Mark Schniepp

May 2023

Where We Are Now

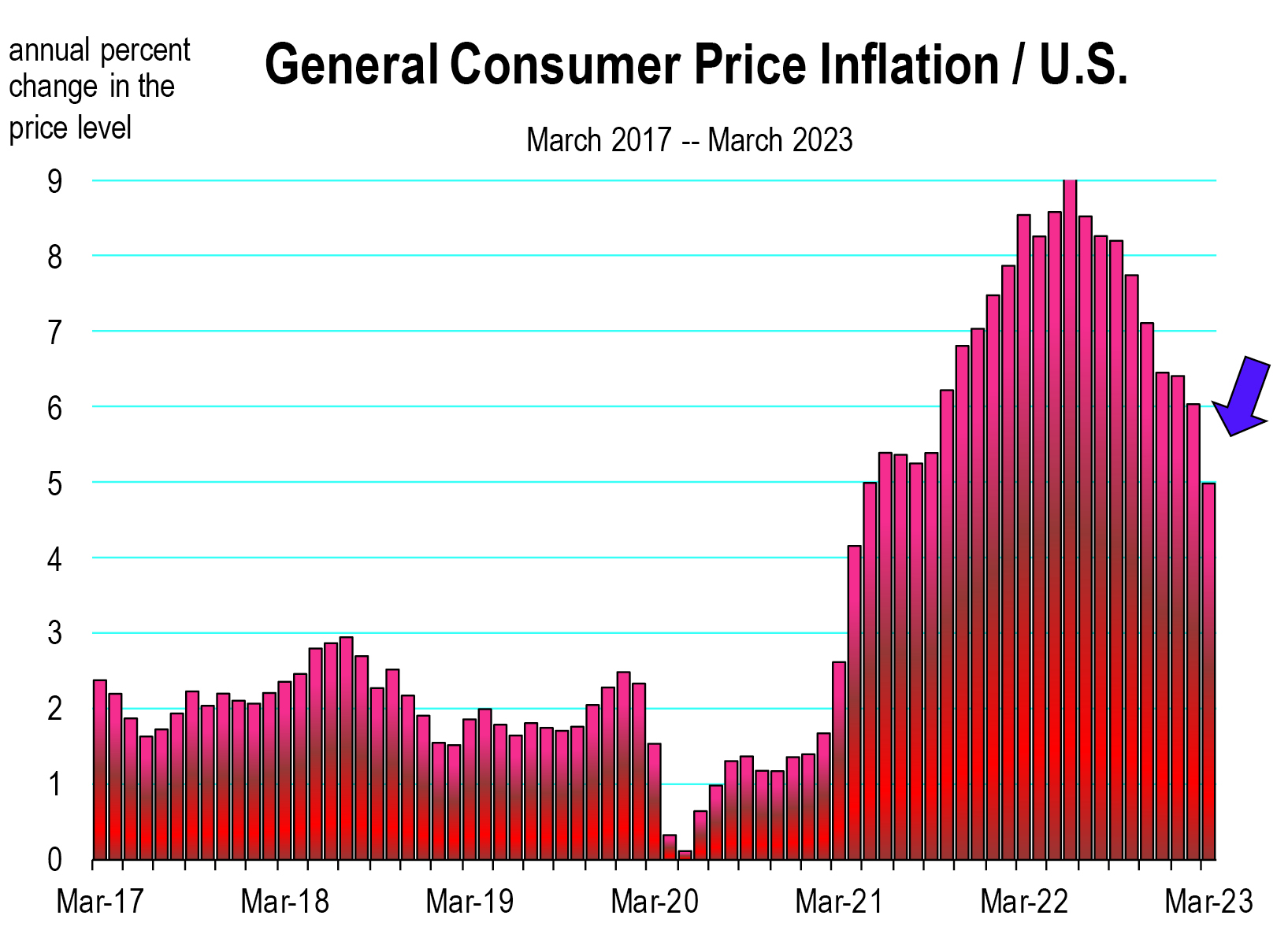

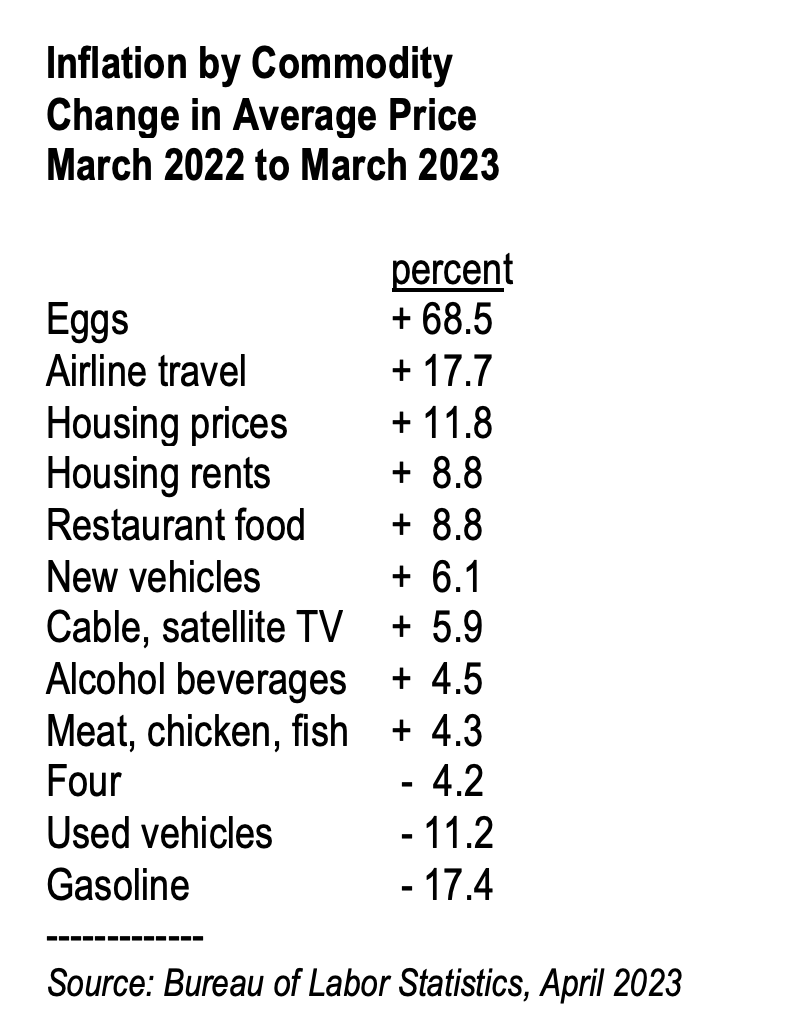

To review, in 2022 inflation soared to the highest level since 1982, remaining elevated since the peak month of June but improving nevertheless.

We are now in a period of disinflation. Or declining inflation. Prices are still rising for most goods, but the pace of price increases for the composite of goods and services is slowing down.

That still means you are paying more for goods (and services) and are stuck with higher prices for many everyday goods. While the price of some goods and services will reverse (as it has for used cars), others will not, even as the rate of inflation is normalized. And “normalized” is moving back to under 4.0 percent and even lower by the end of this year.

For the level of prices to return to 2020 levels, we would need to see general price deflation, a rare and unlikely occurrence, sometimes emerging during a recessionary cycle.

Home Prices

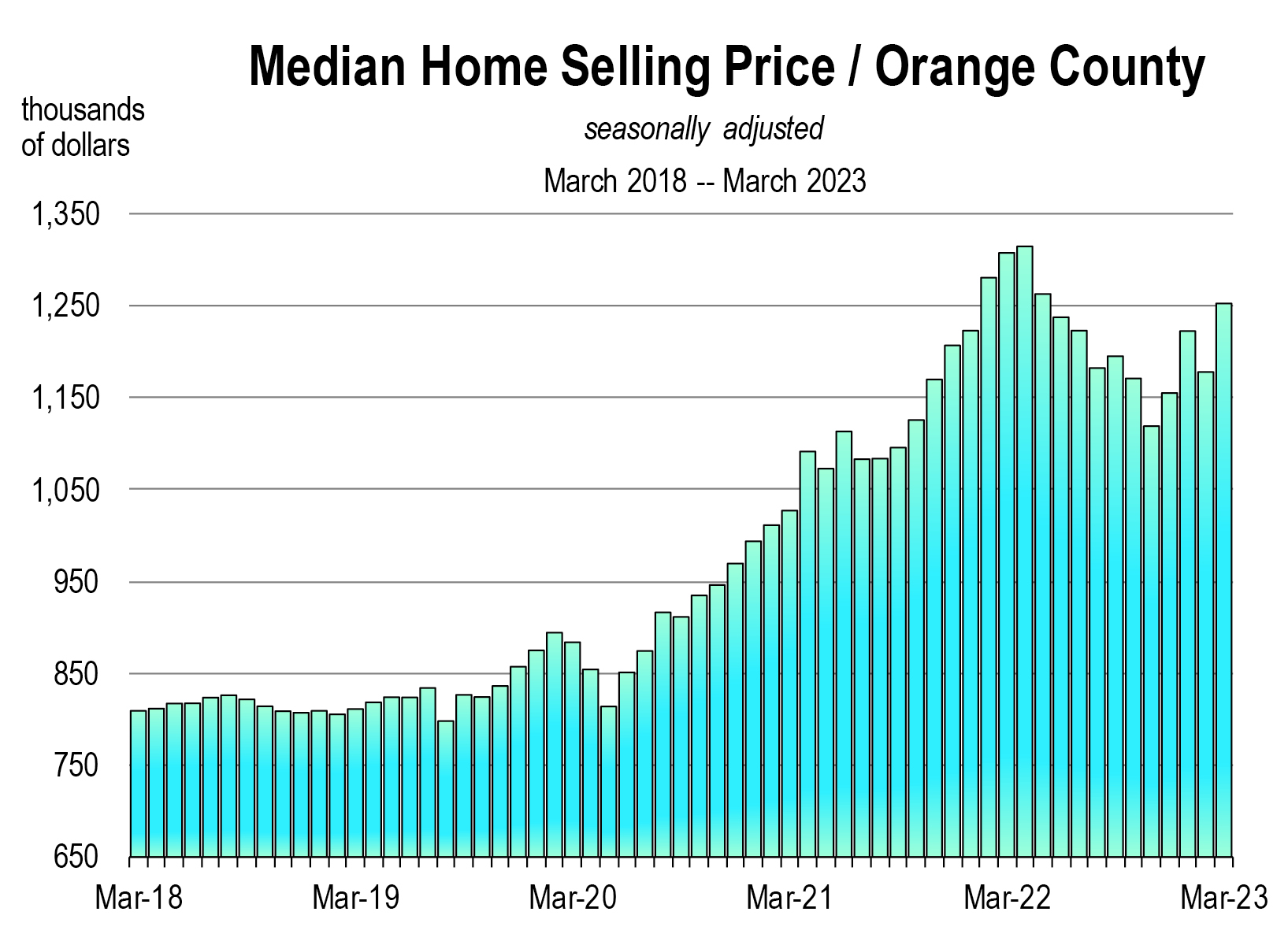

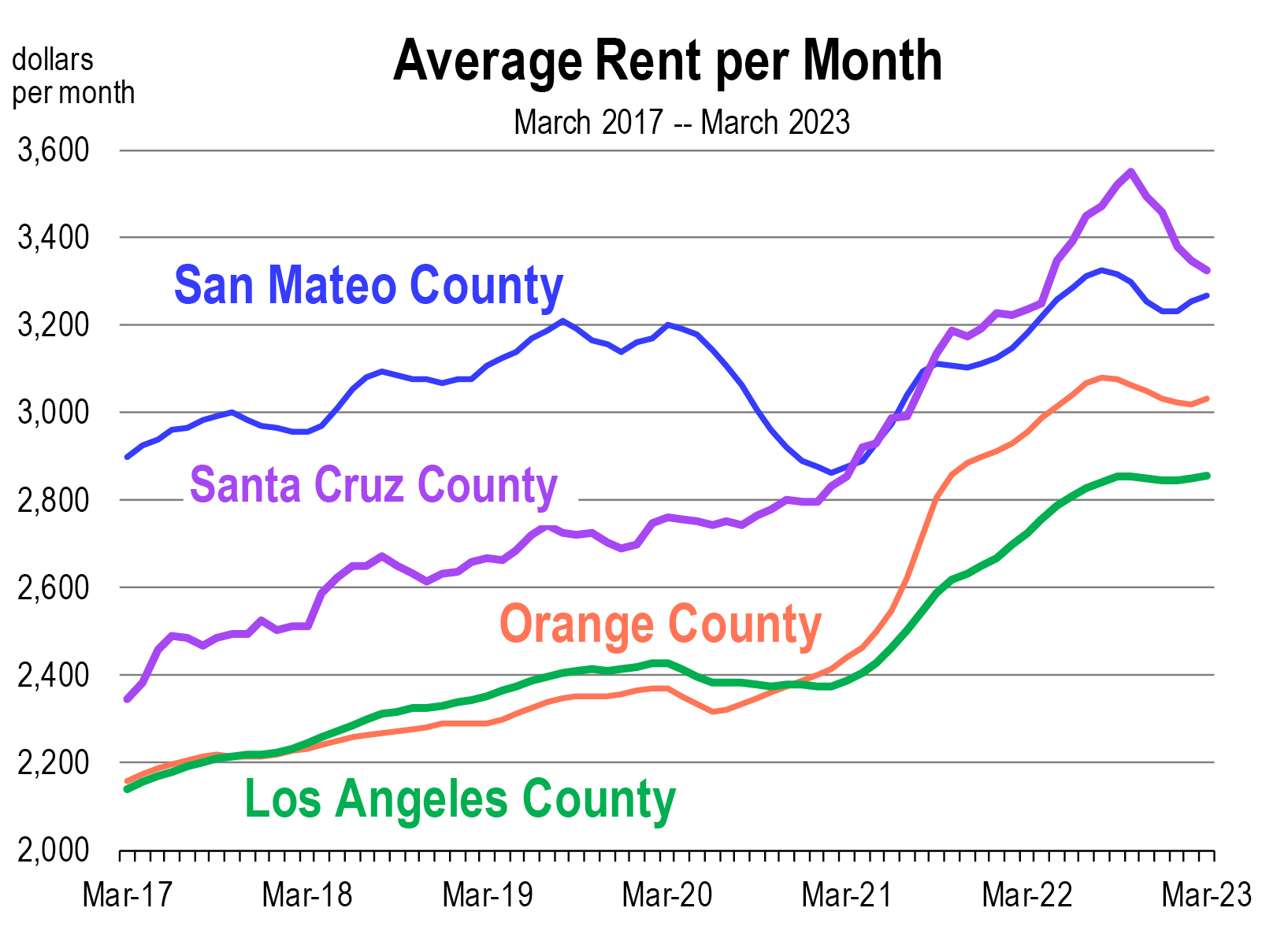

The rise in the cost of housing has clearly abated over the last 12 months. Both selling values for purchased homes, and monthly rents for apartments have declined or leveled off. The housing price and rental price indices that feed into the general price level are still rising, because they are measured with a lag.

Home prices peaked last April or May of 2022, and they declined every month into November or December. For many regions, they have started to rise again especially as the season for home buying arrives.

The median price in Orange County fell 15 percent from April 2022 to November. Since December and counting March 2023, the median selling value has rebounded 12 percent.

Selling values are also rising in Riverside County, Ventura County, and San Diego County.

The increase in average monthly rental prices has also cooled throughout California, with prices moderating or weakening in most counties.

Labor Markets and Inflation

The unemployment rate is 3.4 percent, which by all accounts still implies a tight labor market. Year over year wage growth is 6.1 percent (through April). This is much higher than it needs to be to contain inflation. So while the general CPI report is in decline, one of the key underlying components is still running relatively high. If this persists, inflation will unlikely be contained below 4 percent.

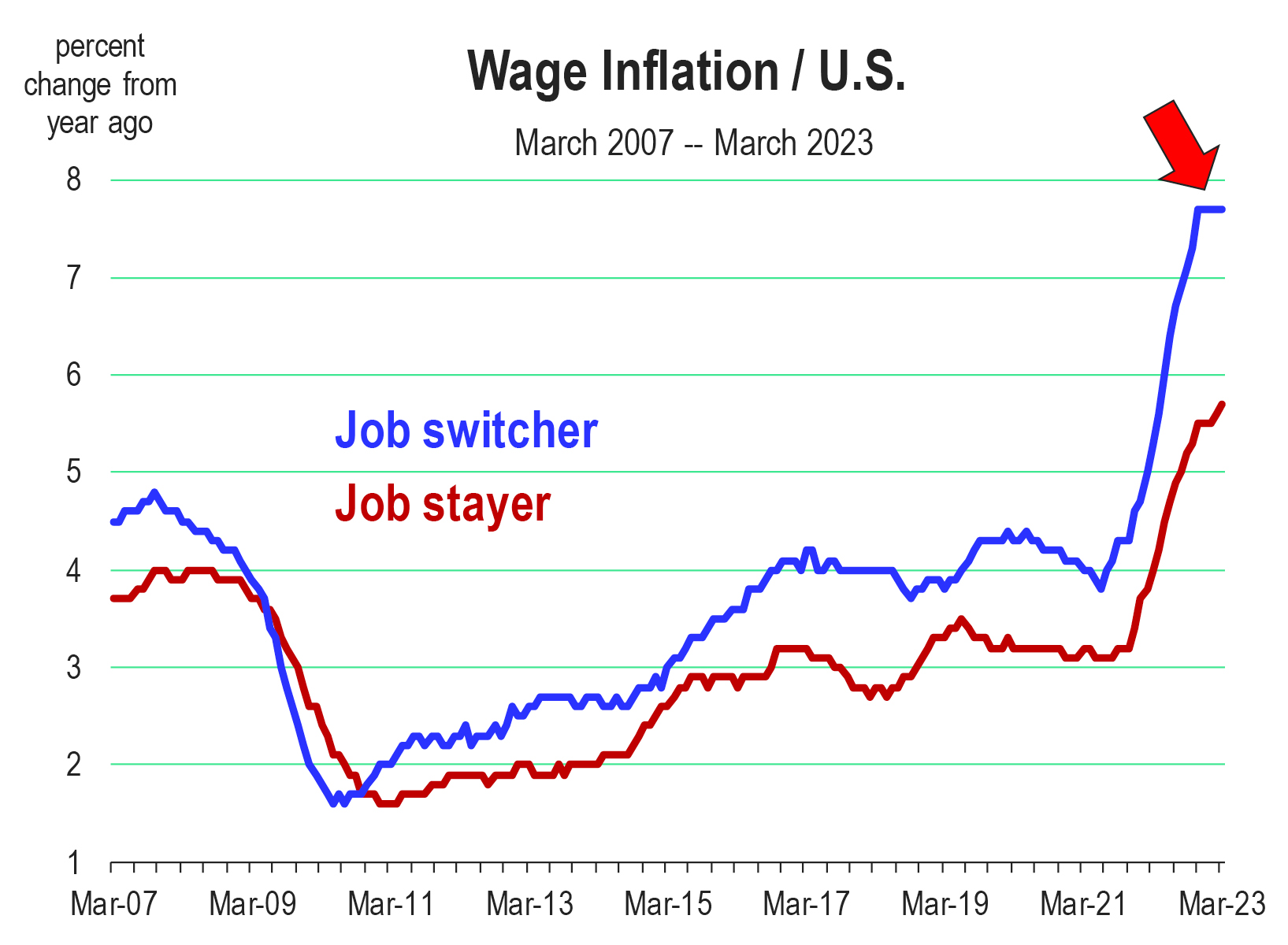

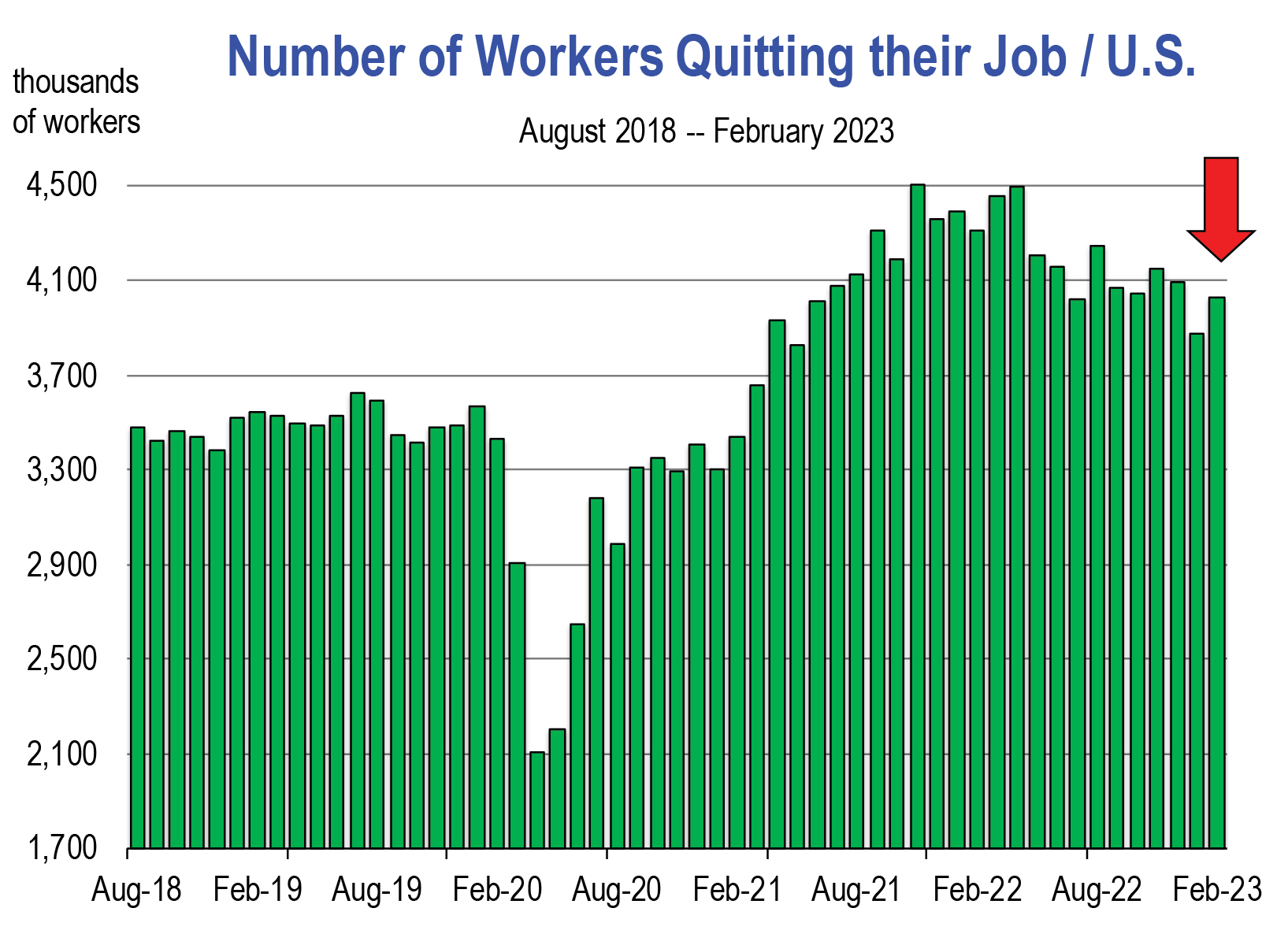

A principal reason for the sharp inflation in wages is the high number of job quitters. Inflation in wages is much higher for people who switch jobs, or workers who quit a job and become re-employed elsewhere. As long as quits remain high, so will wage inflation, prolonging general price inflation, and the rising probability of stagflation.

Can We Avert Stagflation ?

I’ve been warning about stagflation for over a year now. Stagflation is very slow, no, or negative growth combined with Inflation. It’s one of the hardest economic maladies to cure because Keynesian remedies won’t work, and monetary remedies won’t work.

The way to avert stagflation is to rapidly and if possible, gingerly correct the inflationary environment without tipping the economy into rising unemployment and falling consumer demand, or in other words, a recession.

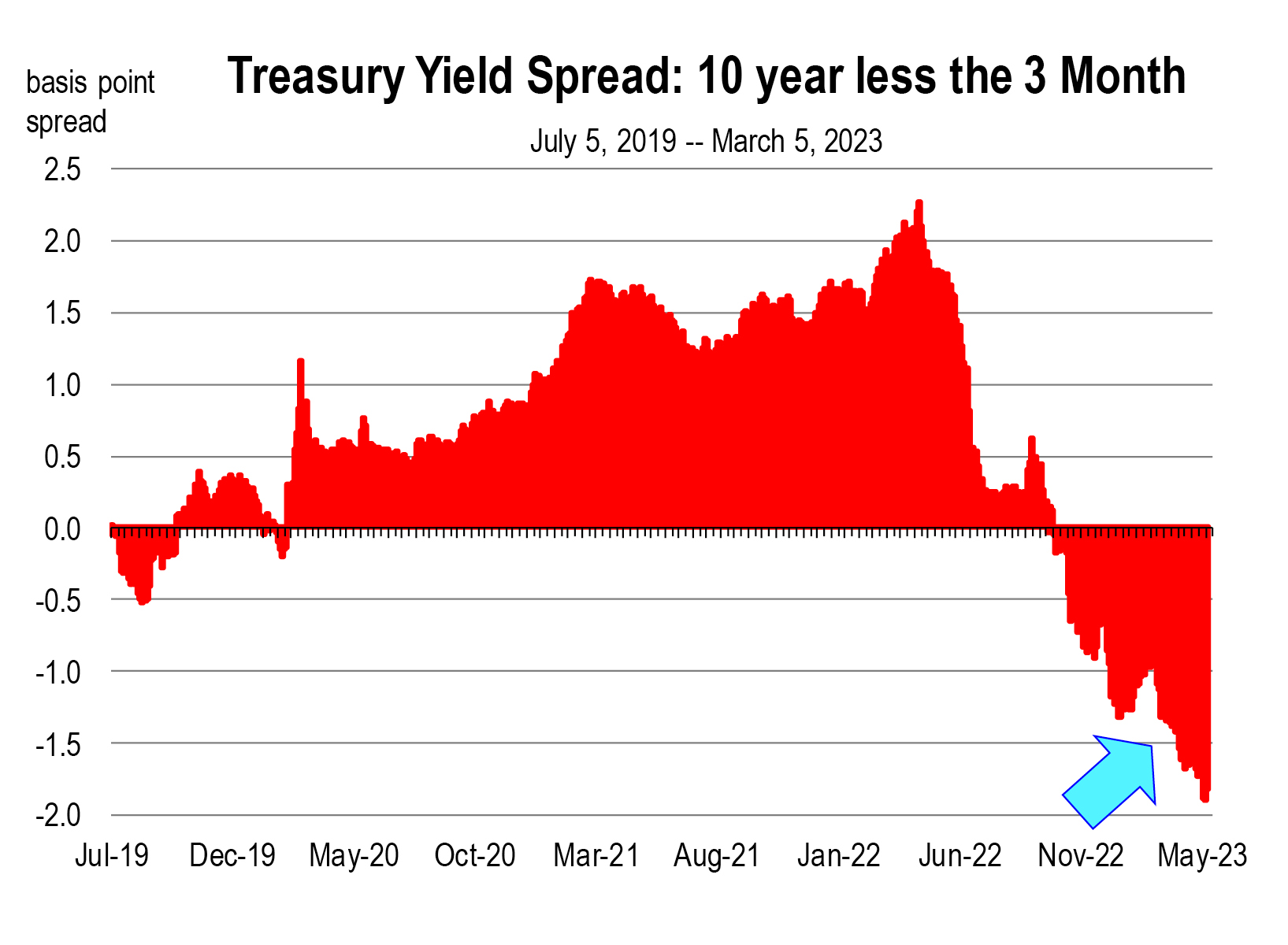

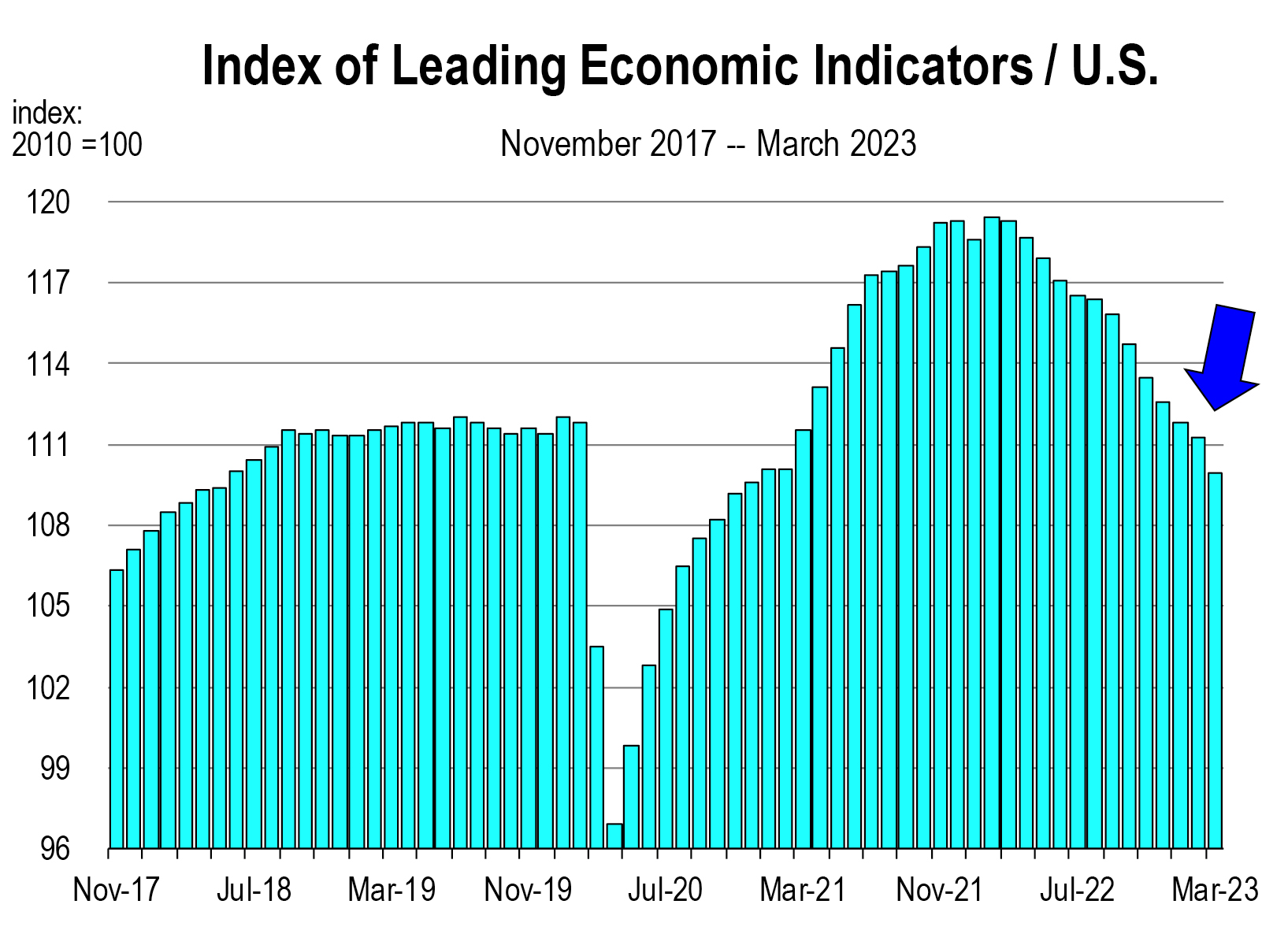

With an inverted yield curve of the current magnitude, and with the index of leading indicators sliding for the last 10 consecutive months, the onset of recession appears inevitable.

Growth is still positive today and has been for nearly a year but the level of growth has moderated. Combined with current inflation, a period “quasi-stagflation” has been present for the last year. Moving into a bona fide recession–meaning negative GDP growth, rising unemployment and diminishing utilization of our factories—then declining demand for products and services will hasten, and producers will cut prices to either move rising inventories of goods that are not selling, or to produce and sell goods to consumers to stay in business.

Inflation will likely fall more precipitously if an old fashioned recession is clearly manifested. To date, GDP growth is NOT negative, unemployment is NOT rising, and factory utilization remains fairly strong. So we can’t yet count on a recession to clear out current inflation, nor do we want one because the human misery is likely to be worse.

The Fed just raised rates, hopefully for the final time during this cycle. Now we wait and see how inflation responds over the next 2 or 3 months. If labor markets loosen up enough to keep workers from quitting and demanding higher wages, and if home prices level off, then those are two components of the general price level that will largely help to control inflation.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.