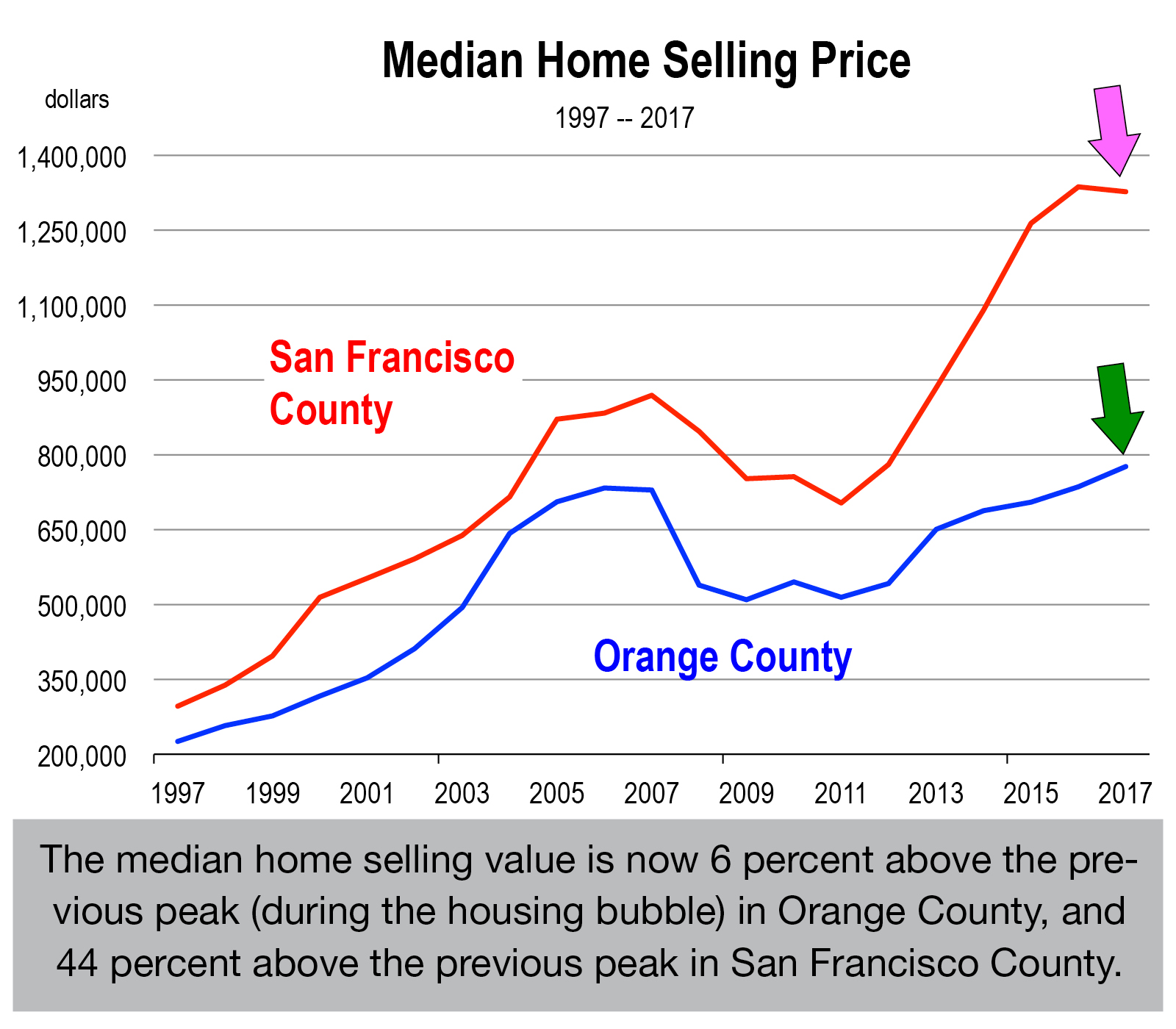

We are now seeing record high selling prices for homes in many markets of California and the nation.

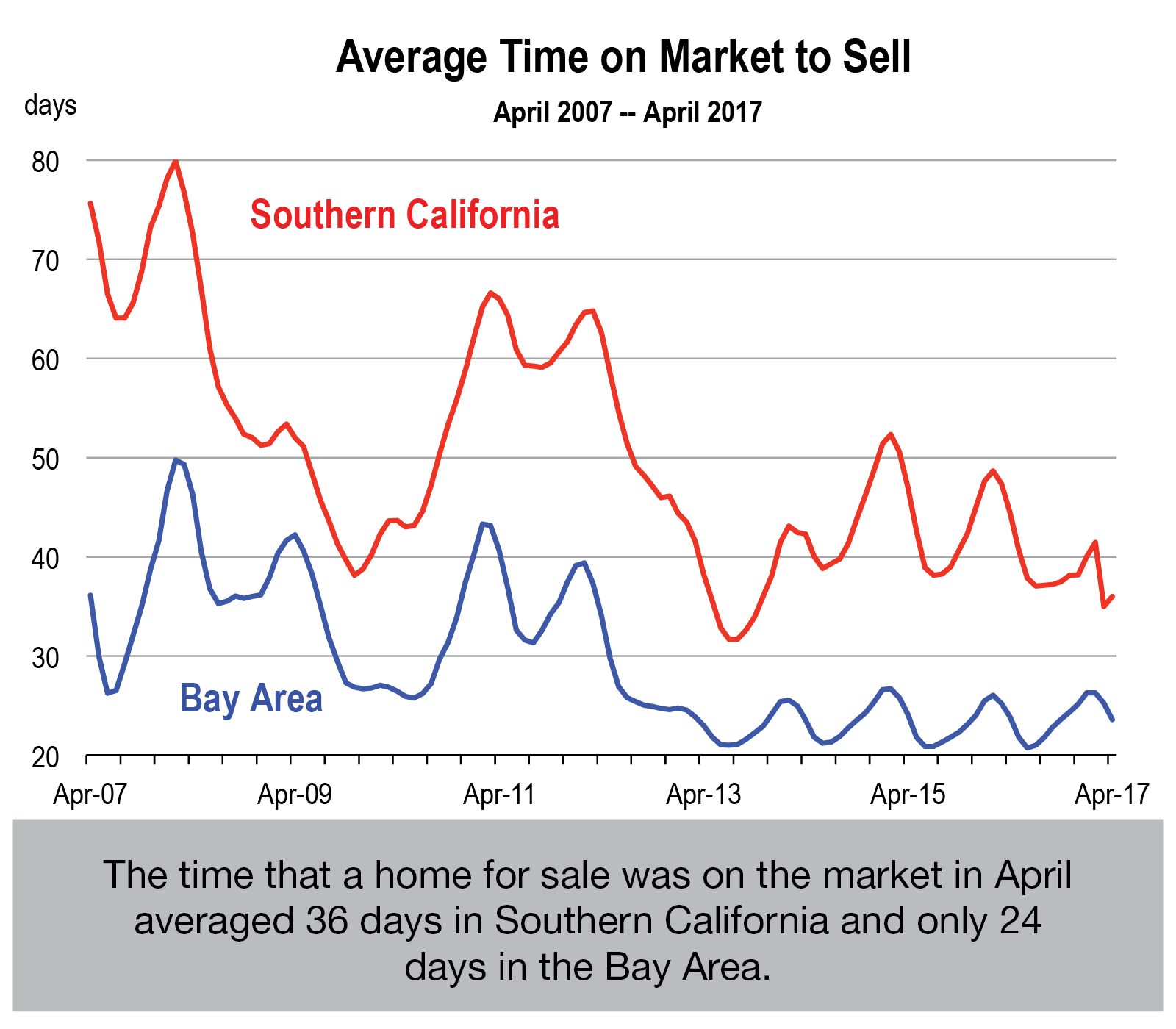

The sky high home values that seemed unbelievable back in 2007 have now been eclipsed in many of the larger markets of the state. The markets in the Bay Area now boast the highest values and record fast sell times.

Demand Conditions

- Employment is strong throughout the state. In all coastal counties, the unemployment rate is now at the full employment level, meaning that job opportunities are relatively abundant and wages are rising.

- The average rate for a 30-year fixed mortgage was 3.83% this week — significantly below the 5% to 6% range during the 2005 to 2007 “bubble” years.

- In fear of facing higher interest rates because of overt statements by the Federal Reserve to push rates higher in a measured fashion, demand for mortgages has increased.

- Because consumer confidence in March was at its highest level since 2000, people in general are feeling very confident about their employment prospects, their future income prospects, and the stability of the economy right now.

- The financial market composite indices are at or near all time record highs. Households owning financial assets are feeling more wealthy today than during the previous 10 years.

Despite the fact that the Millennials aren’t buying many homes today, demand is still strong for housing because of the strength of the economy. Furthermore, pent up demand, ultimately due to rising incomes of Millennials, will drive new housing formation higher over the next 5 years and this will lead to continued demand growth.

Supply Conditions

Supply Conditions

- California’s nonpartisan Legislative Analyst’s Office estimates millions of additional homes would had to have been built between 1980 and 2010 to have stopped the state’s home prices from growing far faster than the nation as a whole.

- Though construction is on the rise, it still remains far below even the insufficient levels of the past few decades.

- Some owners also can’t sell because they purchased or refinanced during the bubble and still owe more than their houses are worth.

- Others refinanced in recent years when fixed rates were closer to 3% and don’t want to lose that rate.

- But many owners don’t want to sell because they will reset their property tax base on a new home. This could double, triple or even quadruple their annual tax obligation.

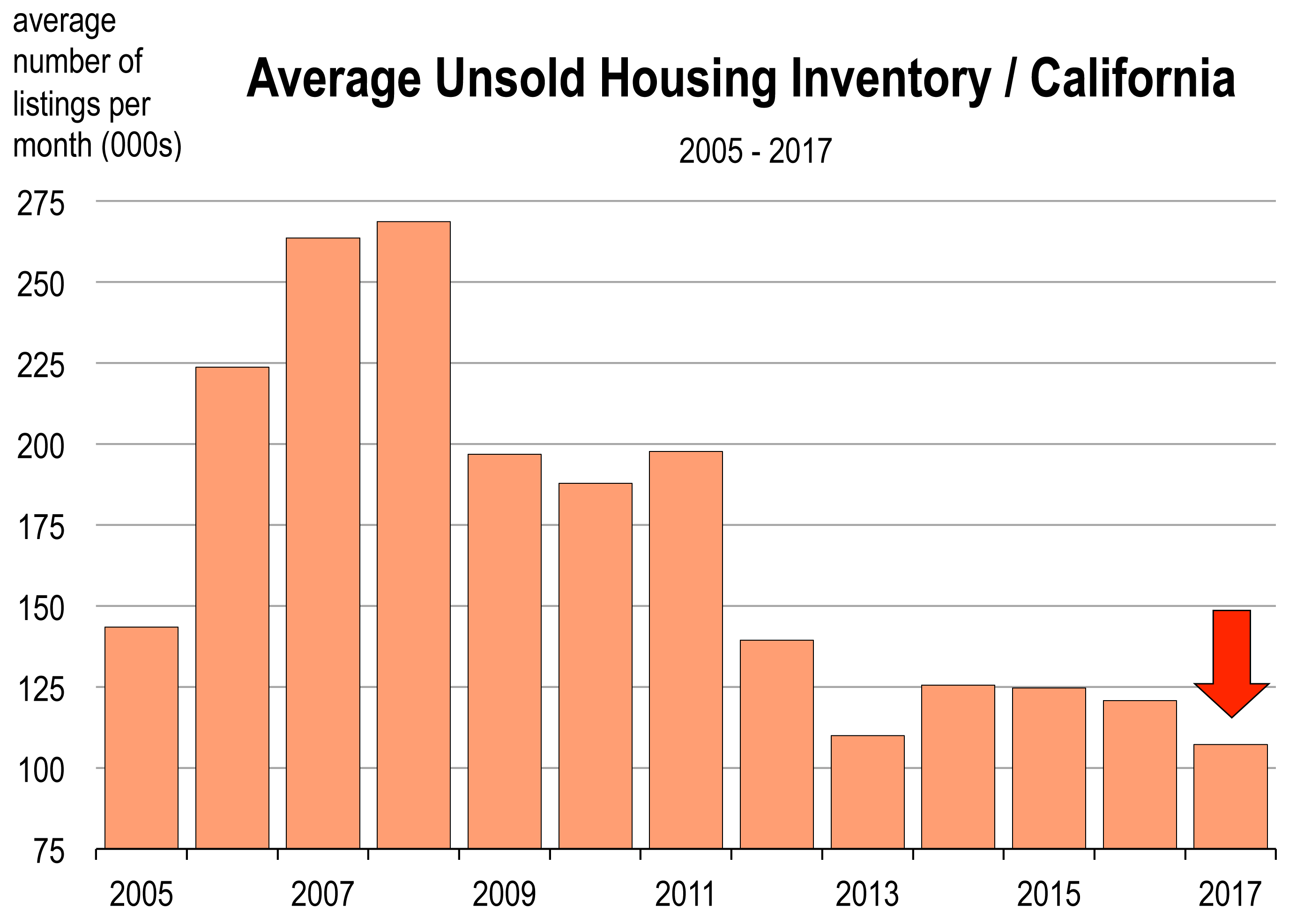

- For-sale inventories of housing are at record low levels and the lack of available supply is materially constraining sales.

Furthermore, following the housing bust of 2007-2008, investors purchased homes en masse and turned them into rentals, taking thousands of homes off the market. Those homes largely remain as rentals today.

Credit Conditions

An expansion of credit is absent. People who have the income and/or the cash are actually purchasing the homes. Credit conditions today are nothing like they were in 2006. FICO scores count and so does documentable income. Furthermore, unless you obtain an usually higher mortgage rate loan through an FHA approved lender, you need a sufficient amount of cash as a down payment.

Conclusion

In the current market, rising prices are the result of demand and supply conditions, and not because of easy credit or speculative conditions.

Austere supply conditions, combined with solid demand for housing, are the root cause of current price inflation in housing. Consequently, we don’t see any bubble forming in home prices. That said, if and when the economy softens, it is likely that housing prices will not decline that much.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.