by Mark Schniepp

October 2016

Is the unemployment rate really full?

We are now at or within months of an economy at “full employment.” This means that (1) anyone wanting a job can obtain one, and (2) labor is tight and the general level of wages and salaries is rising as a result. Evaluation of the data on unemployment, help wanted indices, and wage increases shows that both of these criteria are now being met.

Fortune, February 2016, online

Is it really fair to use the term “full employment” when people are still experiencing difficulty finding work?

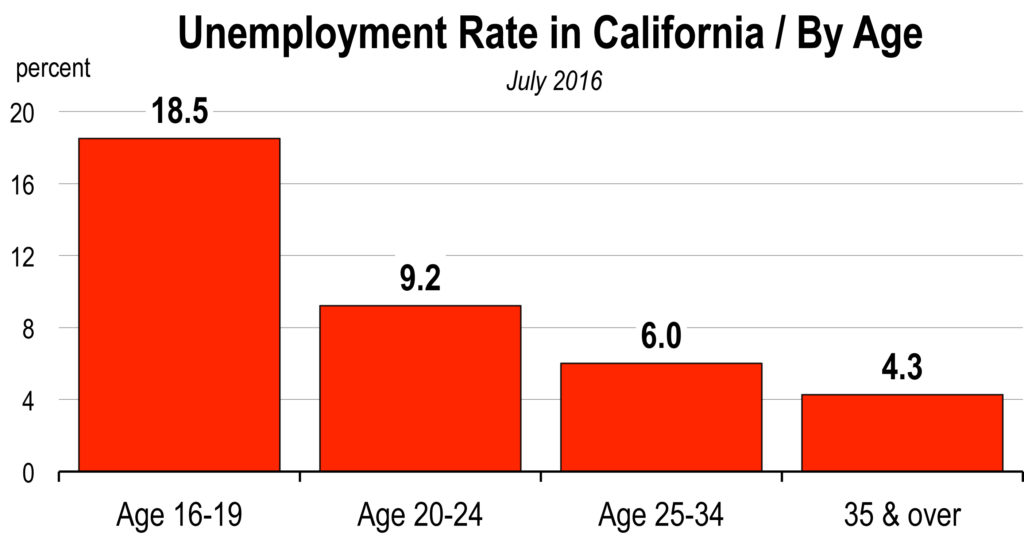

Unemployment is both regional and variant by age. The rate in Tulare County last month was nearly 10.7 percent. In San Mateo County, it was 3.2 percent. If you’re 19 and fresh out of high school, it’s going to be a lot tougher than if you’re 41 with 15 years of work experience.

Underemployment

Underemployment

A discouraged worker is a person of legal employment age who is not actively seeking employment or who has not found suitable employment after long-term unemployment. This is usually because an individual has given up looking or has had no success in finding a job, hence the term “discouraged.”

Often the conventional unemployment rate is criticized because it does not account for discouraged workers that have dropped out of the labor force and are therefore, not counted in the unemployment rate.

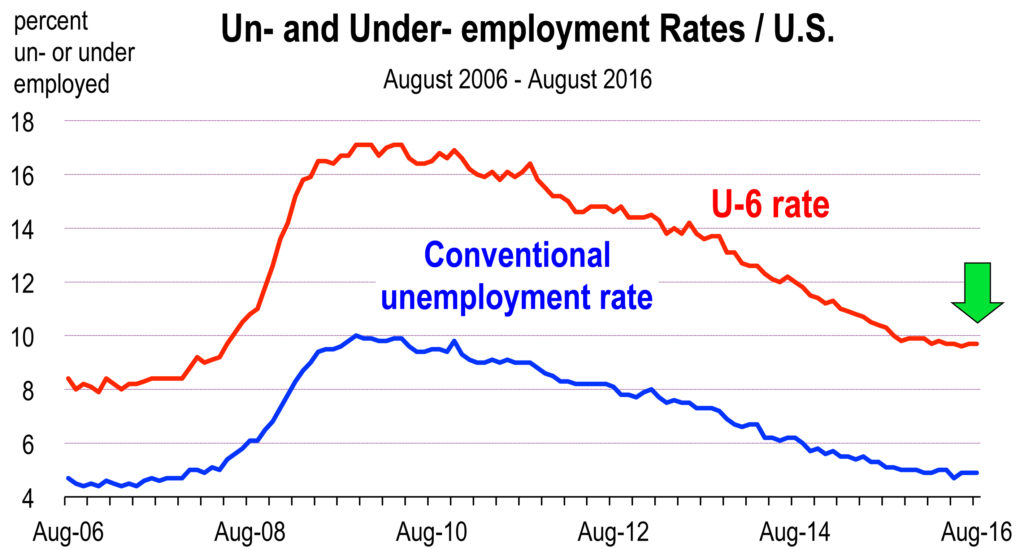

Often we are criticized for declaring that full employment has been reached in particular regional economies since people believe that there is still a significant level of “underemployment.”

Labor that falls under the underemployment classification includes those workers who are highly skilled but working in low paying jobs, workers who are highly skilled but working in low skill jobs and part-time workers who would prefer to be full time.

An alternative measure which seeks to explain underemployment is called the U6 unemployment rate. It expands the definition of the labor force to include “discouraged workers,” or people without jobs who have given up looking for work; “marginally attached workers,” or people without jobs who would like to work but have not sought employment recently, plus people employed part time (less than 35 hours/week) who would prefer to work full time.

An alternative measure which seeks to explain underemployment is called the U6 unemployment rate. It expands the definition of the labor force to include “discouraged workers,” or people without jobs who have given up looking for work; “marginally attached workers,” or people without jobs who would like to work but have not sought employment recently, plus people employed part time (less than 35 hours/week) who would prefer to work full time.

Now, U-6 does not fully explain “underemployment” because there is no statistic that can quantify workers who are working in jobs below their perceived skill level. Therefore we don’t have a perfect measure for underemployment.

U-6 for August 2016 was 9.7 percent, or approximately twice the conventional unemployment rate of 4.9 percent. But U-6 has always been at a level that is approximately twice the conventional rate. Since 2008, the average difference between the two rates has been 6.2 percentage points. Today the difference is 4.8 percentage points.

The lowest reading for U-6 (since 1994 when the statistic started tracking) has been 6.8 percent in October of 2000.

While it is true that U-6 today is not quite back to the low level of 8.4 percent that prevailed prior to the Great Recession, neither is the conventional unemployment rate. Nevertheless, we are at or close to full employment and the U-6 rate today is consistent with historically low levels of that measure.

Who are the unemployed and the underemployed today?

The legal working age population ages 16 to 24 is the principal group that is either out of work or underemployed. The unemployment rate for this age group is currently 9.2 percent (versus 4.3 percent for the 25 to 54 year old age group).

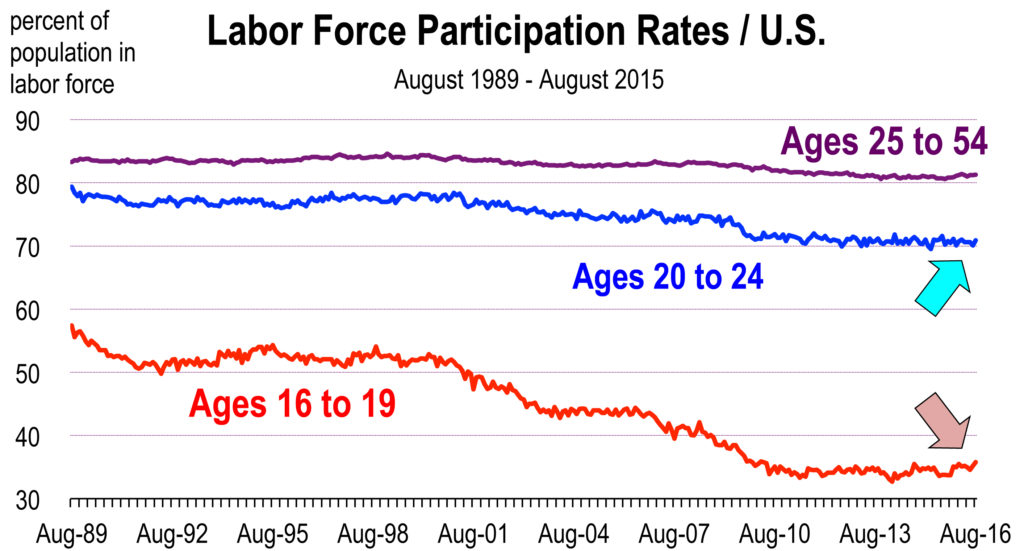

Furthermore, this age group has very low rates of labor force participation compared to the 25 to 54 year old age group. Attending high school, colleges and universities is a large reason for the reduced rates of participation, but does not fully account for the collapse in rates over time. All groups are showing a decline in labor force participation over time, but the younger age group participation rates have tumbled, whereas the 25 to 54 year old group is off only 3 percentage points from the all time record high of 84.5 percent reached in August 1997.[1]

Furthermore, this age group has very low rates of labor force participation compared to the 25 to 54 year old age group. Attending high school, colleges and universities is a large reason for the reduced rates of participation, but does not fully account for the collapse in rates over time. All groups are showing a decline in labor force participation over time, but the younger age group participation rates have tumbled, whereas the 25 to 54 year old group is off only 3 percentage points from the all time record high of 84.5 percent reached in August 1997.[1]

Higher rates of unemployment and lower participation rates for 16 to 19 and 20 to 24 year olds is consistent with their lack of training, knowledge or skill in a modern technical and highly automated economy where these attributes have much higher value today than previously.

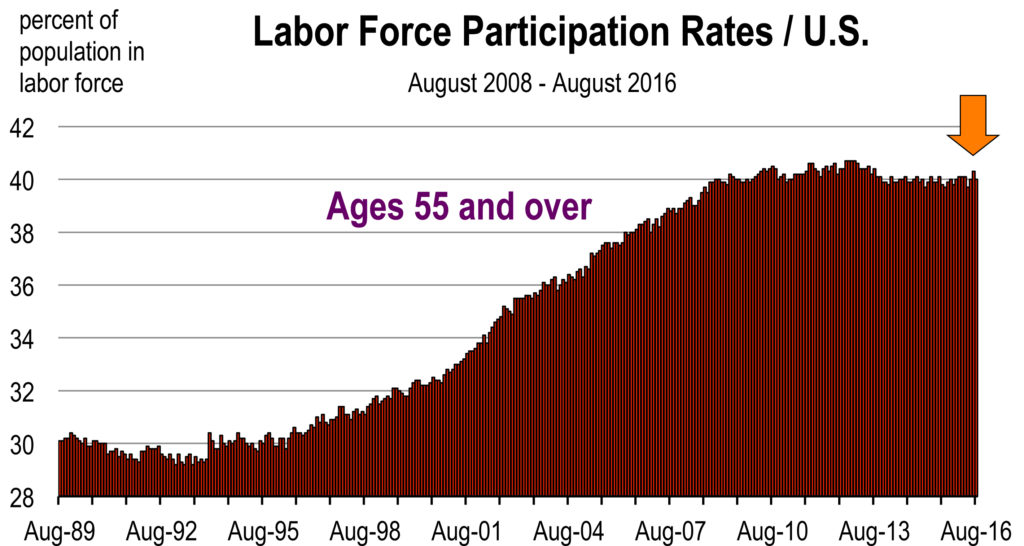

Moreover, labor force participation rates for the population aged 55 and over have been increasing for the past 24 years and are now at their highest levels since 1964. The older Baby Boom generation is educated, experienced, and skilled. They show very little sign of being discouraged in today’s economy, according to this statistic. Oh, and their unemployment rate in August was only 3.5 percent, the lowest of any age group.

Conclusion

Conclusion

Unemployment is low for most of the labor force aged 25 and above. And the rate of unemployment appears to be both full and absent any unusual degree of underemployment for this age group. Baby Boomers are not the discouraged workers in today’s economy.

The rate of unemployment and underemployment is substantially higher for 16 to 24 year olds. The implications of this strongly support the critical need for higher levels of education and/or training of this age group, today and going forward.

It’s not enough to simply attend a university today and obtain a Bachelor’s degree. The kind of degree that students seek will have a much bigger impact on their employability and their future earnings than it did for the Baby Boomers.

————————————————

[1] The participation rate for 20 to 24 year olds was nearly 80 percent in August of 1989. Today, it has declined to 70.9 percent. The 16 to 19 rate fell from 57 percent to 36 percent over this same time period.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

Why Don’t We Deserve a Recession?

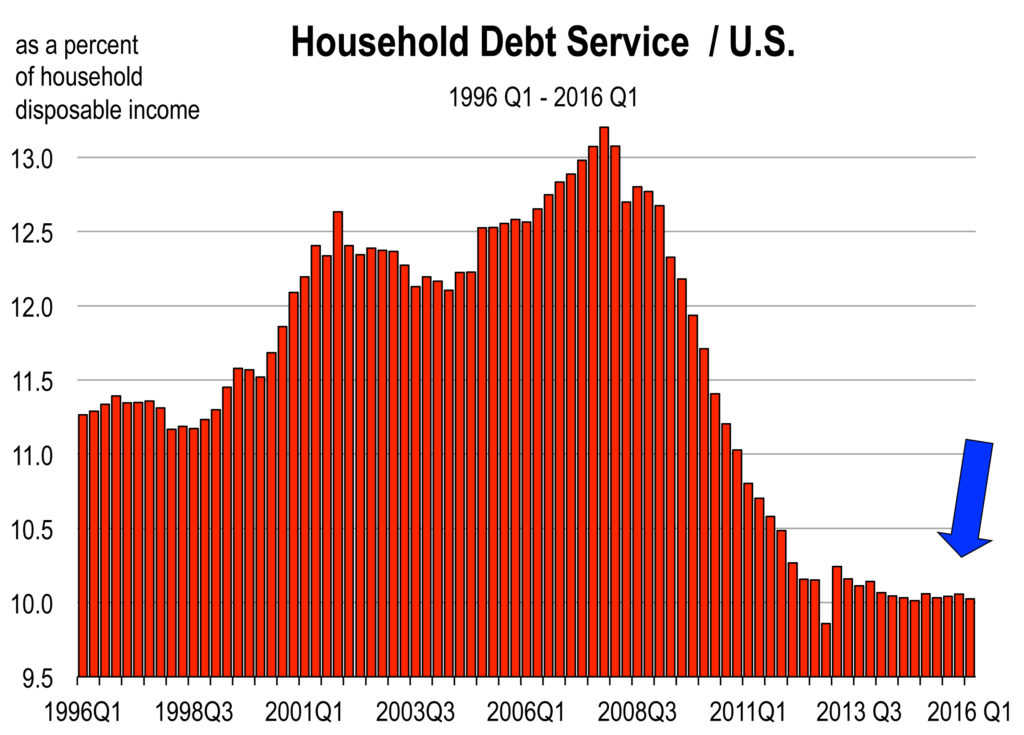

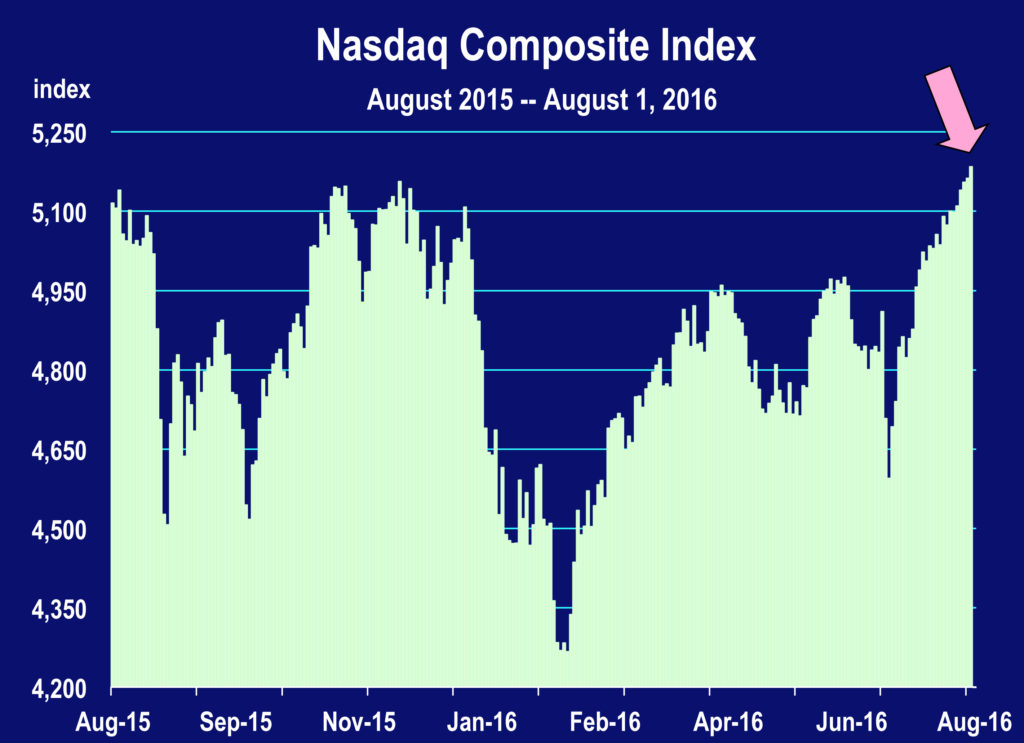

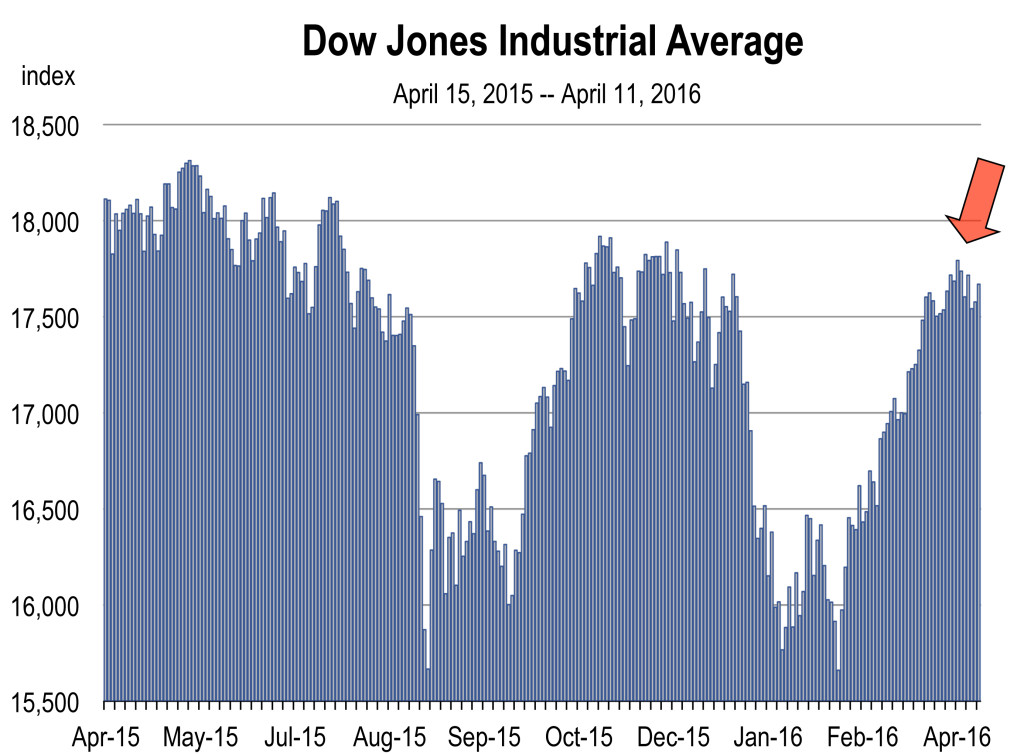

Why Don’t We Deserve a Recession? We have record stock market valuations because corporate profits have been strong, everyone’s working, inflation is contained, and the American economy is growing, relative to many of our global neighbors. The market is clearly not convinced that a recession is inevitable; otherwise stock prices would be eroding.

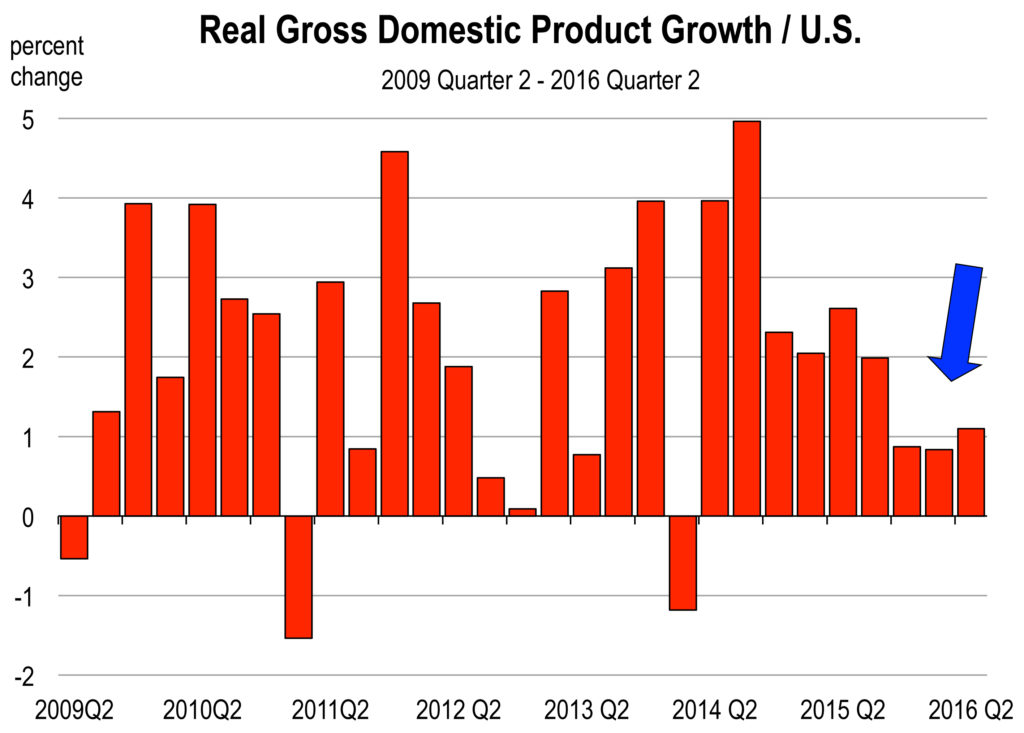

We have record stock market valuations because corporate profits have been strong, everyone’s working, inflation is contained, and the American economy is growing, relative to many of our global neighbors. The market is clearly not convinced that a recession is inevitable; otherwise stock prices would be eroding. The upward movement of GDP this year has been stunningly slow, and is now running at a 1.5 percent rate of growth (we were in the mid 2s in 2014 and 2015). U.S. growth has historically averaged over 3 percent, and about 2 percent per year since the economy started growing again in mid-2009.

The upward movement of GDP this year has been stunningly slow, and is now running at a 1.5 percent rate of growth (we were in the mid 2s in 2014 and 2015). U.S. growth has historically averaged over 3 percent, and about 2 percent per year since the economy started growing again in mid-2009.

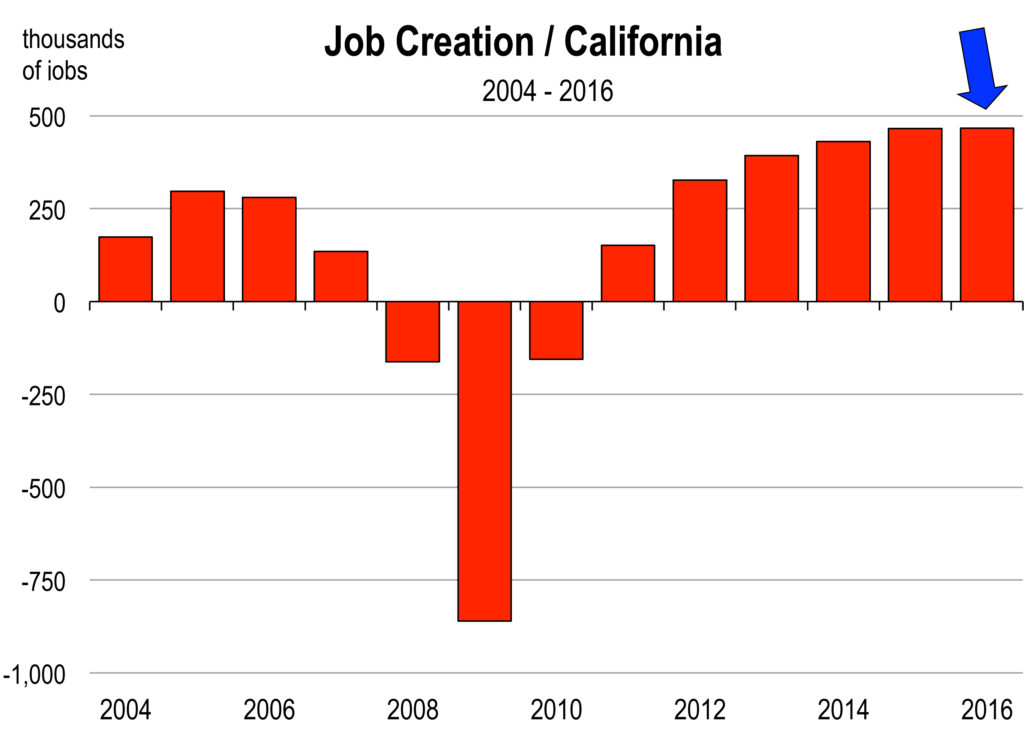

In California, 40,000 jobs were created in June. The pace of new job formation for 2016 to date will result in more than 470,000 new jobs this year, which is a remarkable accomplishment at this stage in the economic expansion.

In California, 40,000 jobs were created in June. The pace of new job formation for 2016 to date will result in more than 470,000 new jobs this year, which is a remarkable accomplishment at this stage in the economic expansion.

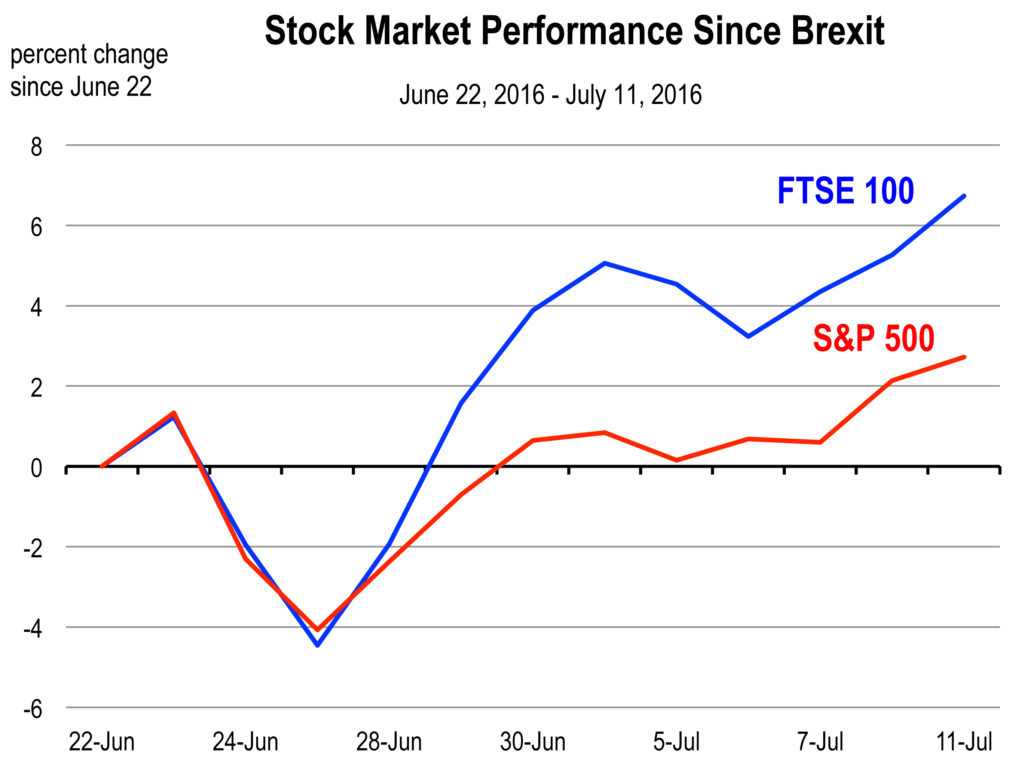

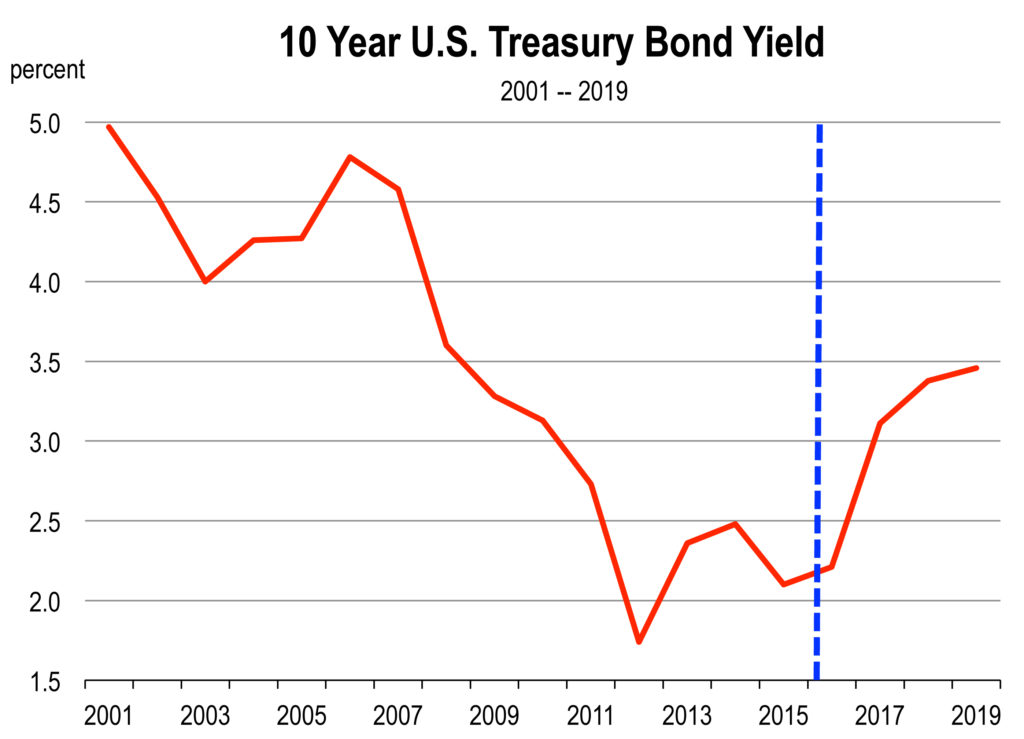

In the minutes and days after the vote, stock markets tumbled around the world. Bond yields fell and the Dollar strengthened as investors rushed to safe haven assets. This was a predictable reaction to a burst of uncertainty, but the turmoil has now subsided and markets have calmed. The S&P 500 has reached a new high, and the index of British blue chips has surpassed its pre-Brexit value by more than 6 percent.

In the minutes and days after the vote, stock markets tumbled around the world. Bond yields fell and the Dollar strengthened as investors rushed to safe haven assets. This was a predictable reaction to a burst of uncertainty, but the turmoil has now subsided and markets have calmed. The S&P 500 has reached a new high, and the index of British blue chips has surpassed its pre-Brexit value by more than 6 percent. They were supposed to go higher in 2016—not sharply higher but noticeably higher nonetheless.

They were supposed to go higher in 2016—not sharply higher but noticeably higher nonetheless.

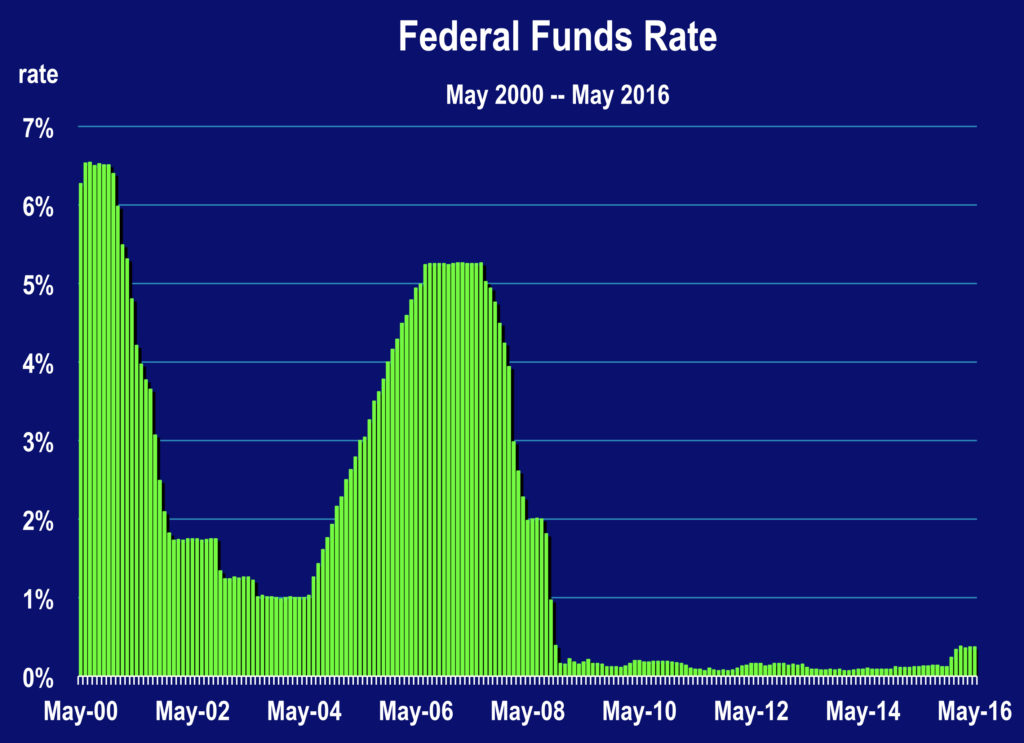

With the economy on the verge of full employment, there is growing evidence of wage and salary inflation, and that will translate into higher general price inflation than what we observe today.

With the economy on the verge of full employment, there is growing evidence of wage and salary inflation, and that will translate into higher general price inflation than what we observe today.

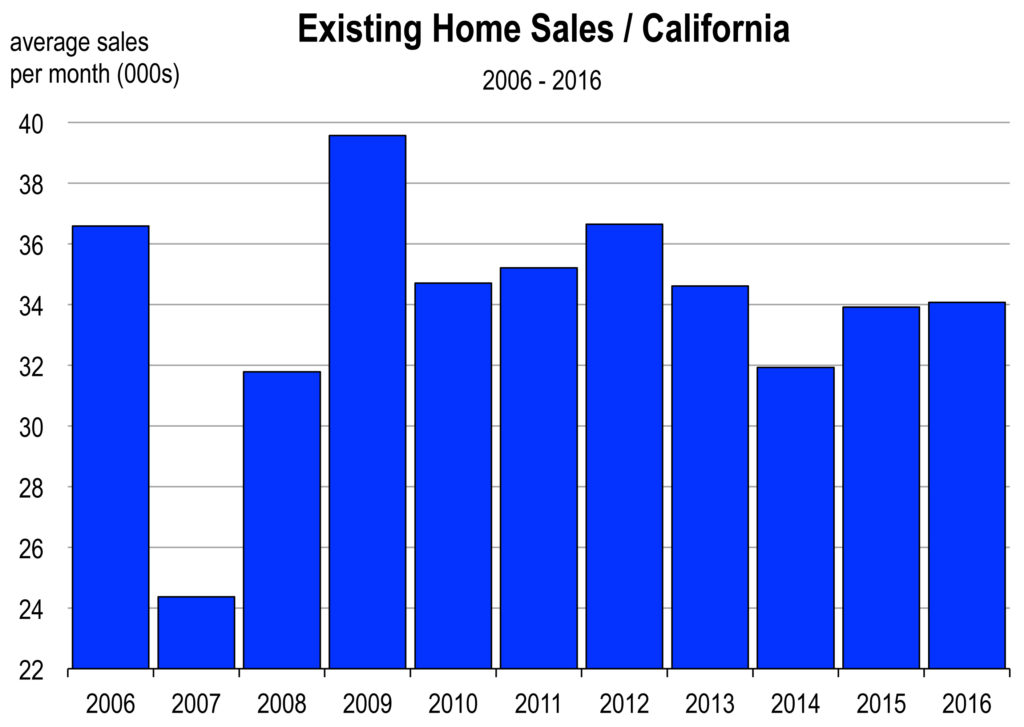

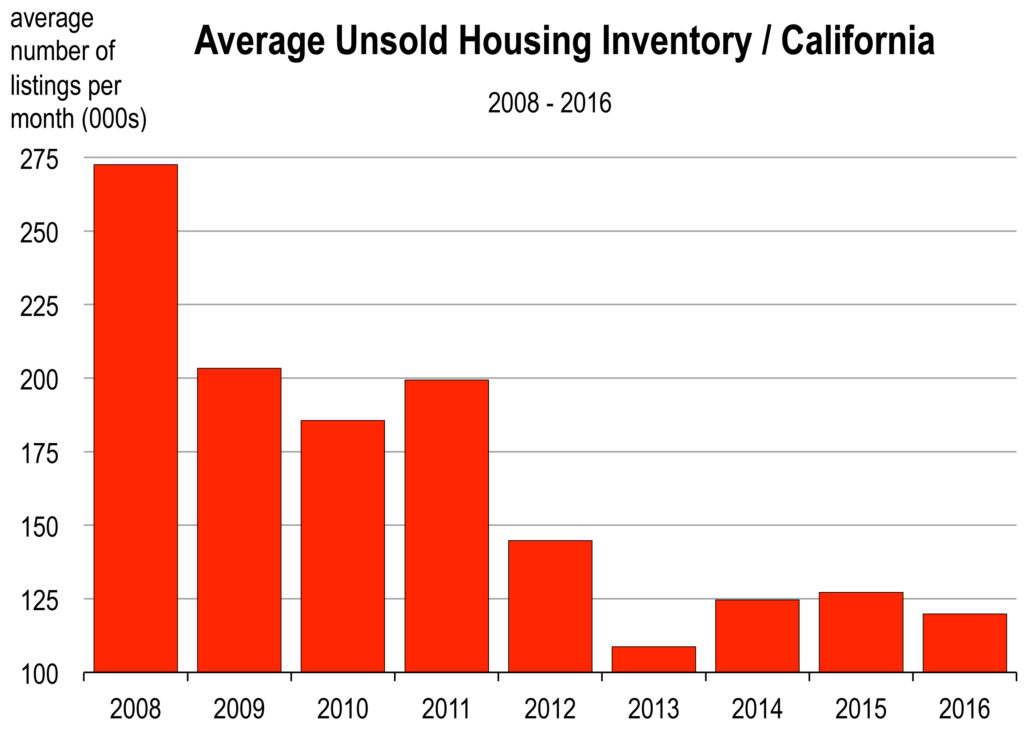

Home prices continue to rise this year, especially in the California coastal markets. Home sales are running at a similar pace as last year—not too hot and not too cold.

Home prices continue to rise this year, especially in the California coastal markets. Home sales are running at a similar pace as last year—not too hot and not too cold. I have addressed the Millennials many times in these monthly reports. But let me reiterate what we are seeing or not seeing regarding them and the housing market:

I have addressed the Millennials many times in these monthly reports. But let me reiterate what we are seeing or not seeing regarding them and the housing market:

The Stock Market is Grinding its Way Back

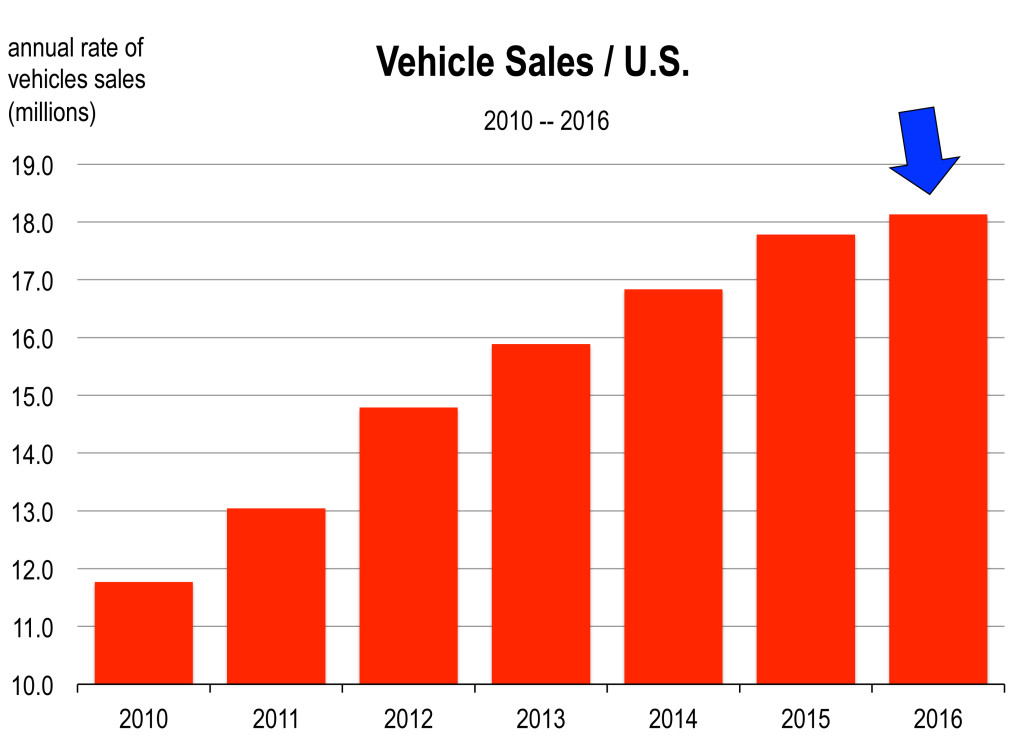

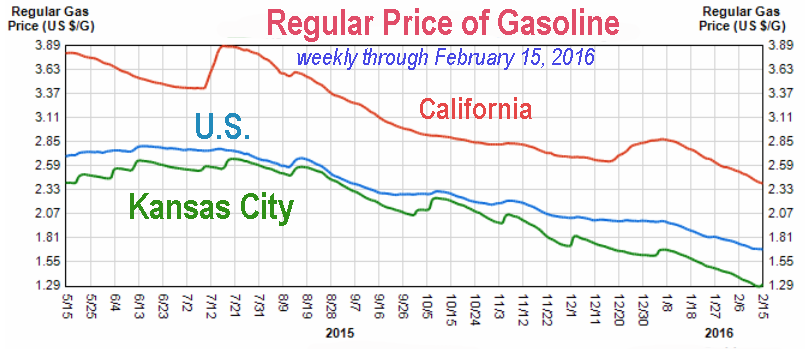

The Stock Market is Grinding its Way Back Americans are buying more cars at a near record pace. There are more vehicles on the road than ever before and traffic remains tough. The seasonally adjusted annualized pace of 17.5 million units in February was the strongest in 15 years. All the gains over the past year have been in the light truck segment thanks to persistently low gasoline prices.

Americans are buying more cars at a near record pace. There are more vehicles on the road than ever before and traffic remains tough. The seasonally adjusted annualized pace of 17.5 million units in February was the strongest in 15 years. All the gains over the past year have been in the light truck segment thanks to persistently low gasoline prices. Manufacturing Rising Again

Manufacturing Rising Again A higher stock market leads to more spending by consumers because of the wealth effect. Retail sales, which have been dragged lower in recent months by falling gasoline prices, should move higher going forward, especially as the U.S. economy approaches full employment and average earnings move higher.

A higher stock market leads to more spending by consumers because of the wealth effect. Retail sales, which have been dragged lower in recent months by falling gasoline prices, should move higher going forward, especially as the U.S. economy approaches full employment and average earnings move higher. An exodus of big employers. Almost every business and government agency that remains in the controlled region struggles with recruiting and retaining workers who cannot afford to live nearby. Firms end up defecting from the region or downsizing and opening operations in uncontrolled areas where access to a larger labor force (and more available and affordable housing) is less challenging.

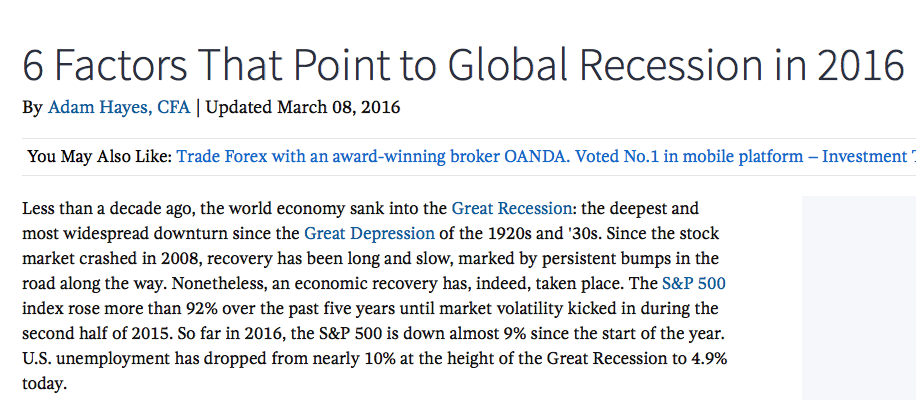

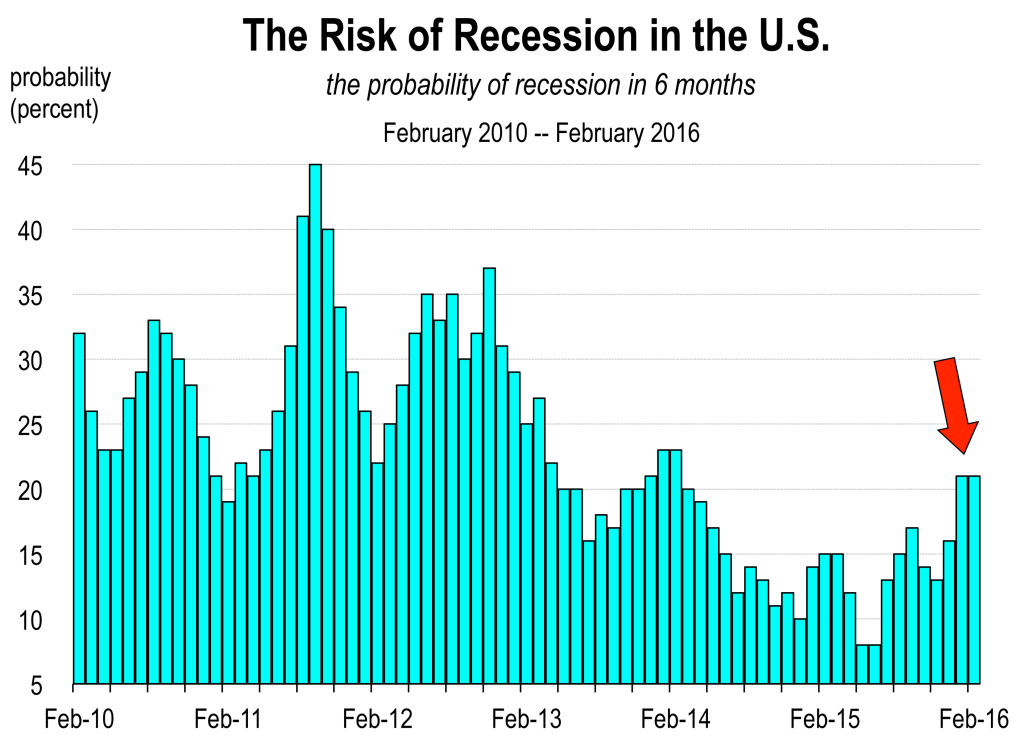

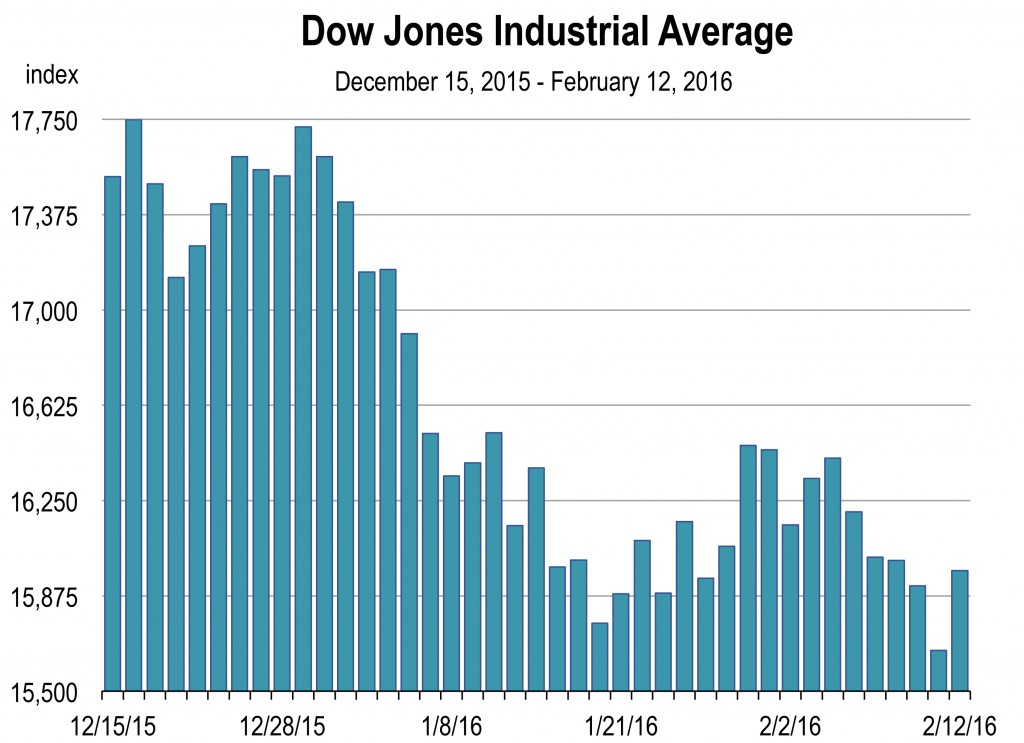

An exodus of big employers. Almost every business and government agency that remains in the controlled region struggles with recruiting and retaining workers who cannot afford to live nearby. Firms end up defecting from the region or downsizing and opening operations in uncontrolled areas where access to a larger labor force (and more available and affordable housing) is less challenging. OK, the market is now down 10 percent from where it stood at the turn of the year. This is a repeat of what happened in August. Why? Is this the early warning signs of the next recession?

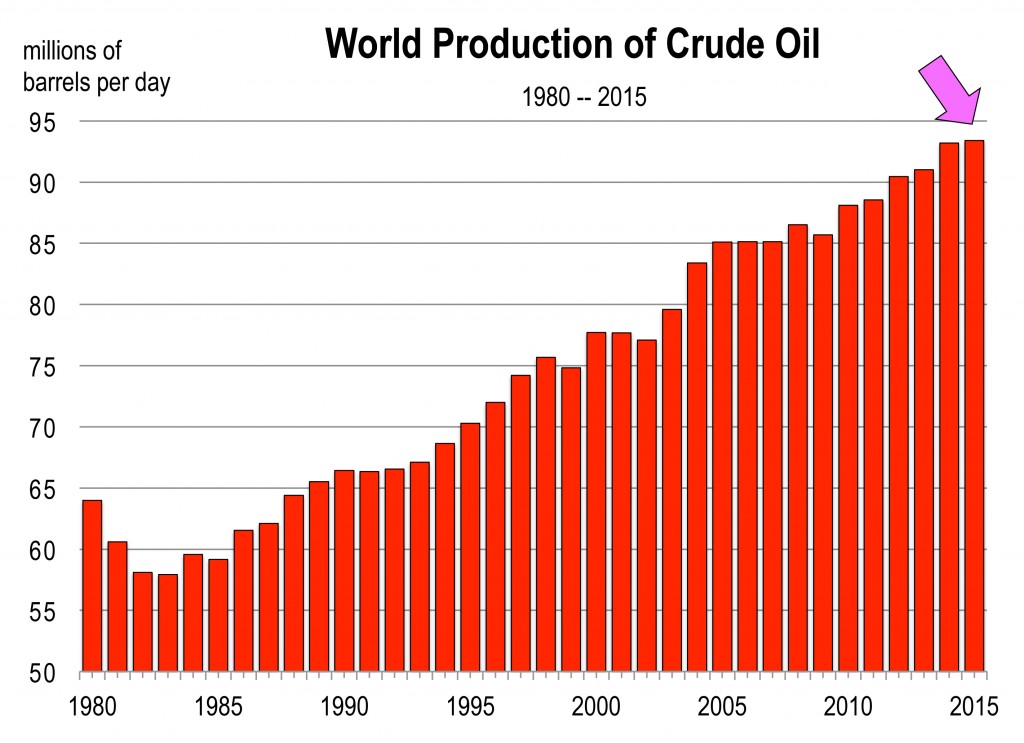

OK, the market is now down 10 percent from where it stood at the turn of the year. This is a repeat of what happened in August. Why? Is this the early warning signs of the next recession? The oil price collapse is due simply to increased supply (mostly by the U.S.) and decreased demand forces. Demand for oil globally began tapering off, driven most importantly by a slowdown in China’s economy. Until 2010, China had maintained an average growth rate of more than 10 percent annually for over 30 years. This high growth scenario started to slow in 2010. Currently (2016) the current GDP growth target set out by Chinese authorities is 7 percent, and many have questioned how much further growth could slow in the second largest economy in the world.

The oil price collapse is due simply to increased supply (mostly by the U.S.) and decreased demand forces. Demand for oil globally began tapering off, driven most importantly by a slowdown in China’s economy. Until 2010, China had maintained an average growth rate of more than 10 percent annually for over 30 years. This high growth scenario started to slow in 2010. Currently (2016) the current GDP growth target set out by Chinese authorities is 7 percent, and many have questioned how much further growth could slow in the second largest economy in the world.

The Chinese stock market is now in a bear market for the second time in 7 months. And U.S. investors are interpreting China’s problems as poison for the U.S. Why?

The Chinese stock market is now in a bear market for the second time in 7 months. And U.S. investors are interpreting China’s problems as poison for the U.S. Why? Source: LA Times, December 27, 2015, page C1

Source: LA Times, December 27, 2015, page C1 Source:

Source:  Source: Economist Intelligence Unit, The Economist, December 30, 2015

Source: Economist Intelligence Unit, The Economist, December 30, 2015