by Mark Schniepp

July 8, 2019

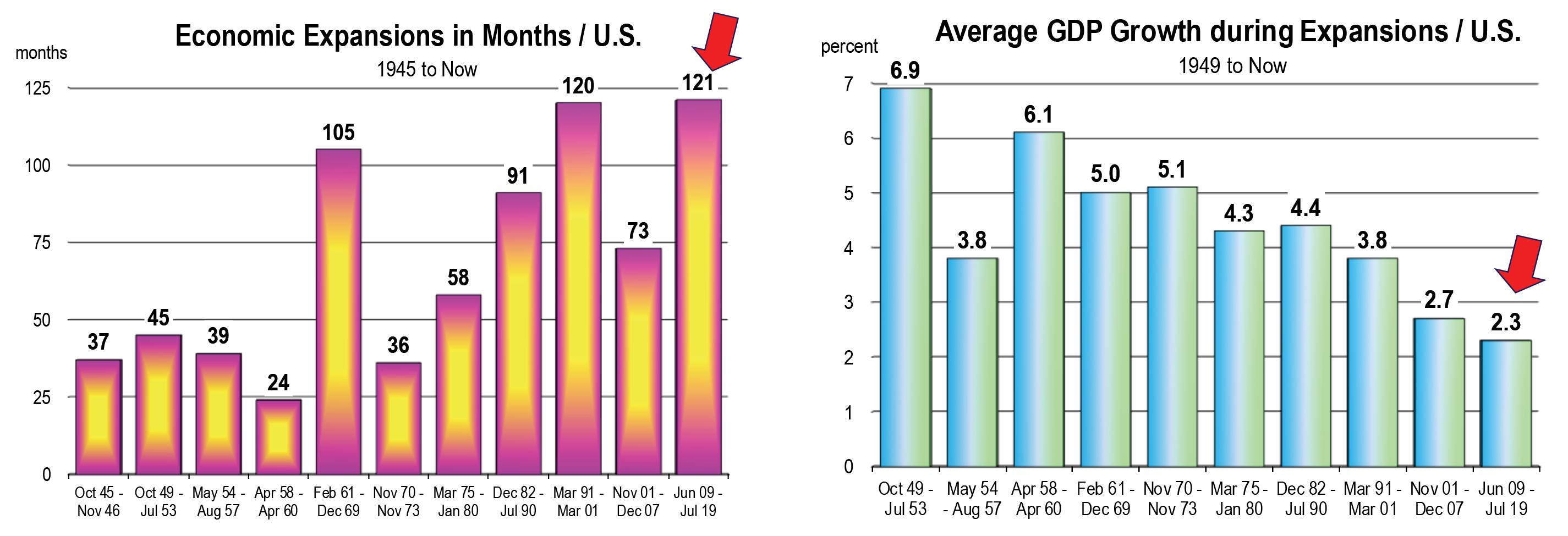

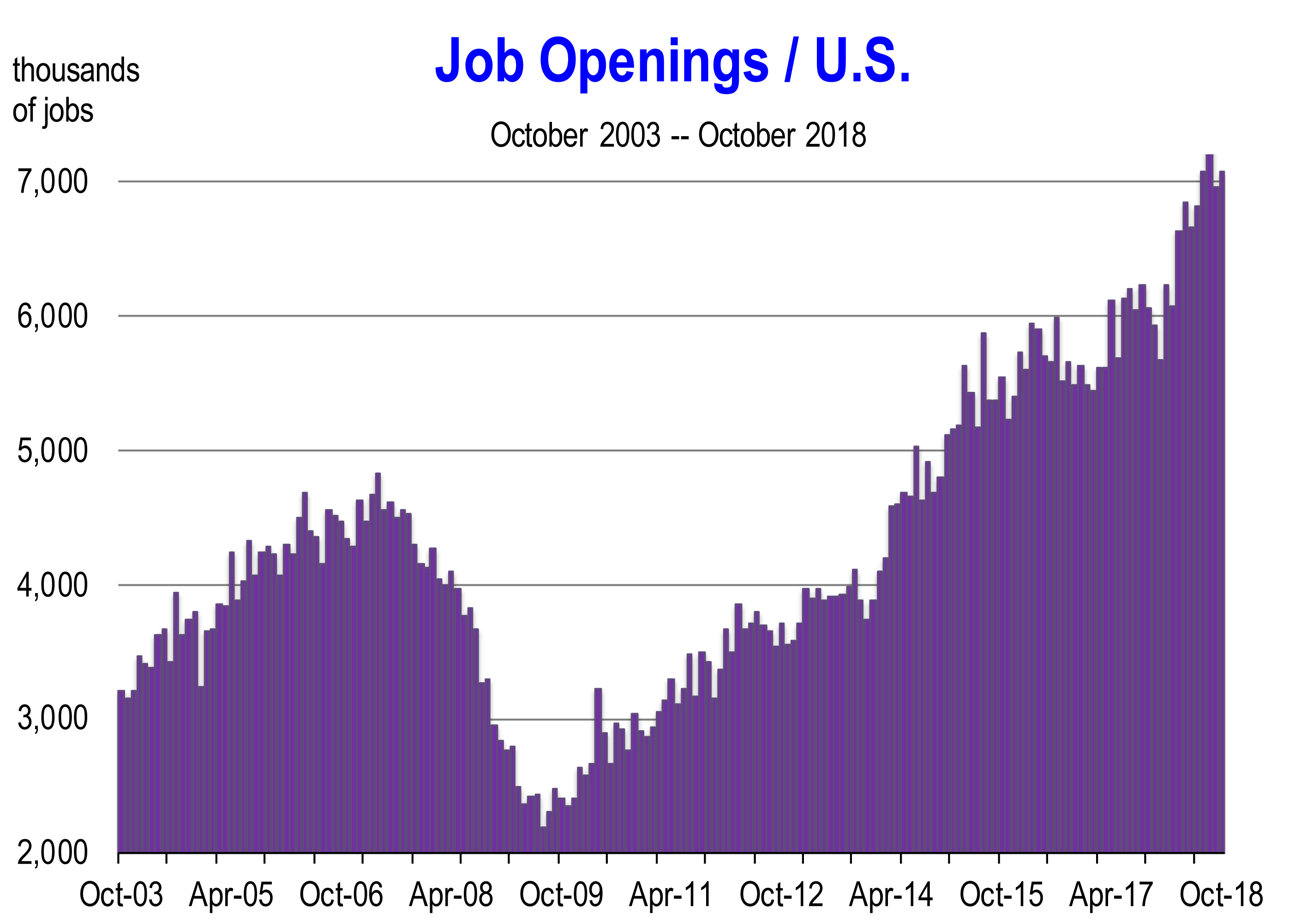

On July 1, the U.S. economy quietly “celebrated” the longest consecutive spell of economic growth on record: 10 years and one month. The expansion officially started in mid-2009, following the horrific Great Recession, and no end is currently in sight.

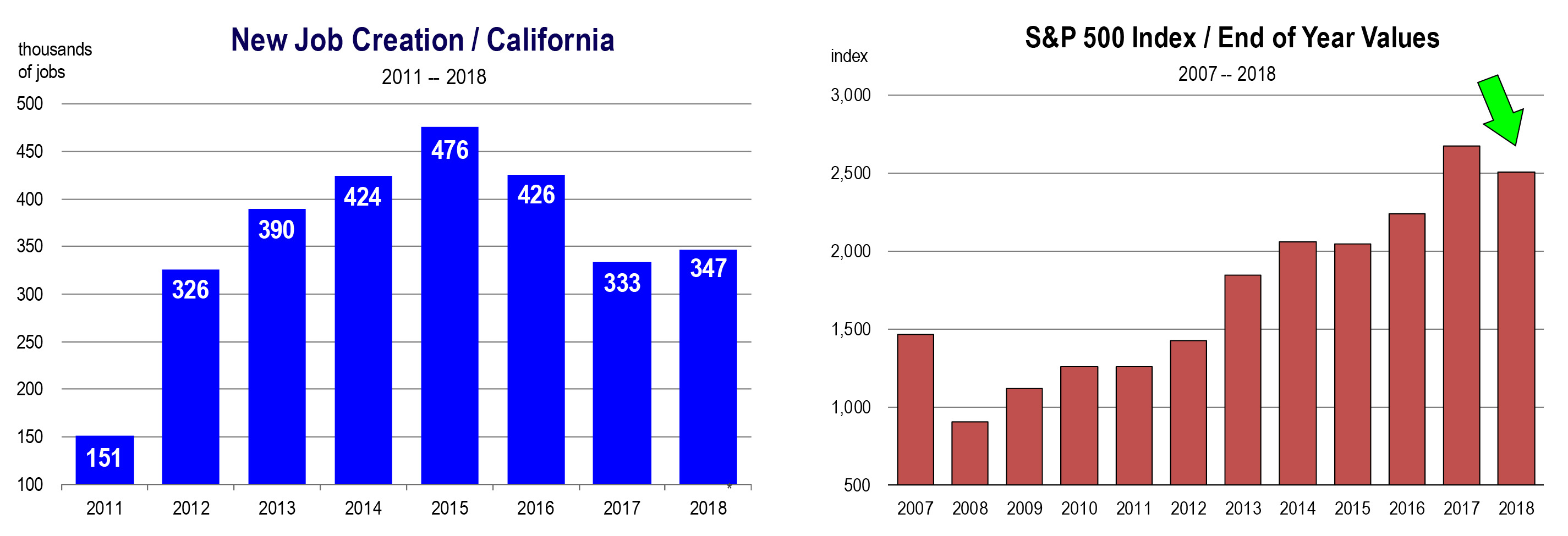

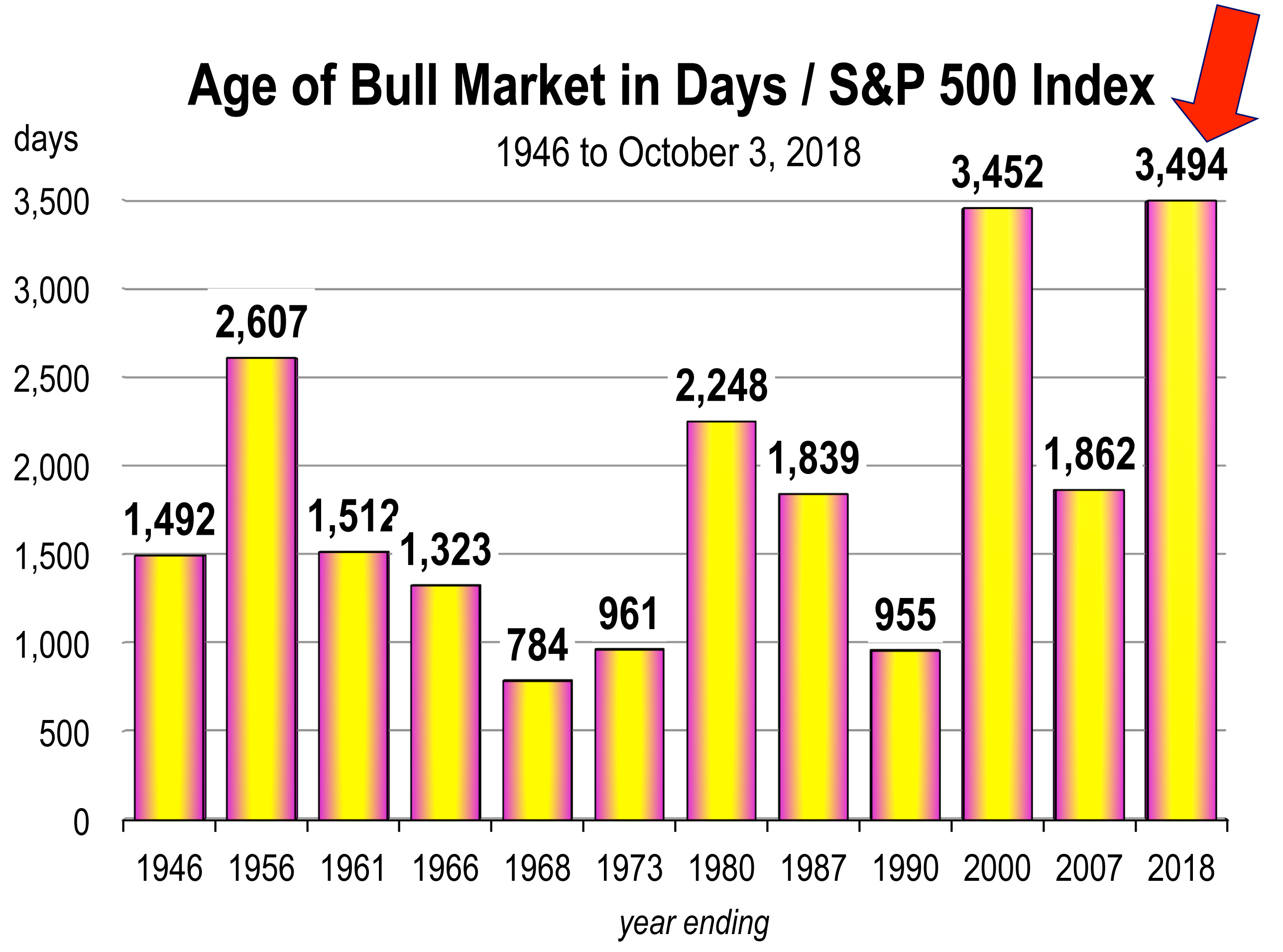

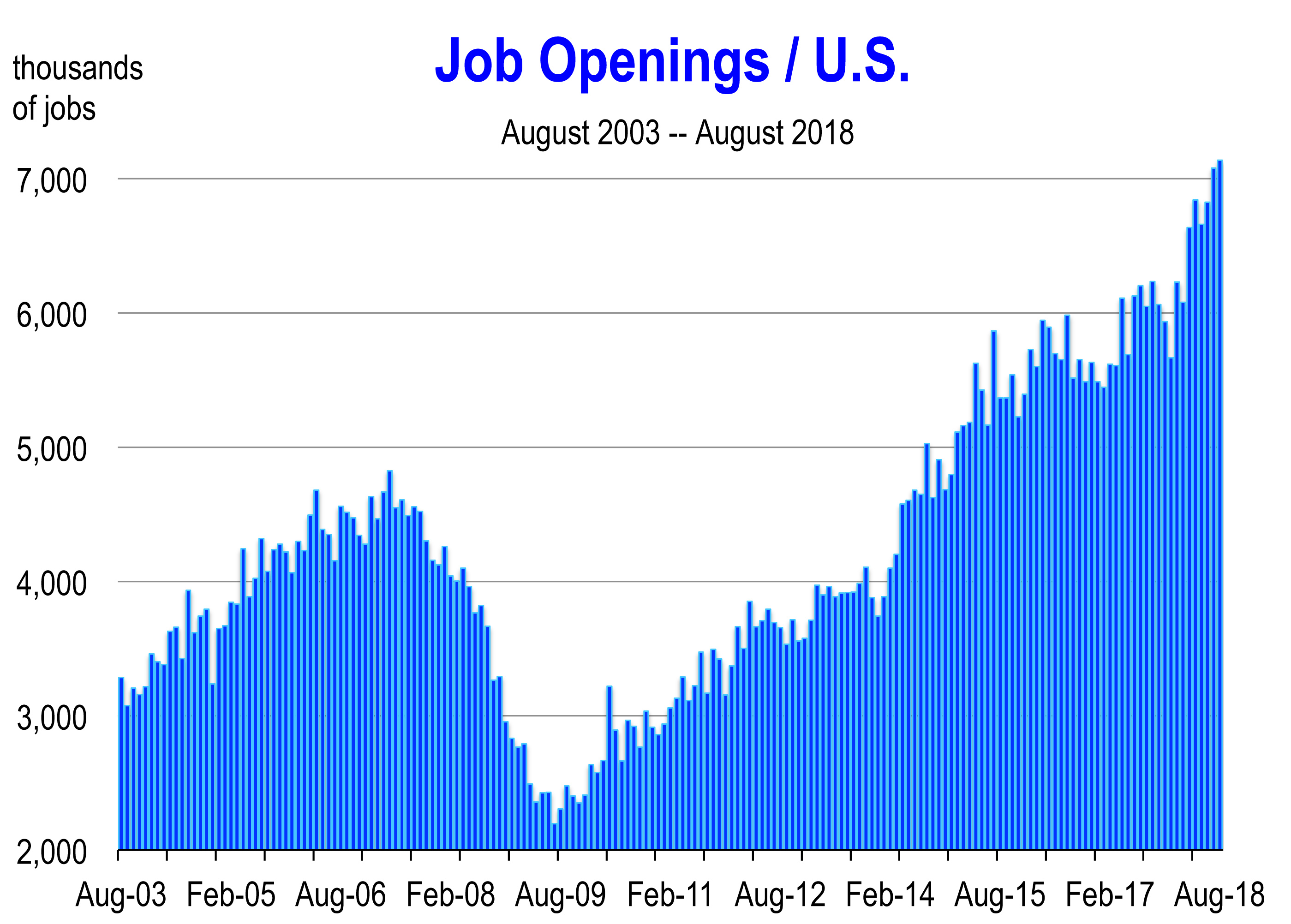

We have already experienced the longest bull market on record in stocks during the expansion, and we continue to set a new record every month for continued positive job creation.

The current 121-month growth cycle edges out the previous record expansion of the 1990s that ended with the start of the 2001 recession, after 120 expansive months.

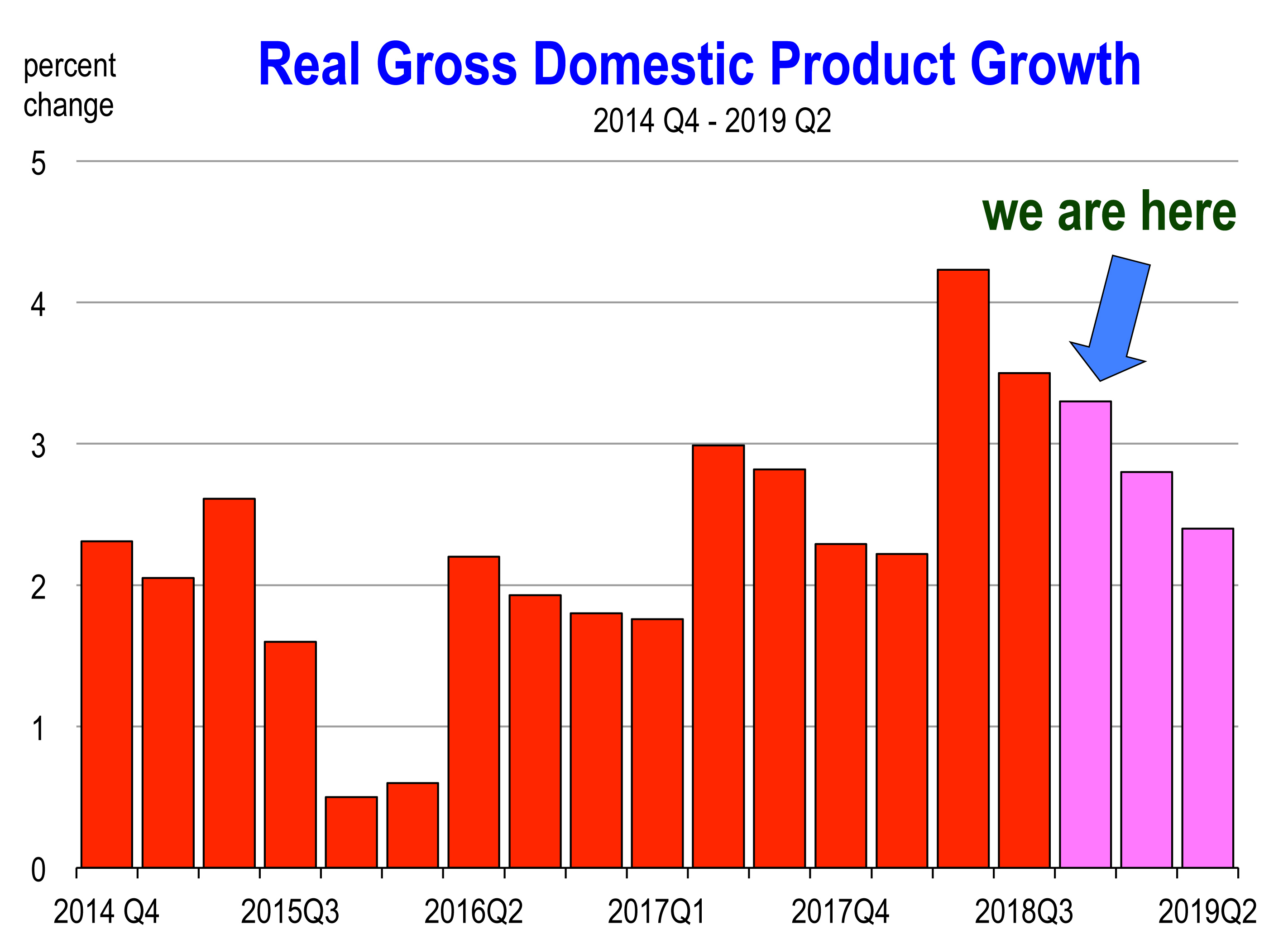

Everyone says that while the length of the expansion is remarkable, the strength of the expansion is not, and has in fact represented the slowest rate of growth over the last 70 years averaging 2.3 percent per year since 2009.

But it’s clear from the chart that the nation has shifted to a new growth path of GDP during economic expansions. Is growth really lackluster, or has it merely been replaced with the understanding that today’s $20 trillion economy won’t likely grow as fast as the $7 trillion economy that prevailed in 1975?

The 2 Percent Economy

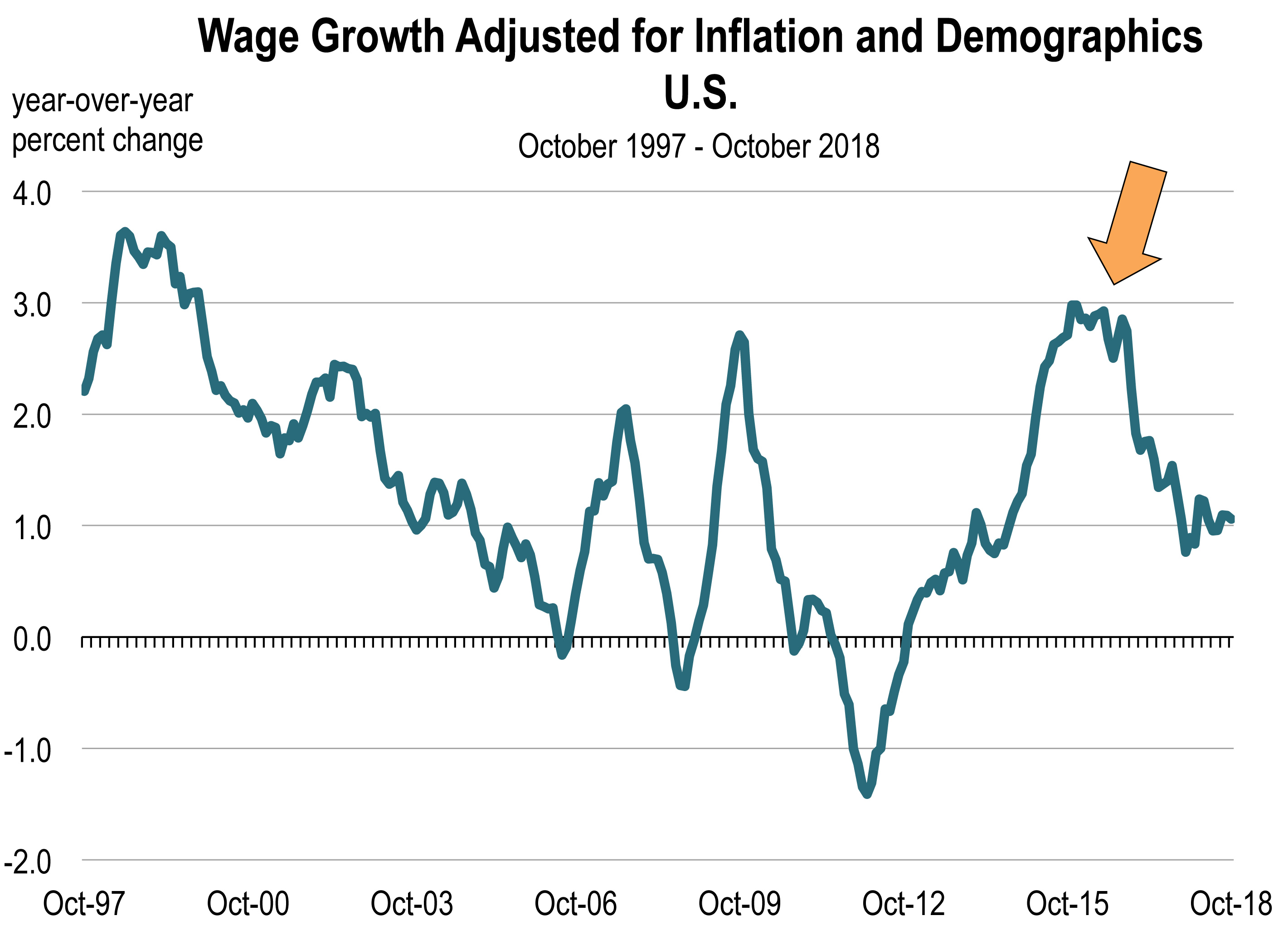

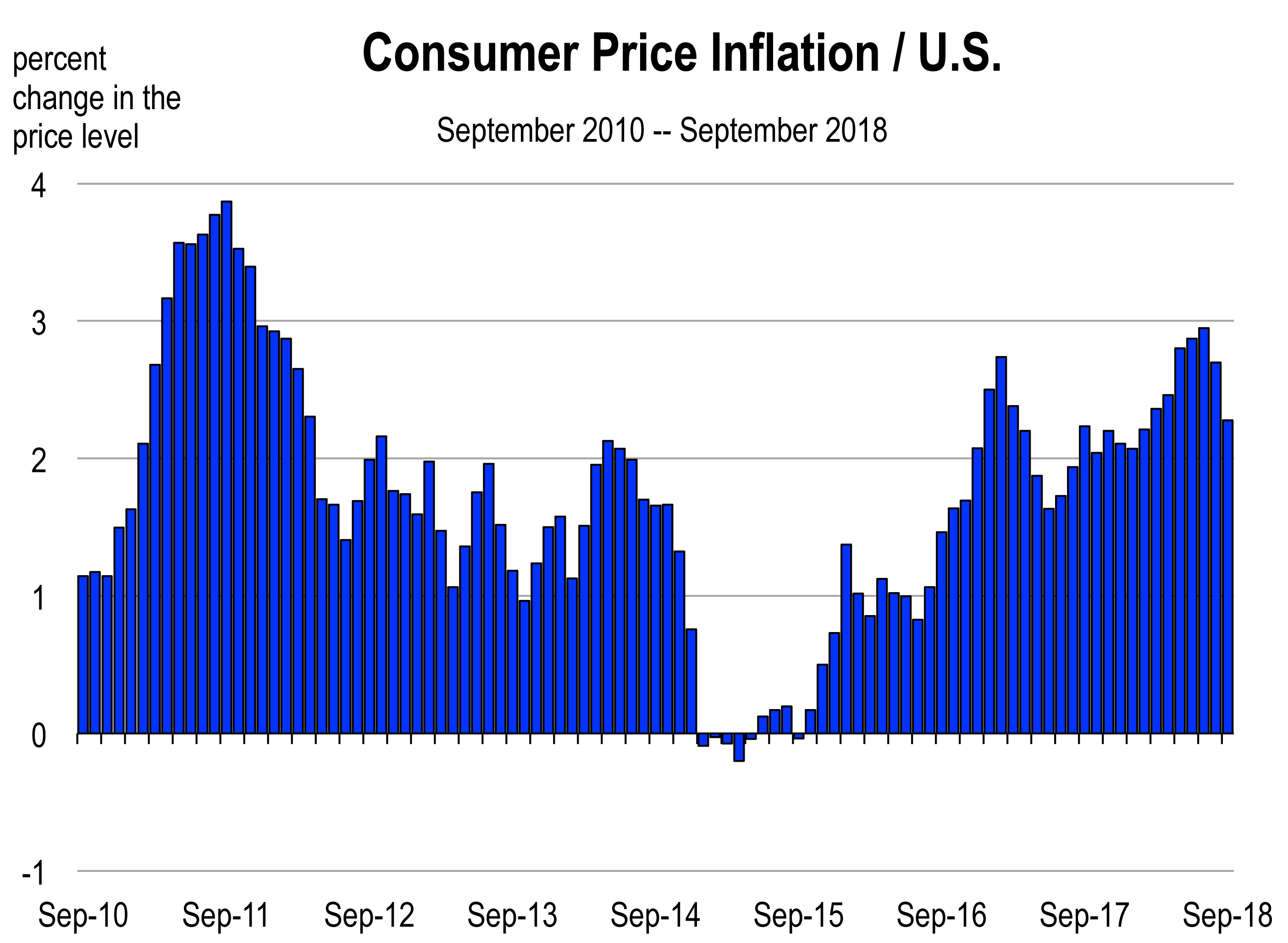

We’ve been in a 2 percent per year expansion for 10 years. But so what? What’s to criticize? We are at full employment. Wages are rising faster than the rate of inflation. Inflation is historically low. Interest rates are historically low. Your car payment is low. If you financed a home purchase between 2010 and 2015, your house payment is low. If you already owned a home before that, your payments are probably even lower.

Technology has given you extraordinary freedom with smart cell phones and you are connected to everything and everybody practically 24 hours a day. Uber has become pervasive and is one of your best friends, and Amazon delivers you everything you need in 2 days or less. All this has occurred during the 2 percent economic expansion.

The End is Near

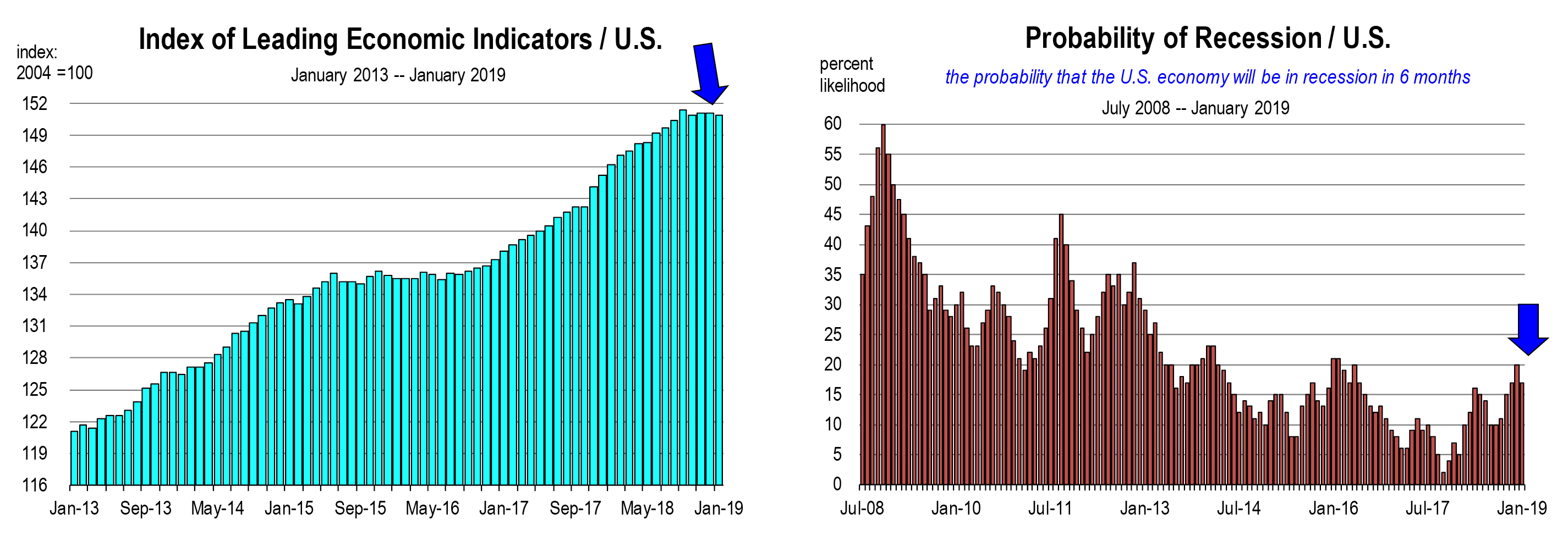

There have been numerous predictions of the onset of recession over the last 5 years, but no real consensus. And sure enough, the economy marched on. There is now a growing consensus that economic growth will slow from this moment on, ultimately manifesting in a recession.

A poll by the National Association of Business Economists in May showed that 60 percent of respondents expect a recession next year, even though there is not much evidence that economic conditions are weakening yet.

A poll by the National Association of Business Economists in May showed that 60 percent of respondents expect a recession next year, even though there is not much evidence that economic conditions are weakening yet.

Corporate profits have weakened, but the stock market continues to set new record highs (the most recent record occurred on July 3, 2019).

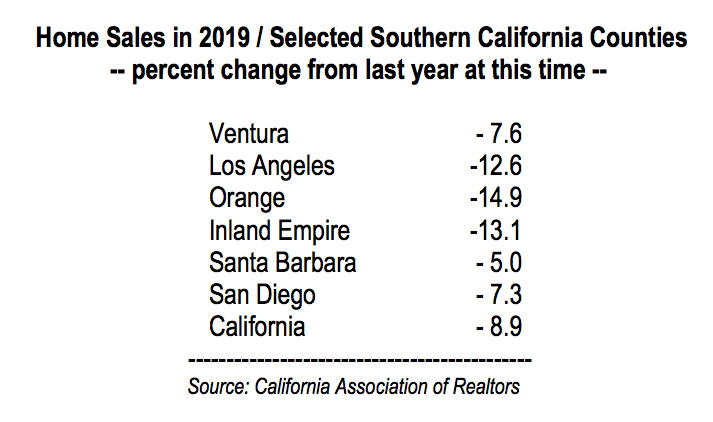

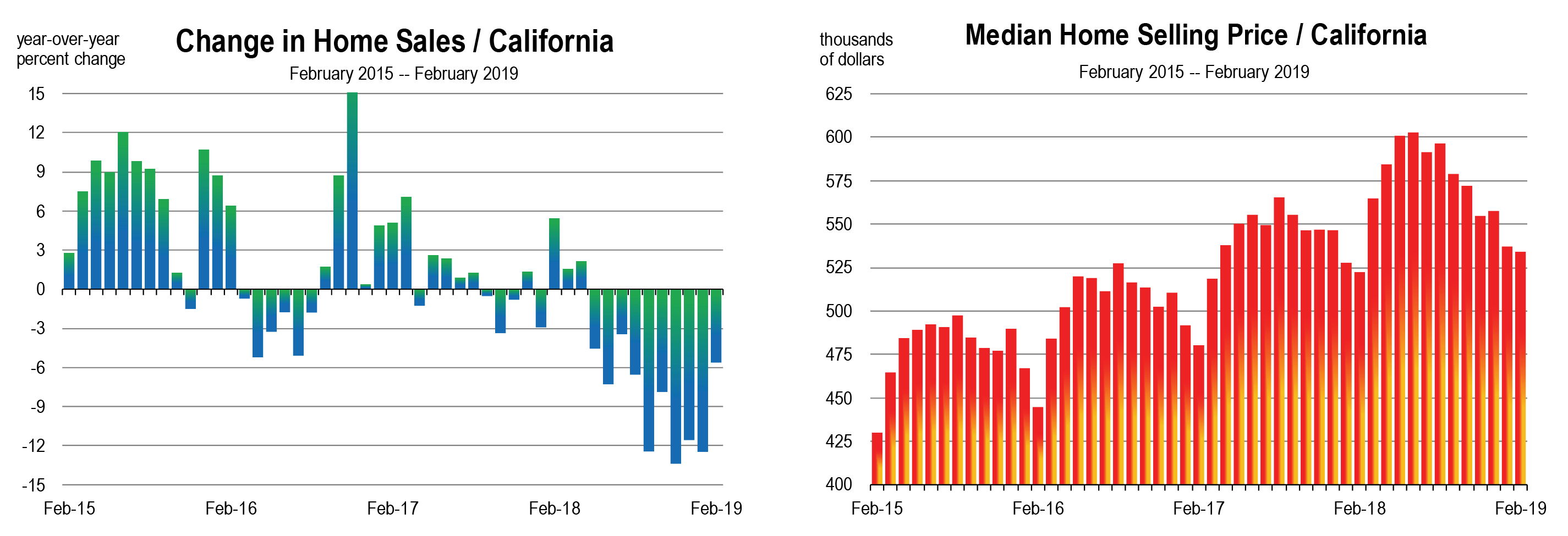

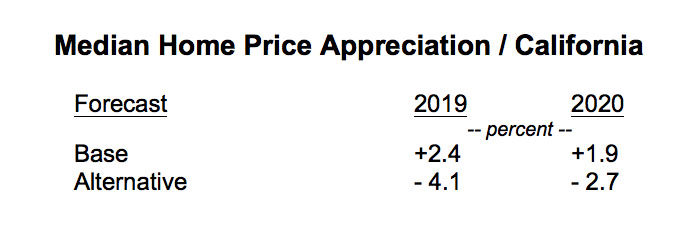

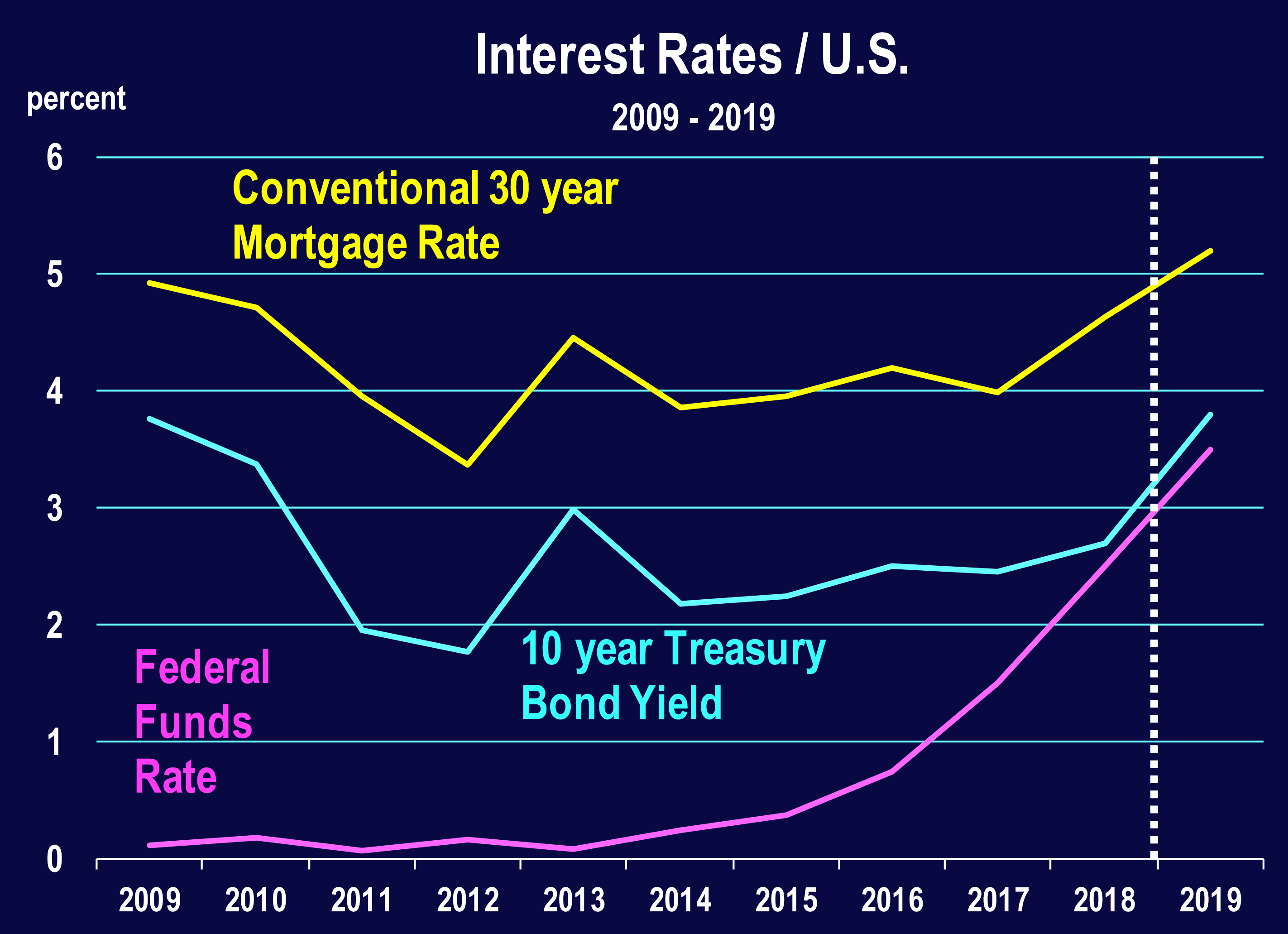

Housing has weakened in all regions of the U.S., but home prices continue to rise, and the recent sharp decline in mortgage rates has produced another refinancing boom.

The trade war is not helping U.S. manufacturing, but the trade war alone is unlikely to push the nation’s economy into negative growth, unless tariffs and counter-tariffs suddenly escalate. This however is a low probability scenario. Even so, the Fed is poised to cut rates given this possibility (or other signs of weakness), and this would boost the outlook for rate-sensitive sectors including housing and automobiles.

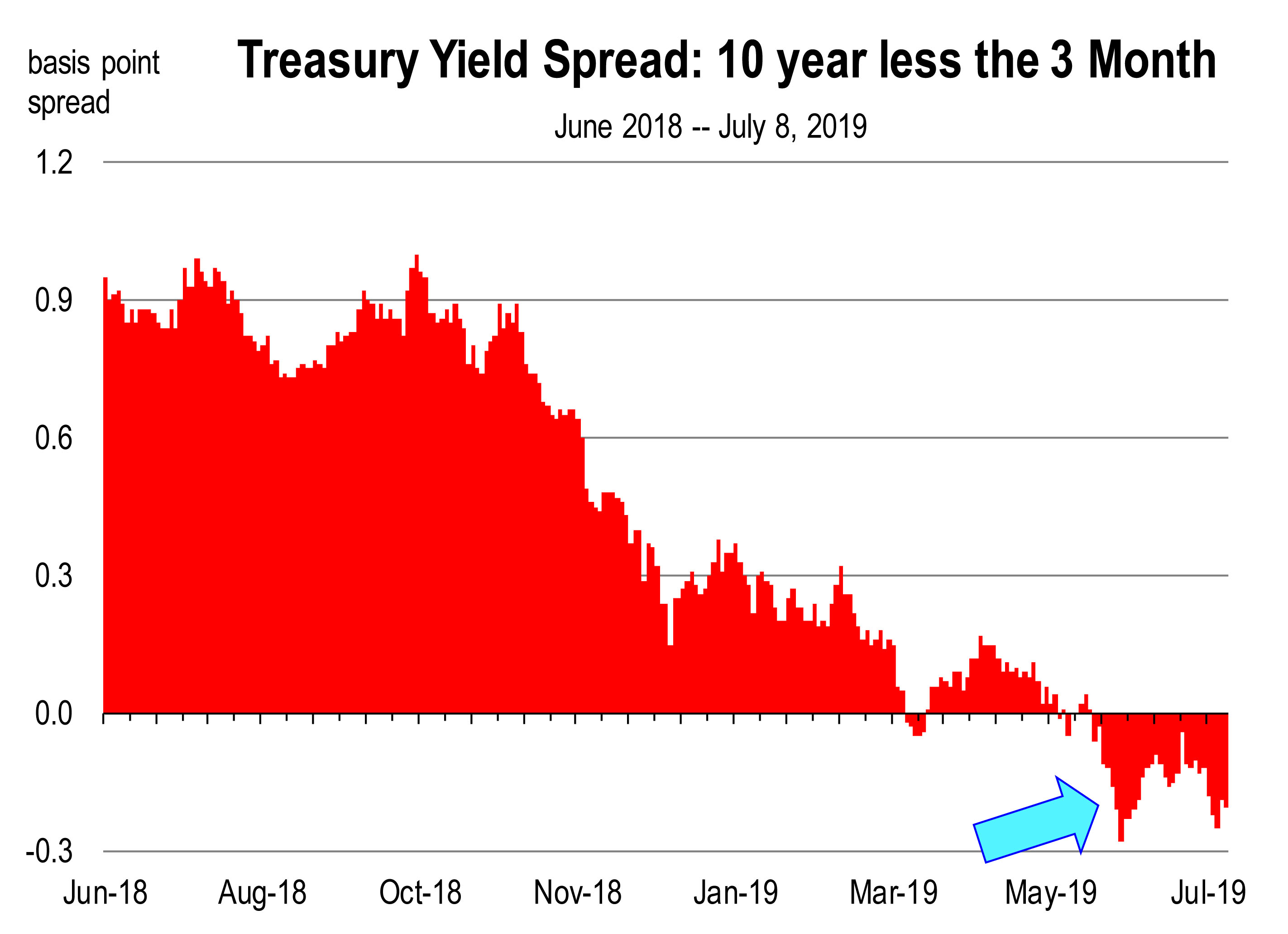

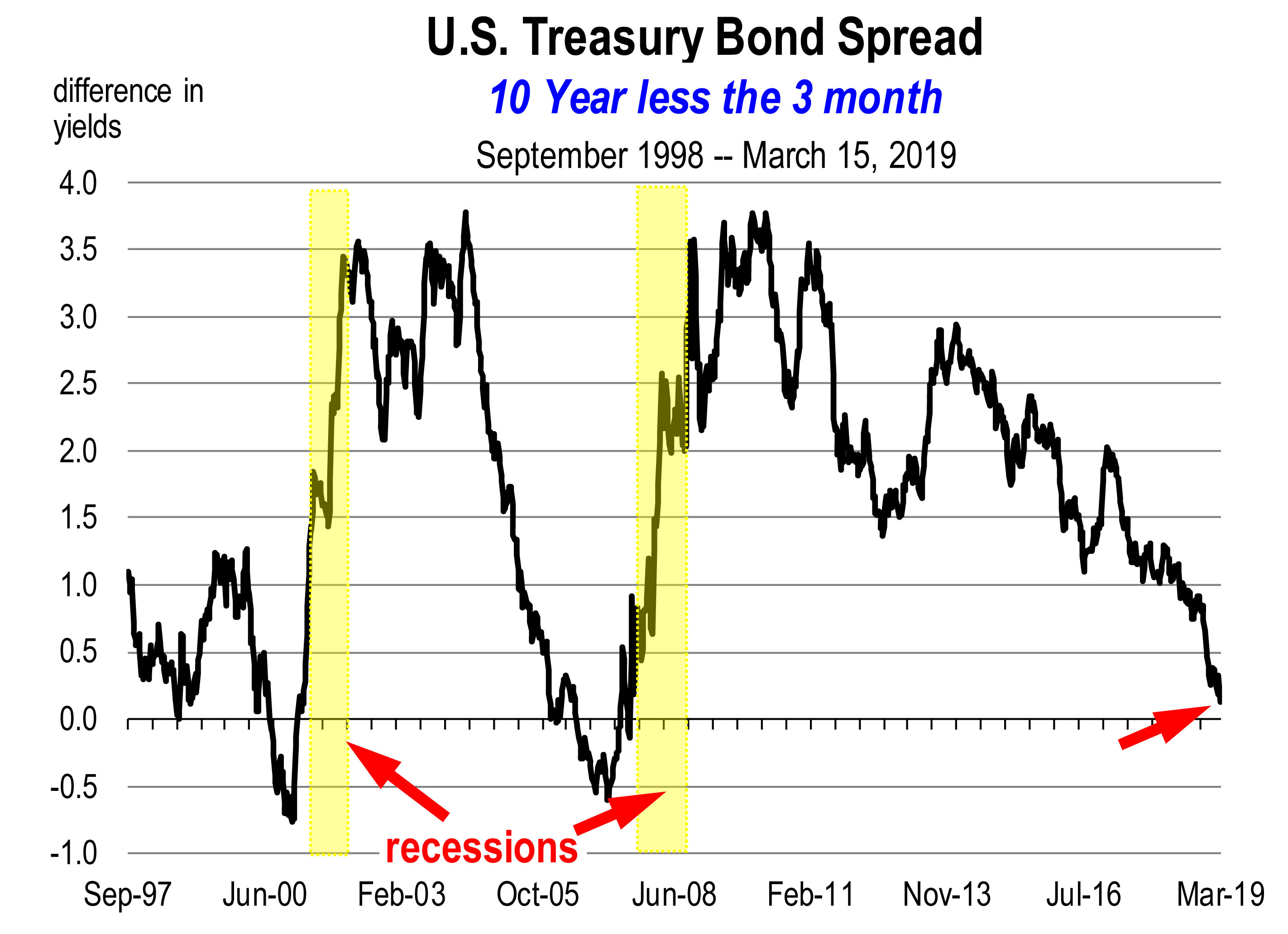

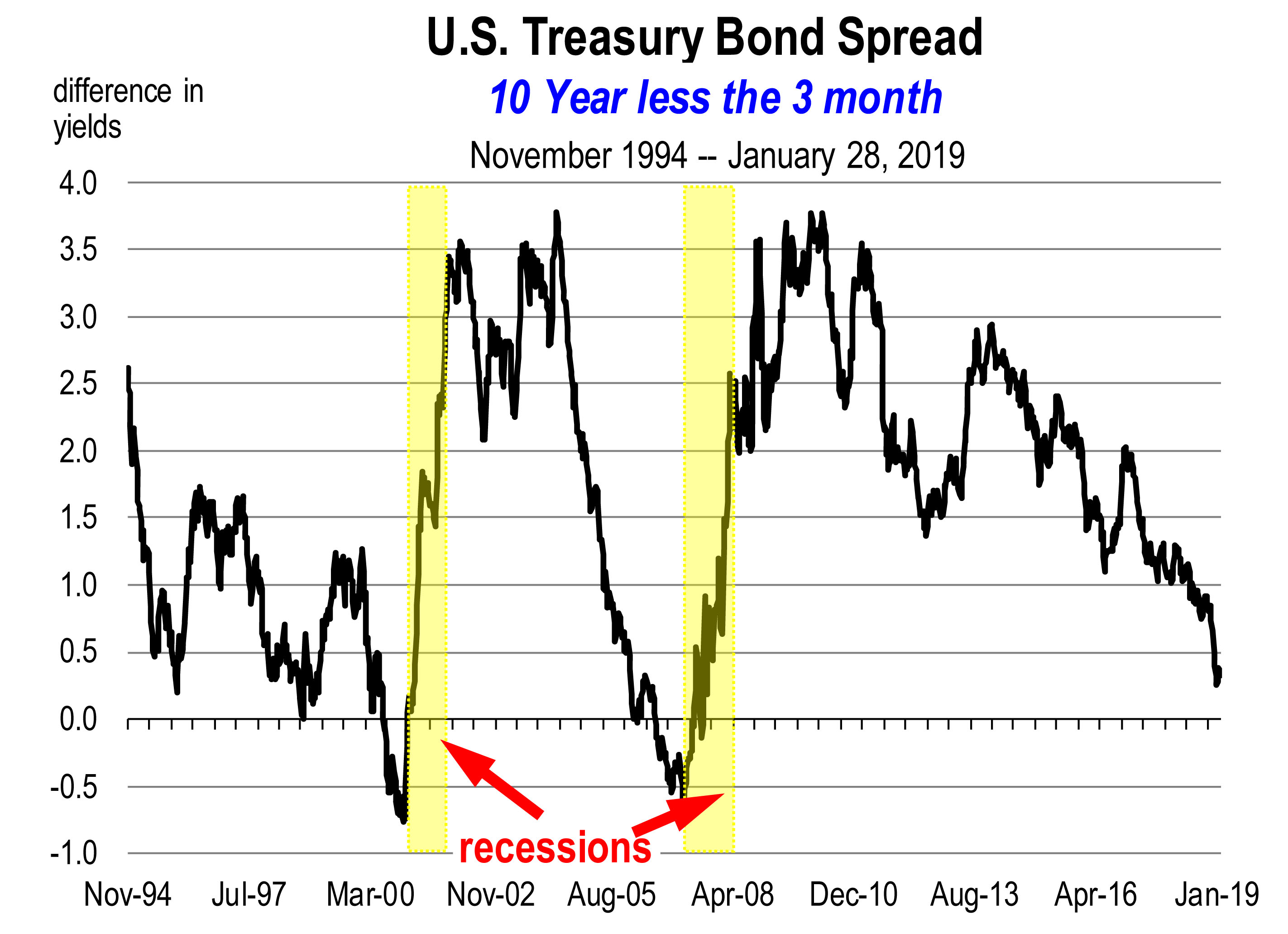

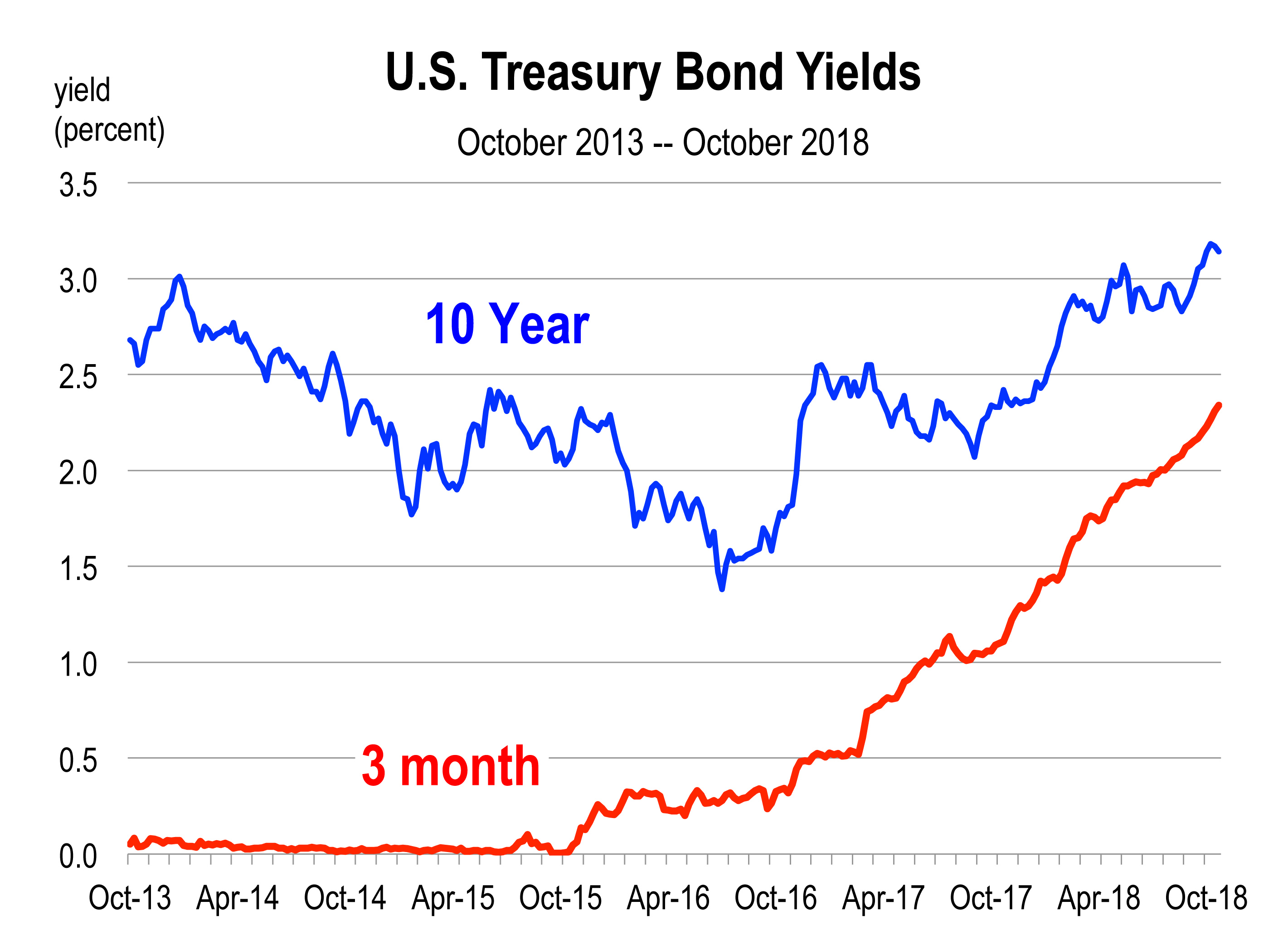

The dreaded flattening of the yield curve has now become more worrisome because the spread between the 3-month and 10-year treasury yield has been negative for more than 6 consecutive weeks. A negative spread lasting a quarter or two is nearly a certain predictor of recession, though eminent doom is often a year or more away.

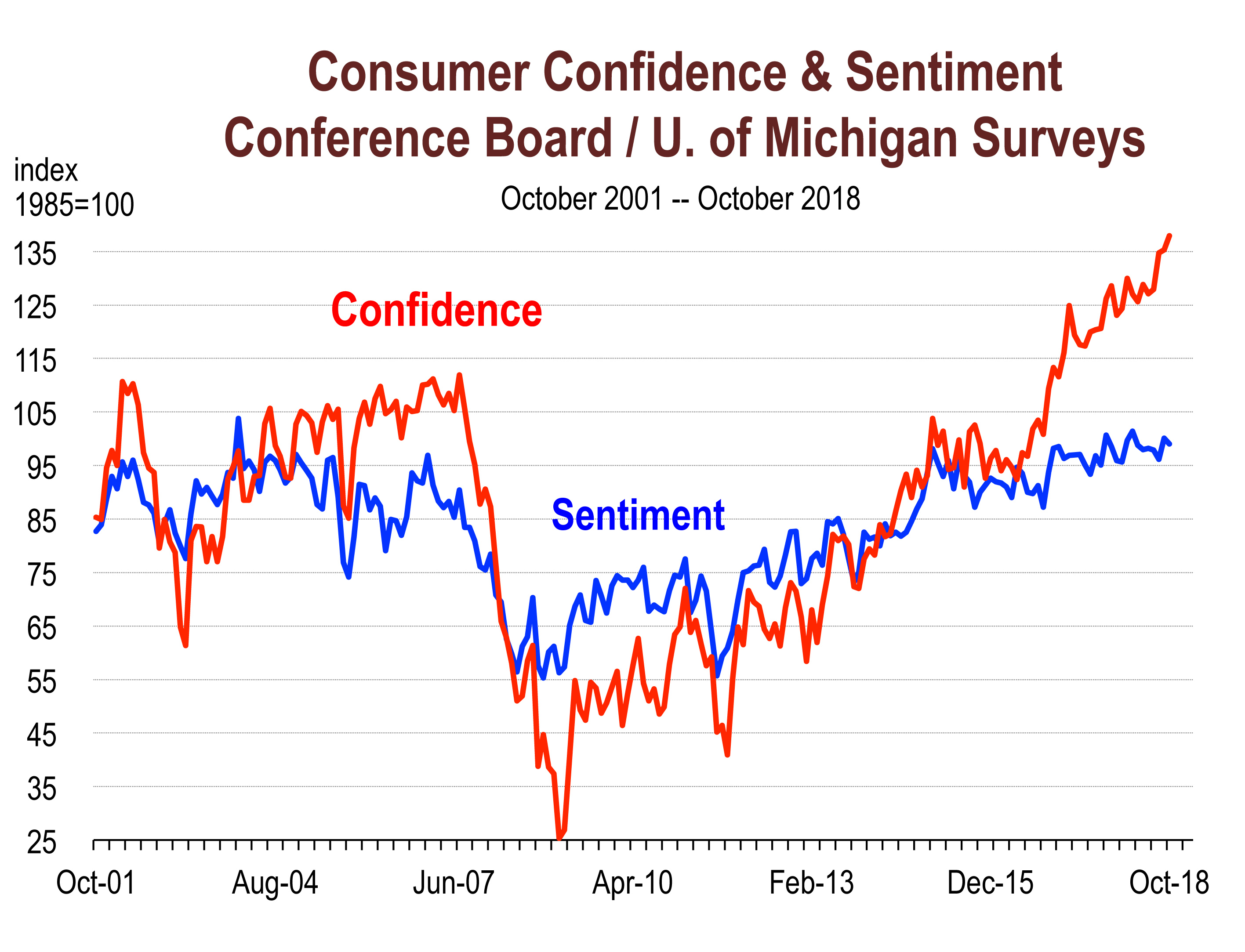

We have been reporting extensively in recent months on the U.S. labor markets, the housing market, interest rates, and the possibility of recession. We’ve been on a vigilant recession watch for over a year. But the aggregate indicators are either not breaking down or not breaking down enough for us to sound the alarm. And many indicators like the stock market, the labor market, and consumer spending continue to show unprecedented strength.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

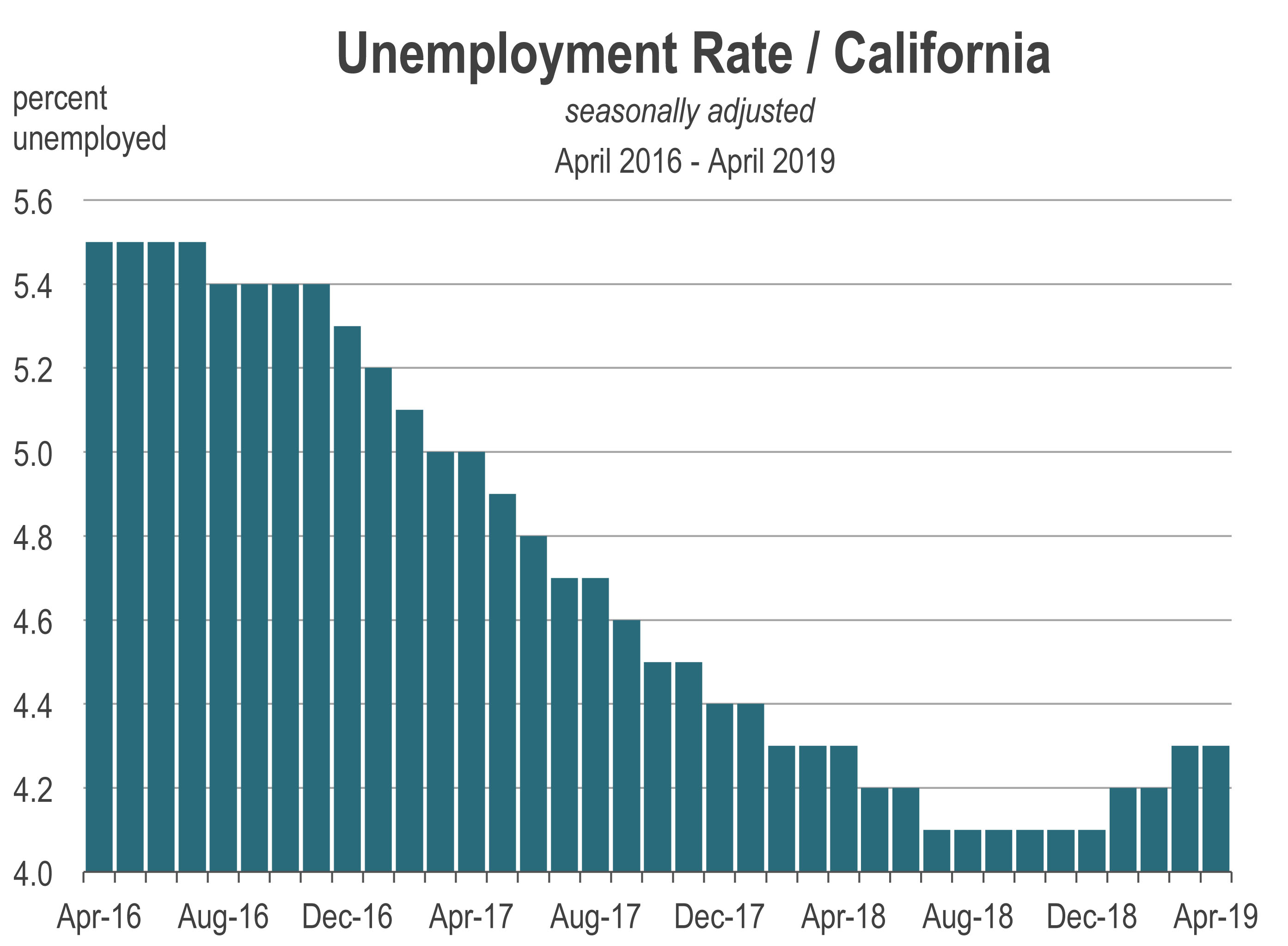

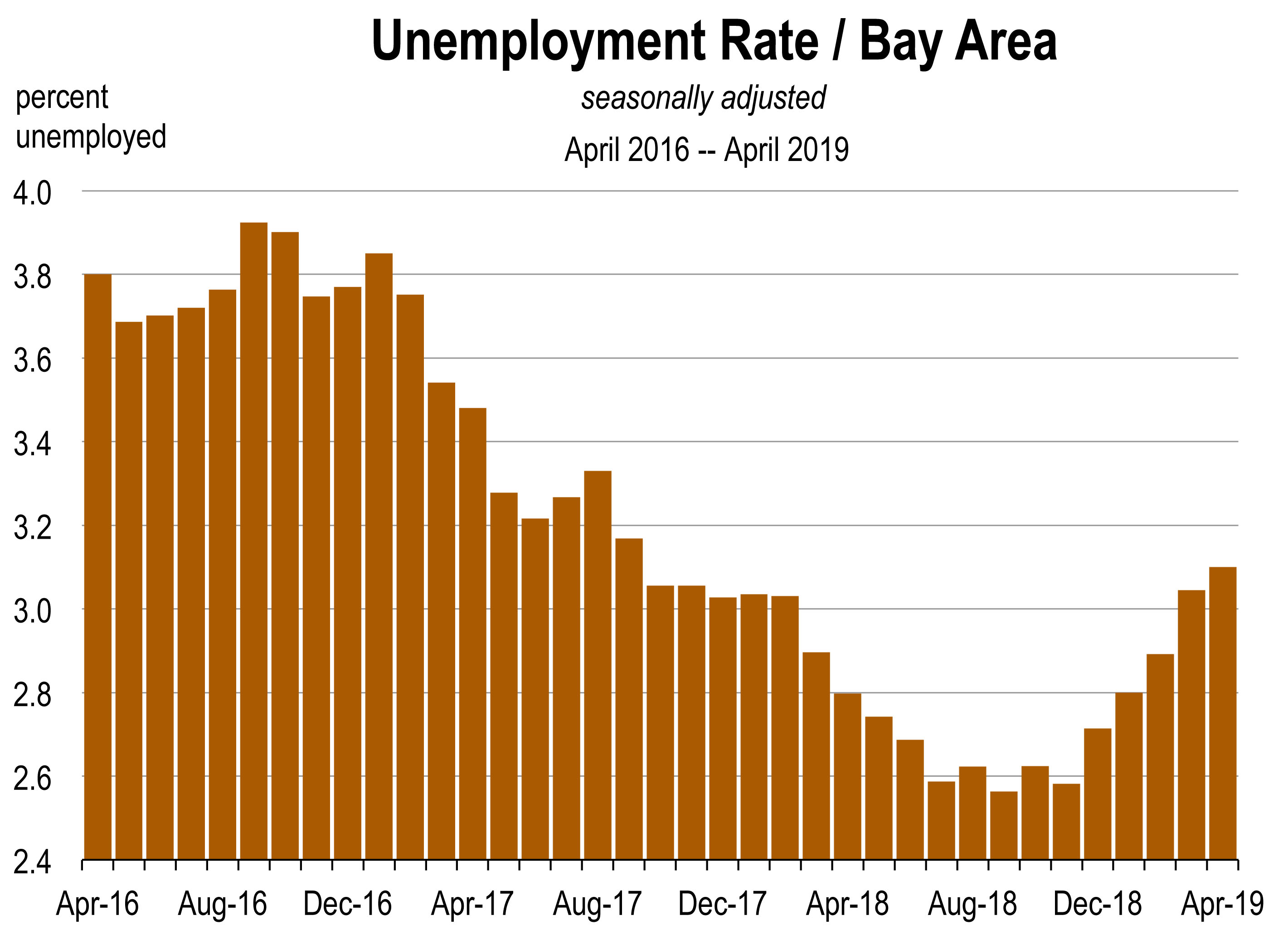

After 8 years of persistent improvement, the California unemployment rate began to drift upward in January 2019. A rising unemployment rate typically indicates that business conditions are deteriorating and companies are slashing jobs, and once the unemployment rate begins to rise, the economy often falls into recession within a year.

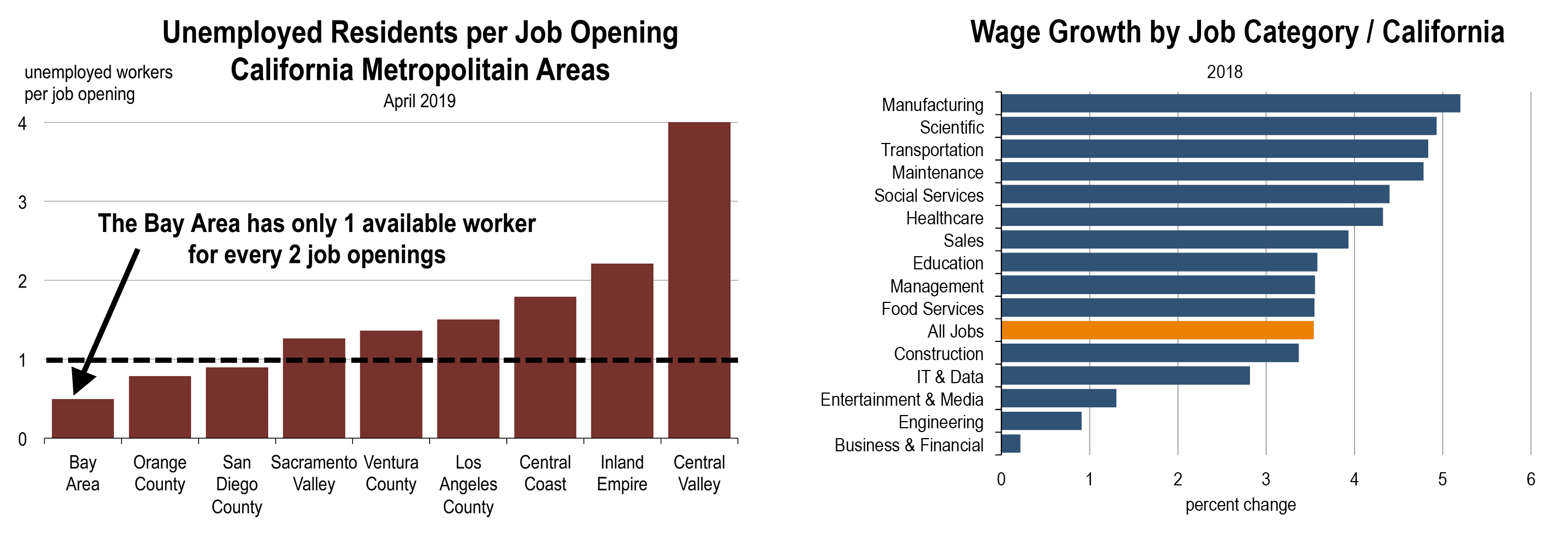

After 8 years of persistent improvement, the California unemployment rate began to drift upward in January 2019. A rising unemployment rate typically indicates that business conditions are deteriorating and companies are slashing jobs, and once the unemployment rate begins to rise, the economy often falls into recession within a year. In such a scenario, companies typically recruit from other cities and increase wages to poach employees from other firms. Both of these strategies are now being deployed, in varying degrees of intensity, across the major regions of California.

In such a scenario, companies typically recruit from other cities and increase wages to poach employees from other firms. Both of these strategies are now being deployed, in varying degrees of intensity, across the major regions of California. The California labor force (the number of people either working or looking for work) is expanding at the fastest rate since 2007. So far in 2019, the state is on pace to get 272,000 new job seekers, and because the job market may not be able to absorb them all, the unemployment rate could continue to move higher.

The California labor force (the number of people either working or looking for work) is expanding at the fastest rate since 2007. So far in 2019, the state is on pace to get 272,000 new job seekers, and because the job market may not be able to absorb them all, the unemployment rate could continue to move higher.

The demand for rental housing instead has dominated housing choice, as both Millennials and Boomers look to non-ownership housing. That’s why of course so much more apartment product is being built nowadays. Moving boomer households may actually prefer to rent to avoid all those annoying repairs and those big property tax bills in December and April. And Millennials simply don’t have the down payment.

The demand for rental housing instead has dominated housing choice, as both Millennials and Boomers look to non-ownership housing. That’s why of course so much more apartment product is being built nowadays. Moving boomer households may actually prefer to rent to avoid all those annoying repairs and those big property tax bills in December and April. And Millennials simply don’t have the down payment.

An inverted yield curve is an interest rate environment in which long-term debt has lower yield than short-term debt of the same credit quality. It occurs when the 10 year U.S. treasury bond yield less the 3 month U.S. treasury bill yield turns negative. This is the conventional spread that is typically evaluated. Alternatively, other analysts use the yield spread between the 10 year and the 2 year T-bill.

An inverted yield curve is an interest rate environment in which long-term debt has lower yield than short-term debt of the same credit quality. It occurs when the 10 year U.S. treasury bond yield less the 3 month U.S. treasury bill yield turns negative. This is the conventional spread that is typically evaluated. Alternatively, other analysts use the yield spread between the 10 year and the 2 year T-bill.

The candidates I’ve been watching closely are:

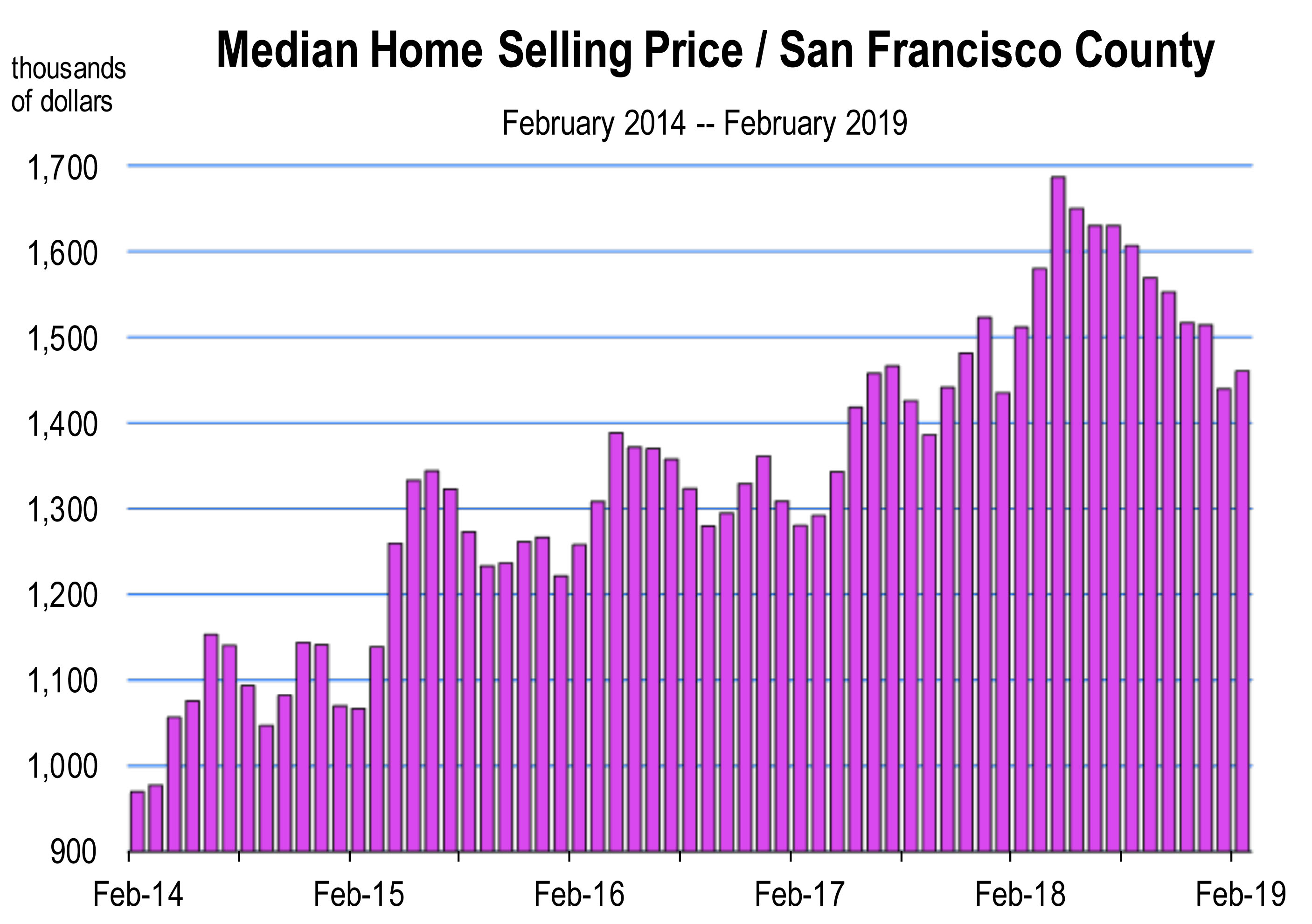

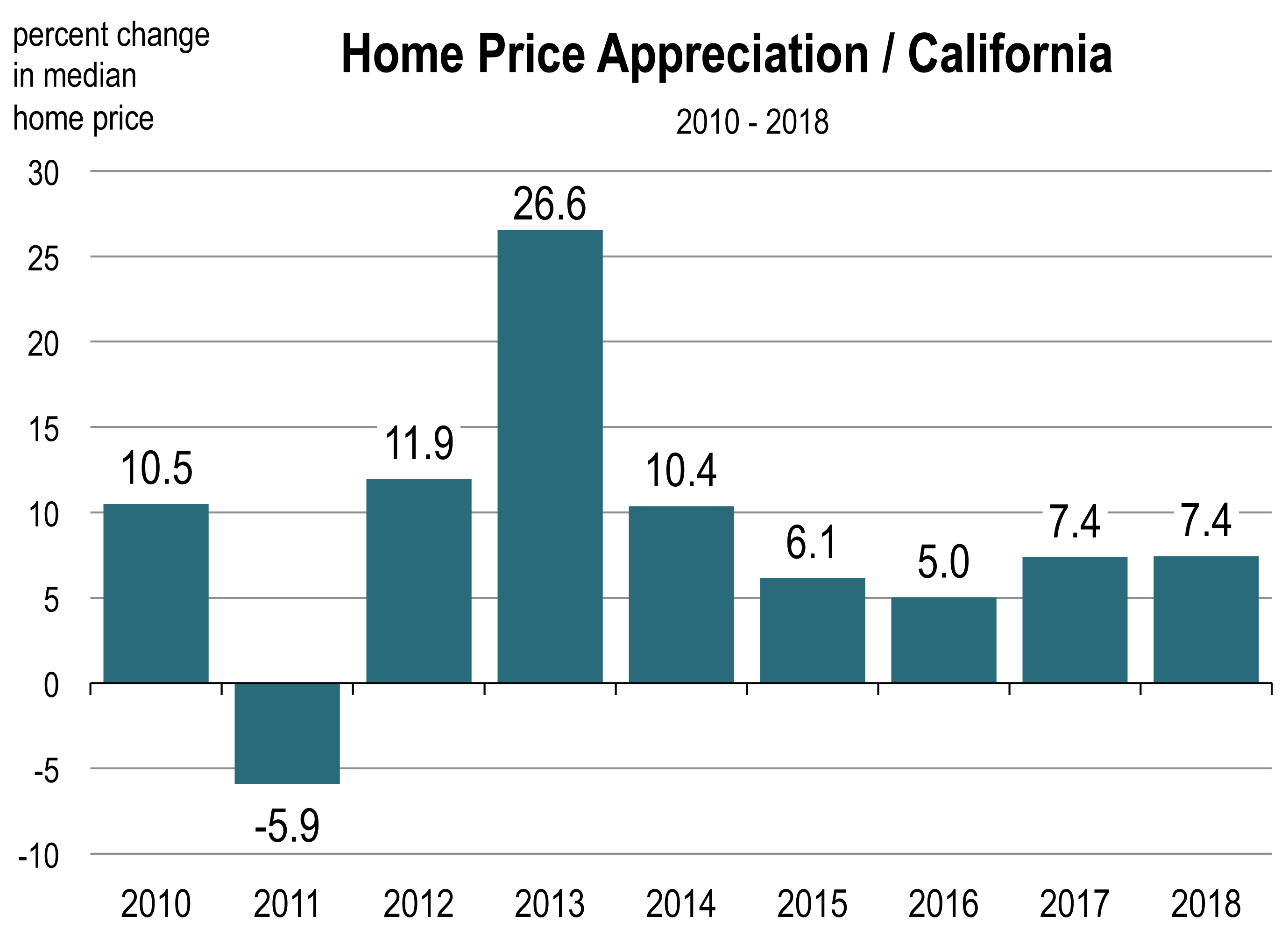

The candidates I’ve been watching closely are: Home sales are weak nationwide. In California, new housing is not keeping pace with commercial and industrial development. Consequently, California has predictably ended up with less new housing and sharply higher housing values. Higher home values are currently indicative of most robust regional economies in the nation.

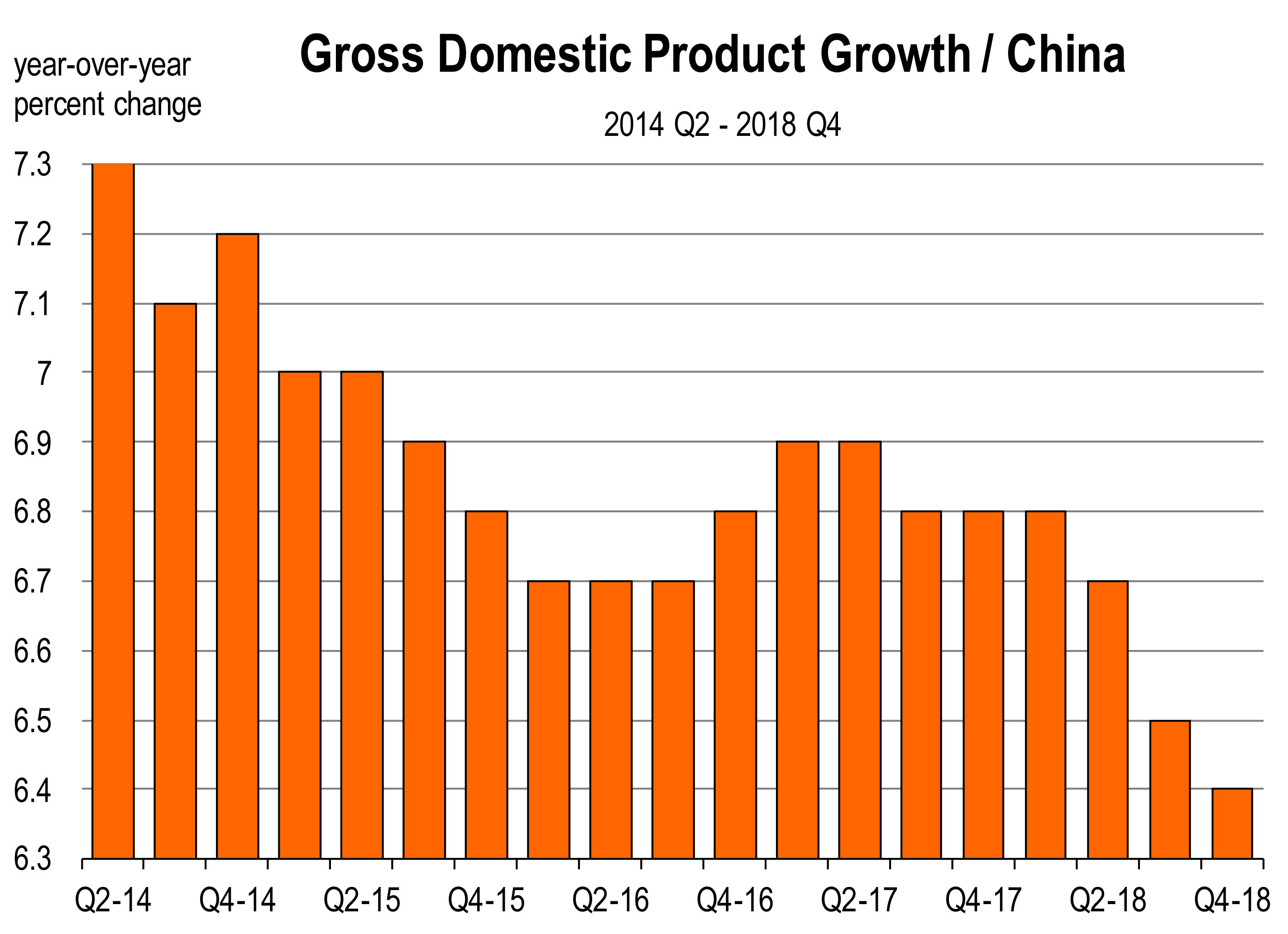

Home sales are weak nationwide. In California, new housing is not keeping pace with commercial and industrial development. Consequently, California has predictably ended up with less new housing and sharply higher housing values. Higher home values are currently indicative of most robust regional economies in the nation. The fiscal stimulus in 2018 enabled U.S. companies to shake off signs of slower growth in China, Japan, Germany and elsewhere.

The fiscal stimulus in 2018 enabled U.S. companies to shake off signs of slower growth in China, Japan, Germany and elsewhere. The yield curve, as measured by the spread between short-dated yields and longer term bond yields, has steadily flattened towards “an inversion.”

The yield curve, as measured by the spread between short-dated yields and longer term bond yields, has steadily flattened towards “an inversion.”

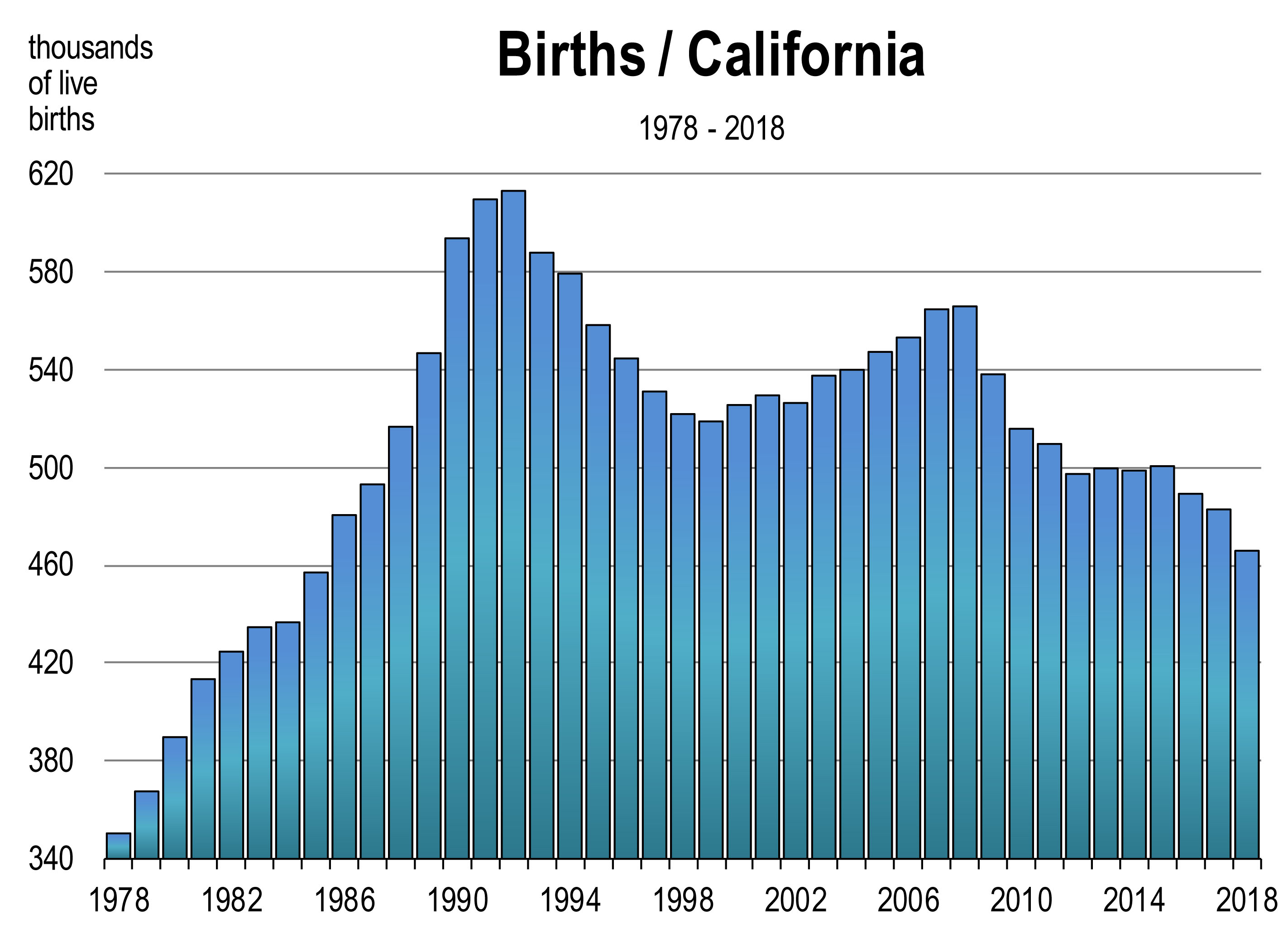

That means a slower year for output and the quarterly GDP reports, unless workers become a lot more productive.

That means a slower year for output and the quarterly GDP reports, unless workers become a lot more productive. The product being produced is largely apartments so more people will rent. If you own apartments, demand this year should keep them fully occupied.

The product being produced is largely apartments so more people will rent. If you own apartments, demand this year should keep them fully occupied.

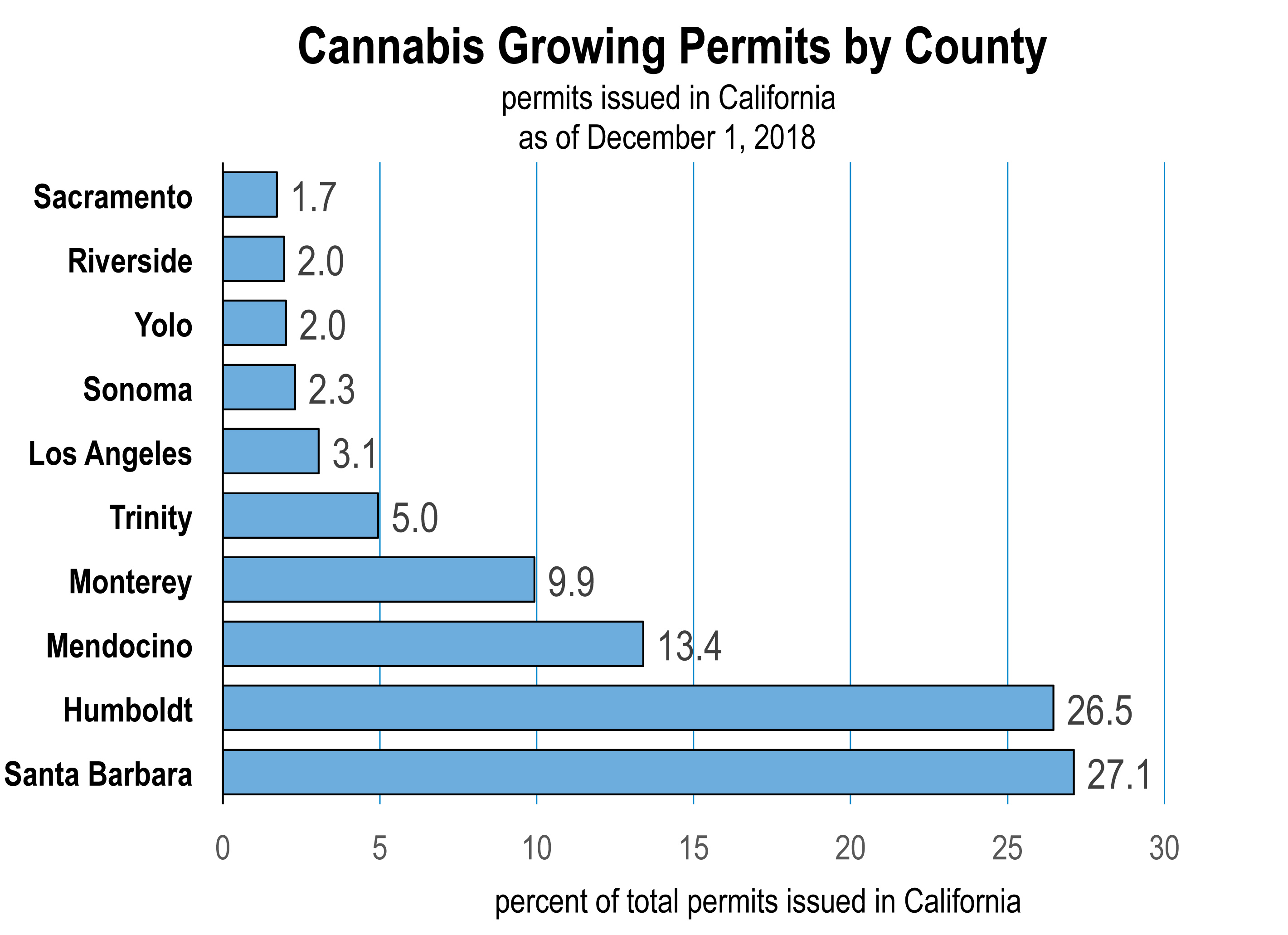

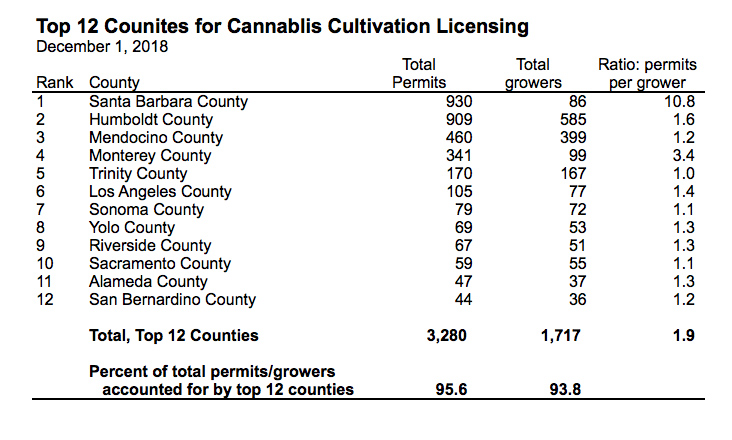

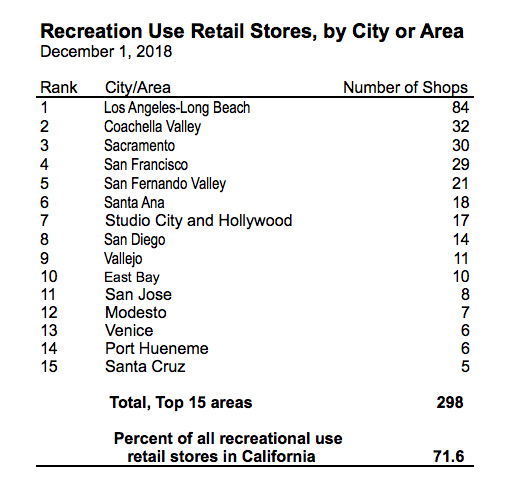

California launched legal recreational marijuana sales and began licensing all other industry businesses including cultivation for the first time on January 1, 2018.

California launched legal recreational marijuana sales and began licensing all other industry businesses including cultivation for the first time on January 1, 2018.

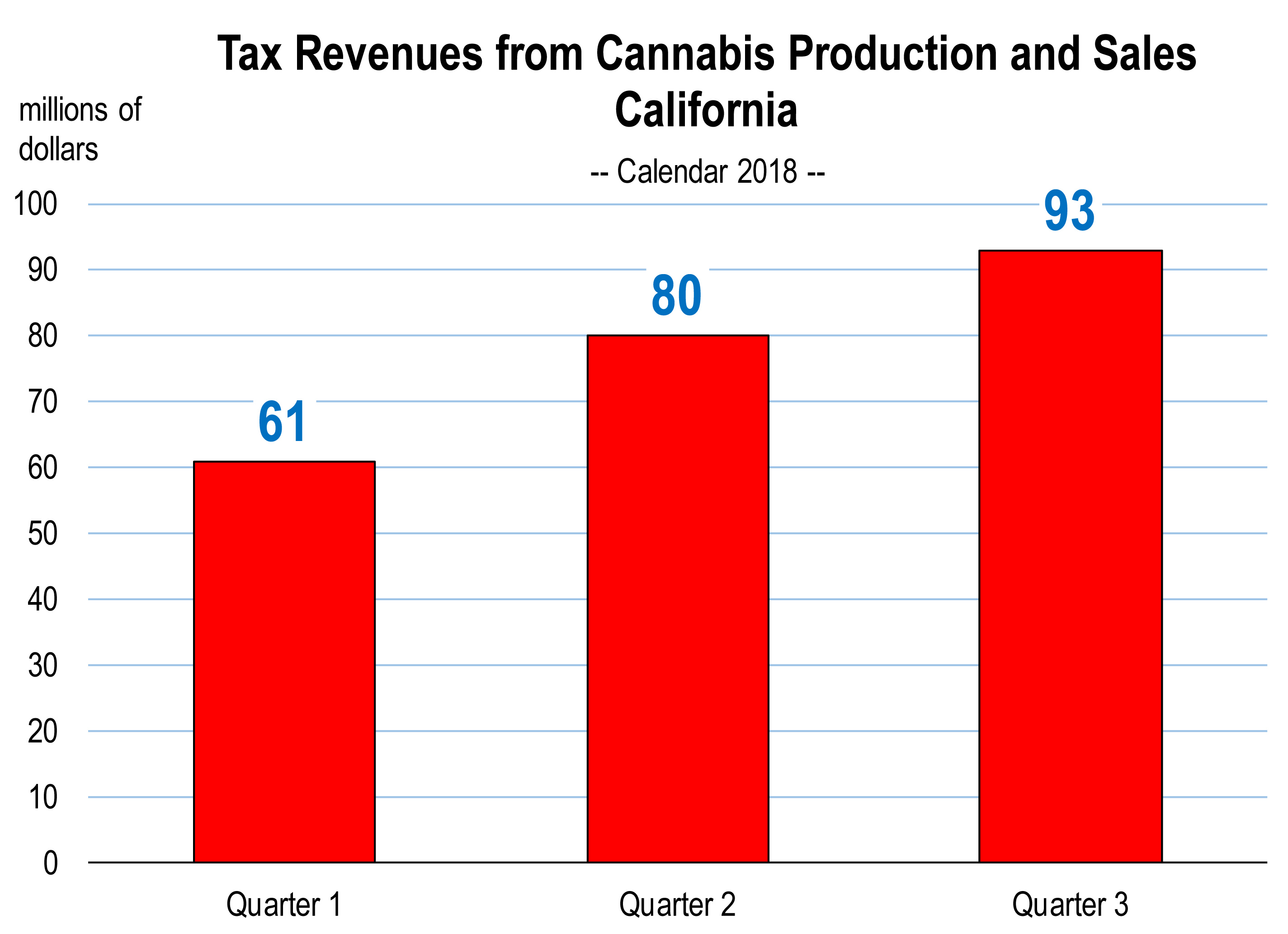

However, during the first 3 quarters of 2018, total tax revenue collection has fallen short of expectations. At the current rate of tax receipts realized through September, it’s likely that just over half of the Governor’s tax revenue goal for calendar 2018 will be realized.

However, during the first 3 quarters of 2018, total tax revenue collection has fallen short of expectations. At the current rate of tax receipts realized through September, it’s likely that just over half of the Governor’s tax revenue goal for calendar 2018 will be realized. Prices

Prices

2. GDP growth has accelerated this year, akin to a breakout

2. GDP growth has accelerated this year, akin to a breakout

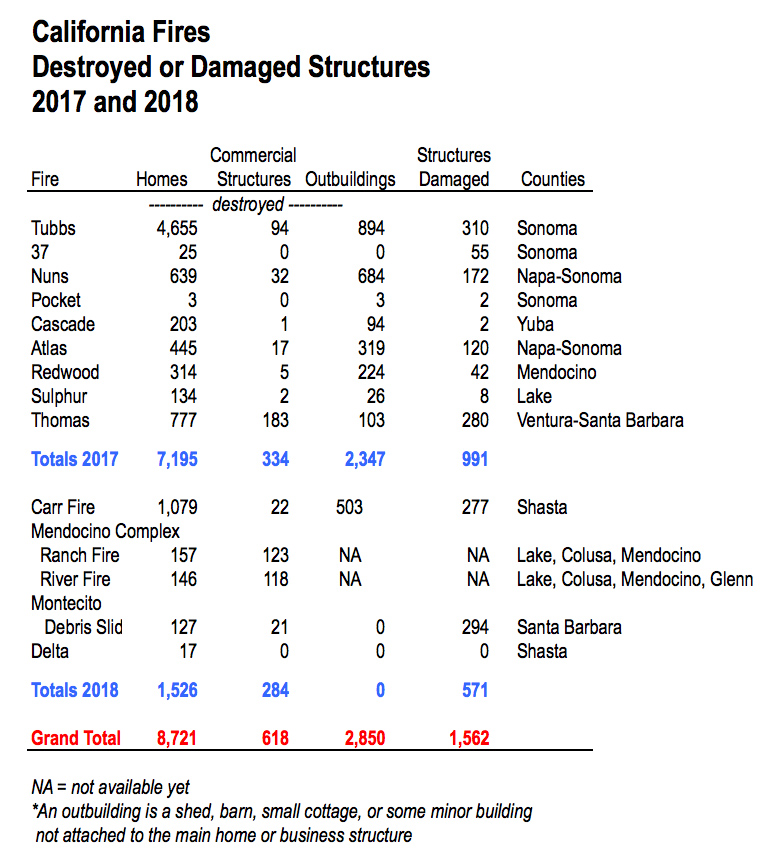

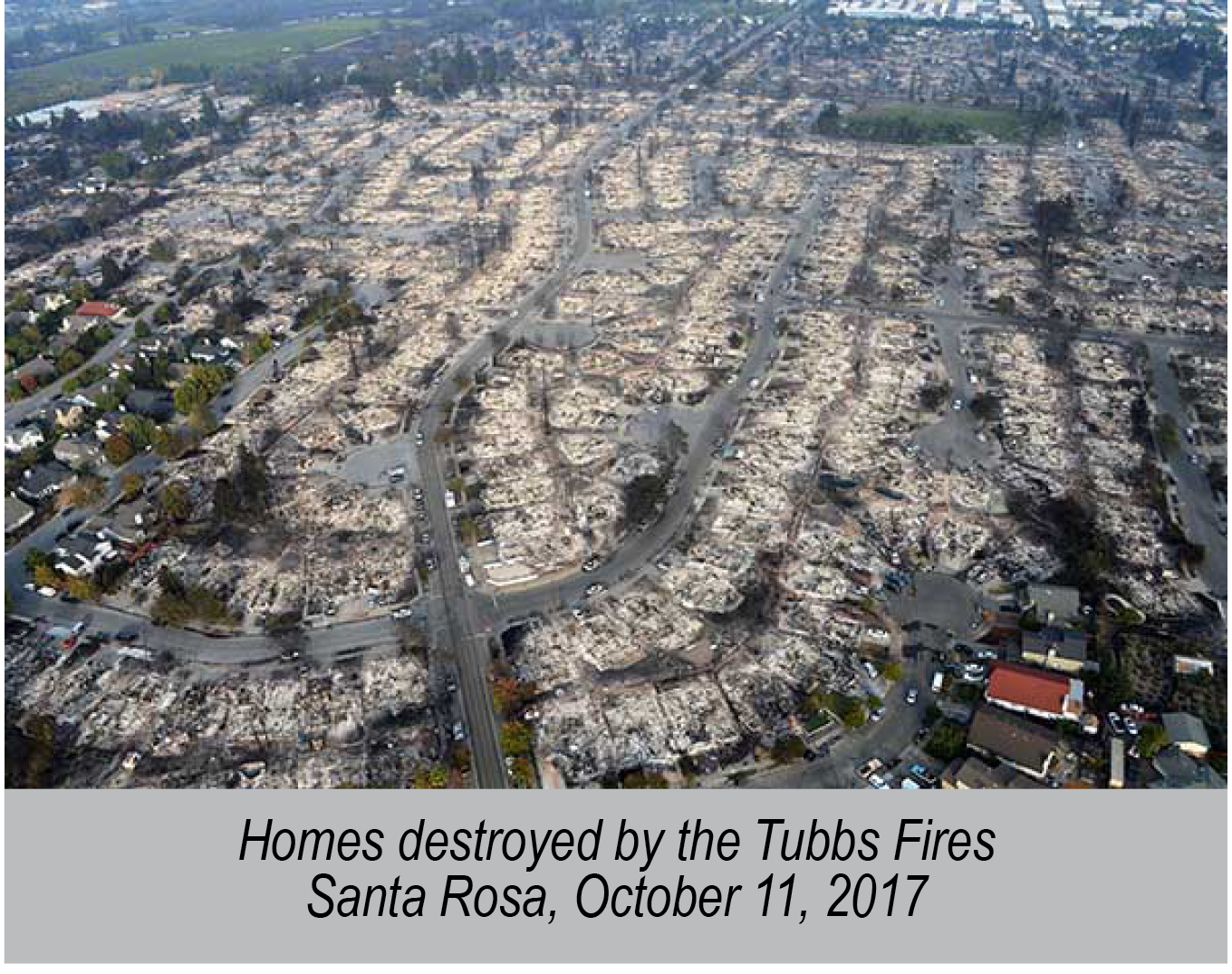

It’s been a year since the worst fires in the modern history of California swept through Northern California creating a path of unprecedented destruction.

It’s been a year since the worst fires in the modern history of California swept through Northern California creating a path of unprecedented destruction. On January 9, 2018, a freak rainstorm that occurred a week after the Thomas fire was completely extinguished resulted in flash flooding that caused a major debris flow in the Montecito community of Southern Santa Barbara County. The flood destroyed 127 homes and severely damaged another 294 homes. The 220 room 4 Seasons Biltmore Hotel was closed for 5 months. The San Ysidro Inn has yet to re-open.

On January 9, 2018, a freak rainstorm that occurred a week after the Thomas fire was completely extinguished resulted in flash flooding that caused a major debris flow in the Montecito community of Southern Santa Barbara County. The flood destroyed 127 homes and severely damaged another 294 homes. The 220 room 4 Seasons Biltmore Hotel was closed for 5 months. The San Ysidro Inn has yet to re-open.