Mark Schniepp

November 15, 2023

The Labor Market

2023 was the year of labor disputes. SAG-AFTRA, Writers, Longshore workers, and hotel workers.

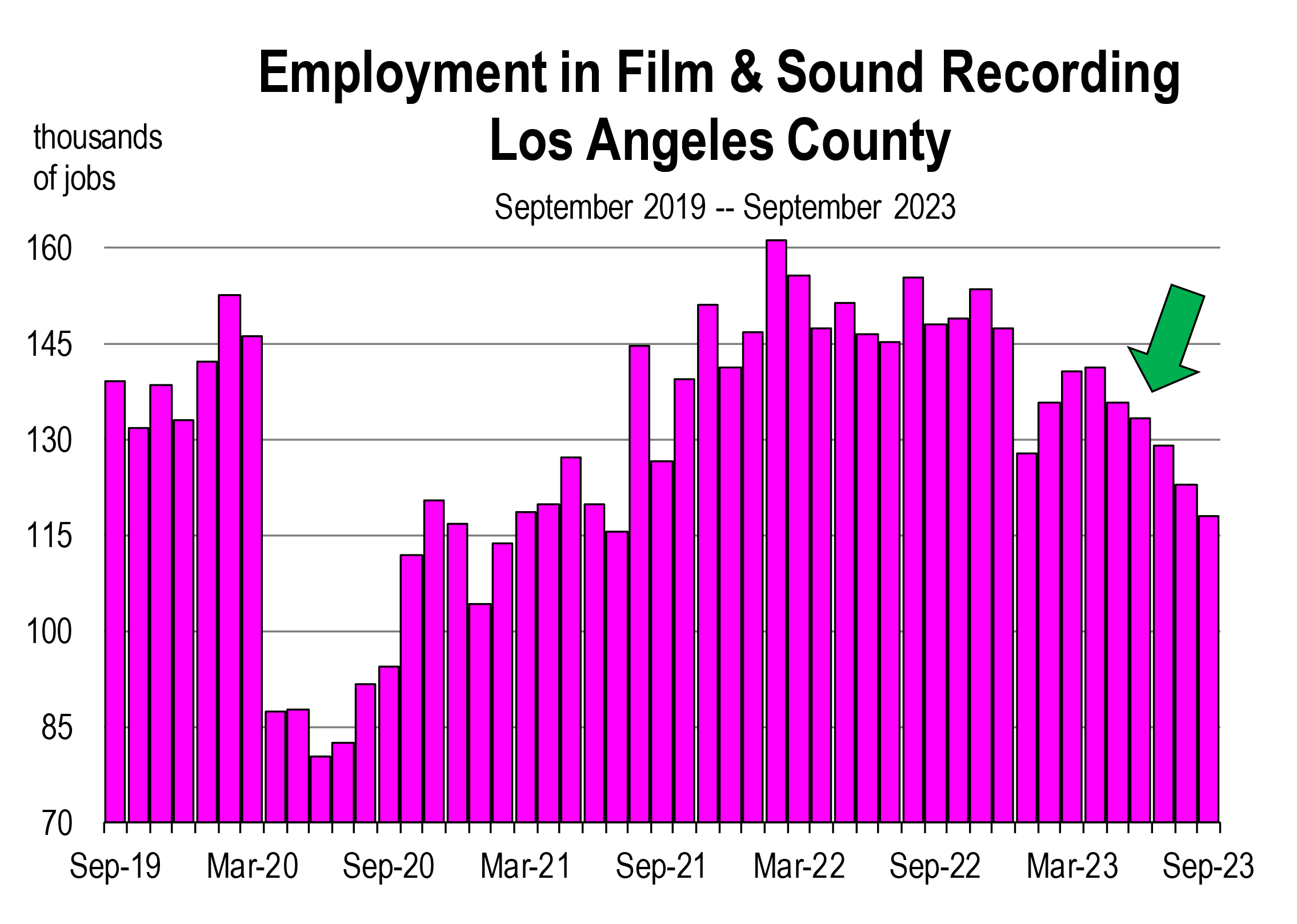

The Screen Actors Guild just resolved their 118 day labor dispute with studios in early November, in the wake of the Writers Guild resolution in September. Thousands of SAG-AFTRA members will now be back to work; 20,000 should return to wage and salary jobs in Los Angeles County alone.

The Longshore Workers were without a contract for 13 months, but their strike was resolved in June and union-ratified in August. The LA Hotel workers strike is still unsettled. The union contract for some 15,000 workers–housekeepers, cooks, front desk agents–at about 60 hotels expired at the end of June. Since then, their union has been fighting for pay raises of more than $10 an hour.

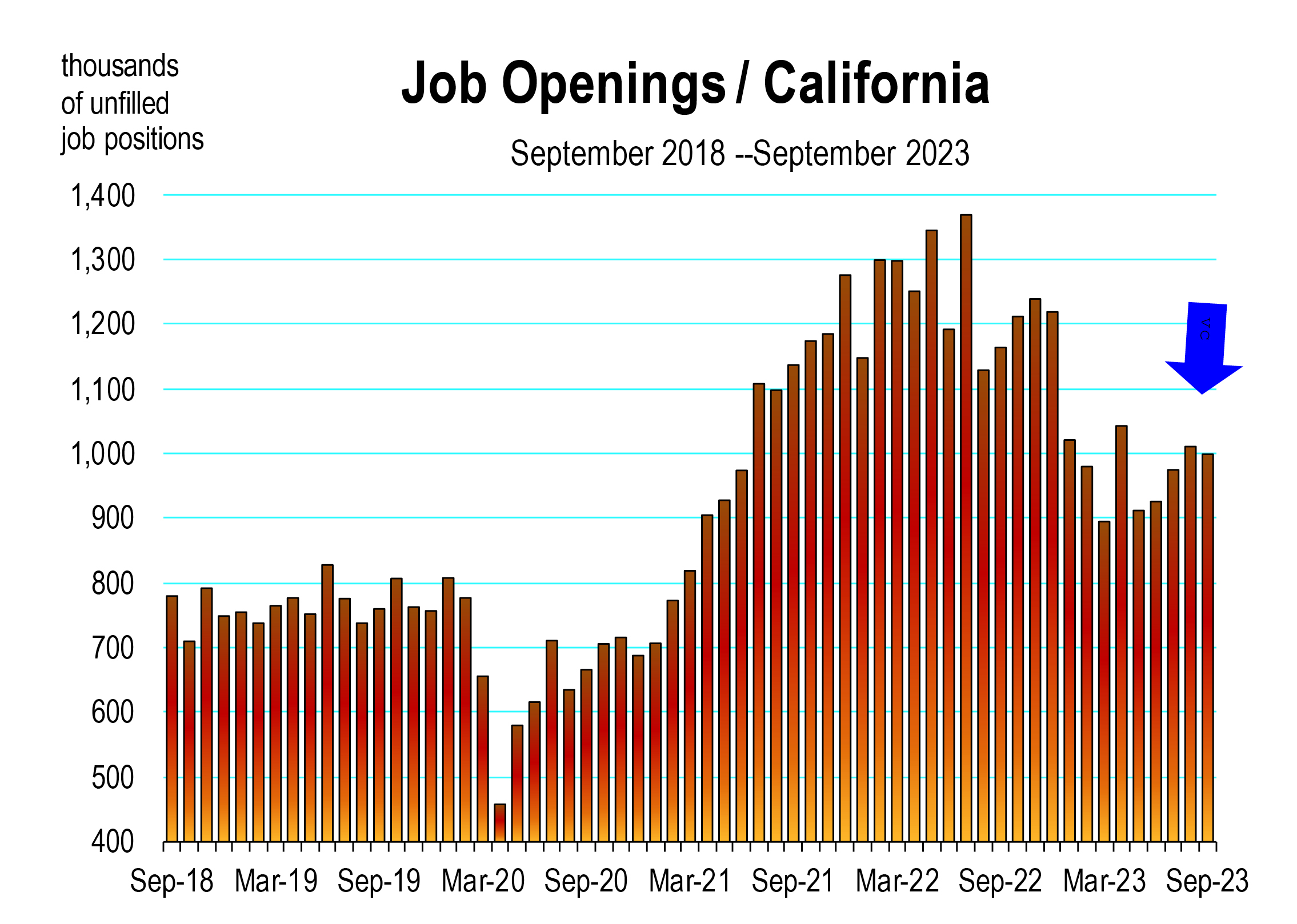

With many of the strikes now over, more jobs needing bodies will be filled. But California still has a million unfilled job openings. So while the end to strikes will bring workers back, the labor market remains too tight. Hence the leverage that workers on strike have had in their negotiations.

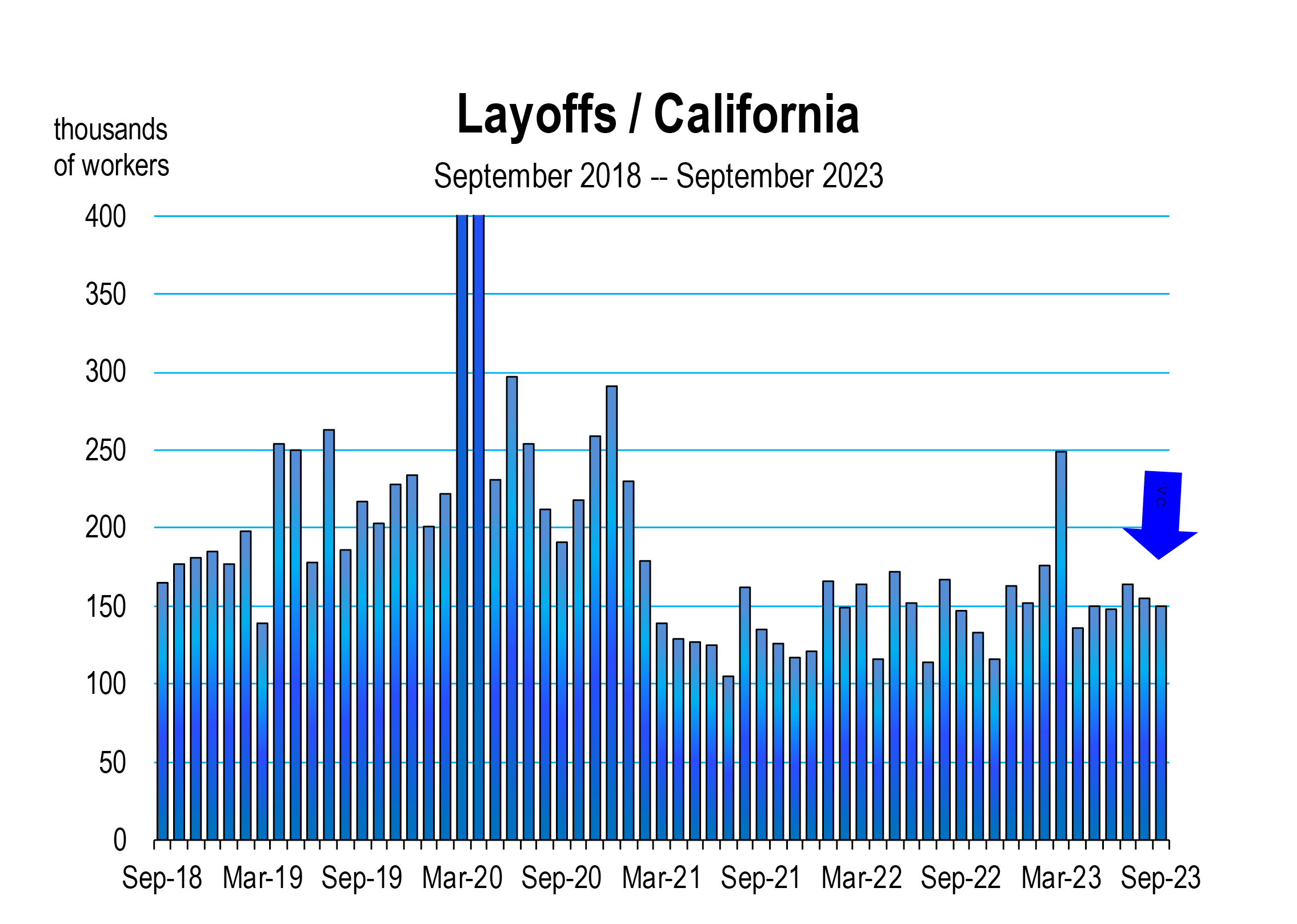

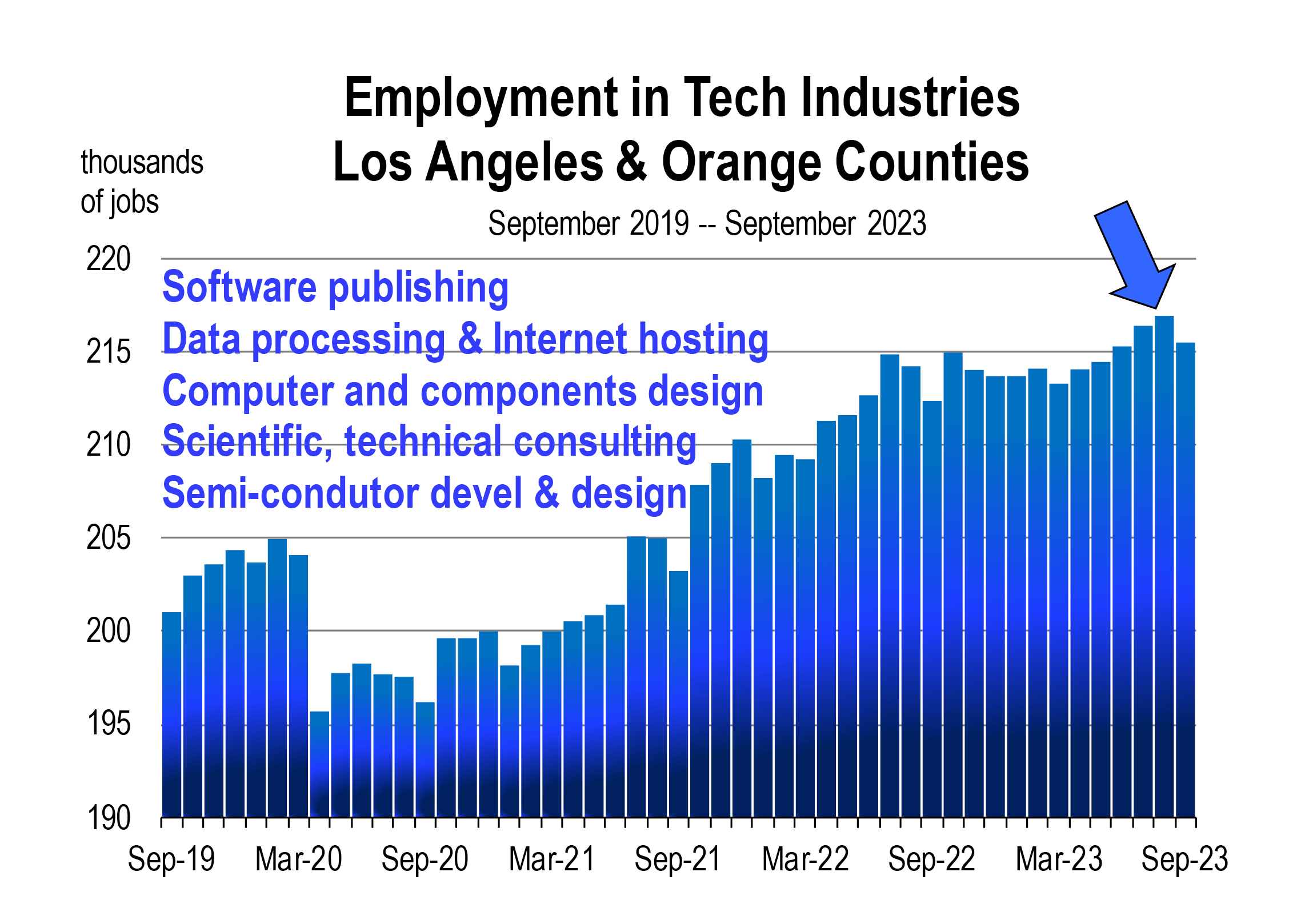

The layoff surge that alarmed the California labor market in late 2022 and early 2023 has subsided. Jobs in tech and retail were jettisoned the fastest, but since March, which represented the peak month, the layoff rate has returned to normal. And jobs in the sectors that principally provide tech services, are rising again.

Summary: Pillars of the state’s economy—entertainment, technology, and the Ports—now have workers back on the job, but the California labor market simply needs more willing participants.

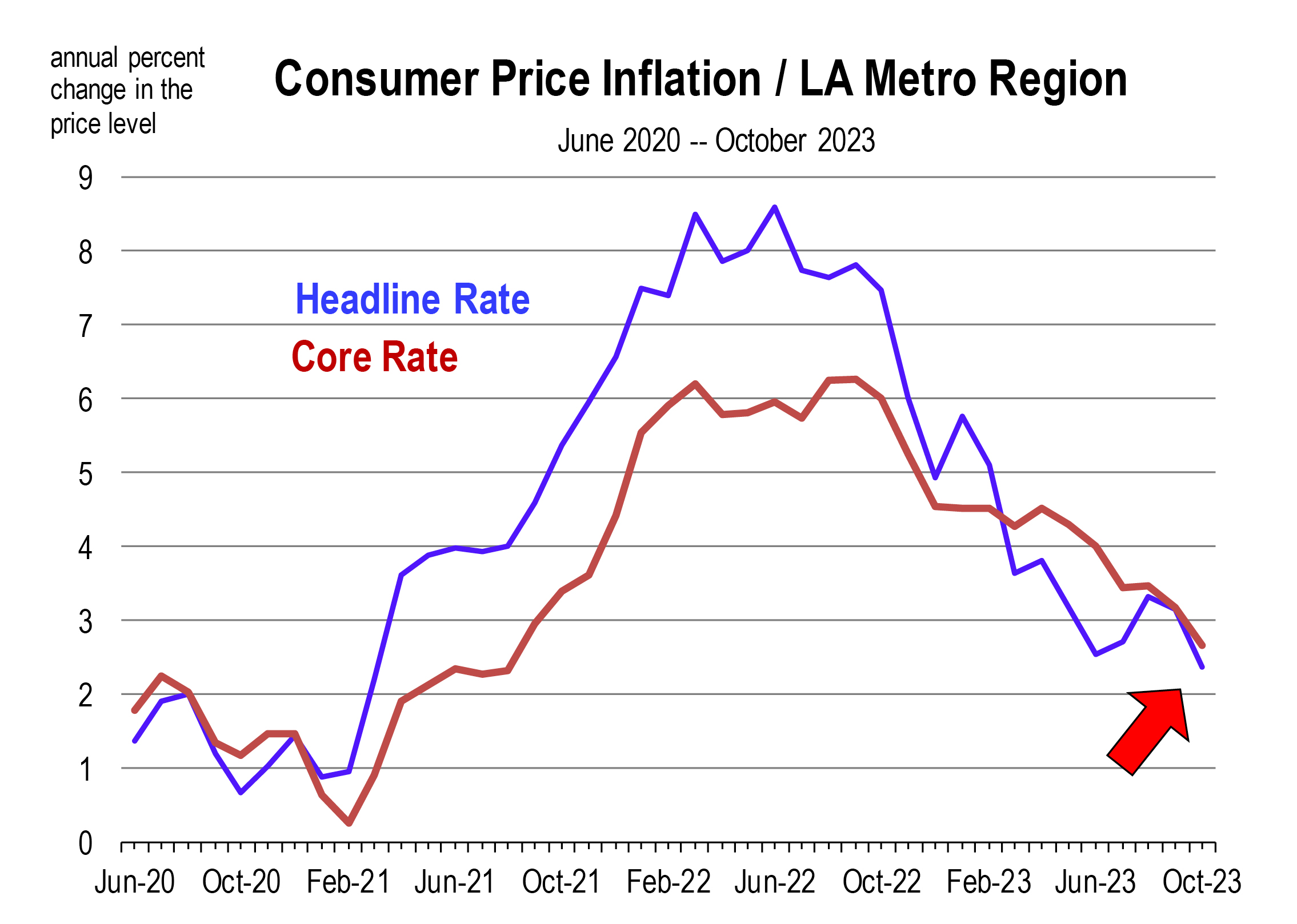

Inflation

The progress on the inflation front has now stalled. October inflation at the national level came in at 3.2 percent, and 4.0 percent for core inflation. The downward trajectory was interrupted in July and has moved laterally since. In California however, local inflation is deflating faster, demonstrating continued progress. The rate for October was 2.4 percent in the greater Los Angeles metro area, and 2.7 percent for the core rate.

Sticky U.S. core inflation remaining at or about 4.0 percent is not going to appease the Fed and their mission to dampen down the rate to 2.0 percent. Now, the biggest risk to the U.S. economy is that more rate hikes may be on the horizon.

Summary: General consumer price inflation at the national level has stalled, and core inflation remains too high, while regional inflation is making clear progress. Nevertheless, the potential continuation of restrictive monetary policy could tip over the economy in 2024.

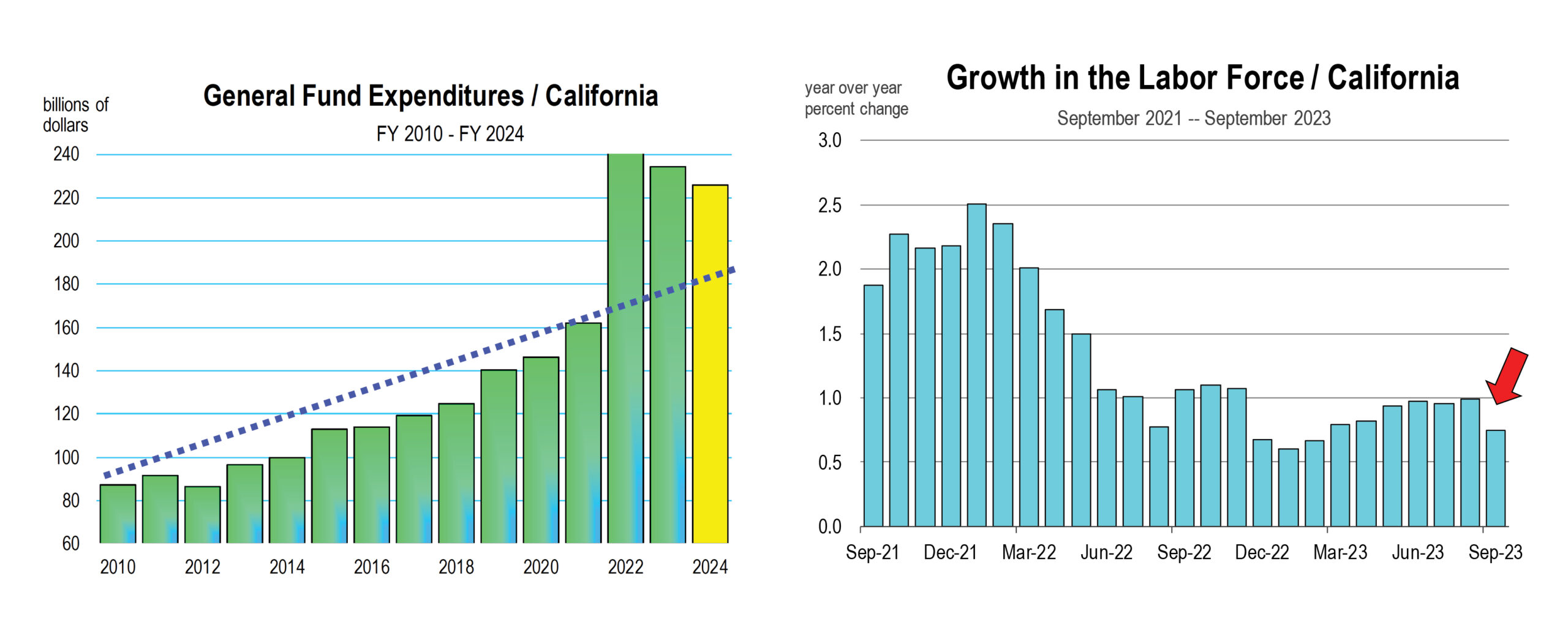

State Budget

Income tax receipts to the state have floundered this year, leaving the state budget in a serious $32 billion general fund deficit before the current budget was adopted in July.

Spending cuts should eliminate about $8 billion of that deficit, but the remaining $24 billion is being reduced with gimmicks that delay spending to future years, and borrow money. Stagnant revenue growth is the forecast from the Department of Finance and the Legislative Analyst’s Office, together with years of projected and meaningful deficits through fiscal 2027. The principal problem with the state of the budget is the high level of spending that has never retreated from the exaggerated spending that characterized the 2020-2021 COVID -19 years.

Drawing on some of the $38 billion that sits in reserves would help the budget this year and next, but the Governor is reluctant to use those funds unless a bona fide recession hits.

Summary: The state budget today and in the next few years will run deficits, even if spending does not increase. We may see more bond issuance to pay for all the spending that has not been downsized to align with projected revenue growth.

The Prospect of Recession

The unemployment rate has risen, threatening to trigger a negative feedback loop of further unemployment that leads to a recession. When workers lose paychecks, they cut back on spending, and as businesses lose customers, they need fewer workers, and that leads to layoffs and higher unemployment, and on it goes . . . .

The signals however are inconsistent.

Hiring continues though it has softened.

The rate of layoffs is low

The rate of labor force growth is low and incomplete.

Consumer spending remains strong even after accounting for inflation.

So for now, not to worry.

Summary: not much evidence of recession yet. And we remain on a vigilant watch.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.