Mark Schniepp

September 1, 2023

I wouldn’t say it if I didn’t have the evidence.

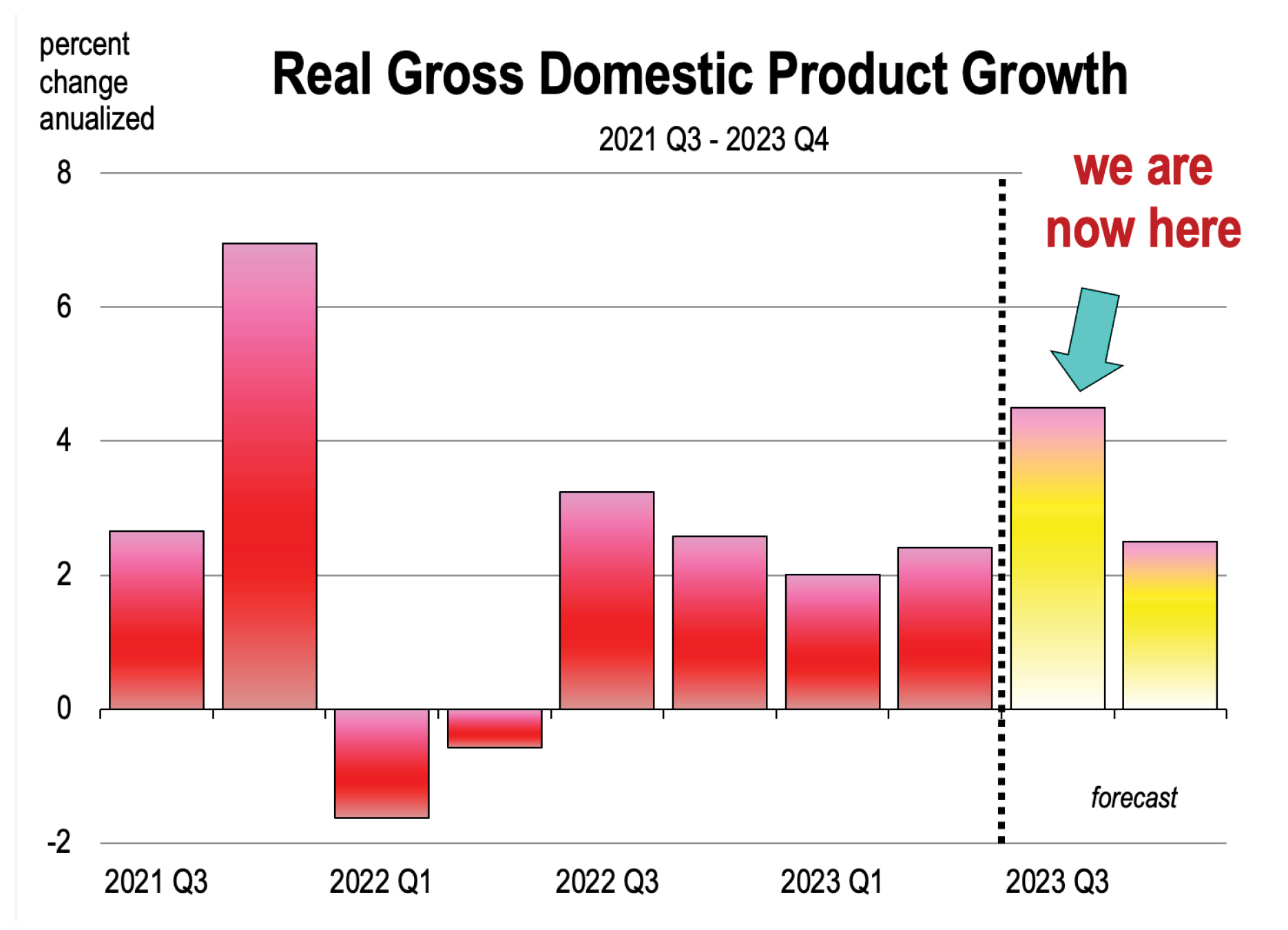

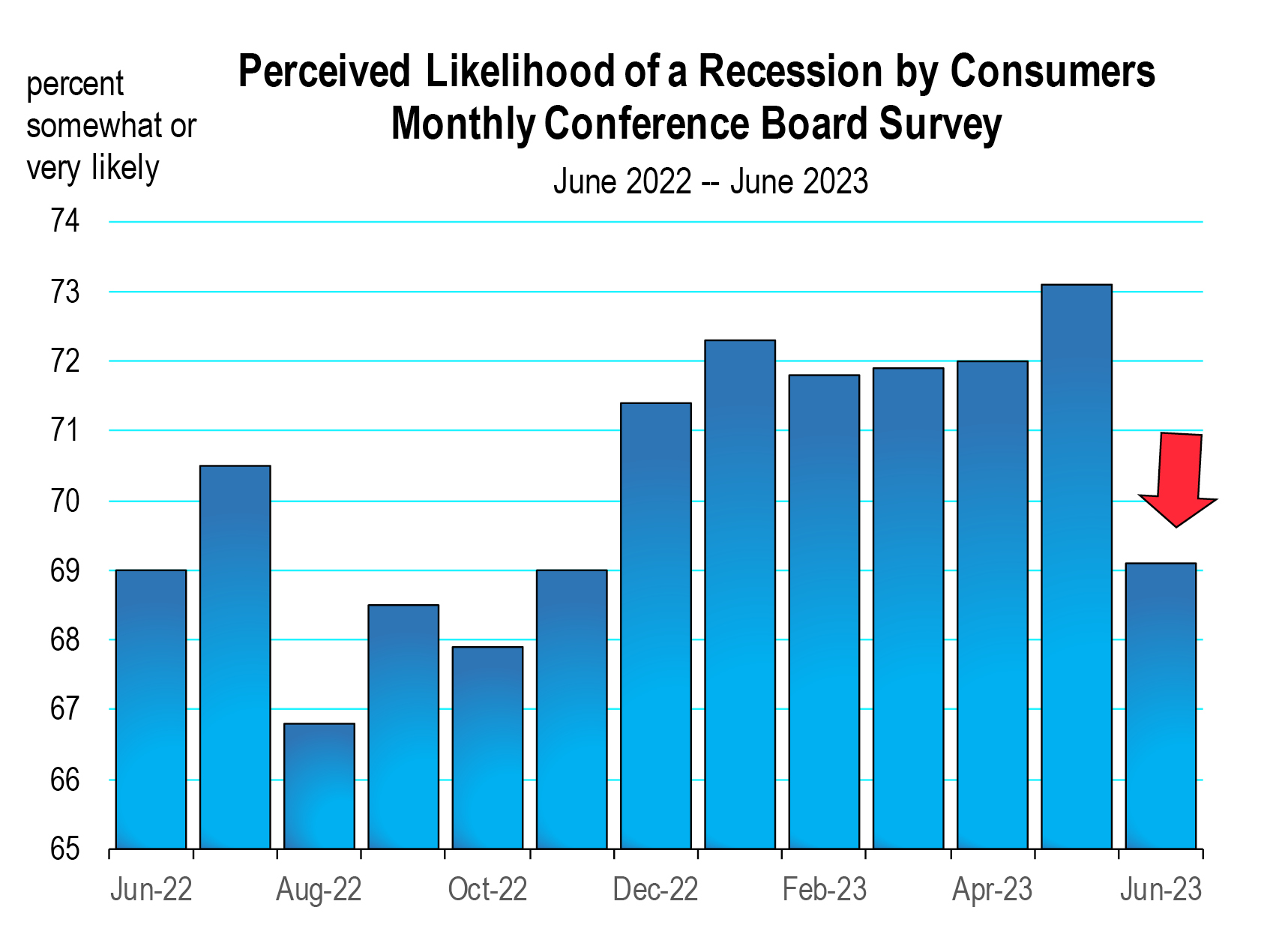

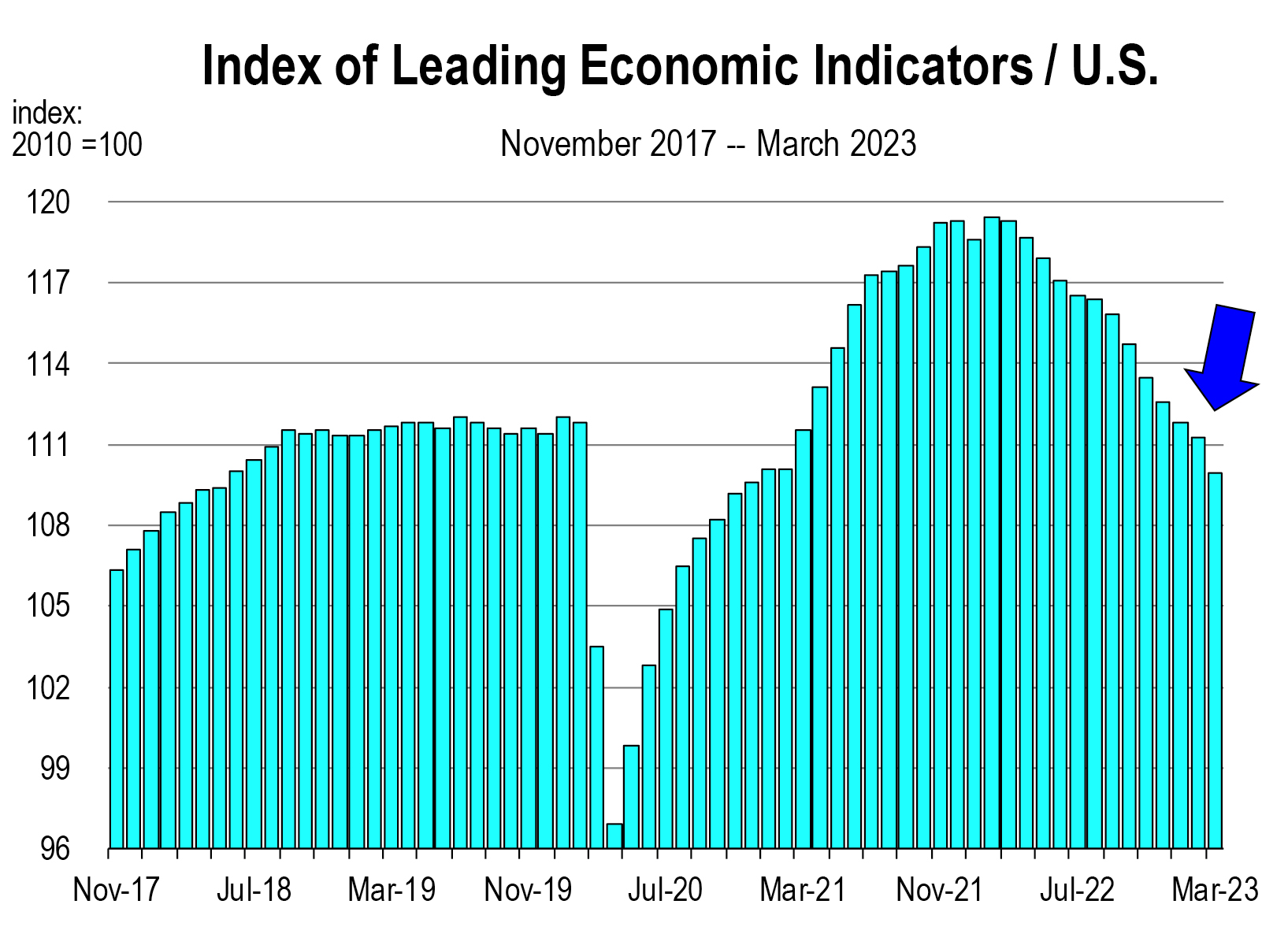

The long awaited recession in 2023 is postponed, and perhaps even cancelled.

The GDP estimate for the current quarter (which ends at the end of this month) is currently running at 3.9 percent annualized growth, says Moody’s Analytics. The Federal Reserve of Atlanta has growth at 5.9 percent for the current quarter through August 24. These rates are quite healthy and entirely unexpected.

These preliminary estimates of GDP growth are based on the most recent incoming data on the economy and to date, there has been strength in a number of indicators:

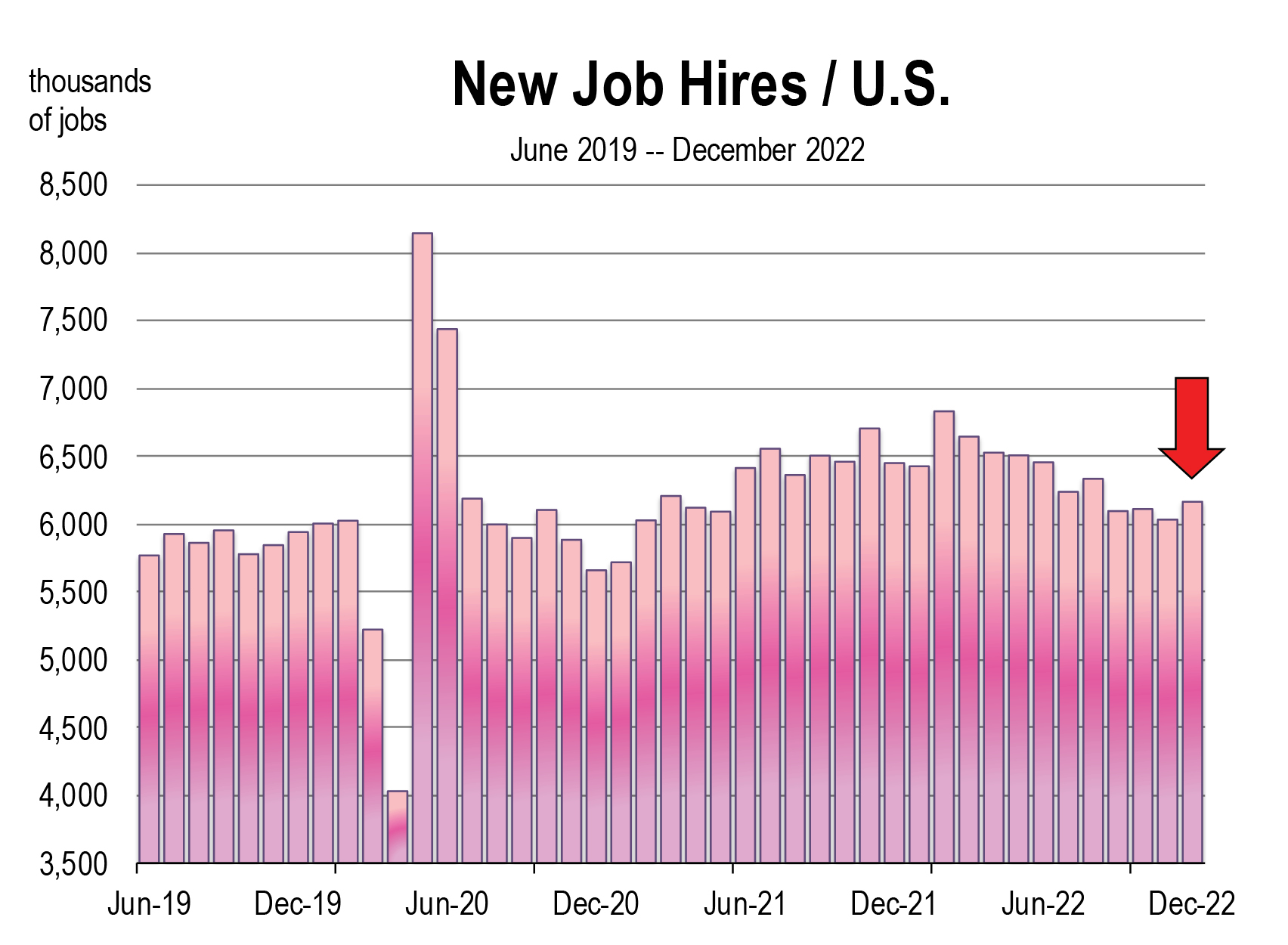

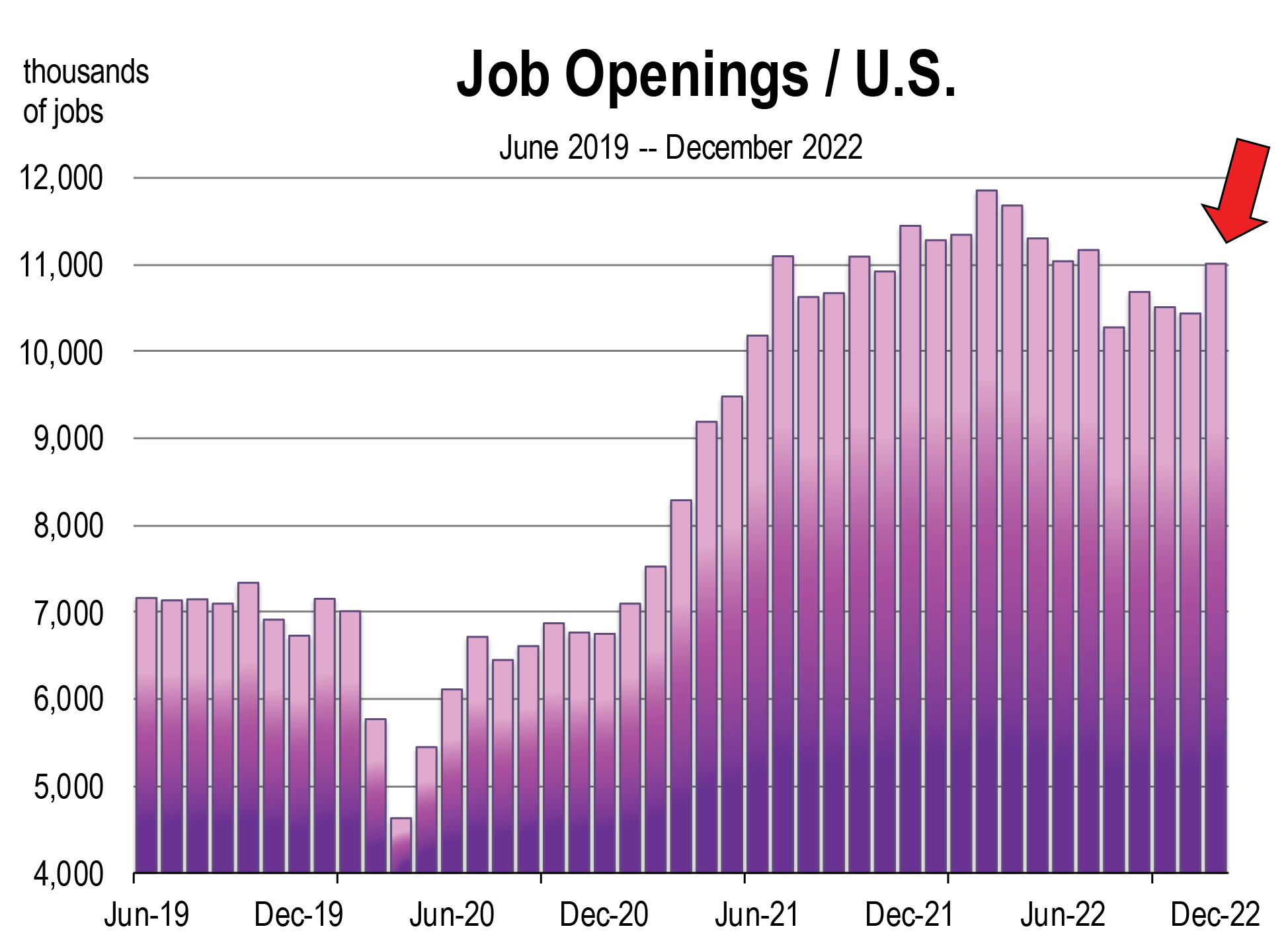

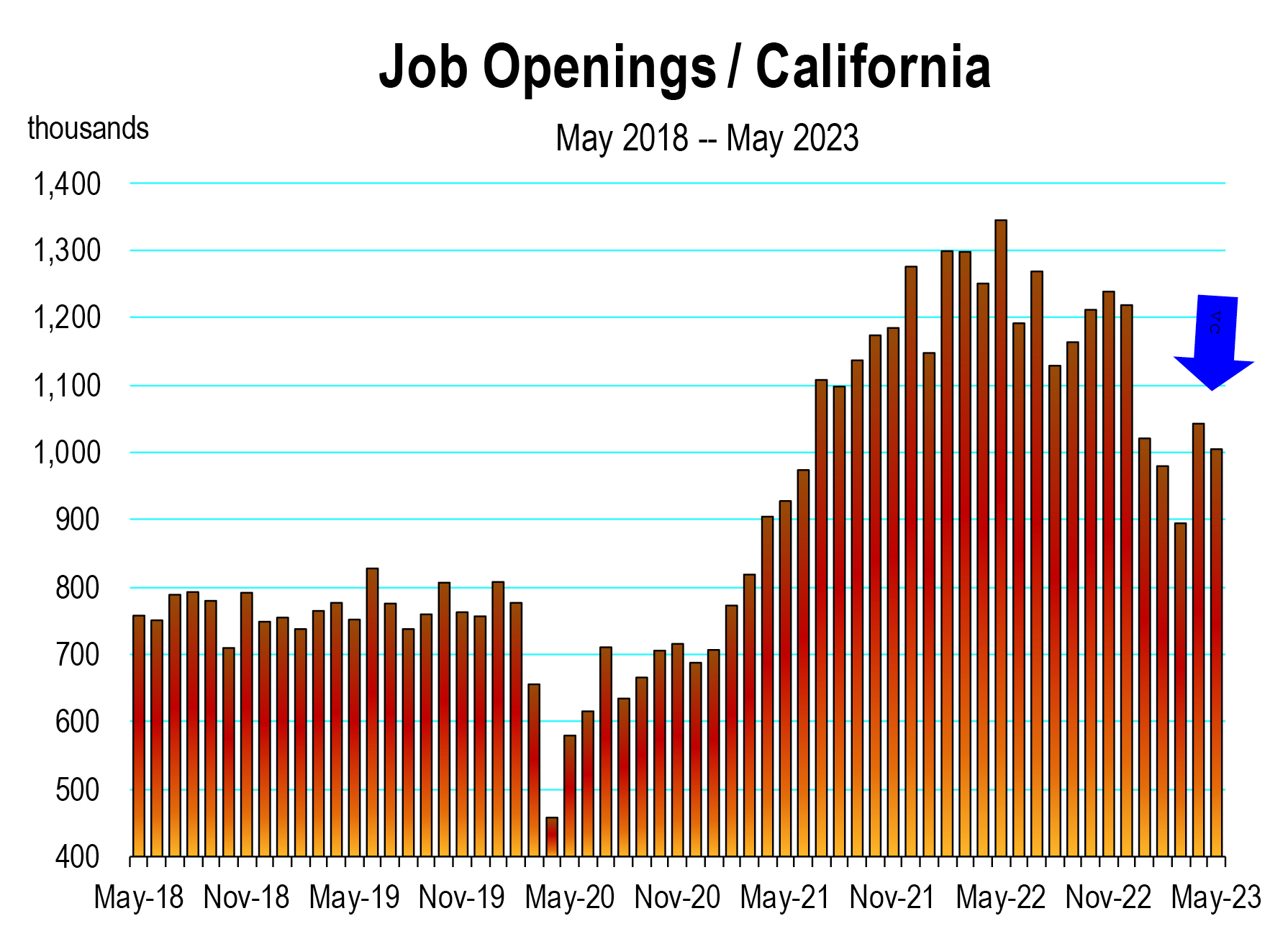

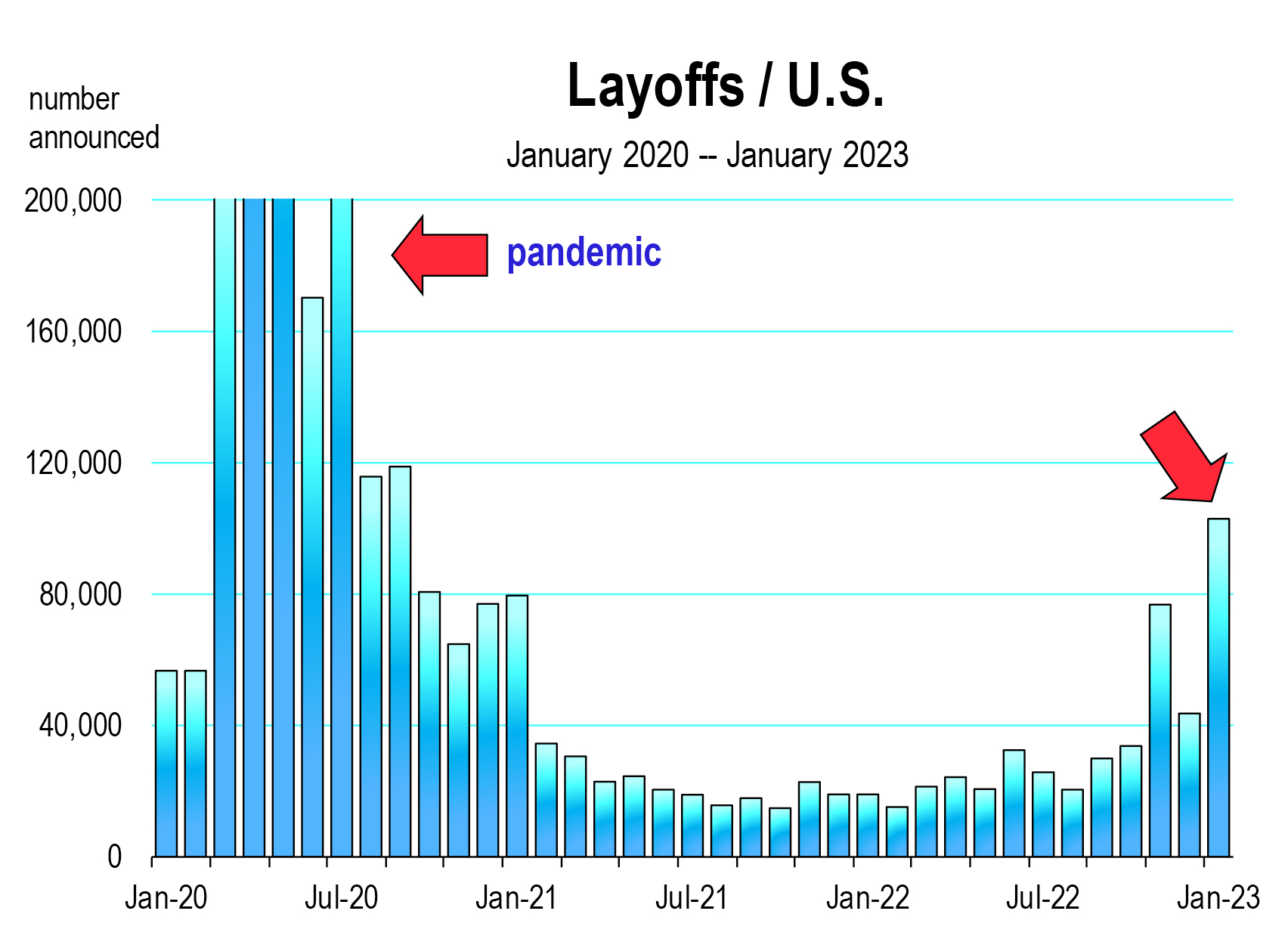

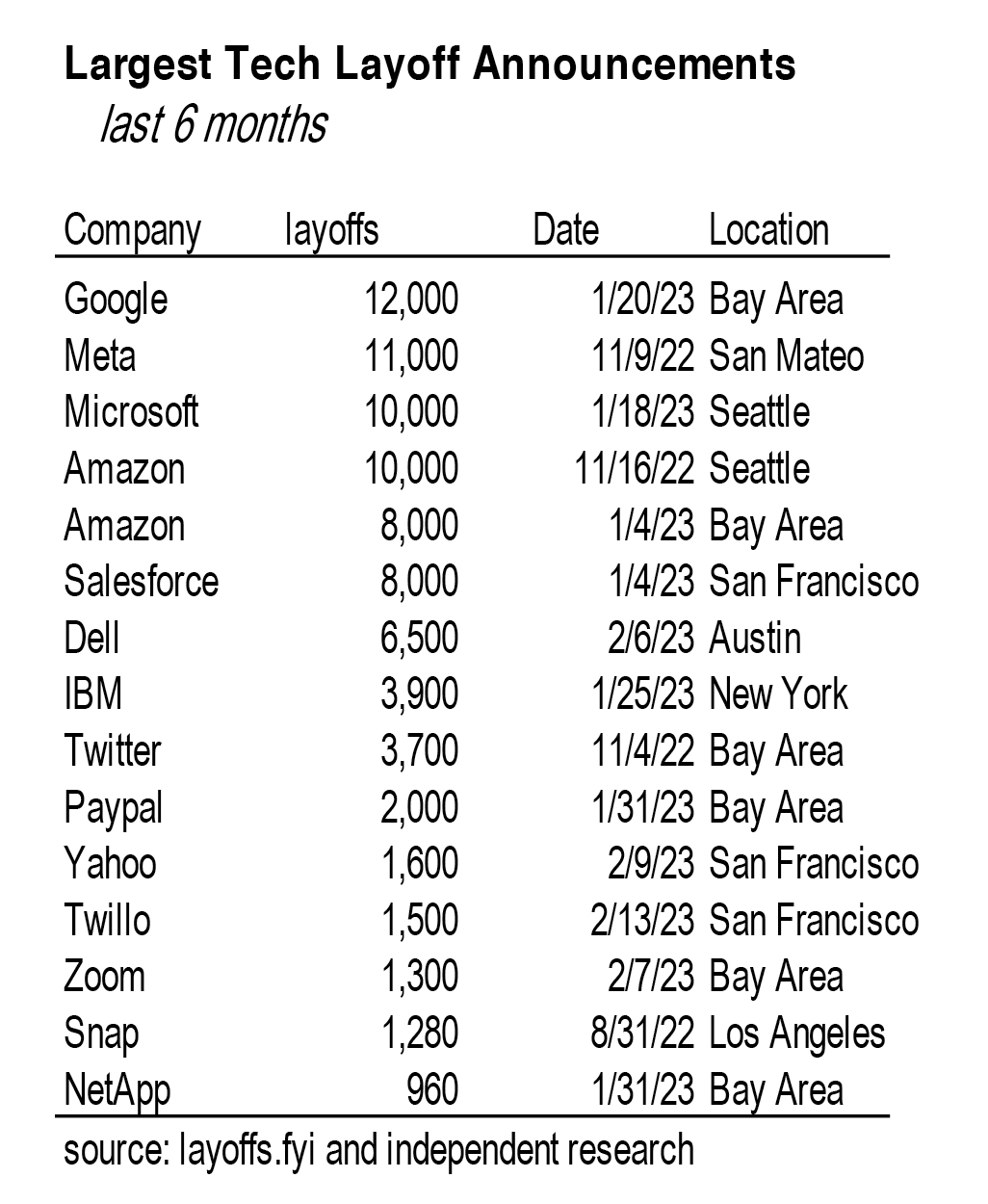

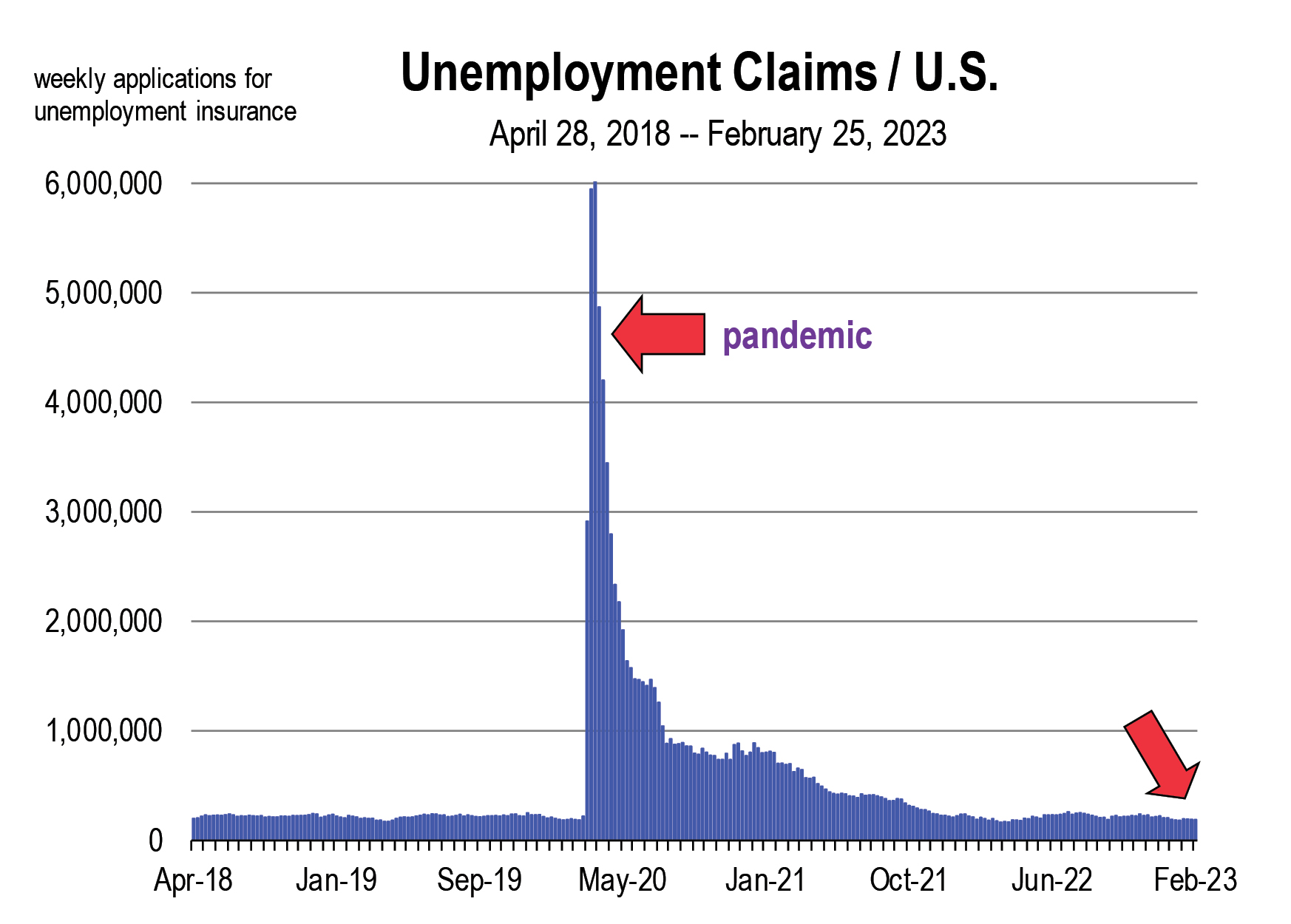

People filing for unemployment insurance claims remain very low. The unemployment rate remains at a scant 3.8 percent.

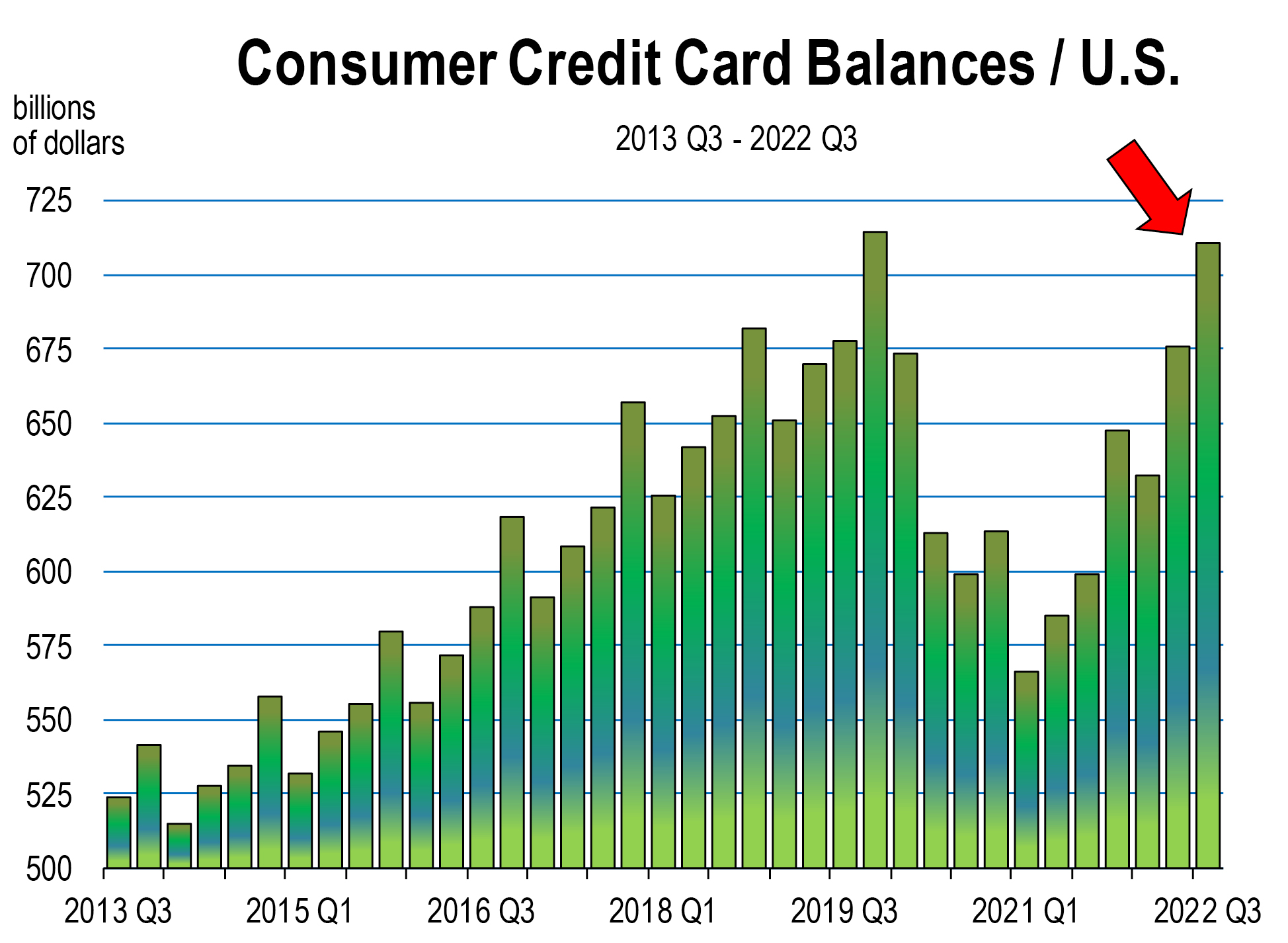

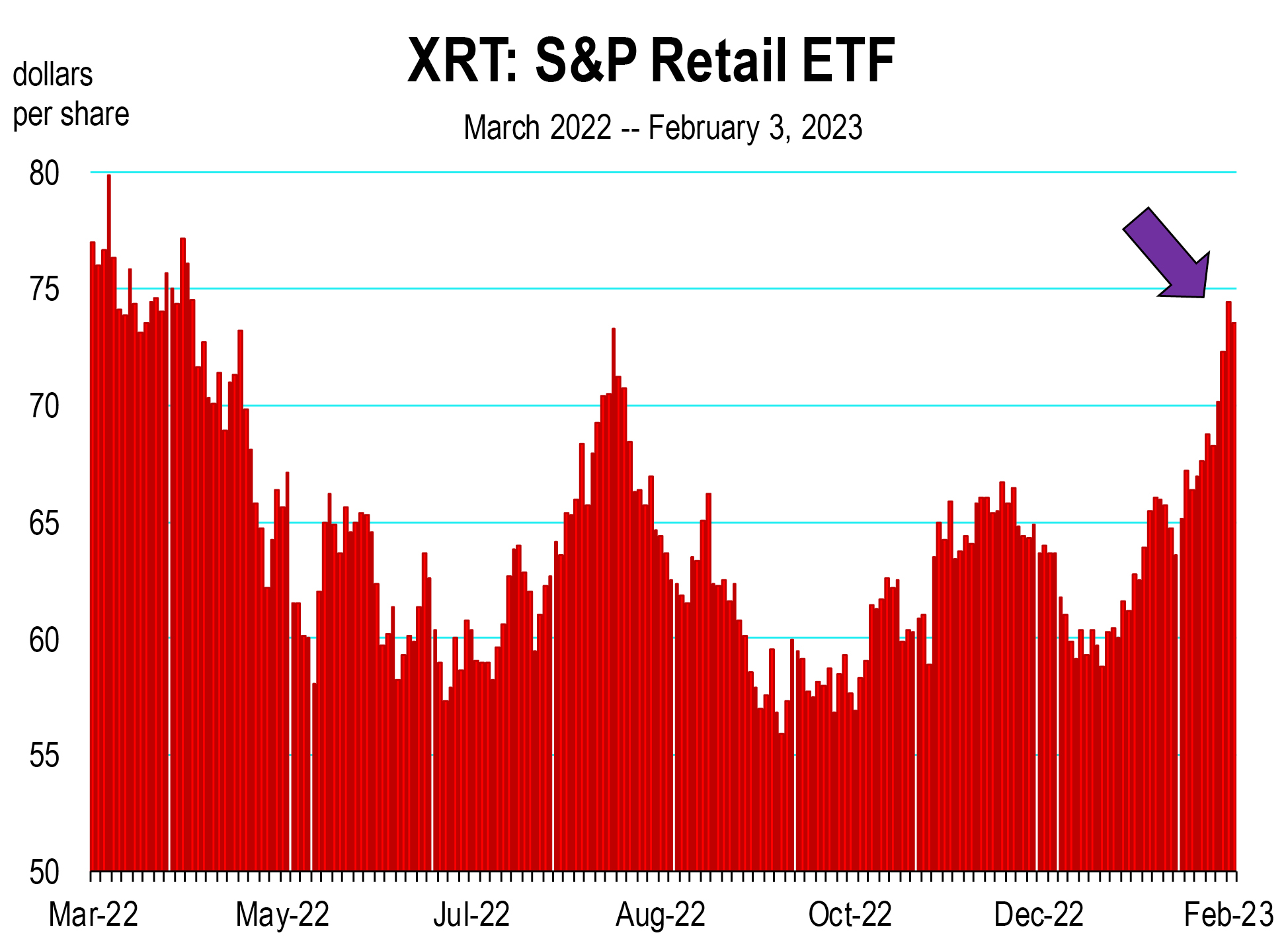

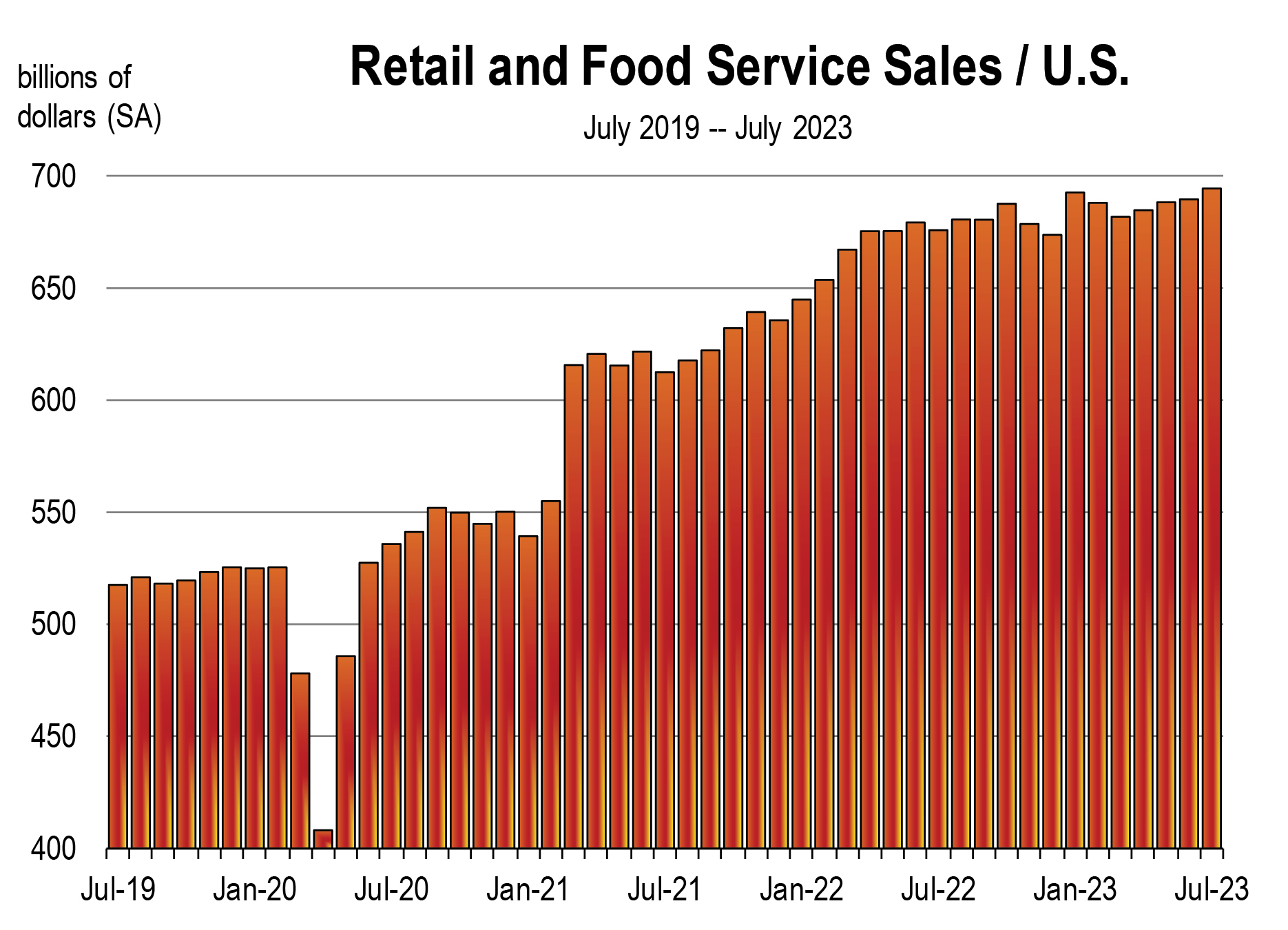

Consumer spending remains surprisingly steady. Retail sales posted their fourth consecutive month of healthy growth in July. Orders for goods in general rose sharply in June.

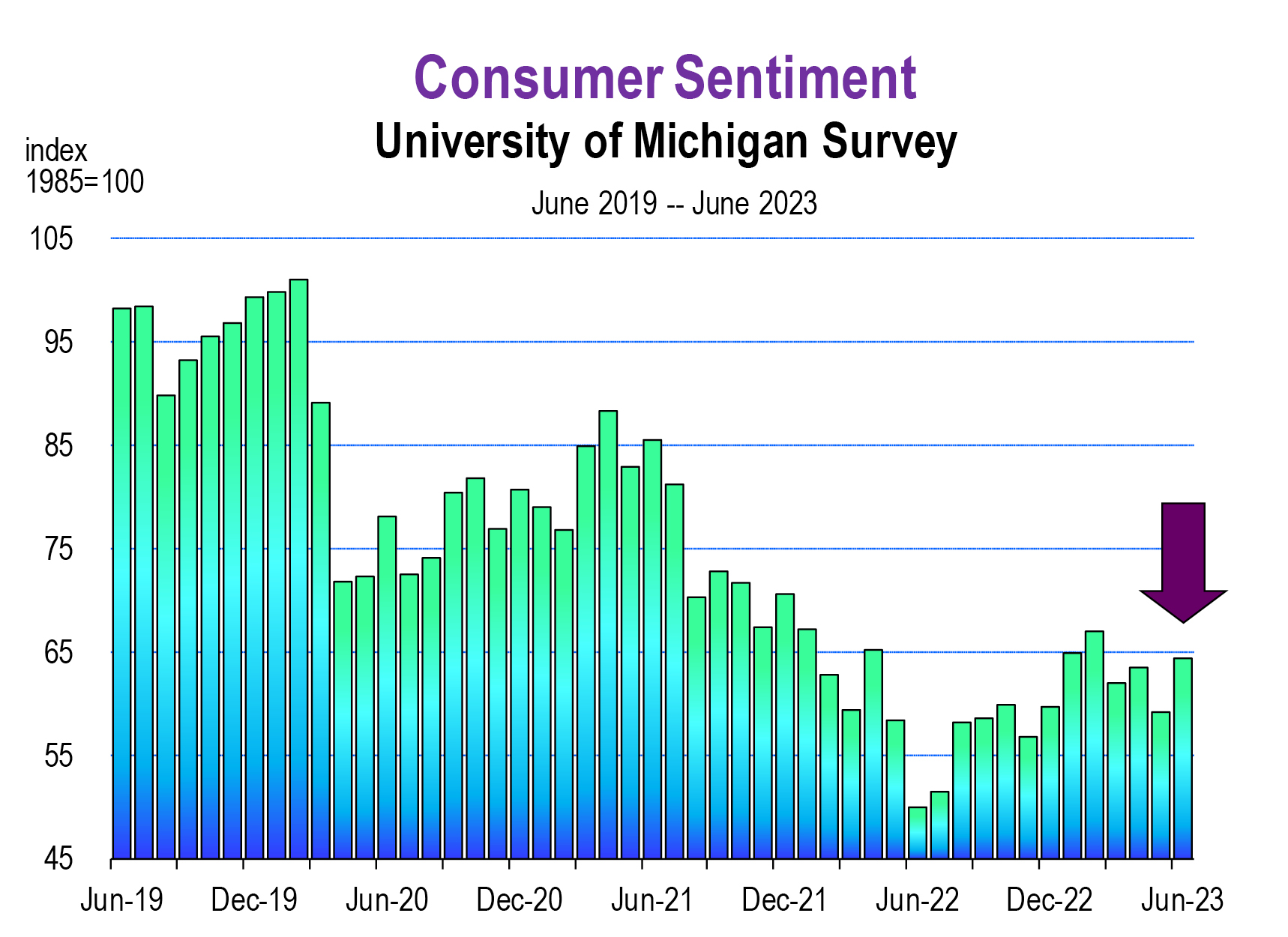

Consumer sentiment, bumping along a record low for the last several months has now meaningfully improved.

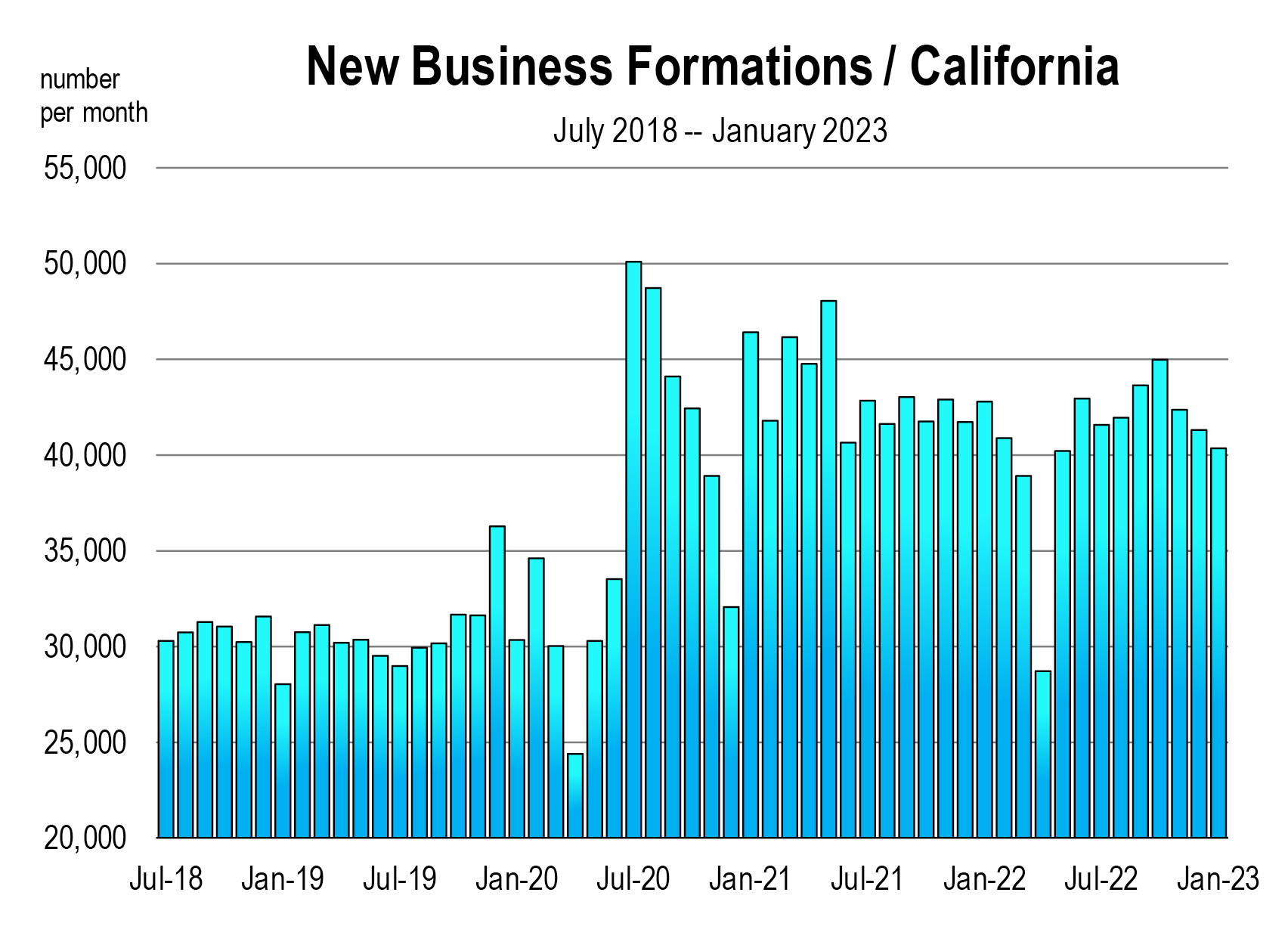

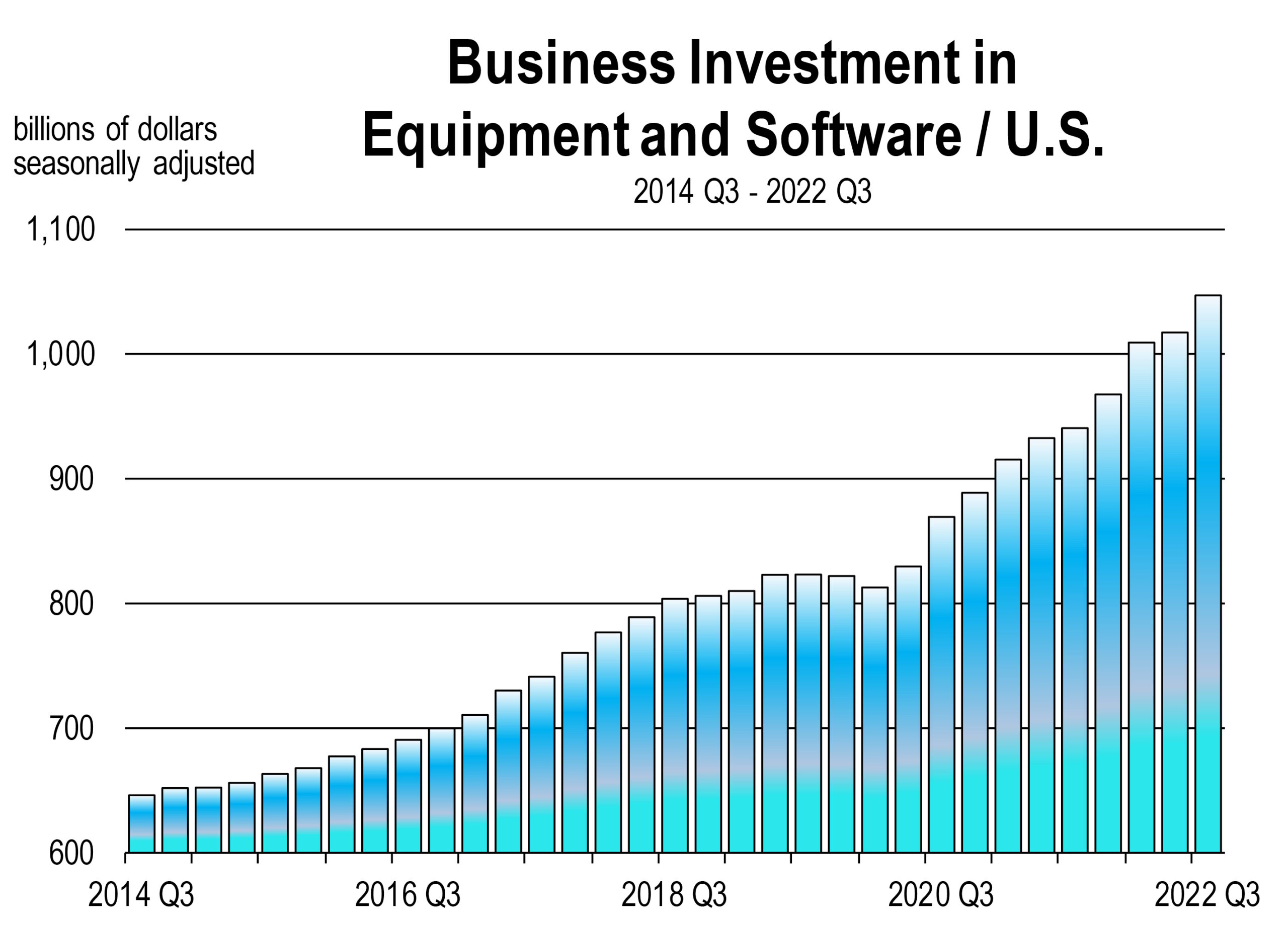

Business investment is holding up well. Boeing reported net orders of 200 new aircraft.

Non-residential investment contributed nearly a full percentage point to GDP growth last quarter and it’s still increasing this quarter.

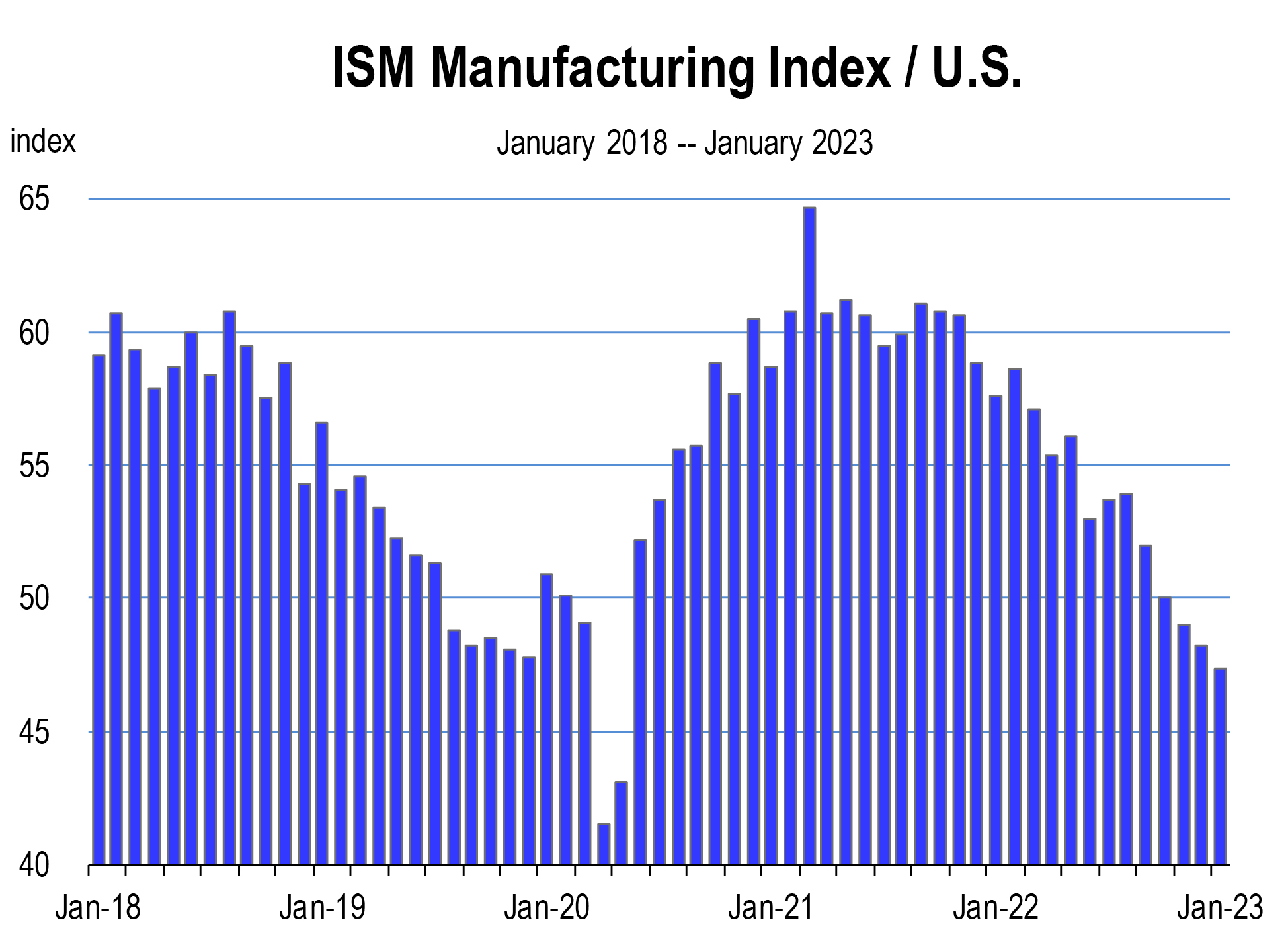

Industrial production reversed its downward trend and came in stronger than expected in July. And even manufacturing improved slightly in August.

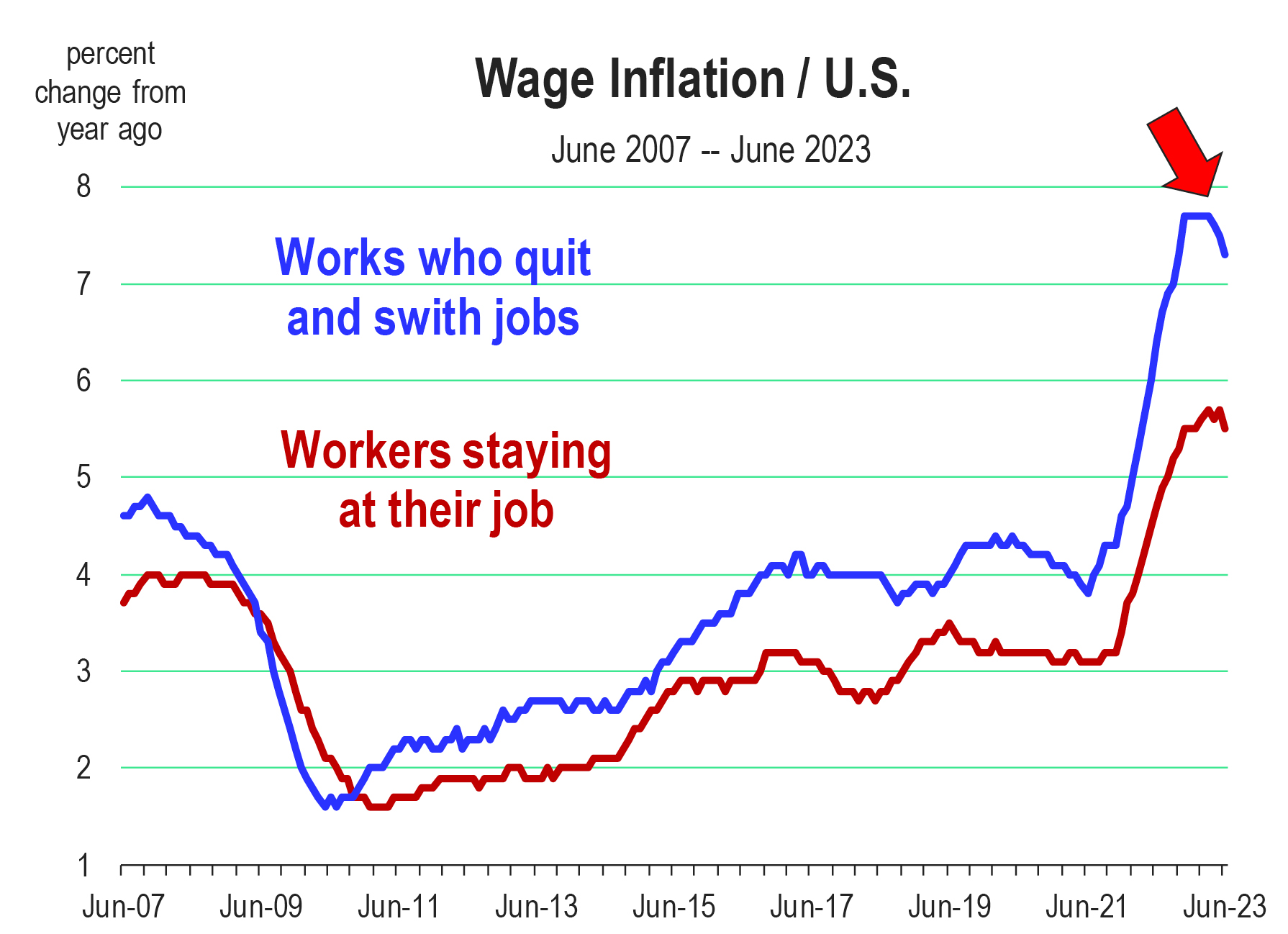

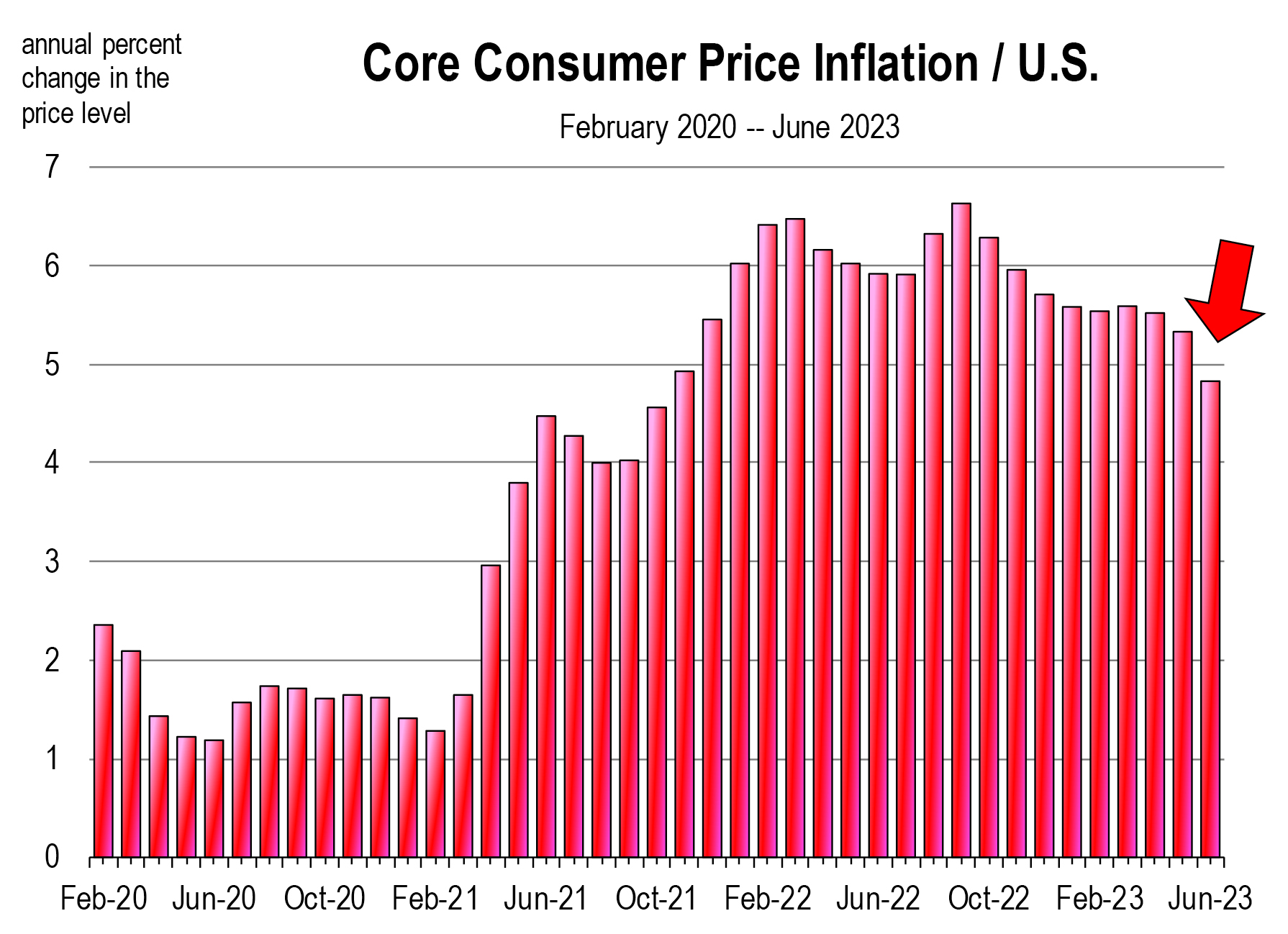

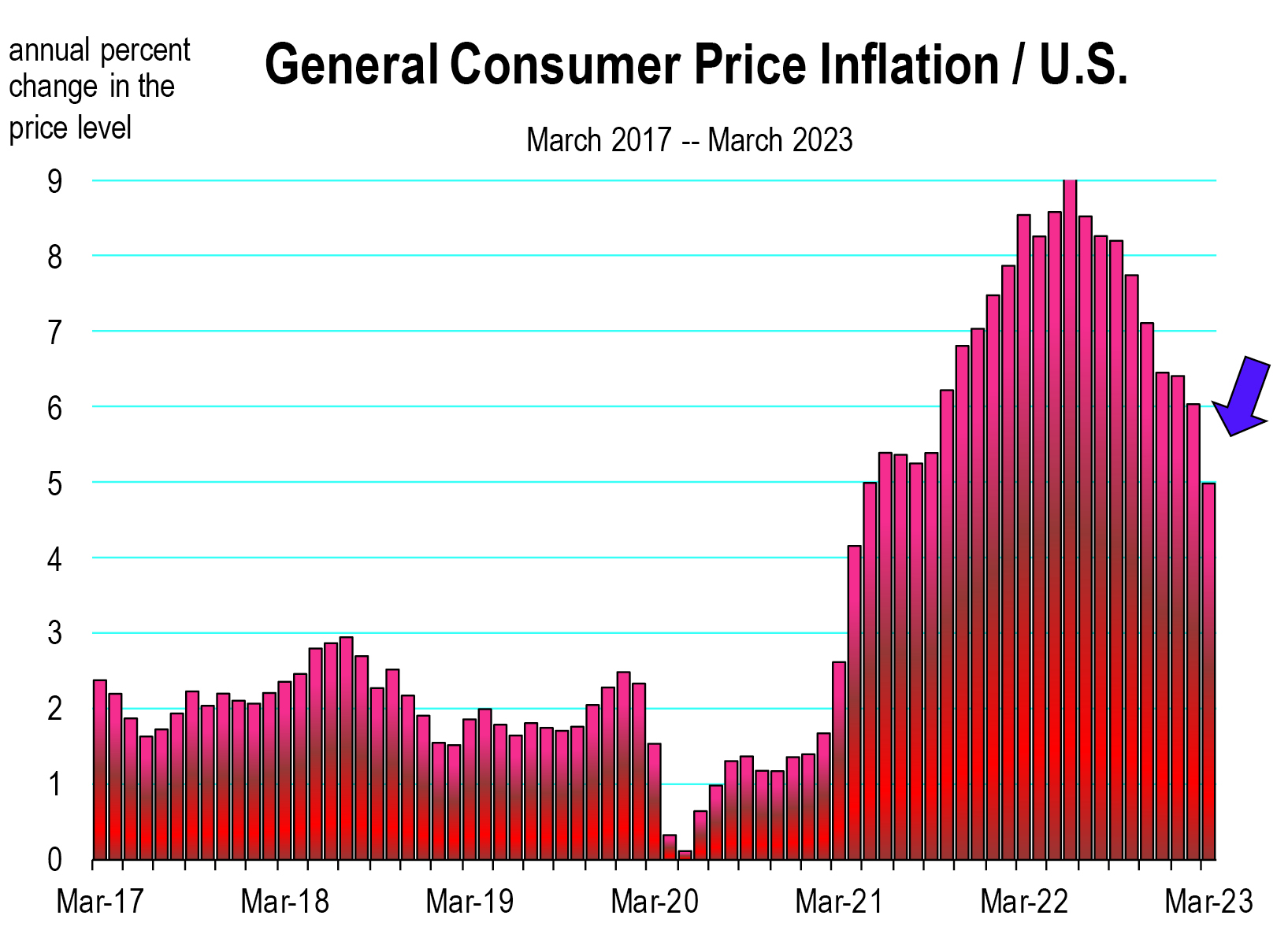

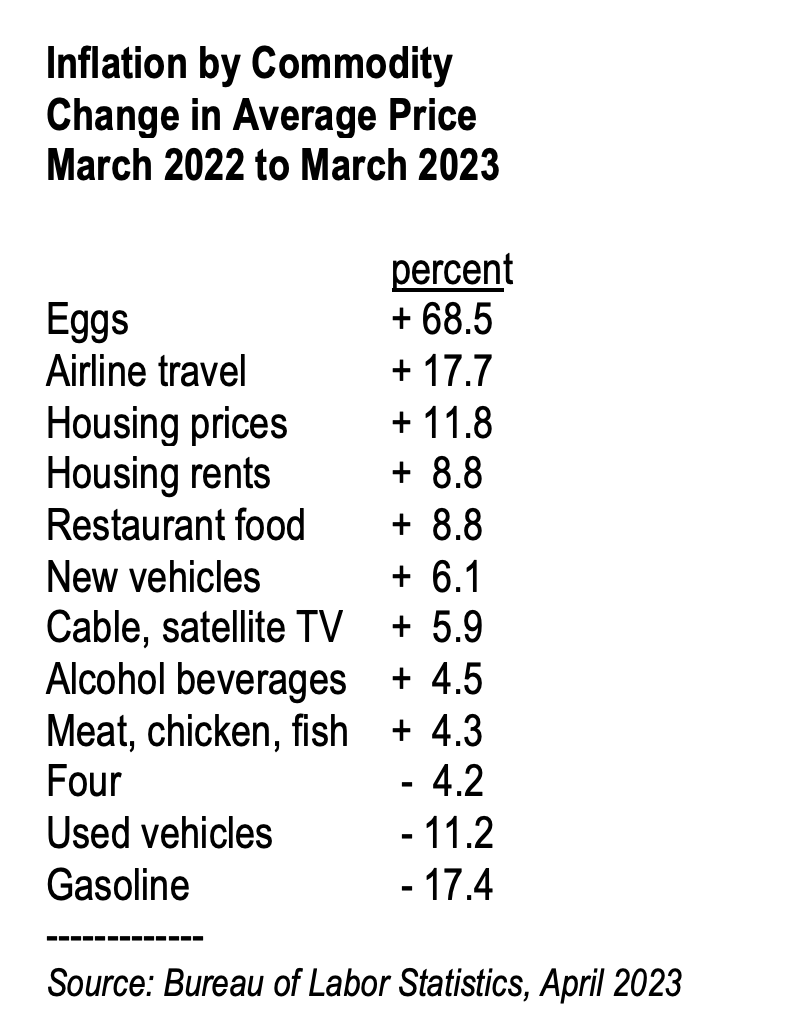

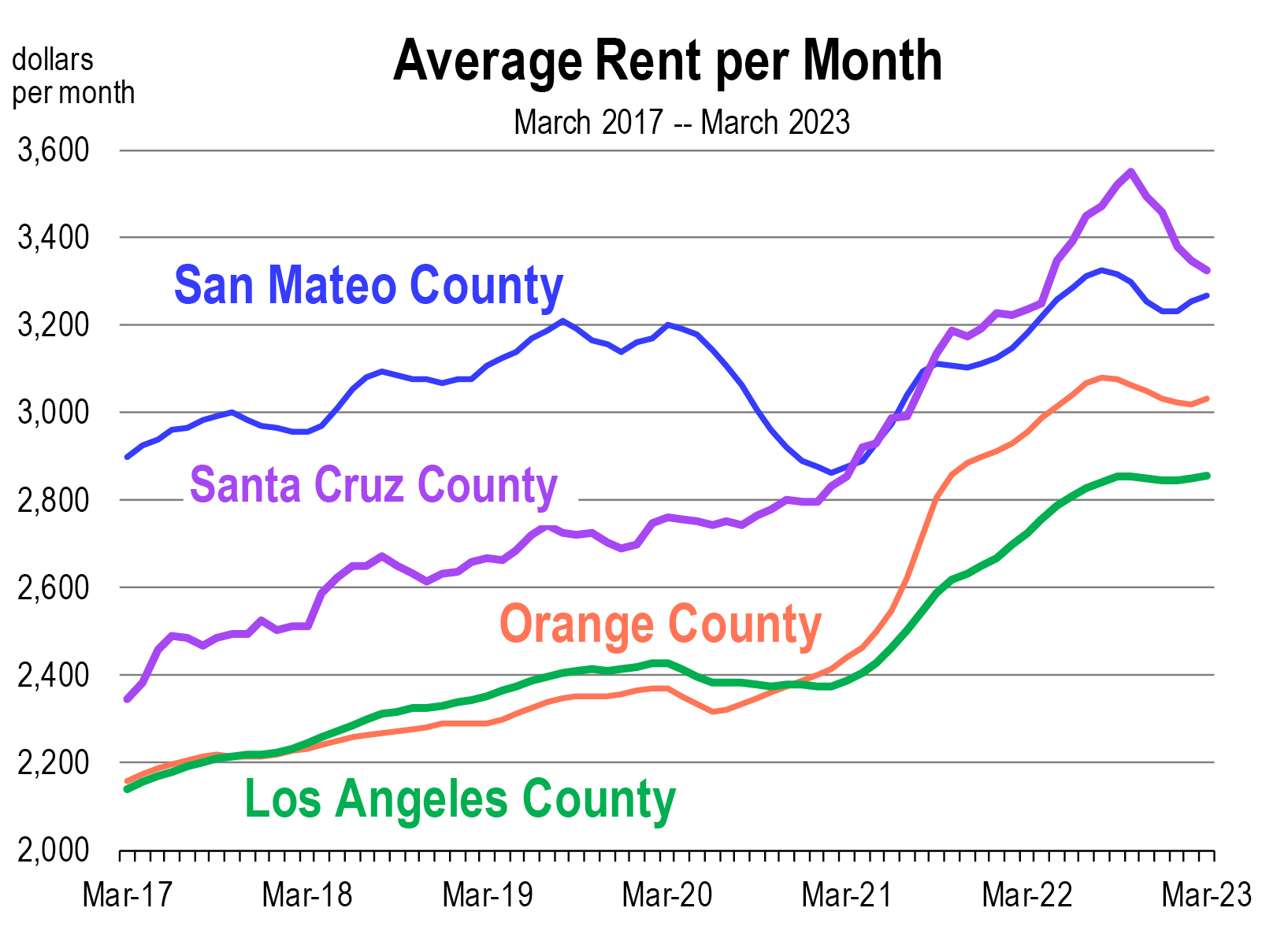

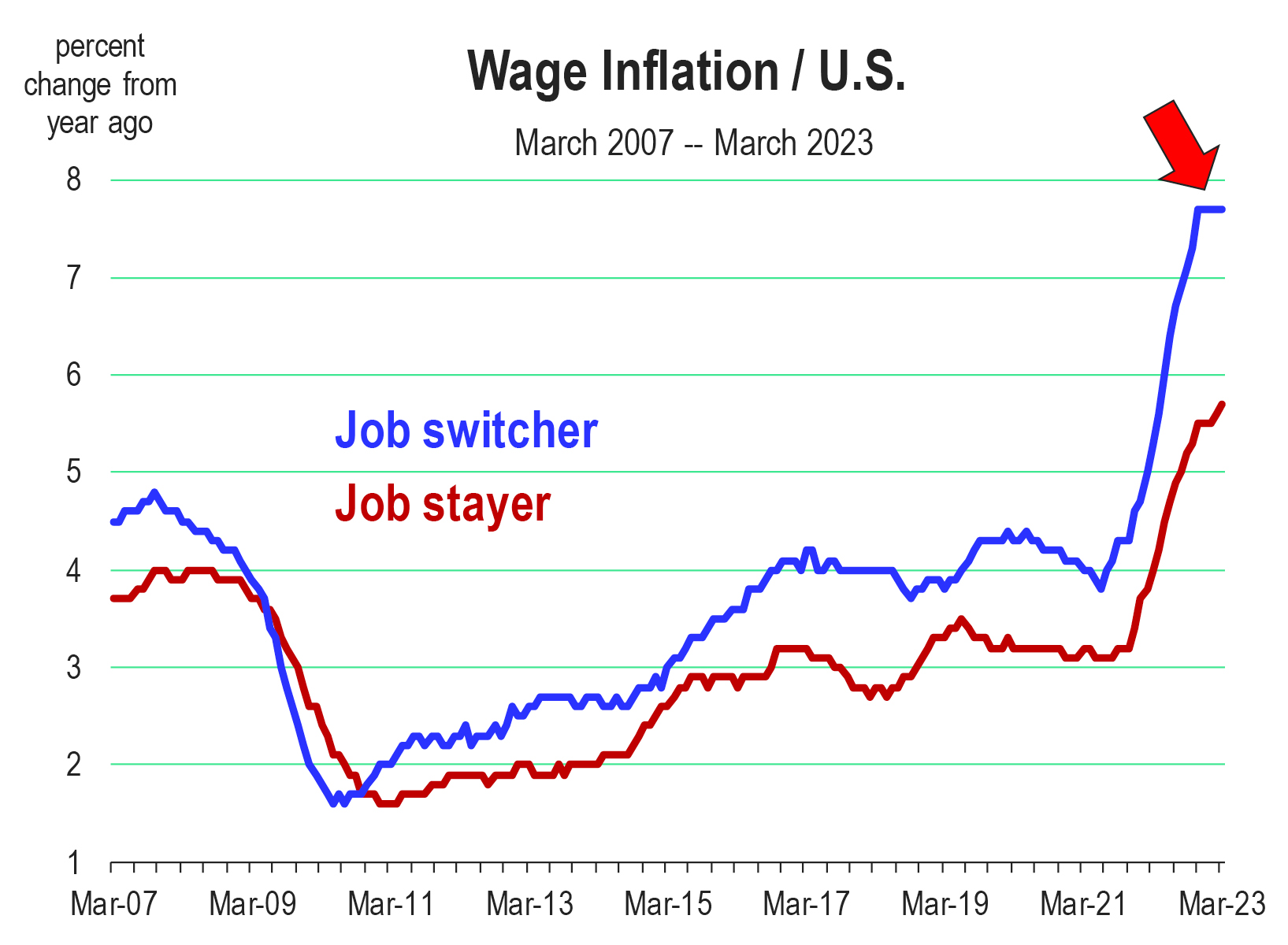

Inflation is moderating and there will be disinflation in vehicle prices and housing rents this month.

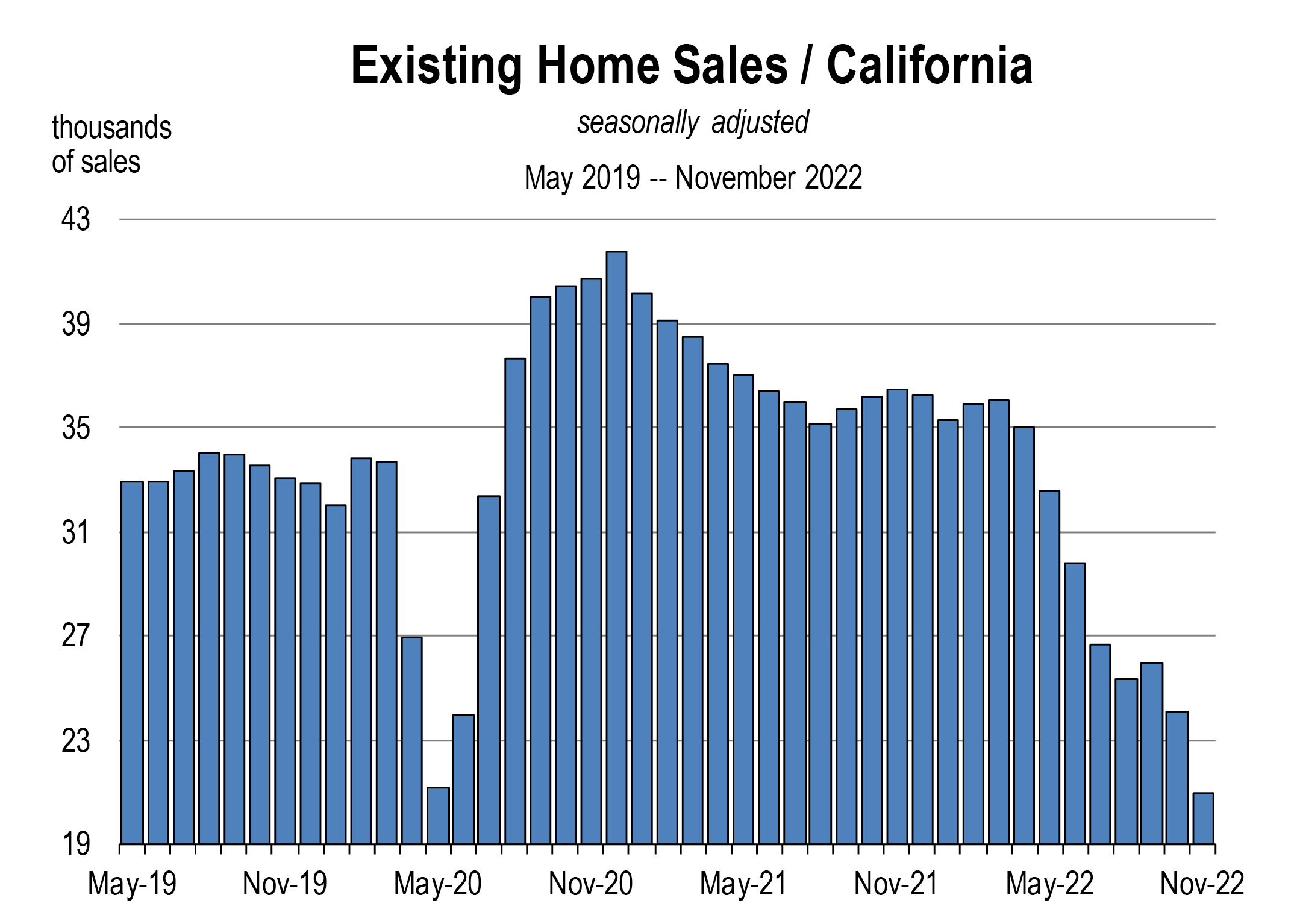

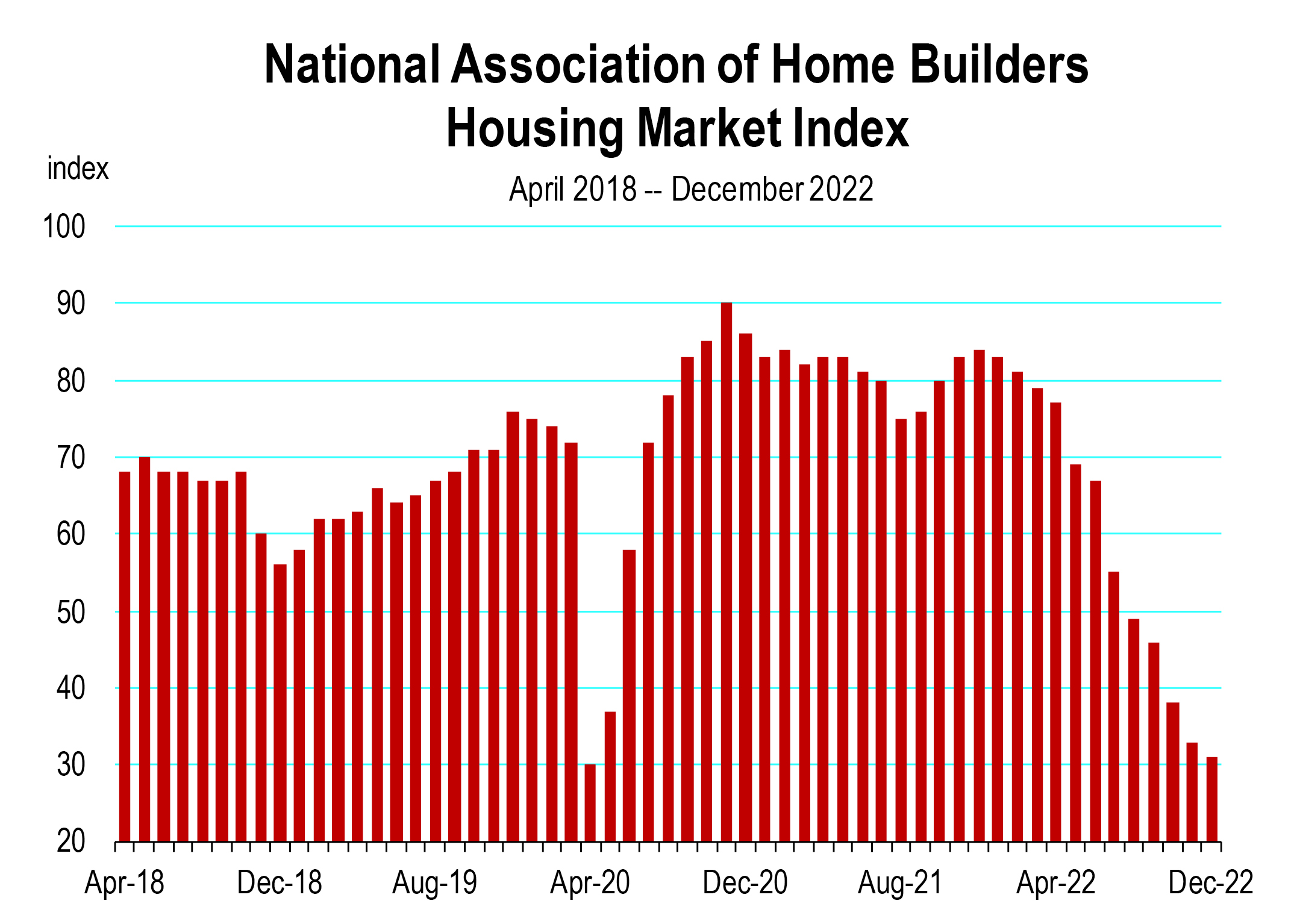

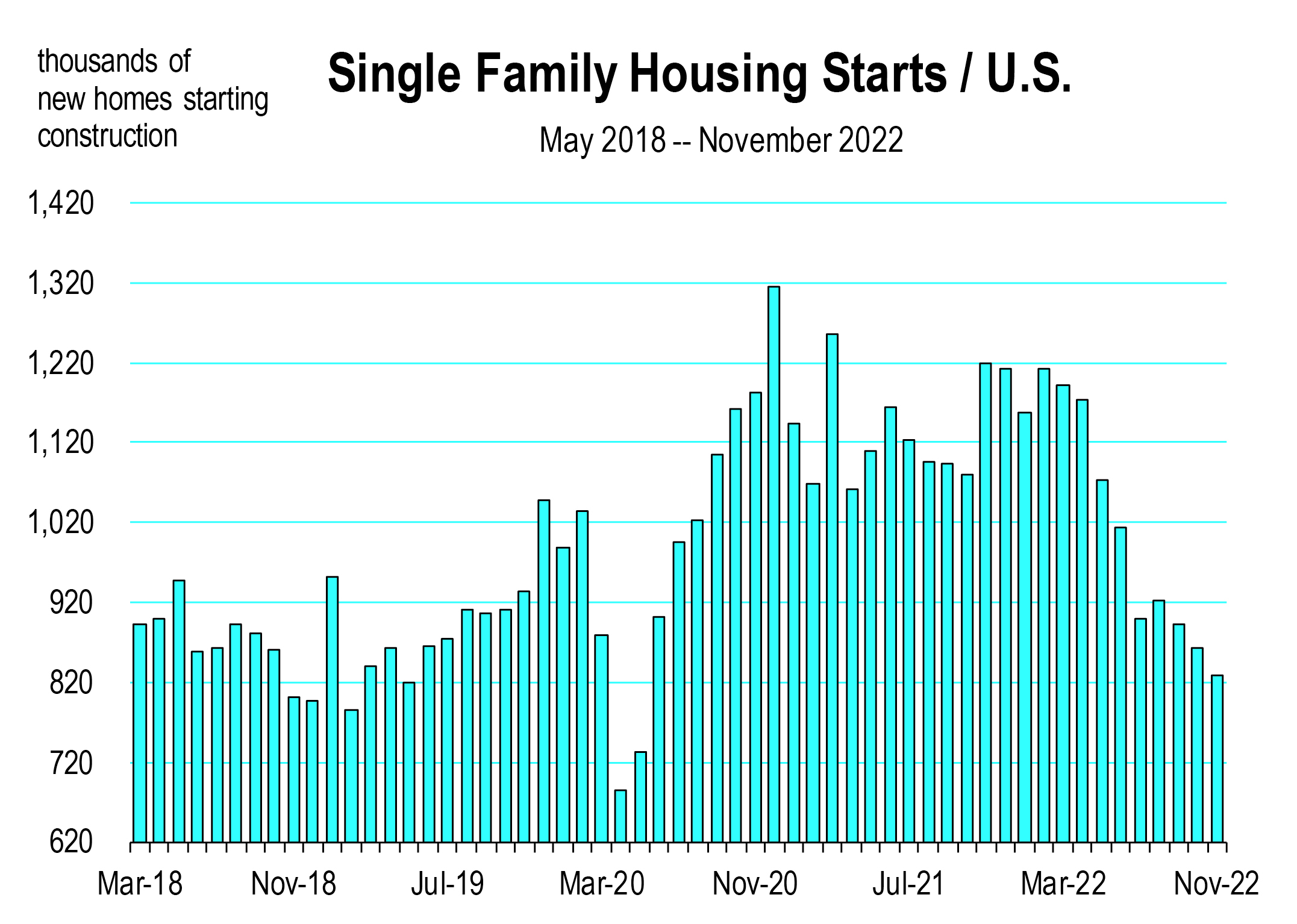

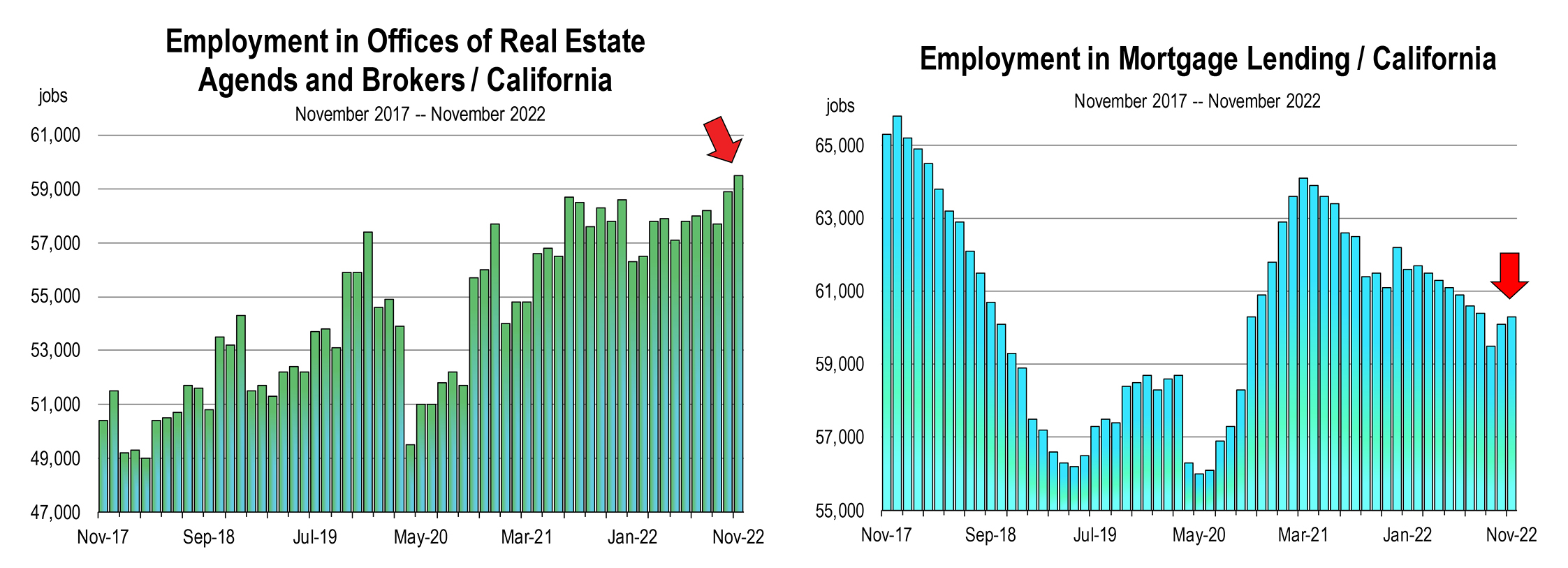

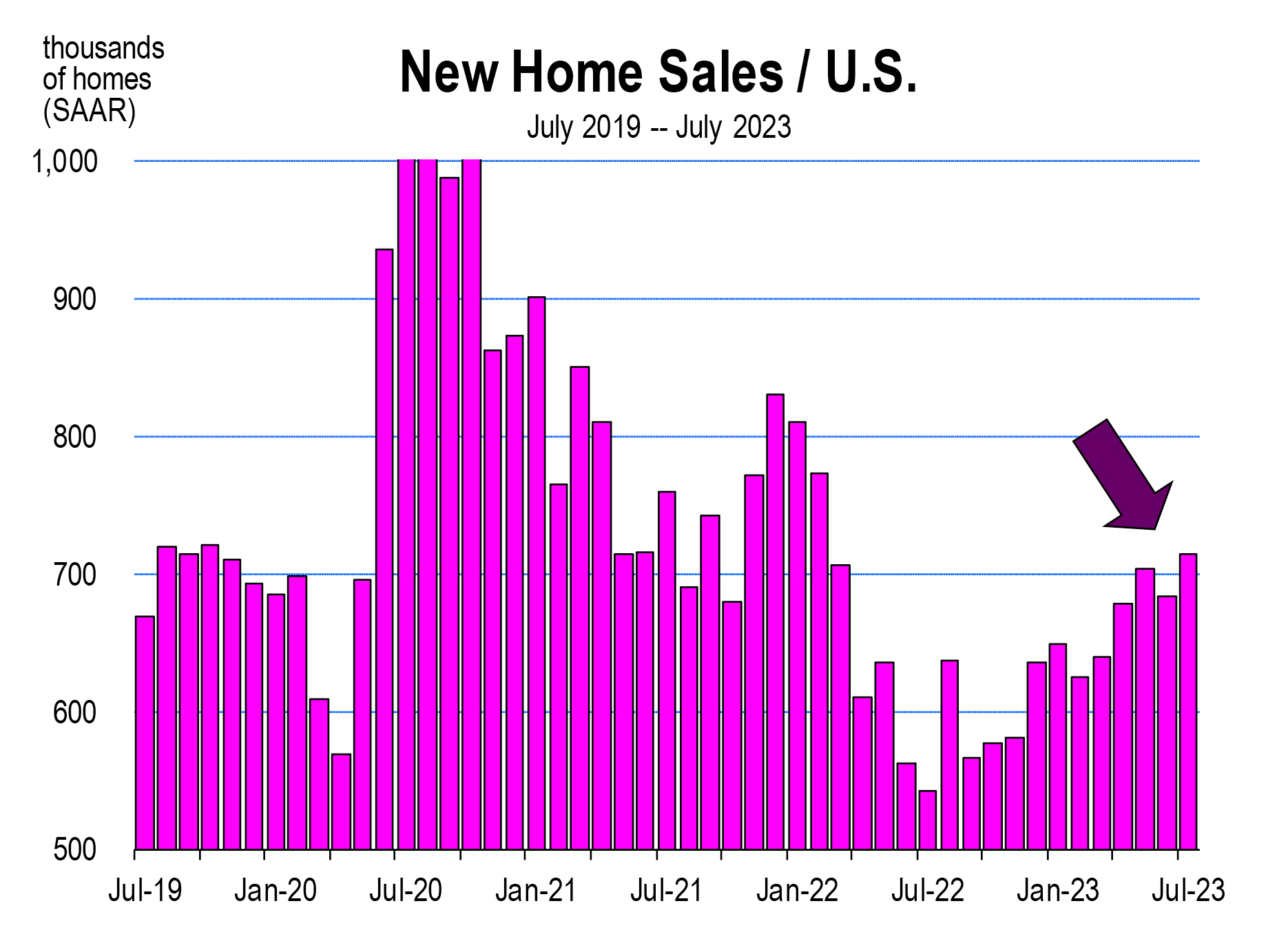

New residential construction has recently accelerated, and new home sales have increased sharply between February and July. The lack of resale inventory is pushing prospective homebuyers into the new-home market and in turn supporting demand for new construction.

Housing not out of the woods

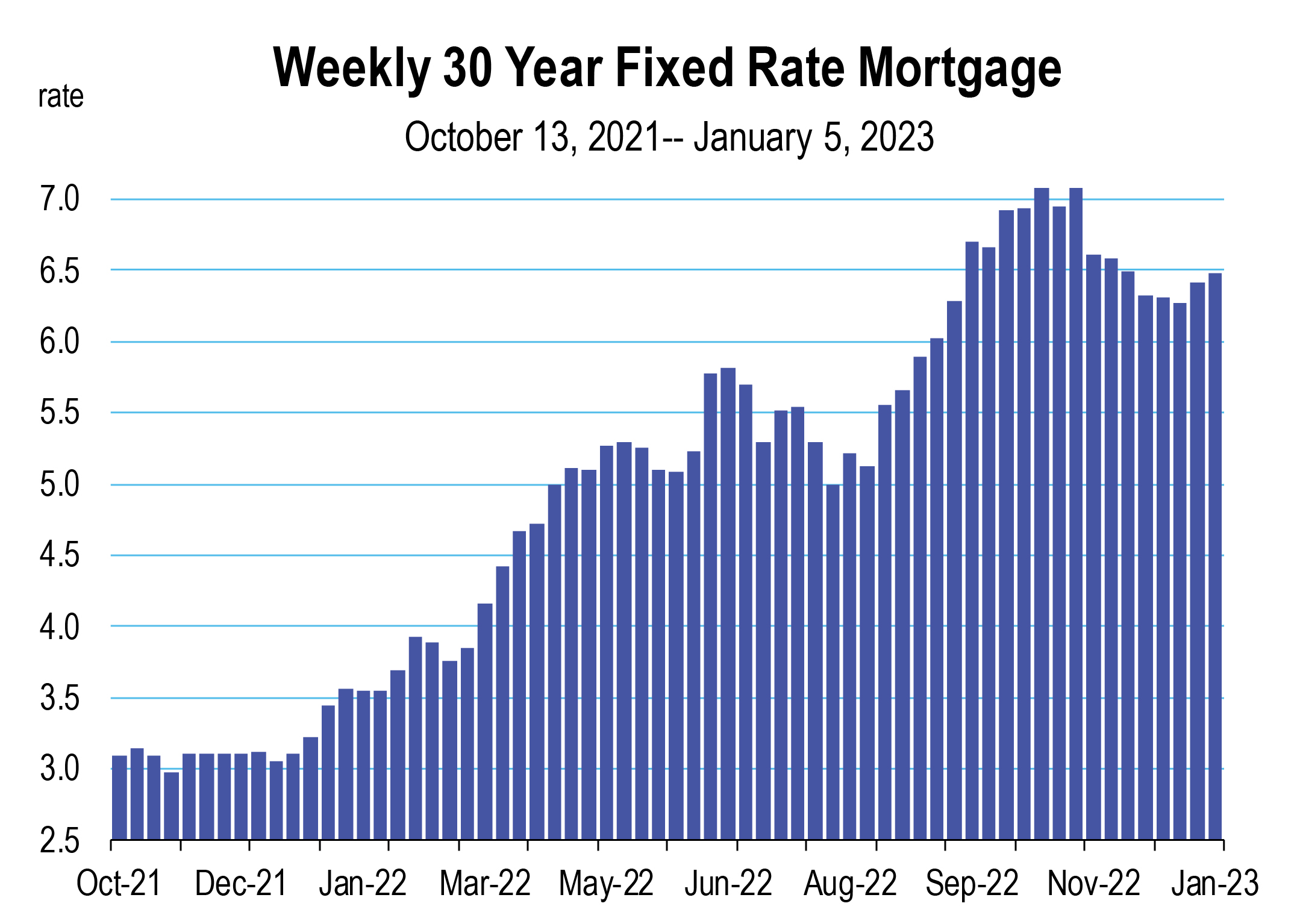

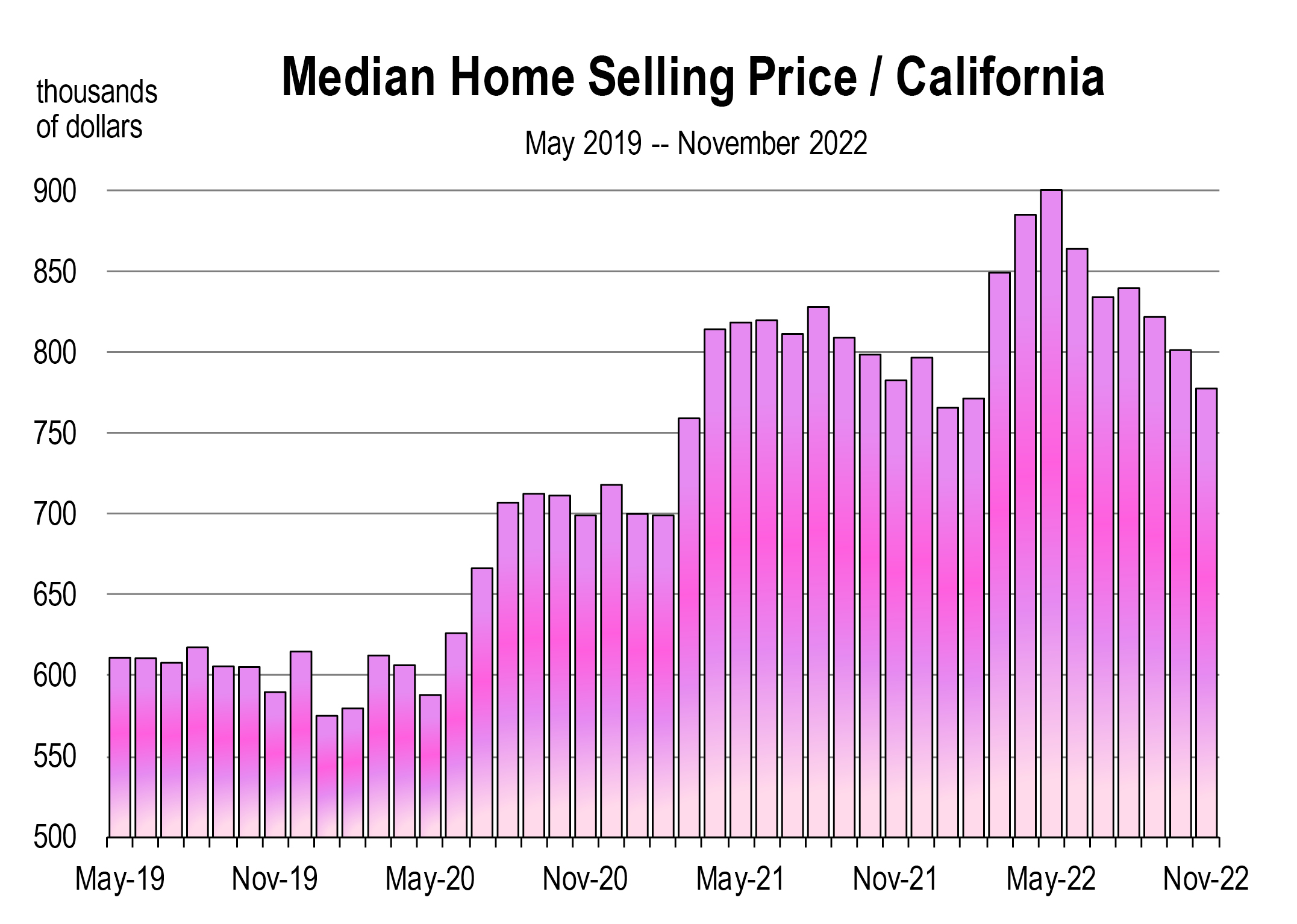

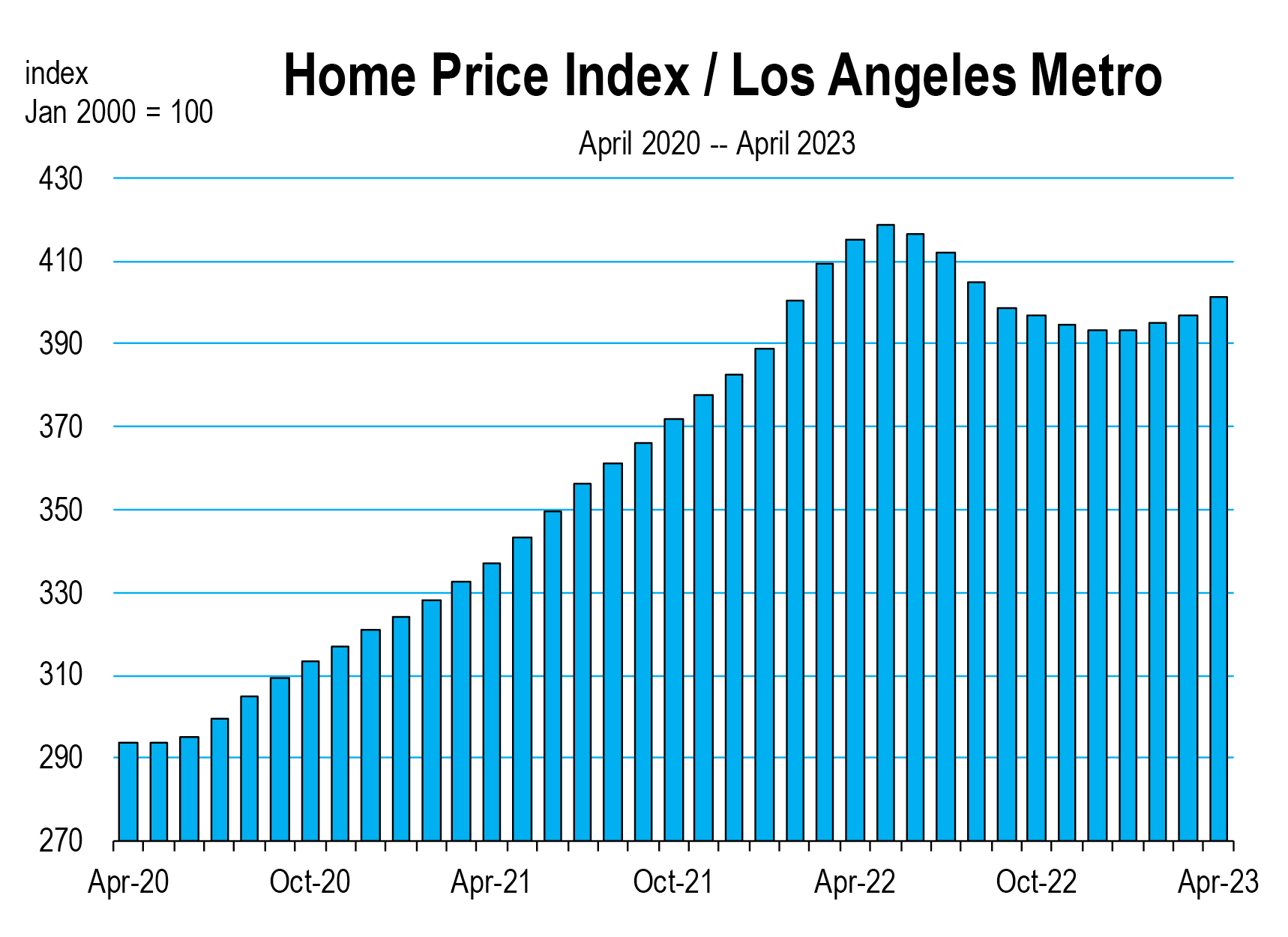

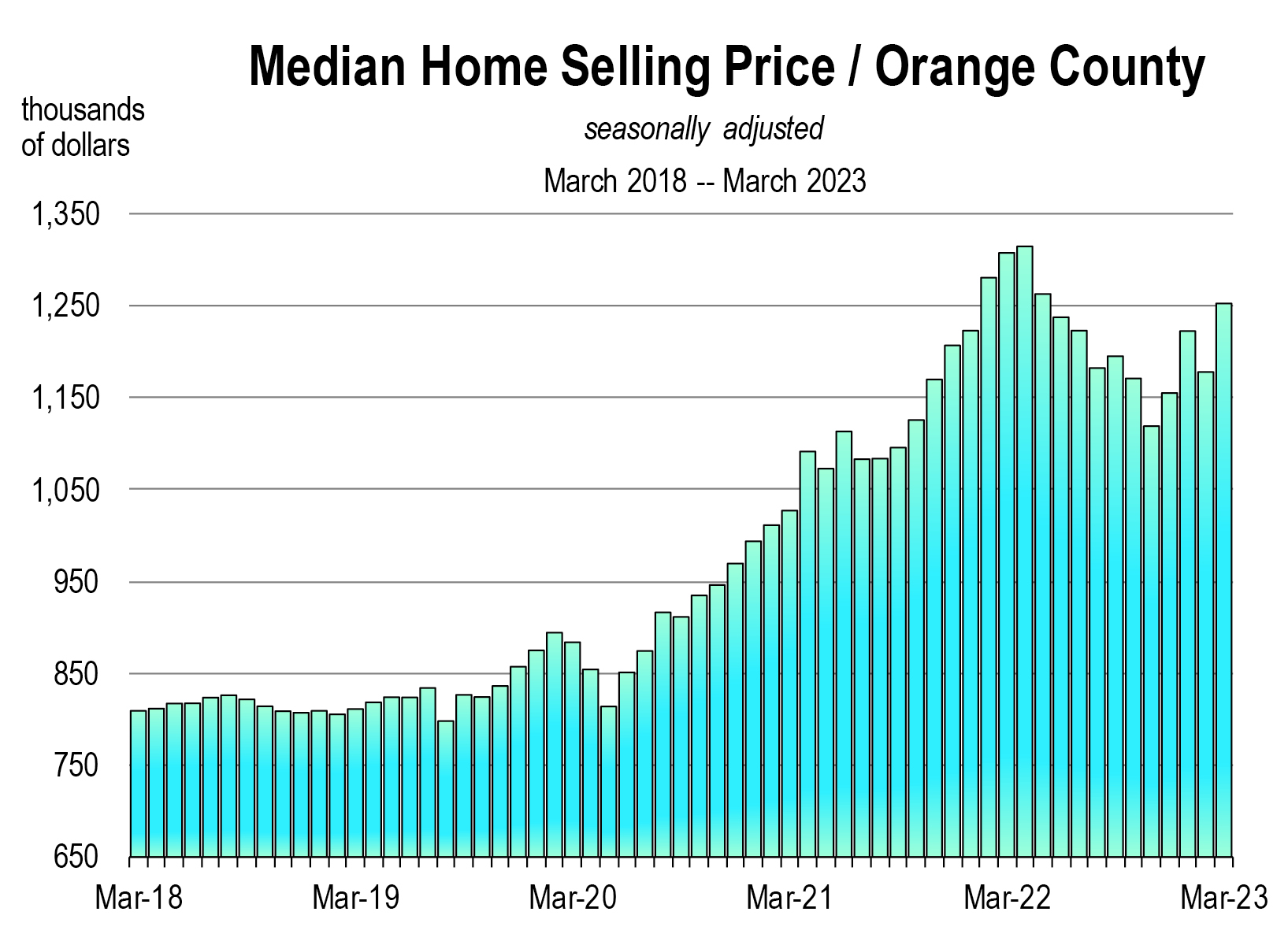

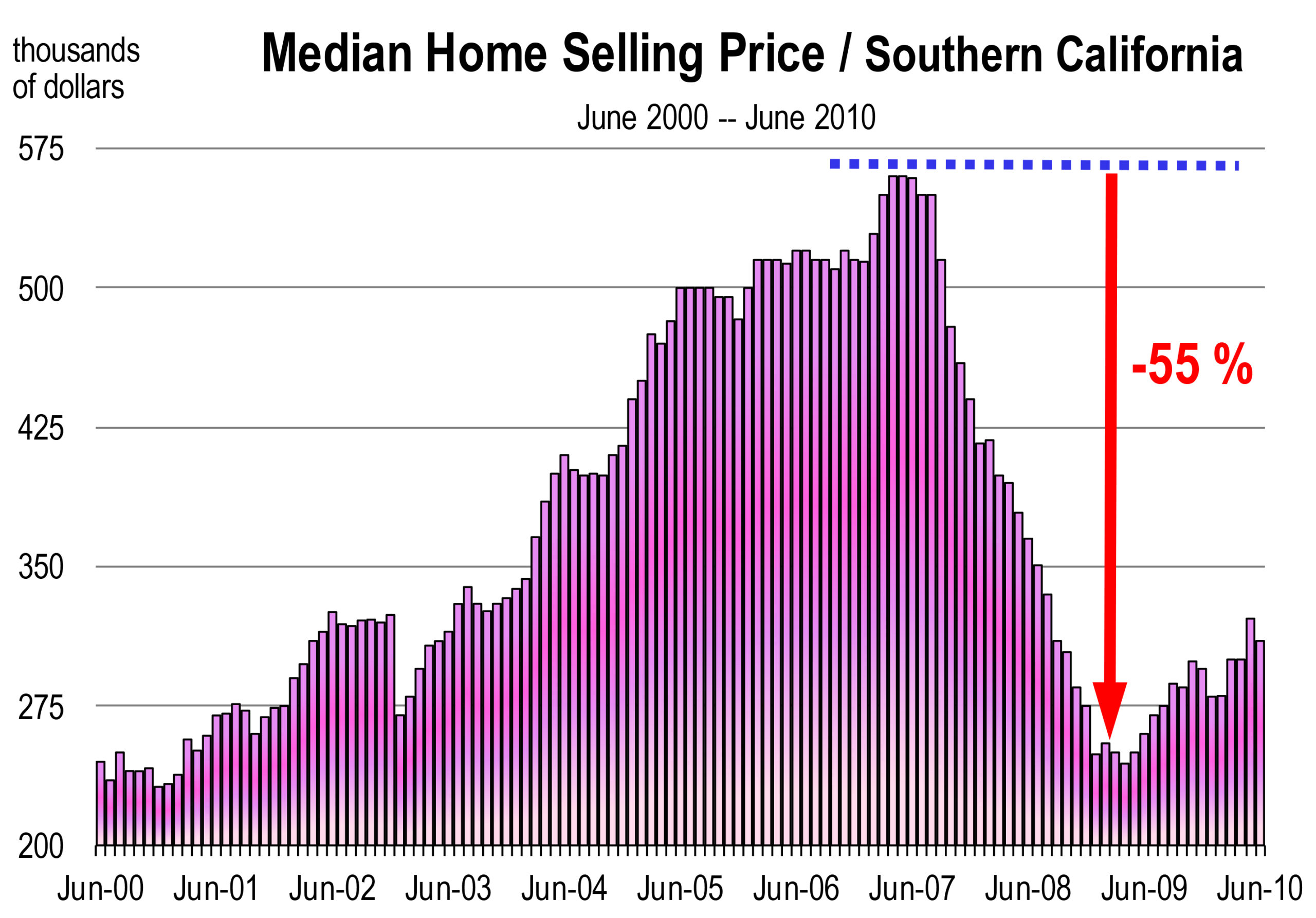

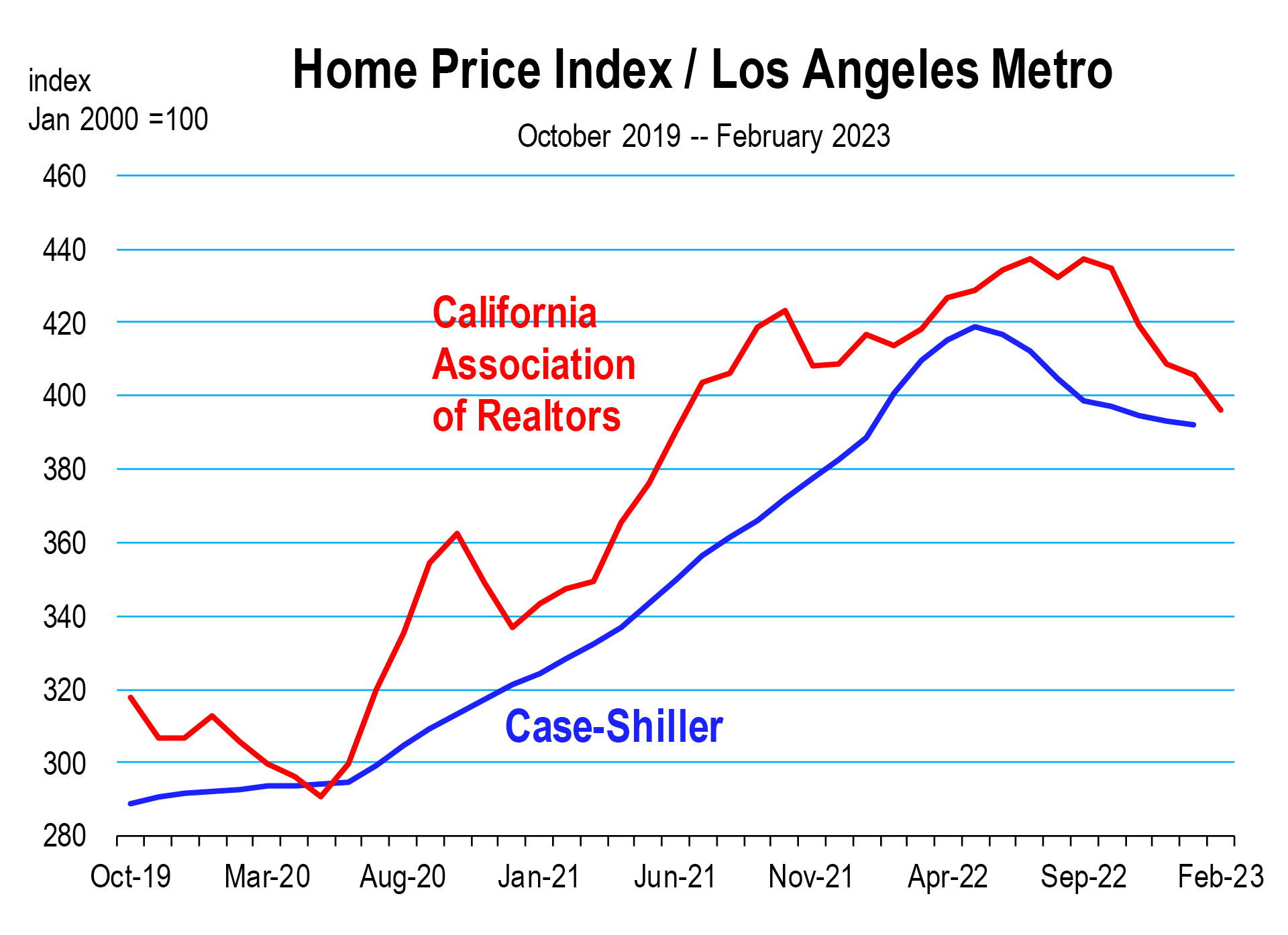

Soaring mortgage rates and rock-bottom affordability have crushed the demand for houses, but a simultaneous reduction in housing supply has supported prices.

Home prices at the national level climbed nearly a full percent in July (from June), topping their previous peak set a year ago.

We are observing rising home prices in California including the high end coastal areas. Selling values have generally risen in April, May, June, and July this year.

As a seller, we don’t think you’re out of the woods yet. With the rate on the 30-year fixed rate mortgage averaging near 7.5% over the last three weeks and a higher path of rates expected, more potential buyers will be pushed out of the market.

The housing market will descend further into correction territory due to the significant headwind posed by an unaffordable and overvalued housing market. Prices are currently inflated relative to what economic fundamentals have supported historically. If demand does weaken as expected, prices should be pulled back toward their fundamental values. The outlook expects prices to decline about 5 percent over the next two years. The correction will be less noticeable in severely supply constrained areas.

Wake me up when September ends (a song by Green Day)

Because that’s when I’ll know the current estimates of growth are real. The economy has proven to be much more robust and resilient than anyone thought this year. The growth estimates are more believable as we see momentum building. While some headwinds still exist, they are fading in many important sectors of economic growth.

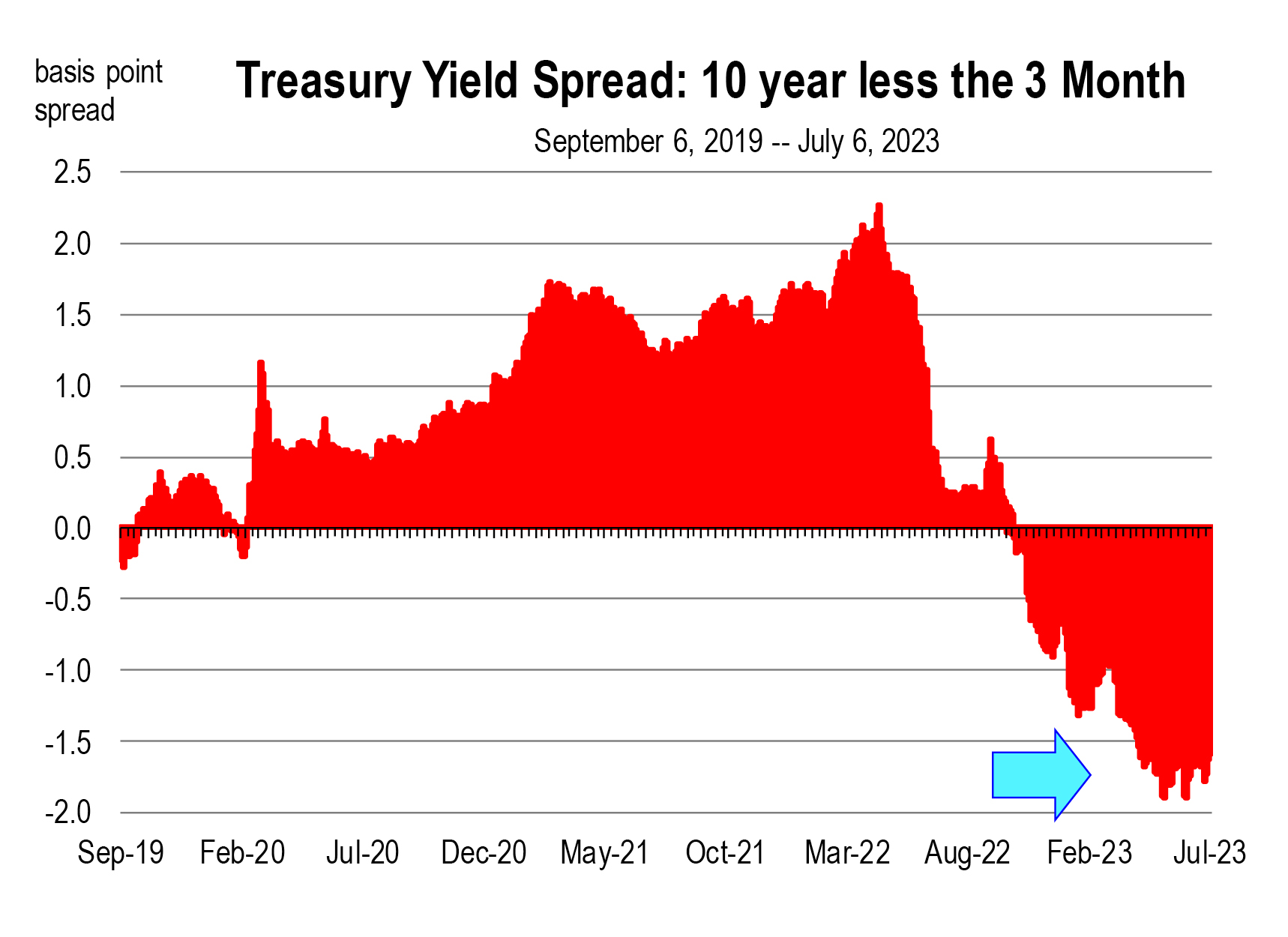

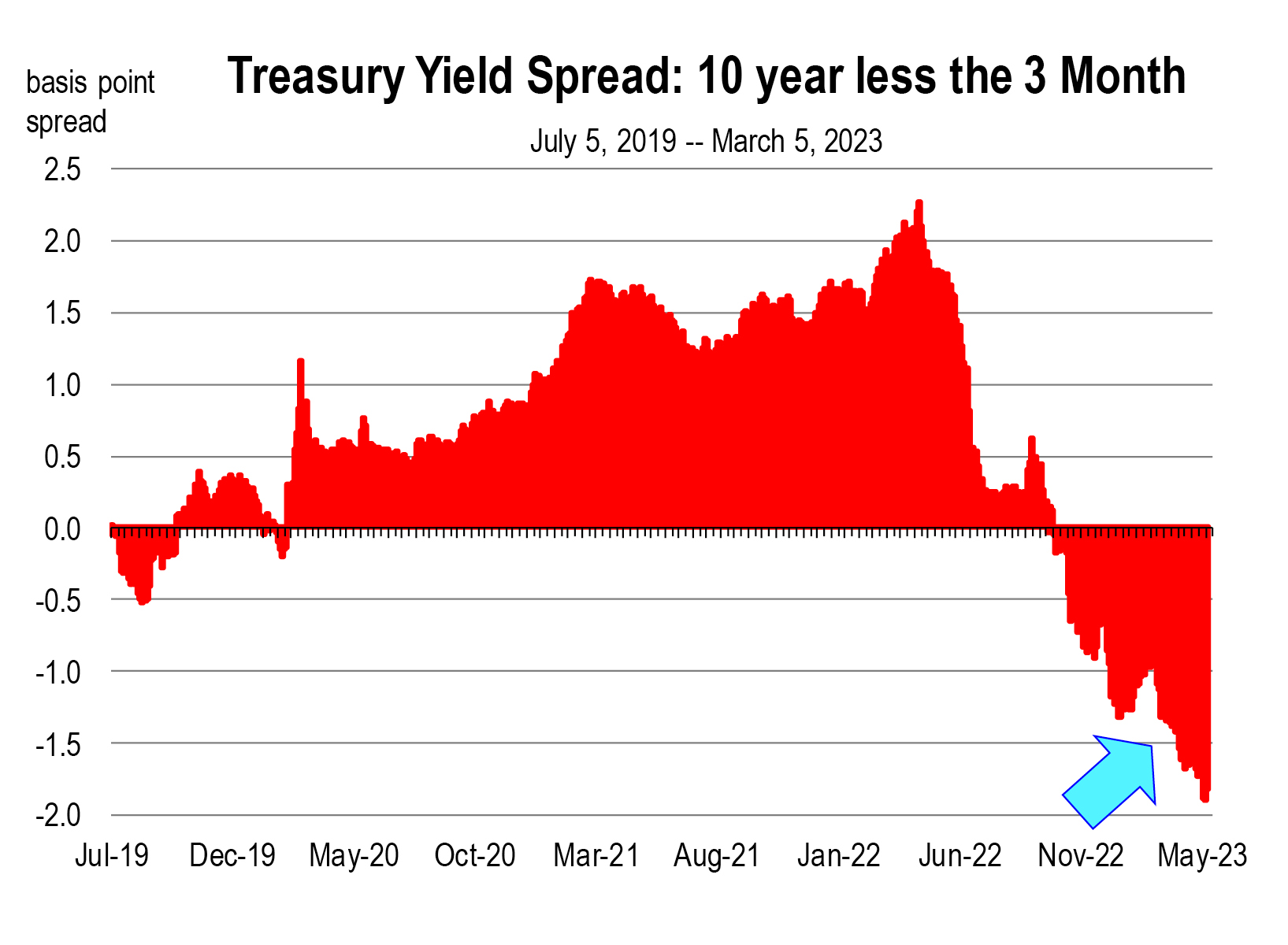

The most aggressive Fed tightening in 40 years hasn’t delivered a recession punch to the economy and it appears it just might not. If inflation continues to improve and growth remains steady, we may not see any further rate increases and that will bury the final fears of recession in 2023.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

However

However