Mark Schniepp

July 2, 2024

It’s mid 2024 and it appears the biggest news in the current cycle is the presidential campaign in which the first (and perhaps only) presidential candidate debate just concluded.

I’ve referred to the monthly Gallup polls in this newsletter over the years. Gallup is the longest running poll on the satisfaction of Americans with the direction of the country.

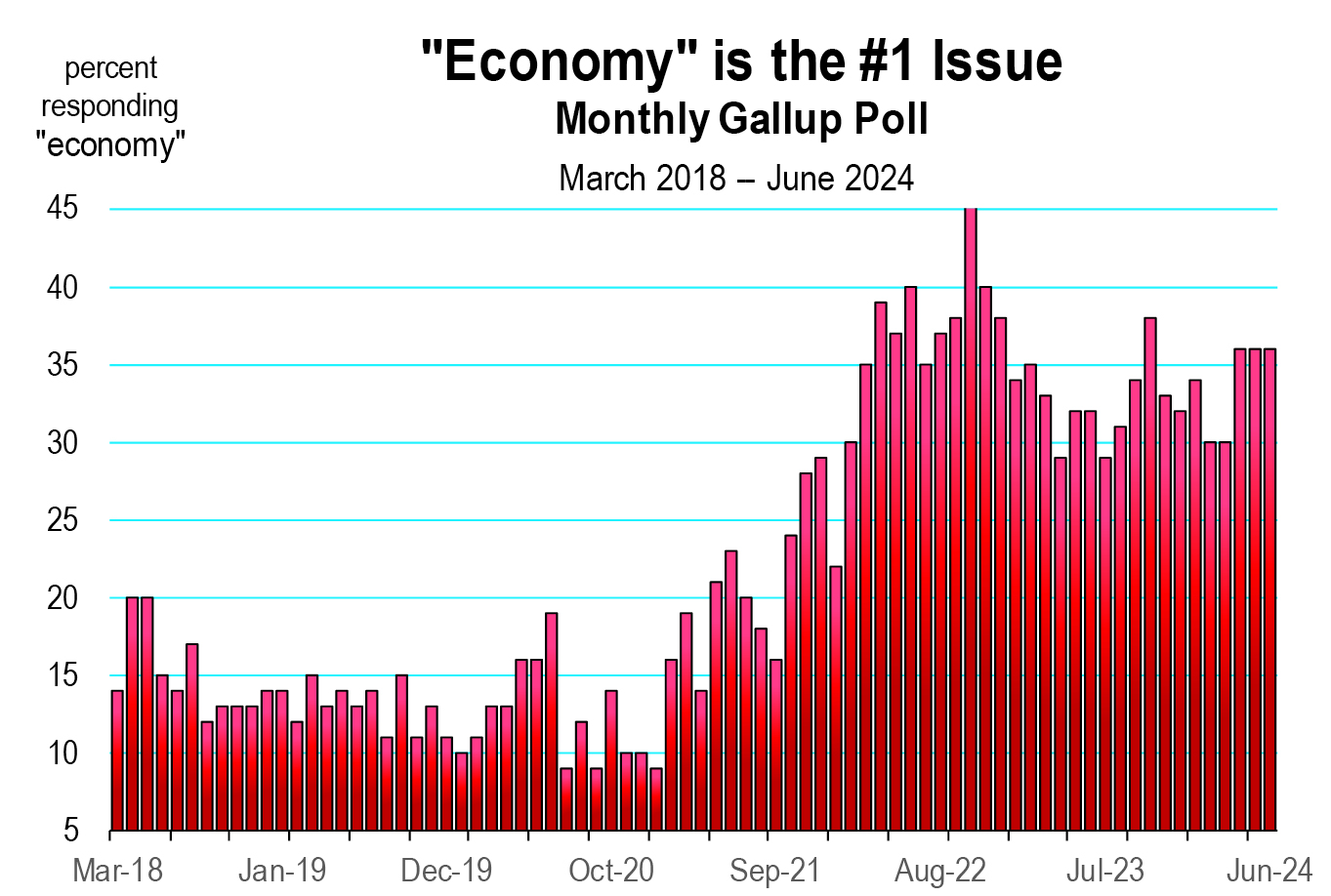

The June survey shows that 21 percent of Americans responded “Satisfied,” and 77 percent responded “Dissatisfied.” The most important issue facing the country today was the economy, with 36 percent of respondents in June citing either the economy in general including wage issues and unemployment, and inflation. This high of a response about the economy has been relatively persistent for the last 2 years.

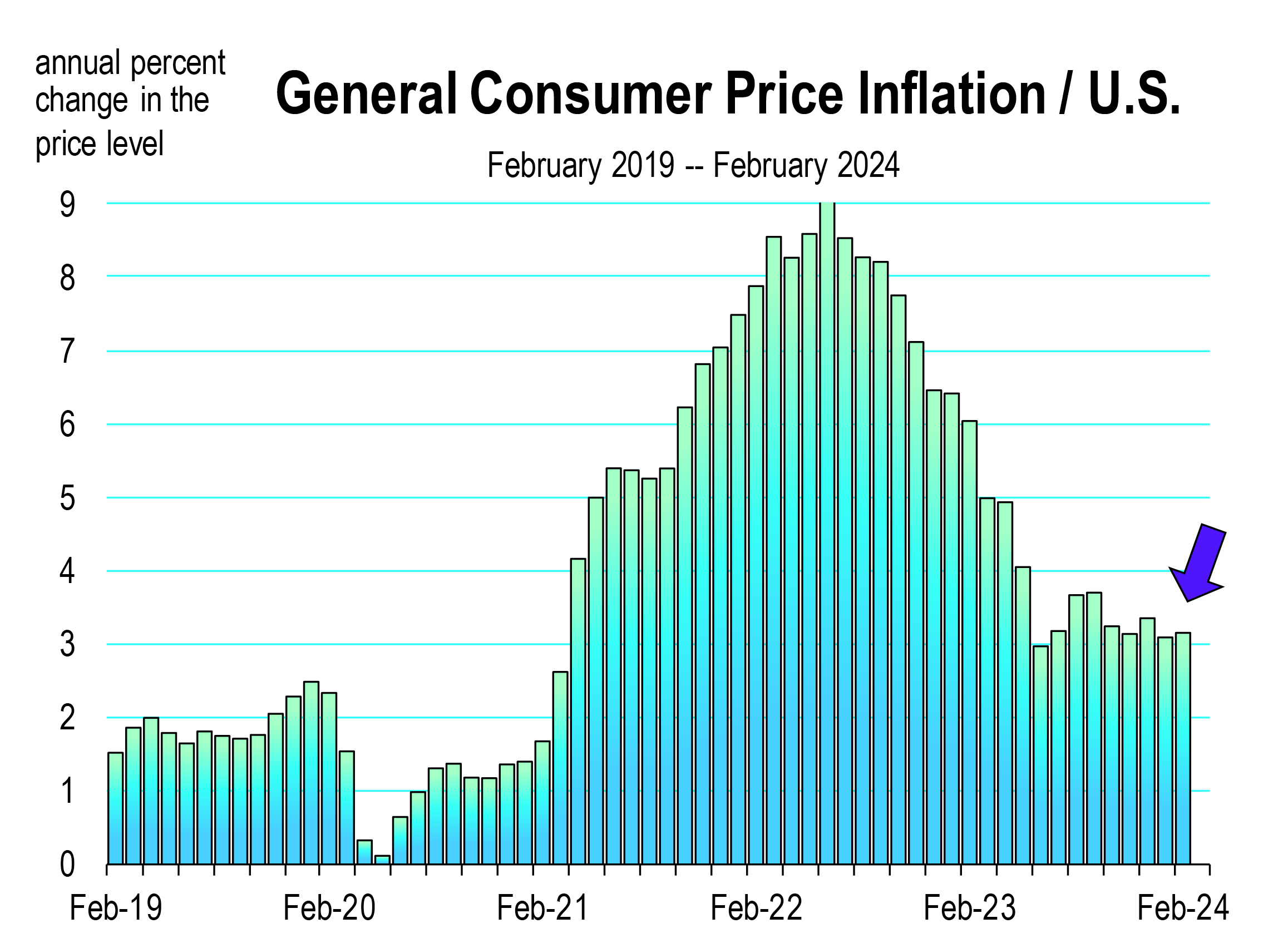

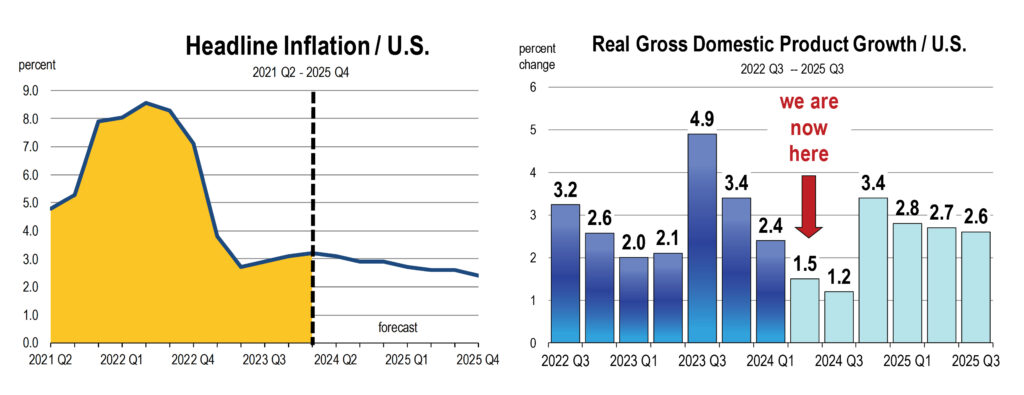

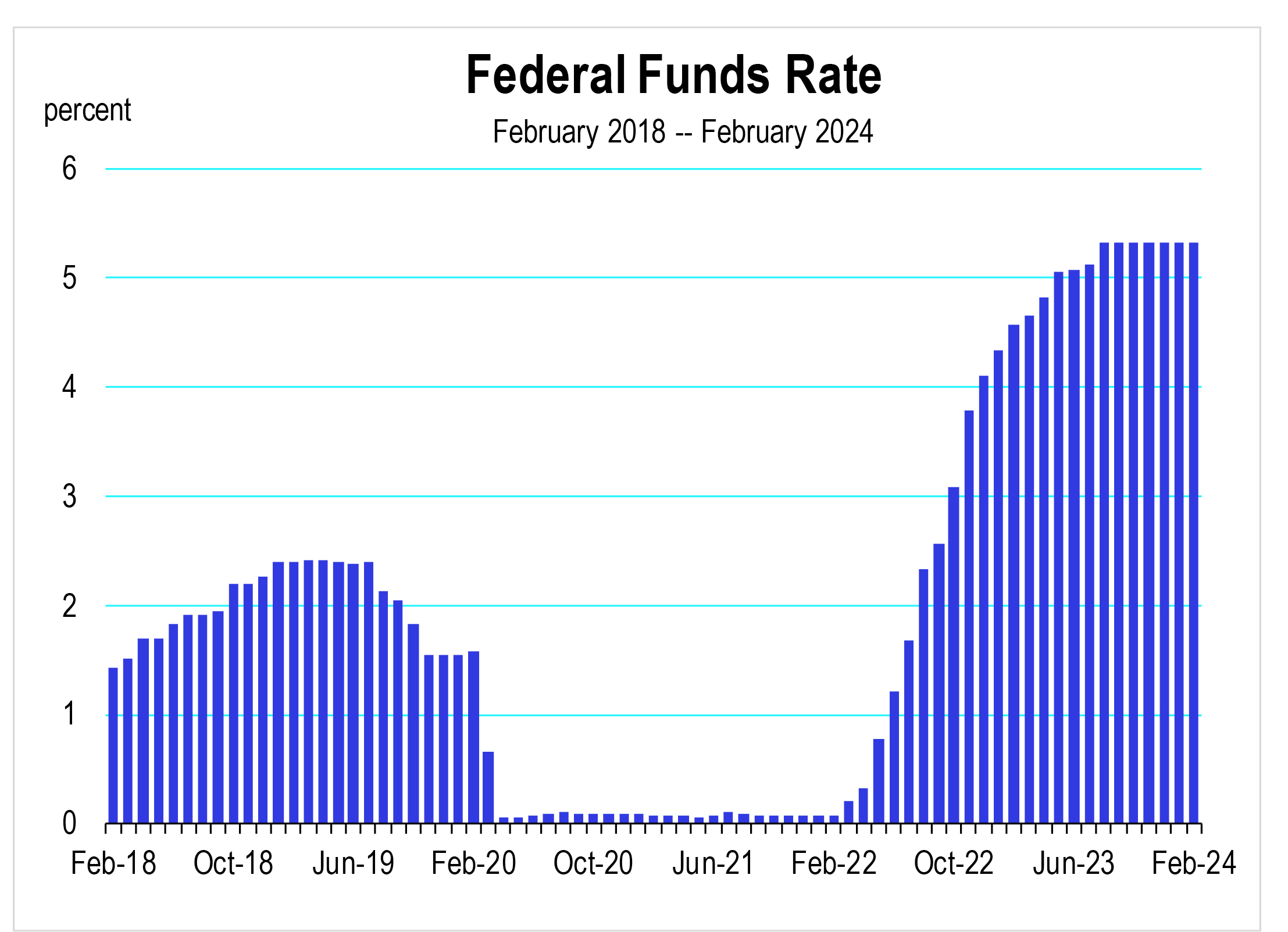

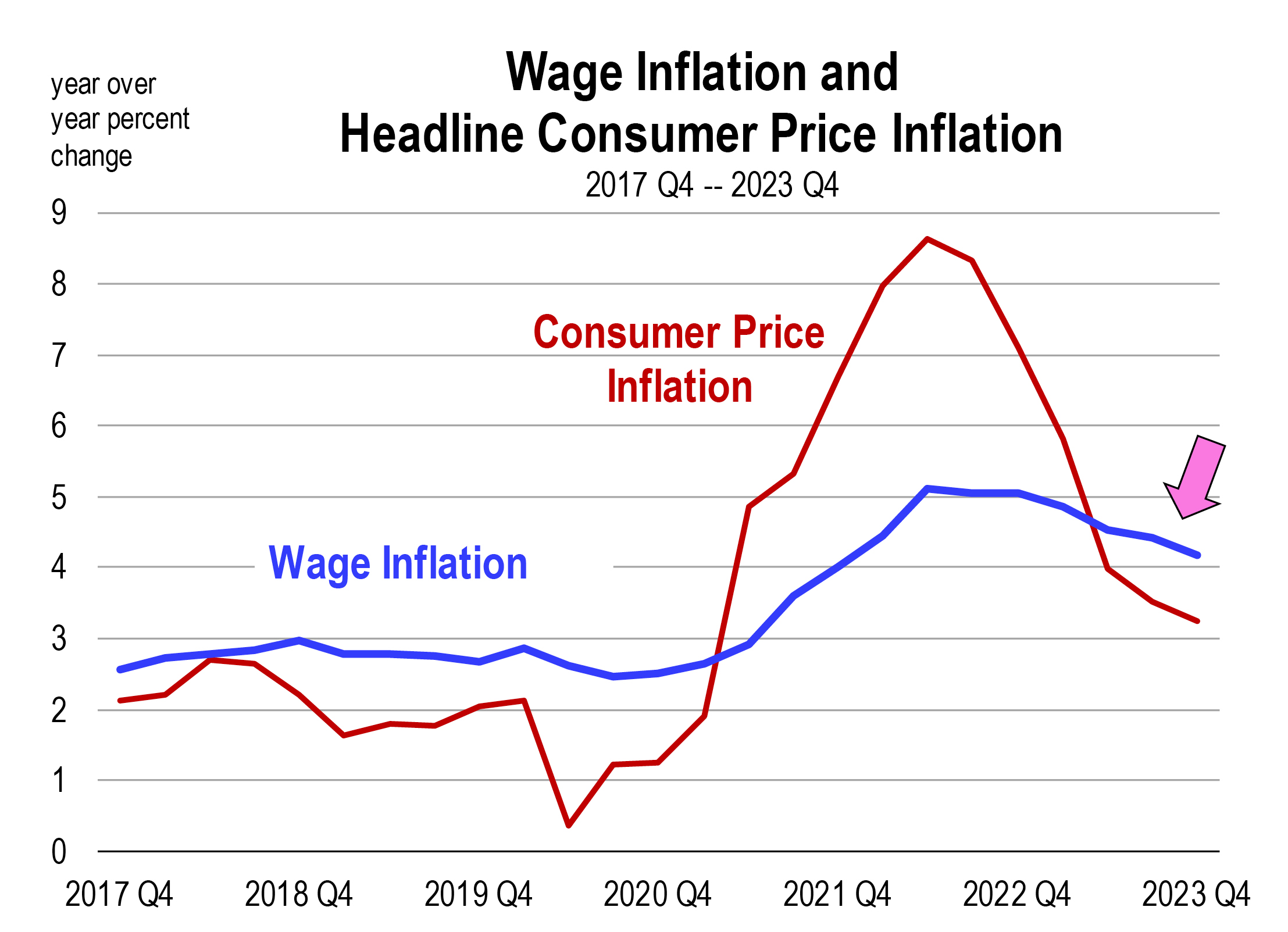

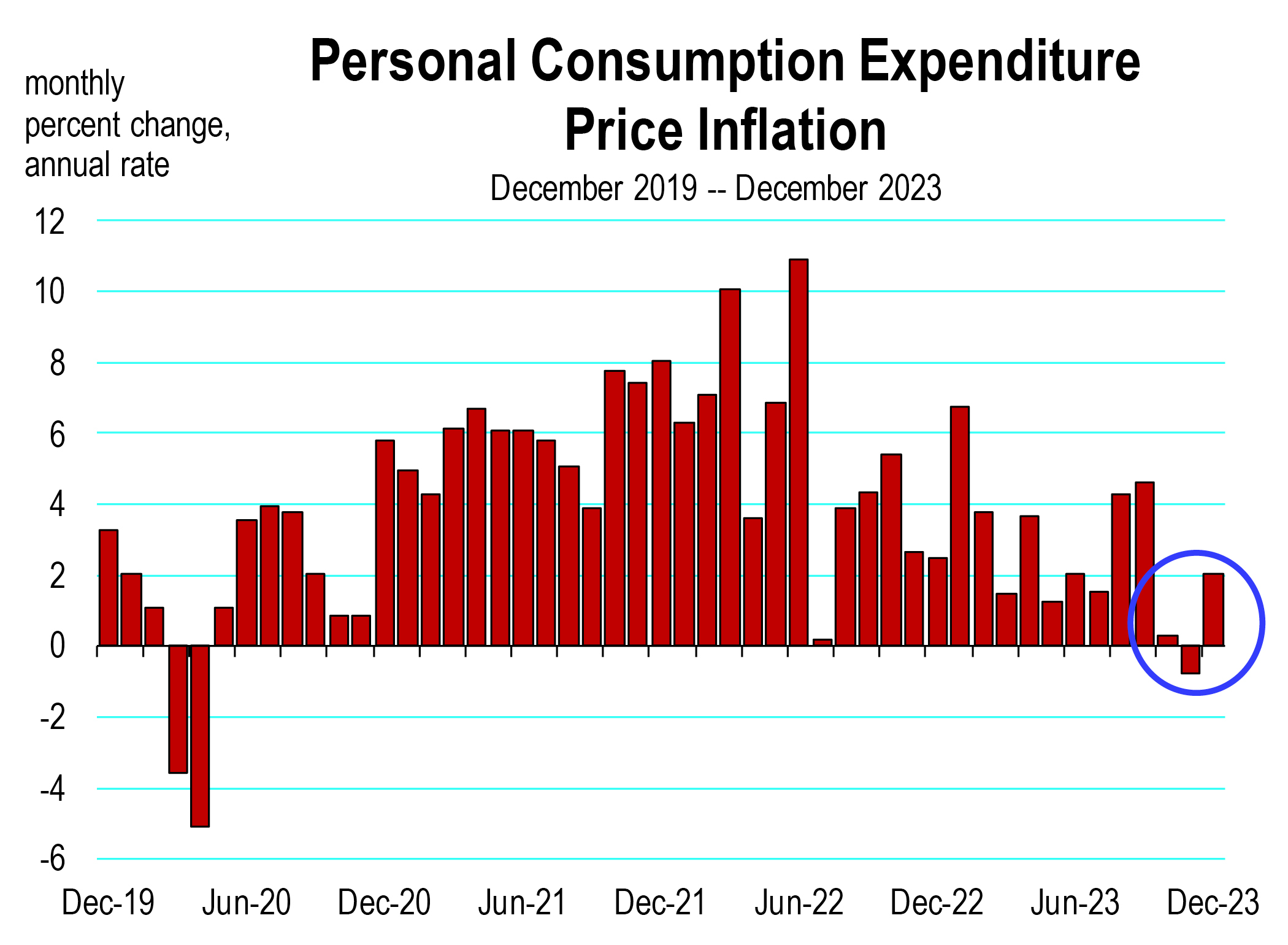

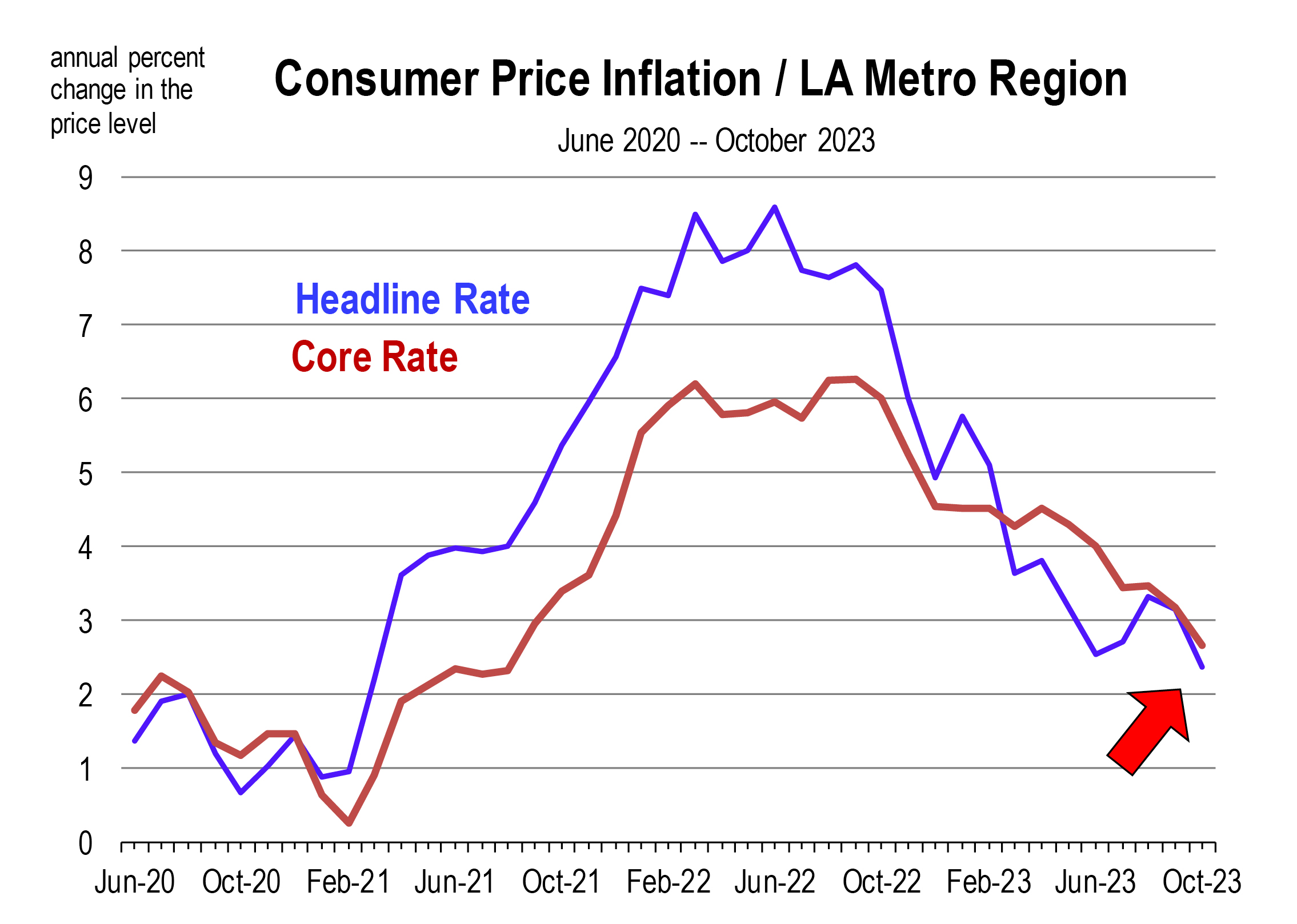

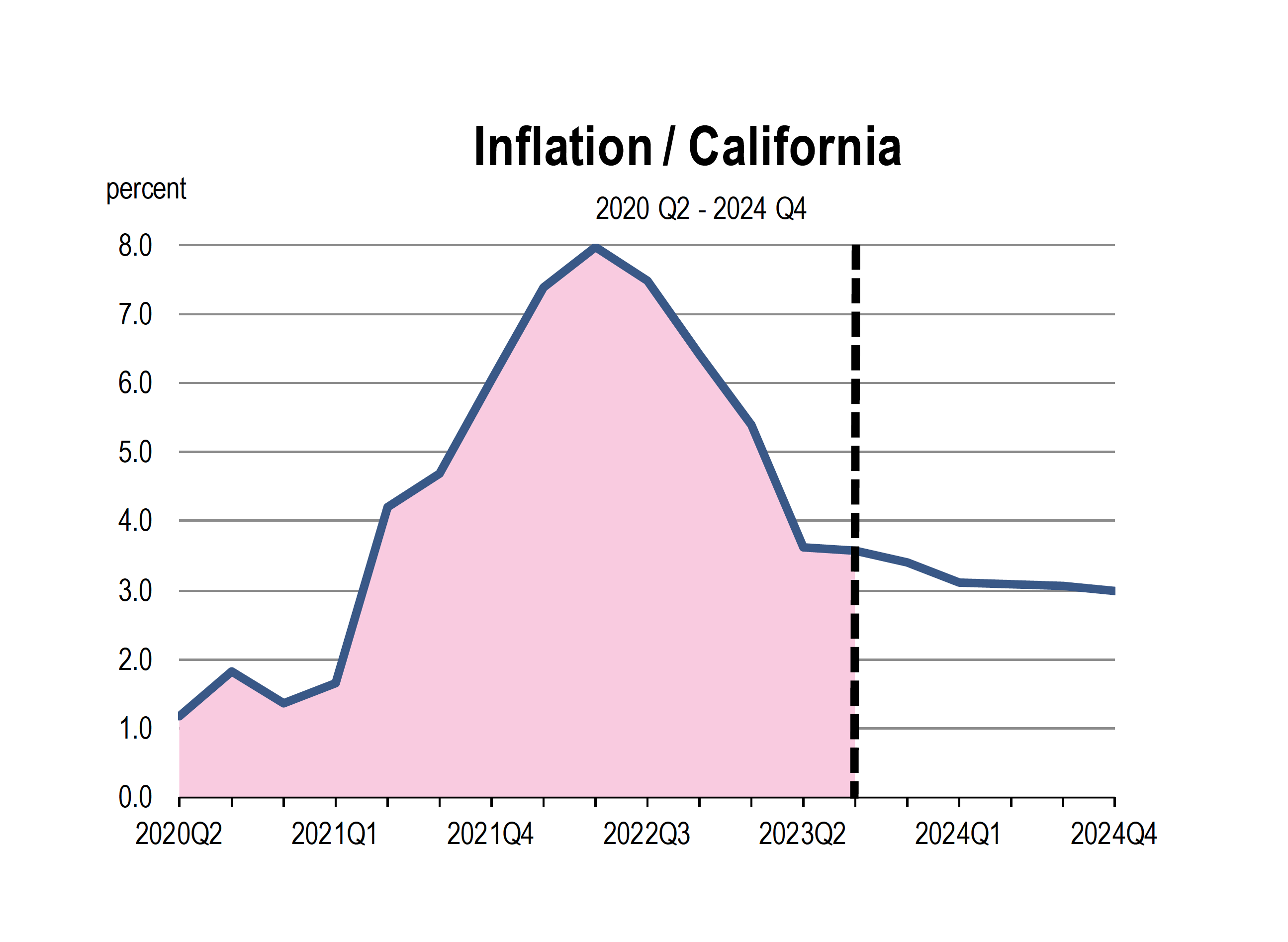

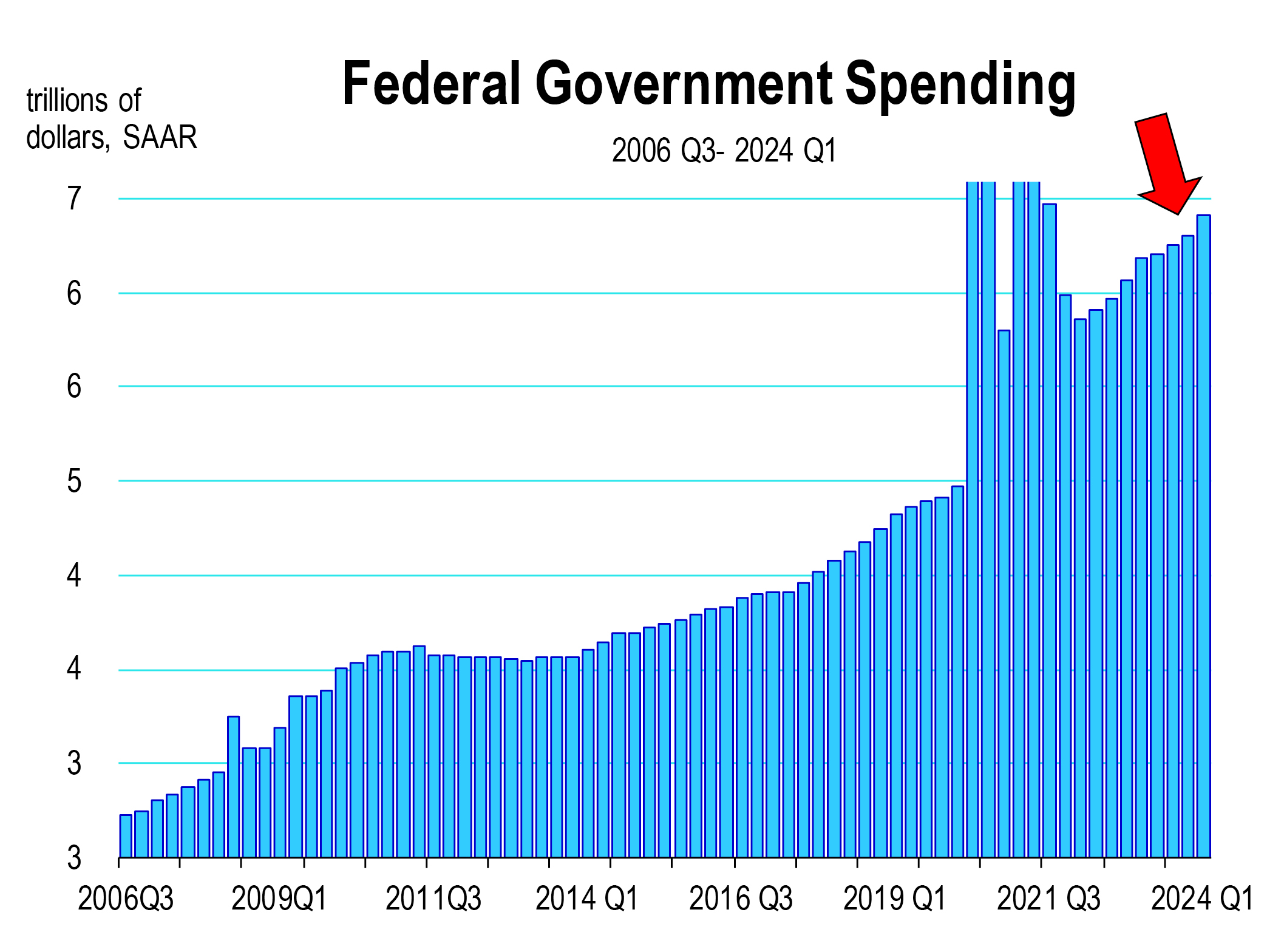

Though inflation has subsided, it has hit a stubborn floor that remains above the threshold needed by the Federal Reserve to begin normalizing interest rates. Furthermore, previously in their lifetimes, many Americans have not experienced inflation of the scale that has pushed general prices of goods and services up 19 percent since the start of Biden’s presidency.

Consequently, inflation continues to loom large over Americans’ evaluations of the country and the economy.

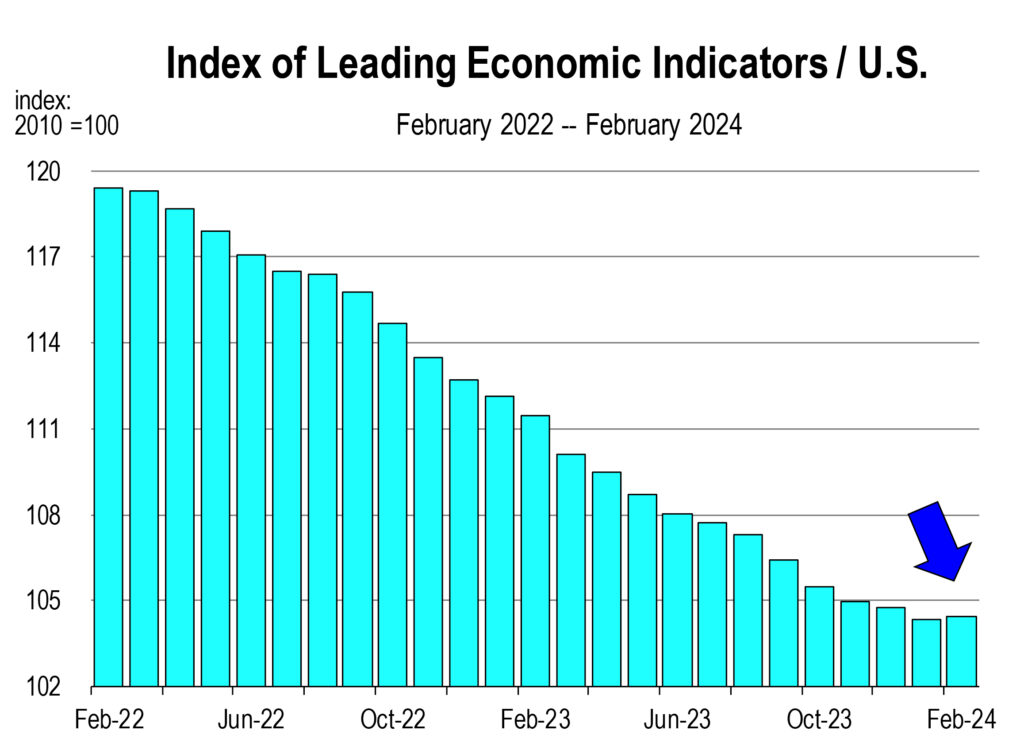

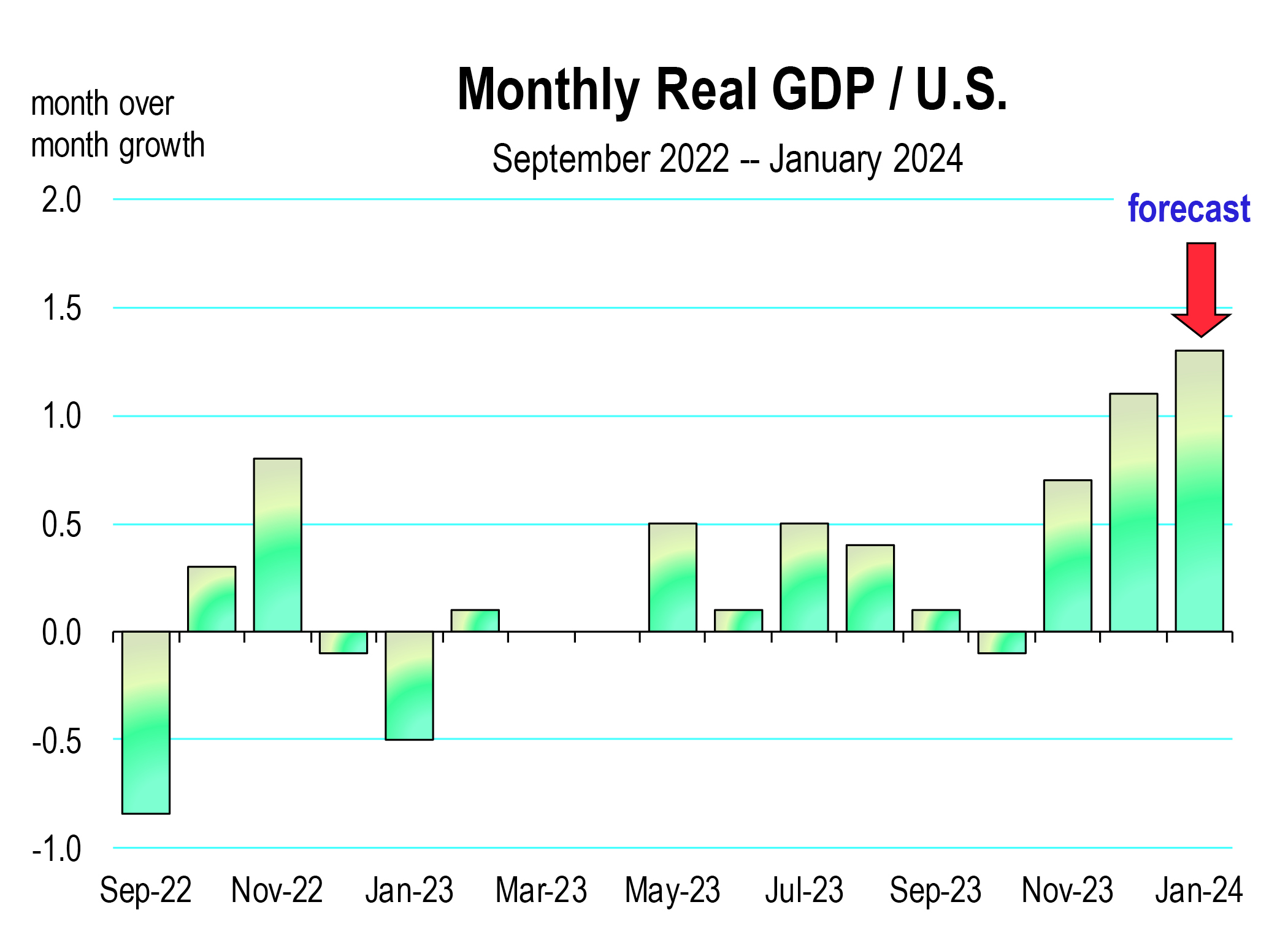

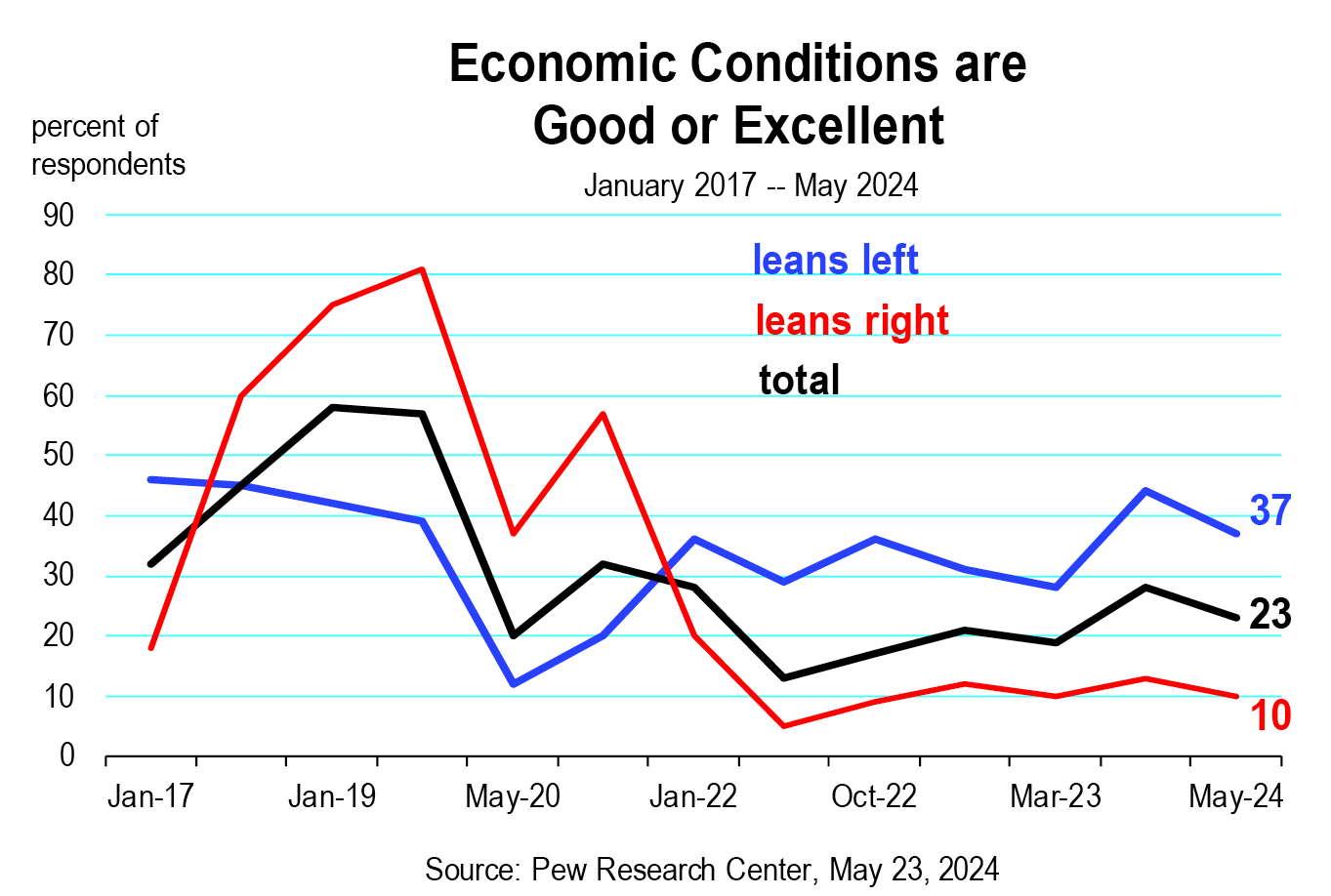

According to another survey, 23 percent of U.S. adults say the economy is in excellent or good shape today, down from 28 percent in January but slightly higher than the 20 percent who rated the economy positively a year ago.

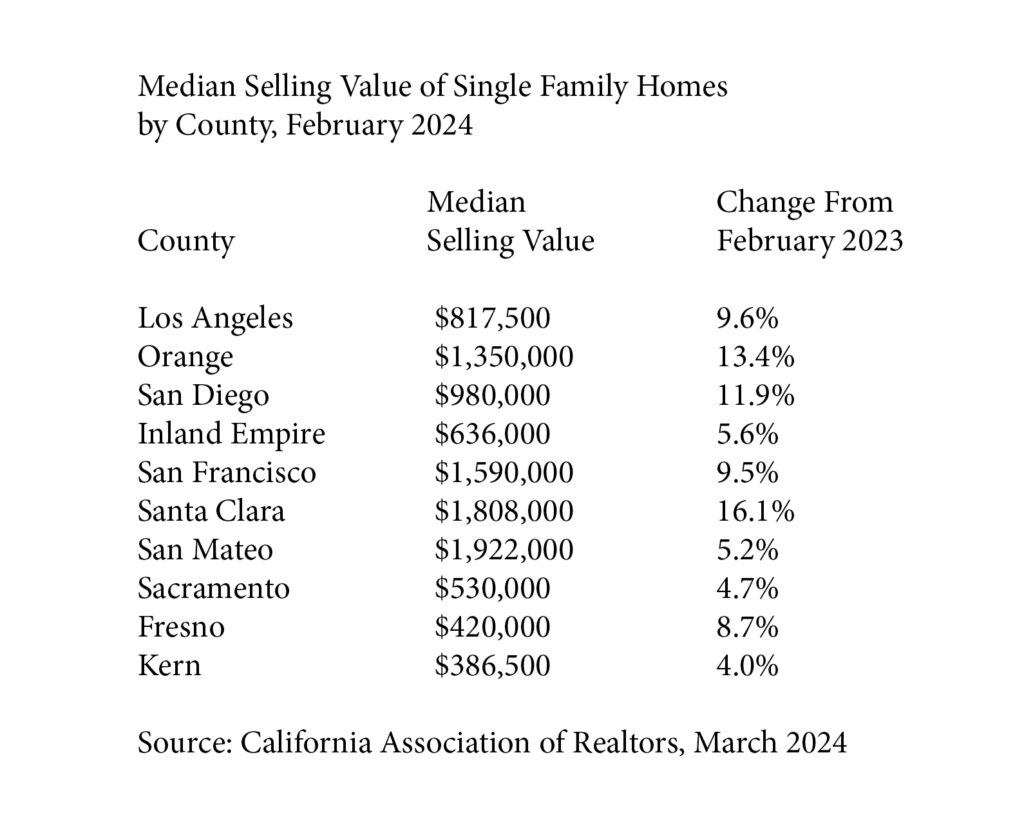

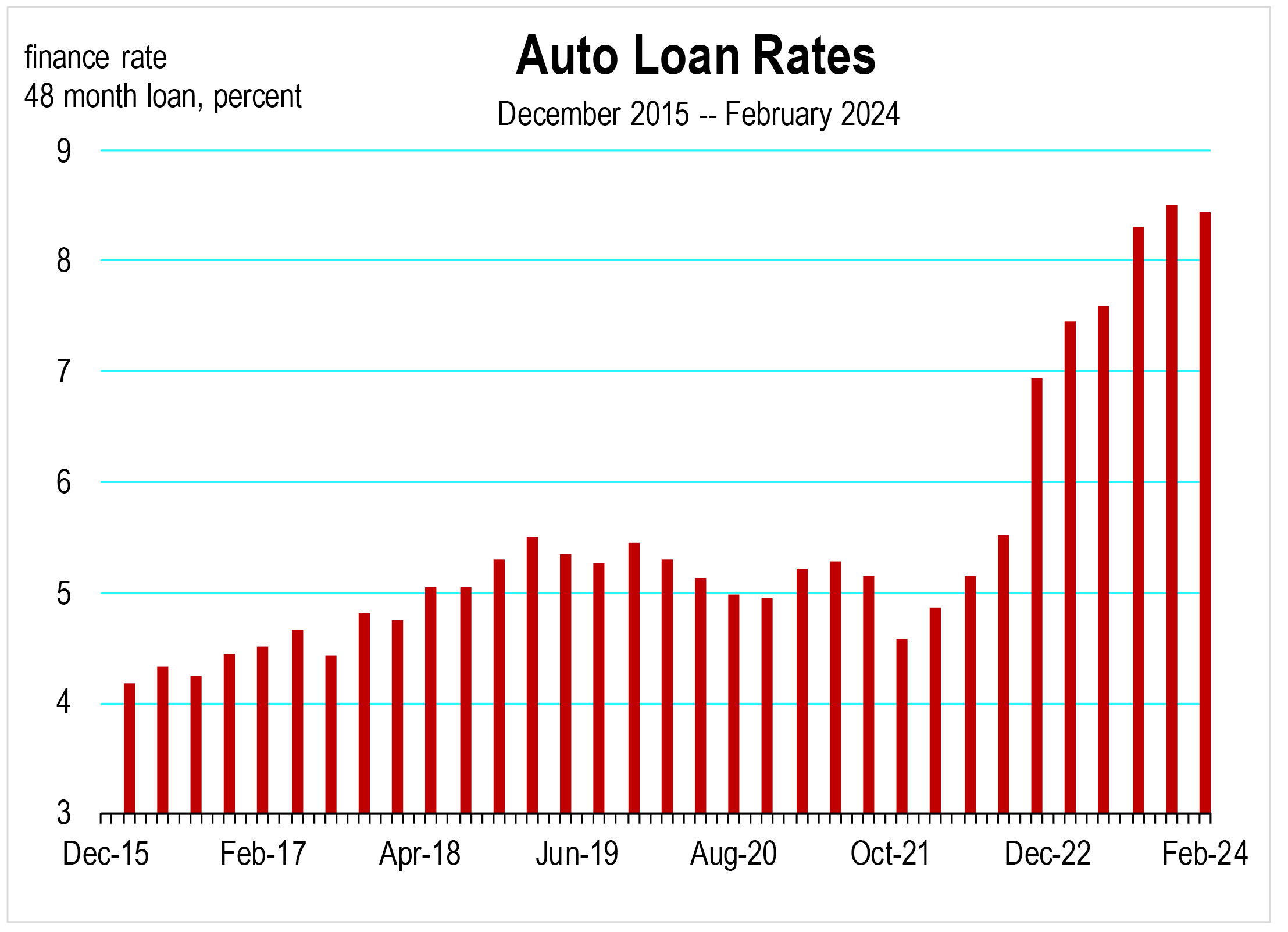

Americans see inflation as one of the top problems facing the nation, with 62 percent responding that inflation is a very big problem for the country in the latest Pew Research Center survey conducted in late May.[1] The increased borrowing costs and the resumption of rising housing costs, are still on the minds of Americans even as the headline inflation rate recedes.

Only 23 percent of Americans rate the country’s economic conditions as either good or excellent, while 36 percent say “poor” and 41 percent say “only fair.” This is consistent with the Gallup Poll.

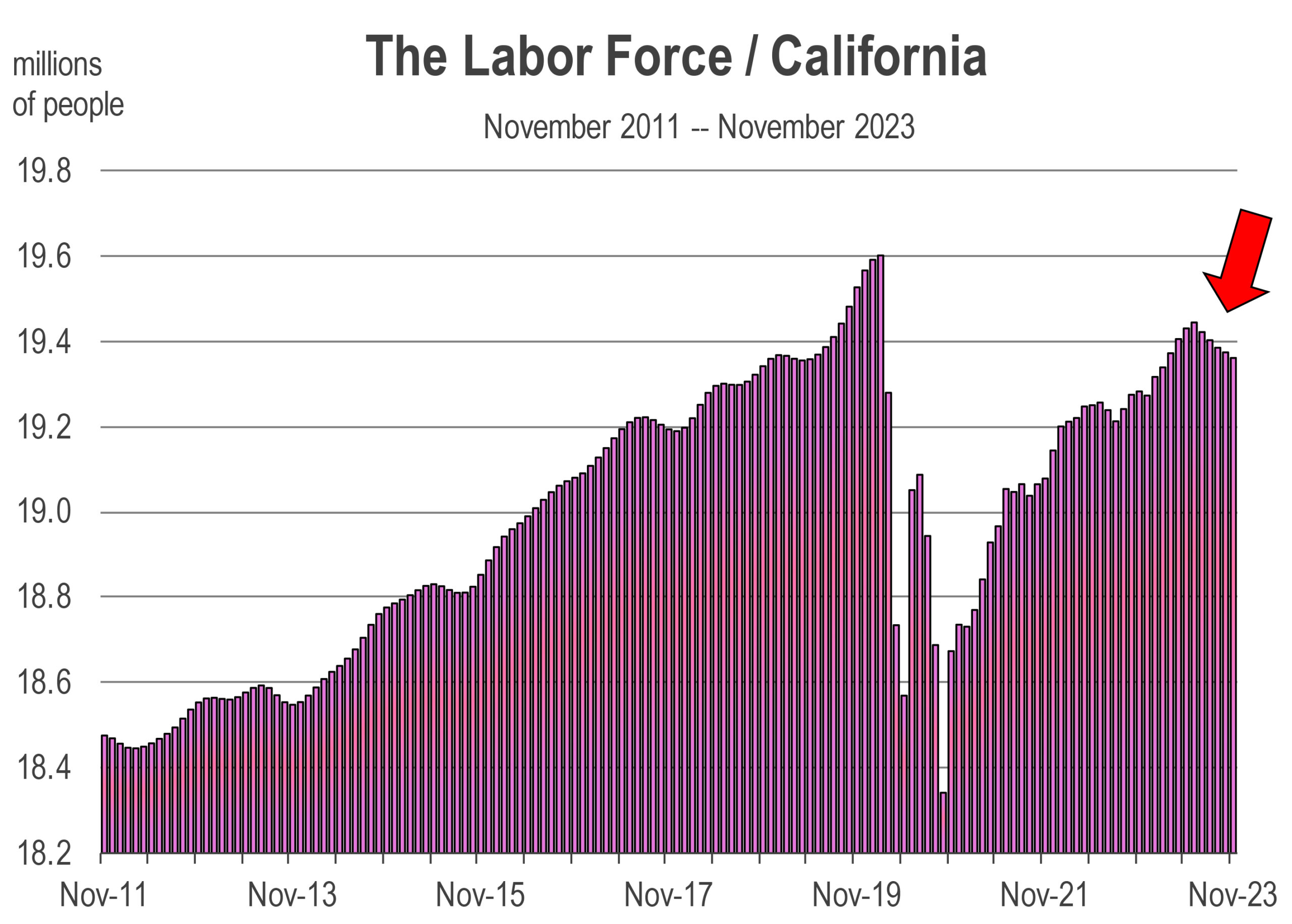

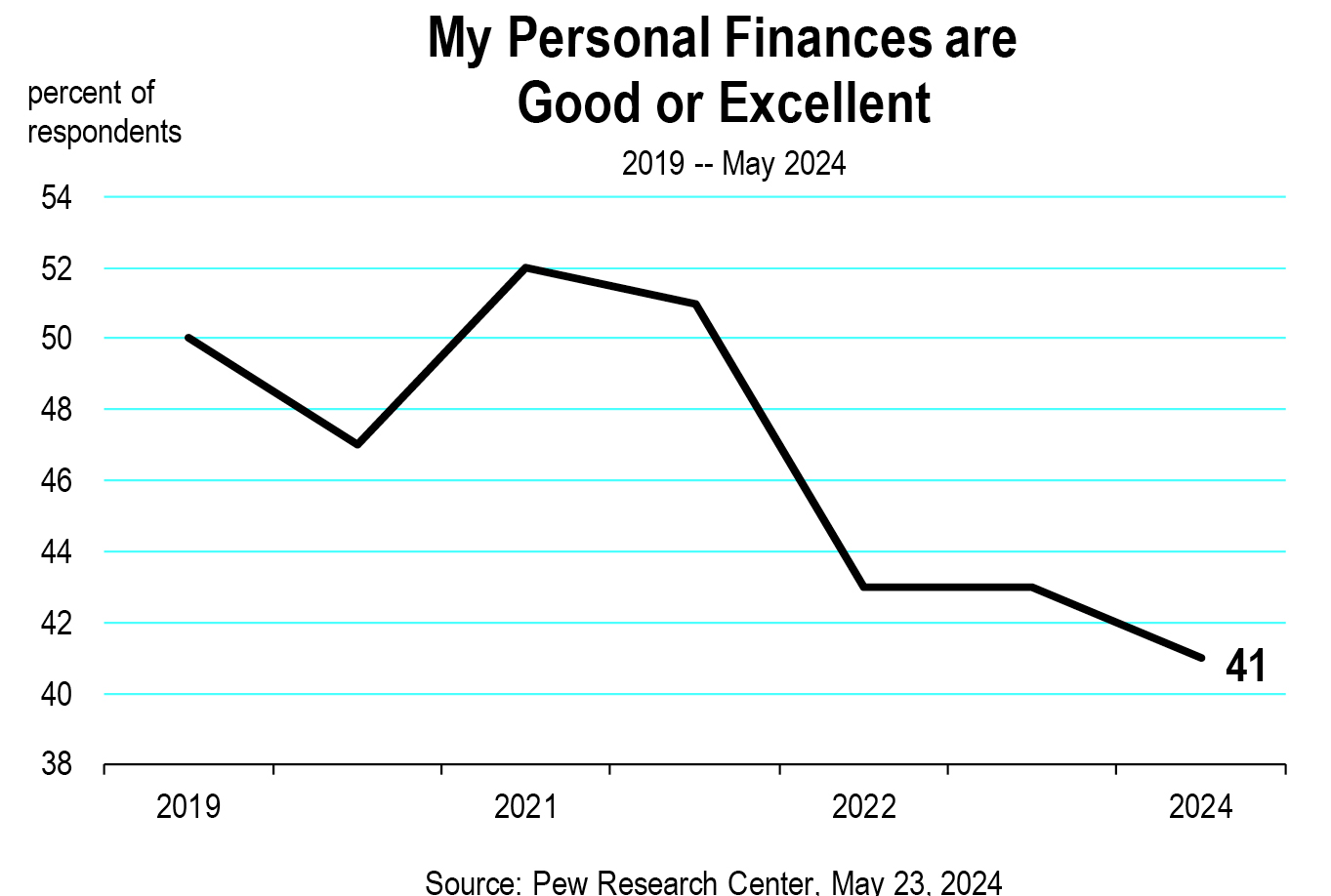

The share of Americans who rate their personal finances as excellent or good declined from 52 percent in 2021 to about 42 percent in 2022, and sinking to 41 percent today. There is very little divide between Americans identifying by political party. What is more relevant however is that Americans believe their personal finances are in the weakest of conditions since the survey began in 2019. And it’s not that they are earning less money, it’s that inflation and high interest rates have eroded the ability of those finances to acquire needed goods and services today.

The most recent ABC News/Ipsos poll found that the economy and inflation remain the most important issues for Americans when determining who they may support for president in November.[2] The economy and inflation received 88 and 85 percent responses respectively as the most important issues affecting presidential support. Nearly half of Americans said that these are the single most important issues for them.

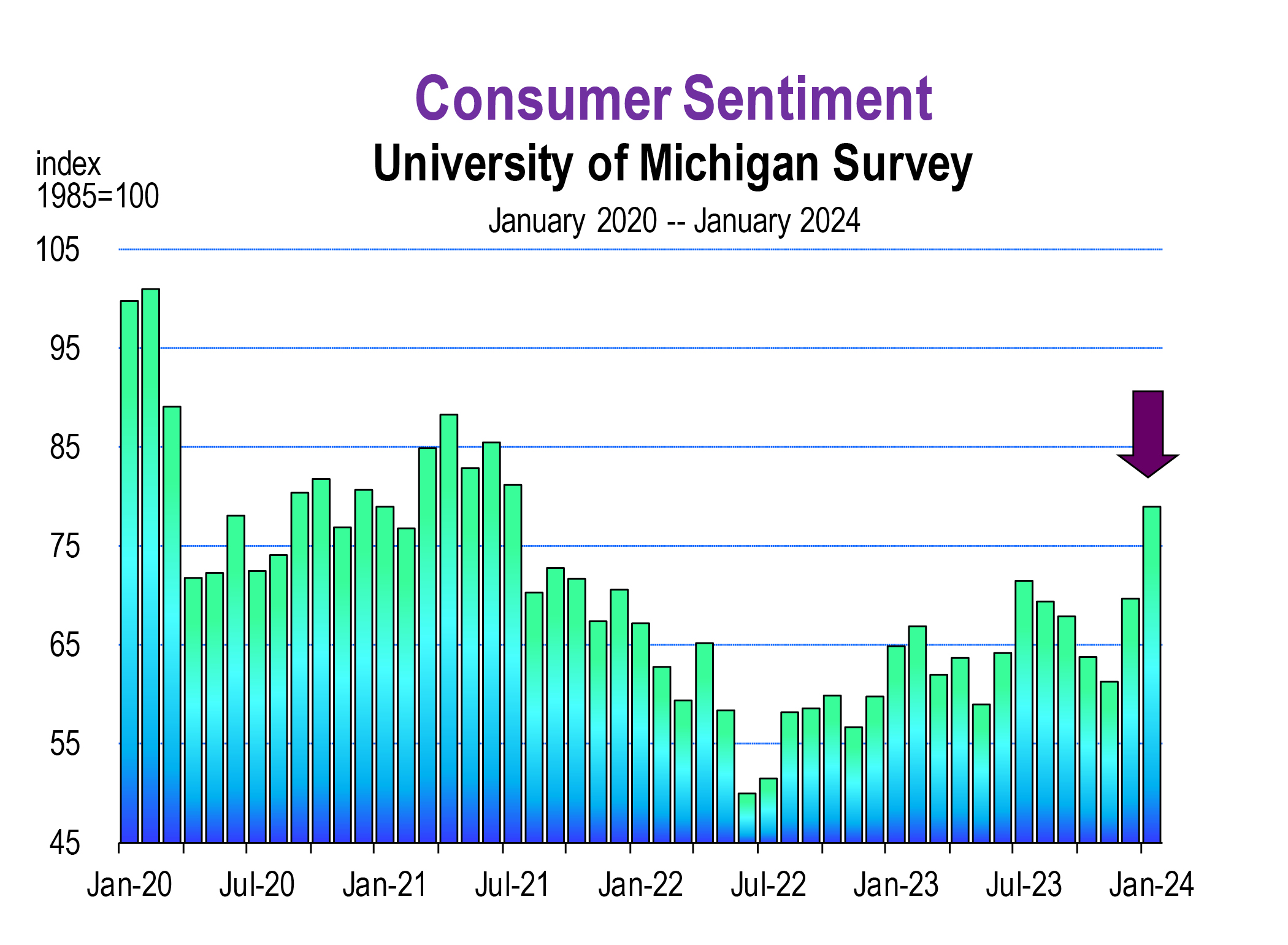

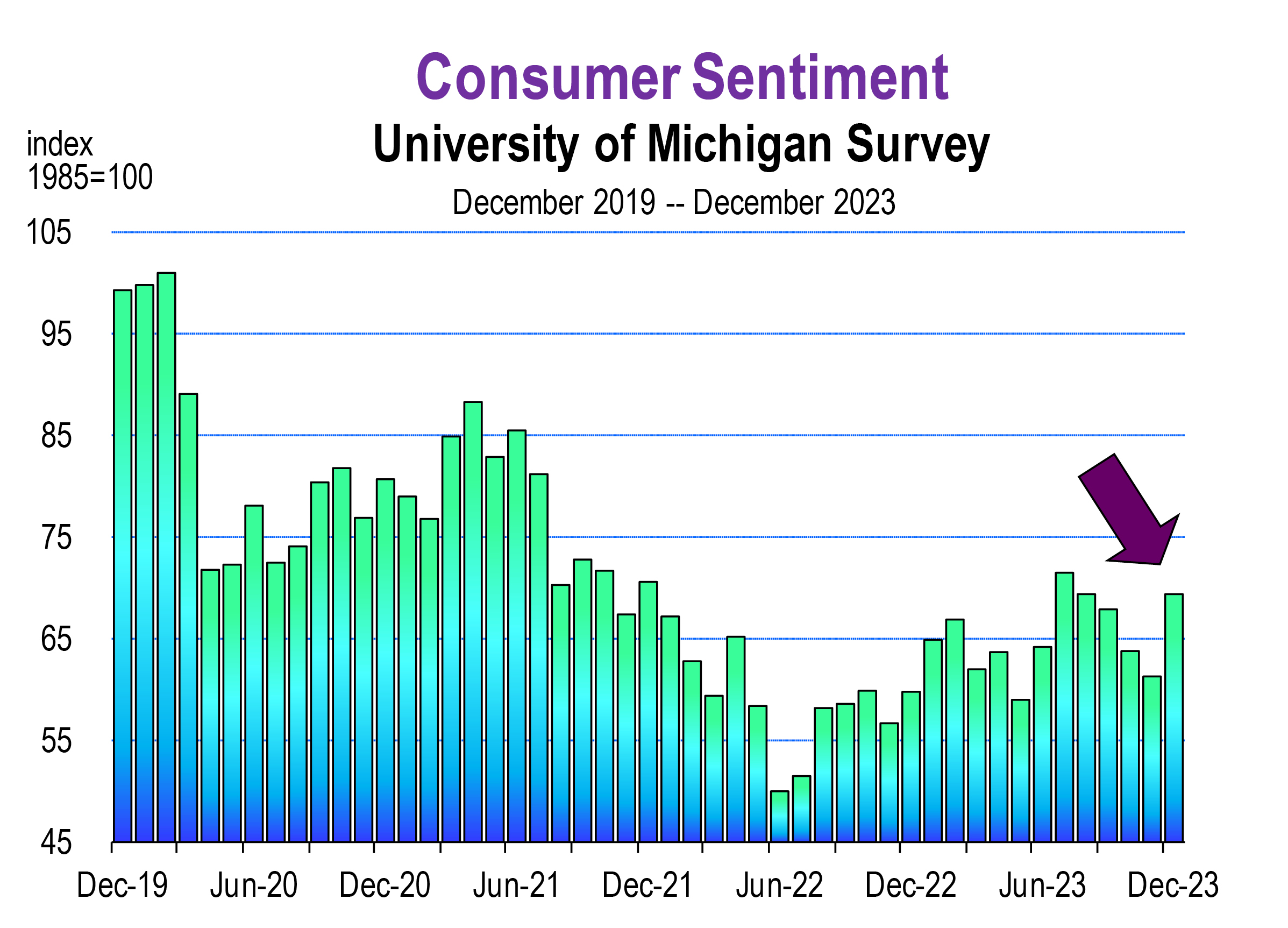

Clearly, this poll, and the Pew Research Survey are both consistent with other surveys such as the University of Michigan Consumer sentiment study that routinely monitors how U.S. consumers rate the economy. Sentiment in that survey has gradually ticked up since 2022 but the level of optimism is still well below expectations based on current economic data.

In summary, Americans are not happy with the current state of the U.S. economy and this typically affects elections, especially presidential elections every four years.

Consequently, other issues of concern, number 2 and number 3 by Gallup being immigration and poor government leadership may not really matter in the grand scheme of things. It’s still the economy stupid as James Carville said during the Clinton-Bush campaign back in 1992. And because he turned out to be correct, we’ve been repeating that mantra during all presidential elections since. Why would this year be any different?

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

[2] ABC News/Ipsos Poll, May 5, 2024, https://www.ipsos.com/en-us/most-americans-say-economy-and-inflation-are-most-important-issues-determining-who-they-will-support-for-president-in-november

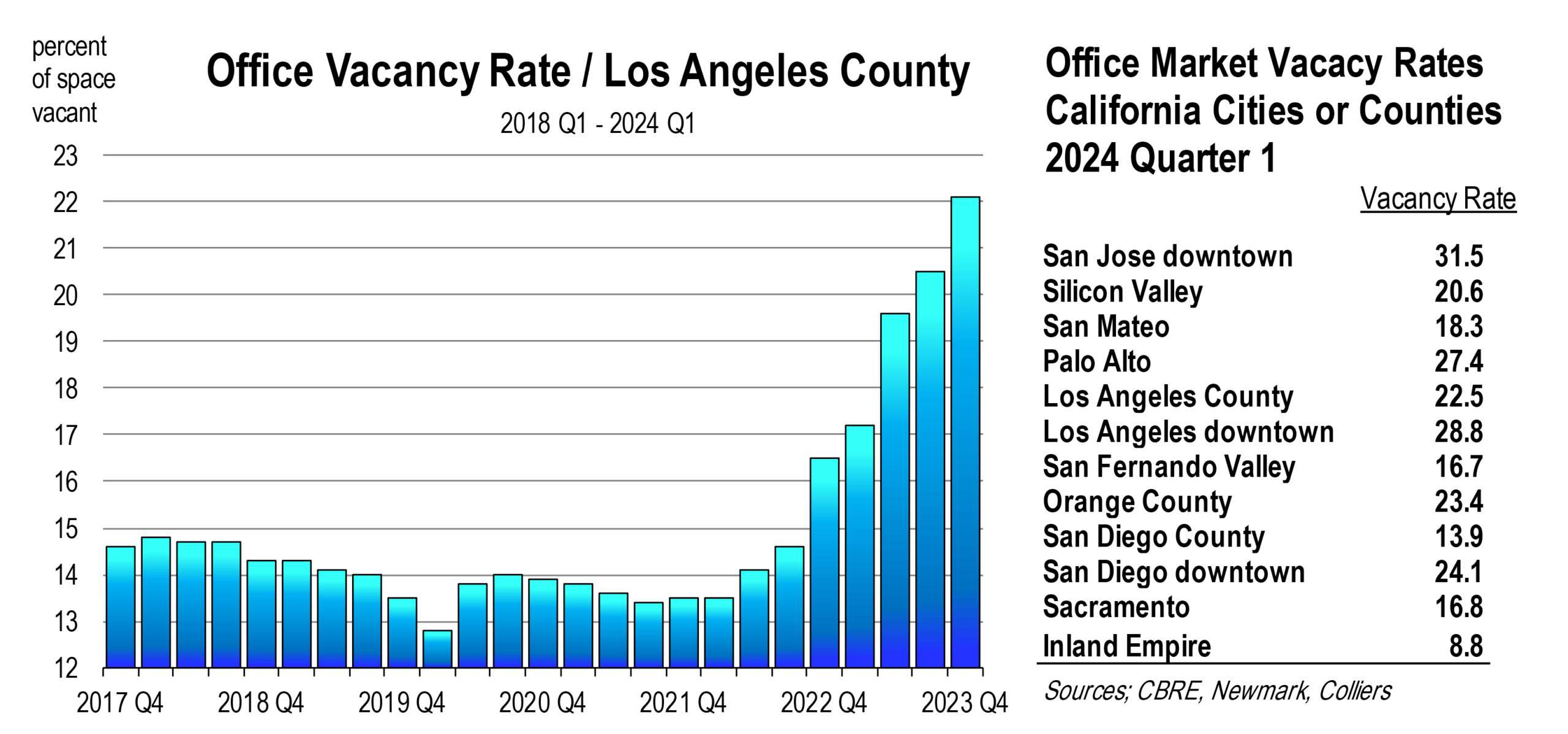

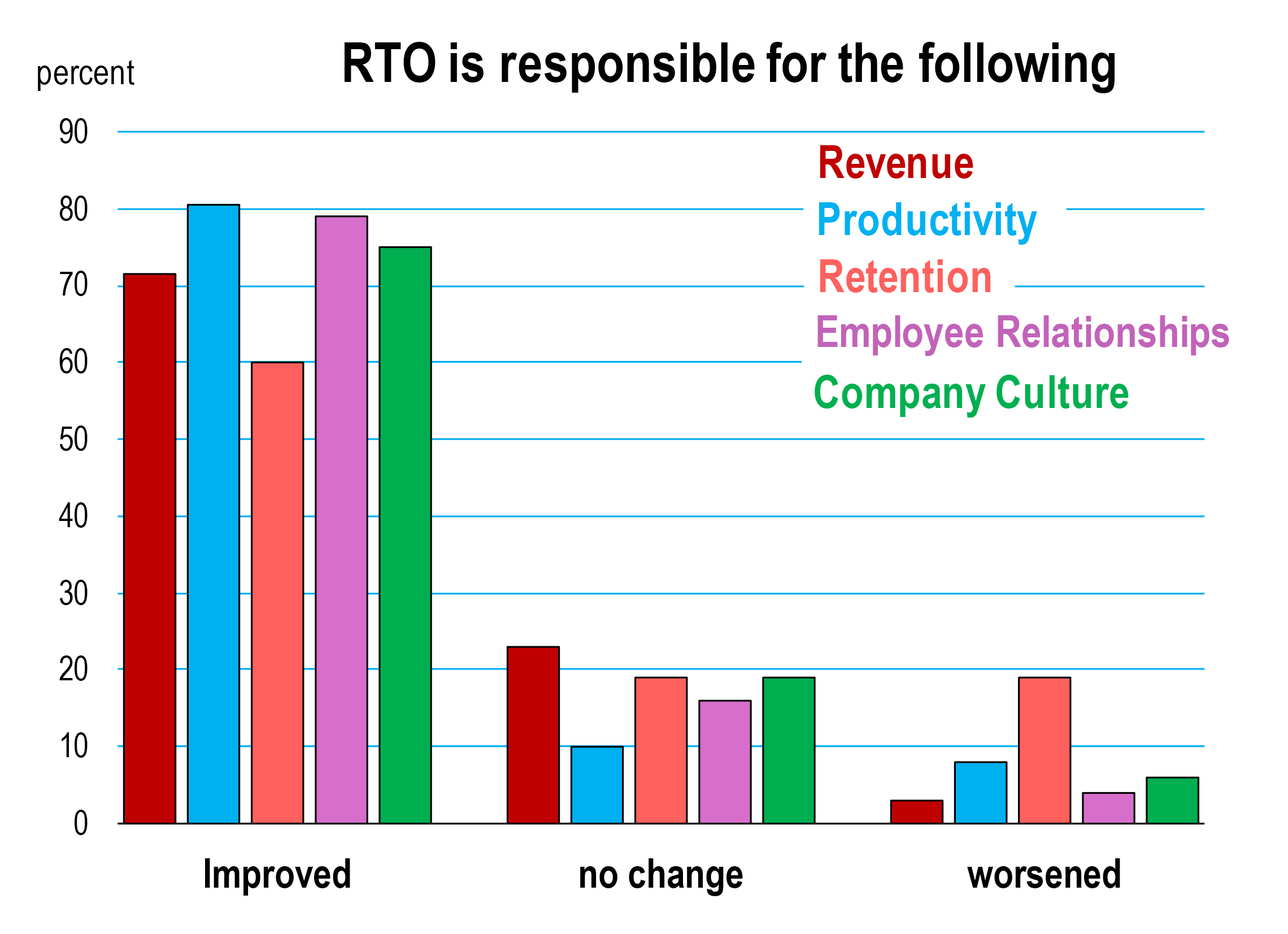

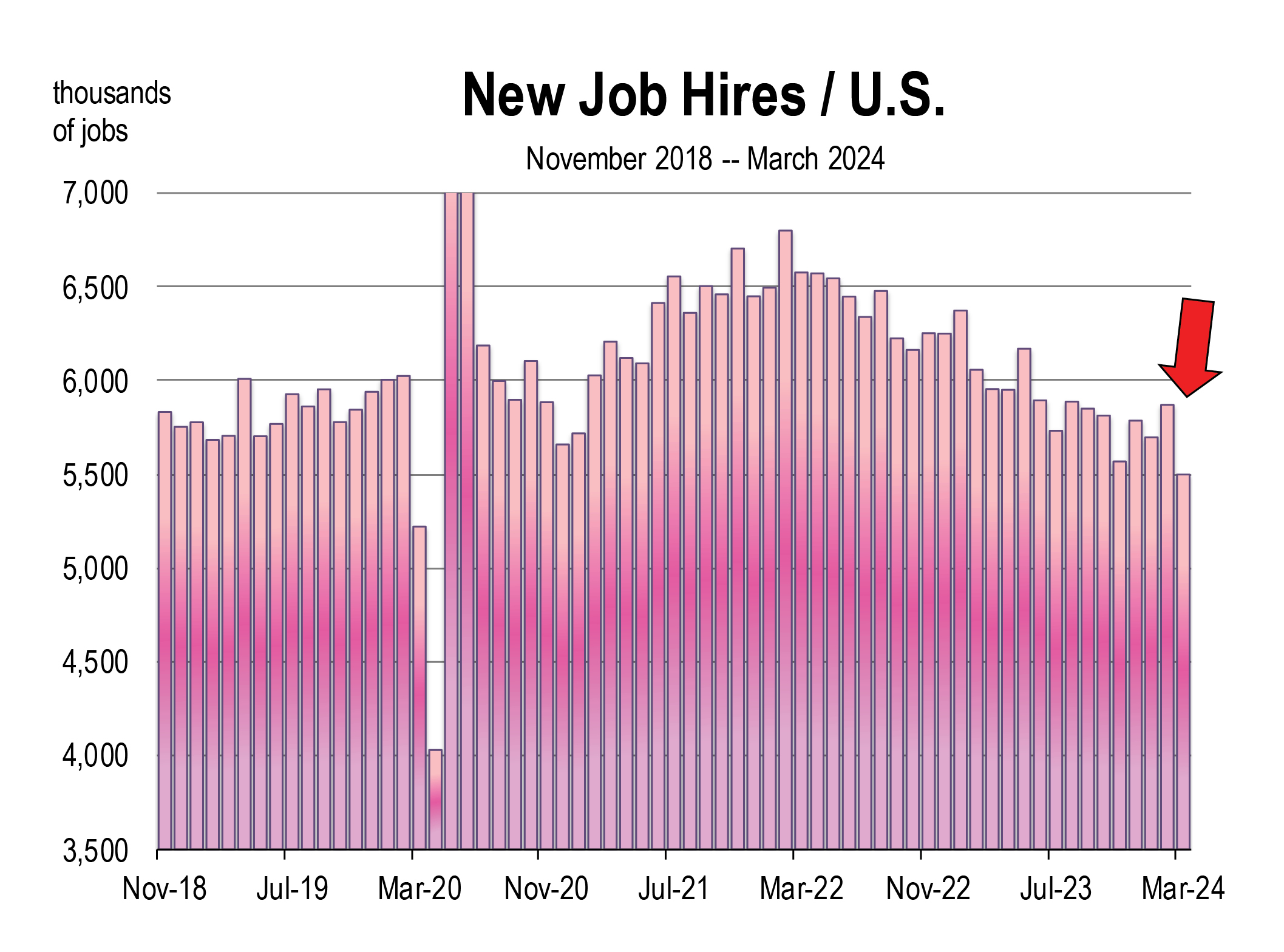

The issue for rising vacancy in the office market is typically that office using employment has contracted as part of a broader based employment decline. Consequently, companies cut back on space to cut costs and “weather the downturn”. That’s not the case this time. We have near record levels of employment in office using sectors. The problem is that many of these workers are not using the office, and are instead working from home.

The issue for rising vacancy in the office market is typically that office using employment has contracted as part of a broader based employment decline. Consequently, companies cut back on space to cut costs and “weather the downturn”. That’s not the case this time. We have near record levels of employment in office using sectors. The problem is that many of these workers are not using the office, and are instead working from home.

Moody’s continued to report the following day that

Moody’s continued to report the following day that