by Mark Schniepp

July 3, 2020

We are assuming that the recession is now technically over, because growth in employment, payrolls, and spending has resumed. Therefore, the recession that began in March and likely ended in May could be both the deepest and shortest recession on record.The average length of a recession is 11 months and none has lasted less than six months. However, this isn’t, or wasn’t, a normal recession or business cycle. This recession wasn’t caused by the traditional catalysts, and the recovery is likely to differ from those in the past.

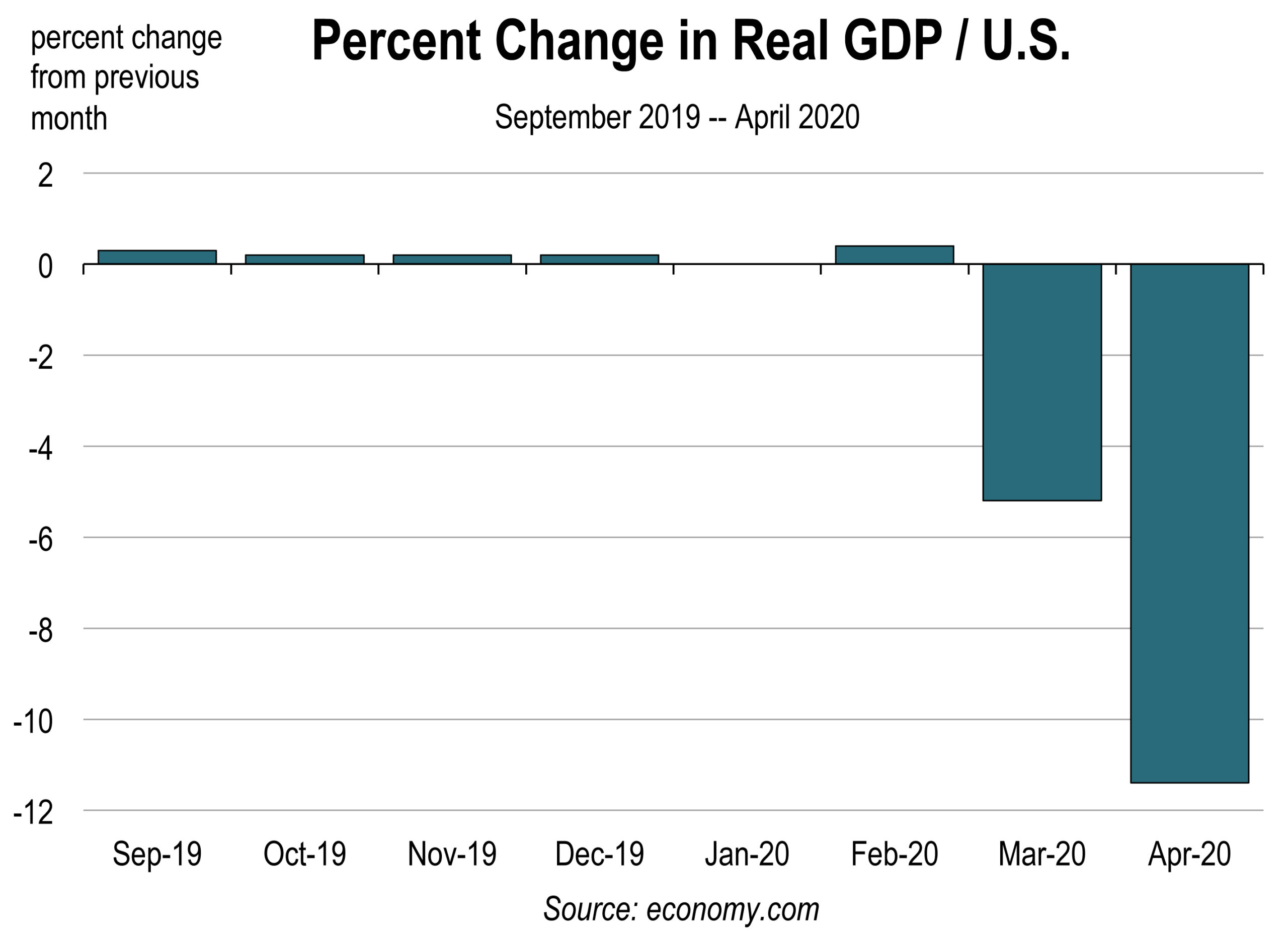

The monthly estimate of GDP declined 5.2 percent in March and 11.4 percent in April.

As of 7/2/20, we were 15 weeks into the Coronavirus crisis. The reopening of many U.S. state economies has led to a gradual economic pickup. Mobility has risen, and although initial claims for unemployment insurance benefits have been steadily declining, they still remain at massive levels. GDP estimates for the month of May should be positive because the economy was allowed to slowly wake up.

But because the reopening is limited to specific business sectors and with capacity limitations it will produce a limited and temporary boost in demand. People still find their movements and options to spend severely restricted.

Consequently, retail sales and services still suffer today from unprecedented reductions.

This is the contributing factor as to why a V shaped recovery cannot occur, because of the manner in which the economy is being allowed to recover.

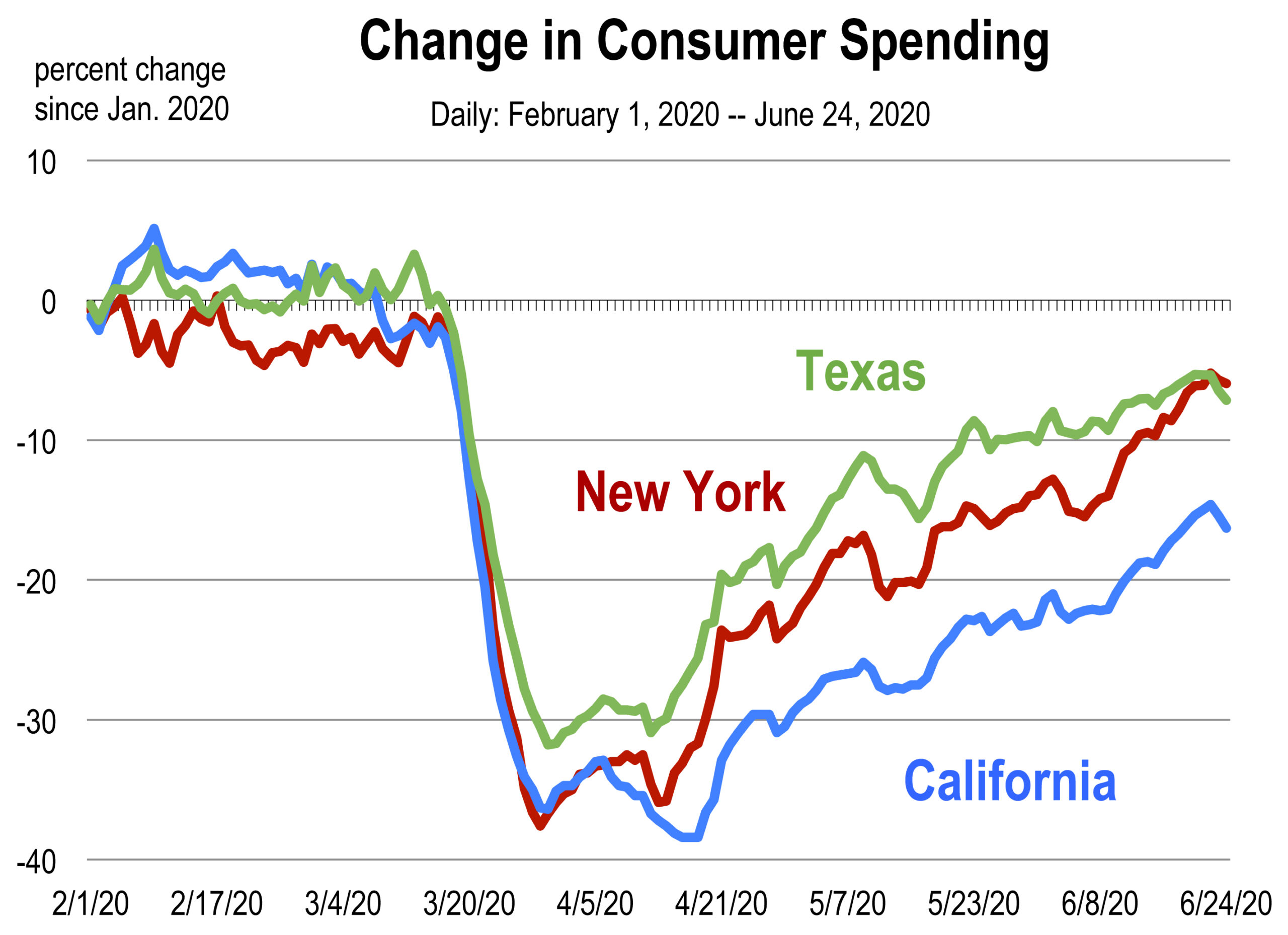

If regional economies could phase out restrictions, economic growth would bounce back more sharply. In sectors or states in which restrictions were eased earlier or more than others, there is a higher level of production and a faster restoration of spending.

If regional economies could phase out restrictions, economic growth would bounce back more sharply. In sectors or states in which restrictions were eased earlier or more than others, there is a higher level of production and a faster restoration of spending.

The PPP Flexibility Act, which became law on June 5, creates a downside for the number of workers rehired in June. Businesses that received PPP loans in late May and June are now in no rush to rehire, and can delay until local lockdown orders easy enough to make it worthwhile to restore workers. Hiring foregone in June should show up in later months providing there is continued progress on reopening up the economy.

Economy Reversals

Troubling signs of coronavirus re-emergence are coming from some of the nation’s largest economies. And with this resurgence, the progress of the economic recovery has now been interrupted.

Bar and restaurant and some gym closures in Colorado, Texas, Florida, Arizona, and Michigan occurred in June. On July 1, dining inside restaurants and drinking inside bars, breweries, lounges and wineries was closed down again in 19 Counties in California. Also closed were movie theaters, zoos and museums, all for at least the next 3 weeks. This is a major setback to California’s economic recovery.

The reclosure of business activity will slow rehires and reduce hours for many restaurant and food services employees. It will also reduce business revenue potential leading to a greater likelihood of more business failures and permanent layoffs.

Consequently, if no new progress is made on reopening the economy further, the gains in employment and revenues are unlikely to continue in the month of July, and may even reverse for the food and beverage services sector.

San Francisco Chronicle, July 1, 2020, online

San Francisco Chronicle, July 1, 2020, online

Uncertainty

There is no shortage of the unknown still, and this is frustrating for us who forecast the economy. Sudden brute-force lockdowns of economic activity, or the delays in deciding to move to Phase 3 or Phase 4 of re-opening, make predicting the growth of new production, jobs and income impossible.

Consequently, the status of the recovery can change weekly based on the public health determinations of what and how much we can and cannot do.

The European Union opened up their economy to international visitors on July 1. However, the U.S. is still precluded from all but essential travel there. This will slow the recovery of airlines and the airports this summer. The EU could still reverse this decision and if they do it could bring major upside impacts to the airlines. But clearly, this is a huge unknown.

Our baseline forecast anticipates that the economy will continue to grow throughout the year and into 2021. We assume a steady path of reopening without start-and-stop reversals of economic activity due to forced shutterings.

But these assumptions are clearly becoming precarious. Backpedaling on the gradual enabling of businesses to operate more normally will have significant economic costs and will lengthen the period of time needed to restore fuller employment. The economic recovery was going to be hard enough without the re-emergence of COVID-19. In the case of much of the country once again subject to reinstatement of some form of shutdown, the U.S. economy could experience a double-dip recession.

The good news is that home buying is rebounding along with automobile purchases. Housing inventory is way down, but that should pick up this summer because home values have not been impacted. Car purchases continue to improve though car production may lag due to factory work stoppages as plants contend with new protocols and COVID-19 concerns.

Neither of these sectors will produce a drag on the recovery providing demand holds up. But here again, demand is dependent on the progress of the recovery which is clouded by the potential erosion in consumer confidence to spend, as a result of the start and stop economy.

From an economic perspective, it’s imperative that this state and all states work cooperatively with the business sector to provide the most effective way to address public health concerns without subordinating business concerns. To date, that has not appeared to be the approach taken, at least not in California.

Watch for our regular updates on the U.S. and California economies during the pandemic. Follow our COVOD-19 page to be the first to understand the extent of the fallout and the trajectory of the recovery.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.