By Mark Schniepp

December 3, 2022

Understanding the Current Environment

The first step in updating your business plans for 2023 is understanding the current and likely direction of the economic environment. Know where you stand currently and where the business is likely to be by say, June of next year.

Are your clients exporters? Are you an exporter?

Exports are forecast to slow way down due to clearly slowing global demand.

Are your clients domestic consumers?

Higher prices for goods and services will slow down the pace at which consumers will buy goods and services, along with a pullback in spending due to uncertainty and a lower valued stock market.

Is your client the government?

State and local governments will remain fairly autonomous and in a position to maintain their fiscal budgets which generally end on June 30, 2022. Austerity will likely set in during fiscal 2024. The GOP led House of Representatives is likely to fiscally restrain the federal government starting January 3, 2023.

Is your client age-dependent?

Millennials are working and will likely stay employed and demanding the kinds of goods and services that they buy. Gen Z is part of the entry level workforce or graduating from colleges and universities. They will be vulnerable to layoffs and some might struggle to find employment.

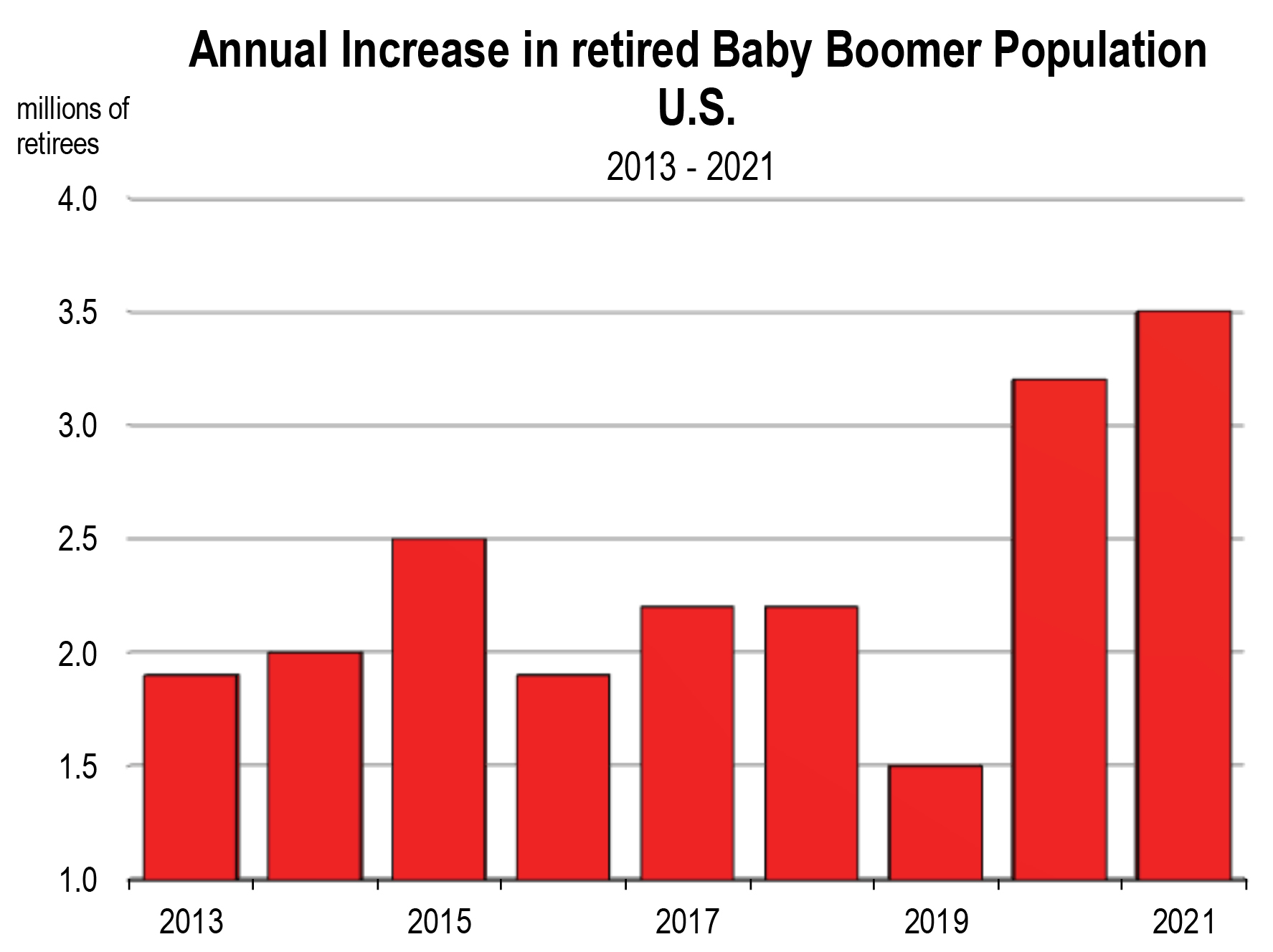

Boomers are retiring in a rapidly growing wave that started in 2020. In 2023 and 2024, we will see the largest waves of Boomers turn 65. An estimated 36 percent will not retire and elect to remain in the workforce. Nevertheless, expect many of the senior people in your workforce to retire and require replacements. This will lighten your healthcare expenses but could increase your recruiting expenses.

Today’s Environment

The current estimate for how GDP is tracking in the 4th quarter ranges from 2.2 to 2.8 percent growth, annualized. Consequently, providing the November and December data don’t significantly deteriorate, calendar 2022 will wind up with both positive and meaningful growth over the last 6 months.

For many businesses including retailers, “adequate” revenue growth will likely finish out the year despite significant talk of recession and struggle.

Job growth, nominal income growth and a rise in real inflation adjusted consumer buying has powered the economy forward during 2022. But conditions are changing.

Headwinds into 2023

High profile layoff announcements are starting to pile up though you don’t see any evidence of that yet in the unemployment rate. But layoffs are coming, and the record number of job openings present in the economy will shrink from 11 million to 6 million over the next four to six months.

Manufacturing is now facing significant challenges as 2023 approaches. High producer prices, rising interest rates, and supply-chain issues are the headwinds here. Deteriorating business confidence is another key concern. Expectations can turn on a dime, but the increasingly pessimistic outlook among businesses does not bode well for the near-term prospects.

So far, manufacturing reports have managed to stay positive. New orders however are contracting. And expectations gleaned from surveys indicate a significant drop in both current and future expenditures on product inventories.

And this is occurring as manufacturers monitor potential consumer demand for, in particular, larger durable manufactured goods, including furniture, appliances, vehicles, and electronics.

The housing market has cooled off, needless to say. Both existing home sales and new home sales are below their pre-pandemic levels now. If your business relies on real estate, 2023 will be tough because mortgage rates will remain high and the risk of declining real incomes is high.

The interest on the 30-year fixed mortgage rate has backed off a bit from its peak of more than 7 percent, but the rate has effectively doubled since the start of the year. Buyers are priced out of the market and will have to delay their jump into homeownership.

However, many buyers will still be looking for ways to buy homes so creative financing arrangements should work to sell homes in 2023.

Real estate will look better on the back end of 2023, or after the traditional buying season is over. Why? Because the business cycle bottom may be occurring at that point. Perceived bottoms are the start of stock market rallies, and there will be bargain-hunting buyers for all assets. So be prepared for when the darkest hours approach.

Pessimism among Consumers

Consumer sentiment from surveys is currently at levels that are consistent with a bona fide recessionary environment. The American consumer is clearly frustrated with high gasoline prices, the steep decline in stock values, and on-again off-again shortages of goods. The high levels of inflation are leaving real household incomes lower than were they were a year ago.

Compared to last year, consumers will spend as much this Christmas but receive less. That means businesses will sell less product, while facing higher costs. Consequently, there is a greater likelihood of a lower net income holiday season for retailers that disproportionately rely on the holiday season.

January and February will also remain slow because U.S. export markets will be impacted by recessions in Europe and in China.

The most encouraging component of business confidence surveys are the responses about the company’s hiring intentions. Few businesses are laying off. Businesses realize that they will have a perennial problem filling open job positions as baby boomers age out of the workforce, and not enough of generation Z will enter the labor force.

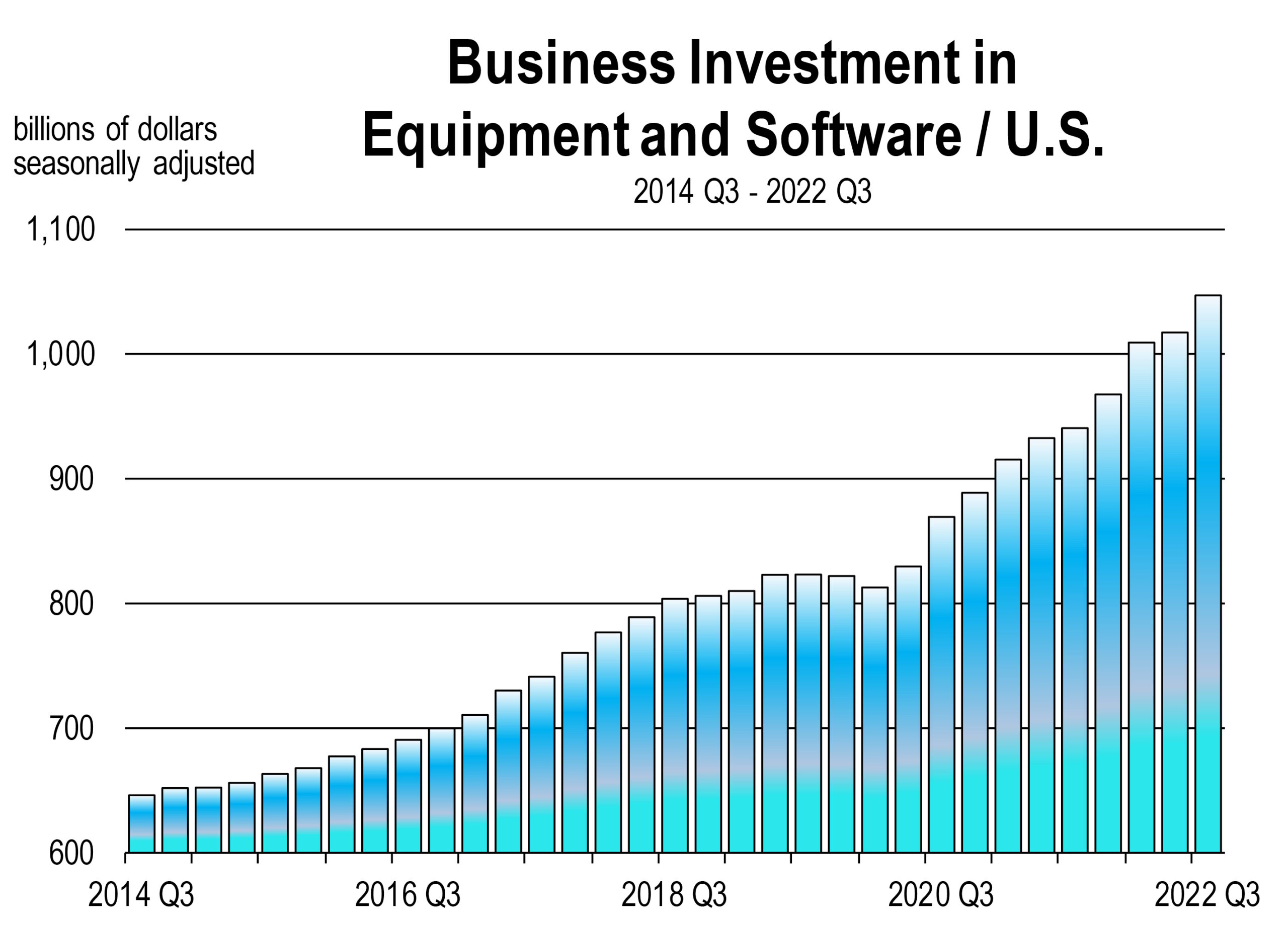

That said, intentions by businesses to invest in further equipment and software remain favorable in preparation for the potential inability to fill all job positions.

Planning

Inflation has peaked though it remains uncomfortably high at nearly 8 percent. Households would be spending on average, $433 more per month if they were to buy the same goods and services as they did in 2021. However, they aren’t doing this because they can substitute into lower priced items or postpone buying them for now. This means lower demand in general for products and services. This this could very well be your product or service.

Therefore, be ready for a year in which you anticipate and can therefore plan for lower demand. Unlike the last two recessions (in 2008 and 2020) in which businesses were largely ambushed, you now have lead warning that conditions will weaken into 2023.

You can expect to need fewer workers which is usually the largest business cost you incur. If you’ve invested wisely in 2022, your automated functions are running efficiently and you can probably delay filing job vacancies.

Watch the monthly labor market reports for early clues on the direction of the economy. Unemployment is currently 3.7 percent. Job creation is around 250,000 per month. An upward trajectory in the former and/or a downward trajectory in the latter represents the weakening that we are forecasting.

Watch the bond market. The inverted yield curve would have righted itself and the spreads between short and longer term yields will be widening, suggesting the end of contraction.

Watch the stock market. A sharp upward movement lasting more than a few weeks would be an indication that the bear market has reversed and the market is projecting rising growth 6 months hence.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.