by Mark Schniepp

March 2016

There are many forms of growth controls in place in California counties, particularly along the coast. And there are many shapes and sizes of these controls but all have the expressed or unexpressed purpose of restricting population growth and urban sprawl to prevent a future for a region that includes more traffic and the loss of open space.

Examples of growth controls include containing development within specified urban boundaries, building permit restrictions, development impact fees, infrastructure requirements, MS4 regulations, and mandating inclusionary housing.

While the latter requirement might not overtly limit growth, it often reduces the density of housing and it leads to higher home prices on market rate housing which effectively limits the demand for housing.

These are typically the symptomatic costs of growth controls:

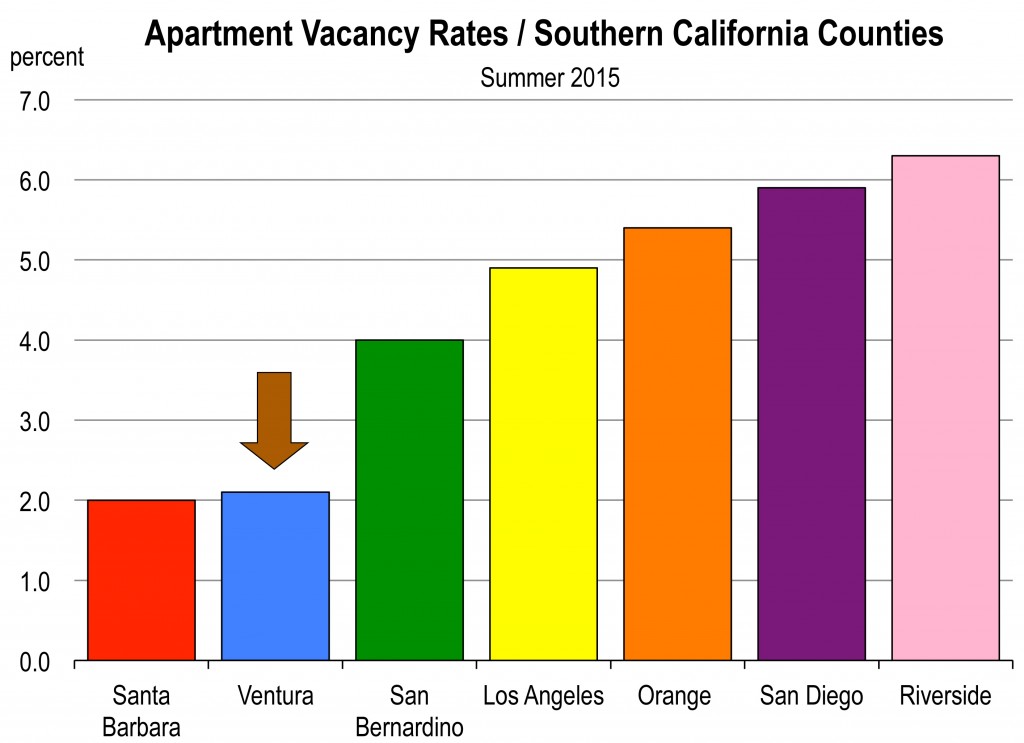

Higher housing prices and higher rents. Controls limit housing, but they do not (and cannot) deny new populations from moving into the controlled region. Demand for housing often exceeds supply and prices tend to rise faster in controlled regions as opposed to regions without controls. Certainly enough, the median price of homes is rising faster in the San Francisco Bay Area and Coastal Southern California than in the Inland Empire or Central Valley.

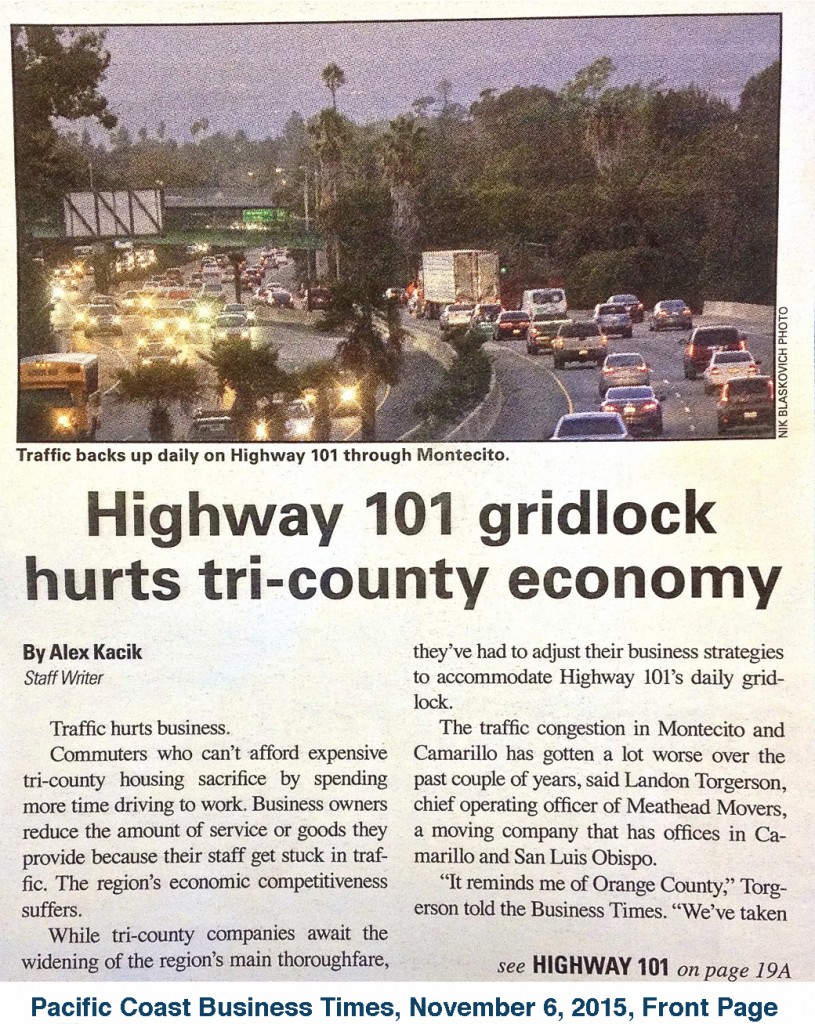

It’s a paradox, but traffic congestion, energy consumption and air pollution frequently increase in areas with growth controls. Why? Because commuting patterns of workers are inefficiently altered when firms in the controlled region need workers but there is an absence of housing. Commuters, forced by housing prices and the lack of supply to live far from where they work, clog California highways and choke side streets during peak drive times to work.

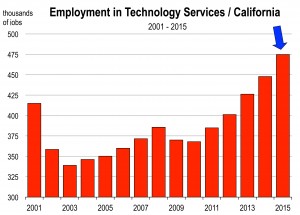

An exodus of big employers. Almost every business and government agency that remains in the controlled region struggles with recruiting and retaining workers who cannot afford to live nearby. Firms end up defecting from the region or downsizing and opening operations in uncontrolled areas where access to a larger labor force (and more available and affordable housing) is less challenging.

An exodus of big employers. Almost every business and government agency that remains in the controlled region struggles with recruiting and retaining workers who cannot afford to live nearby. Firms end up defecting from the region or downsizing and opening operations in uncontrolled areas where access to a larger labor force (and more available and affordable housing) is less challenging.

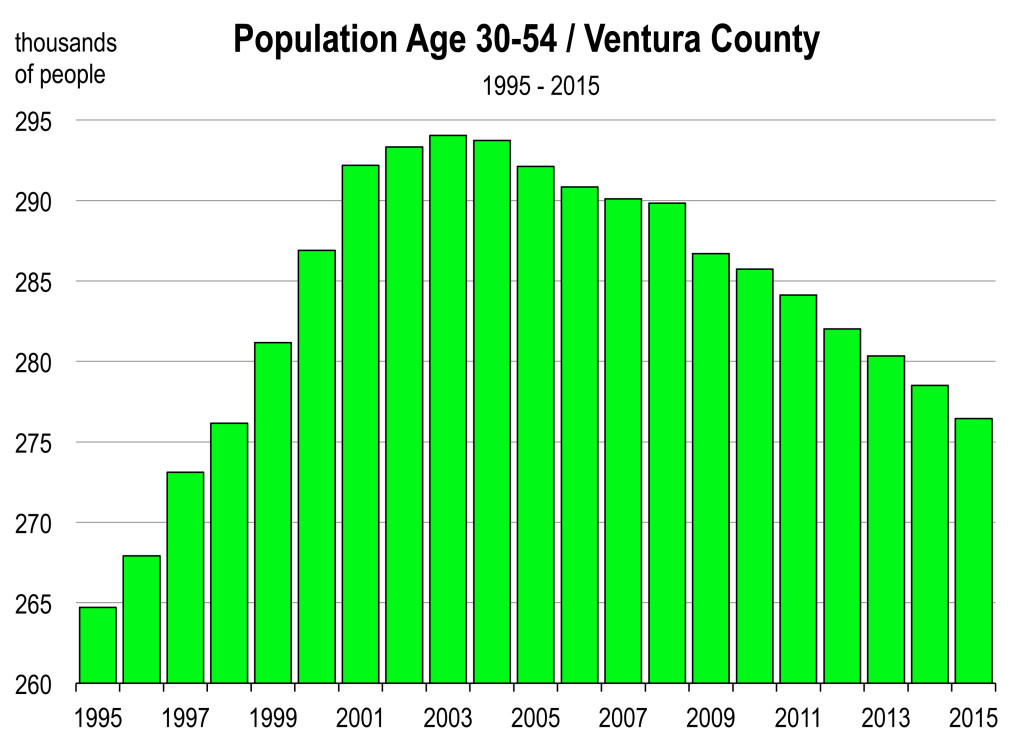

Altered communities. Poorer families are often forced to double- and triple-up in rental housing. Unable to buy homes, many middle-class families with children move away. We have observed this particularly disturbing phenomenon occur in Southern Santa Barbara County and Ventura County.

Other adjacent regions are impacted. Firms move to adjacent areas and workers move to adjacent areas where housing is more available and more affordable. The result is a downsizing economy in the controlled area, leading to lower economic growth, less prosperity, fewer jobs and high home prices. There will be fewer services offered to the resident population. This might be fine for the retired couple or individual, but it’s problematic for working households.

These are the unintended consequences of growth policies. The intended consequences of growth controls: less population, less housing, and more open space are realized, but at a cost that includes fewer jobs, a smaller middle class, expensive housing, fewer services, and more traffic on existing highways and roads.

Growth controls (SOAR) have been in effect for nearly 20 years in Ventura County and the number of vehicles traveling on interstate 101 and highway 23 are at record levels. The number of commuters to and from Ventura County to Los Angeles County is at record levels. The average commute time of workers in Thousand Oaks, Moorpark, and Simi Valley is above the state and federal average commute time and akin to workers who reside in the San Fernando Valley.

__________________________________

Upcoming Economic Forecast Conference

Orange County Economic Outlook 2016

In Partnership with the UCLA Anderson Forecast

April 28, 2016

Irvine, CA

Register Now

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

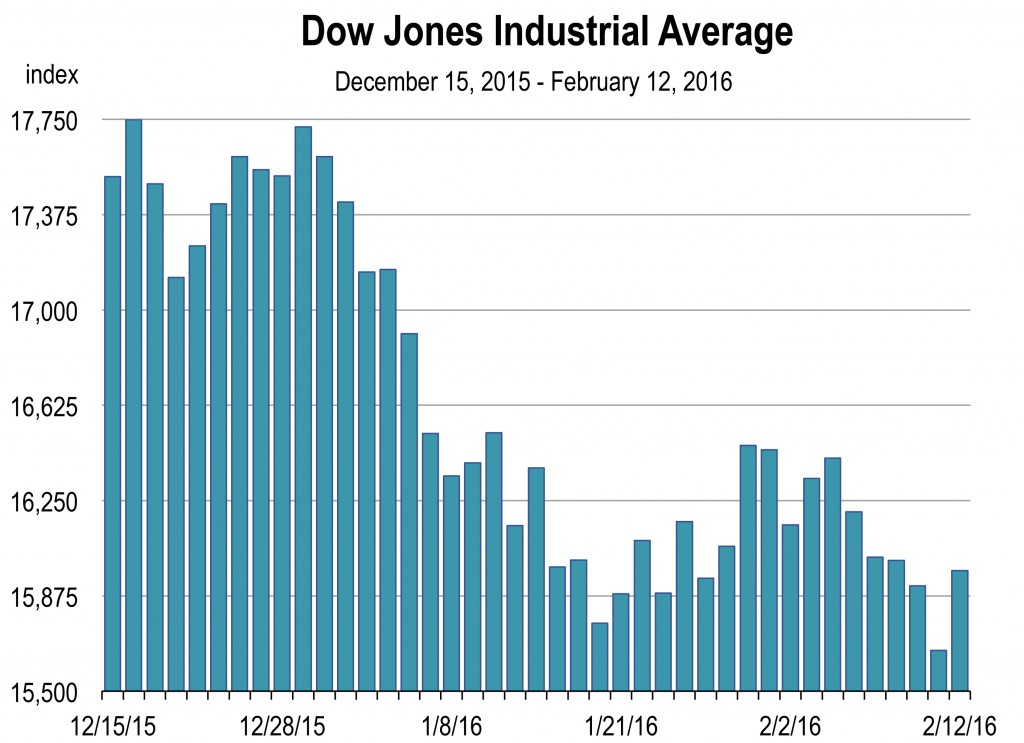

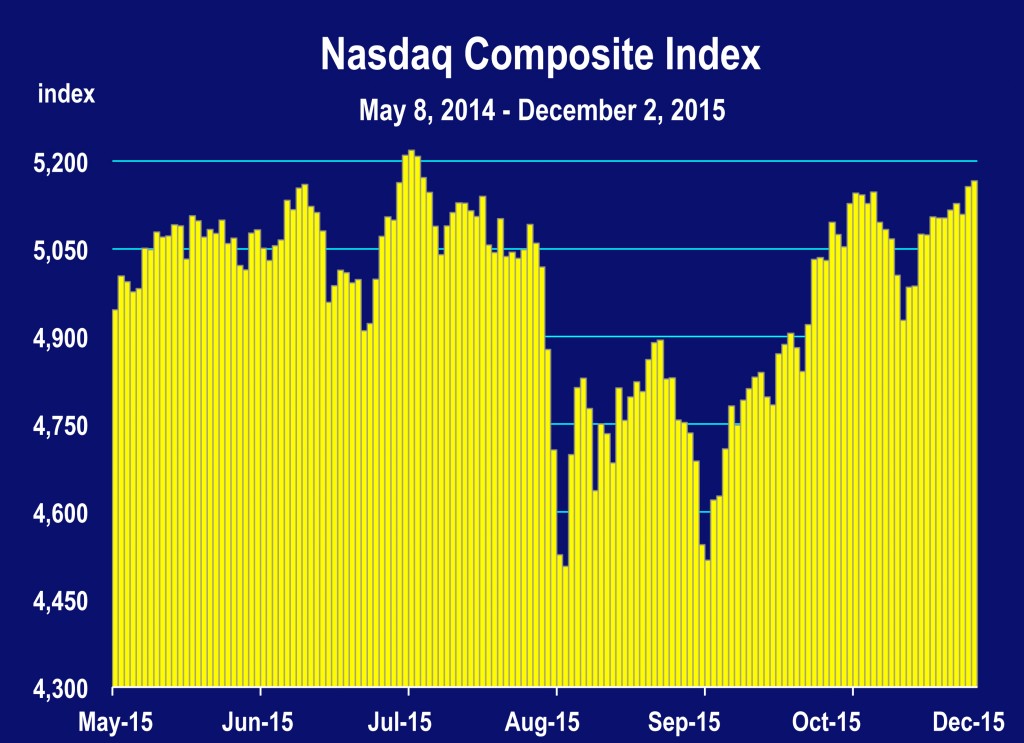

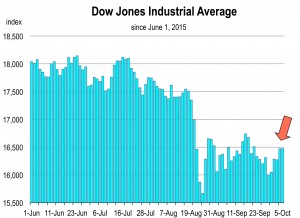

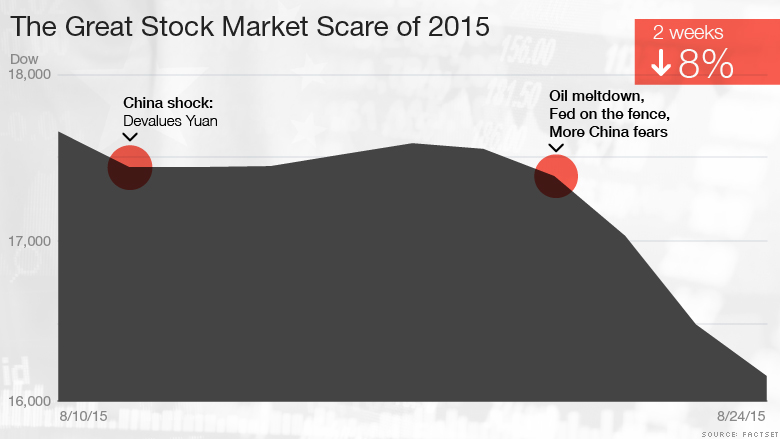

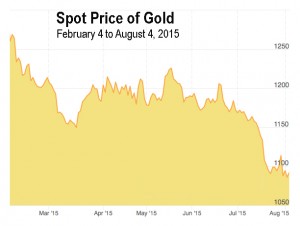

OK, the market is now down 10 percent from where it stood at the turn of the year. This is a repeat of what happened in August. Why? Is this the early warning signs of the next recession?

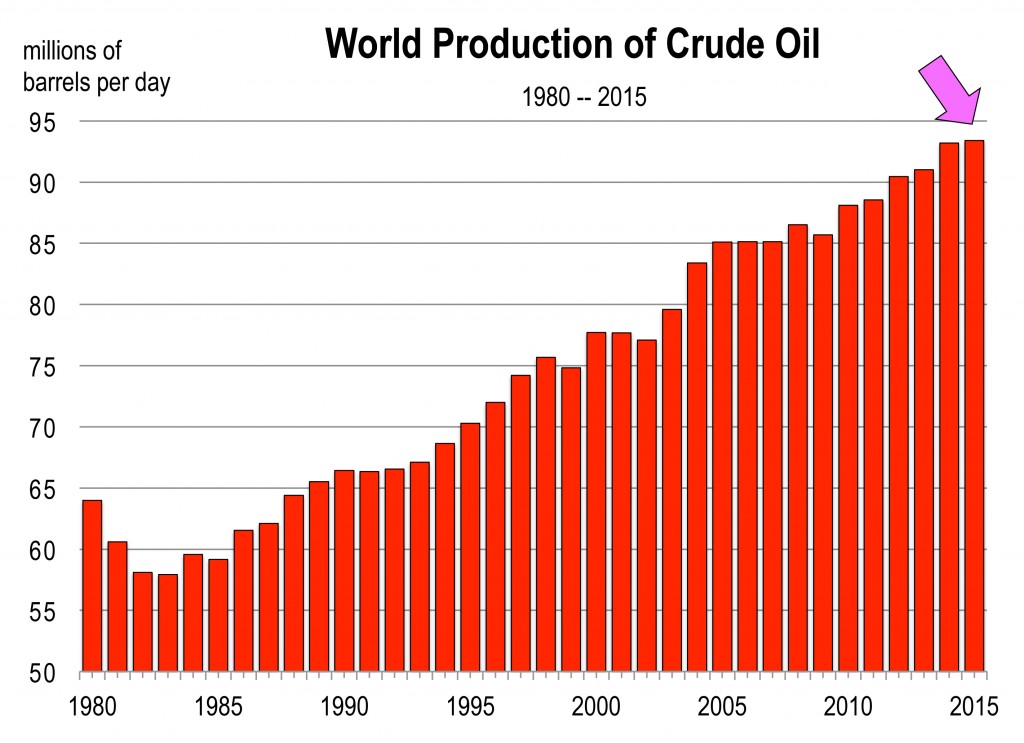

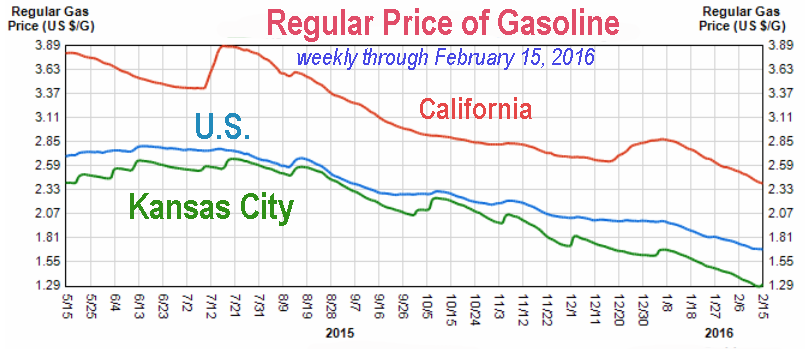

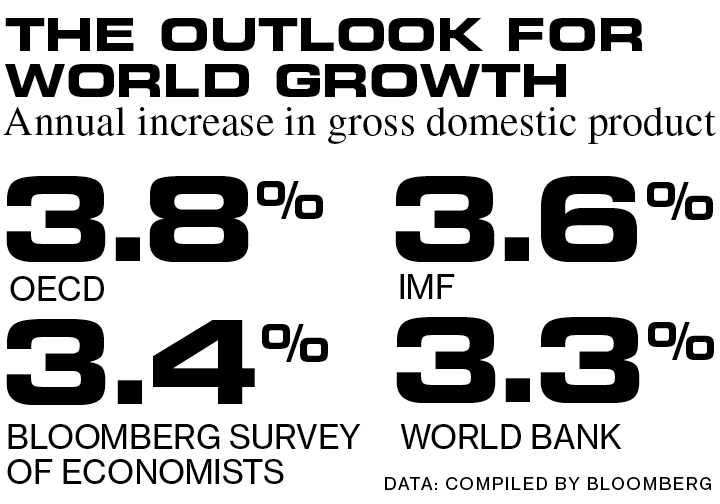

OK, the market is now down 10 percent from where it stood at the turn of the year. This is a repeat of what happened in August. Why? Is this the early warning signs of the next recession? The oil price collapse is due simply to increased supply (mostly by the U.S.) and decreased demand forces. Demand for oil globally began tapering off, driven most importantly by a slowdown in China’s economy. Until 2010, China had maintained an average growth rate of more than 10 percent annually for over 30 years. This high growth scenario started to slow in 2010. Currently (2016) the current GDP growth target set out by Chinese authorities is 7 percent, and many have questioned how much further growth could slow in the second largest economy in the world.

The oil price collapse is due simply to increased supply (mostly by the U.S.) and decreased demand forces. Demand for oil globally began tapering off, driven most importantly by a slowdown in China’s economy. Until 2010, China had maintained an average growth rate of more than 10 percent annually for over 30 years. This high growth scenario started to slow in 2010. Currently (2016) the current GDP growth target set out by Chinese authorities is 7 percent, and many have questioned how much further growth could slow in the second largest economy in the world.

The Chinese stock market is now in a bear market for the second time in 7 months. And U.S. investors are interpreting China’s problems as poison for the U.S. Why?

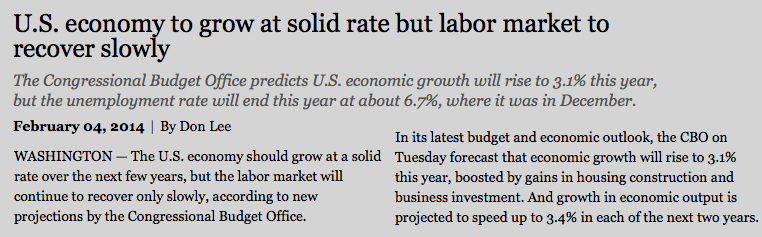

The Chinese stock market is now in a bear market for the second time in 7 months. And U.S. investors are interpreting China’s problems as poison for the U.S. Why? Source: LA Times, December 27, 2015, page C1

Source: LA Times, December 27, 2015, page C1 Source:

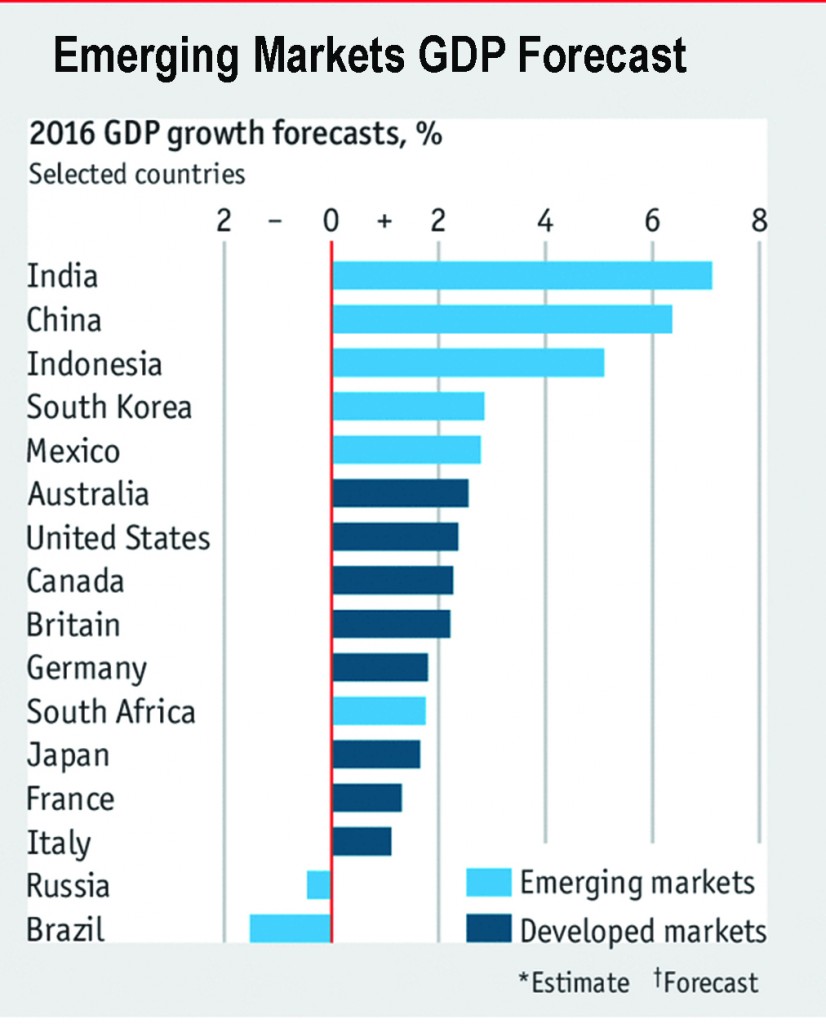

Source:  Source: Economist Intelligence Unit, The Economist, December 30, 2015

Source: Economist Intelligence Unit, The Economist, December 30, 2015

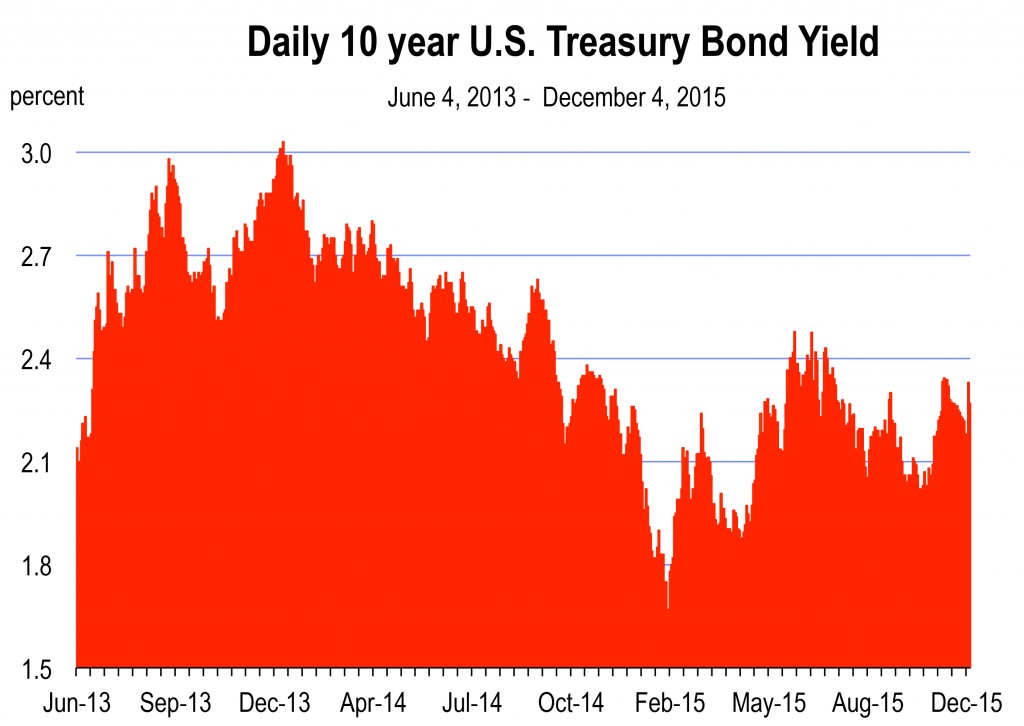

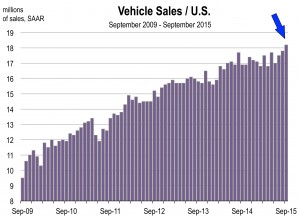

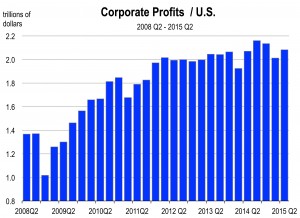

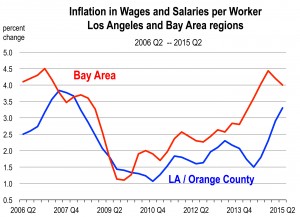

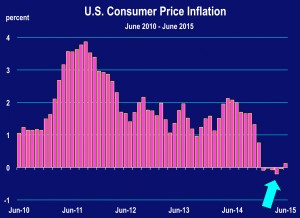

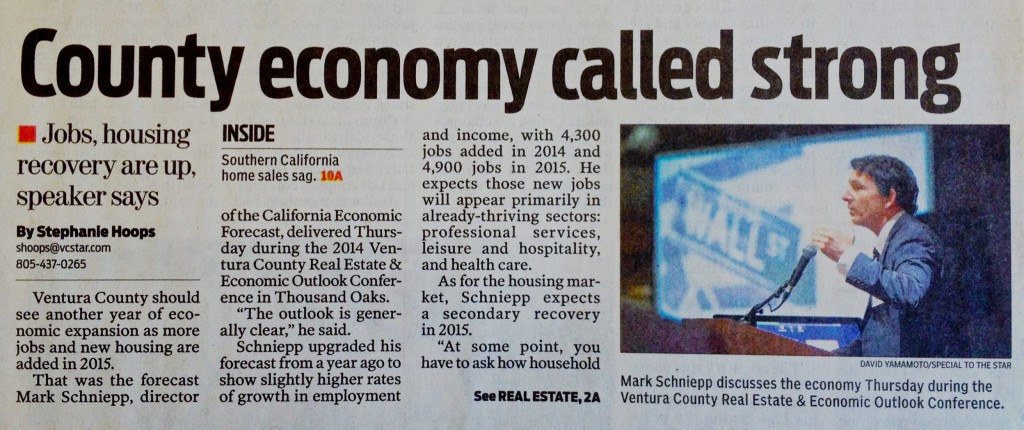

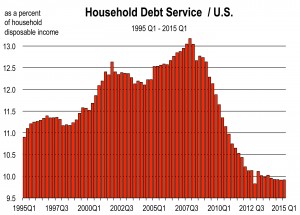

The creation of jobs is strong and broad-based, and wage growth will accelerate more significantly as the economy approaches full employment. Household debt is about as low as it has ever been, and many homeowners have locked in the exceptionally low interest rates by refinancing their mortgages.

The creation of jobs is strong and broad-based, and wage growth will accelerate more significantly as the economy approaches full employment. Household debt is about as low as it has ever been, and many homeowners have locked in the exceptionally low interest rates by refinancing their mortgages.