by Mark Schniepp

September 2018

The Seasons Are Changing

It’s fall. School started again. My kids began their junior year in high school. Though they didn’t say anything about it and would certainly never admit it, I think they were glad at the change in their daily schedules that 6 hours of school brings. After all, school also brings their friends together, sports, and social events.

And parents’ schedules often change to accommodate school. You have to drive kids to school, to sports, and to the events. You have to make time to attend some of the school functions. You might even be asked to solve a homework problem or two, or help with a school project.

It’s getting darker in the morning, so I have to turn the lights on when I get up. I also have to shut the windows (halfway) because I’m noticing falling temperatures in the early morning hours and slightly cooler days. My cilantro was bolting like crazy in July, but now I can grow it again. There is change with seasons.

It’s getting darker in the morning, so I have to turn the lights on when I get up. I also have to shut the windows (halfway) because I’m noticing falling temperatures in the early morning hours and slightly cooler days. My cilantro was bolting like crazy in July, but now I can grow it again. There is change with seasons.

And what about the economy? Though some subtle changes are occurring, for the most part, there’s a lot less change than what’s happening with school starting, temperatures falling, fewer hours of sunlight, and my cilantro garden.

Tariffs Are Here

They represent a change, but how big a change?

Following the round of tariffs in the spring, another wave of tariffs was implemented last week, this time on $16 billion worth of Chinese goods imports. China has retaliated in kind, with 25 percent tariff rates on $16 billion worth of U.S. goods imports, targeting chemical and fossil fuel industries.

The latest wave of tariffs has imposed duties on $100 billion worth of goods imports. However, this represents only about 4 percent of total imports, so it’s not that significant of a change.

Some protected industries may benefit from higher tariffs on foreign competitors, but businesses that rely on foreign imports, such as retailers and finished goods manufacturers, will face higher input costs, and U.S. consumers will face higher prices. Protectionist trade policies have also resulted in retaliation by some principal trade partners but the extent of that retaliation has not been very significant.

Though we haven’t seen much yet, trade-related uncertainty is likely to weigh on business confidence and investment, while an escalation of tariff activity has the potential to slow down consumer spending if import prices rise. However, recent negotiations with Mexico over NAFTA, which have resulted in a new agreement, and the resumption of talks with China could signal an appeasement of tensions in coming months.

To reiterate, there is little to any indication that new tariffs have impacted the economy. Manufacturing continues to grow, exceeding expectations, as is consumer spending, and the value of exports is still rising together with imports.

Inflation and Interest Rates

Both are rising, but gradually.

A tighter labor market, stronger wage growth and the tax cuts have provided a big boost to spending, especially at restaurants and clothing stores. Retail sales growth has surged over the last several months, and consumers continue to be a strong engine of growth for the economy.

The acceleration in spending together with a fully employed economy incentivizes the Fed to continue normalizing interest rates, and this month rates will go up again, likely by another quarter point.

GDP Growth

Above trend performance.

Above trend performance.

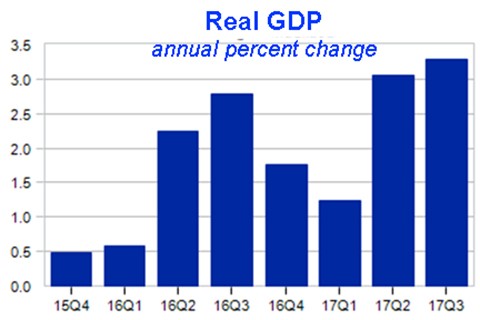

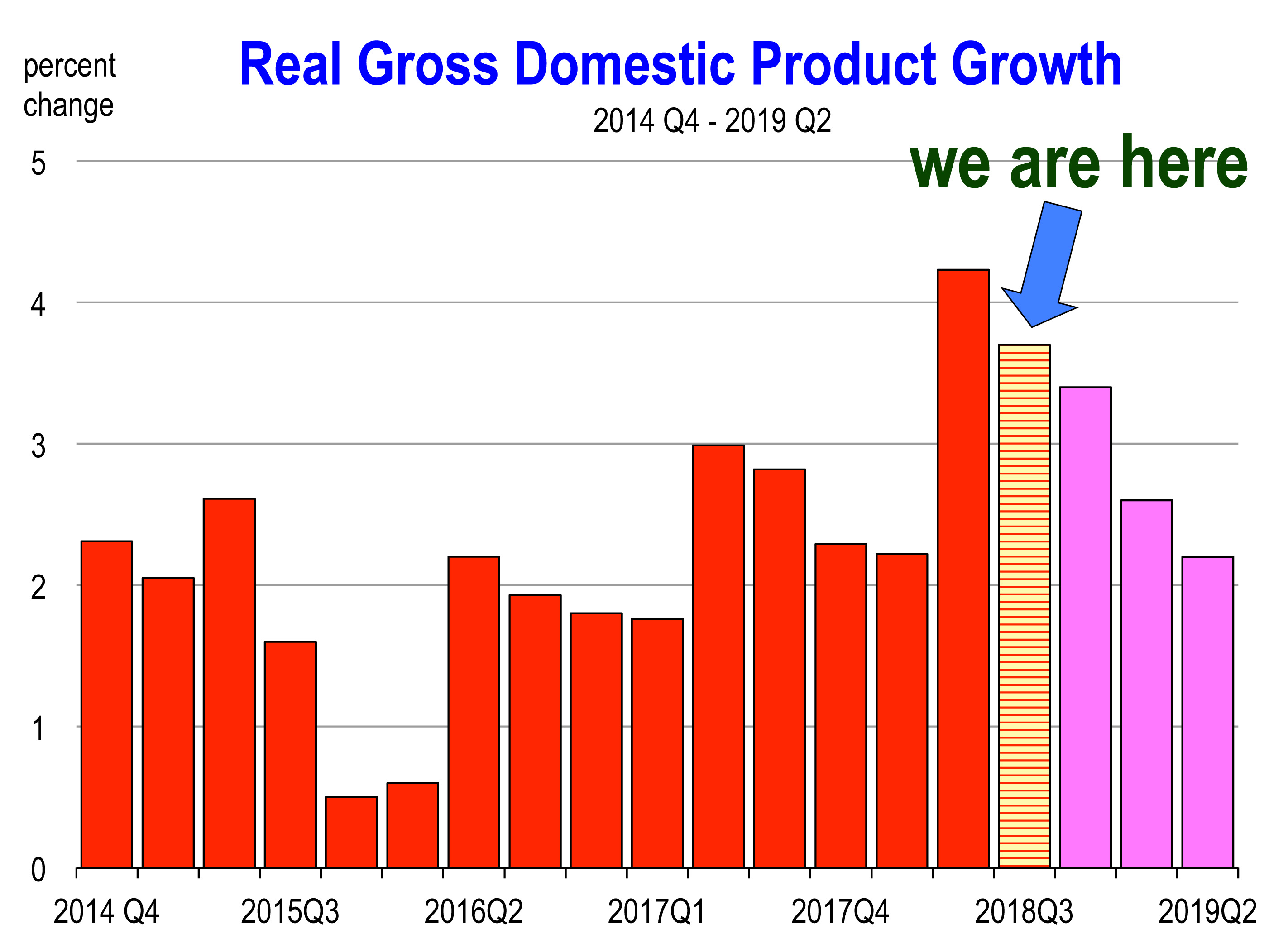

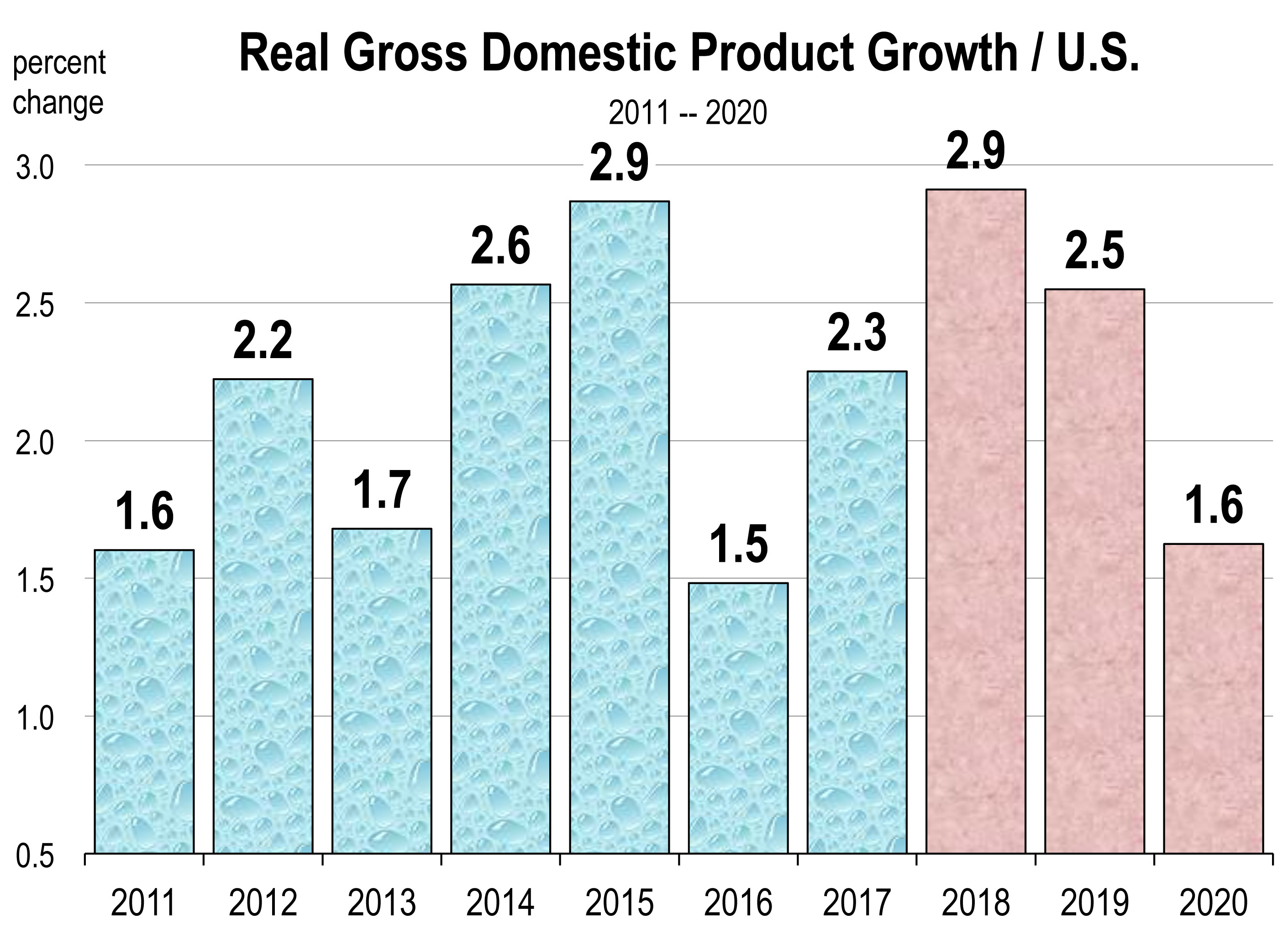

Second quarter 2018 growth was revised upward to 4.2 percent, and third quarter GDP is tracking at between 3.5 and 4.0 percent growth. These values are a change to the upside and represent some of the fastest growth observed during the current expansion.

The economy keeps firing on all cylinders domestically and the implications for GDP growth are positive. The consensus forecast has the economy on track for above-trend performance this year and during the first quarter of 2019.

What’s Not Changing?

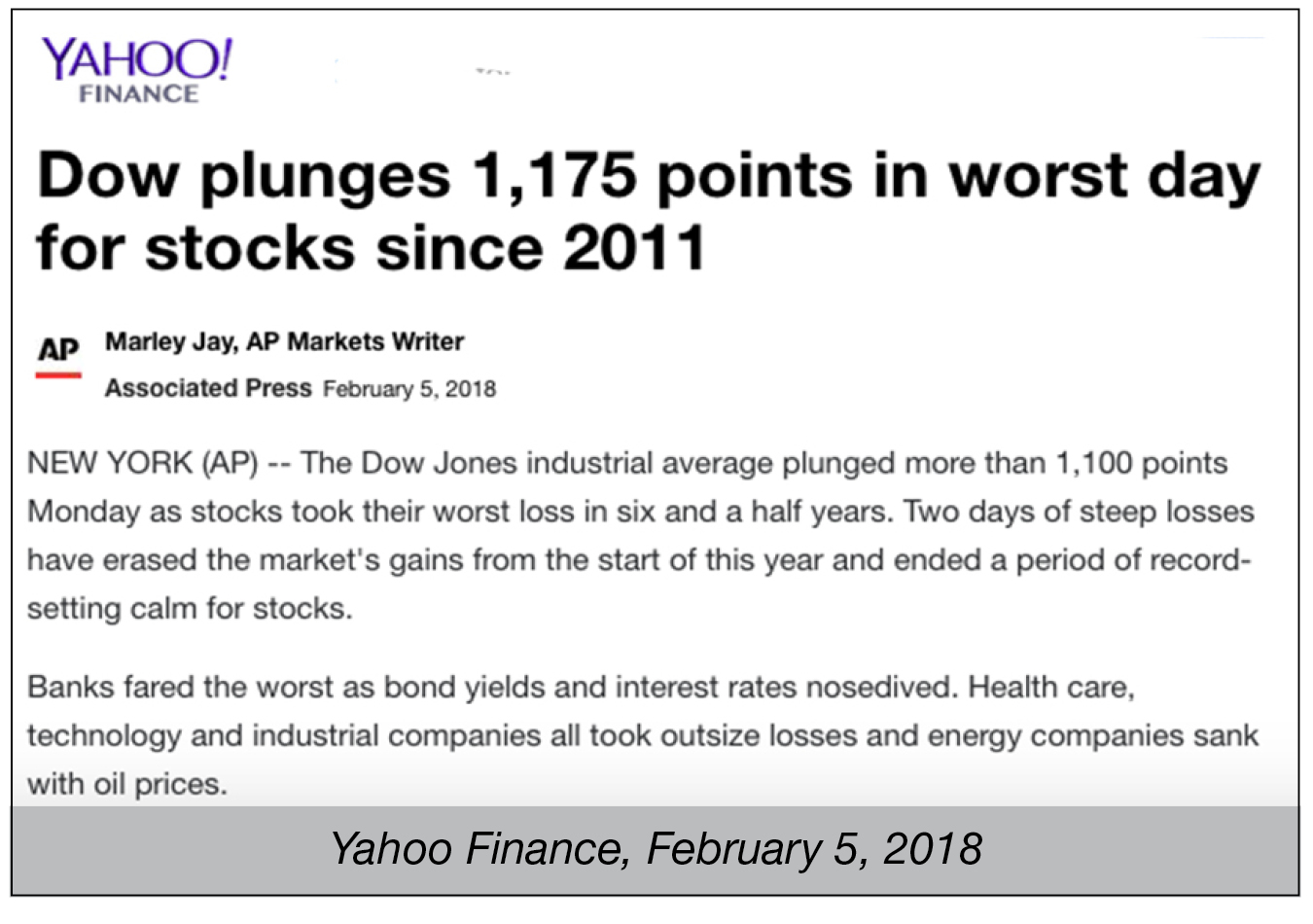

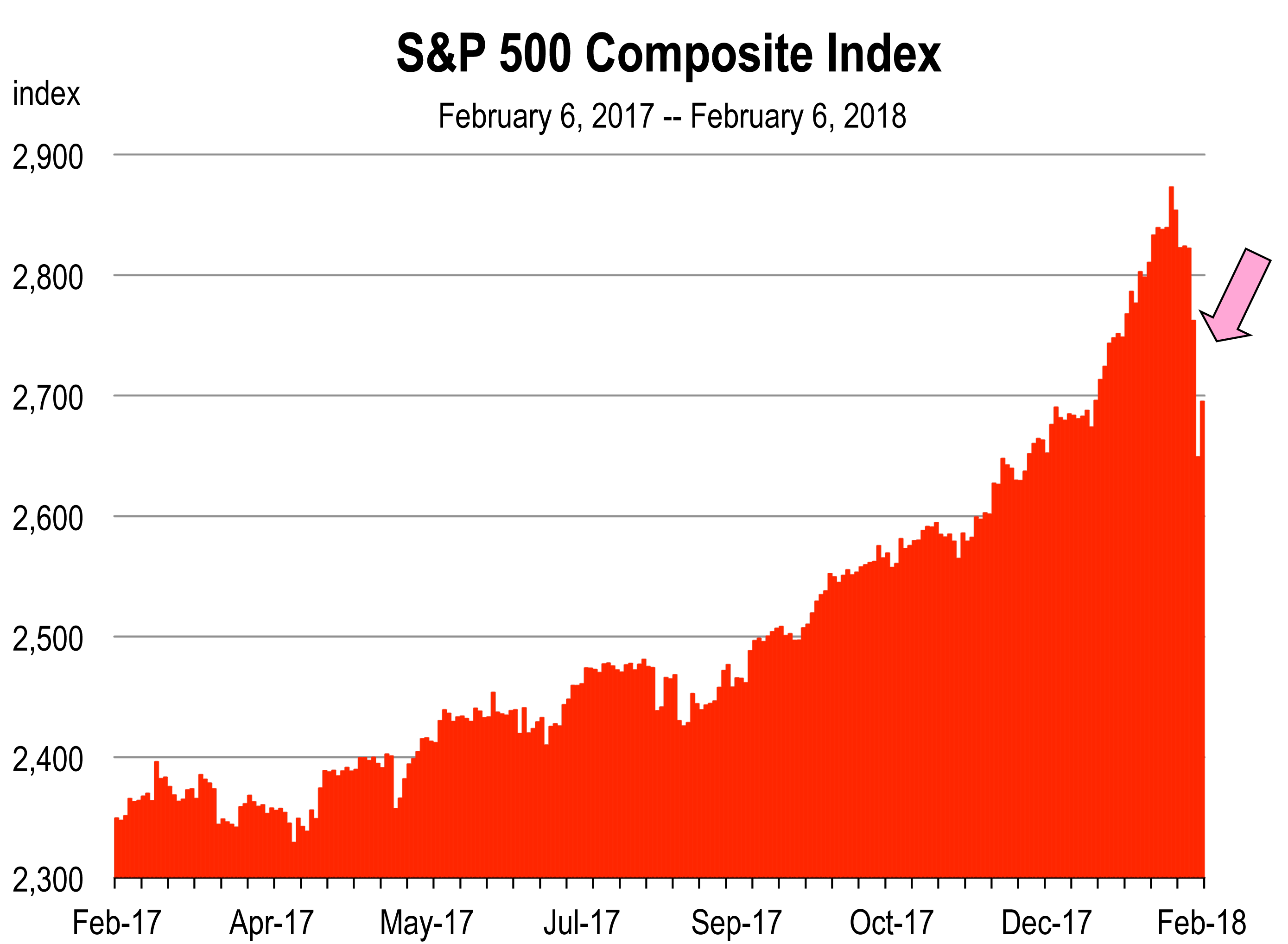

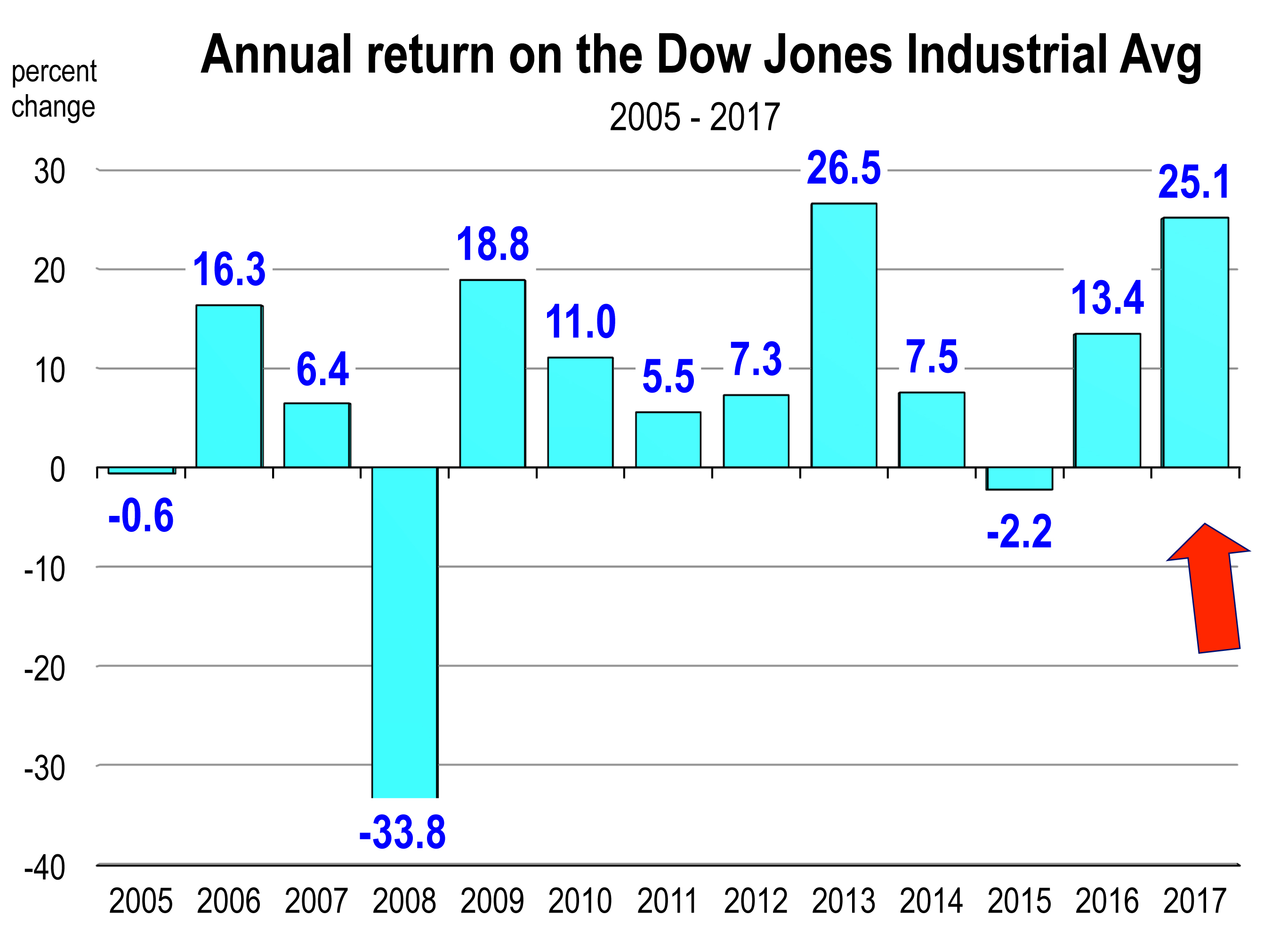

Fed interest rate policy. The Fed was expected to raise rates gradually in 2016, 2017 and 2018 and that’s exactly what has happened. Investors have not been ambushed and are pleased with predictable interest rate conditions. Consequently, long interest rates have only moved slightly higher over the last 18 months, the stock market is moving upward again, and there has been no slowing impact on growth.

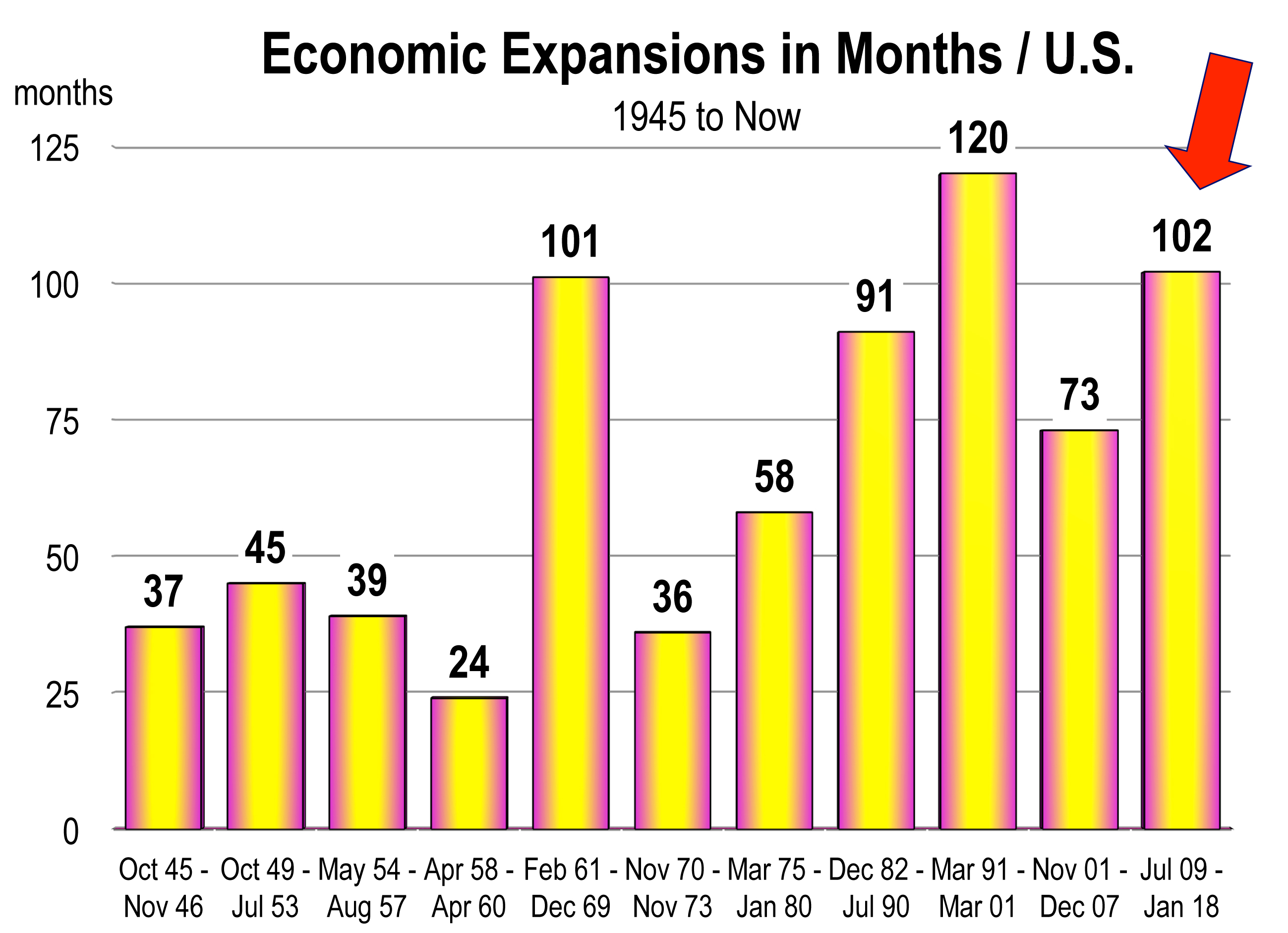

General economic conditions. Basically, the economy hasn’t changed much, despite entering into the 10th year of the current expansion in July. Another 10 months and the 2009-2019 economic expansion will be the longest in recorded history. By now, economists thought a slowdown would have occurred along with a faster pace of inflation, higher treasury bond yields, a stock market correction, and a hiccup in international trade flows. None of this is here yet.

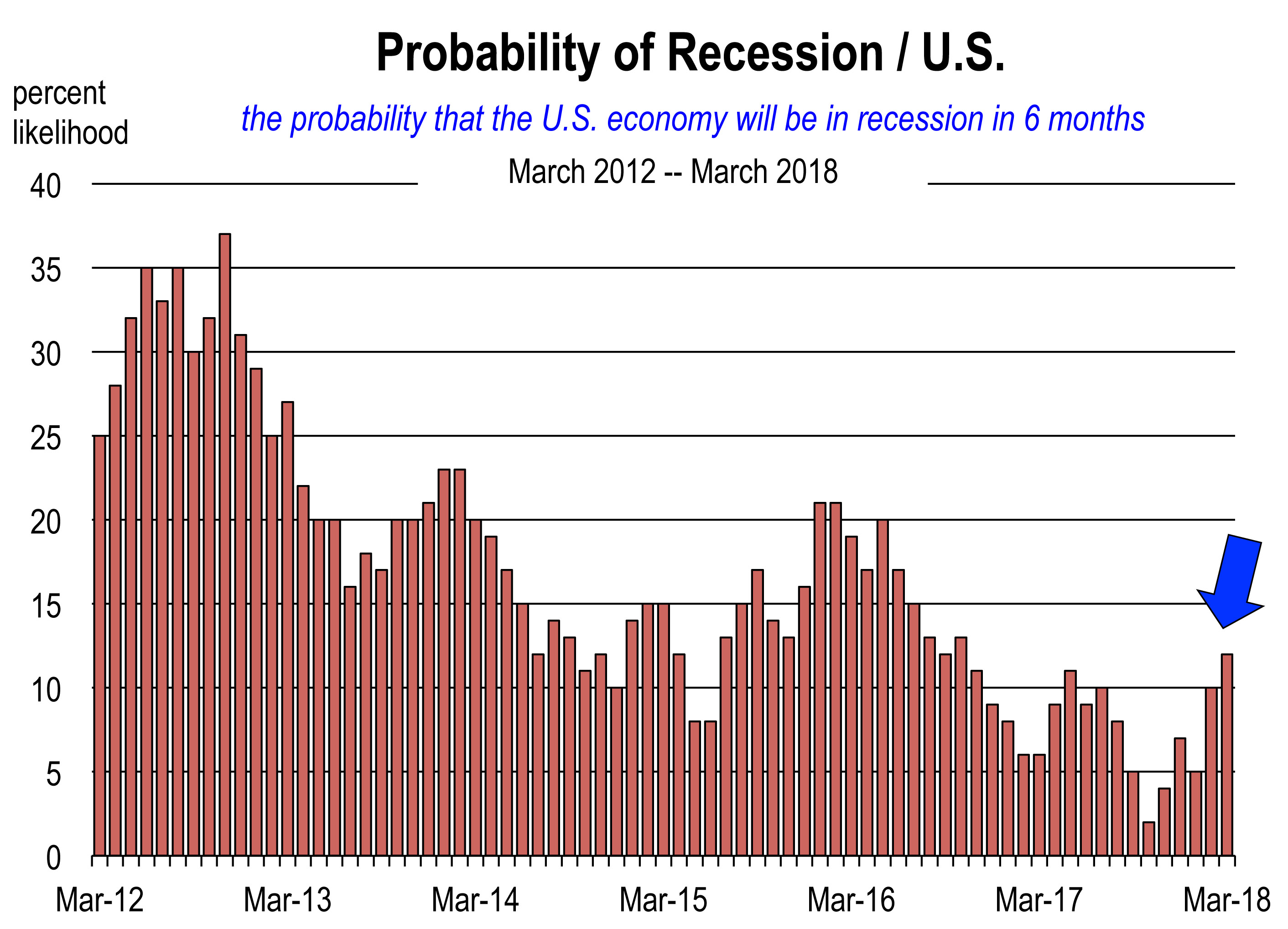

Both consumers and businesses still feel very good about today’s economy. And they should be with the value of output rising, wages and salaries rising, the stock market near all time highs, and labor markets fully utilized. Furthermore, the likelihood of recession remains very low and is, in fact, declining again.

Now is not the time to worry yet. Enjoy the fall.

———————

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

Three Come to my Attention

Three Come to my Attention No.

No.

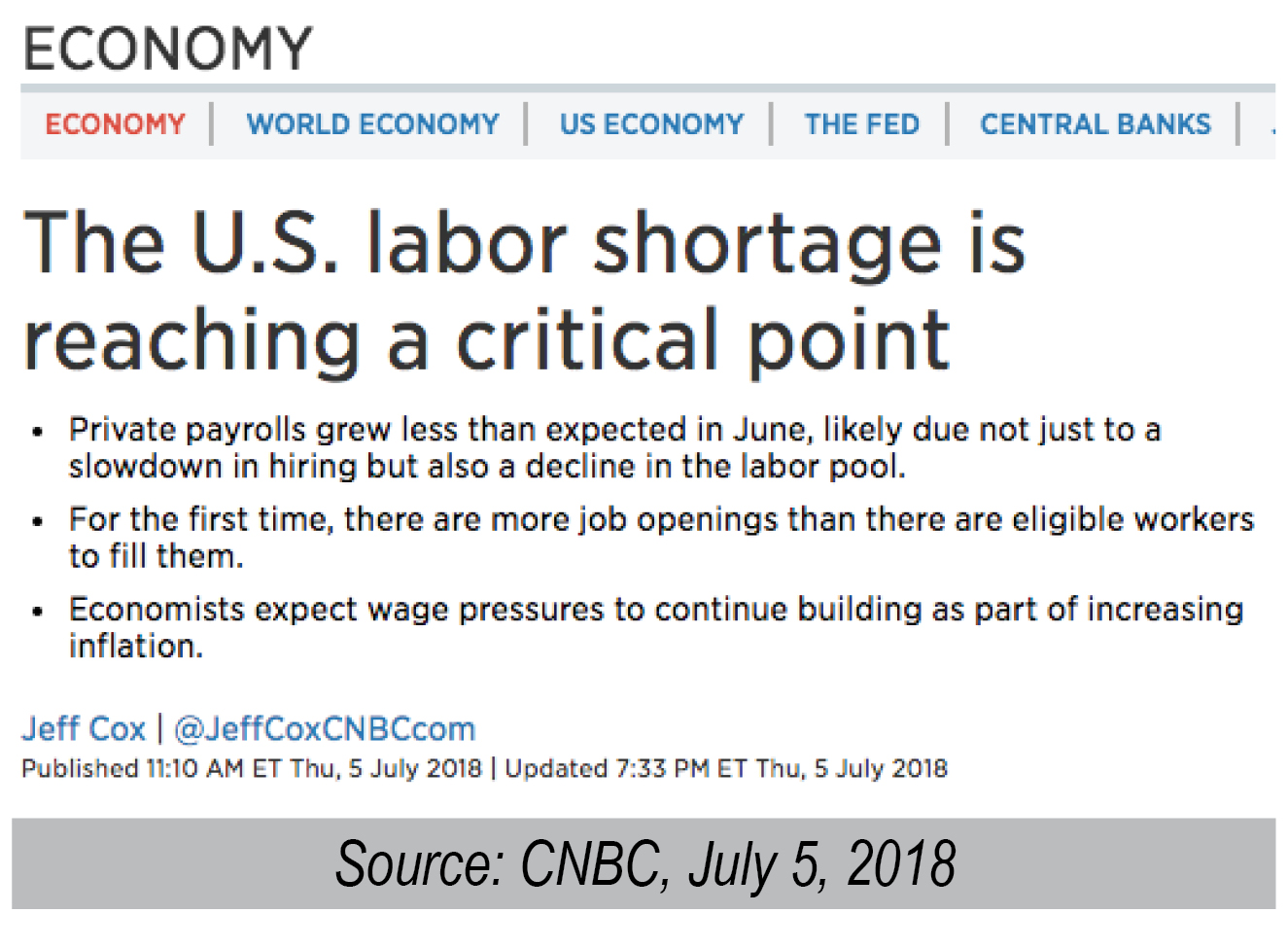

the tightness of the labor market. This is disappointing for workers but it will keep the Fed on track for three rate hikes this year because inflation remains predictably in check. It’s likely that stock market volatility will also subside, at least for the meantime.

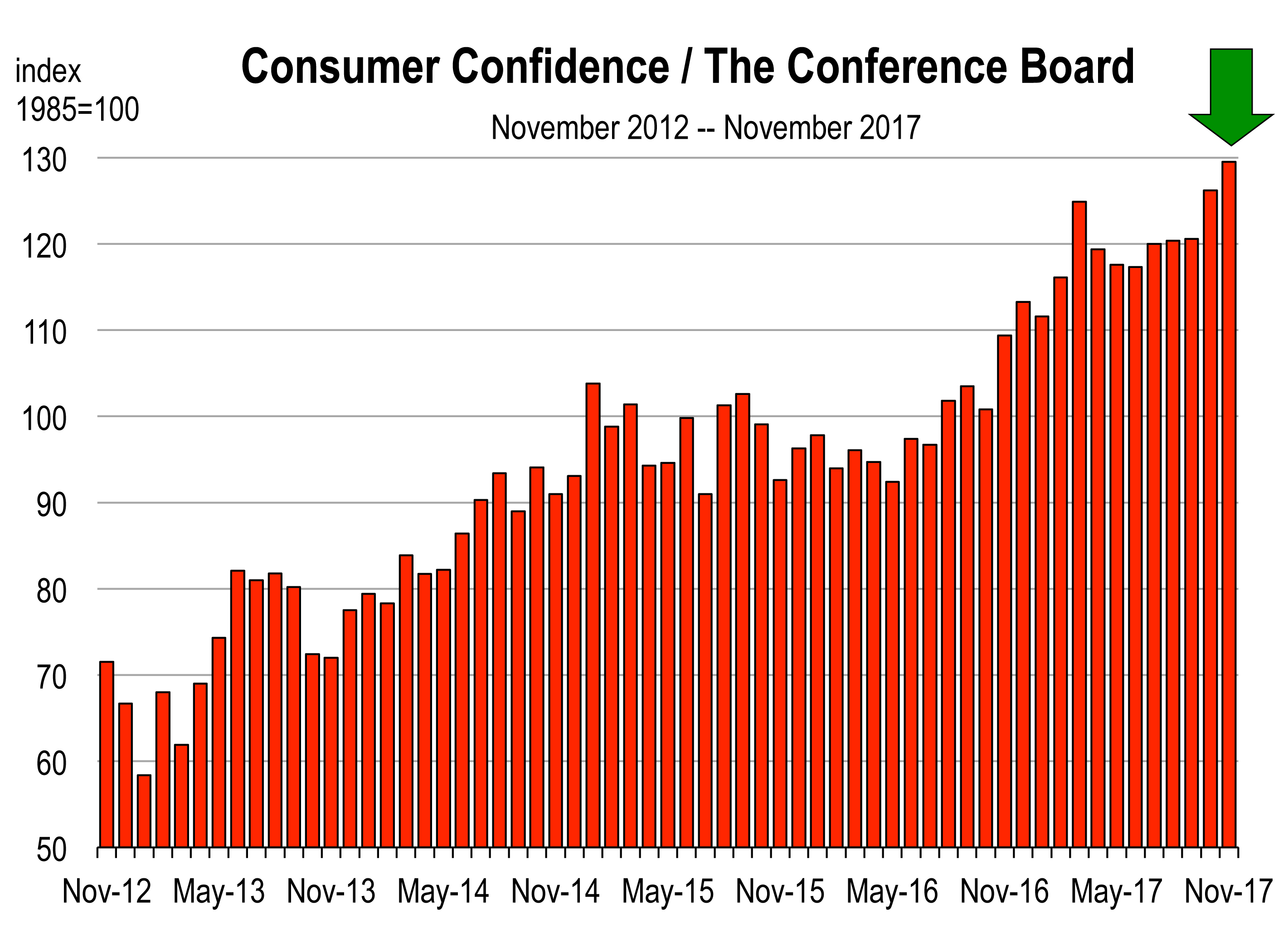

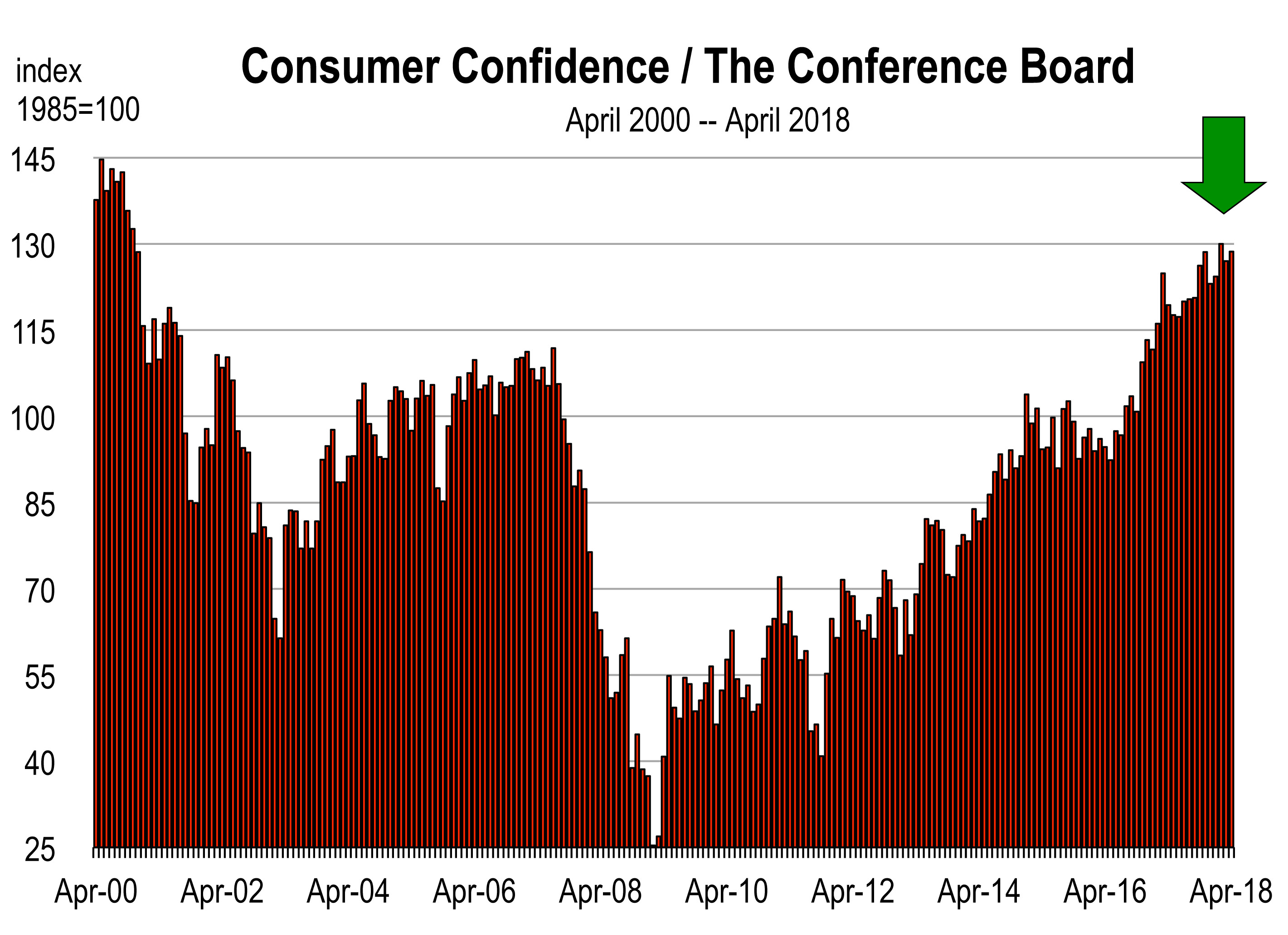

the tightness of the labor market. This is disappointing for workers but it will keep the Fed on track for three rate hikes this year because inflation remains predictably in check. It’s likely that stock market volatility will also subside, at least for the meantime. Consumer confidence remains near its highest level in a generation. The present economic climate is rated consistently more favorably while economic expectations remain strong.

Consumer confidence remains near its highest level in a generation. The present economic climate is rated consistently more favorably while economic expectations remain strong.

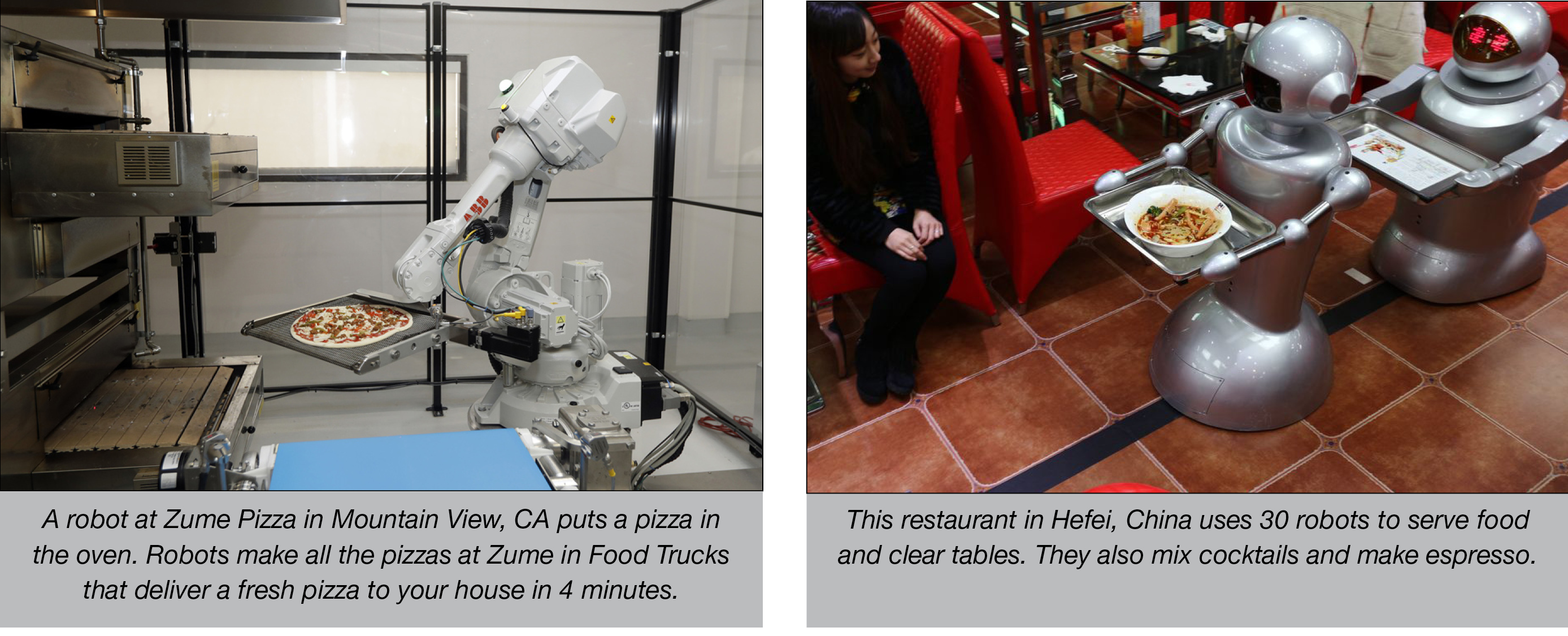

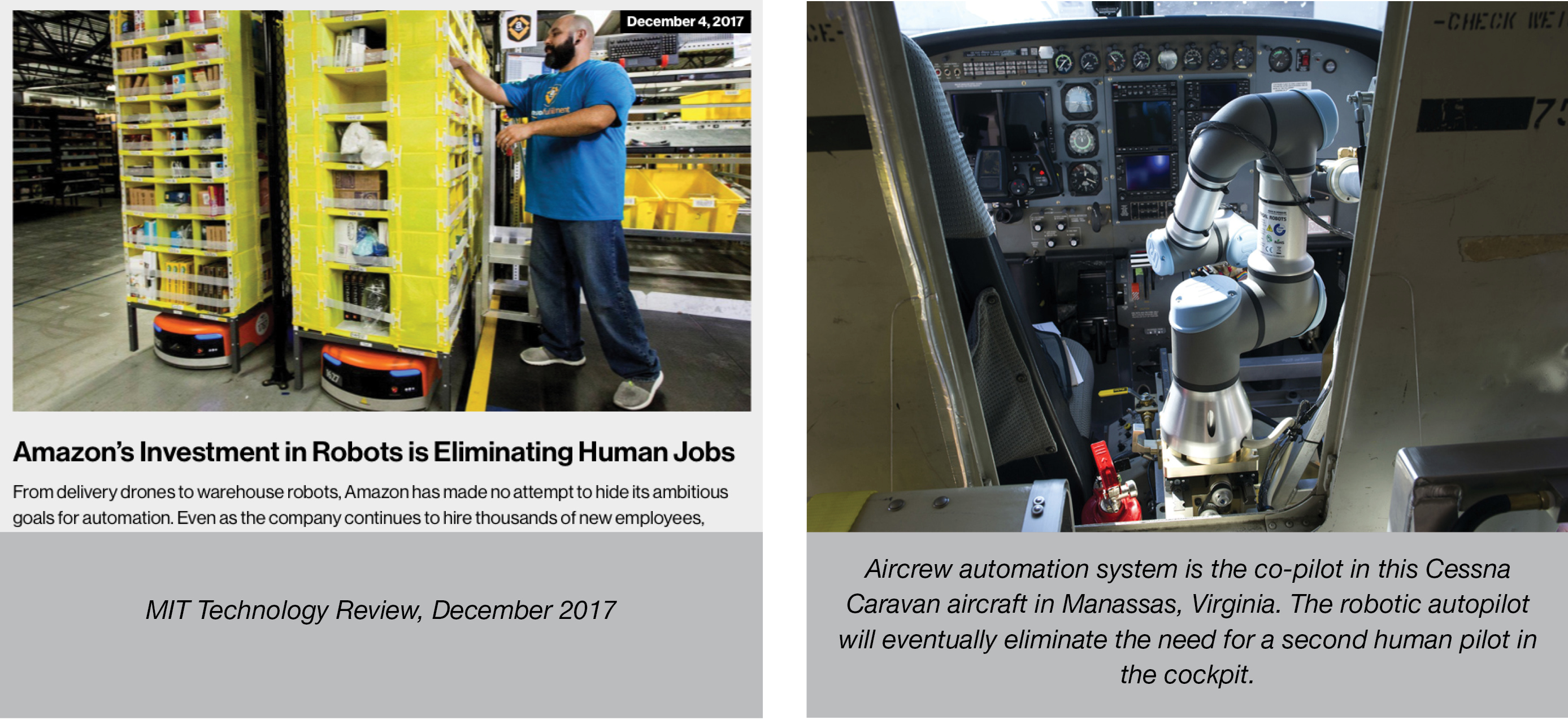

In late January, the first Amazon Go opened in Seattle. The convenience food store allows shoppers to scan their phone upon entrance, grab whatever items they want off the store shelves, and automatically get charged after exiting the store without needing to stop at a register. In fact, there are no registers and the only employees in the store are those that prepare fresh food, check IDs for beer and wine, and stock the shelves with merchandise.

In late January, the first Amazon Go opened in Seattle. The convenience food store allows shoppers to scan their phone upon entrance, grab whatever items they want off the store shelves, and automatically get charged after exiting the store without needing to stop at a register. In fact, there are no registers and the only employees in the store are those that prepare fresh food, check IDs for beer and wine, and stock the shelves with merchandise.

The probability of recession is unbelievably low and business confidence around the world remains surprisingly strong. Just because the financial markets are going through a correction doesn’t mean that economic momentum has changed.

The probability of recession is unbelievably low and business confidence around the world remains surprisingly strong. Just because the financial markets are going through a correction doesn’t mean that economic momentum has changed.

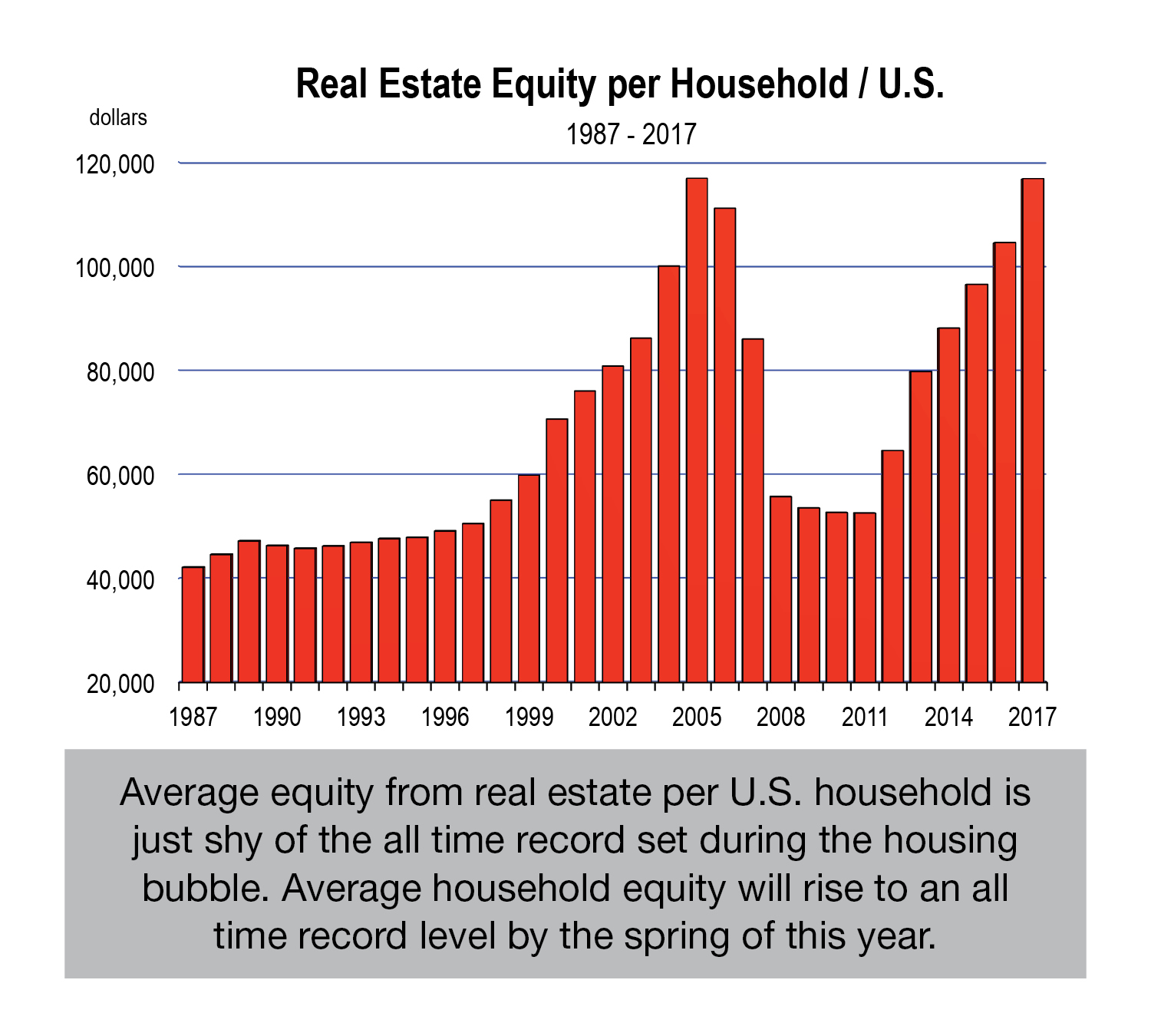

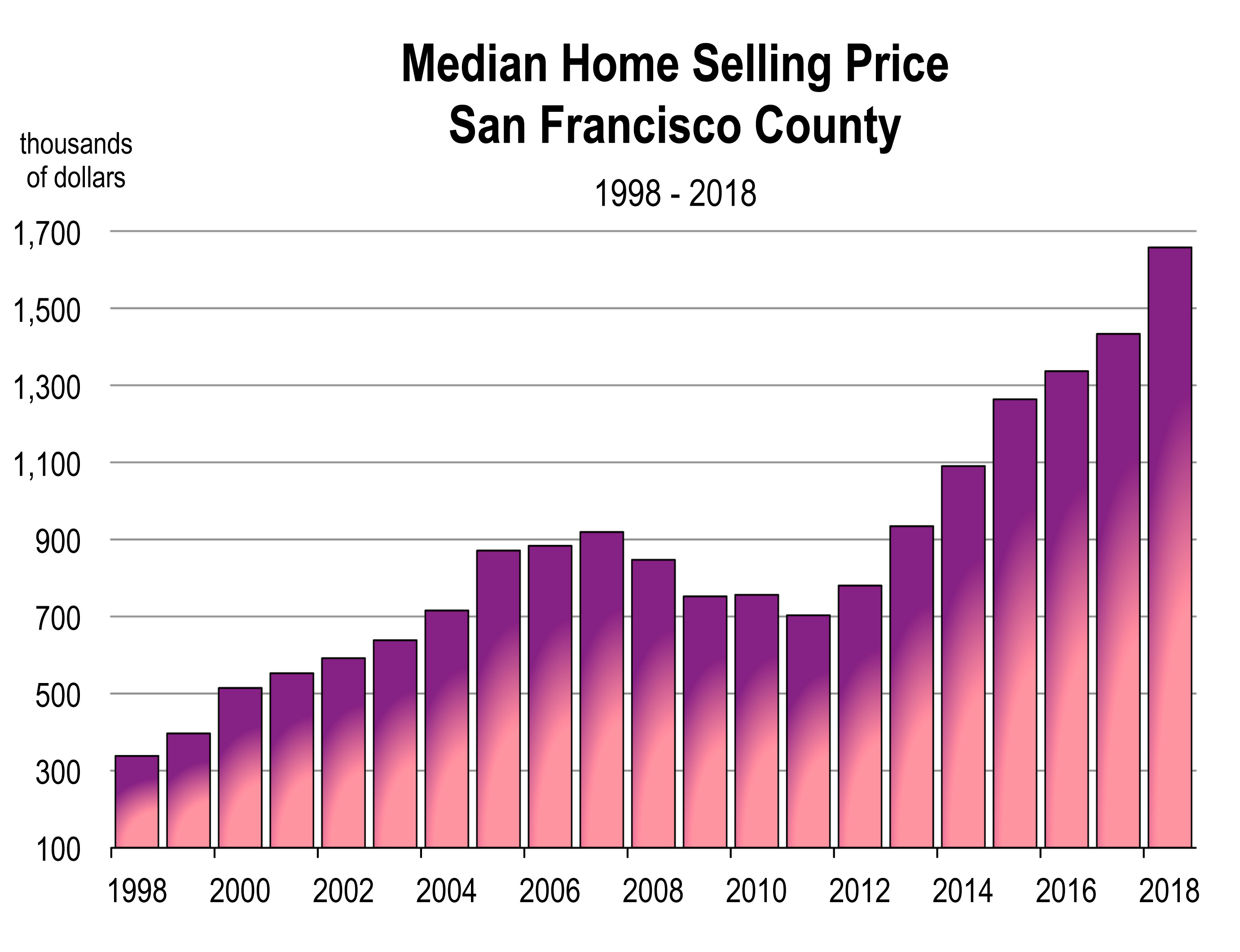

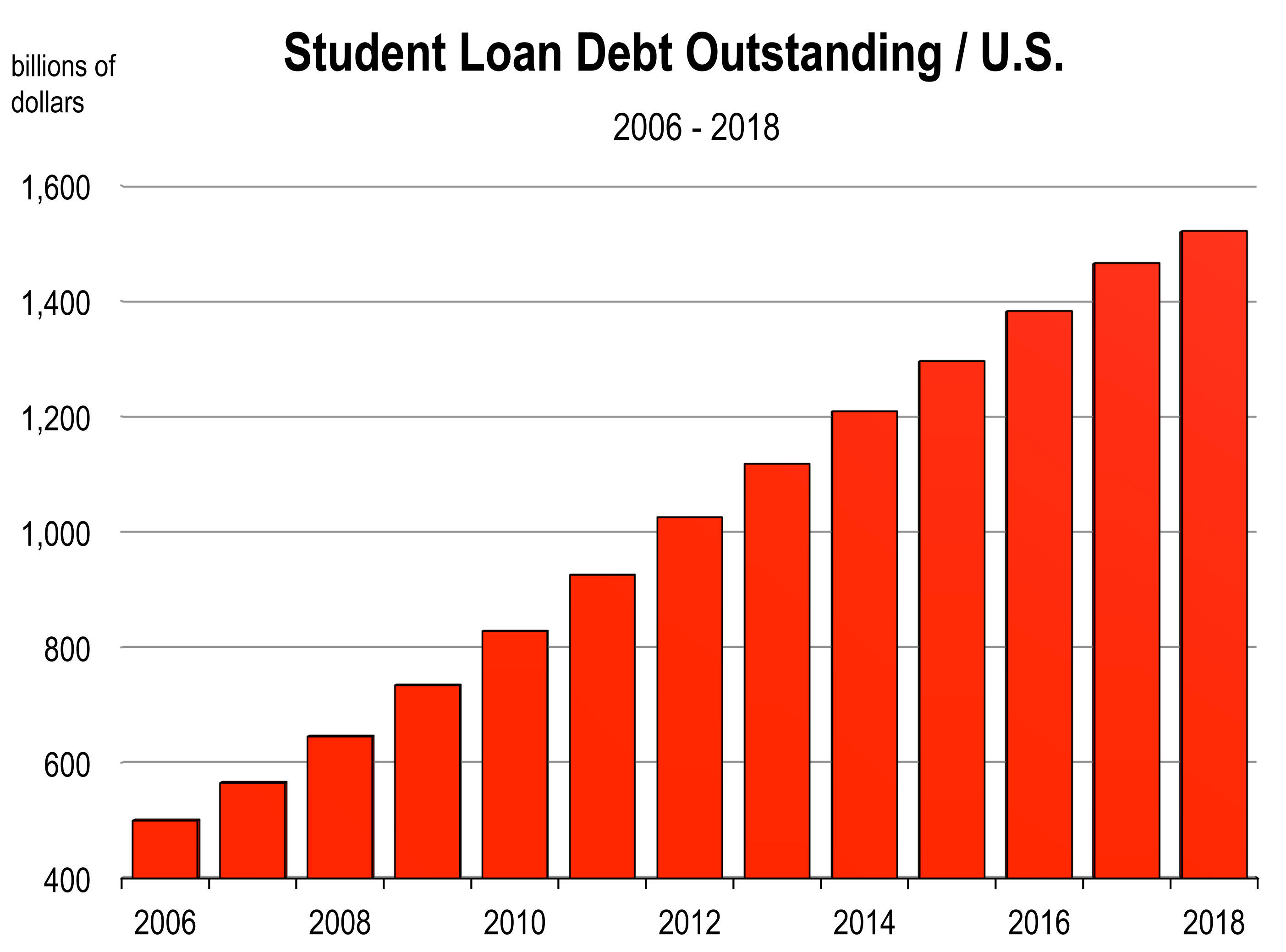

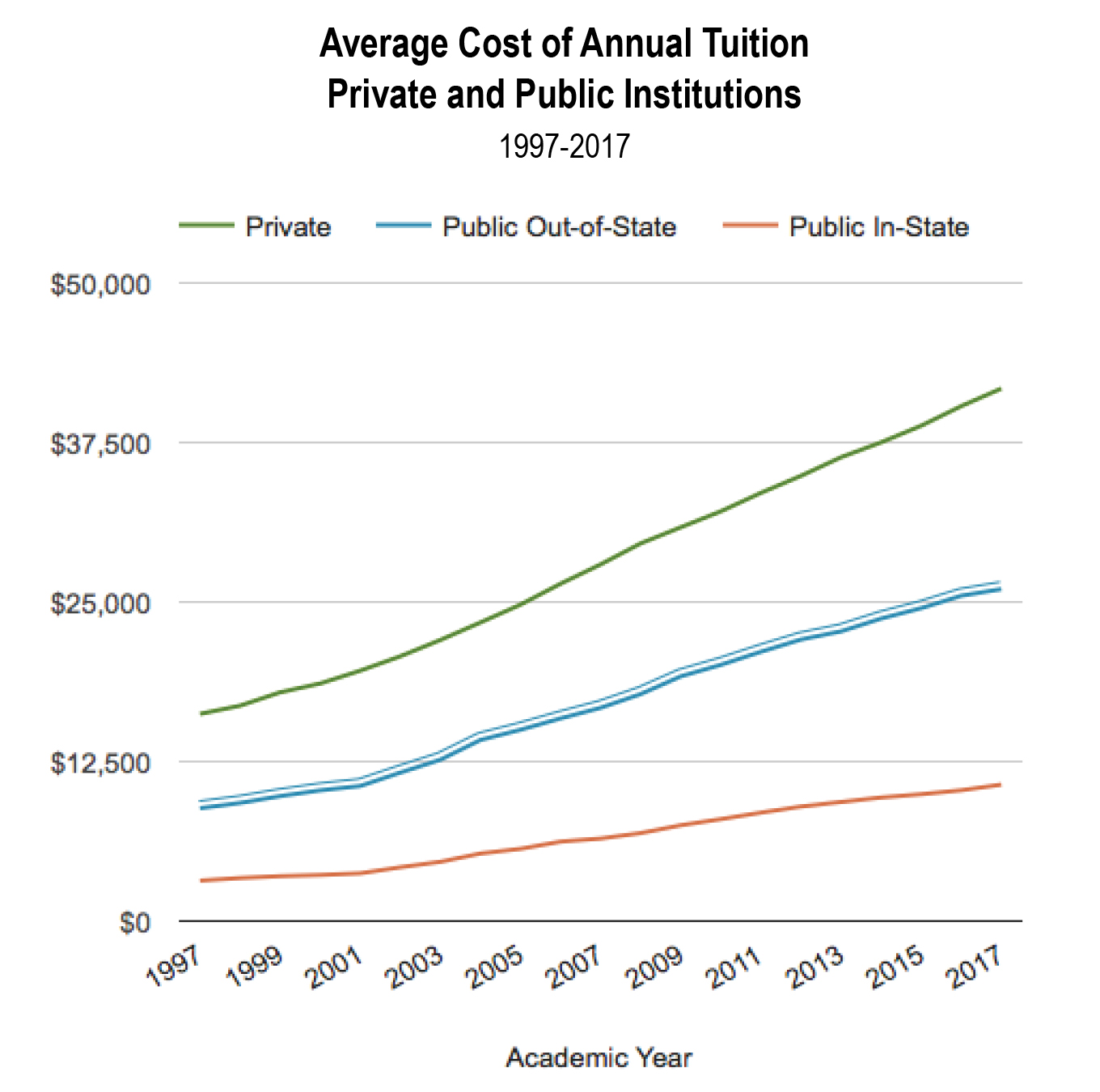

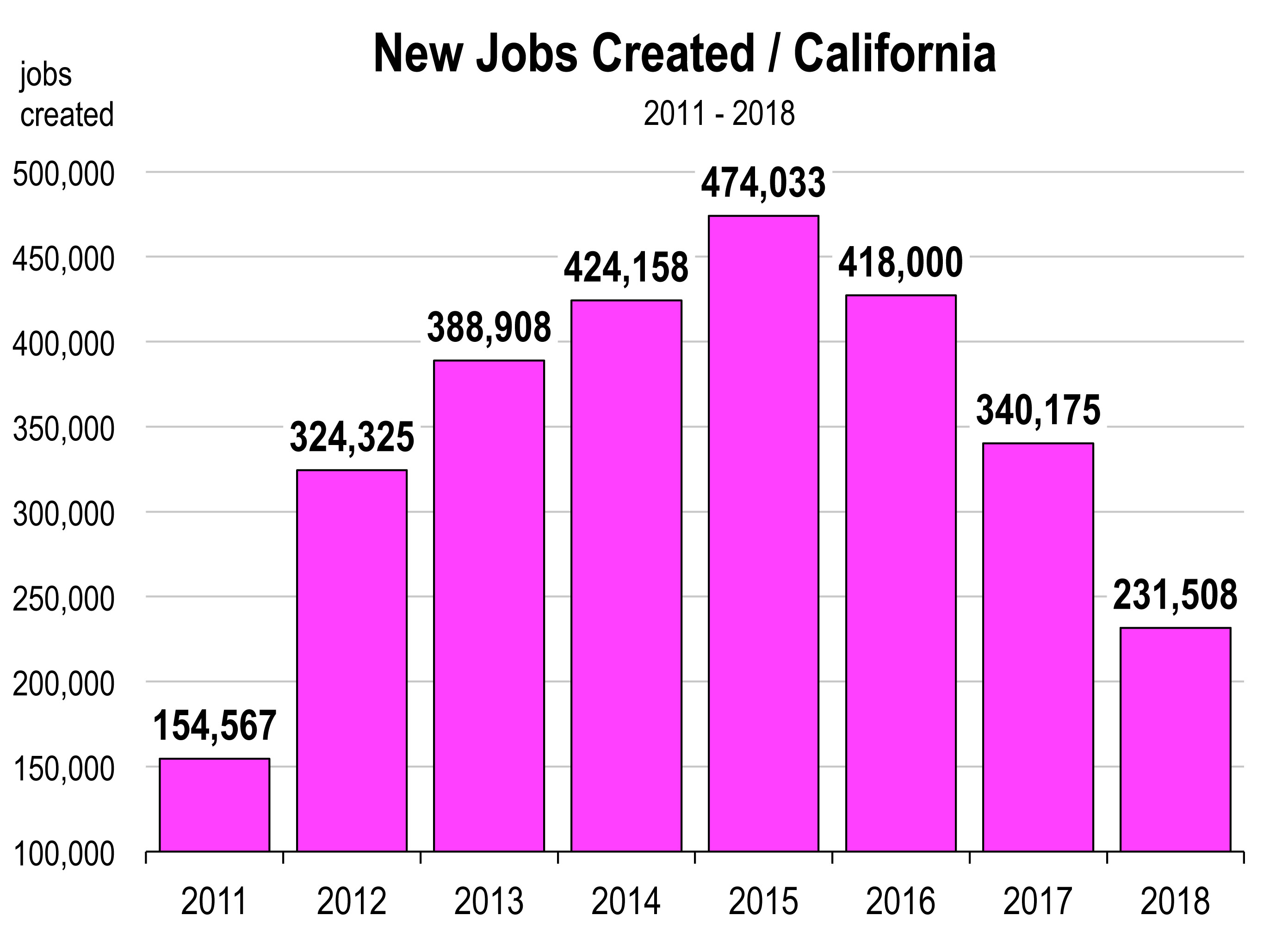

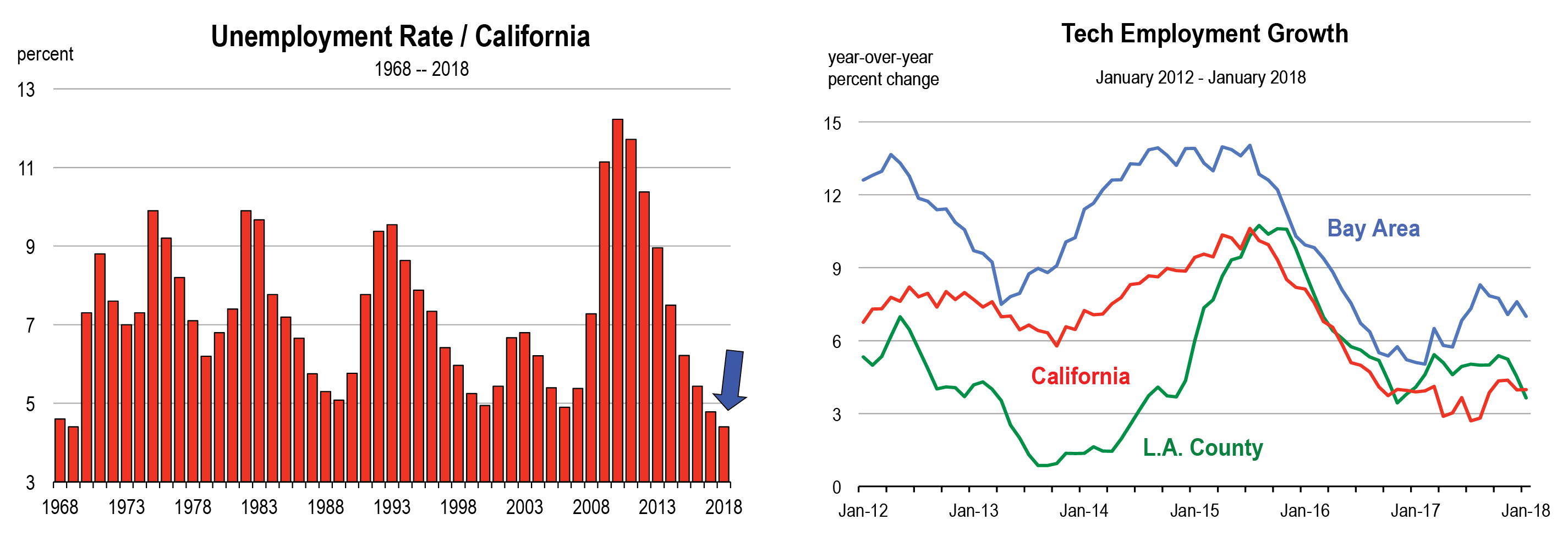

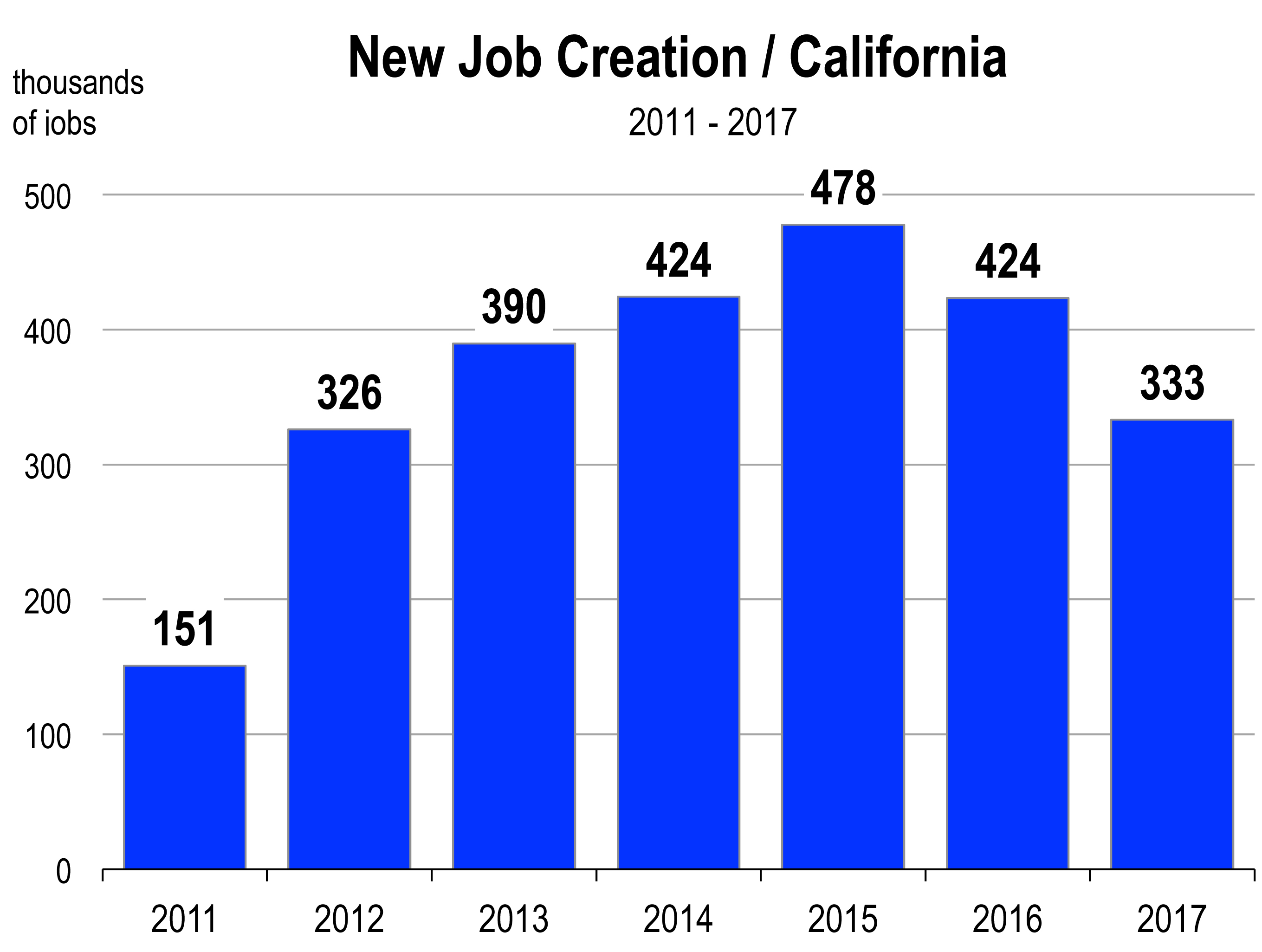

However, real estate is more highly dependent on local factors. Creation of higher paying jobs, for example, are lacking in certain parts of the nation. And though homes are much less affordable in California and other coastal hotbeds, there remains strong demand for higher paying positions, particularly in the technology sectors. The state continues to attract population from other states and abroad. Furthermore, there’s all those millennials living with parents. Are they ready to move out yet?

However, real estate is more highly dependent on local factors. Creation of higher paying jobs, for example, are lacking in certain parts of the nation. And though homes are much less affordable in California and other coastal hotbeds, there remains strong demand for higher paying positions, particularly in the technology sectors. The state continues to attract population from other states and abroad. Furthermore, there’s all those millennials living with parents. Are they ready to move out yet?