Mark Schniepp

March 2024

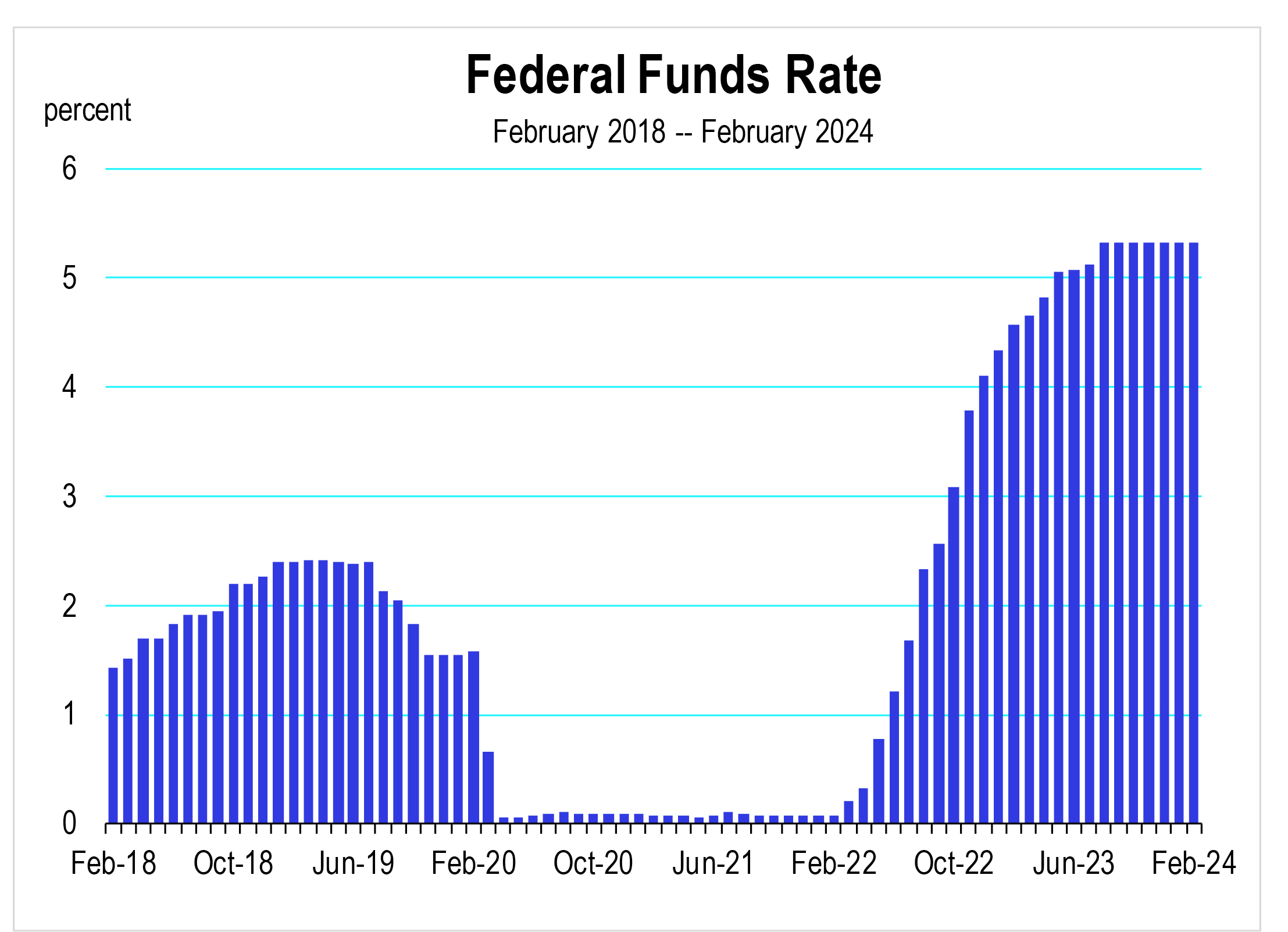

The Fed Controls the Federal Funds Rate

The federal funds rate has been at the 5.25% to 5.50% range since July 2023, the highest level since 2007. This is the interest rate that banks can charge each other and it’s the principal monetary policy instrument that the Fed controls.

After raising the funds rate 11 times in 15 months, the Fed forecasted as recent as December 2023 that it would make quarter point cuts—up to 3—by the end of this year, lowering the benchmark rate to 4.6 percent, or in a direction that has a more neutral impact on the economy.

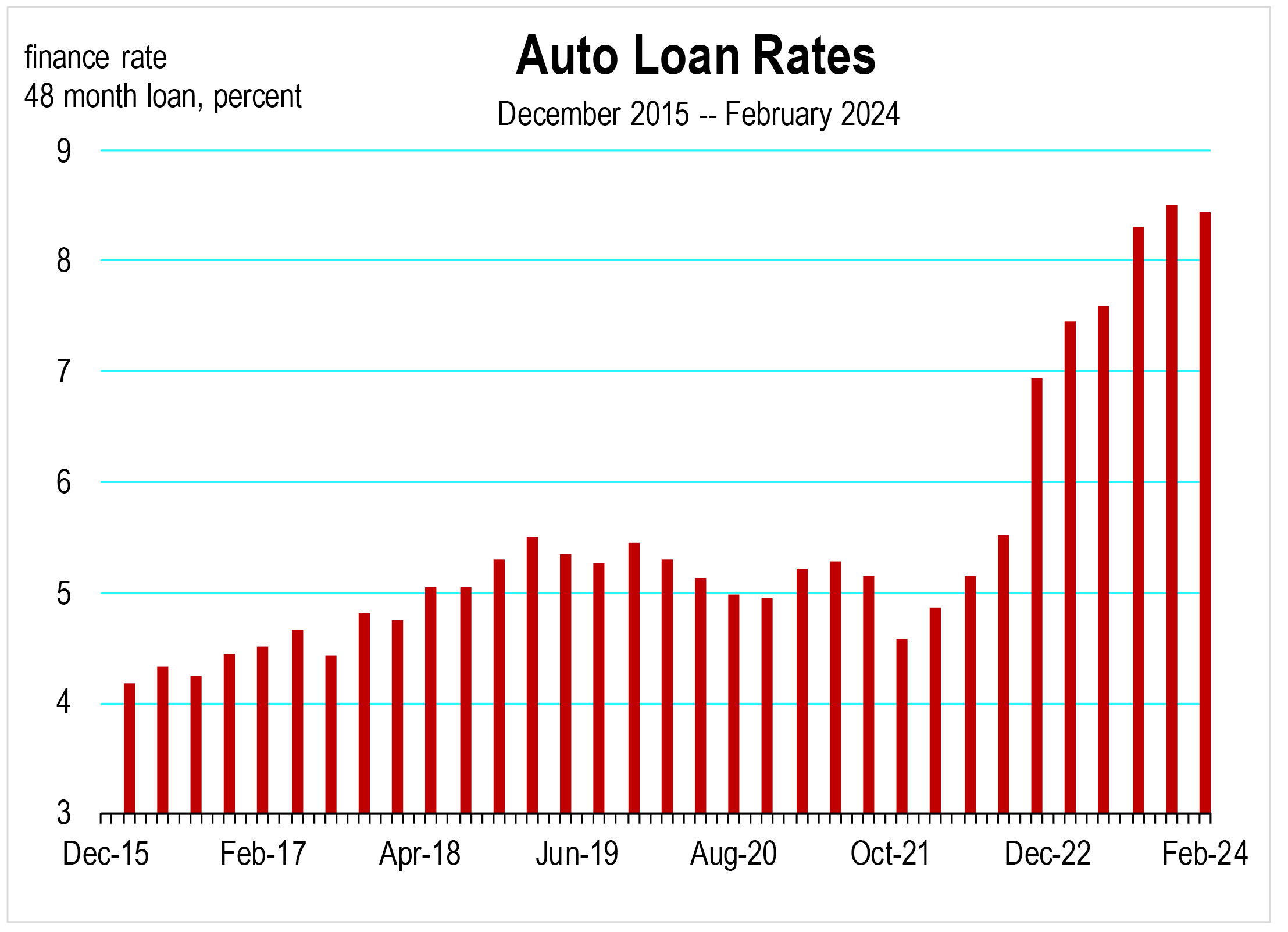

Lowering the federal funds rate will also push down shorter term treasury bill and bond rates but not necessarily longer term bond yields like the 10 year which directly influences mortgage rates and vehicle loan rates. However the actual act of cutting rates will likely rally the stock and bond markets, the latter which will push long bond rates lower.

Can We Expect Cuts Soon ?

The Fed indicated it needs to see more ”positive data” before pulling the interest rate lever. There are seven “Open Market Committee” opportunities for the Fed to cut rates this year, with the first one coming up this month on March 20.

What I believe this year is that the data won’t demonstrate compelling enough news for the Fed to cut rates anytime soon, and (1) at least not until mid-year and (2) probably not until the end of the year. But whatever I think, it’s not going to be a factor.

A justification for the lowering of rates now is the progress made on the personal consumption and the headline inflation front. Even the core rate has improved considerably and it receives no help from lower prices for energy which have been in a general decline over the last year. Moreover, the Fed preferred personal consumption expenditure price deflator has now declined to 2.0 percent which is line with the Fed’s target.

And don’t forget it’s an election year so despite data that don’t comply, there will be pressure put on the Fed to lower rates to help the economy and stock market look good under the current administration.

In January, the Fed indicated a rate cut or more this year was still possible but said that cuts were not imminent. This is because incoming data on the economy directly influences their decisions about monetary policy: quantitative easing and interest rate moves.

Incoming Data

GDP growth is still pretty expansive, running at 3.2 percent last quarter and currently estimated by GDPNOW at 2.2 percent for the current quarter of 2024.

That kind of growth really doesn’t need a boost from a drop in rates. If GDP growth slows in March and through the Spring, then the likelihood of a rate cut rises. But with better economic conditions than expected being reported daily, growth is not slowing down.

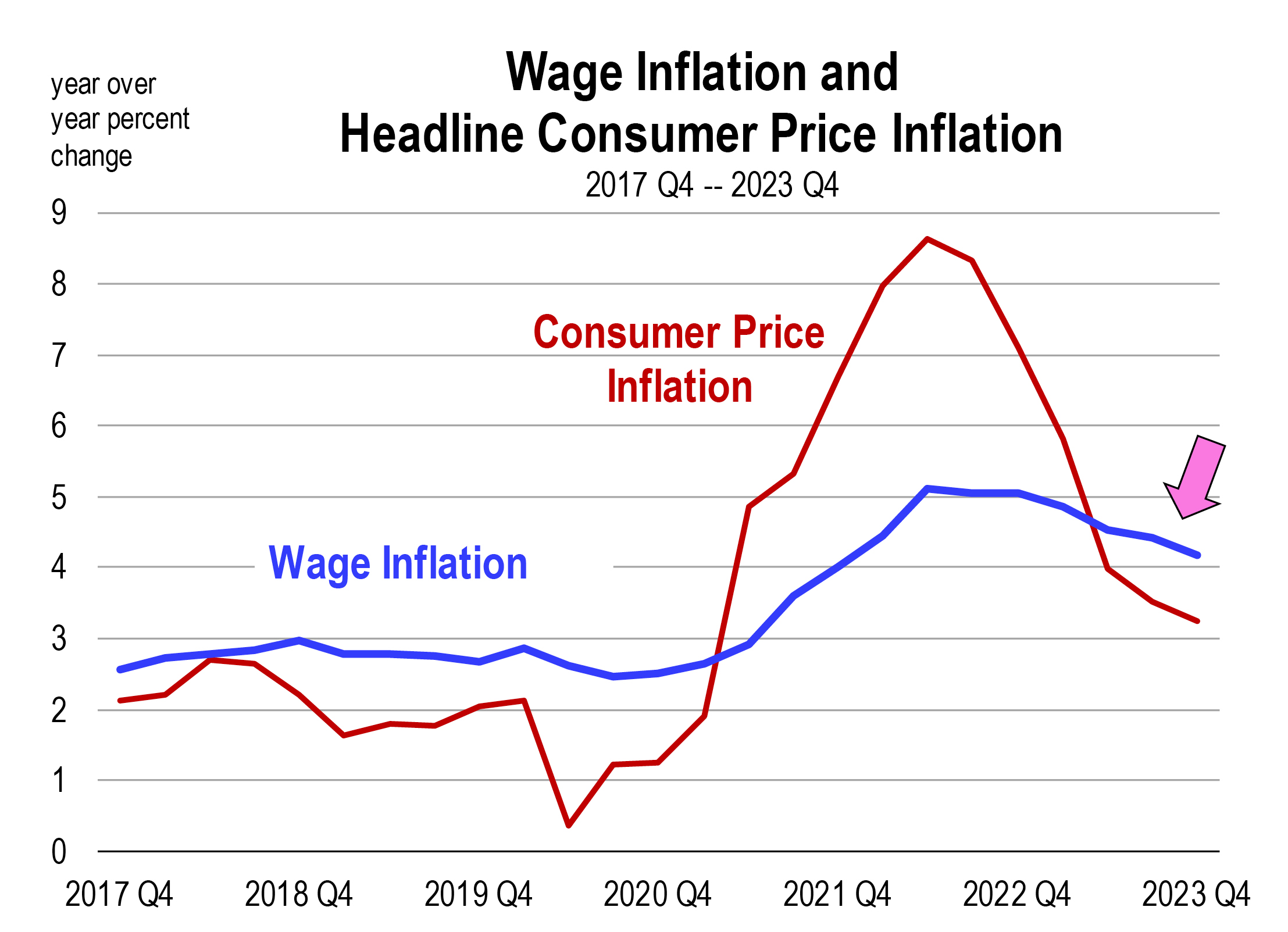

Headline inflation has fallen to 3.2 percent. This is a big improvement over a year ago but progress in lowering consumer price inflation has stalled. Headline inflation has moved little since July 2023. Food prices rose sharply between December and January, the highest monthly rate of increase in a year. Core inflation is still too high at 3.9 percent. We seem to be stuck in an inflation rut.

Unless progress on inflation resumes, and core inflation falls faster, the Fed might be reluctant to touch rates. However, since their goal is a 2.0 percent inflation rate, which has now been met by their preferred Personal Consumption Expenditure Price Deflator, they are now becoming satisfied that enough progress on the inflation front has been made. I’m not convinced of that yet. We need to see what happens in February and March.

There is wage inflation that is now exceeding general price inflation, a condition that adds upward pressure on the 2 percent inflation target. But with rising productivity of workers, higher wages are in line with higher levels of output and add that results in less pressure on the price level. Furthermore, the share of labor in the economy has declined to levels lower than at any time over the last 20 years. This means that firms have higher profits than normal and as the labor share climbs back, the profit rate will return to normal as wages climb. Under this condition. Inflation pressures subside.

There is also the federal deficit which has soared to $34.5 trillion of which $1 trillion per year represents interest payments. This type of spending by Congress—now with sharply rising debt financing adding to the burden—is an automatic spending boost on the economy. How the Fed weighs this factor is unknown, and they will likely ignore it in an election year.

The evidence is mixed on what the Fed will do and when. I believe data needs to be more convincing; otherwise, we face a rapid increase in private spending to go along with Federal spending. That combination leads to growing pressures on the inflation rate.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.