Mark Schniepp

February 2024

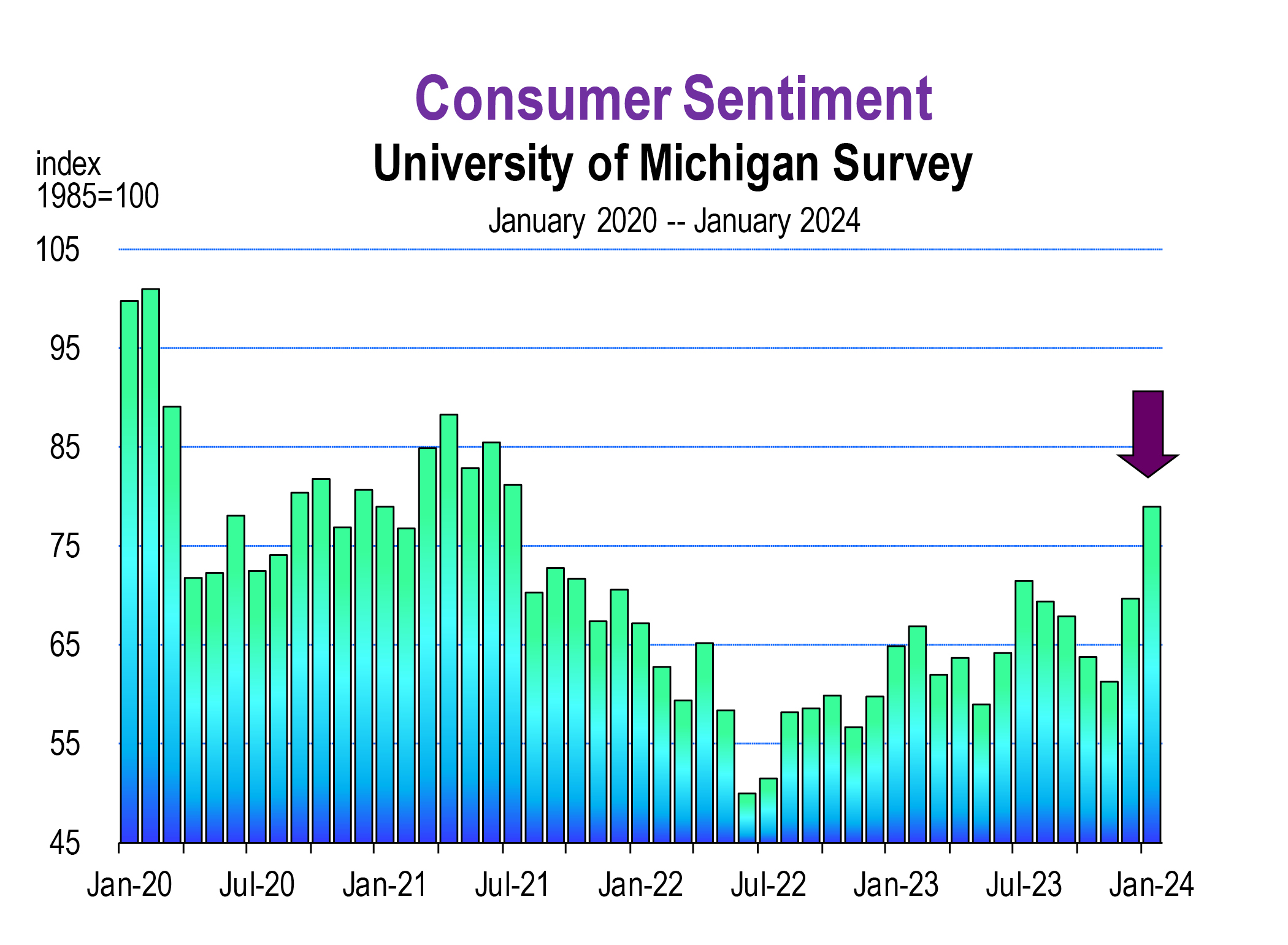

Yes, we’ve started 2024 being happier than at any time during 2023.

The sentiment and confidence indexes that measure how consumers feel about the economy both today and in 6 months hence have improved in recent months.

The latest measure shows consumer feelings about the economy at a 2 year high.

The economy in the survey is defined by inflation, job prospects, and interest rates. The improvement in January was the third straight month of upward movement and the highest since December 2021 when the pandemic was generally abating.

January’s increase in consumer confidence likely reflected slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions. The gain in sentiment was largest for people age 55 and over, but improved for all age groups.

Meanwhile expectations for inflation fell to a three year low and expectations of a recession this year also declined. Inflation expectations dropped to under 3.0 percent in January, which is down sharply from 4.5 percent in November.

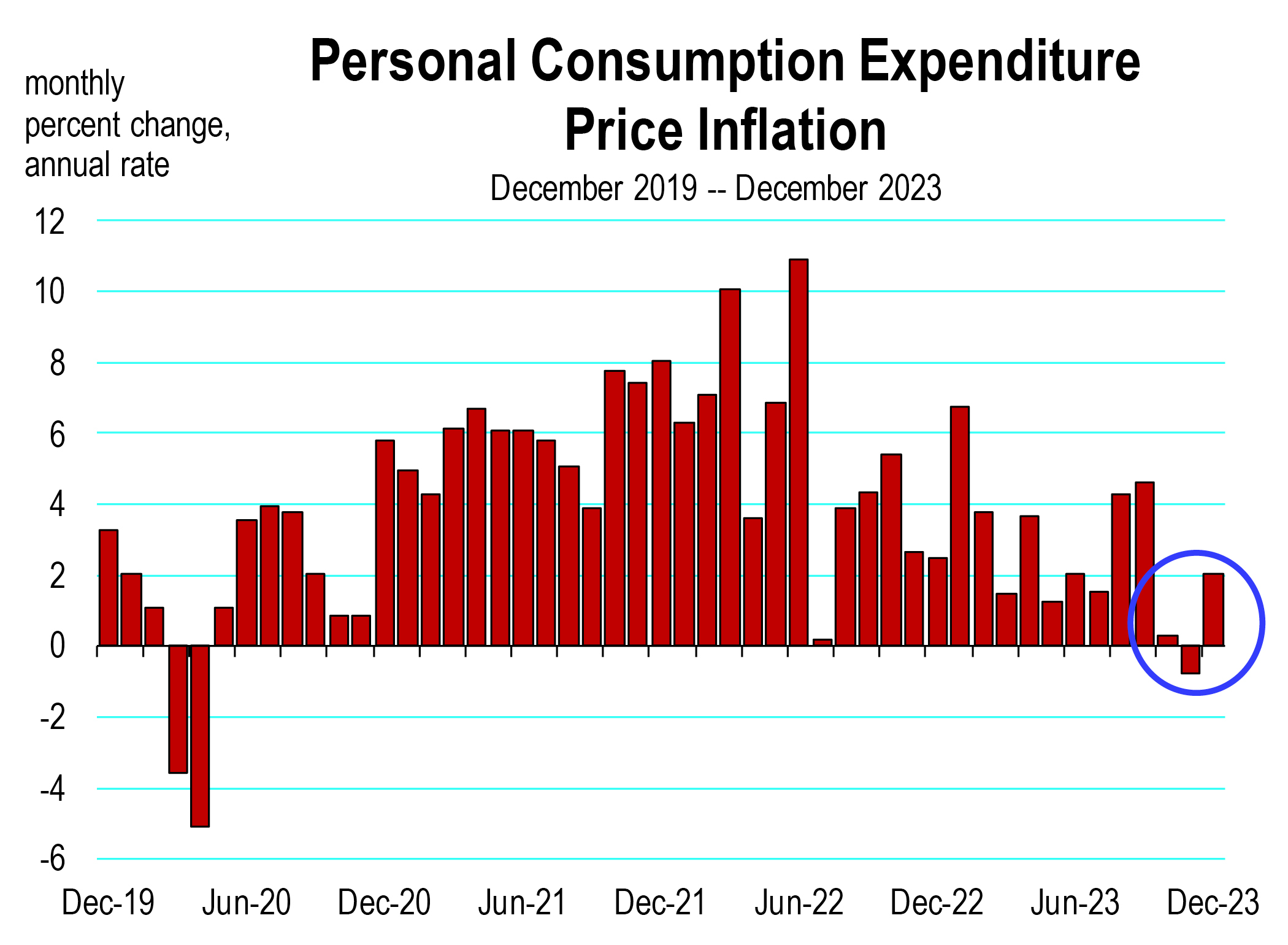

The personal consumption expenditures price index, the preferred measure of inflation by the Federal Reserve, rose 2 percent for the month of December, following a 0.3 percent increase in October and a 0.8 decline in November. A year ago, this inflation measure was at 6.7 percent.

Conditions on the inflation front are clearly improving. These conditions, together with an all time high in the stock market, a tight labor market, and falling interest rates, are all responsible for the rising moods of consumers in early 2024.

The January jobs report was strong: employers hired about twice the number of people than economists had expected. The unemployment rate is also now at 3.7 percent —- still extremely low by anyone’s measure.

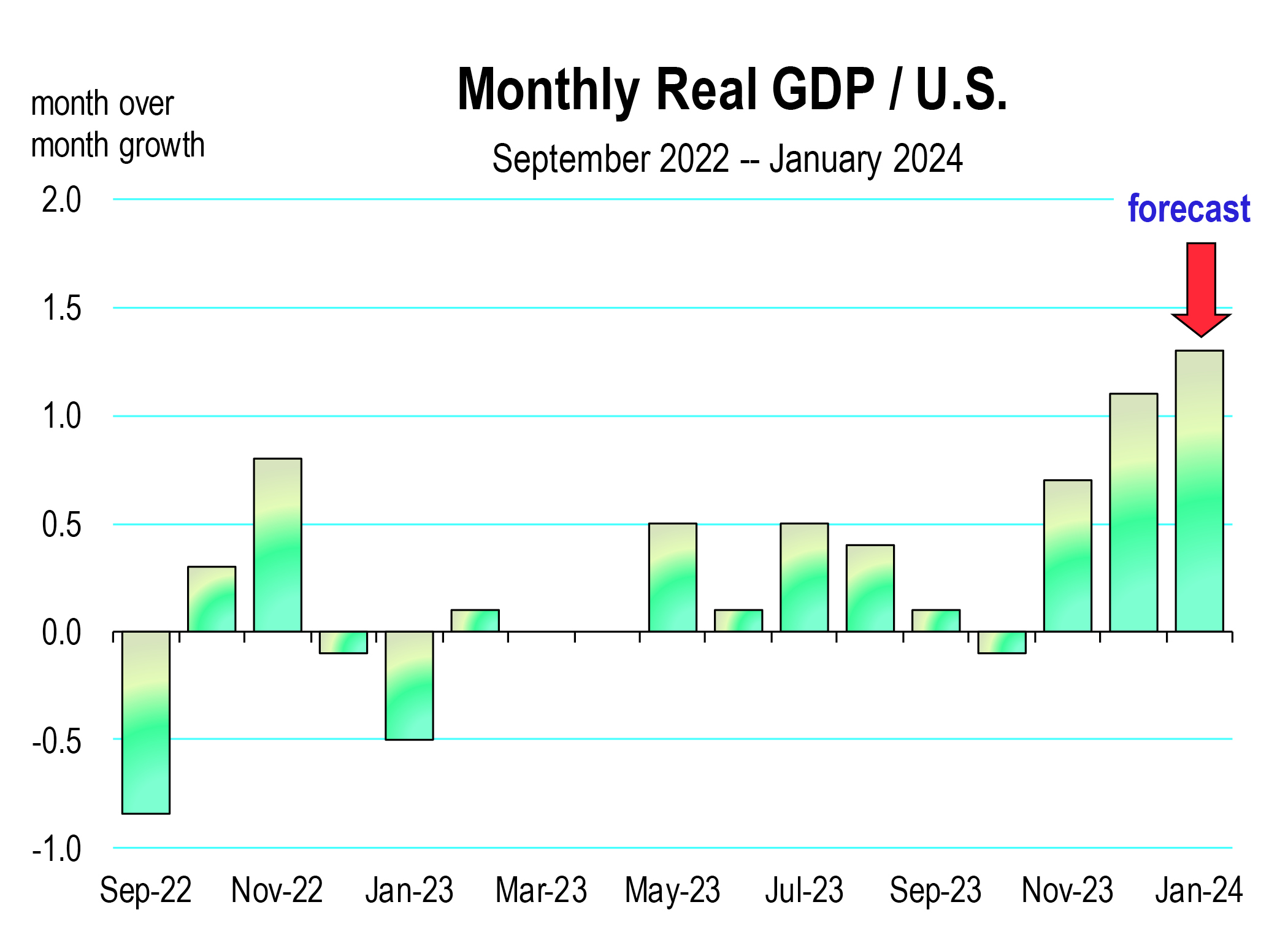

The strong economic reports in November, December and now January, have led to rising estimates of growth for the end of 2023 and the beginning of 2024.

The Con to Strong Growth

It was looking like the Fed was growing eager to initiate interest rate cuts this year in view of the progress on inflation. But wage inflation is still running at a 4.5 percent clip and that is too high the target rate—2.0 percent—-to be reached, probably not until the 2nd half of 2024.

Postpone therefore, the housing market rally in 2024 because it’s unlikely that mortgage rates are going to retreat much anytime soon.

Rigged Improvement through 2024?

The sentiment and confidence indices had been at levels consistent with recession through much of 2023, but with nothing but improvement in recent months, those signals are now retreating.

The vulnerability of the economy that pervaded much of last year is no longer evident now. And if the inflation reports continue to improve, the Fed just may be persuaded to begin cutting rates by mid-year.

Remember, 2024 is an election year so policymakers may make decisions that try to influence voters and this may be more likely as the year progresses into November. The Biden Administration would benefit from the semblance of a strengthening economy.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.