A Mid-Year Assessment

Mark Schniepp

July 8, 2023

Fortunately, current conditions are not yet supporting the widespread expectation of inevitable recession this year.

Back on March 27, the majority of economists forecast a U.S. recession in 2023, and for many good reasons. And while the economic clouds are darkening . . .there’s no storm yet.

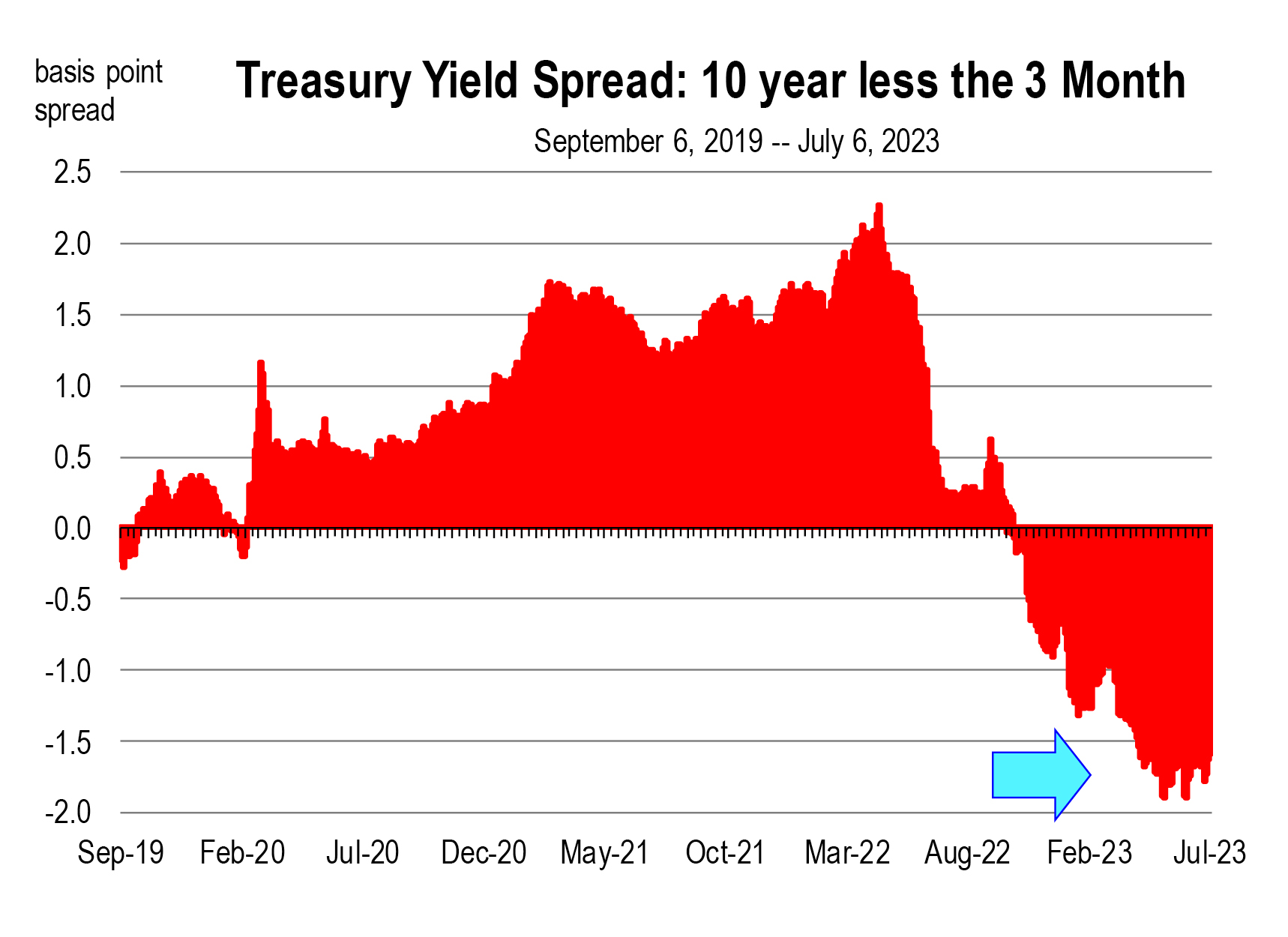

The sharpest increase in interest rates in 40 years, the excessively inverted yield curve, growing more excessive by the week, and the dismal ratings in American polls regarding government leadership and the direction of the country have not tipped over the U.S. economy.

The Recent Evidence

The financial market indices are all higher during the first half of the year. The laggard is the Dow Jones Industrial Average, ahead by just 2.4 percent year-to-date. The S&P 500 index is up 15 percent and the Nasdaq Composite is soaring, up 31 percent. The bull market in stocks is now about 9 months old. Global economic conditions are improving.

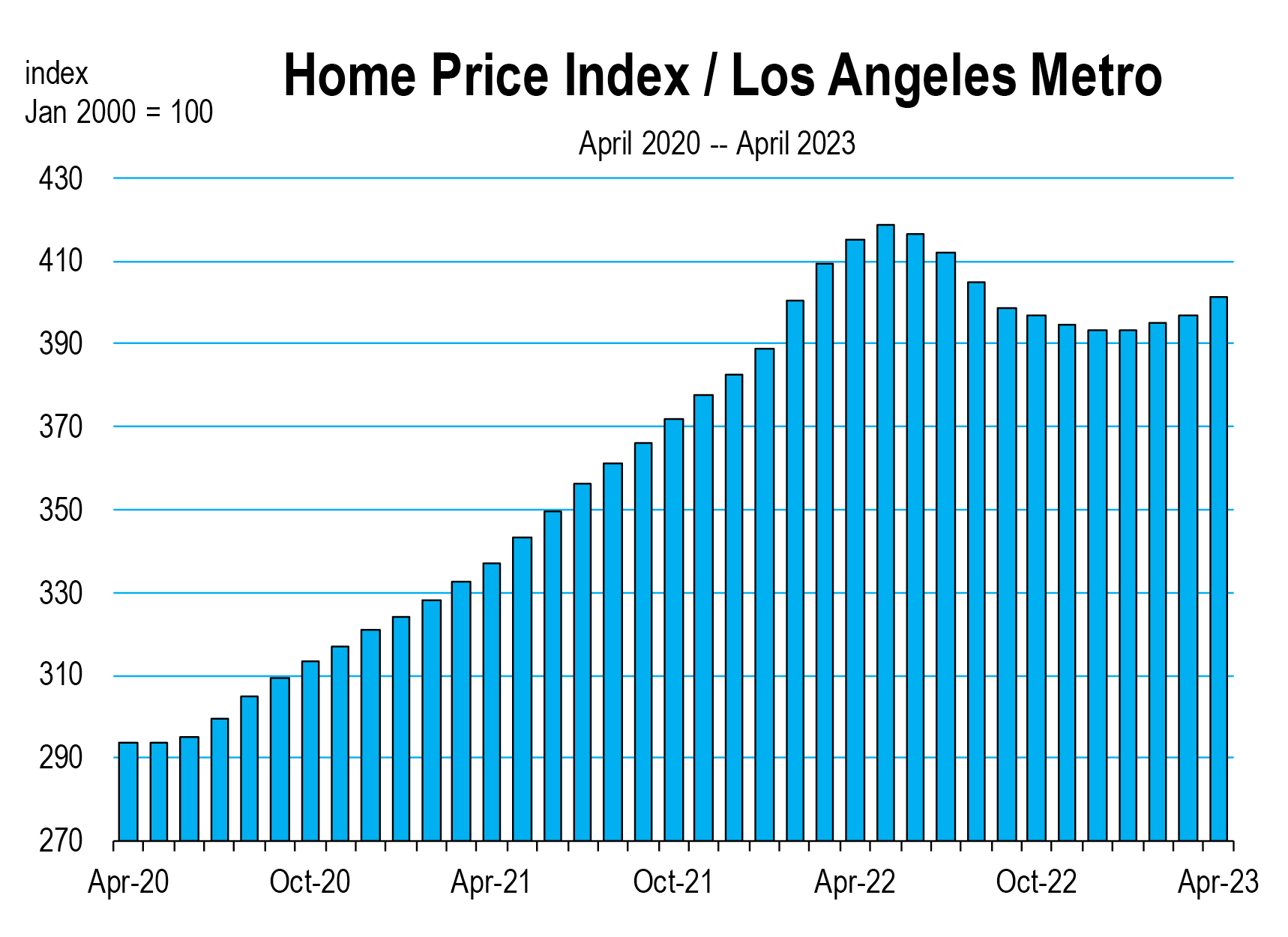

Surprisingly, despite mortgage rates hovering near their peak for the cycle, new home sales were higher in May. Recent price declines have helped to increase sales. But now even home prices are reversing again, with a number of price indices rising in March, April and May.

Fed chair Jerome Powell said last week that he expects further interest rate increases, consistent with the assessment of his fellow policymakers at the June meeting of the Federal Open Market Committee. We are very likely to see another hike in July.

Even absent more rate hikes, there is little doubt that recessionary risks have risen this year, and they will continue to haunt the economy for the rest of 2023. But as they do, firms continue to hire, households continue to spend, and the economy continues to grow.

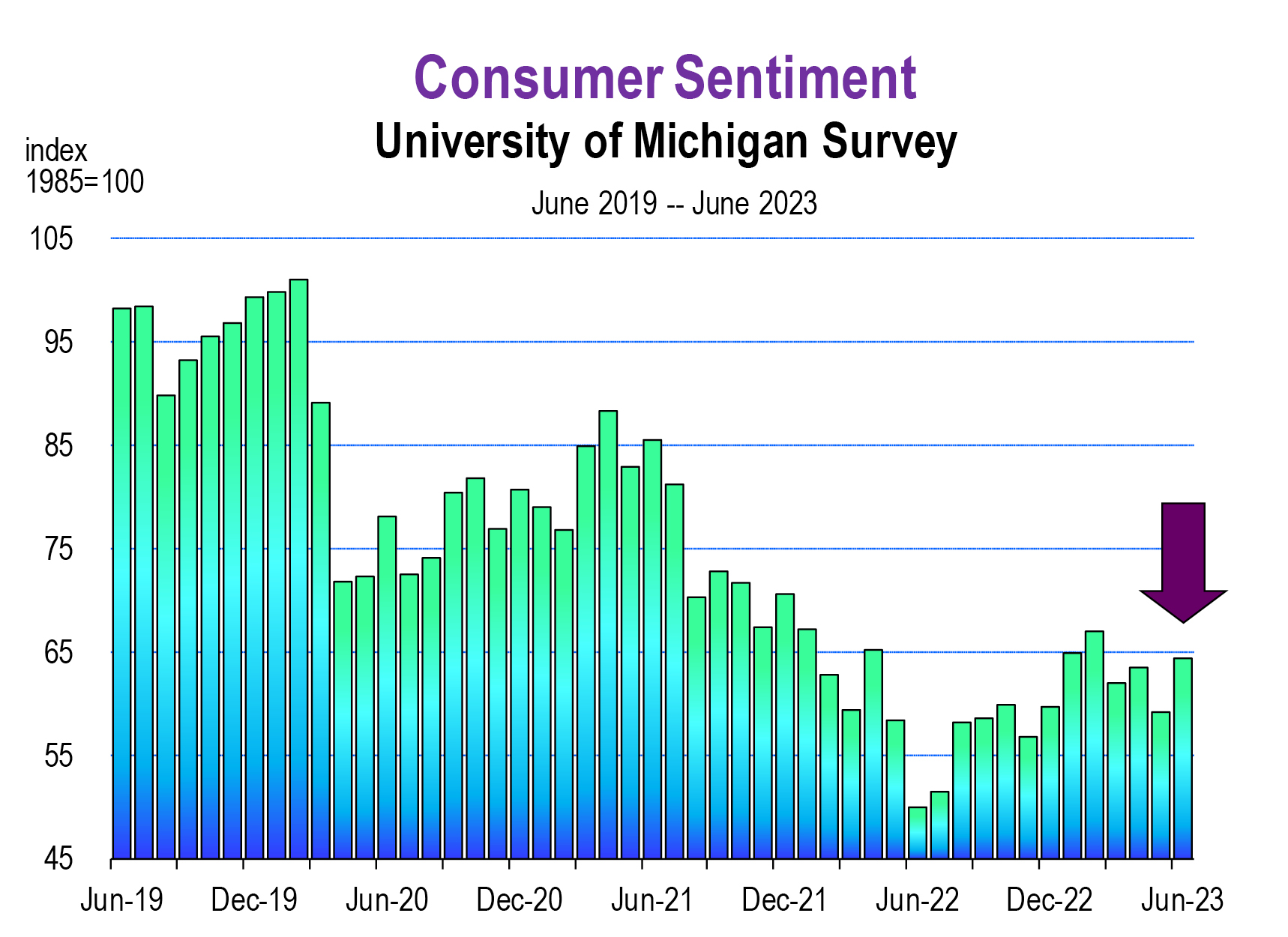

The current level of consumer pessimism is consistent with past periods of economic recession, but that pessimism Is not deepening. . . . . . In fact, the consumer sentiment index rose 5 points in June and is 14 points higher than a year ago. The labor market’s persistent strength is an encouraging sign that is leading to an uptick in optimism.

The GDPNOW estimate is running at 1.9 percent for quarter 2 which just ended.

The Atlanta Federal Reserve estimates GDP growth for the contemporaneous quarter, based on the economic indicator reports coming in daily.

We’ve had two positive growth quarters this year so far (both at about 2.0 percent), with some momentum building as we head into Q3. Inflation reports have consistently been lower every month for a year now.

Manufacturing indicators are mixed, so we can’t draw too many conclusions from that. Actual production has been contracting, but new orders for manufactured goods are rising. And business investment in both structures and equipment rose in the 2nd quarter, contributing about half of the positive growth in GDP for Q2.

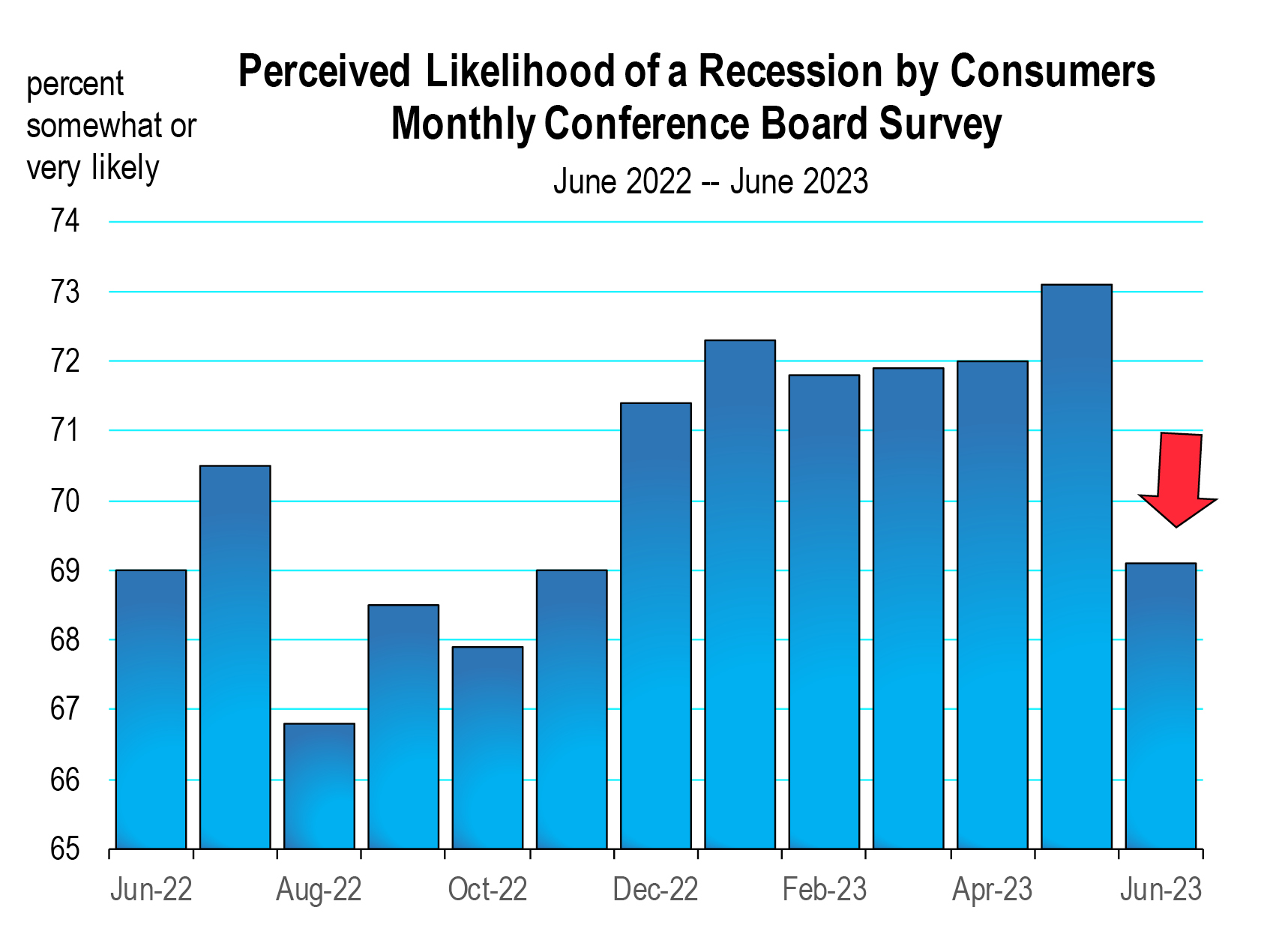

While most economists have stubbornly not changed their position on recession in 2023, consumer expectations of recession significantly reversed in June, though their spending has become more cautious.

We expect real consumer spending growth to remain modest through the summer and then slowly gather momentum. On the plus side, the few remaining drags from supply constraints will lessen, inflation will continue to slow, and jobs will remain plentiful.

Despite many of the indicators moving in the right direction, admittedly, job growth is slowing, the level of inflation still remains high, wage growth has slowed, and household savings are being drawn down further. Real consumer spending rose 2.7% in 2022, and will grow less than 2 percent in 2023. But the fact that it is still growing is one of the more encouraging signs that a soft landing this year is not a remote possibility.

Summary

This mid-year assessment reports that the economy has heroically avoided recession so far, and that there is a rising chance that recession could be averted in 2023. The strong indicators in the economy remain mostly unchanged, and many of the weak indicators are actually improving.

But we are not out of the woods. Two more rate hikes threatened by the Fed could be a tipping point. Issues with the leadership of the nation are starting to take center stage in the news—including the fringe, the fake and the mainstream media. Depending on what transpires this summer, potential revelations could rally businesses and consumers or shock them.

That said, we don’t expect much overall improvement in the economy until late 2024 or early 2025 when interest rates will be in decline, the housing sector will have turned around, and inflation should have returned to the longer run average.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.