Mark Schniepp

June 2023

“Default could trigger a spike in interest rates, a steep drop in stock prices and other financial turmoil. Our current economic recovery would reverse into recession, with billions of dollars of growth and millions of jobs lost.”

— Janet Yellen, Secretary, U.S. Treasury, January 15, 2023

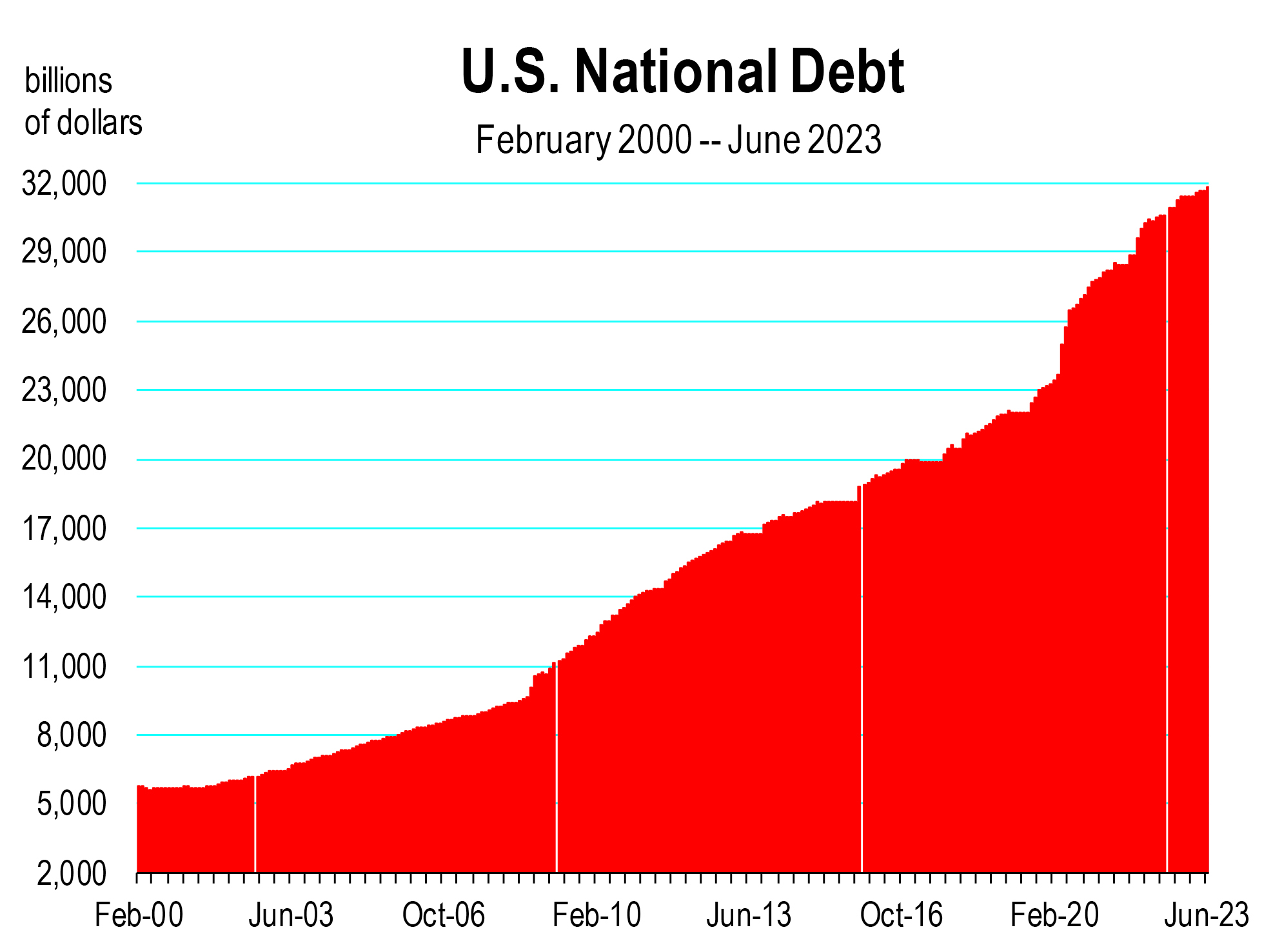

Through June 11, the Federal government has received $2.994 trillion in revenue for fiscal year 2023. And through June 11, the Federal Government has spent $4.149 trillion for fiscal year 2023. We continue to outspend our revenues and have for the last 22 consecutive years. This is how we always run up against the debt limit that is set by Congress every few years to enable more spending. Our national debt is now at $31.8 trillion as of June 2023.

The President and Speaker McCarthy just agreed on a resolution for the debt limit: to suspend it until 2025, and enable spending to continue and current obligations by the federal government to be paid on time.

The debt limit or ceiling is the maximum amount of money that the United States can borrow cumulatively by issuing bonds.

When the debt of the U.S. government bumps up against the ceiling, then the Treasury Department must resort to “extraordinary measures” to pay government obligations and expenditures until the ceiling is raised again so more borrowing can ensue. Extraordinary measures (which are not that extraordinary) have been in place since January 19, 2023 when the ceiling of $31.4 trillion was reached.

The worst case scenario by the U.S. government is a default on its secured debt.

So this is the issue our Treasury Secretary isn’t explaining. Default is the inability of the U.S. government to make required interest and principal payments on secured debt: treasury bonds and bills that have been issued over time.

A default does NOT occur if the federal government can’t make all its payments, such as pension contributions every month to federal workers, or aid to Ethiopia, or finance military arms or other resources going to Ukraine, or keep the postal service running 7 days a week.

There is so much that the federal government can suspend or delay in terms of monthly expenditures in order to keep the debt ceiling from being breached.

There is enough revenue that is received by the Federal Government each month to fund interest payments to holders of government securities, and/or to redeem bonds or bills that mature. So in order to avoid a default, the U.S. Treasury would shift money around to keep paying interest on Treasuries. A default is not going to occur in June as they intimated could occur. Nor would it occur in July, August, or September, and likely not in October or November for that matter.

Other impacts that might occur (and that we are being threatened with) as a result of this shifting are only speculative, and largely without precedent.

There have been a number of showdowns over the debt ceiling in Congress since 2011, some of which have led to partial government shutdowns, such as temporary or partial closures of national parks, reducing the number of delivery days for mail, or a furloughing of federal workers in some departments. But chaos and calamity was always averted, despite dyer threats of such outcomes.

The Treasury can always prioritize payments. And like you if your revenues were to fall short of your monthly liabilities, the Treasury can always call their vendors and ask to extend their payment schedule until revenues increase or the debt ceiling limit is ultimately raised. A creative U.S. Treasury can work tough times out, providing everyone ultimately gets paid.

Furthermore, Congress can always “claw back” appropriated obligations that haven’t been spent yet, reducing overall debt. This is what the House wanted to do with unspent COVID-19 appropriations. They achieved some of this regarding unspent pandemic relief payments and also regarding the funding of 87,000 new IRS agents that was appropriated by Congress last August as part of the Inflation Reduction Act.

More claw backs are possible; they are just not politically desirable. But neither is default. Clearly, Congress should be more accountable for their spending behavior as to how it will impact the debt ceiling. This is what you as a household would do when you are faced with credit card limits and knowledge of your revenue flow from month to month.

We would not have defaulted this month as we were warned. This is all part of a game of chicken that the branches of government play to get the other side to cave.

Payments would have been prioritized and/or delayed, some government functions would have been temporarily suspended, and some of the funding obligated as part of the trillions of dollars of spending bills authorized by Congress since 2021 could have been clawed back. This is how businesses and households run, and this is how we should expect the Federal Government to run when faced with a budget crisis.

Had we seen this playout, I believe Americans would have been encouraged by creative action rather than rhetorical statements by the Federal Government to address the spending limit, and capital markets would likely be more supportive of any semblance of genuine fiscal restraint.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.