2020 May be Winding Down but Housing Demand is Turning Up

by Mark Schniepp and Ben Wright

December 17, 2020

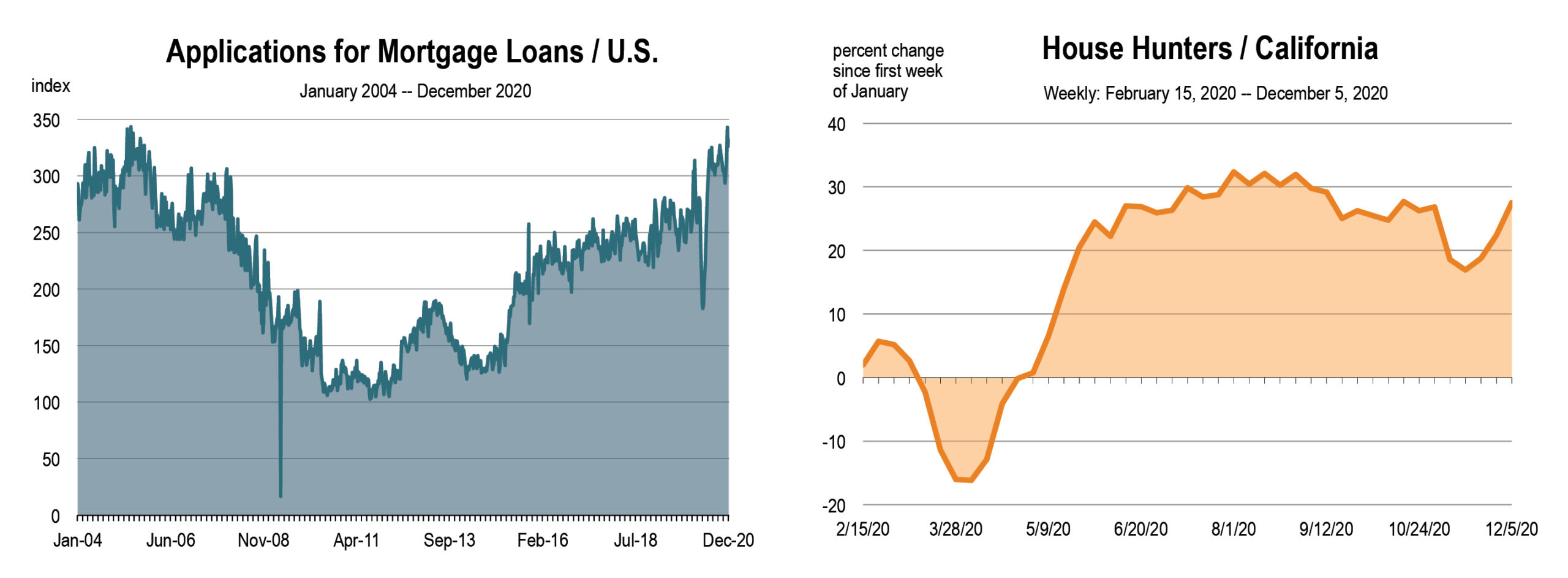

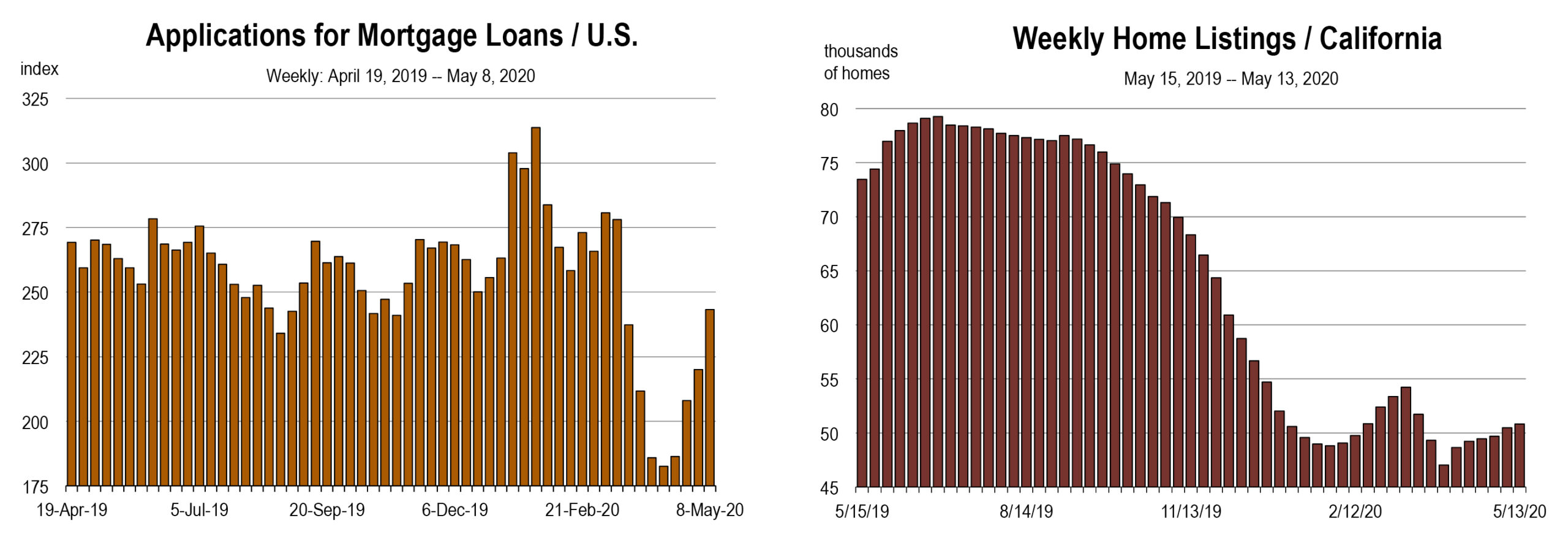

Just as we enter the typical winter lull, demand for housing actually appears to be rising. Nationwide, it’s approaching the highs of the housing bubble era, with mortgage applications surging in November and December.

In California, the number of house hunters has been climbing for several weeks and is rising faster than similar data nationwide.

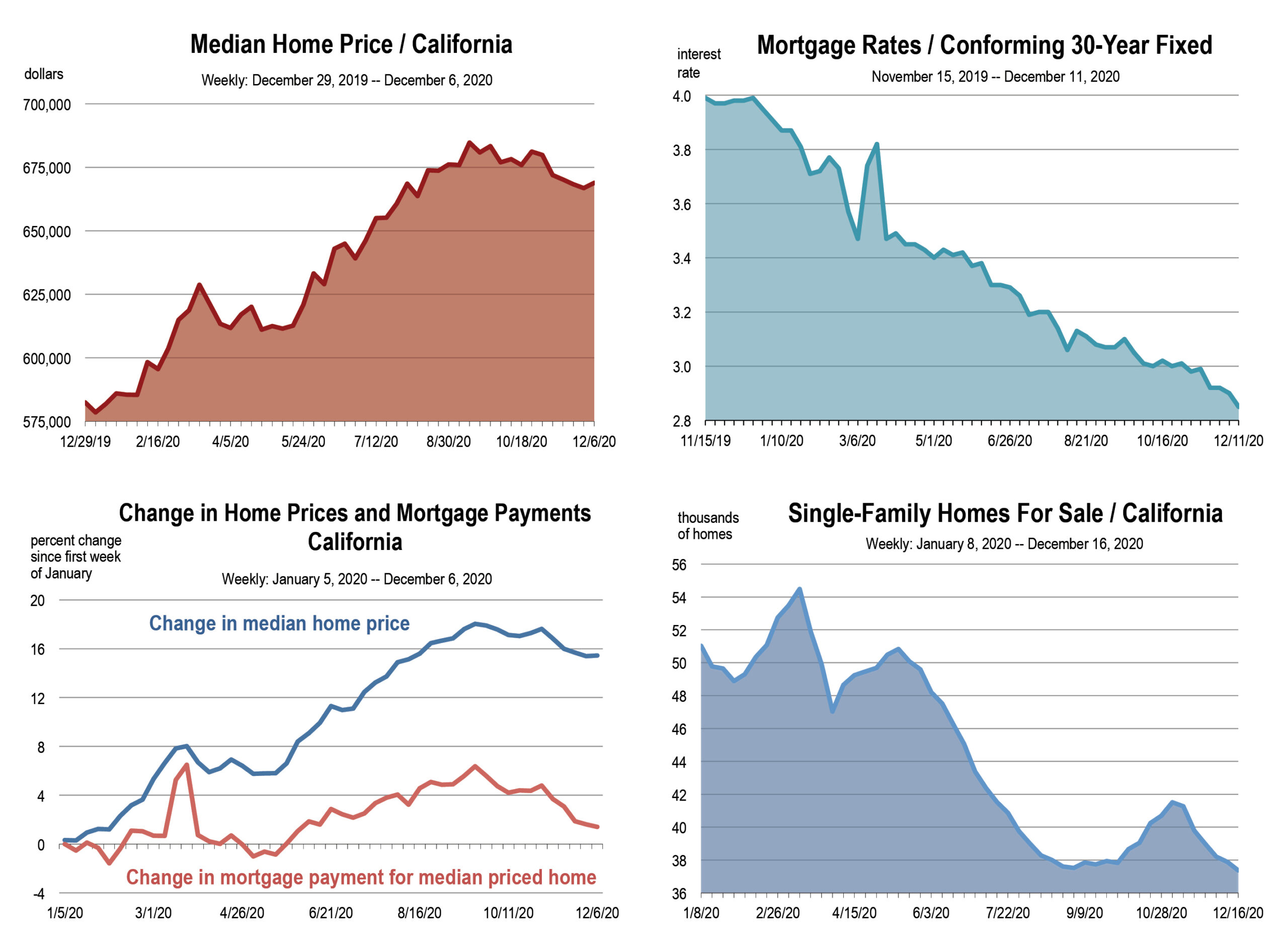

It appears that home prices are falling into a more affordable range. The median selling price has depreciated meaningfully since August and September, and listing prices have fallen even faster.

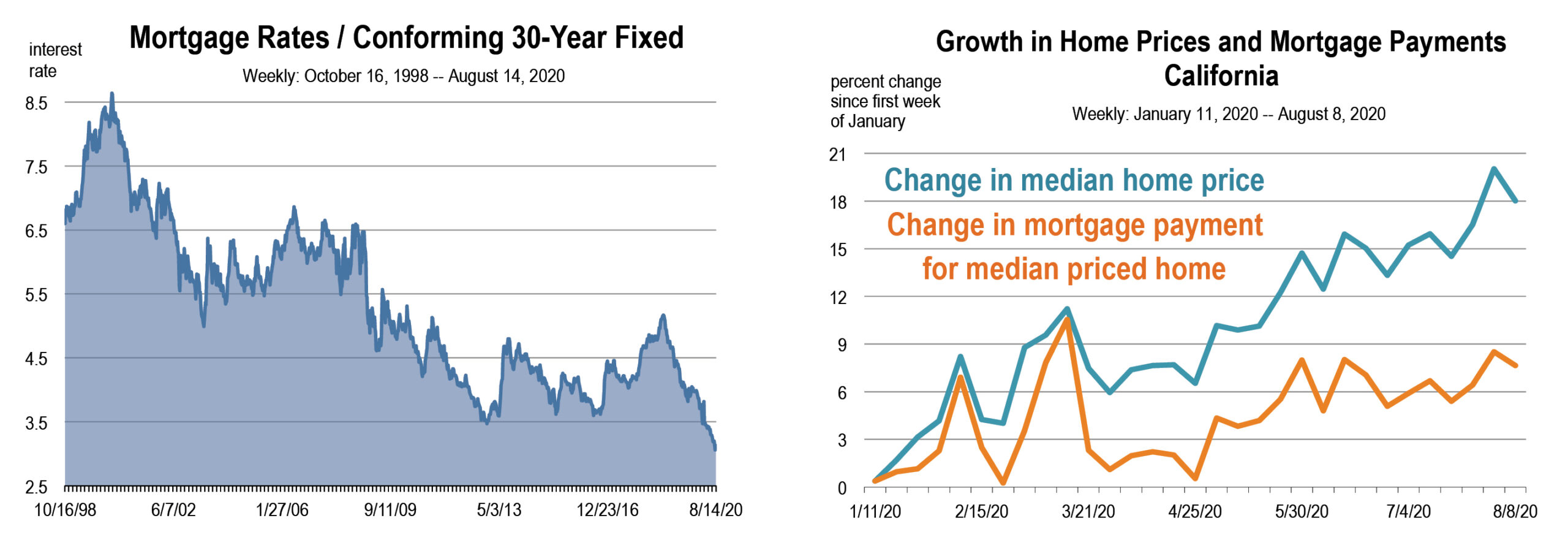

Mortgage rates keep setting lower new records each week, and even though prices are still 15 percent higher than they were at the beginning of 2020, the typical mortgage payment on the median priced home is only up by 1 percent.

Bargain hunters have emerged from hiding, pushing up demand. At a time when inventory is declining, we wouldn’t be surprised if another increase in selling prices follows.

What the last few months has shown is that home buyers have become more sensitive to price, largely because of how prices have behaved this year, rising much more sharply than in the previous 2 years.

California’s New Stay at Home Order Will Slow Down the Recovery Rather Than Reverse It

by Mark Schniepp and Ben Wright

December 15, 2020

Last week, California instituted a new round of business restrictions that prohibit outdoor dining and indoor gyms, salons, and barbershops. They closed hotels to everyone except critical infrastructure workers and limited retail stores to 20% of normal capacity.

This new Stay at Home order covers 99% of the state’s population, and resembles the first lockdowns that were implemented in March and April, when the pandemic first swept through the U.S.

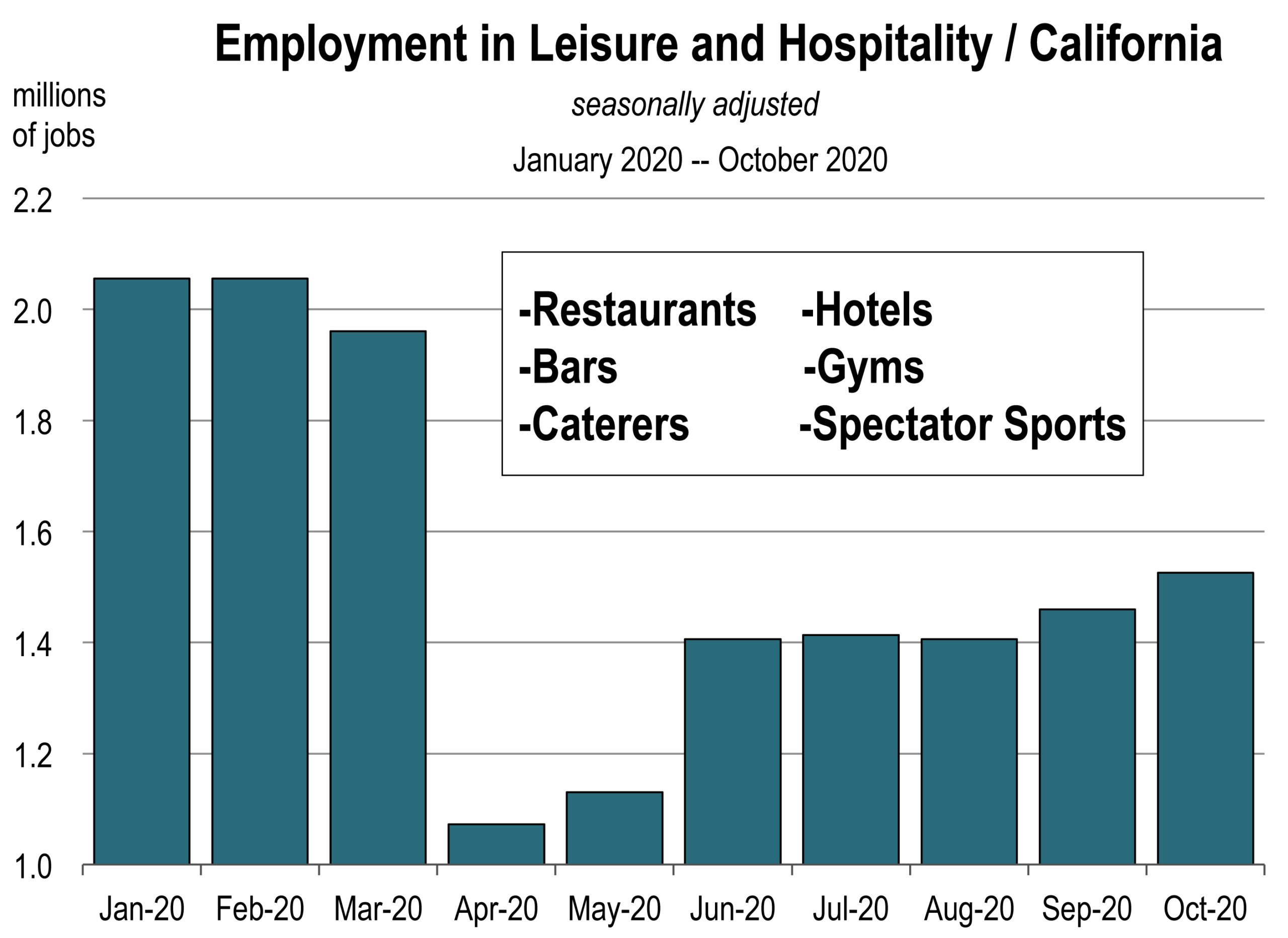

The new restrictions will hit certain industries hard. Leisure and hospitality—which is primarily comprised of restaurants, bars, hotels, and gyms—will lose jobs in December and January as waiters and maids are laid off or furloughed. Some businesses will close completely, and maybe even permanently.

The new restrictions will hit certain industries hard. Leisure and hospitality—which is primarily comprised of restaurants, bars, hotels, and gyms—will lose jobs in December and January as waiters and maids are laid off or furloughed. Some businesses will close completely, and maybe even permanently.

But the leisure sector was already well below its pre-pandemic employment level, and there aren’t too many jobs remaining that can realistically be cut. At most, we expect this sector to shed 200,000 jobs over the next few months, and it’s possible that the damage will be mild.

There will also be some seasonal weakness in the retail sector, with far fewer jobs gained than during a normal holiday season, and California could shed more jobs at schools and government agencies.

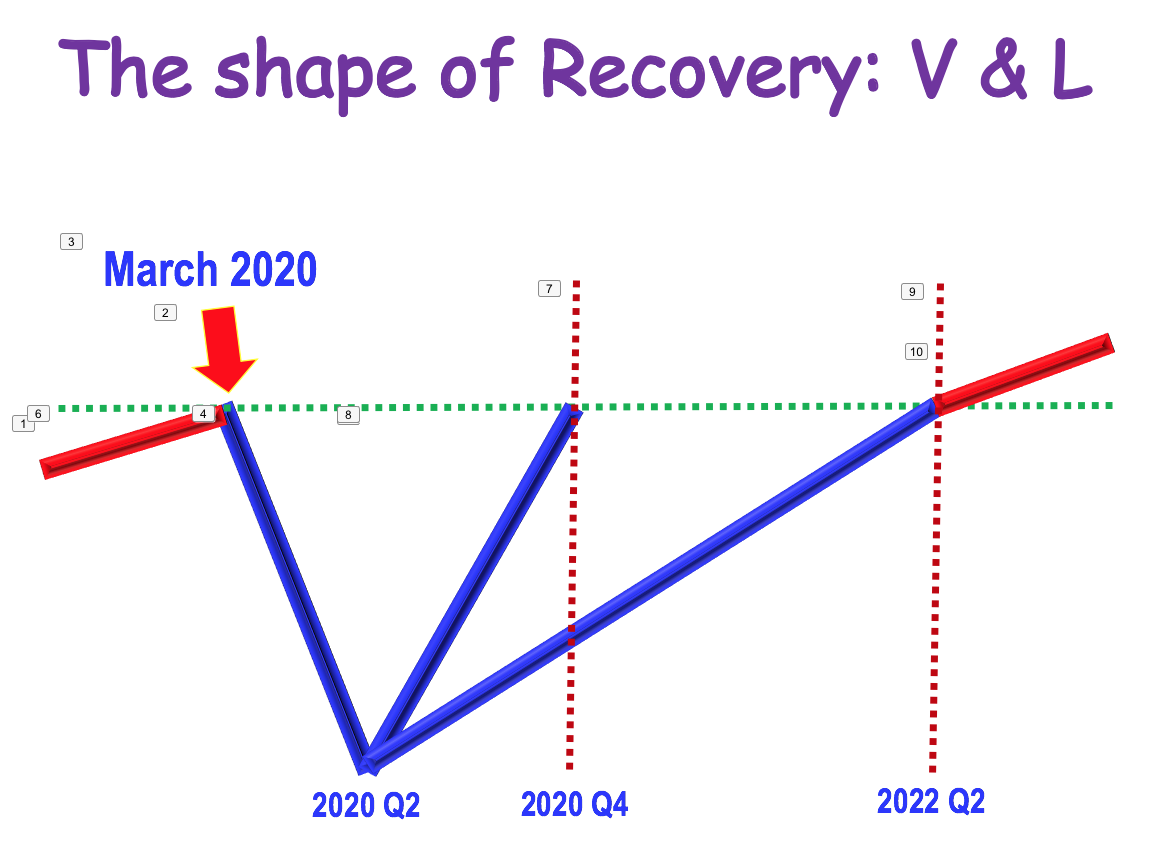

But we don’t see a W shaped economy where growth turns negative a second time.

Why?

Because virtually all other industries should continue to expand. The professional business services sector will be largely unaffected by the Stay at Home order, and will probably gain jobs in December and January.

Warehousing and delivery services could see rapid job creation as online purchases dominate Christmas shopping and everyone orders takeout through DoorDash and Grubhub.

New construction should continue with infrastructure, residential, office, and industrial projects across the state. Eighty-five percent of all construction jobs lost between February and April have been restored, and more will probably be re-gained.

New construction should continue with infrastructure, residential, office, and industrial projects across the state. Eighty-five percent of all construction jobs lost between February and April have been restored, and more will probably be re-gained.

Financial services has been largely unaffected this year, losing less than one percent of total employment. This industry includes jobs at real estate agencies, which have been surging since the summer months.

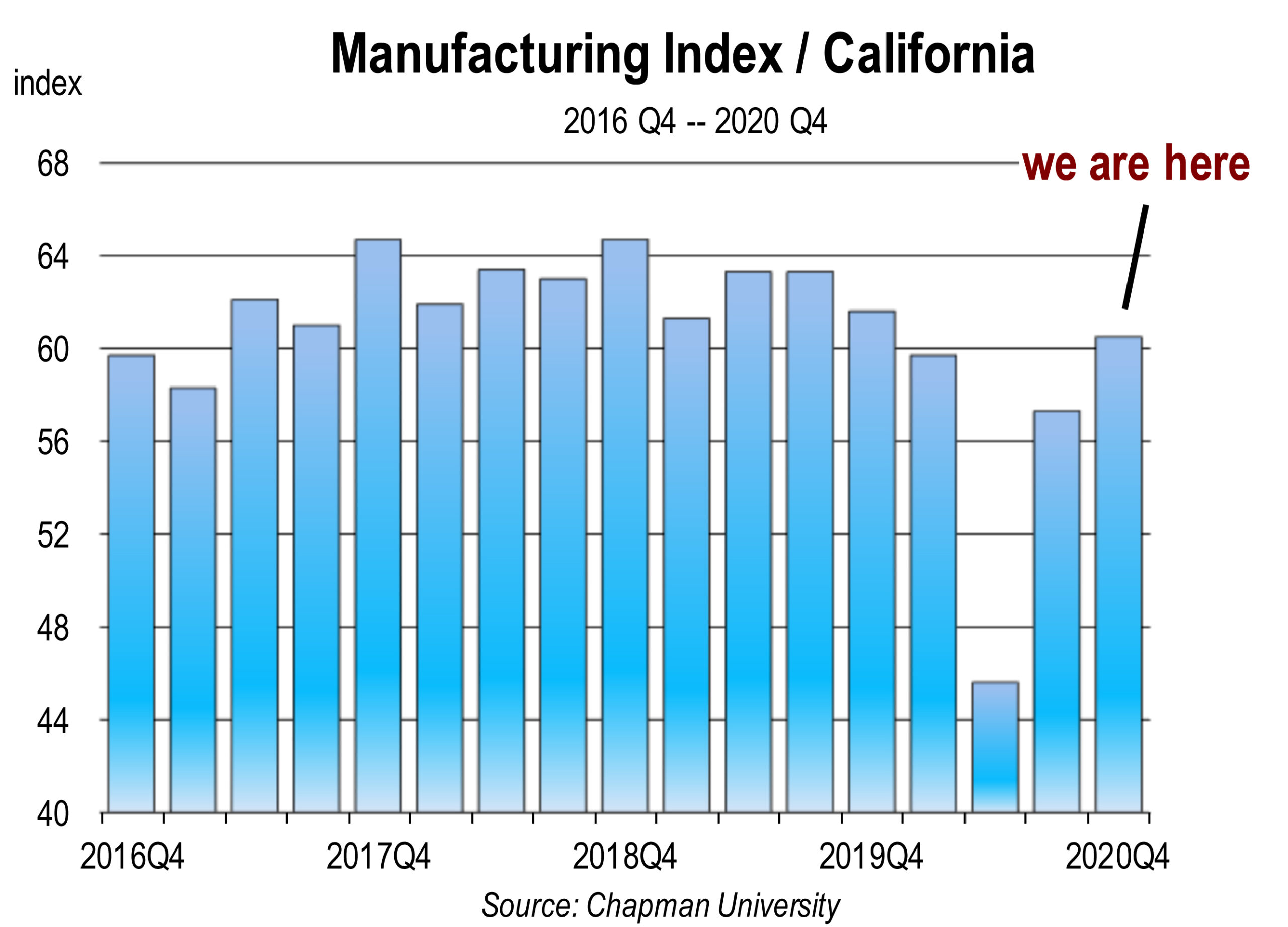

The composite index for California manufacturing shows that production is back to first quarter 2020 levels.

There is a meaningful chance that total non-farm employment will contract during the winter months, pulled down by the inevitable layoffs in leisure, hospitality, accommodation, and retail, but it is unlikely that any economy-wide jobs losses will be large enough to cause a double-dip recession. Rather, it will probably be a temporary blip as we wait for mass immunization, at which point the economy could soar.

We’ll outline our expectations for 2021 in an upcoming post, so stay tuned…

The Vaccine is Here

by Mark Schniepp

December 14, 2020

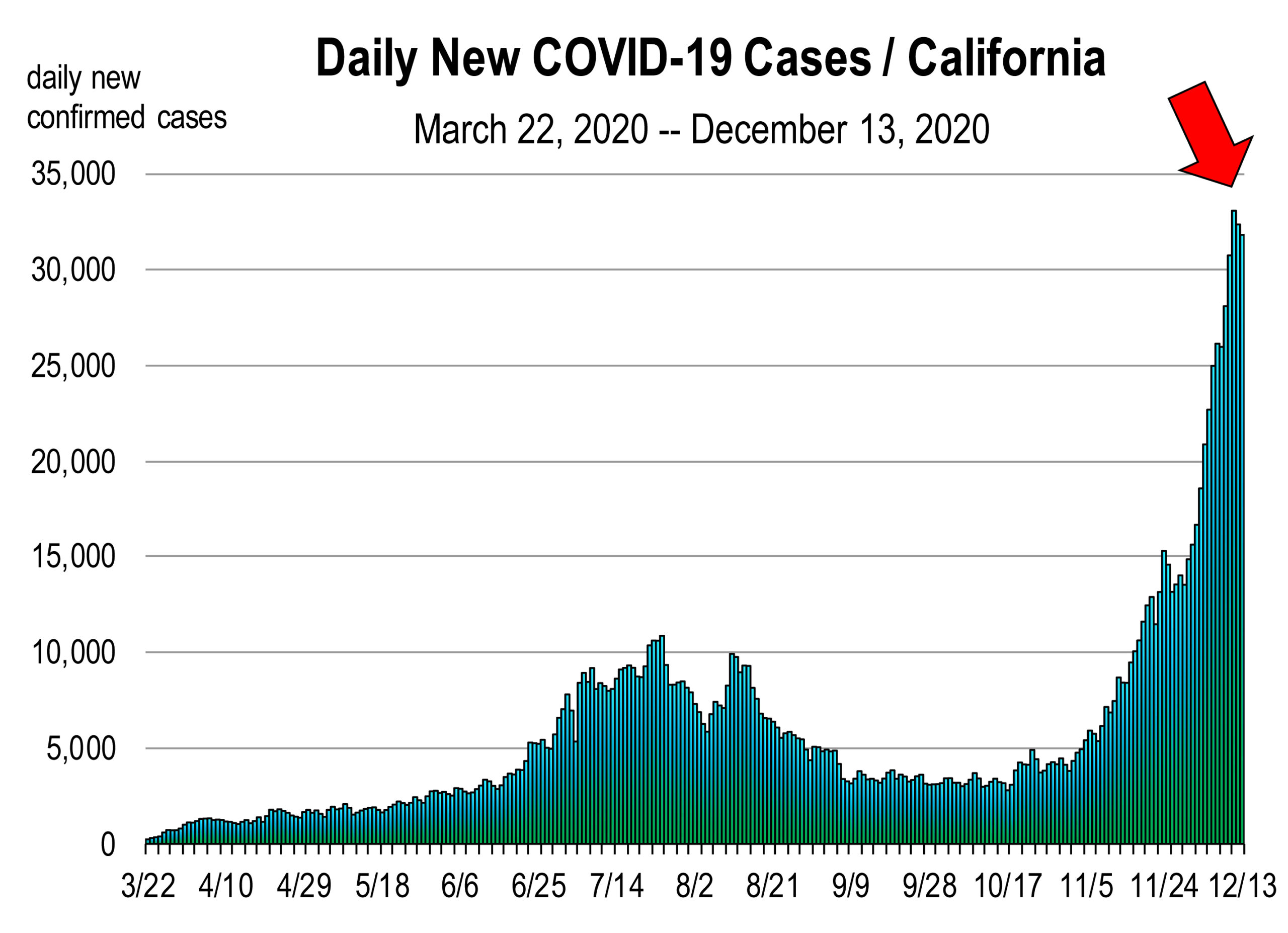

Because the coronavirus is entirely responsible for the economic calamity and recession of 2020, ending the pandemic is tantamount to restoring a fully employed, fully functioning economy.

Therefore the vaccine is critical to this restoration. It’s not only the most important step, it’s actually the first giant step.

Therefore the vaccine is critical to this restoration. It’s not only the most important step, it’s actually the first giant step.

Scientists estimate that herd immunity would require around 80-90 percent of the population to have COVID-19 immunity, either through prior infection or vaccination. Consequently, experts are encouraging the public to get the vaccine when available.

Pfizer was granted emergency approval by the FDA on December 11, 2020. The company has already launched the start of the nationwide vaccine effort. Starting the week of December 13, vaccinations will arrive in 950 dose boxes all over the country.

In most cases front line health care workers and the staff and residents of long-term care facilities are first in line to receive the vaccinations this week. Such is the recommendation by the CDC. Then essential workers; then people with compromised medical conditions.

Vaccination doses occur in 2 steps, 3 weeks to one month apart, so coordination will be critically necessary to ensure efficacy of the vaccine towards building herd immunity quickly.

Pfizer expects to have 20 million doses this year and 1.3 billion next year. The U.S. Government has purchased enough of the vaccine from Pfizer to treat 150 million Americans between now and the Spring.

Moderna claims it will deliver 20 million doses of their vaccine by the end of this year, and another 80 million in the first quarter of 2021. The company expects that up to one billion doses would be produced during calendar 2021 for worldwide distribution.

On the December 13 program of Fox News Sunday, Moncef Slaoui, head of Operation Warp Speed, stated that at least a third of the population of the U.S. should be vaccinated by the end of next March. Another 100 million doses of the Pfizer vaccine will be delivered in the second quarter of 2021. The U.S. government has an option to obtain an additional 400 million doses from Moderna next year.

The AstraZeneca vaccine will likely be used in Europe first, before being adopted in the U.S. to supplement the Pfizer and Moderna vaccines. Slaoui expects the AstraZeneca vaccine will be approved in late February in this country, with another two vaccines—by Johnson & Johnson and Novavax–to be approved by the FDA in February.

There have been many mixed messages regarding the timing next year of widespread availability of the vaccine. A month ago, the CDC and estimates from Pfizer predicted that by April, the vaccine would be readily available to anyone.1 That timeline may be moving forward faster than expected. We now believe late first quarter is a better estimate, providing that Pfizer can deliver 20 million doses this month and Moderna receives FDA approval by the end of this week.

By March of 2021, we should have observed a marked improvement in case counts, hospitalizations, and ICU utilization in the U.S. including California. This would be attributed to both warming weather conditions, a fading flu season, and rapidly spreading immunity in the population.

Consequently, we would expect state authorities to begin loosening restrictions as the case data improves.

The current conventional wisdom has the U.S. economy expanding 3.5 to 4.1 percent in 2021. Most of that growth occurs in the 2nd half.

However, economists are generally optimistic that businesses will be able to operate more freely as the vaccine becomes widely distributed.

The first quarter 2021 growth forecast is modest but still positive at 1.8 percent. Growth only accelerates from that point onward next year.

California

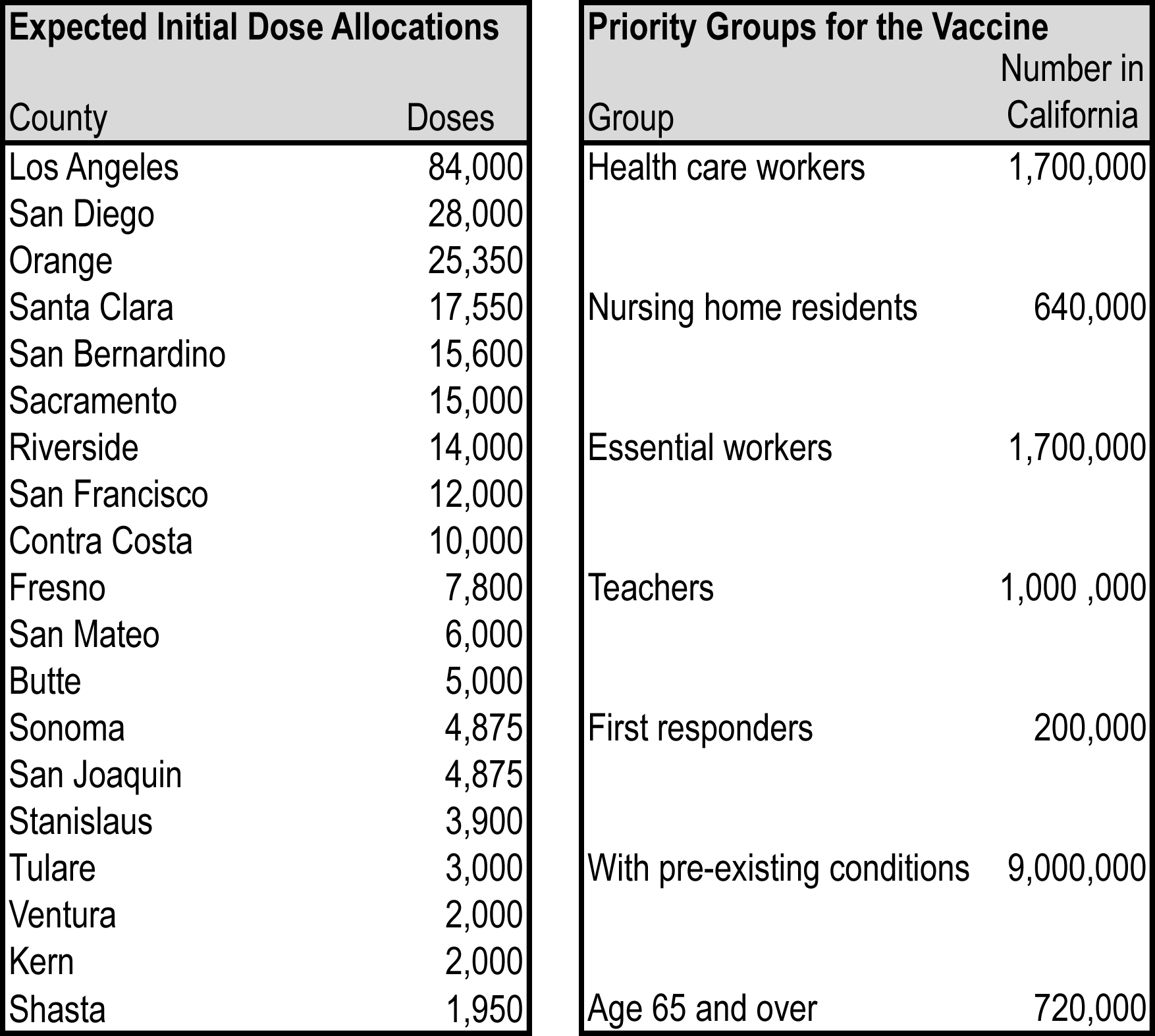

The expectation has the initial allocation of 327,000 Pfizer vaccine doses for California this week.

From Moderna, California anticipates an initial allocation of 672,000 doses.

The first shipments to the state arrive on Monday, December 14. By the end of December, 1.8 million doses of vaccination are expected to be received in California, enough to vaccinate 4.5 percent of the population.

The number of doses each county gets mostly corresponds with the size of its population.

First in the California line to get the vaccine are health care workers, especially in acute care, psychiatric facilities and correctional facility hospitals. Skilled nursing facilities and assisted living facilities, paramedics, EMTs, emergency medical services and dialysis centers are also in the first tier of recipients.

——

1 https://www.npr.org/2020/11/27/939490445/fauci-predicts-widespread-vaccine-availability-by-april-are-americans-ready

Expect a Busy Ski Season in Tahoe and Big Bear, Lower than Normal Demand in Mammoth, and Big Hits to City Budgets in all Ski Towns

by Mark Schniepp and Ben Wright

December 8, 2020

Virtually all of California is under new Stay at Home orders, but the ski slopes are open, meaning that lockdown-fatigued skiers will flock to the mountains this winter, filling ski towns with visitors.

Virtually all of California is under new Stay at Home orders, but the ski slopes are open, meaning that lockdown-fatigued skiers will flock to the mountains this winter, filling ski towns with visitors.

But because many hotels are closed to everyone except essential infrastructure workers, most Californians must plan on single day visits to ski resorts, heading to the mountains in the morning and getting home after dark.

These hotel closures are part of the three-week Stay at Home order, which expires on December 27, but there is a high likelihood it will be extended into January if case counts don’t diminish.

If you live in Southern California, your best day-trip options are the resorts near Big Bear, and there are a few additional runs near Mt. Baldy.

By our count, there will be only 21 functioning chair lifts for the 24 million people that live within 4 hours of Big Bear and Mt. Baldy, which could lead to traffic jams, parking nightmares, and long ski lift lines.

Conditions in Tahoe should be better. We expect 13 Tahoe resorts to open this winter, with a maximum capacity of 143 chair lifts.

If you’re among the 10 million people who live North of Modesto and South of Red Bluff, you’re almost certainly within driving distance and the supply/demand relationship could work in your favor.

Travel restrictions have not yet hit the Tahoe area, so the hotels are still open, but health experts predict they will close within the next week. However, Tahoe ski resorts are right next to the Nevada state line, and Nevada businesses are still largely open.

Heavenly is located in South Lake Tahoe, less than 1,000 feet from the Nevada border, right next to a slew of hotels and restaurants. Northstar and Squaw Valley are near Incline Village, which has its own visitor district.

So even if hotels close in California, a decent number of travelers will stay in Nevada and cross the state line to ski.

Because Tahoe-area hotels in California could soon close, the cities of Truckee and South Lake Tahoe are expected to lose lodging tax revenues, the lifeblood of their budgets. A potentially large share of restaurant sales taxes would also be diverted to Nevada. Consequently, these two cities are at substantial risk of general revenue decline this year.

Mammoth Mountain is in an entirely different situation altogether. Hotels are currently closed to skiers and day visits to Mammoth would be arduous. The only major population center within a few hours is Reno, Nevada, which has just 400,000 residents. Without lodging options, visitors from Southern California or the Bay Area face unreasonably long drives to Mammoth, and far fewer than normal will make the trip.

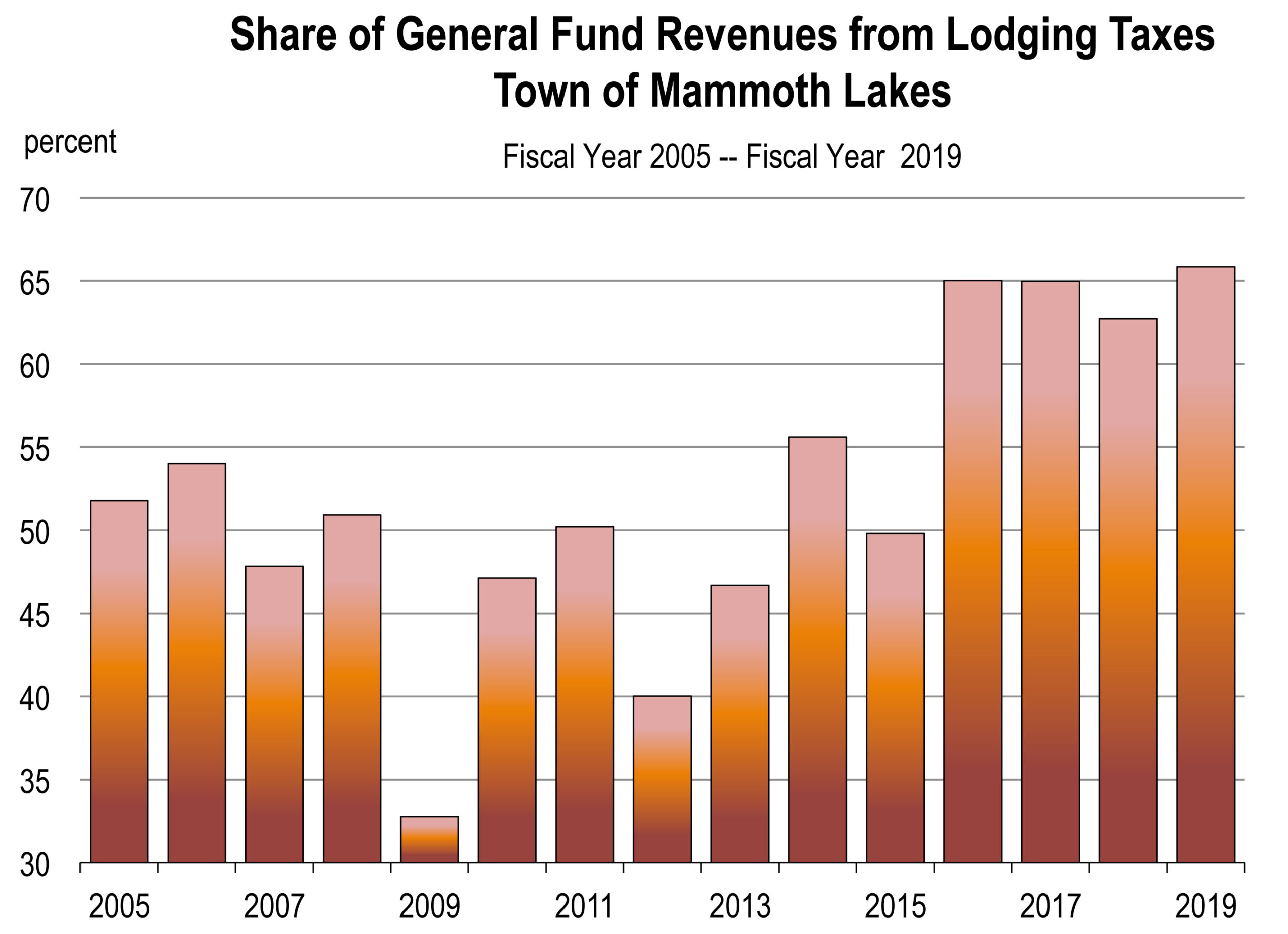

Mammoth typically receives 1.3 million visitors between November and March. And with 4,775 lodging units in the town, lodging taxes account for 66 percent of total general revenues. This year however, the only skiers might be locals, people who own a second home in the area, and rule breakers who rent a rogue Airbnb or sleep in their car or RV.

This is also true for Big Bear. Google lists 137 lodging facilities in the town of Big Bear Lakes and there are numerous additional vacation homes for rent. Thirty percent of annual general fund revenues come from transient lodging taxes, meaning that city revenue generation during the all important ski season potentially faces significant interruption.

The Coronavirus Recession Is Impacting City Budgets Across California

by Mark Schniepp and Ben Wright

November 19, 2020

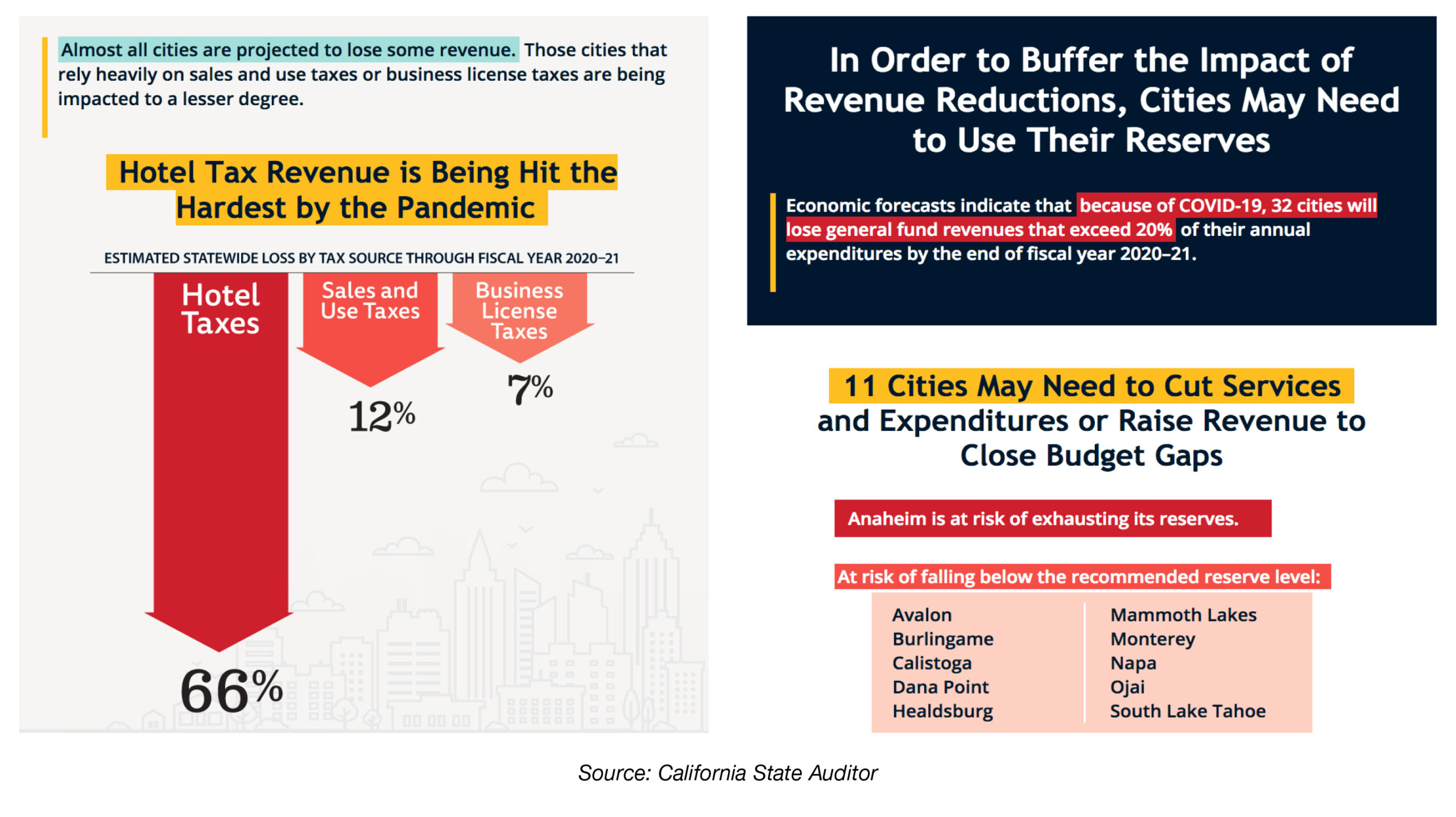

We’ve been working with the California State Auditor to identify cities at risk of fiscal distress, and the results are finally in.

In California, virtually all city budgets will be impacted by the Coronavirus Recession, and some will be impacted significantly. Revenue declines could exceed 20% of total expenditures in more than 30 cities, and at least 10 cities may have to cut services during fiscal year 2021, which we are in now.

Revenue shortfalls will be largest in cities that rely heavily on hotel taxes, parking taxes, and admission taxes for live events.

The City of Indian Wells relies heavily on admission tax revenues from the BNP Paribas Open, a professional tennis tournament that is traditionally held in March. It was cancelled in 2020 and it might be cancelled again in 2021. Consequently, the city budget is facing substantial revenue risk.

Anaheim, the home of Disneyland and California Adventure, also faces substantial revenue declines, largely from a reduction in bed taxes. Without major intervention, Anaheim is at risk of exhausting its fiscal reserves before the amusement parks can re-open.

Only 21 cities are at minimal risk of budgetary distress. Most of these municipalities rely primarily on sales and use tax revenues, which have been less affected than other revenue sources because consumers are purchasing fewer in-person services but a higher volume of taxable goods.

Read the full analysis by the California State Auditor.

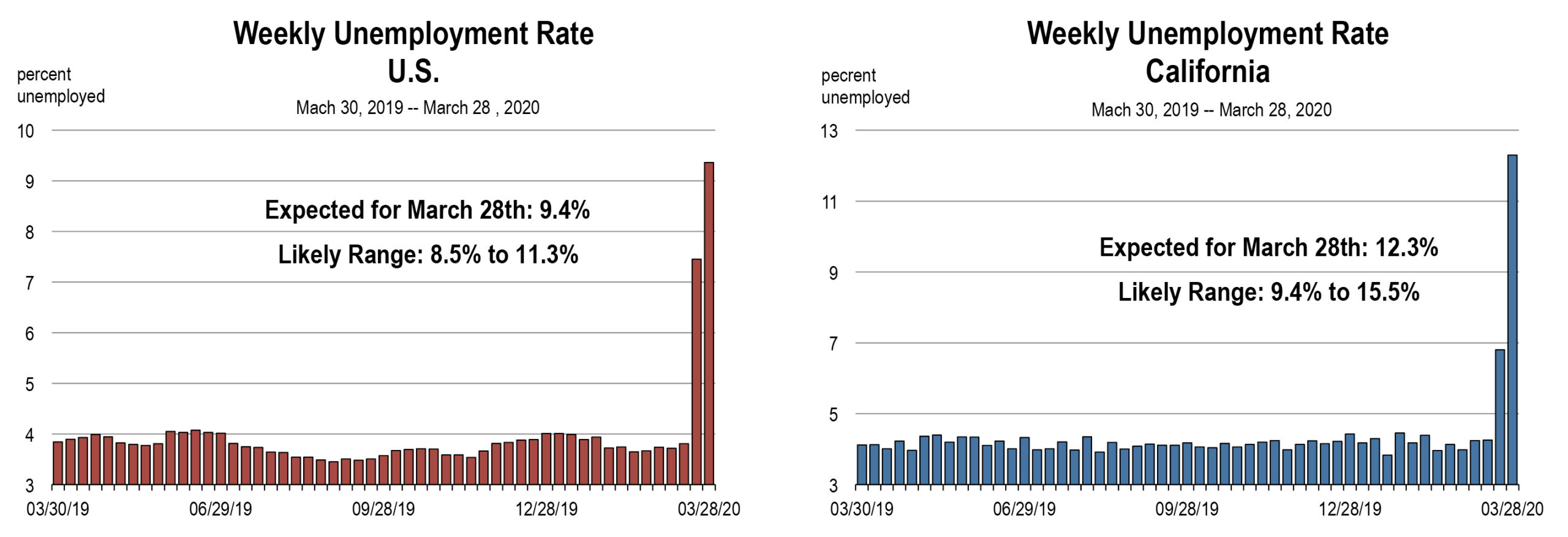

Weekly Unemployment Remains Stuck at 15 Percent

by Mark Schniepp

September 18, 2020

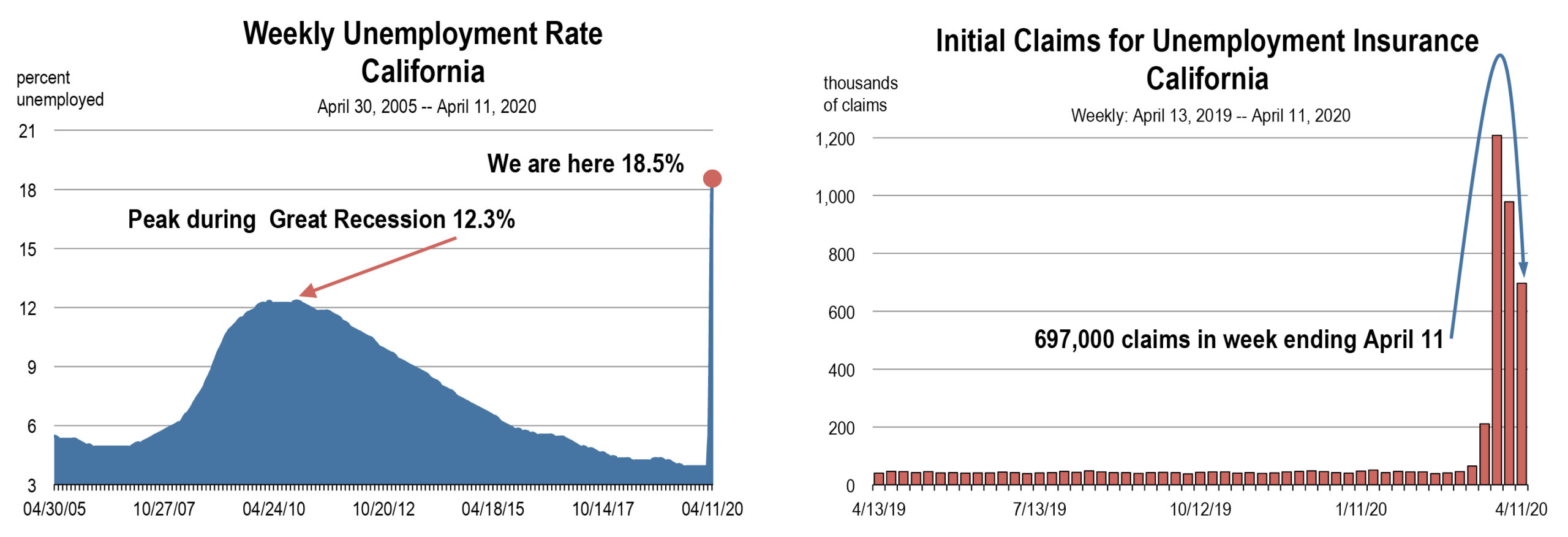

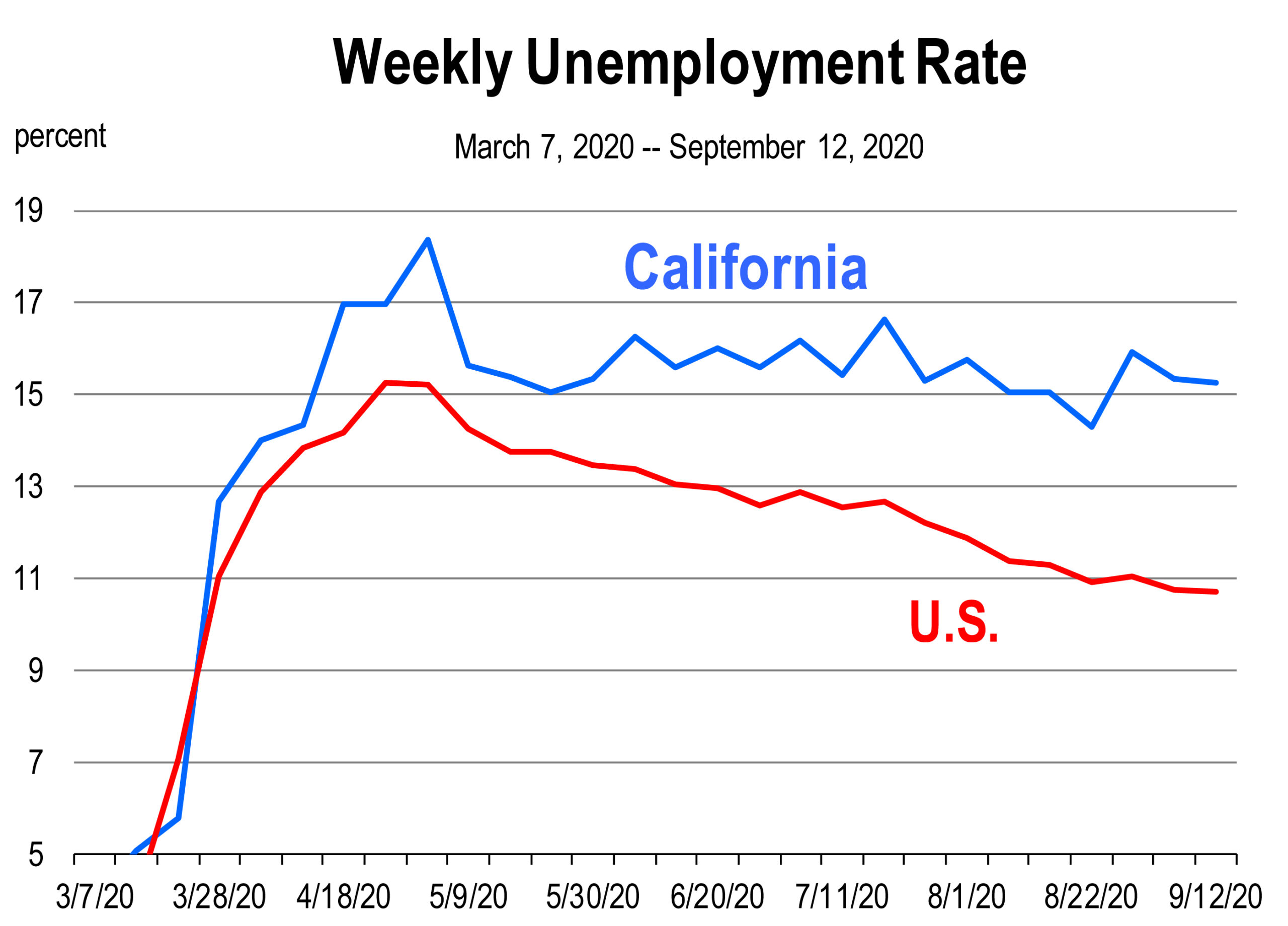

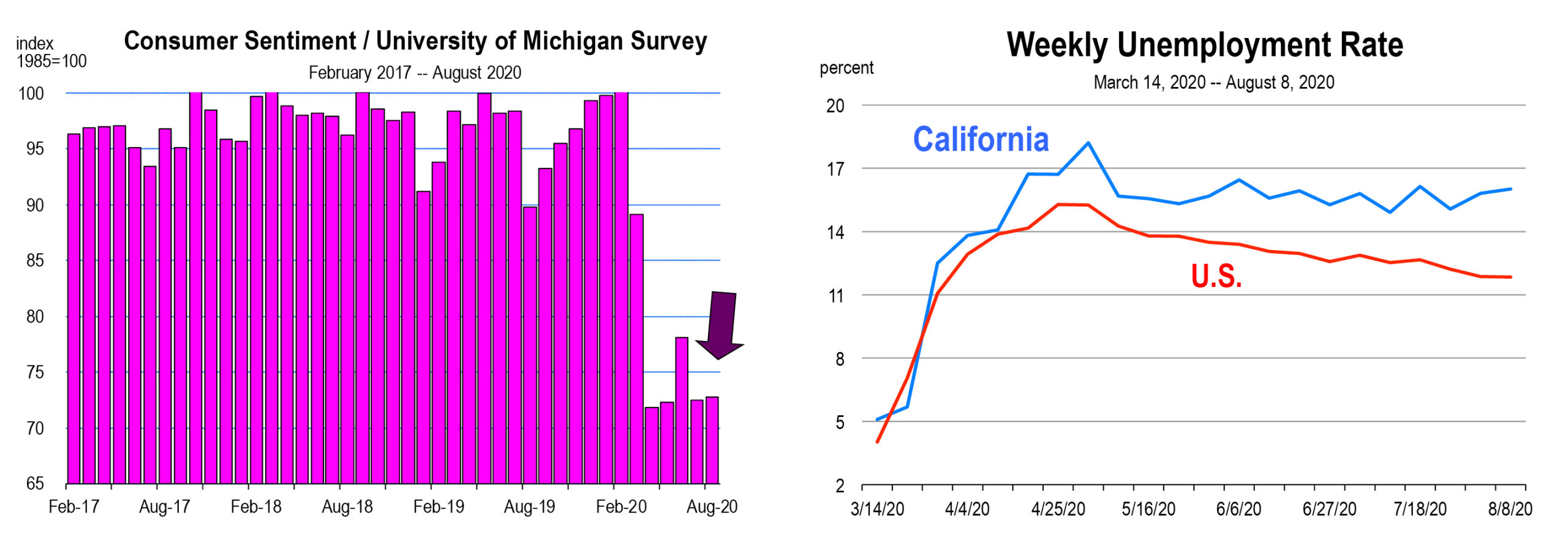

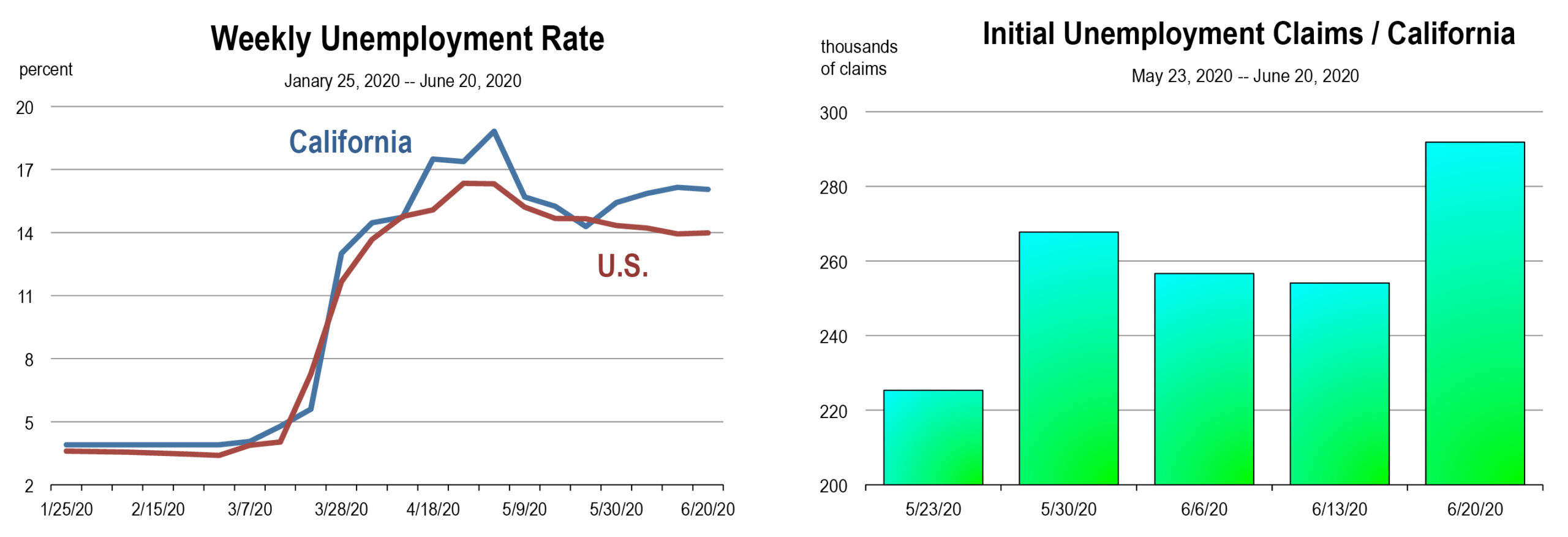

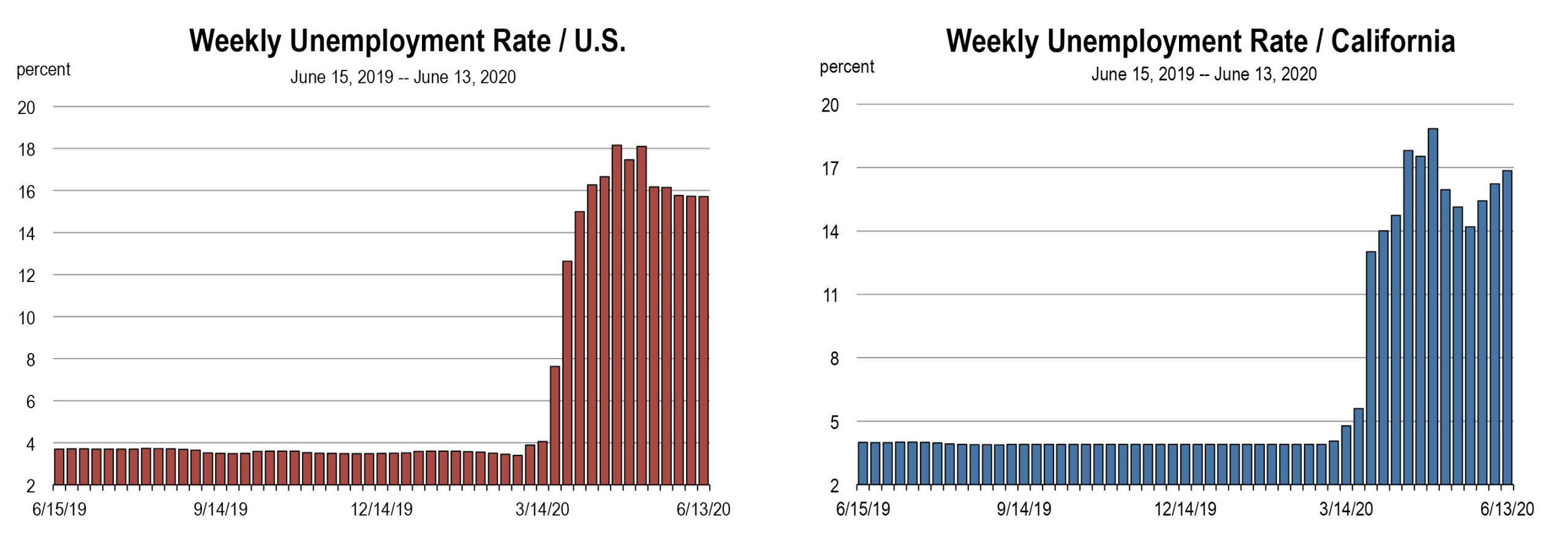

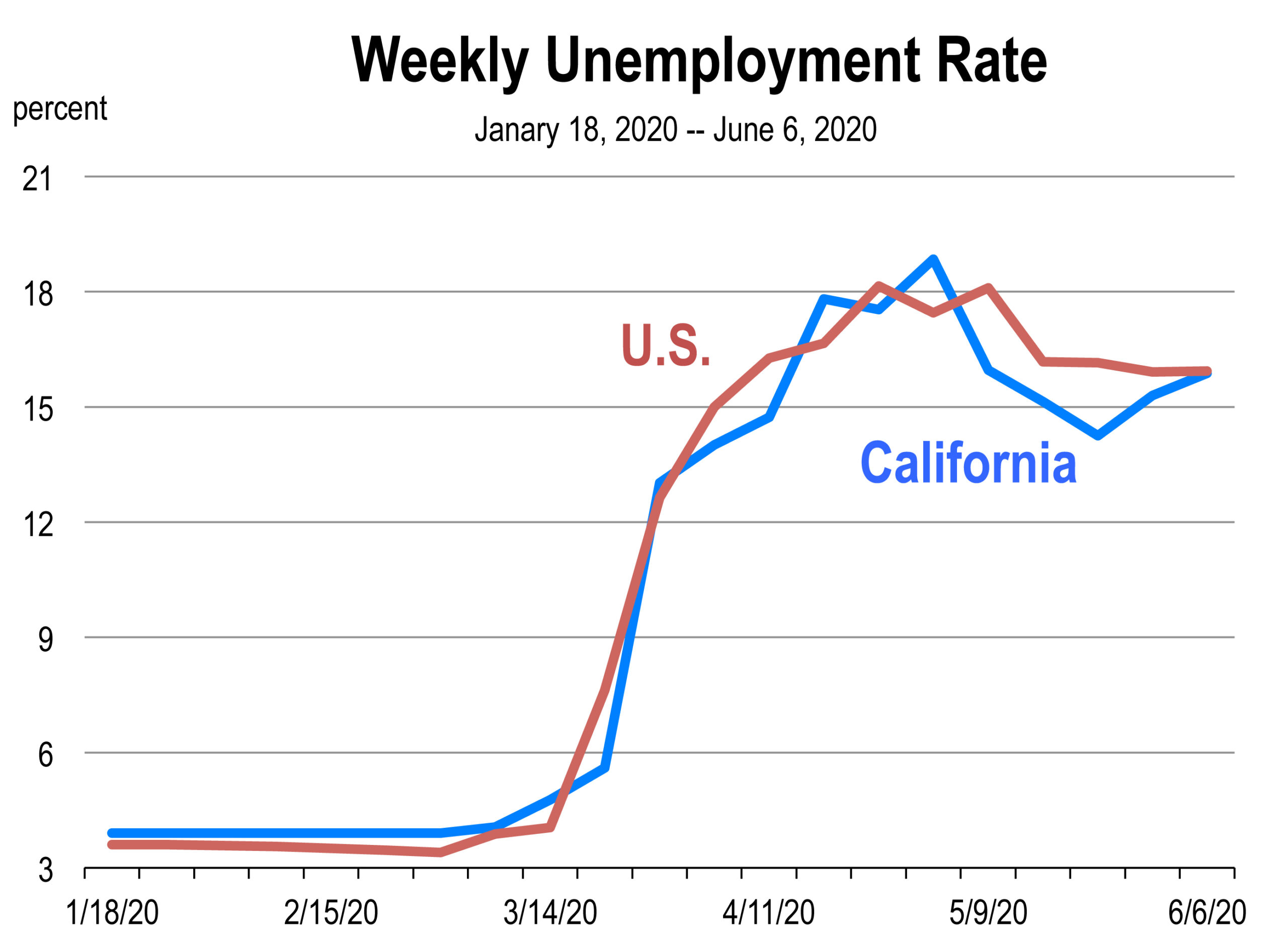

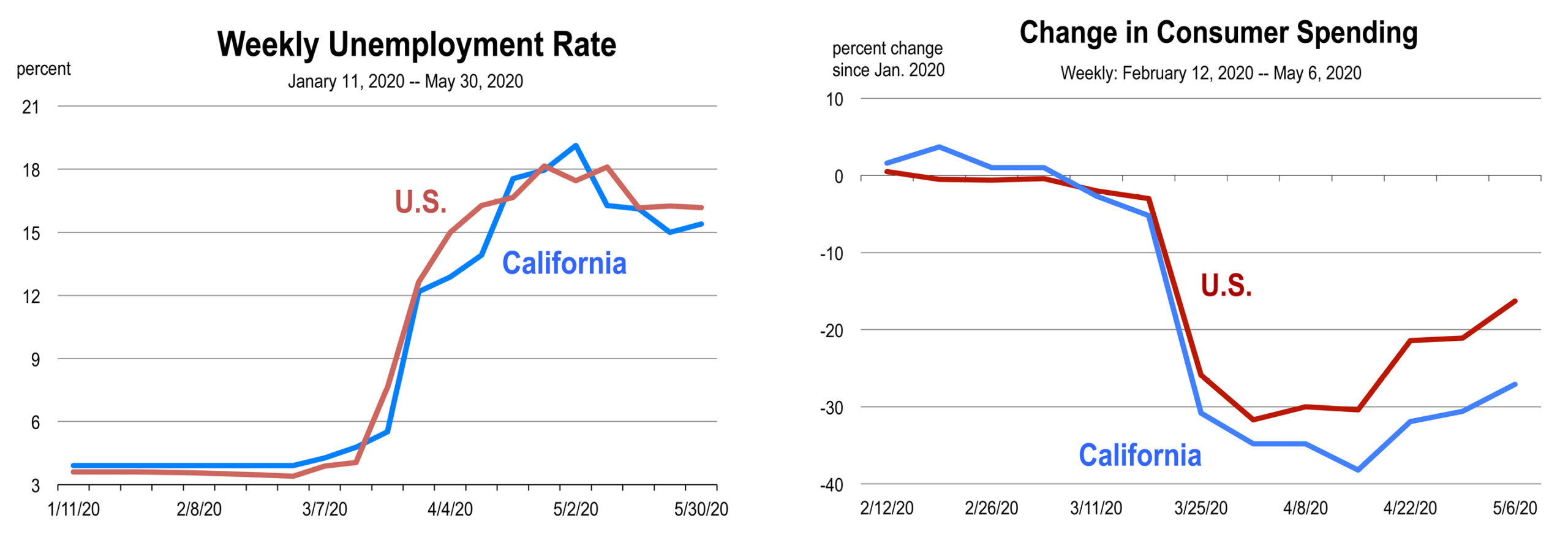

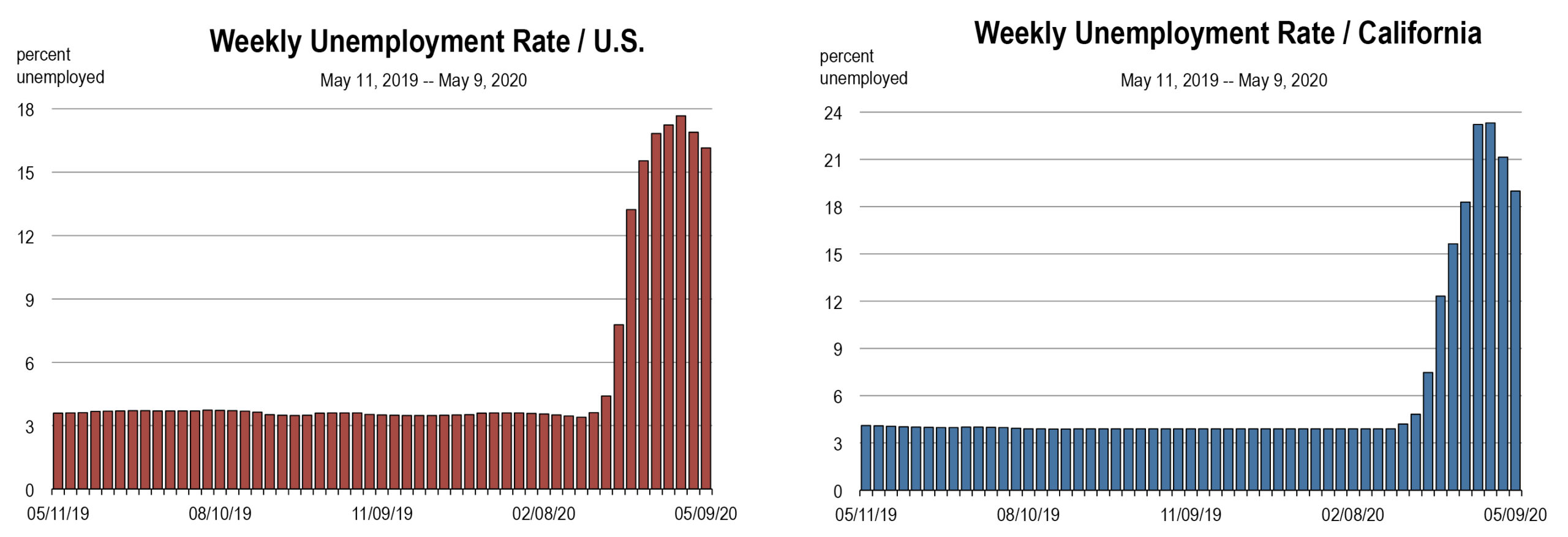

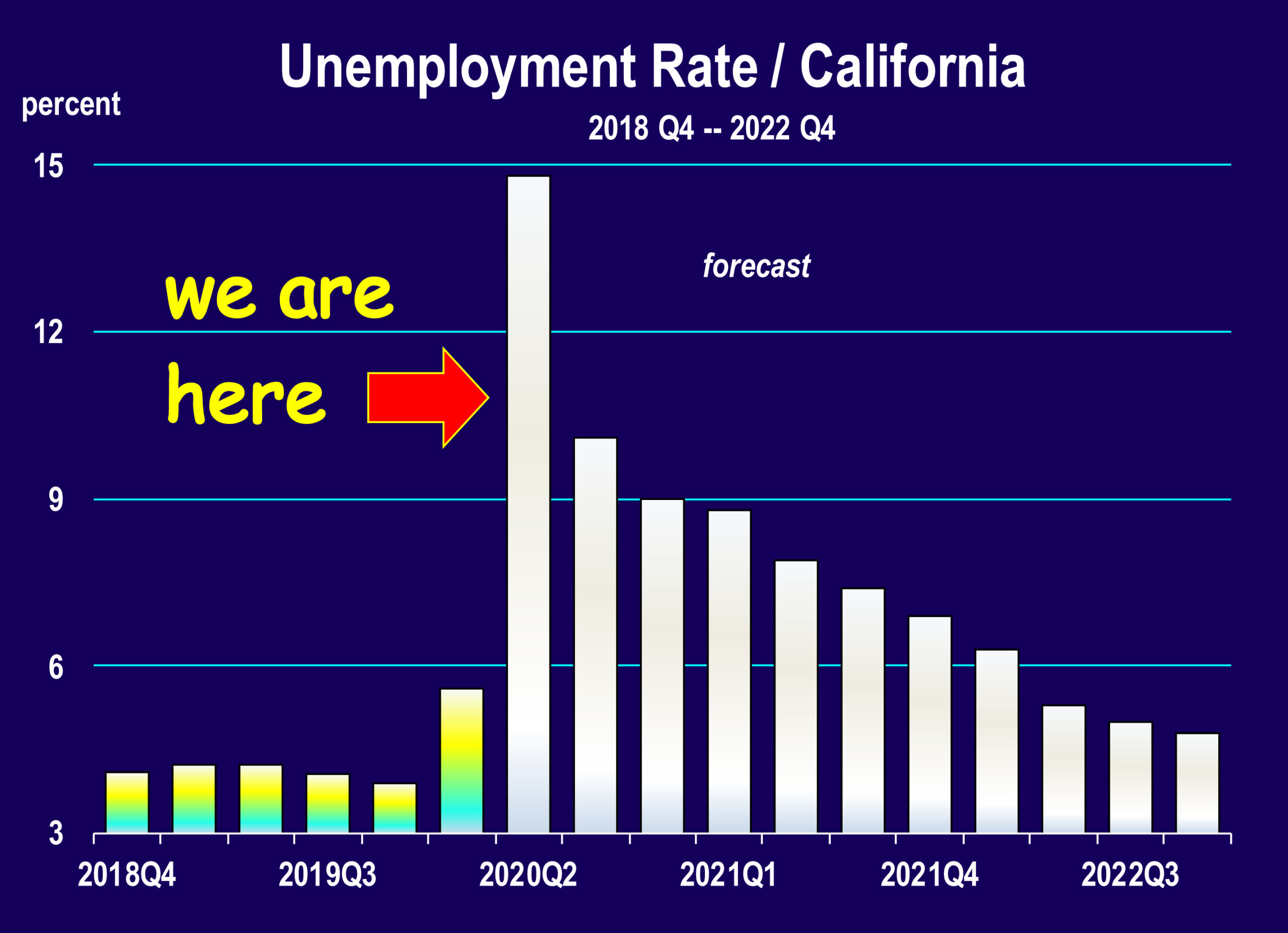

Our estimates of the latest weekly unemployment rate from last week have the nation improving but the State moving laterally. The State’s rate remains stuck at 15.3 percent.

The dip in the U.S. rate to less than 11.0 percent occurred because claims for unemployment declined last week, but that week included Labor Day which could have impacted total new filings.

The official unemployment rate in August for the nation is 8.4 percent, but in view of who is receiving unemployment benefits, it’s effectively much higher.

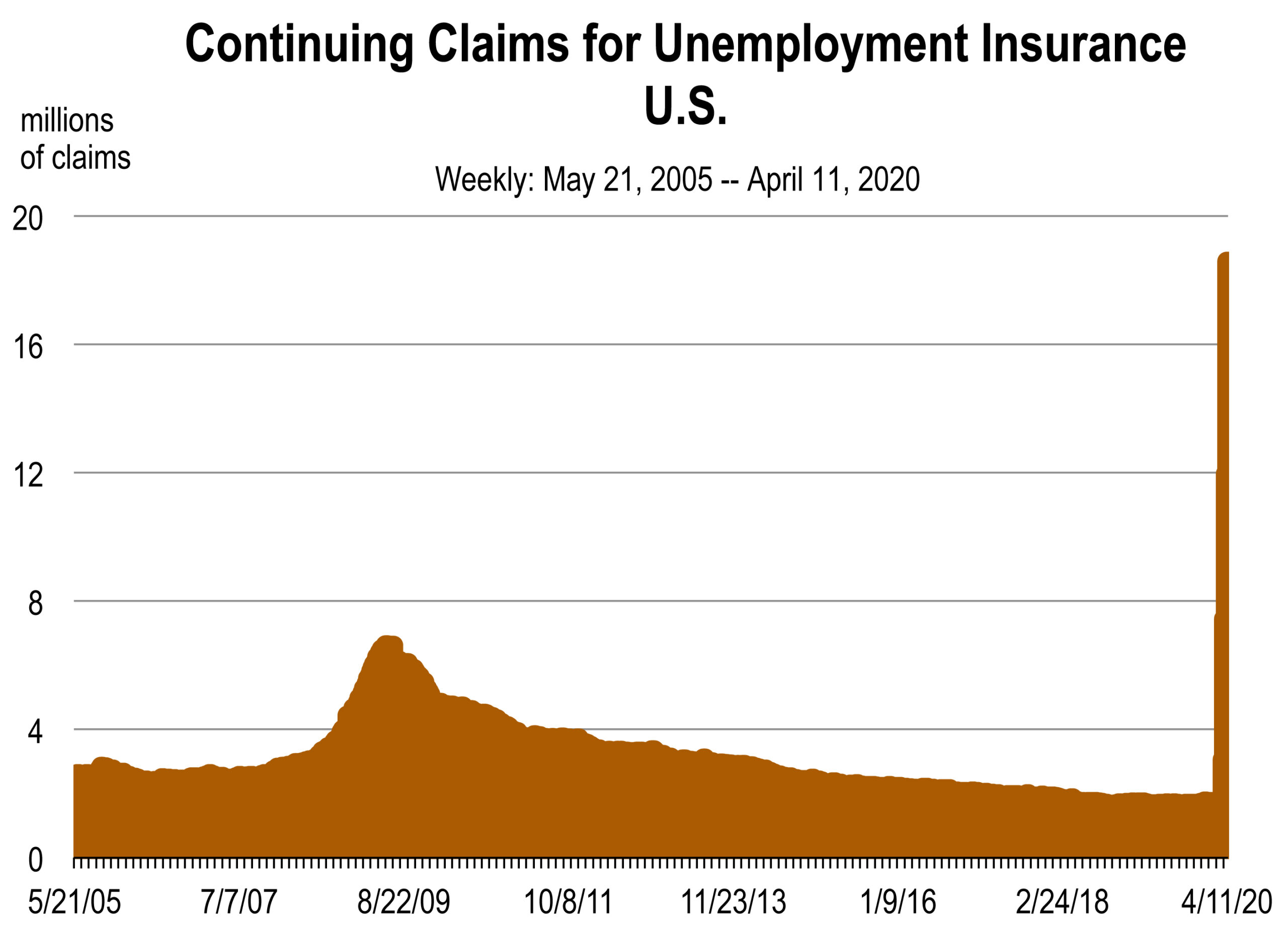

Continuing claims for unemployment insurance currently exceed 13 million. This level of unemployment claims remains above the peak observed in past recessions, affirming the ugly impact of the coronavirus on the labor market after 5 months of limitations on businesses.

The U.S. is slowly opening up, state by state. This is not the case for California. The new blueprint for a safe economy will keep conditions very restrictive for businesses for the next couple of months in California.

Though COVID-19 cases are declining nearly everywhere in the State, along with hospitalizations and fatalities, the limitations on business remain onerous, and perhaps somewhat arbitrary.

The labor market report for August was presented today by the State of California. The unemployment rate fell to 11.6 percent. Inconsistencies in the report imply that this preliminary August estimate of the California labor market includes misclassification errors of surveyed unemployed respondents.

During August, a month in which most California businesses were 25 to 50 percent open (or not open at all) the state created 102,000 jobs. After a closer look at which sectors contributed those new jobs, it appears to be mostly federal and local government offices. They account for 67 percent of the jobs created. The federal jobs are temporary Census workers. These jobs will likely only last through October or no longer than November.

Because of the business reversals that went into full effect by July 13, the report shows that the “other services” industry, which includes salons and barbershops and gyms, and the leisure/hospitality sector that includes restaurant and bar worker, lost jobs in August.

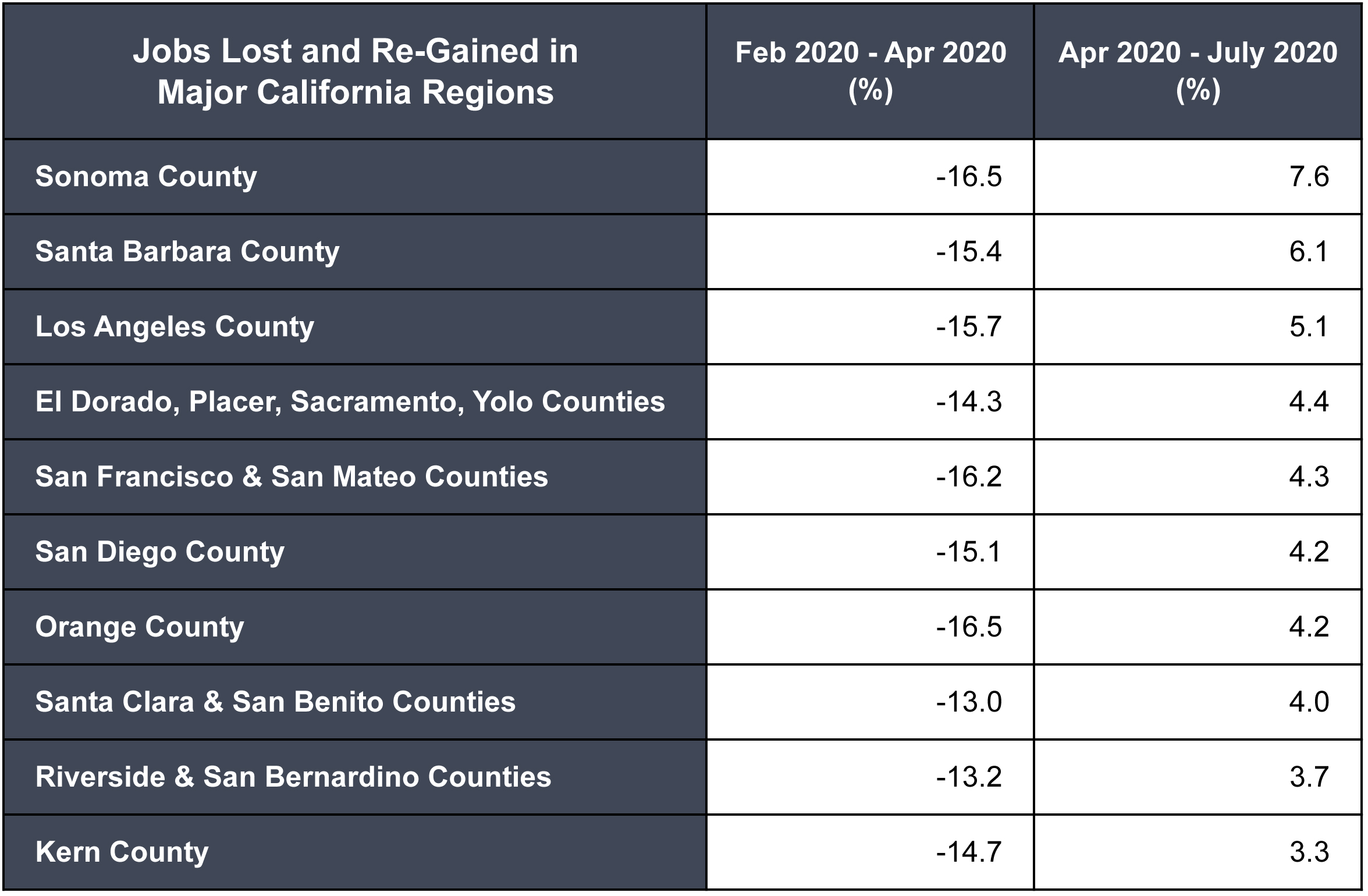

2.5 million California jobs were lost in March and April. Since May, 33 percent have been “recovered” while for the entire nation, 52 percent of jobs have been recovered to date.

We Are Moving Sideways . . .

by Mark Schniepp

August 21, 2020

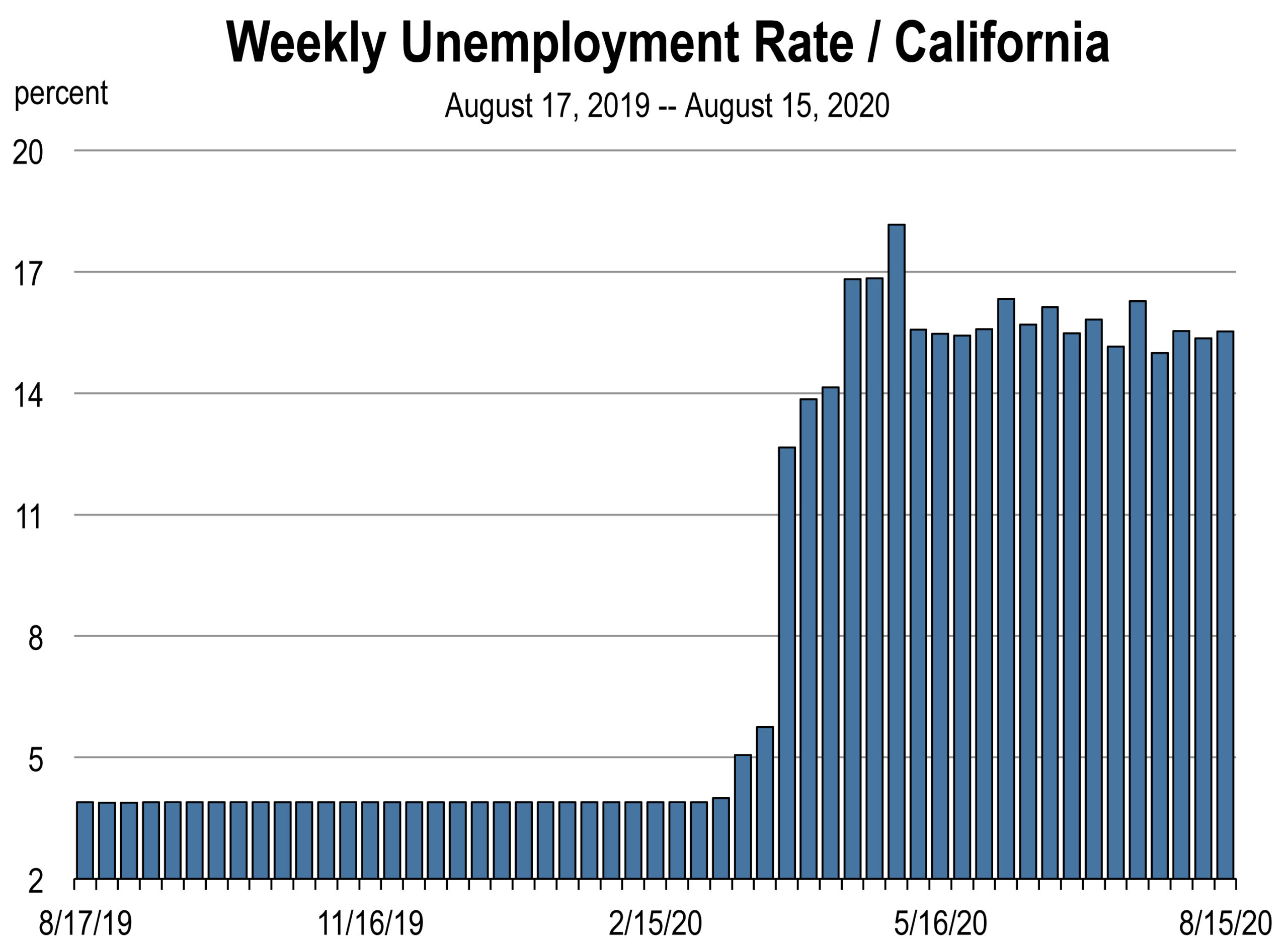

Unemployment remains high and the improvement in the nation’s labor market is marginal. In California, there was some improvement in July and less (if any) improvement in August.

And we should not expect much improvement in view of the static nature of re-opening businesses and economic activity here.

And we should not expect much improvement in view of the static nature of re-opening businesses and economic activity here.

The July report on the state’s labor markets shows some positive change from June. Conditions in all of the principal MSAs have remained largely unchanged.

For the state, there are 1.73 million fewer workers employed in July than a year ago. And the July rate of unemployment was clocked at 13.7 percent.

The estimate of weekly unemployment for the week ending August 15th was 15.5 percent. Our estimate does not suffer from some of the misclassification issues associated with how the monthly labor market survey counts unemployed workers.

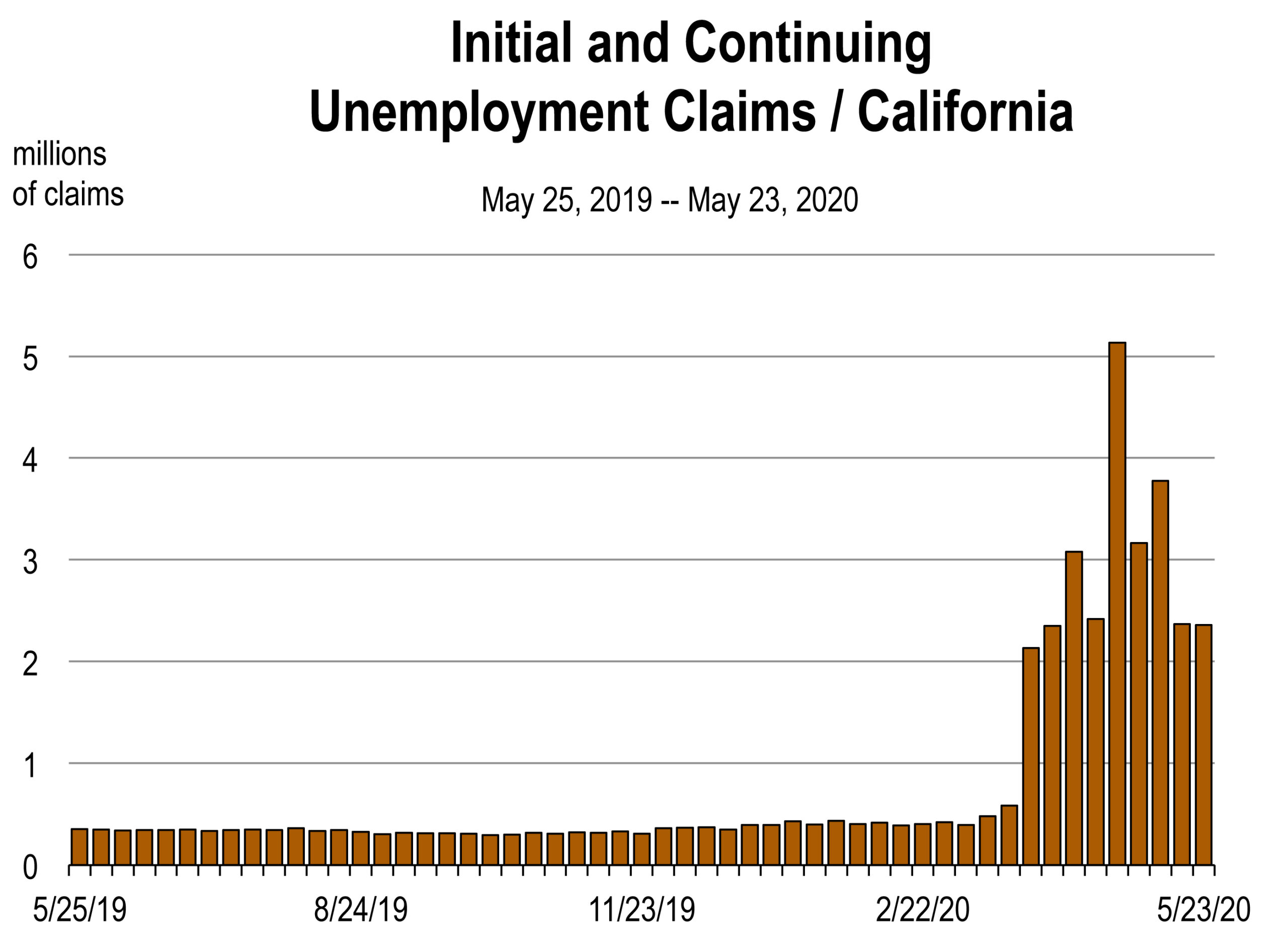

Today’s report showing the unemployment rate declining to 13.7 percent is misleading when the latest unemployment claims report (from last Saturday) shows that 3.1 million Californians are drawing unemployment benefits and this number has been virtually unchanged over the last 4 weeks.

California recipients of unemployment payments now represent 20 percent of the nation’s total, yet the state’s population represents just 12.2 percent of the nation. Clearly, the disproportionality of unemployment benefit distributions to Californians is due to a more restrictive economy here.

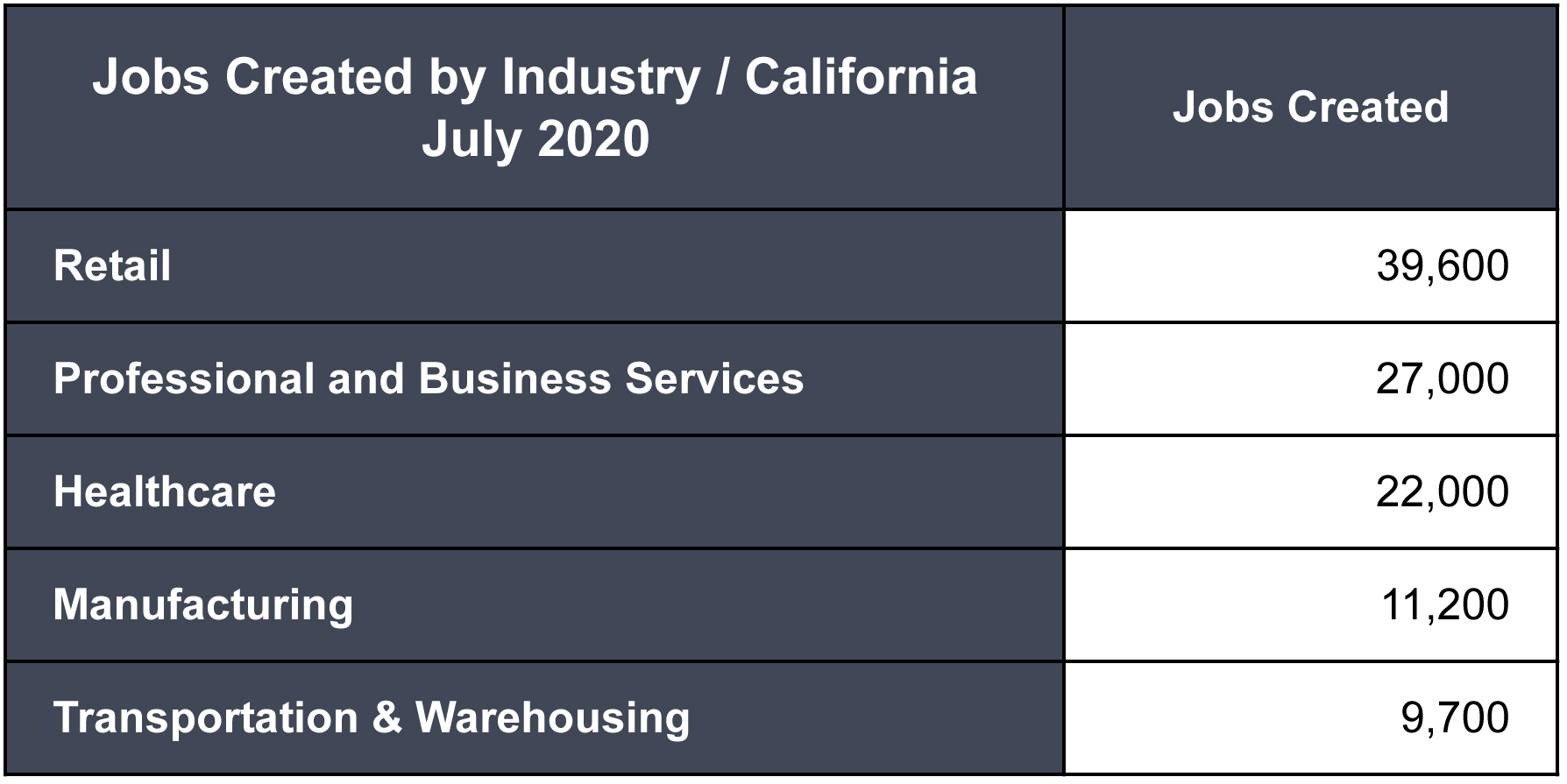

There were 129,000 jobs created in July from June in California. These are jobs in the private sector. The sectors with the largest gains were:

The increase in July employment at retail stores can be attributed to the re-opening of retail establishments in all counties and the increased business due to summer visitors.

Statewide, accommodation and food services showed virtually no improvement over July, because the reversals imposed in late June have limited restaurant service to outside dining only. This sector now employs 630,000 (or 30 percent) fewer workers than a year go, and remains the largest industry casualty of the pandemic.

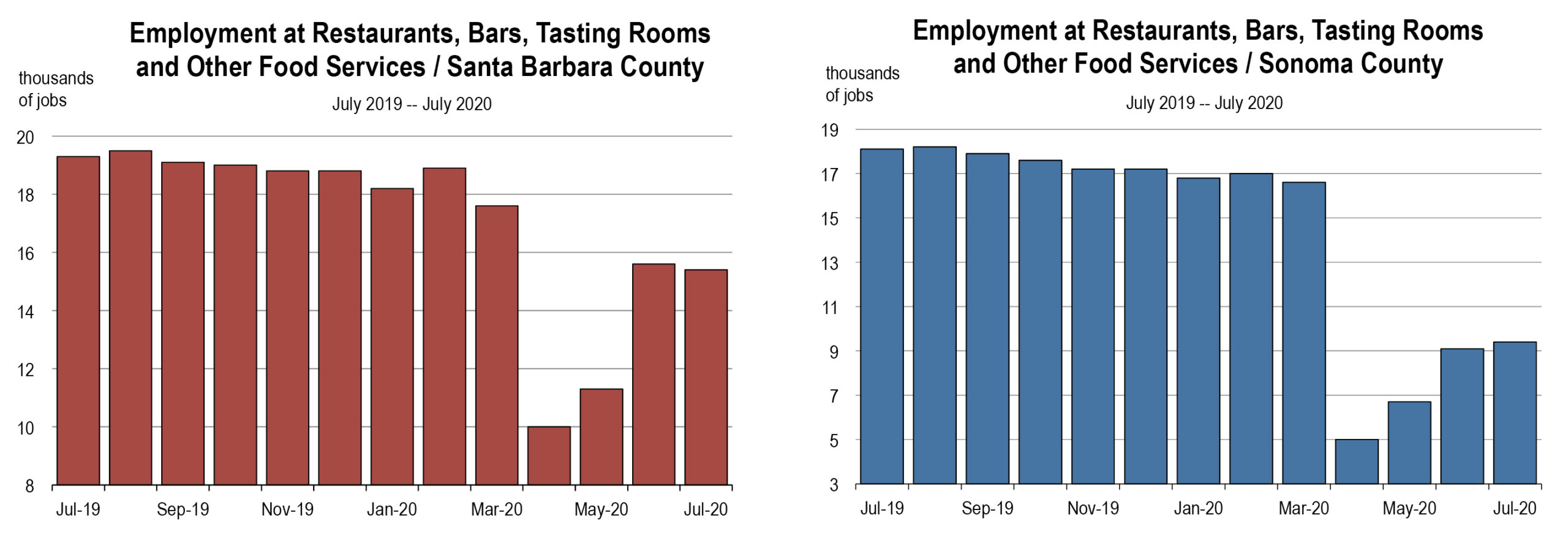

In some areas, however, the re-opening of wineries and bars has added a significant boost to local economic performance. The job markets in Santa Barbara and Sonoma Counties have recovered faster than most areas of California, and these regions also have prominent dining and drinking industries that are attracting visitors from Los Angeles and San Francisco.

State and local governments (excluding education) reported virtually no improvement in July compared to June. The current restrictions in California still limit government departments operating to essential functions only. So until this requirement is relaxed, it’s unlikely that the public sector (which schools all closed as well for the Fall semester) will help the overall state labor market recover.

California Housing Inventory is Approaching Record Lows

by Mark Schniepp and Ben Wright

August 20, 2020

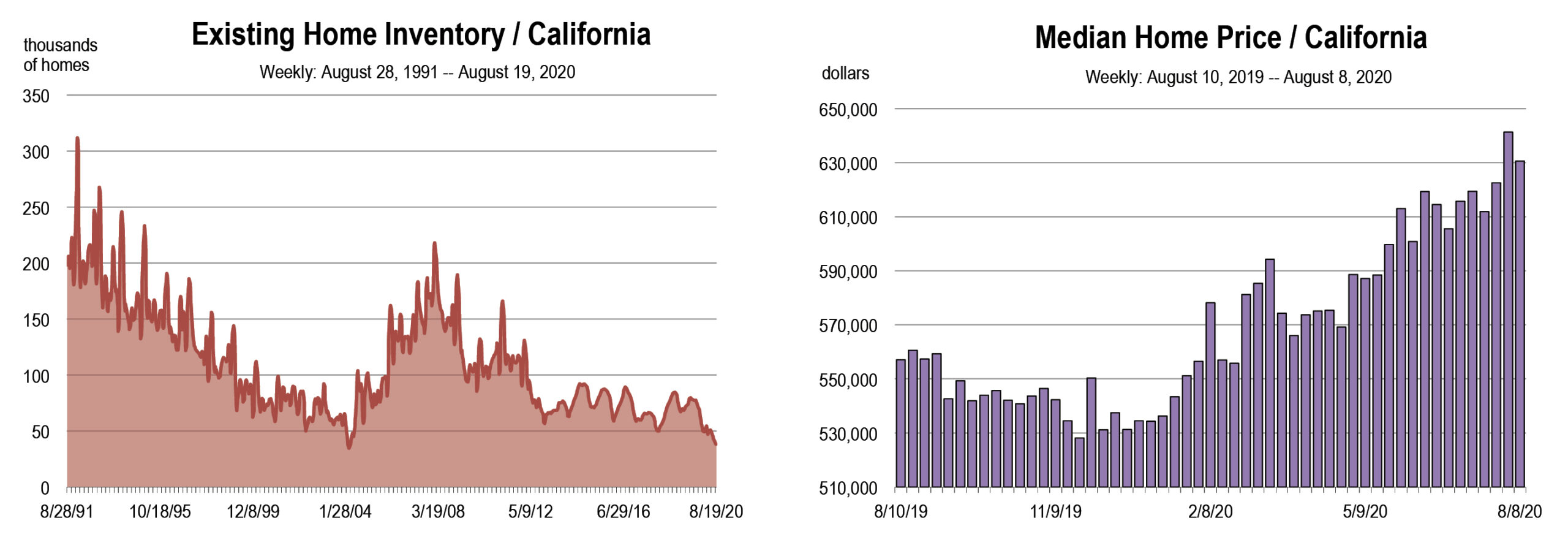

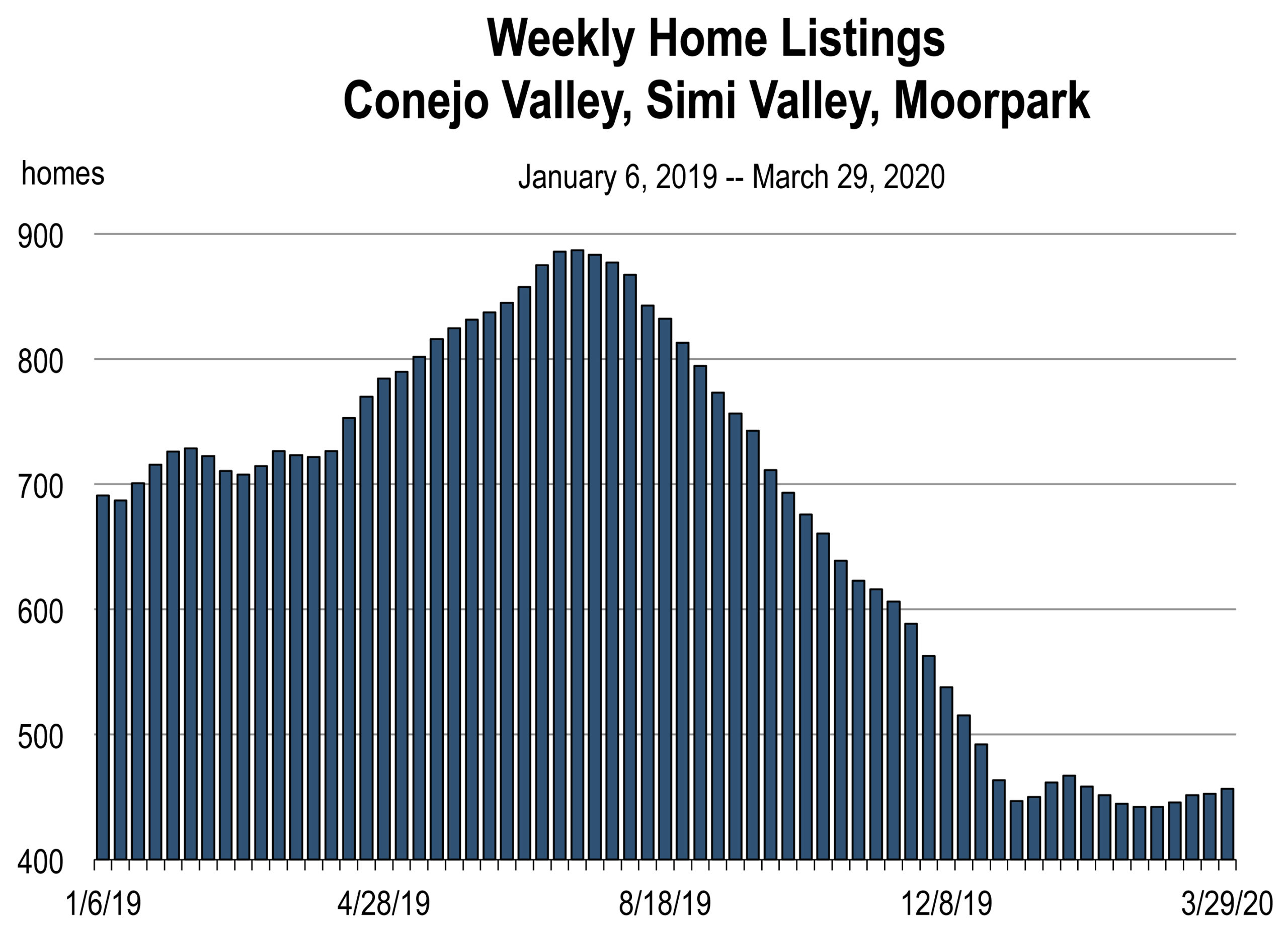

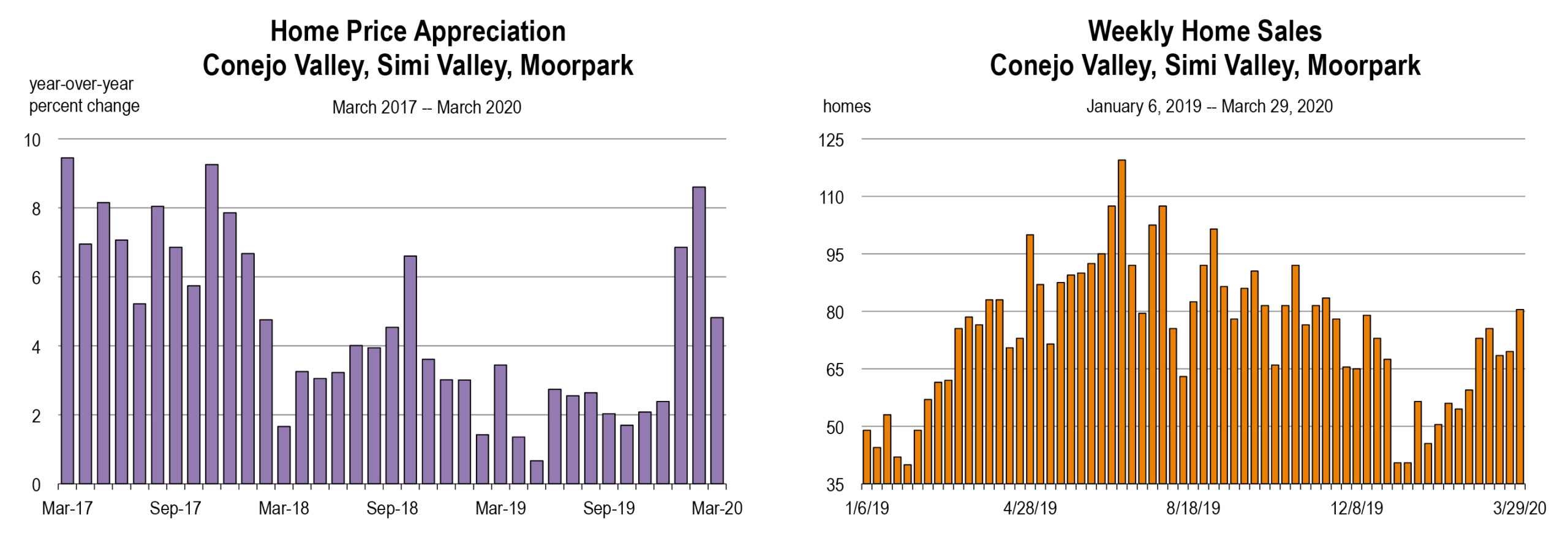

Despite a record decline in employment and massive uncertainty about where the economy is headed, housing prices are surging in most areas of California.

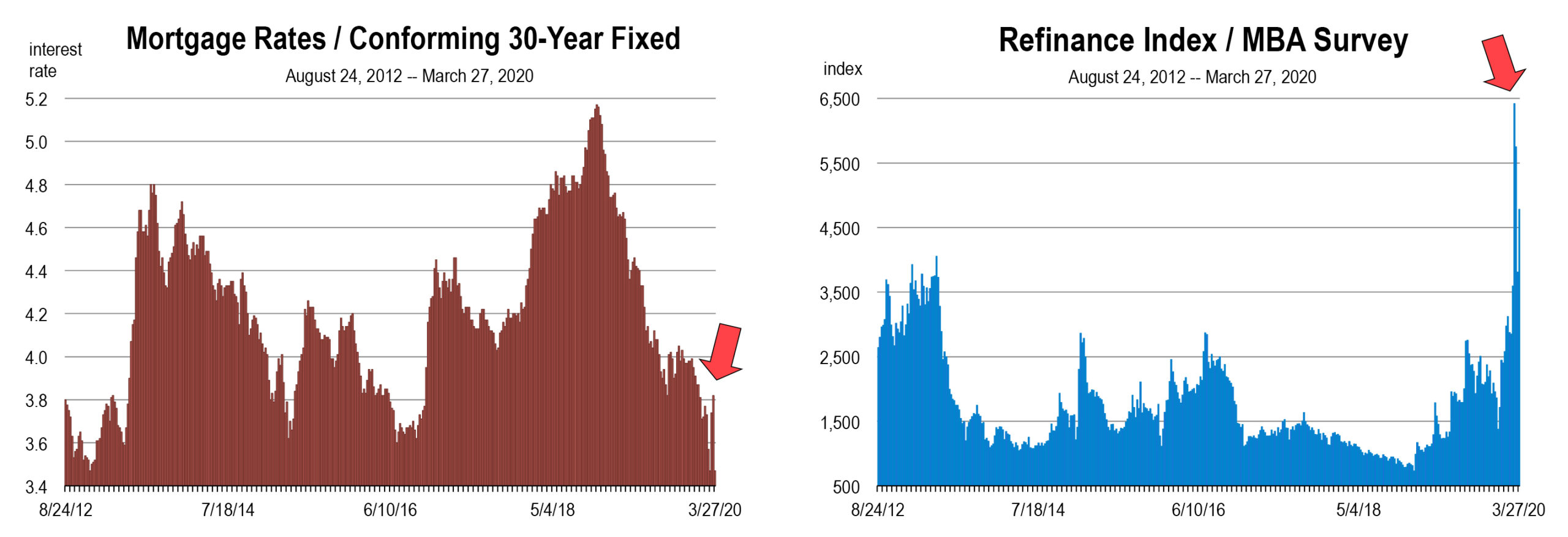

Why? Demand is high, interest rates are low, and there are fewer homes for sale than at almost any other time in the last few decades.

As of August 19th, 2020, there were 37,999 single-family homes for sale in California. Other than a brief period in the year 2004, housing inventory has never been sparser, creating a severe supply constraint.

House hunters are now forced to compete for a shrinking number of homes, giving sellers the opportunity to raise prices. And sellers have been taking advantage. Since the first week of January, the median price for a home in California has risen by 18 percent.

But because interest rates are also near record lows, the mortgage payment on the median priced home has increased by only 8 percent, meaning that fewer buyers have been pushed out of the market than headline data would suggest.

Earlier in the Coronavirus Crisis, we predicted that the housing market would be weighed down by massive unemployment, a record number of business closings, and the end of fiscal stimulus. However, there is no convincing data to suggest that housing has been traumatized by these events.

Weekly Economic Evaluation and the Unemployment Rate

for the Week Ending August 14

by Mark Schniepp

August 14, 2020

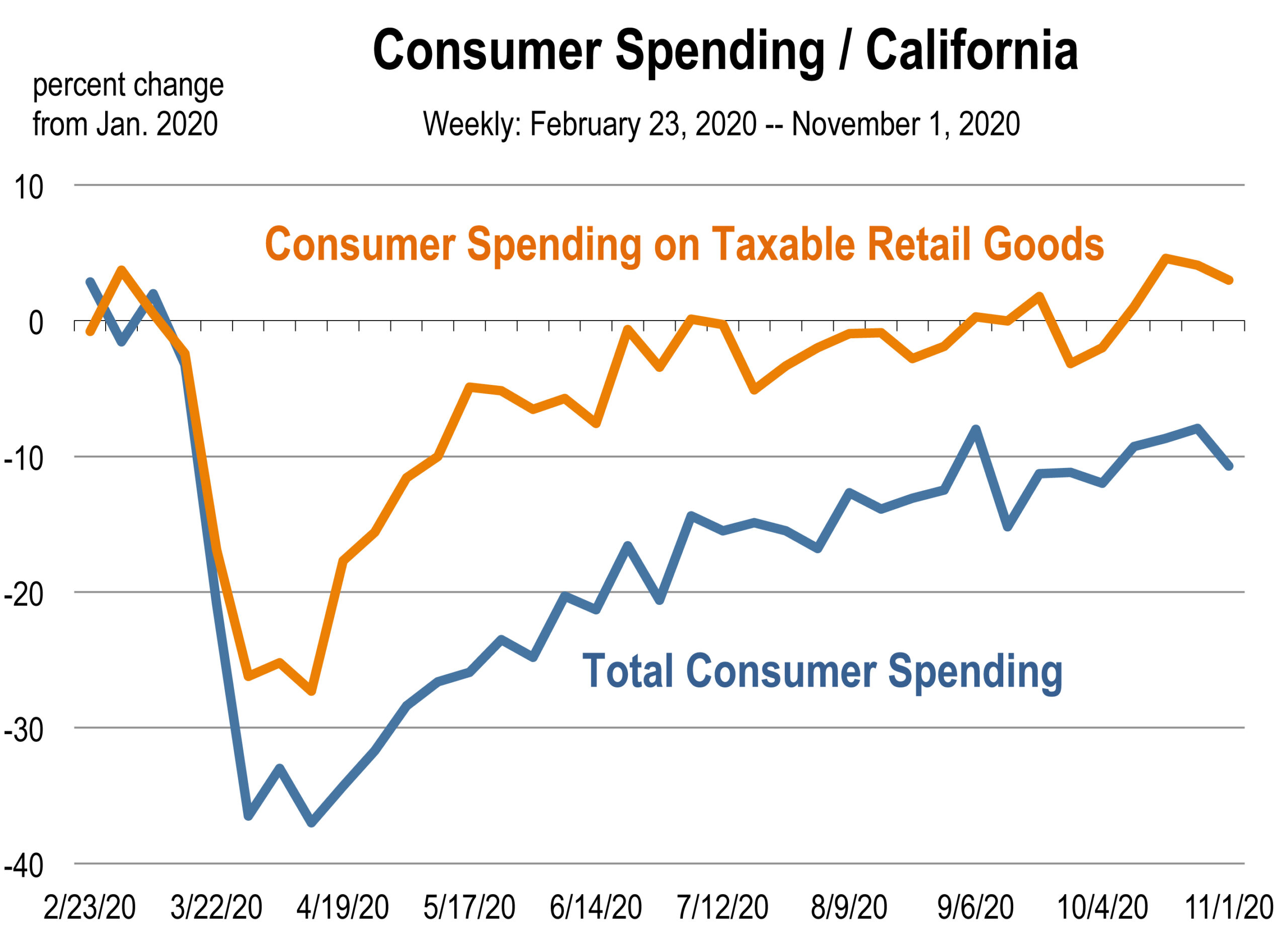

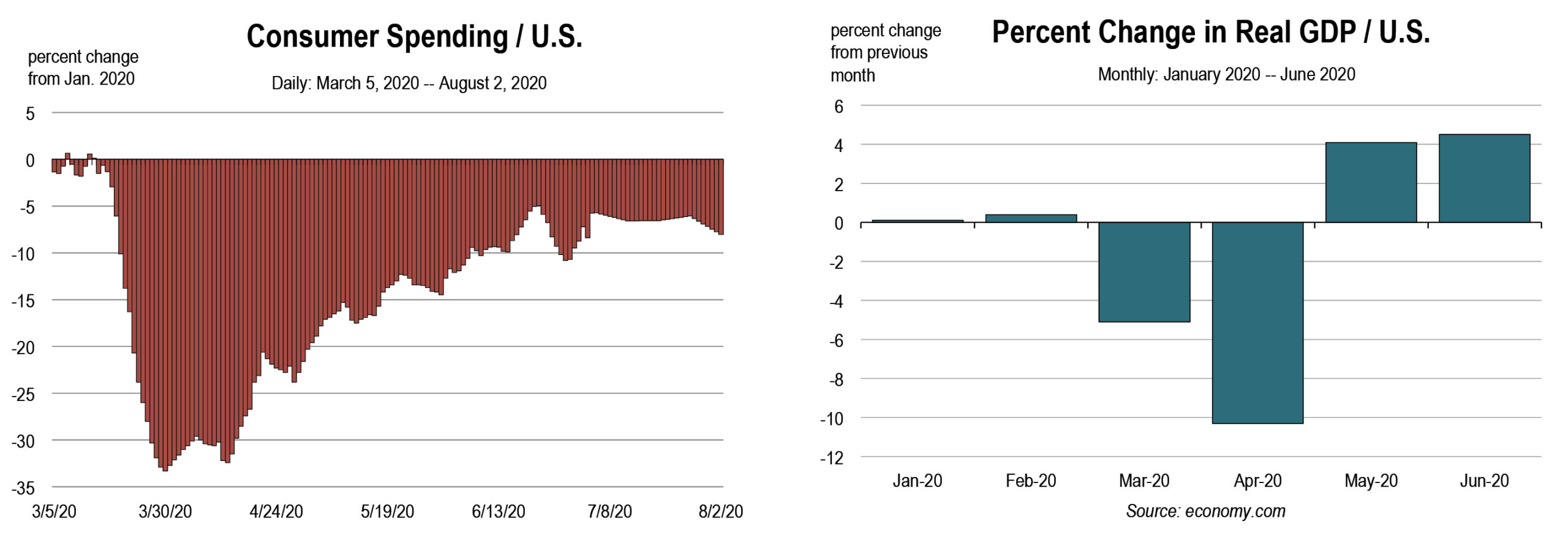

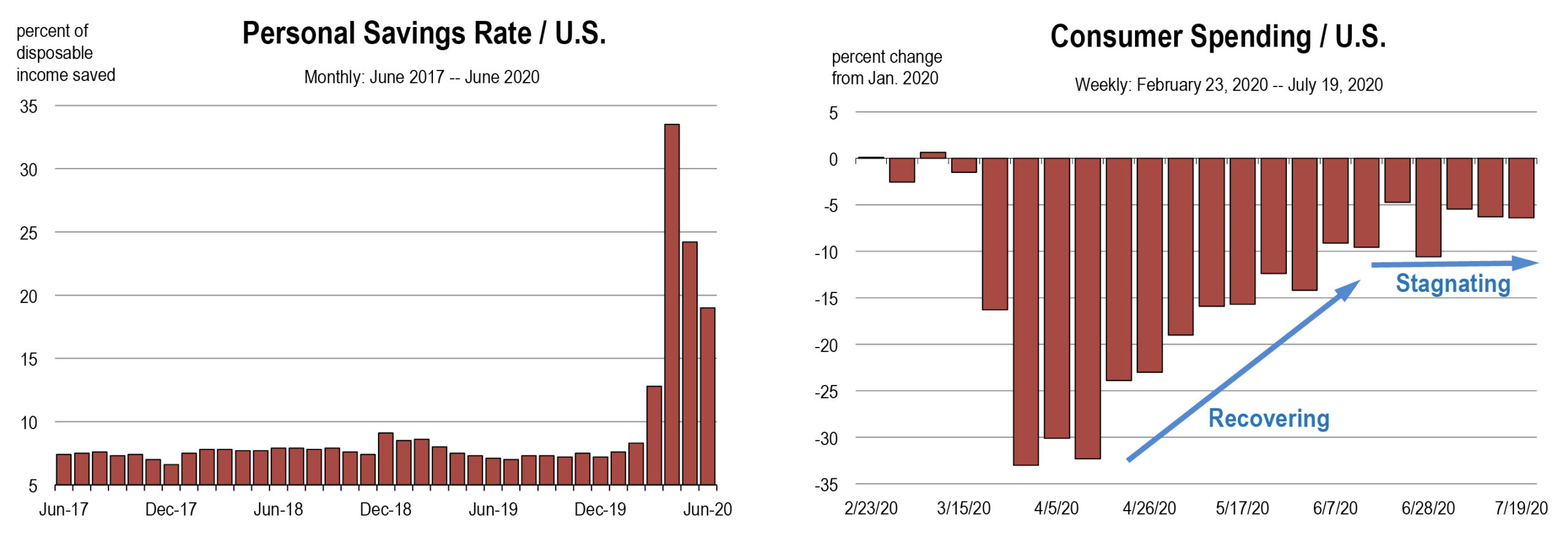

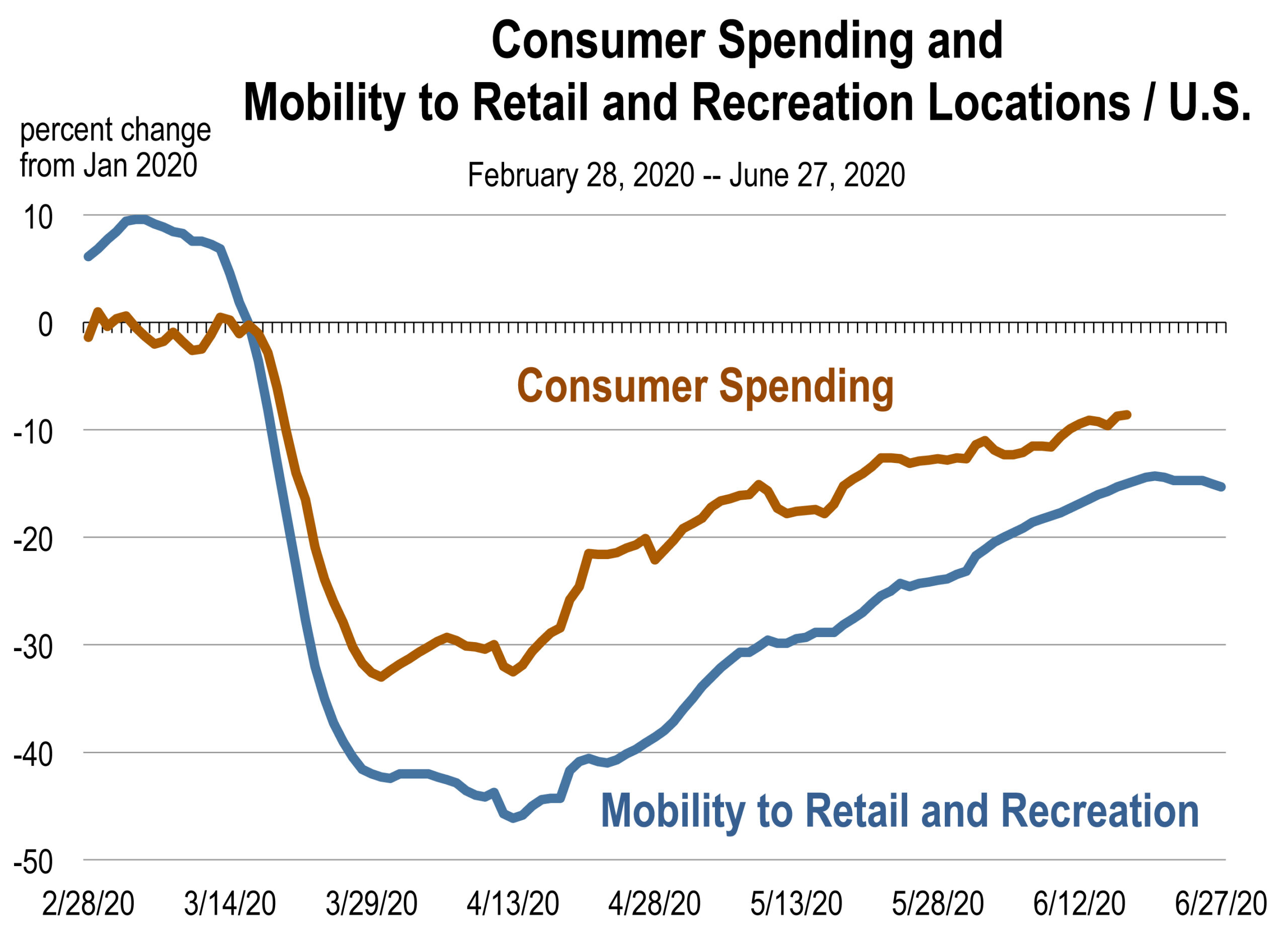

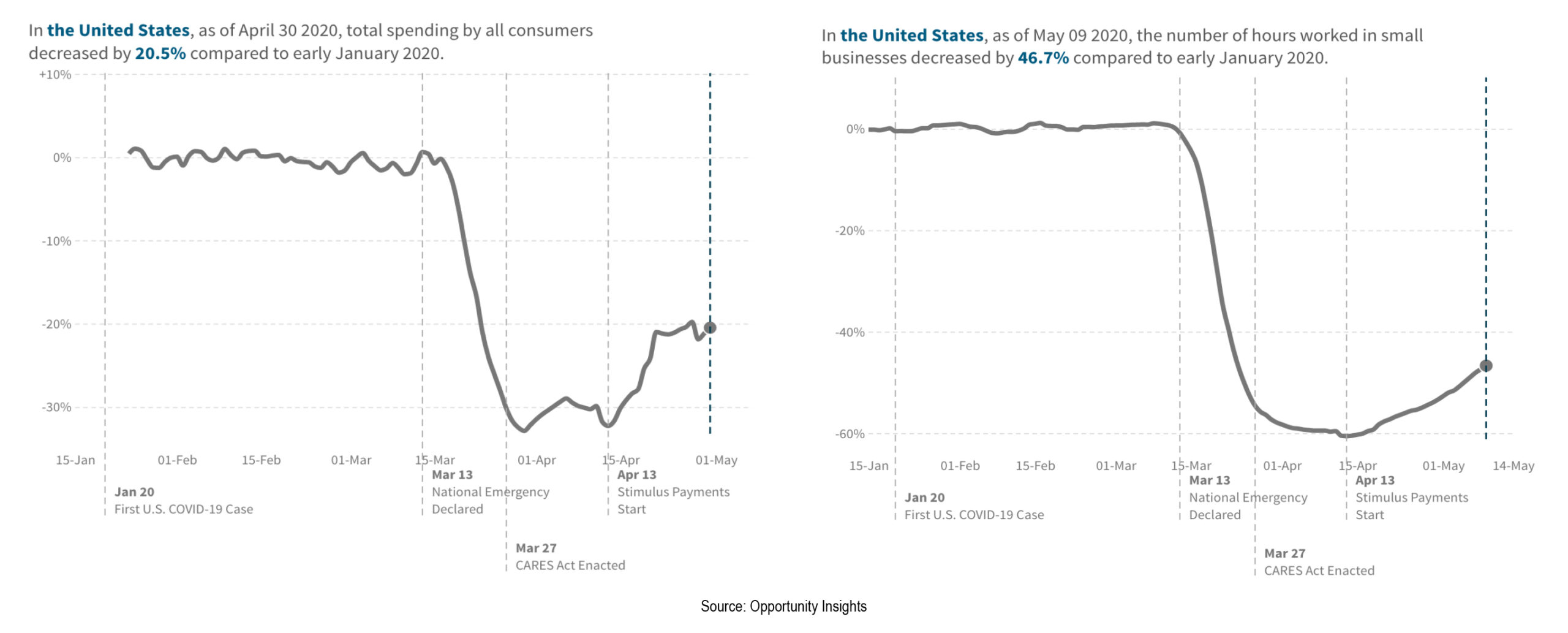

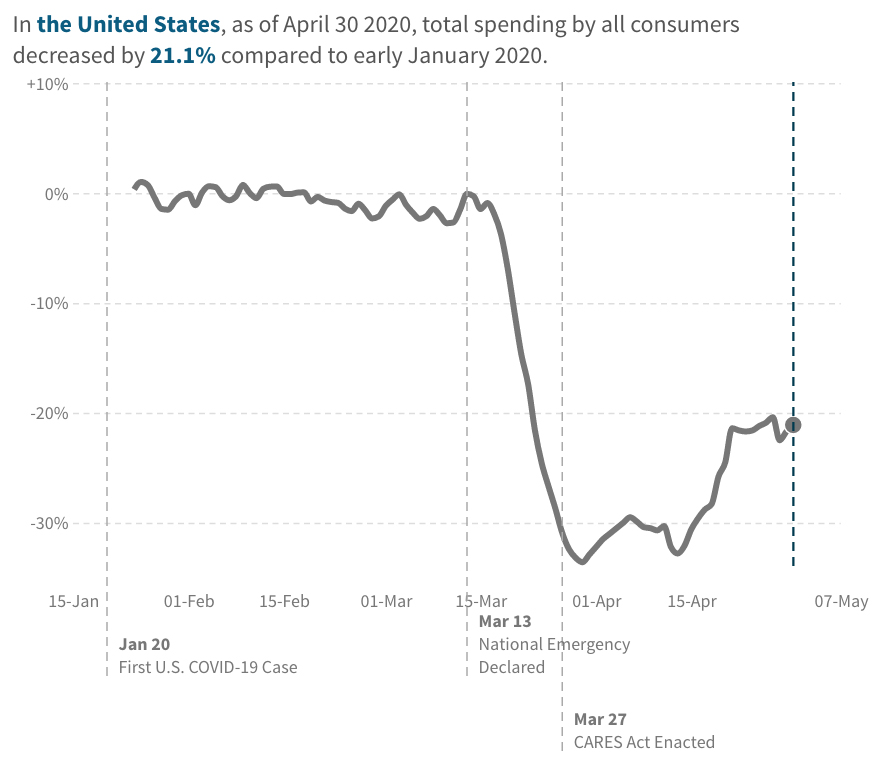

The states rolling back or pausing their reopening is principally contributing to the duration of elevated unemployment in the nation today. It has also resulted in a flattening of consumer spending growth from mid June through August 2.

While economic conditions are improving, the labor market being restored to pre-pandemic levels is going to lag many other indicators for the remainder of this year and very likely next year.

Americans are picking up their consumption and the monthly estimates for GDP through June indicate solid growth.

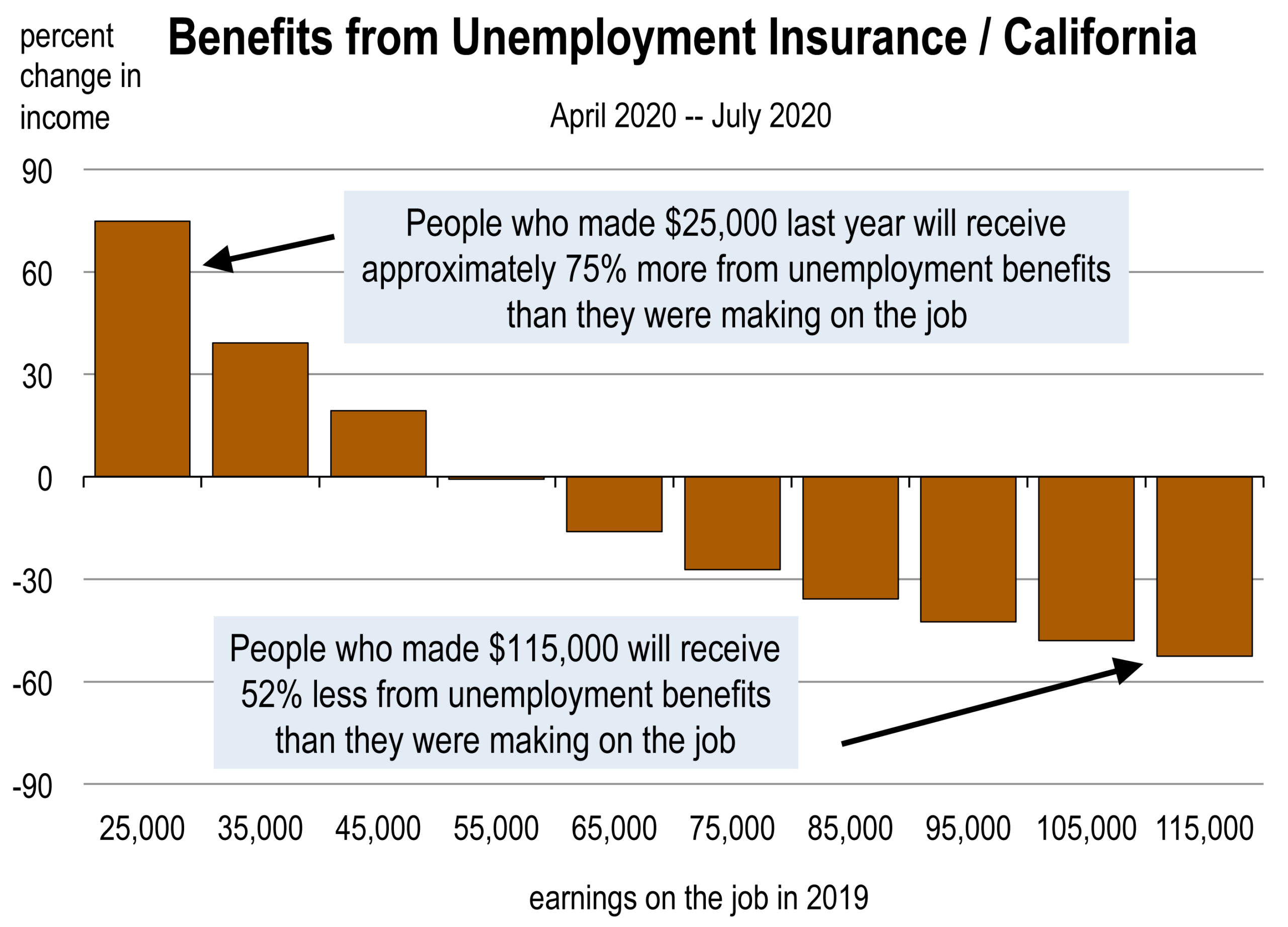

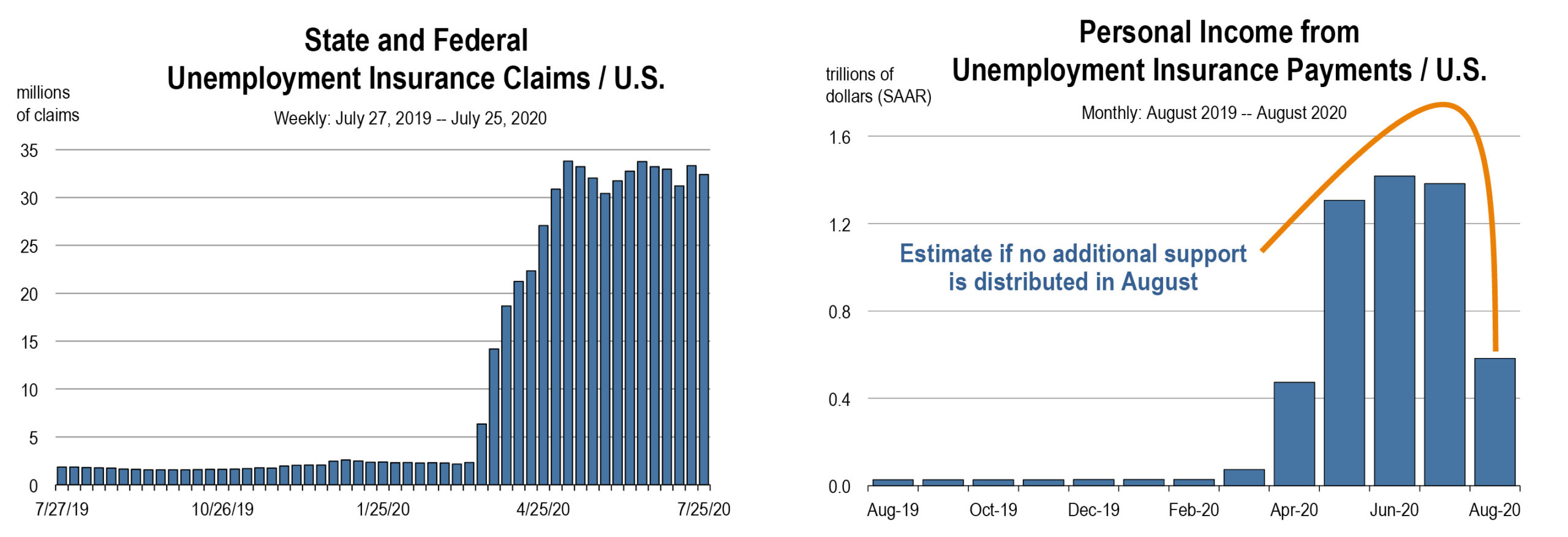

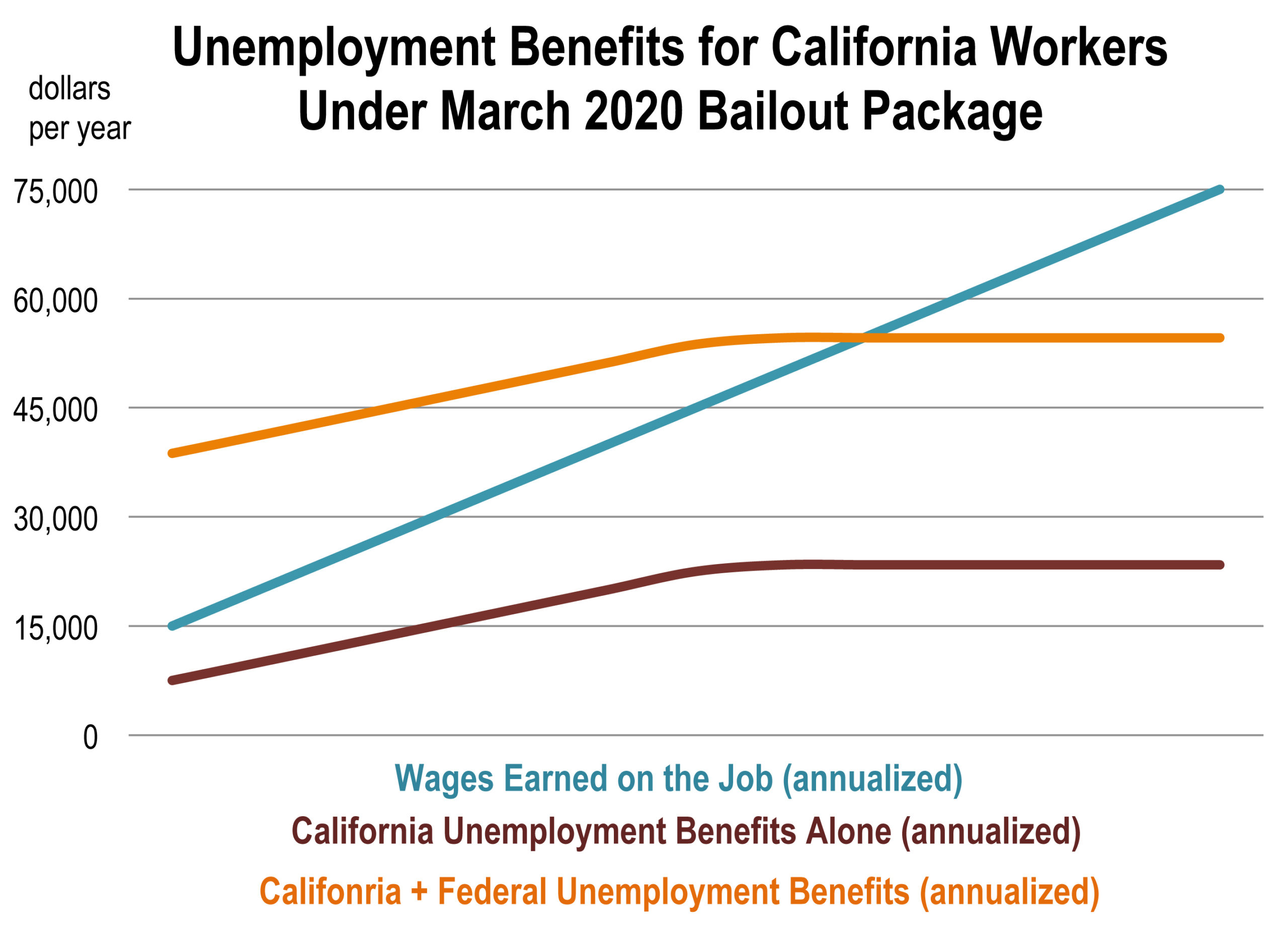

But because of reversals, and the end of the federal unemployment benefits on July 31, a drag on the growth in spendable income will occur going forward. The federal unemployment bonus payed from April through July supported consumer spending during that entire period.

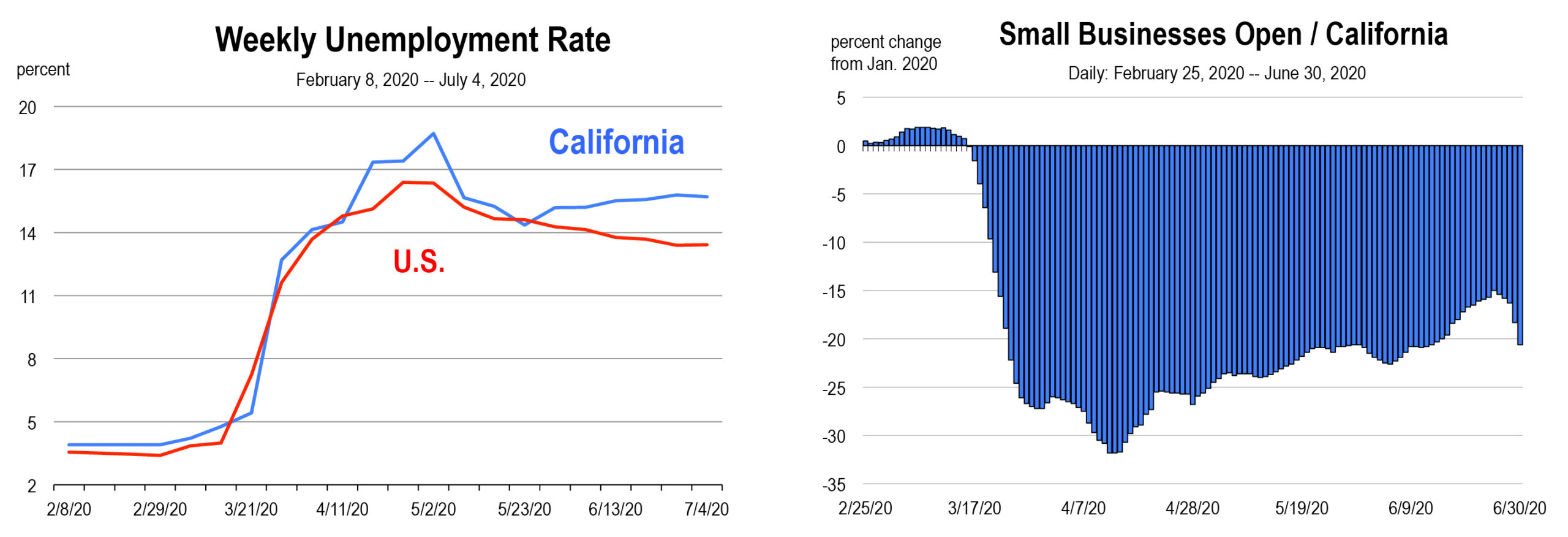

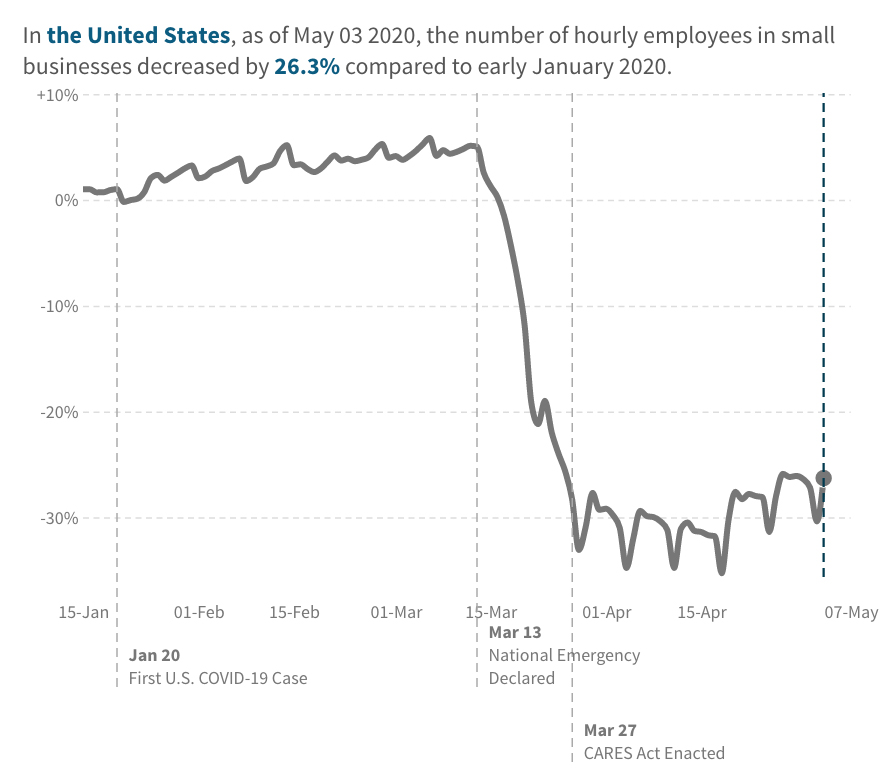

It also appears that through the end of July, the number of operating small businesses in the U.S. is now declining again, largely due to the interruptions in the reopening of economies throughout the nation. This is especially acute in California where the reversal in business openings has been the most severe.

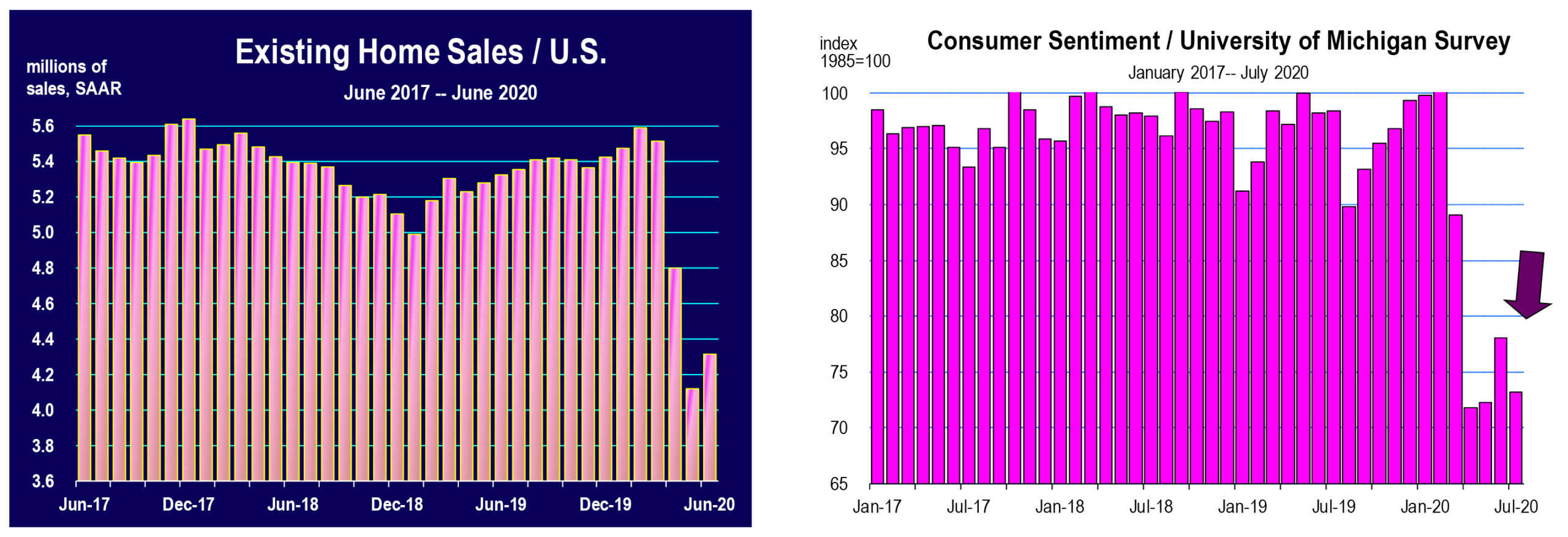

University of Michigan Consumer Sentiment for August has not improved. The index, which quantifies how consumers feel about the economy, remains near its cycle low. In the face of increased infections throughout the U.S. leading to business opening reversals, confidence in either present or expected economic conditions is not rising.

Another coronavirus relief bill is likely, not this month but in September, and likely smaller than the first. However, the absence of stimulus in August will weigh down GDP growth and hiring.

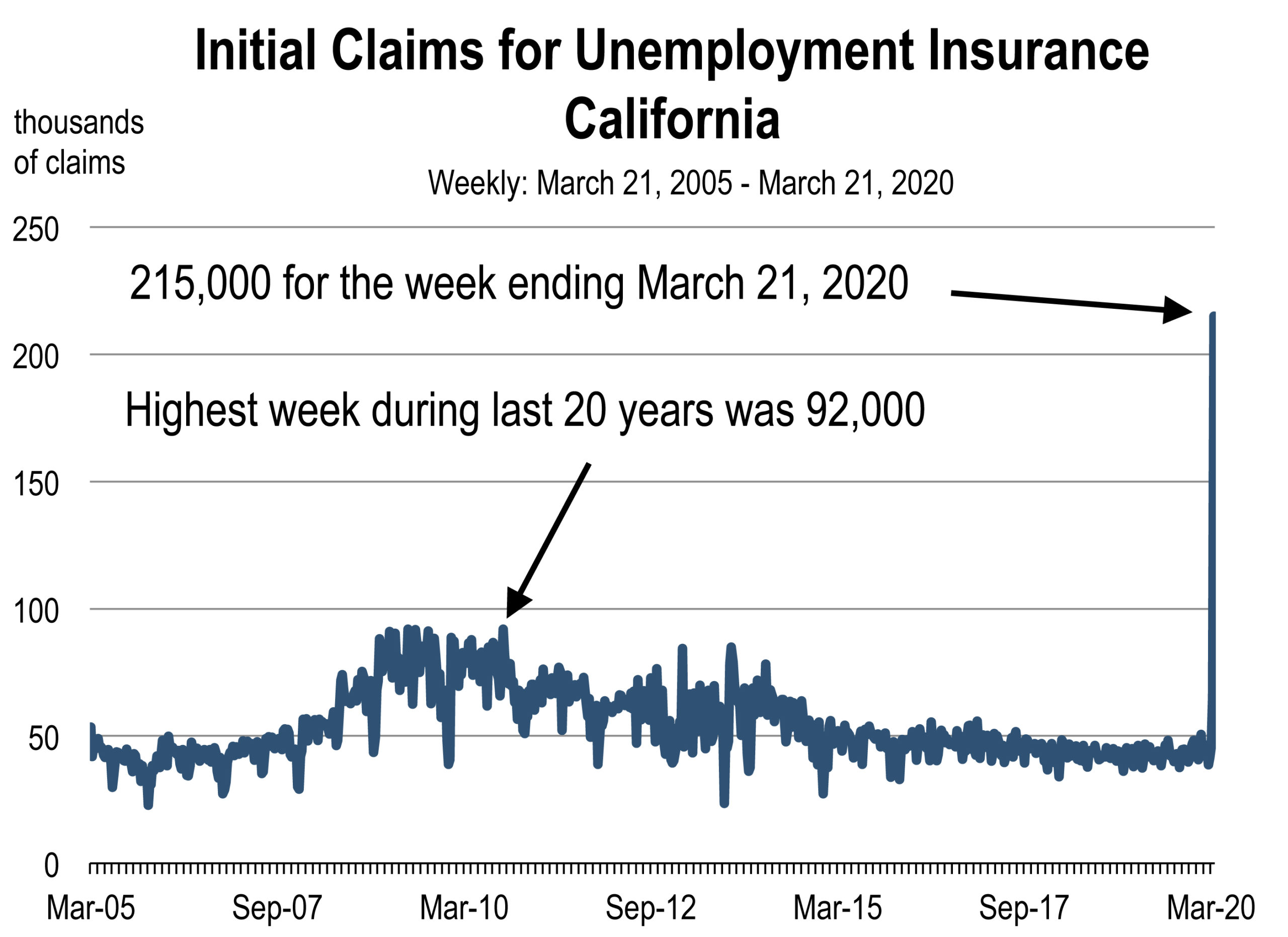

The pace of hiring has already moderated. And unemployment benefit recipients remain very high. Unemployment insurance claims are improving gradually in the nation, but not so in California, which still represents the most business-restricted state in the nation.

Initial claims for unemployment insurance declined slightly in California in the latest week ending last Saturday, but the number of people with continuing claims for unemployment rose by 200,000, pushing the weekly unemployment rate over 16 percent again. Nationally, the weekly unemployment rate has fallen under 12 percent.

Lack of Congressional Action Just Sent Us Over the Fiscal Cliff

by Mark Schniepp and Ben Wright

August 3, 2020

Congressional delays in legislating a replacement rescue measure just sent us over the fiscal cliff and 32 million people will lose their federal unemployment payments. Total personal income will decline by 4% over the course of a week, which is a meaningful number. For perspective, personal income fell by only 8% during the entire 2008-2009 recession.

Will consumer spending also decline by 4%? Probably not. A high share of those $600 payments were saved, not spent, and many households probably have at least a month of savings. Some people will return to their jobs now that they can’t earn a sustainable income while staying at home, but job postings have tumbled since late June in tandem with a new round of business closures in many states, including California, so there may not be many jobs to return to.

Considering all the evidence, it’s hard to imagine that consumer expenditures will continue to rebound. It’s not clear what the next rescue bill will include, or when it will become law, effectively leaving unemployed workers hanging in the lurch. The uncertainty of when their next paycheck will arrive will cause people to tighten their belts and spend less.

At this point in the recovery—if we are still in a recovery—any decline in spending will be tough for the economy to absorb, especially when economic growth was already stagnating.

How much runway do we have before we relapse into another broad economic contraction? We are monitoring the weekly and monthly economic indicators and they don’t look great. Every week that passes without a worker aid package pushes us closer towards a double dip recession, if a double dip hasn’t already begun.

The Recovery Remains Shaky

by Mark Schniepp

July 23, 2020

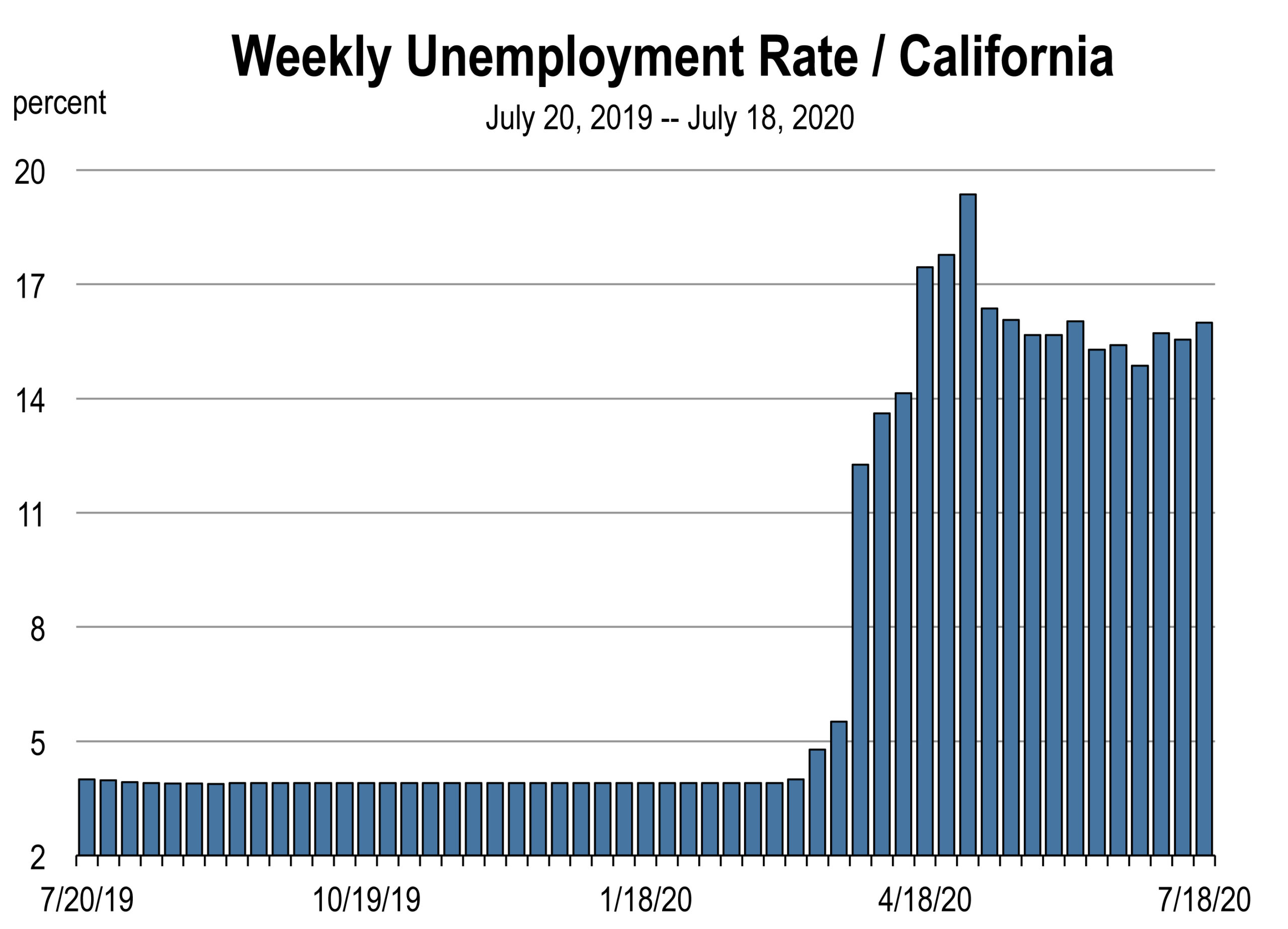

The weekly unemployment rate for California continues to push higher after initial claims for unemployment benefits by wage and salary workers rose by 8,000 in the week ending July 18, 2020.

The weekly unemployment rate for California continues to push higher after initial claims for unemployment benefits by wage and salary workers rose by 8,000 in the week ending July 18, 2020.

There are now 5.4 million workers drawing unemployment insurance benefits in California, an increase of nearly 500,000 from the previous week. Most of this increase was observed in the Pandemic Unemployment Assistance claims filed by non W-2 workers (self employed and contractors).

The unemployment rate is now at the highest level since the economy reopened in mid-May. The recent shutdown of indoor restaurants, gyms, museums, and personal services has contributed to rising claims.

The national unemployment rate for the week ending July 18 remained constant at 12.6 percent. There are 31.9 million workers now either receiving unemployment insurance or who have just filed for benefits. In the latest report, fewer non W-2 workers are receiving benefits as the greater U.S. economy struggles to improve. However, it is dragged down by the reversal of many state reopening plans including California.

The index of leading indicators improved in June, rising 2 percent. The increase was the result of diminishing claims for unemployment during the month and a rising stock market.

Existing home sales rose 21 percent in June, rebounding sharply from the month of May when sales declined 10 percent.

Consumer sentiment declined this month, probably due to the pauses and reversals in the reopenings of state economies throughout the nation. The twice a month survey by the University of Michigan indicates that consumers have soured on how they expect economic conditions to evolve this year. COVID-19 remains a wildcard for how the economy will create meaningful opportunities for jobs, income growth, and activities for spending.

California Reverses / Unemployment Rises

by Mark Schniepp

July 16, 2020

On July 13, The Governor ordered the closure of bars, movie theaters, museums and all indoor operating restaurants in California. Indoor places of worship, fitness centers, hair salons, barbershops, malls, casinos and zoos were also ordered to shut down in 30 counties which represent 90 percent of the population.

San Francisco Chronicle, July 13, 2020, online

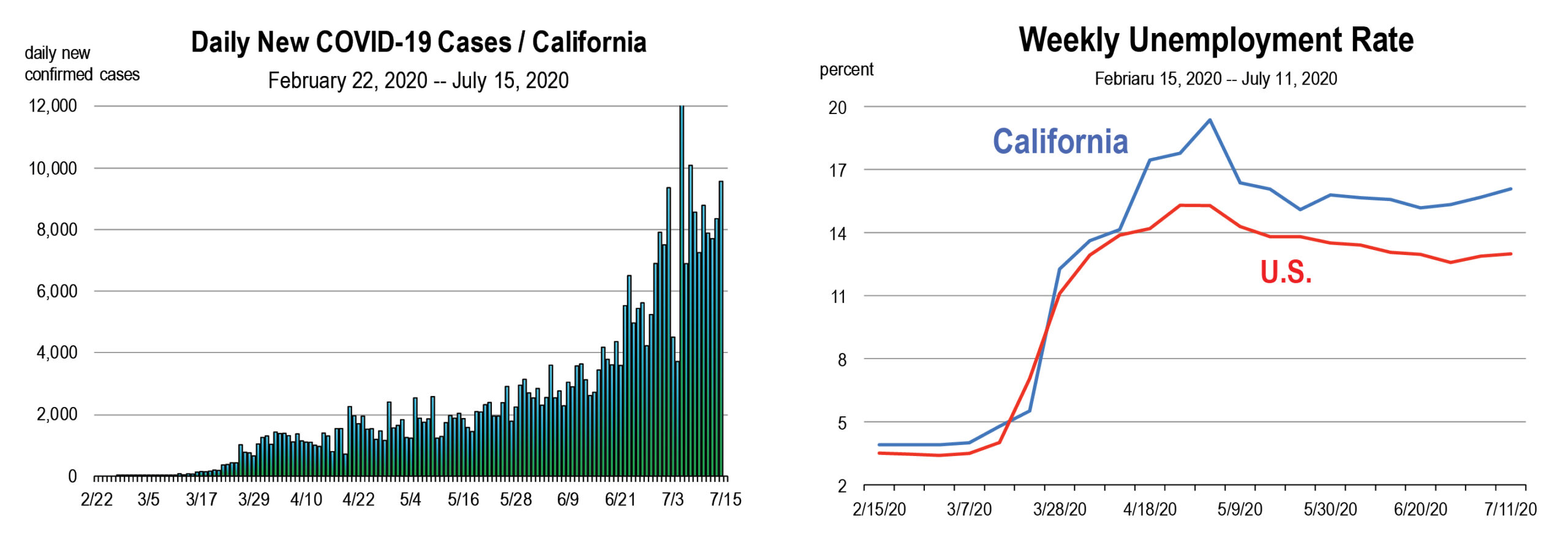

This is in response to generally rising daily COVID-19 cases throughout the state since Memorial Day.

The new order reverses California’s opening of commerce that has been gradually underway since mid-May in most counties. Though limited, we have been observing improvement in the economic indicators for the state in late May and during the month of June.

However, claims for unemployment insurance by laid off workers and workers whose hours have been dramatically reduced have been generally rising over the last few weeks. The closures will intensity new claims for unemployment this week and interrupt the limited progress being made in the state’s labor market.

Based on initial and continuing unemployment insurance recipients through July 11, the estimated weekly unemployment rate has increased to 16.4 percent, up from 15.7 percent in the previous week.

Nationwide, the estimated unemployment rate is 13.0 percent, about the same as it was in the previous week.

California currently is subject to the most restrictive conditions in the nation regarding the opening of the economy. As of July 16th, restaurants are closed except for outside seating in California. This is also true for only 4 other states. Hair salons are closed and only in California. Houses of Worship are closed and only in California and Washington. Gyms are closed in California and in 6 other states. For the rest of the nation, all commerce (other than large public gathering events) is largely open.

The reversal is devastating to consumer confidence. Closing down the economy again, warranted or not, broadcasts the notion that the pandemic is out of control and dangerous. This causes consumers to retreat further from their spending patterns, sentencing the economy to an extended period of recession and eventual recovery.

Nearly in tandem with the new shutdown orders and renewed layoffs of workers this week is the expiration of the federal $600 weekly unemployment insurance bonus on July 31st. Consequently, another fiscal rescue is needed for California workers, but is unlikely to occur.

Labor Market Improvement is Set Back by Renewed Shutdowns

by Mark Schniepp

July 9, 2020

The lack of significant improvement in the nation’s unemployment totals likely reflects the pausing or reversal of re-opening plans in some states and California counties. This is in response to rising daily COVID-19 cases.

And the increase is due principally to the resumption of businesses opening during the last half of May and early June throughout the nation. The protests around the nation from late May and through much of the month of June are also said to be responsible for the current uptick in cases.

Unemployment insurance claims fell in the most recent report (for the week ending July 4) in both the U.S. and California, but the reductions were slight. If the current outbreaks lead to further lockdowns of business in counties and states, then regional economies will struggle and small businesses will close, leading to a resurgence in layoffs.

Right now, we estimate the unemployment rate in California at 15.7 percent. For the nation, our unemployment insurance claims model predicts at rate of 13.4 percent for the week ending July 4th.

There are now 21 percent fewer small businesses open in California than there were in January of this year. Progress was being made since the low point in mid-April but the recent mandatory shutdowns of bars, wineries, breweries, dine-in restaurants, and theaters in 26 Counties has resulted in a meaningful closure of small businesses over the last week.

Closures lead to layoffs. Layoffs lead to UI claims. They also lead to lower spending by households which further causes business closures. The overall result is a downward spiral.

Real-Time Economic Data is Becoming More Worrisome

by Mark Schniepp and Ben Wright

July 2, 2020

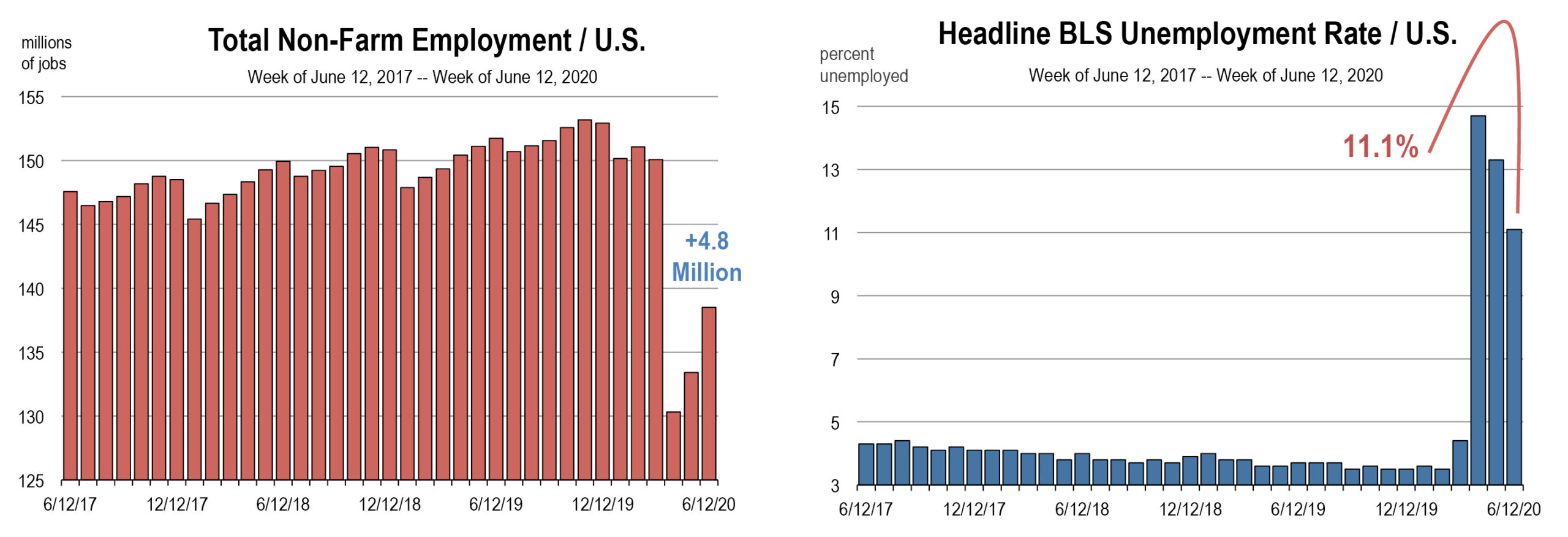

The June labor market report form the BLS showed millions of job gains and a falling unemployment rate. The improvement in June occurred as total employment increased by 4.8 million jobs, the largest monthly gain in job creation in the history of recorded data.

The increase is due principally to the resumption of businesses opening during the last half of May and early June throughout the nation.

But monthly data has become a lagging indicator and does not always capture current economic conditions.

As we reported last week, we are becoming increasingly concerned about the outlook for August and September, and real-time evidence suggests our concerns are warranted.

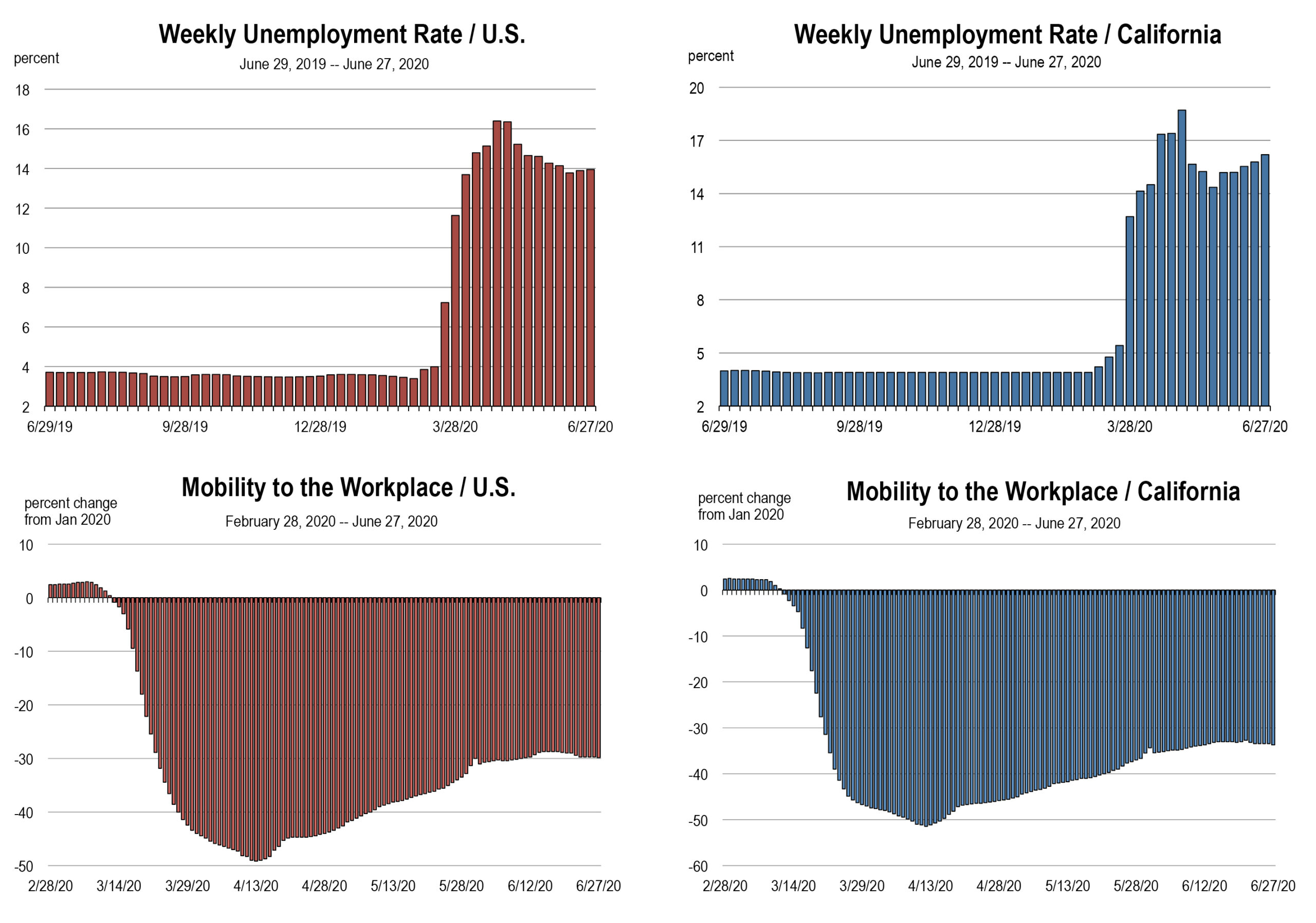

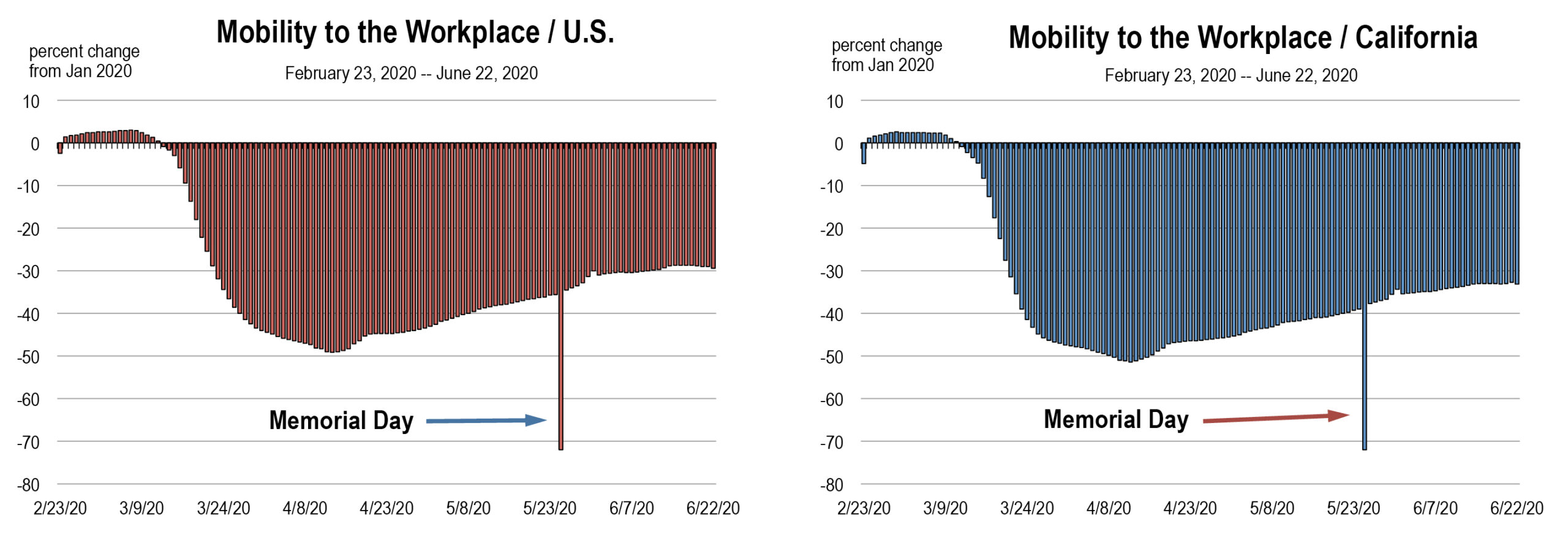

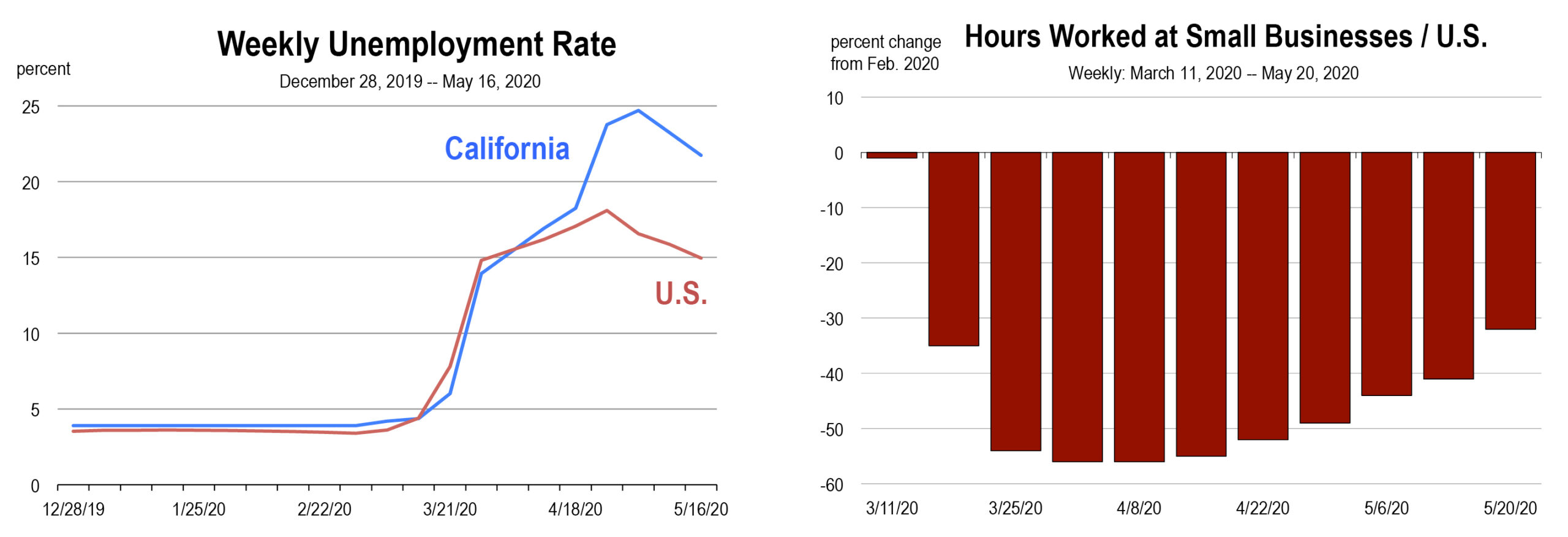

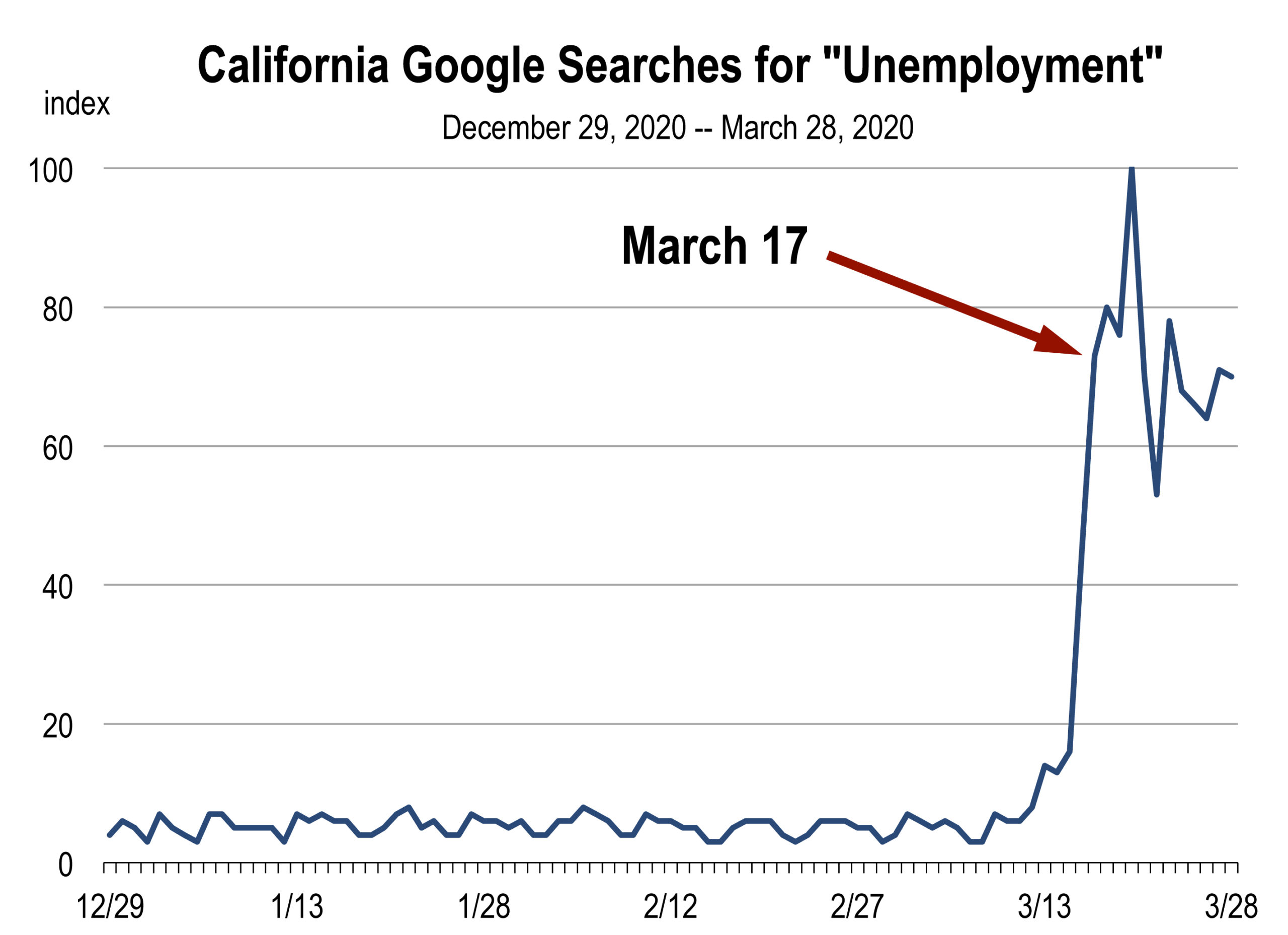

The California unemployment rate that we estimate each week has been rising for over a month, and now the U.S. rate is increasing too. Cell phone tracking data indicates that fewer people were commuting in late June compared to late May.

Cell phone tracking data has been an accurate predictor of consumer spending, and people are now taking fewer trips to stores, hotels, restaurants, and other retail/recreational locations. Reduced spending is likely to follow.

Why is the data turning negative? There are a number of reasons contributing to this and the most obvious is the partial re-closures of businesses in Arizona, Colorado, Texas, Florida, Michigan, and California. Furthermore, some consumers are growing more worried about the rising infection rate and are choosing to isolate themselves.

Then there is the growing awareness that the economy is about to hit an income cliff when the federal bonus of $600 per week in unemployment benefits expires at the end of July. After this month, unemployed workers will have much less weekly income available for spending.

Finally, firms can now use the Paycheck Protection Program loans for expenses other than wages and salaries. As a result, there is less of a rush to restore workers (until they are needed) and more of an incentive to pay other expenses. Therefore, hiring could decrease in July unless the recent orders to re-close businesses are removed and consumers increase their spending.

We will keep you posted as new information becomes available.

Total Effective Unemployment is Much Higher than Reported

by Mark Schniepp and Ben Wright

July 2, 2020

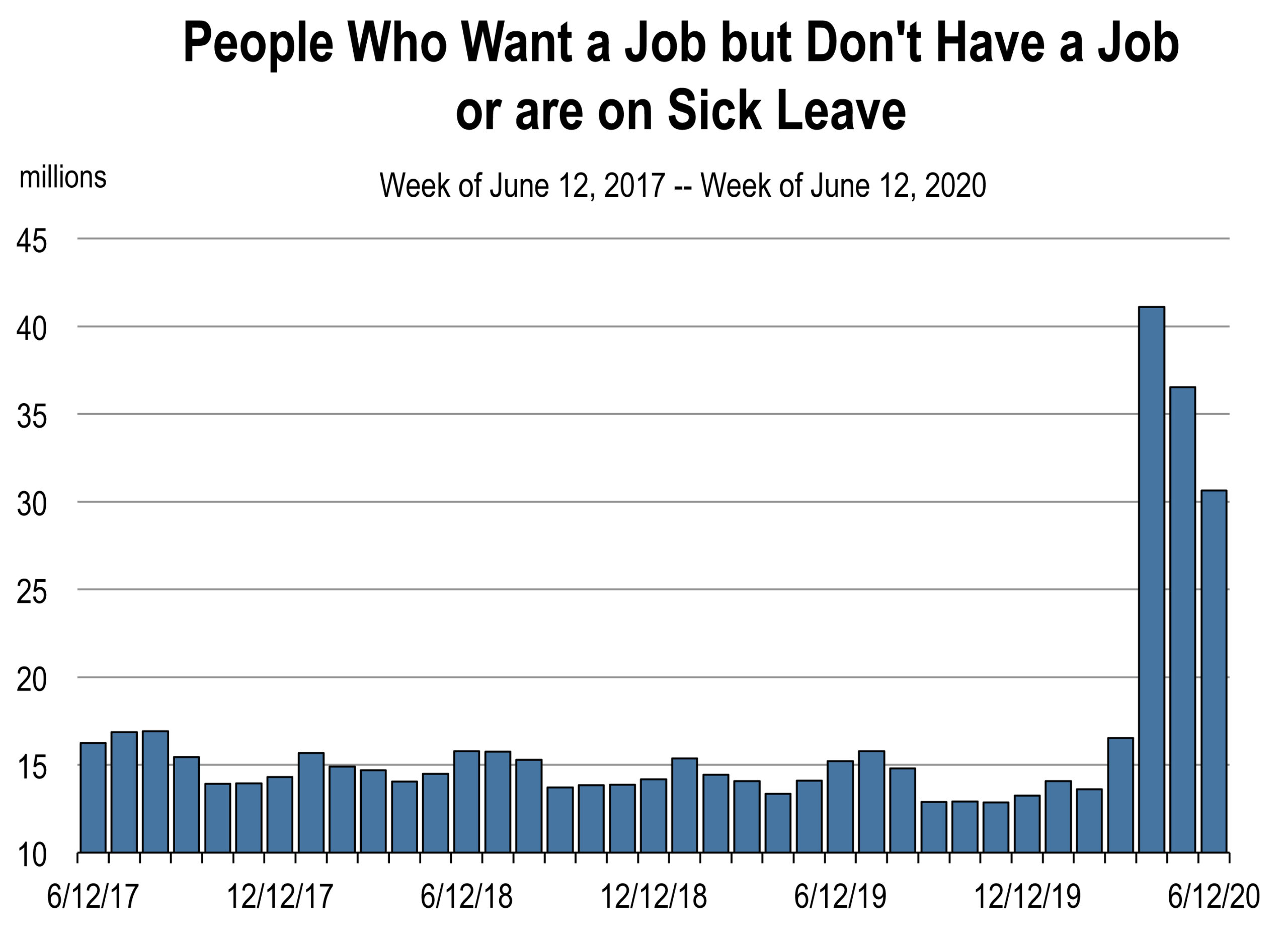

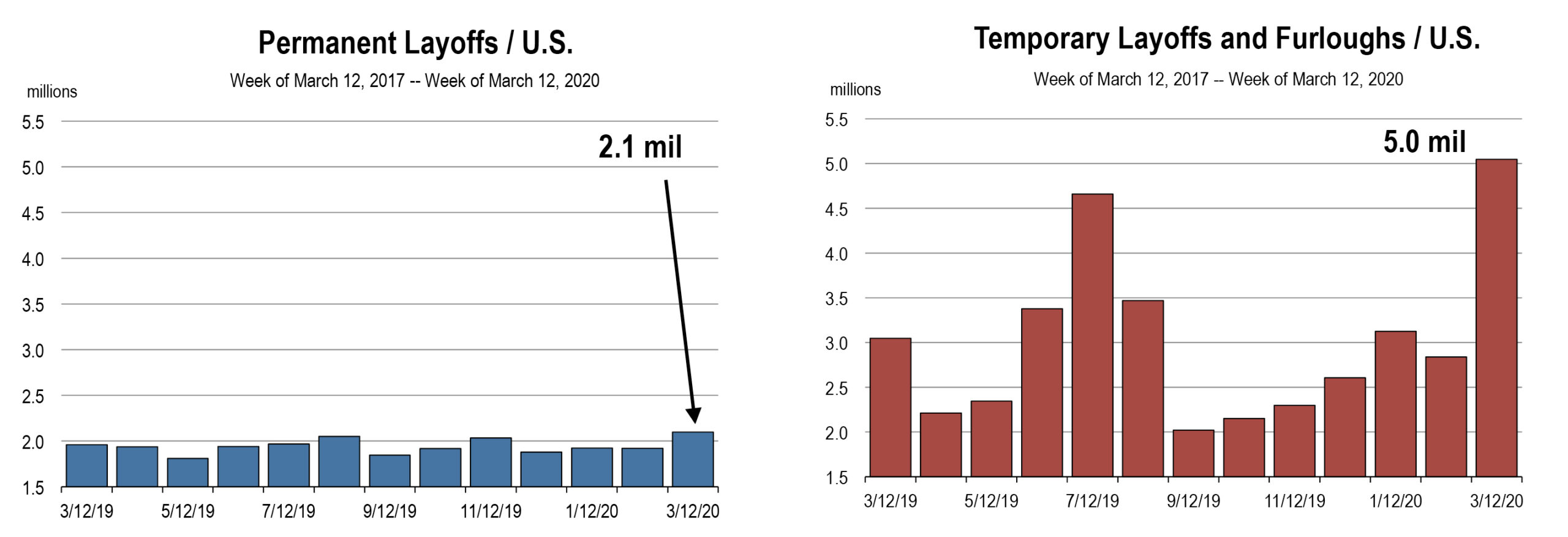

Between mid-May and Mid-June, the U.S. economy gained 4.8 million jobs and the unemployment rate declined to 11.1 percent. Without question, these are both terrific developments that show an improvement in the labor market.

But as we have mentioned repeatedly, the headline job market reports have not represented the whole story of the Coronavirus Recession.

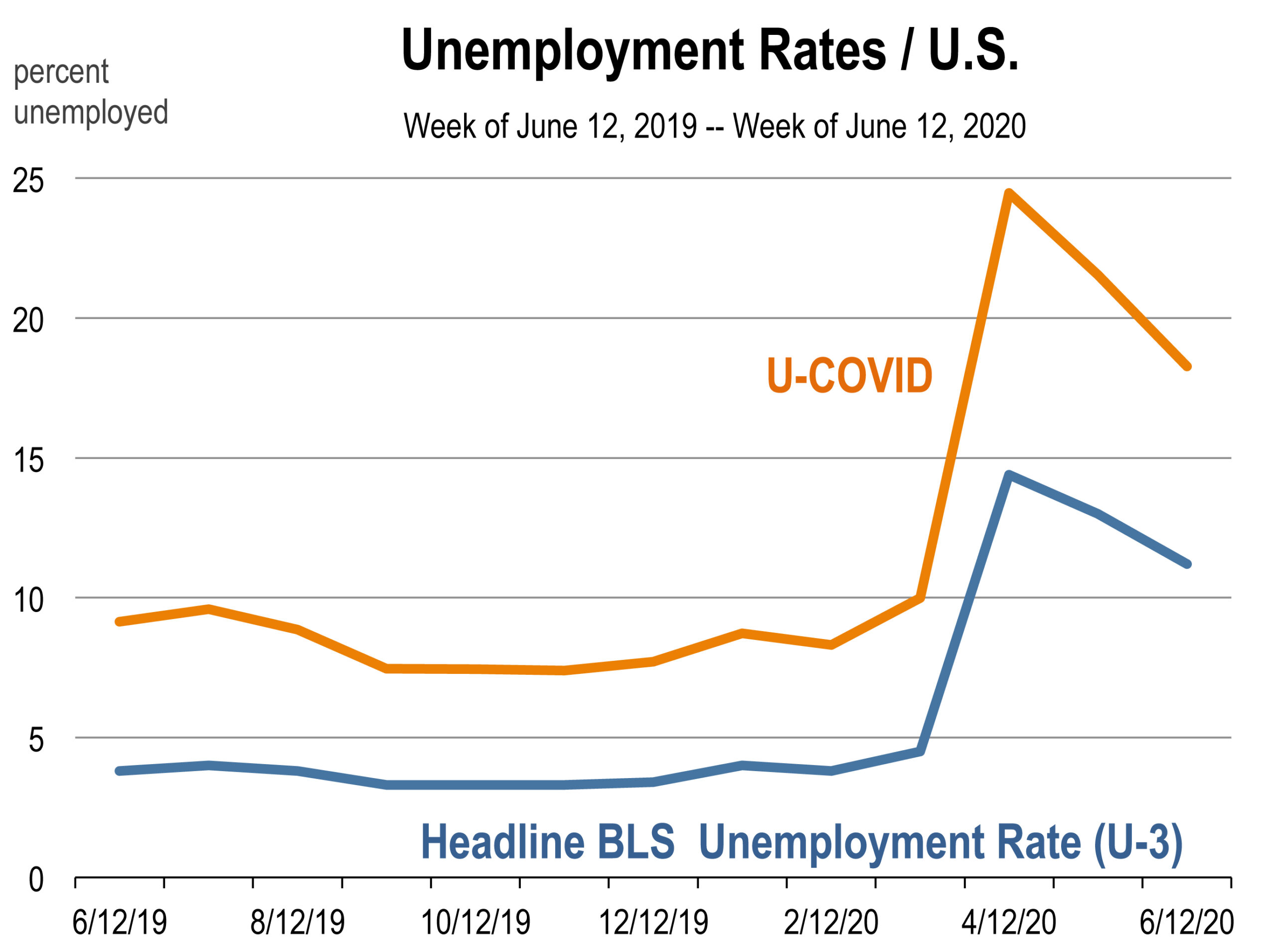

Today we’d like to introduce a new indicator that shows total unemployment in the COVID-19 era. It expands upon the traditional headline unemployment rate by including other types of hardships that have become prominent, including:

Today we’d like to introduce a new indicator that shows total unemployment in the COVID-19 era. It expands upon the traditional headline unemployment rate by including other types of hardships that have become prominent, including:

- People who have been temporarily furloughed

- People who are on sick leave

- People who want a job but aren’t looking for a job

We chose these categories because they have risen to unprecedented levels and capture most of the work stoppages directly caused by the pandemic and lockdowns. None of these people are counted in the headline unemployment rate. Yet the number of people who want to work but aren’t, either because they can’t find work, have given up looking for work, or are too sick to work, total 31 million.

As of mid-June, these extra categories raise the true unemployment rate (we’ll call it U-COVID) to 18.3 percent, which is an improvement from the 24.5 percent that was recorded in April, but shows that the labor market is still very close to depression-era conditions. It’s a sobering reality that needs to be understood alongside the positive analysis that you will probably see on the news tonight.

U-COVID measures the total rate of unemployment in the coronavirus era.

It includes the traditional headline unemployment rate from the BLS (officially called U-3)

and adds people who have been temporarily furloughed, people who are on sick leave,

and people who want a job but aren’t looking for a job.

The Labor Market Recovery is Looking Stagnant

by Mark Schniepp and Ben Wright

June 26, 2020

We’re becoming more concerned about the job market. We are now 7 to 8 weeks into the re-opening of the U.S. economy and amidst trillions in fiscal/Fed stimulus, the unemployment rate has failed to make meaningful improvements.

In California, the unemployment rate declined slightly last week, but is still generally moving higher in a disappointing sign of weakness for the statewide economy. Initial jobless claims for unemployment insurance have generally been rising since late May, all through the Phase 2 openings of economic activity.

More sources are beginning to show a slowdown in job market activity, including cell phone tracking data that captures travel patterns to/from places of work. After a clear resumption of commuting across the U.S. and California (with a pause on Memorial Day), progress in work related travel began to stall in early June.

The reasons behind the recent labor market weakness are unclear, but the most likely causes are:

- PPP loans began to run dry, resulting in new layoffs

- Businesses have been unable to survive the slow, phased re-opening of the economy, particularly in states like California

- Businesses that have remained open have had to reduce their headcounts due to a lack of sufficient revenue

- Local governments (cities and counties) have laid off more staff after realizing that initial furloughs were too optimistic

If the re-opening of the economy does not speed up, sufficient demand from consumers does not materialize to boost business revenues, or the rising rate of coronavirus infections leads to another round of lockdowns, there is a rising likelihood that the U.S. economic recovery could turn into another contraction.

Unemployment Rate Constant in the Nation, But Rising in California

by Mark Schniepp

June 18, 2020

Initial claims for unemployment remained high for the week ending June 13th. Another 1.5 million workers filed last week, keeping the total number of people receiving unemployment benefits at 20 million.

In California, an increase in new unemployment claim filings this past week now puts total unemployment insurance beneficiaries at 3.3 million.

Based on the number of workers receiving benefits, the weekly unemployment rate for the U.S. is now estimated at 15.7 percent. In California, the rate has meandered upward to 16.9 percent, the highest level since the first week in May.

While initial jobless claims for unemployment insurance on a weekly basis are clearly in decline nationally, the declines are getting smaller and smaller. In California, initial claims moved slightly downward but continuing claims moved higher. Relative to other states, the California economy is still not as open. Tourism destinations are just now starting to re-open, such as Yosemite National Park.

We are 13 weeks into the economic crisis caused by the pandemic. Unemployment is still at enormous levels. The PPP Flexibility Act (signed into law on June 5) gives businesses more time to spend the PPP funds on employee payrolls and employers can delay rehiring until demand for their products or services makes it worthwhile to restore workers. Hiring foregone in June will show up in later months if (1) the business does not fail first, and (2) demand for its goods or services is sufficiently restored.

Consequently, millions of workers will remain unemployed and this will keep the unemployment rate high through June and likely through July.

To the extent that distancing and capacity restrictions can be phased out, the economy would bounce back more quickly, making more hiring a clear necessity.

The Recovery is Happening, but What Could Knock it Off Course?

by Mark Schniepp and Ben Wright

June 17, 2020

For the last 6 weeks we have been tracking the economic recovery and presenting the recent evidence. However, more important to your planning is the business cycle outlook for August, September, and October, which will be critical months for the trajectory of the U.S. and California economies.

It’s probable that the recovery will continue into the fall and winter, but the economy will have to avoid or overcome some potential obstacles. We are watching 4 principal issues that could impede the recovery or possibly lead to an extended recession.

- Another reduction in consumer spending

- An escalation in business failures and personal bankruptcies

- An acceleration in layoffs at state/local governments

- Another round of lockdowns

Yesterday’s retail sales report surprised many economists (most economists are still behind the curve) with a large rebound in activity, and it’s clear that consumers are ready to spend, with real-time credit card purchase data showing even higher expenditures through early June.

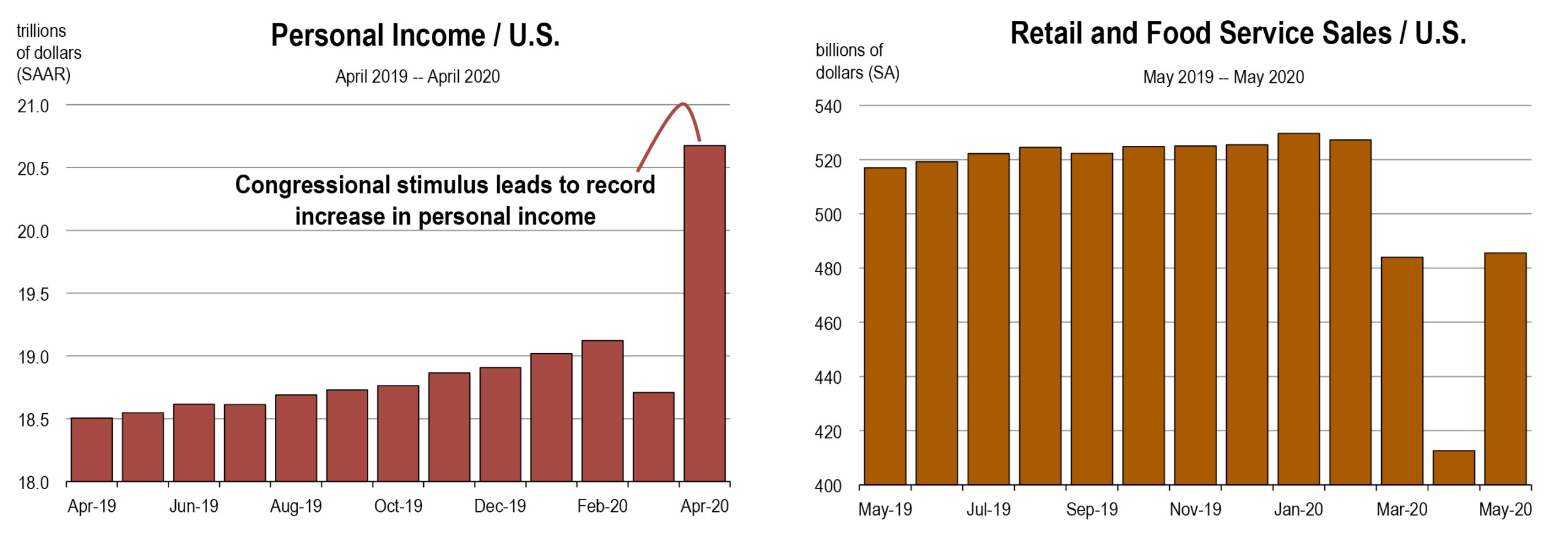

Keep in mind that the increases observed in May and June have largely been supported by government stimulus. The federal government’s $600/weekly unemployment checks have caused income levels to increase to record levels, giving many unemployed workers the chance to spend more than they did when they had a job in February.

Clearly, federal stimulus funds aren’t going to last forever, and when they wear off the economy could experience another contraction in consumer activity.

As of now, federal unemployment funding will end on August 1st, a time when there will still be millions of unemployed workers, and it will be critical to observe how consumers react when this major source of income is depleted.

Consequently, we are fairly concerned about the first scenario of another downturn in consumer spending, and we will cover the remaining scenarios over the next few weeks.

A Surge of Re-Employment This Month: California Bars and Gyms are Now Open

by Mark Schniepp and Ben Wright

June 15, 2020

If you live in California, odds are good that you can go to a bar this week. Most parts of the state moved into Stage 3 of the reopening process, allowing more businesses to open and thereby giving people more options to spend money.

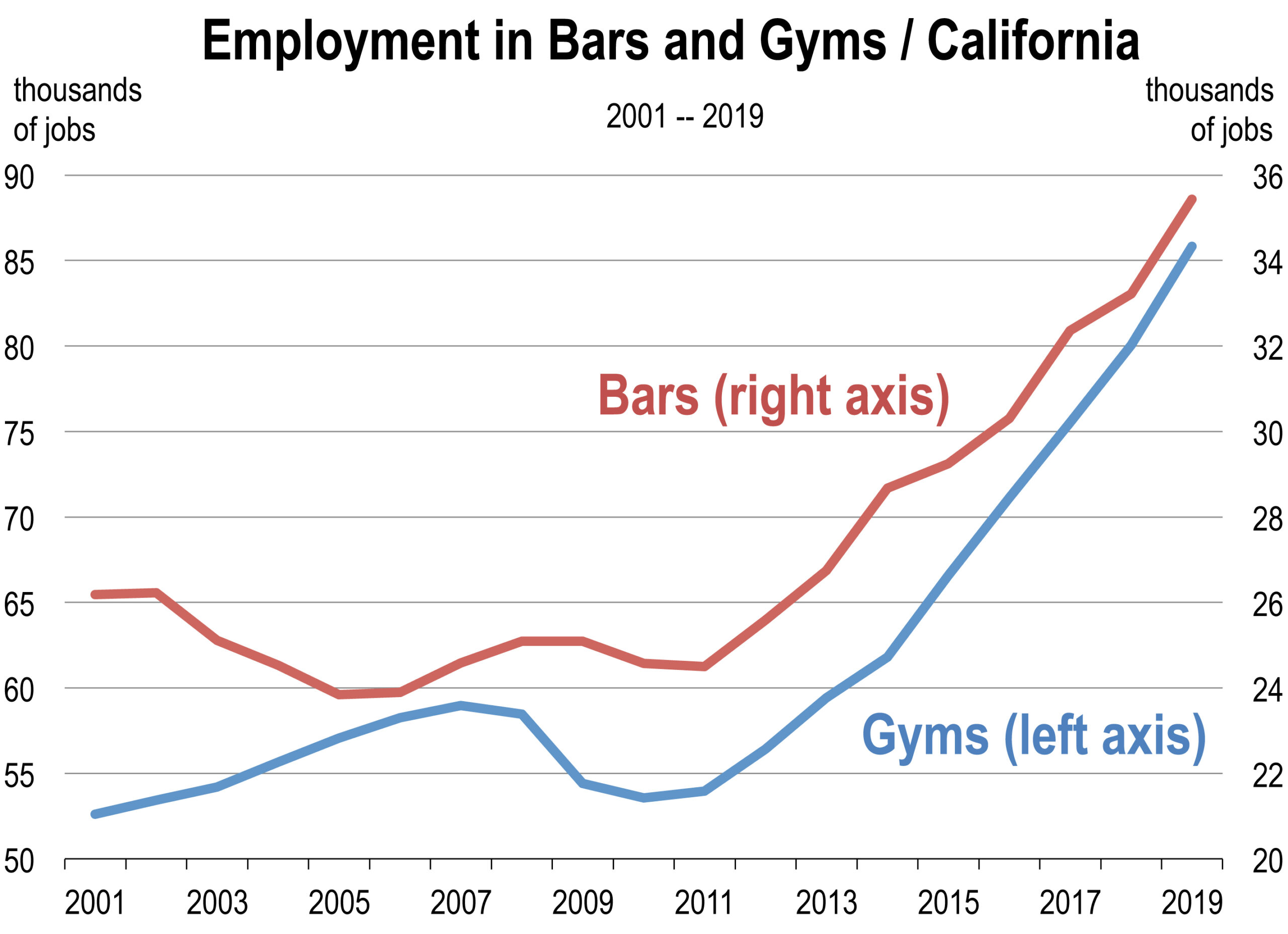

Job growth at bars and gyms has been rapid over the last few years, but our research shows that more than 90 percent of these workers were laid off, furloughed, or had their hours cut sharply in March and April. The reopening of bars, wineries, and gyms, even at a reduced capacity, is expected to increase consumer spending and bring additional jobs back to the economy just as the labor force recovery began to stagnate.

Foot traffic has gradually returned to the California bar scene because bars that serve food were permitted to open several weeks ago, but now that almost all bars, wineries, and breweries (but not nightclubs) are allowed to resume operations at reduced capacities, it is likely that tens of thousands of people will become re-employed in June and July.

We won’t know for certain until the Employment Development Department jobs report presents the official evidence of job formation (we probably won’t see this evidence until the report that is released in late September), but it would be an encouraging real-time indicator if workers begin to drop from the continuing unemployment insurance claims this month and next.

Is The Labor Market Rebound Stuck in Neutral?

by Mark Schniepp and Ben Wright

by Mark Schniepp and Ben Wright

June 11, 2020

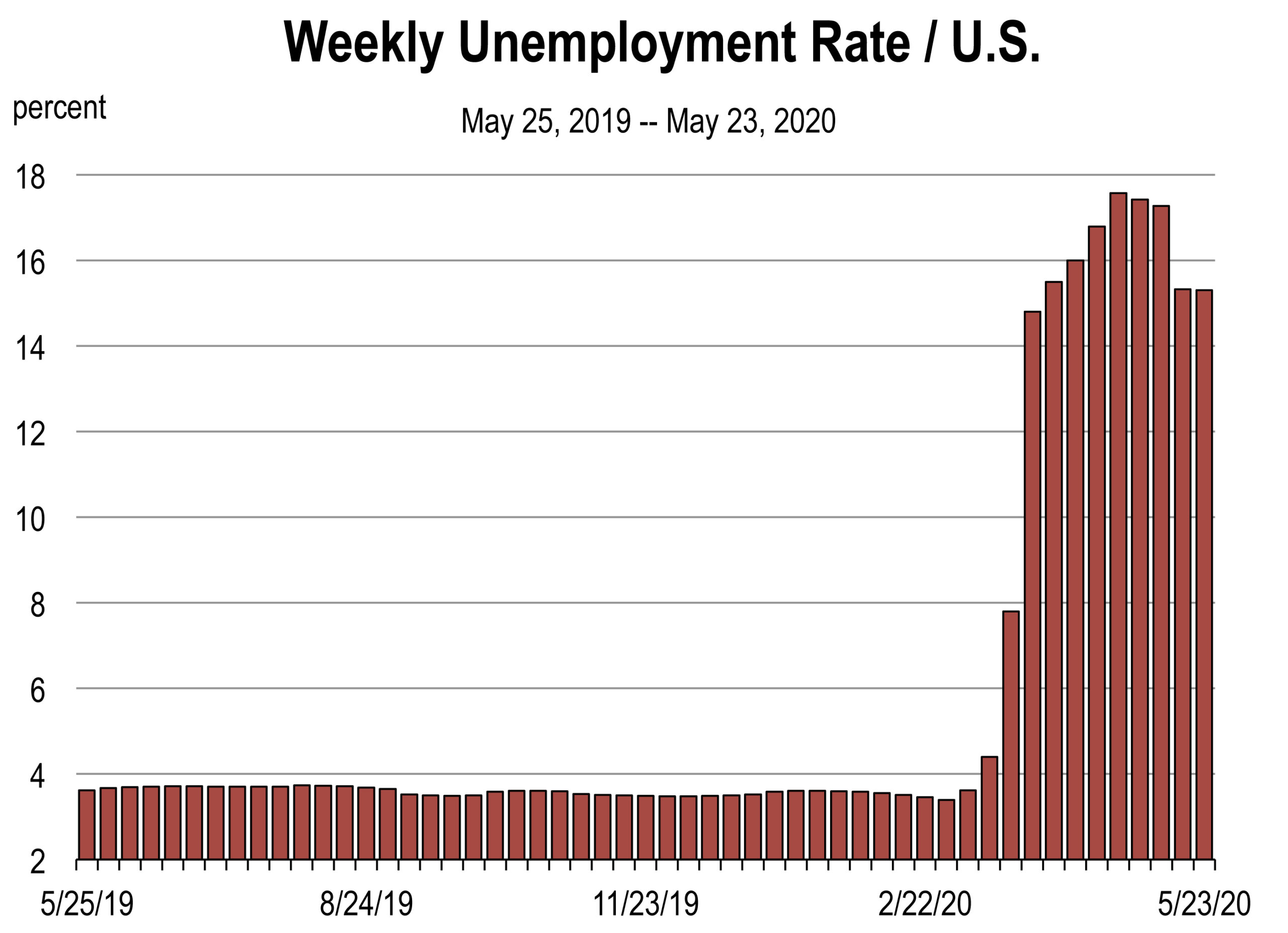

After meaningful declines in late April and early May, the weekly U.S. unemployment rate has been virtually frozen near 16 percent for the past 4 weeks. The unemployment rate in California has begun to increase again.

The unemployment rate, however, may be masking improvements that continue to unfold, as many economists believe that backlogs in unemployment insurance offices have distorted the data.

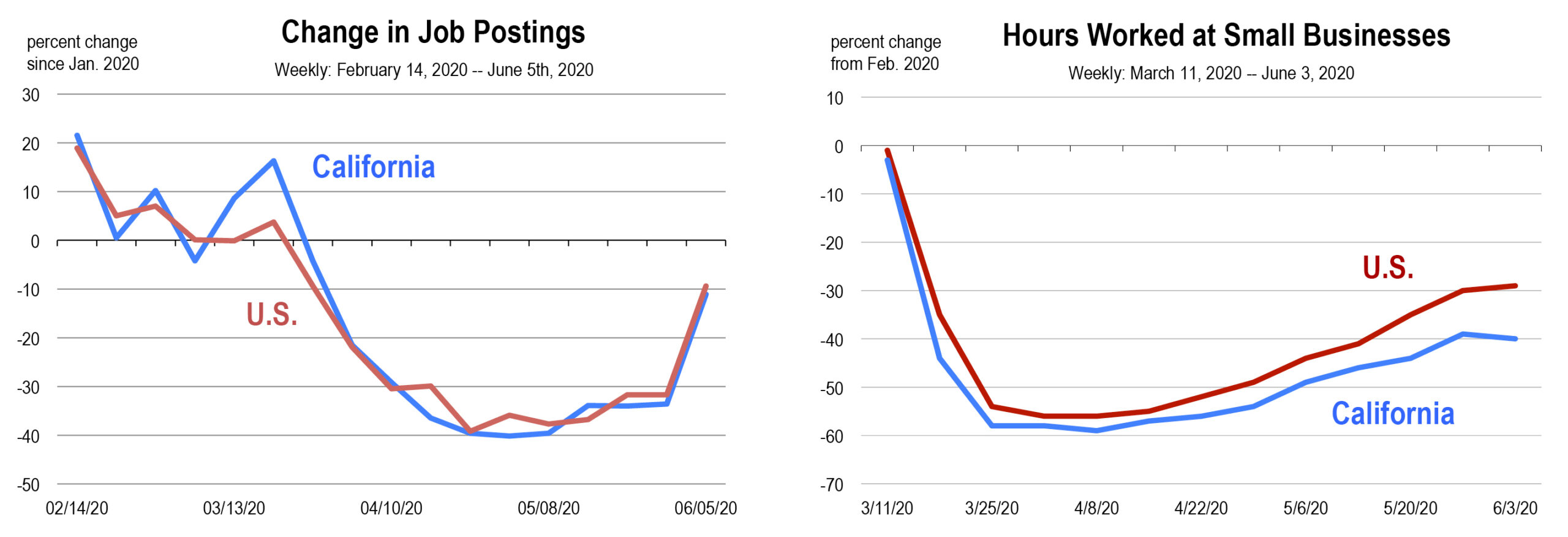

Aside from initial claims, virtually all other data shows continued progress in job market conditions. Job postings turned upward very sharply in early June and are now only 10 percent below where they were in January, indicating that employers are ready to hire again.

The number of hours worked at small businesses has also continued to improve, showing that increases in consumer demand are giving employers the confidence to re-hire former staff.

But the failure of the unemployment rate to improve could be a warning sign that needs to be taken seriously. Consumers are still spending less than before the pandemic, the unemployment rate is still unacceptably high, and there are a number of major risks to the economic outlook.

At the end of July, the $600/week supplement to UI checks is scheduled to stop, PPP funding for small businesses will effectively end, and some moratoriums on foreclosures and evictions only last into the fall. Is the flatlining unemployment rate an indicator that businesses are preparing for another downturn? We don’t know, but we will be watching this development closely and will report our findings on this page.

If You Were Surprised by Today’s BLS Report You Haven’t Been Following Our Coverage of the Coronavirus Recession

by Mark Schniepp and Ben Wright

June 5, 2020

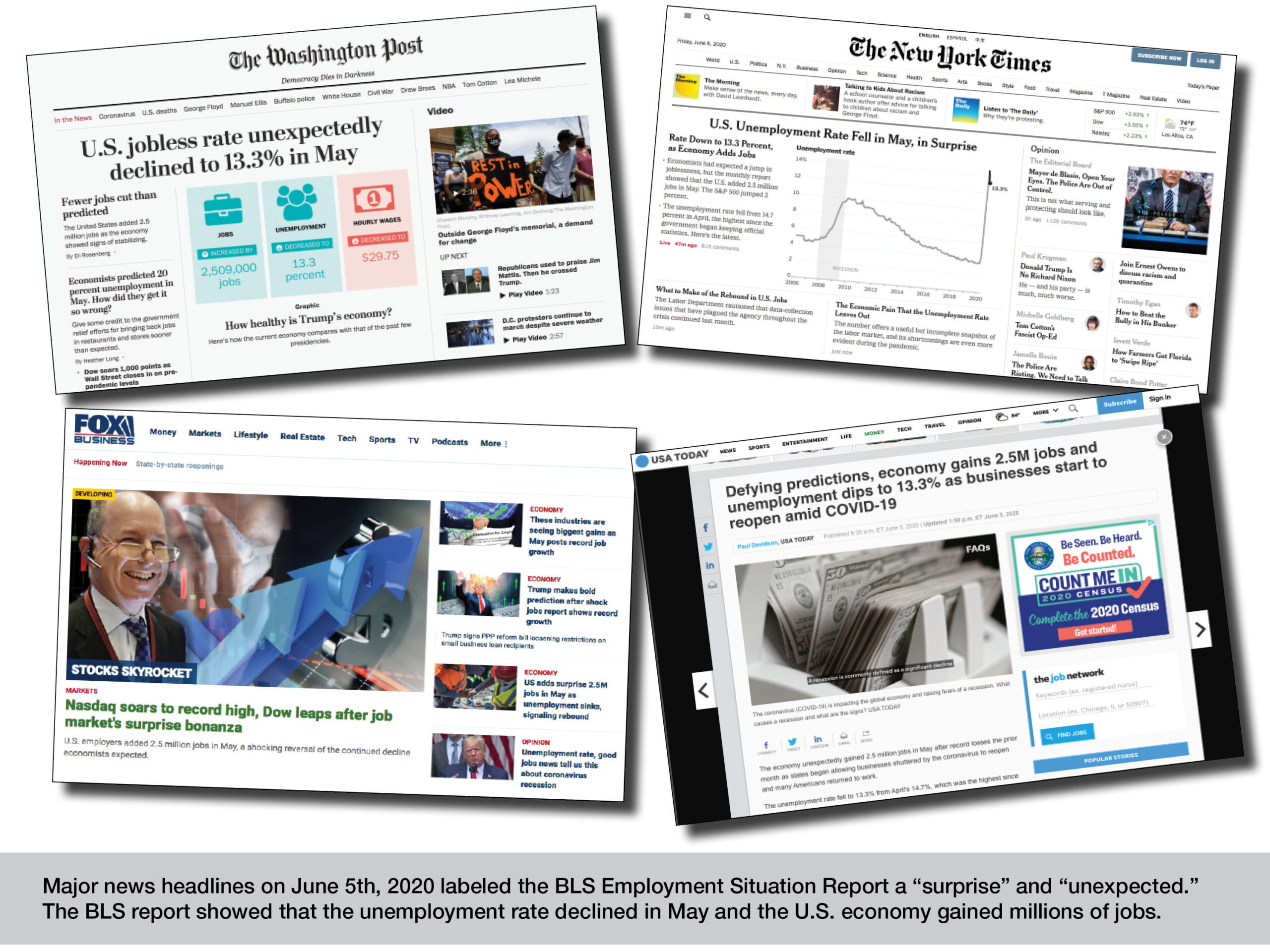

Today the BLS reported that the unemployment rate improved and the U.S. economy gained millions of jobs between mid-April and Mid-May.

Media headlines almost unanimously labeled the report as a surprise. The Dow Jones opened the day with a 3 percent increase, indicating that investors were caught off guard.

But the BLS report basically confirms the message we have been reporting for over a month: most sectors of the economy bottomed in April and a recovery began in May.

The outlook for the next few months is more uncertain, but it will largely be determined by the supply side and the extent that businesses will be allowed to create goods and services to meet demand. A faster pace of reopening would support business viability and job creation, while a slow reopening would put the economy at risk of sustained damage.

Equally as important will be the demand side. Can the confidence of consumers be restored? Will households increase their spending if a vaccine or mass testing limit the health risks of the virus? Will incomes and business/government revenues be replaced with more Congressional aid? The answers to these questions will have huge implications for the trajectory of the economy.

All said, there is good reason to believe the recovery will be very slow over the next few months, and maybe even slower than the tepid upturn that was observed in May. We’ll provide more detail on our outlook, and the evidence to support it, over the next few weeks.

The Status of the Job Market in the U.S. and California

by Mark Schniepp

June 4, 2020

The U.S. and California reached peak unemployment in April with clear reductions occurring after the first week in May. This is consistent with:

- State re-openings which began in late April

- Funding from the PPP loans being used to finance employee salaries and benefits

- Stimulus and unemployment insurance distributions being received in April and May

- An increase in consumer spending through early May

But virtually no additional improvement was observed in the second half of May, with the unemployment rates for the U.S. and California stuck at 15 or 16 percent.

Consumer spending has improved since the low point observed in April, but there is reason to believe that spending will plateau even though more restaurants and personal care services are now allowed to operate. At this point in the restart process there are still limited options for consumer spending.

There are more car and home sales occurring at this time. And manufacturing is slowly returning to some of the more industrial markets in the U.S. But without broad availability of retail store options, entertainment venues, theatre, sports, and general tourism activities, spending will remain muted. Business revenues will therefore remain muted as will hiring.

We expect the monthly unemployment rates for May, which will be released by the Bureau of Labor Statistics, to remain near the April levels for the U.S. and California.

The tepid recovery will continue until restrictions on the number of customers and the distancing required between customers is relaxed, and larger public gathering venues can open.

Unemployment Rate Holds Steady at 15 percent

by Mark Schniepp and Ben Wright

May 28, 2020

The U.S. unemployment rate was virtually unchanged last week after a sharp improvement during the week of May 16th.

There are now only 575 counties that are still shut down, and these counties account for less than 15 percent of nationwide GDP. Just a month ago, the 2,600 counties that were shut down represented 30 percent of GDP.

The reopening process, along with PPP loans and other fiscal/Fed support, have brought millions of people back to work and put the economy into rebound mode.

The California job market is also improving, but there is considerable uncertainty about the unemployment rate. The most timely labor market indicator – claims for unemployment insurance – has been erratic for California, and we’re not exactly sure what’s causing the volatility.

The number of reported claims has varied from 2.1 million to 5.1 million during the Coronavirus Recession, and it has bounced around from week to week. There is a clear trend towards fewer claims and lower rates of unemployment, but the labor market situation in any given week has become unclear due to the erratic data.

There are many plausible explanations for volatility in the claims data, and it’s possible that people could be entering and leaving the unemployment system in a haphazard fashion. But it’s also possible that the data is not being collected or reported correctly, that California residents are not filing their claims correctly, or that they’re not filing at all.

In any case, we will closely monitor the situation and provide more concrete updates when possible.

For now, most of the counties in California have had many restrictions lifted. Only 9 have not, including Los Angeles, Imperial, Monterey, Lassen, and 5 counties in the Bay Area.

California’s lockdowns began to be lifted on May 8th, with more counties approved for Phase 2 openings last week, enabling dine-in restaurant services, in-store retail, and barbershops and salons.

The next phase of re-opening will include a larger swath of businesses, but large public gatherings like weddings and conferences are still prohibited in all but 4 California Counties, and they are unlikely to be allowed soon.

The Impact of the Pandemic on California Counties

Unemployment rates moved higher for tourist destinations than the tech-heavy regions

by Mark Schniepp

May 27, 2020

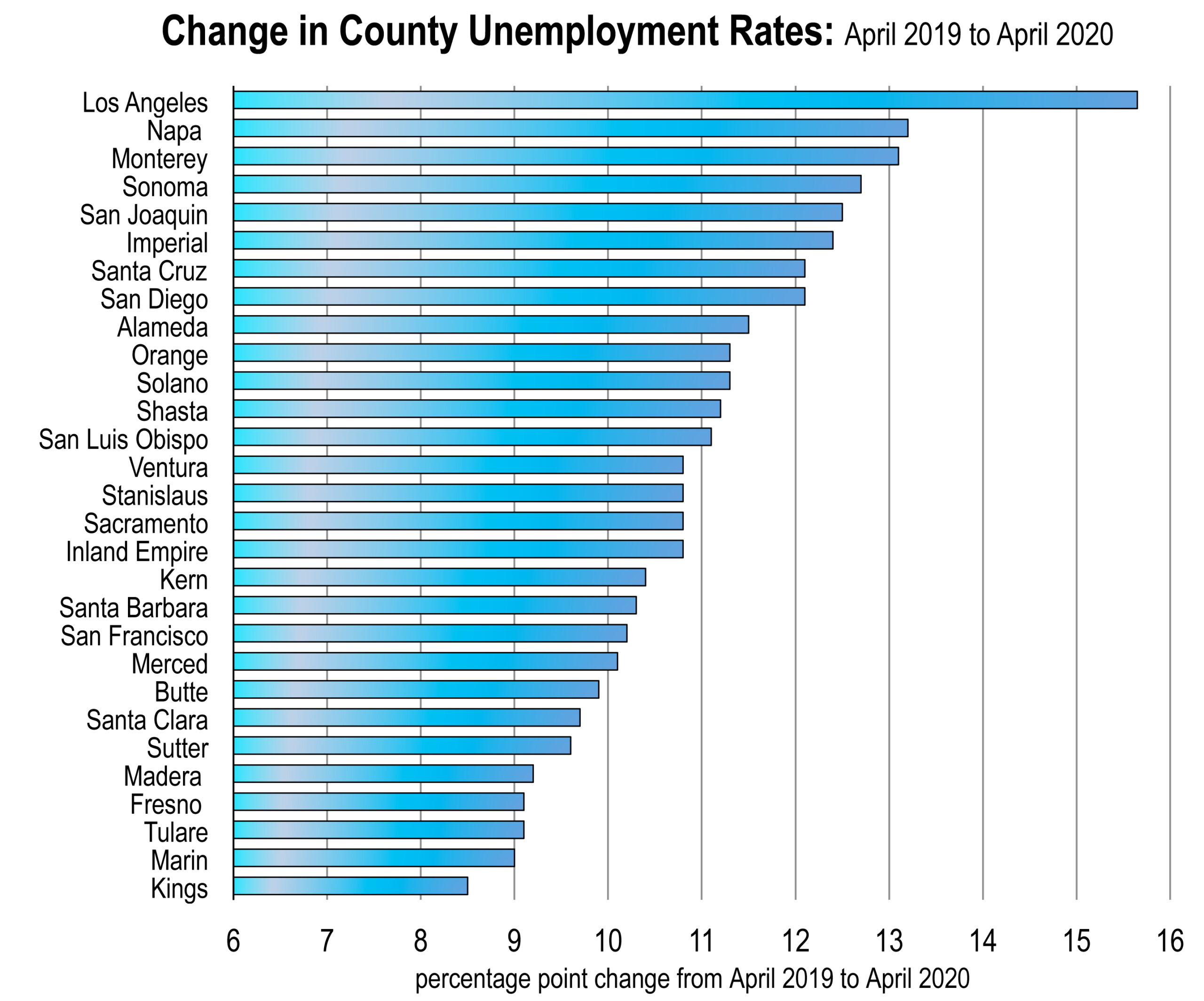

The change in the rate of unemployment between April 2019 and April 2020 offers us a consistent comparison of how workers were impacted across California by the pandemic.

Clearly, Los Angeles County was hit the hardest. Not only did it record one of the higher unemployment rates among regions in the state (20 percent), the change from last year was the highest, close to 16 percentage points higher.

Why Los Angeles County? While it has a large technology sector, it also has the largest entertainment sector in California including film, TV, sound, video, the Dodgers, the Lakers, the Clippers, Universal Studios, Magic Mountain, Hollywood, Santa Monica, the Getty Center, museums, beaches, all of which were shut down or closed.

Why Los Angeles County? While it has a large technology sector, it also has the largest entertainment sector in California including film, TV, sound, video, the Dodgers, the Lakers, the Clippers, Universal Studios, Magic Mountain, Hollywood, Santa Monica, the Getty Center, museums, beaches, all of which were shut down or closed.

It has the Ports of LA and Long Beach which were significantly idled by the lack of incoming cargoes from China and elsewhere. It has the second largest airport in the nation with over 80 million passengers annually. Domestic and International passengers were off 96 percent in April.

The biggest changes in the rate of unemployment occurred in the coastal counties or the counties that disproportionately serve visitors (or are home to workers in the tourism industries).

Napa, Sonoma, Santa Cruz, Monterey, San Diego and Orange are in the group with the largest increases in unemployment. However, oddly, San Francisco and Santa Barbara did not join this group. Why not?

Fewer residents of San Francisco are out of work than neighboring counties. This does not imply the County’s plight was any less severe than other Bay Area communities. Because it is largely hospitality and leisure services, it is likely worse. However, most workers in the City don’t live there. They live elsewhere, including the East Bay or further away in Sonoma or Solano Counties. And it’s where you live (not work) that affects regional unemployment. Certainly enough, rates were relatively higher in those counties.

In Santa Barbara, the largest employers are Vandenberg Air Force Base, UCSB, Santa Barbara City College, Raytheon, Procore and County government. These institutions or enterprises were not impacted much with layoffs. Other tech companies are also able to keep workers on payrolls by having them work from home. So many of the tech heavy regions show lower unemployment rates including Santa Clara and Marin (Marin’s tech residents largely work in San Francisco) with the lowest rates of unemployment in the state during April.

The increase in unemployment over year ago levels provides us with some indication of which regions may struggle more to recover from the recession because they have suffered more from permanent layoffs today. Permanent layoffs will be harder to replace as the economy rebounds because a share of those laid off workers will not have a workplace to return to. Many businesses will have failed during the shutdown or during the restart due to capacity limitations on customers and the ability to generate enough revenue to remain viable.

So for now, it appears that the counties that have the least carnage due to the pandemic are Marin, Santa Clara, Santa Barbara, and the Inland Empire. The latter is likely due to its large logistics industry which includes Amazon fulfillment centers and other online warehousing.

Counties like Fresno, Madera, Kern, Tulare and Kings Counties are neither tourism destinations nor technology hubs, but they are farming counties—an industry that was able to remain largely employed over the last 2 months.

The Unemployment Rate Continues to Improve

by Mark Schniepp and Ben Wright

May 21, 2020

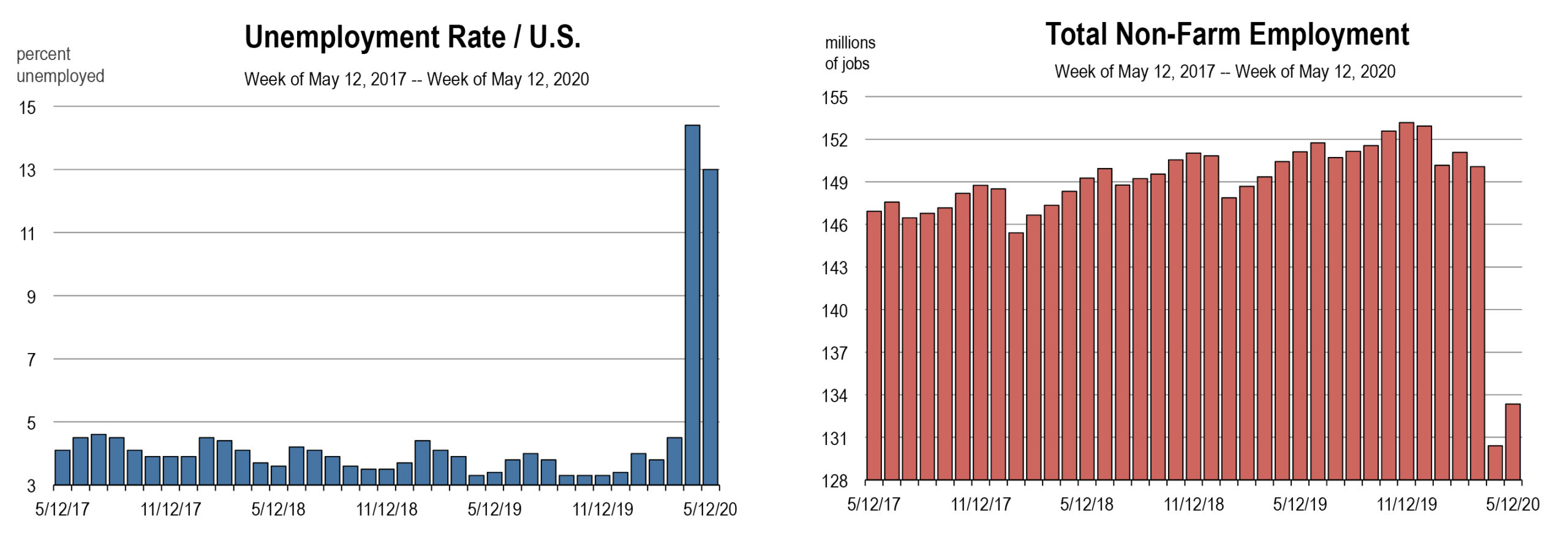

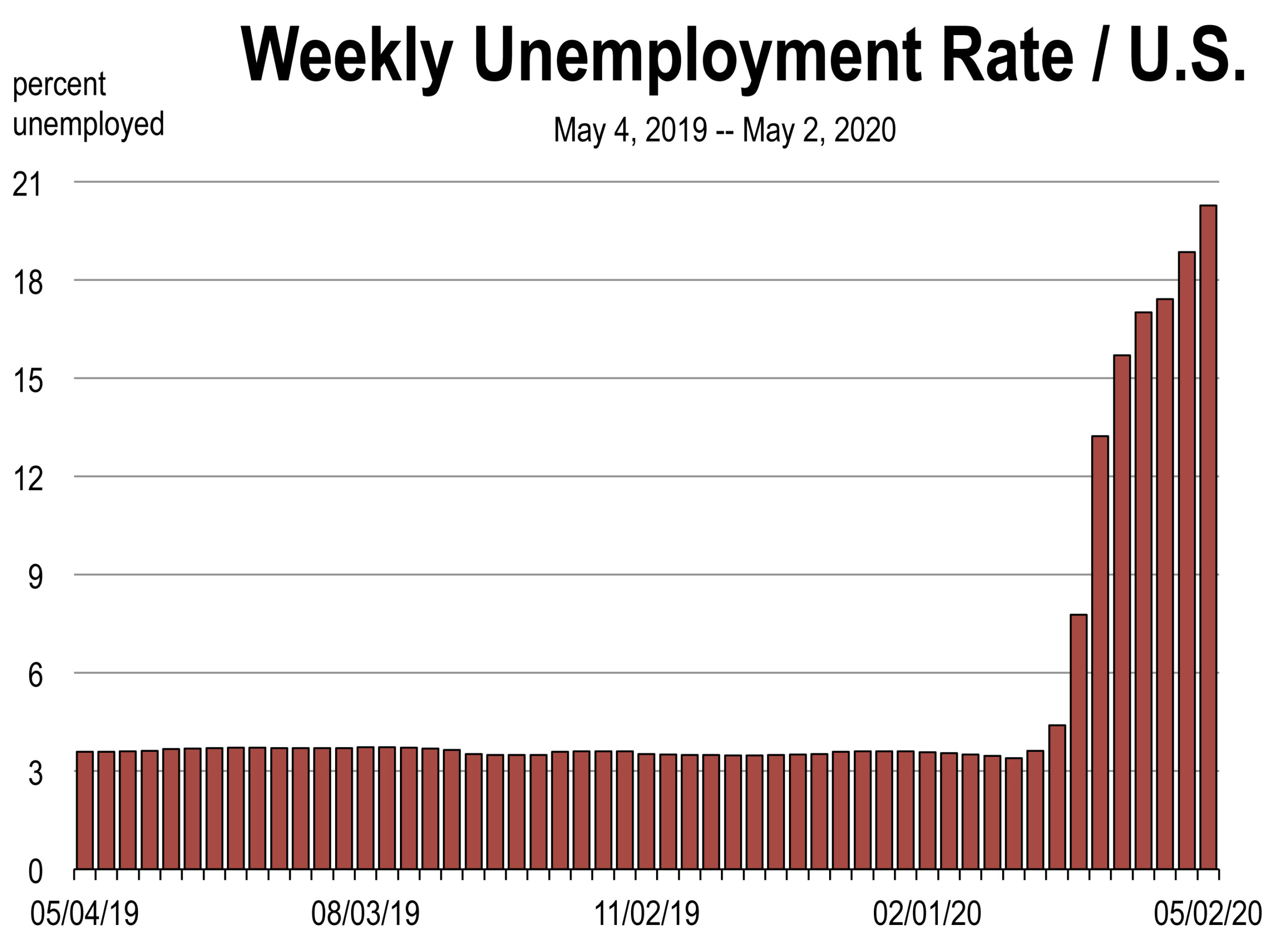

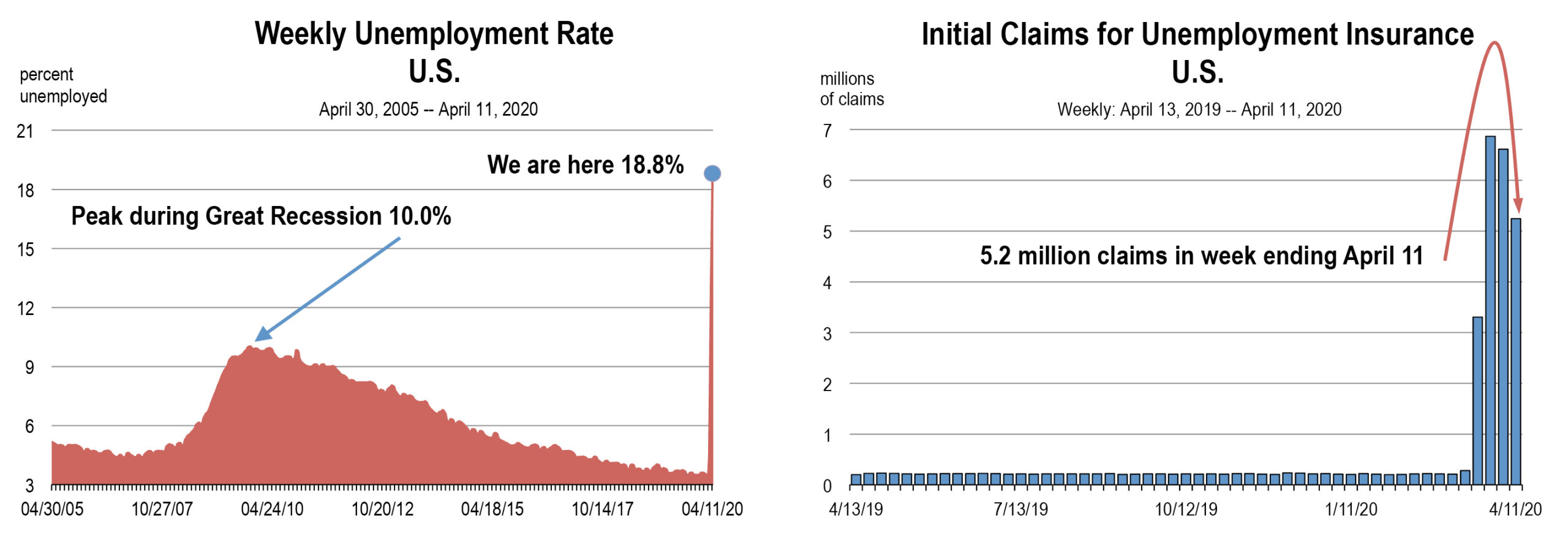

After rising above 18 percent for the first time in almost a century, the U.S. unemployment rate has decreased for three consecutive weeks. As of May 16th, approximately 15 percent of the workforce was unemployed.

In California, the estimated weekly unemployment rate declined to 21.7 percent.

Improvements in the unemployment rate match data showing the number of hours worked at small businesses. Employee hours had declined by as much as 56 percent during the first weeks of the Coronavirus Recession, but have steadily increased and are now only 32 percent below the number of hours worked in February.

Just to be clear, the economic crisis is not over. The unemployment rate is still exceptionally high and there are very plausible scenarios that could cause another contraction. The recovery is virtually guaranteed to be long and arduous.

Little has been done to stem the tide of layoffs, and the problem could get worse as capacity limitations for restaurants, retail stores, and event spaces make it difficult for these businesses to remain profitable, potentially resulting in a wave of business closures and more layoffs. These business closures would be permanent, creating permanent job loss.

There could also be another round of reductions in consumer spending due to fear and/or the increase in precautionary saving until the coast is clear.

Furthermore, we might see an acceleration in layoffs at state and local governments that have been devastated by the lack of sales tax, hotel tax, and other revenue for the last 60 days.

We will discuss these scenarios in future updates, but it is important to be aware that the labor market contraction has reversed for now.

The Recovery Appears Underway

by Mark Schniepp and Ben Wright

May 14, 2020

The unemployment rate peaked in late April and began to improve in the first week of May.

Is this the beginning of the end for the labor market crisis? Will the re-hiring process accelerate from here? That is still a large unknown, but right now the evidence does suggest that the labor market is better today than it was yesterday.

Continuing claims for unemployment benefits are now declining for both the U.S. and California. Perhaps the Paycheck Protection Program is working to re-employ workers who were laid off in March and April. The construction industry has also returned to work here in California and a number of counties have been given the ok to “open up.”

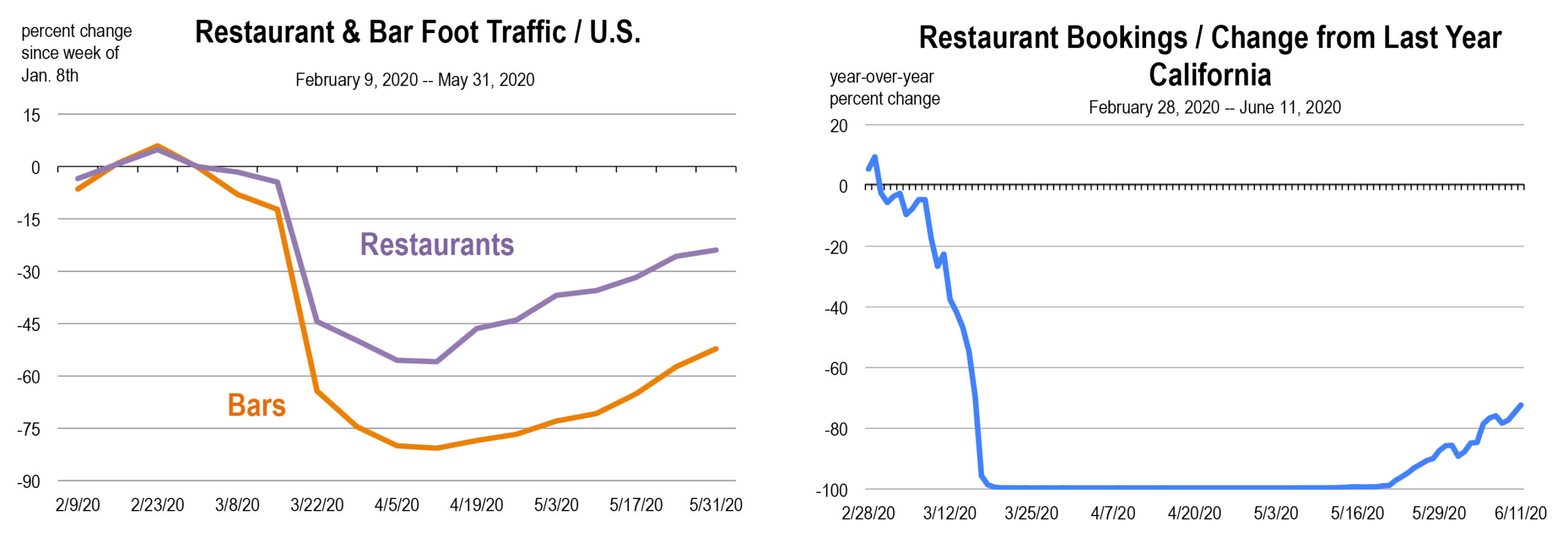

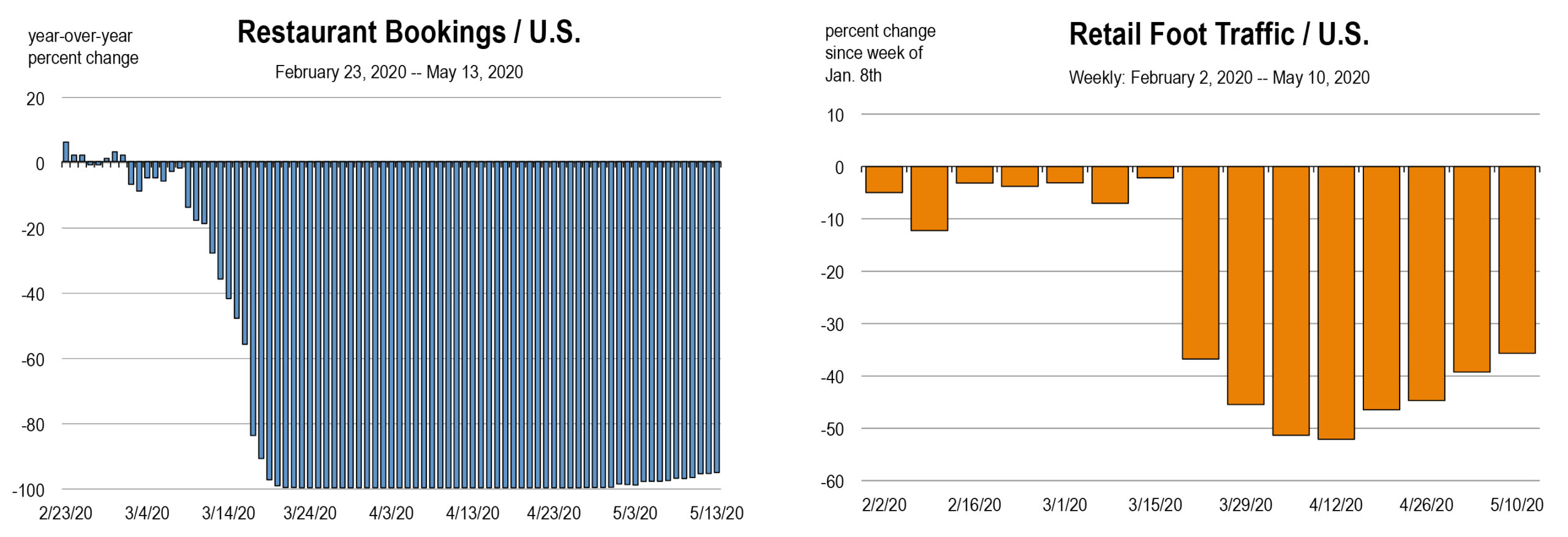

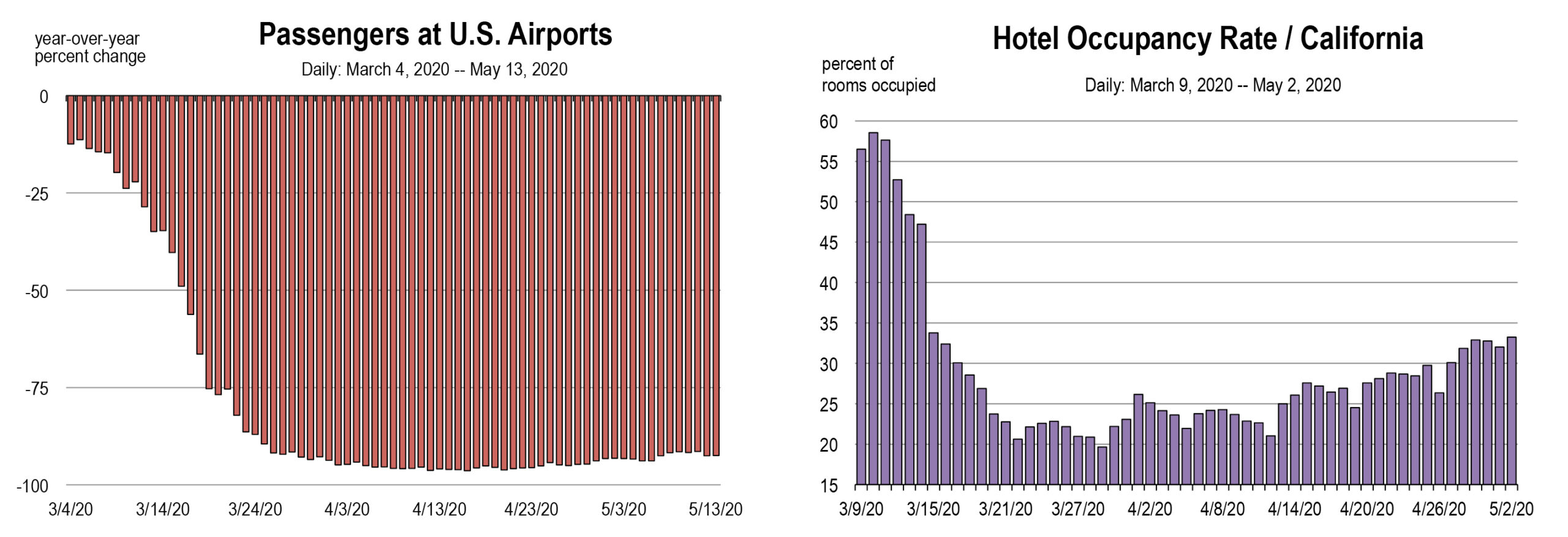

The following charts show a range of real-time data that all demonstrate improvement across various corners of the economy. Consumer spending turned upward right after the $1,200 checks began hitting recipient bank accounts. Weekly hours worked at small businesses bottomed at virtually the same time.

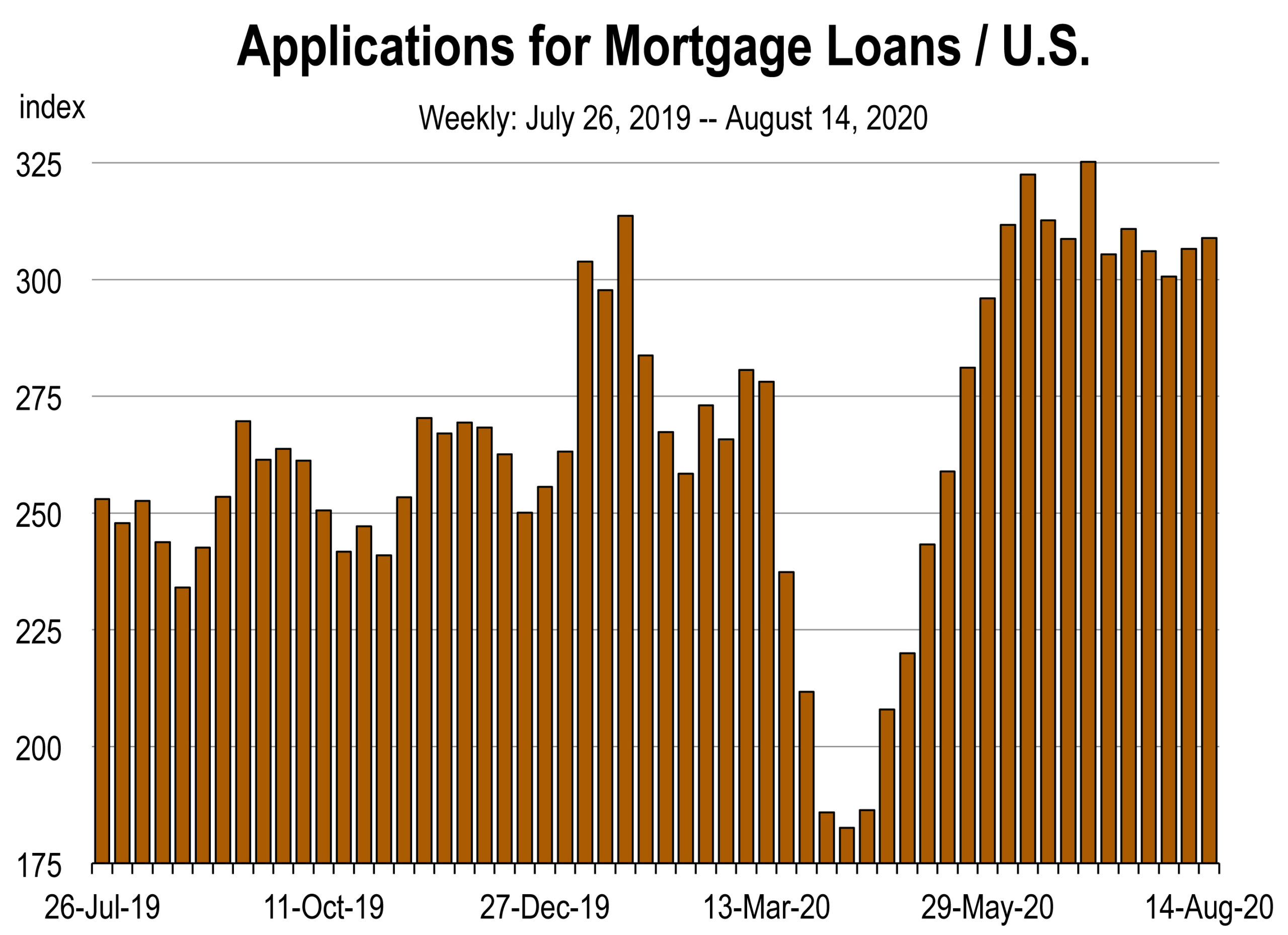

Homebuyers are applying for more mortgage loans and more sellers are putting their properties on the market. Restaurant bookings are up and foot traffic is returning to retail stores. Hotel occupancy rates are improving and air traffic is rebounding ever so slightly.

At this point, evidence of a business cycle turning point is becoming more convincing. There is still great uncertainty about the dynamics of the recovery, and there is concern that the rebound will be meager and/or short lived if virus infections begin to turn up again or business failures intensify. But it’s now clear that the recovery has started because a myriad of indicators have begun to turn positive.

Weekly Unemployment Rate Ticks Up Slightly in the U.S. and California

by Mark Schniepp and Ben Wright

May 7, 2020

A few days ago we speculated that the recession would end soon and the unemployment rate would begin to decline within the next few weeks.

There is mounting evidence to support this prediction, and there is new data showing that certain sectors have likely bottomed. But this recession is all about jobs, and for the week that ended May 2nd, the unemployment rate continued to increase very slowly.

There are a myriad of reasons why the unemployment rate continues to rise despite the fact that 1) nearly half of all states have eased their lockdowns and permitted some business to partially open, and 2) $349 billion in Paycheck Protection loans have been issued to small business.

There is some evidence that PPP funding has been used to rehire workers that had been laid off. Research by Harvard and Brown economists shows that small business employment began to rebound during the week of April 20th, shortly after the first round of loans was disbursed and before the lockdowns began to be lifted.

Small business employment in the U.S. declined by more than 30 percent between January and mid-April. By late April small business employment had begun to rebound by a small amount.

Source: Opportunity Insights

But the rebound in small business employment has been minimal, and large corporations continue to issue layoffs. Just within the last few days, layoffs and furloughs were announced at:

- Boeing (16,000 layoffs)

- Hertz (10,000 layoffs)

- Uber (3,700 layoffs)

- Virgin Atlantic (3,150 layoffs)

- Airbnb (1,900 layoffs)

- Lyft (982 layoffs and 288 furloughs)

- TripAdvisor (900 layoffs)

More than 20 states have started to ease their lockdowns, but the re-openings are unfolding very slowly, meaning that there is not enough work to warrant rehiring many employees. At least not yet.

So far only limited categories of retail shops have re-opened and dine-in restaurants have been required to severely reduce their seating capacity. A wider range of medical procedures is now being allowed, but hospital waiting rooms are still pretty empty. Some type of manufacturing activities have resumed, but not for big-ticket items like cars and airplanes.

This recession is primarily the result of supply-side constraints, with government mandates preventing businesses from supplying their goods and services to the economy. But the massive number of job losses have reduced consumer demand, and the uncertainty about job security will limit spending even after the lockdowns are lifted. As industries are slowly unfrozen, these demand-side limitations will probably lead to a recovery that is both slow and bumpy.

Consumer spending is now moving higher, but not by a large enough amount to influence the unemployment rate yet. Many restaurants and consumer goods firms still have skeleton staffing levels, and have been able to partially reopen without re-hiring former employees.

Consumer spending in the U.S. declined by more than 30 percent between January and early April. By mid-April consumer spending had begun to rebound.

Source: Opportunity Insights

How Will the Economic Recovery Start?

by Mark Schniepp

May 6, 2020

What We can Expect at First

The closure of nonessential businesses, disrupted global supply chains, and ordering everyone to stay at home has crashed the U.S. and global economies, resulting in the deepest recession in our lifetime. And we have reported on it each week, every step of the way.

But conditions are now changing, albeit much slower than the initial free-fall that abruptly halted economic growth. The easing of shelter-in-place will enable stores to sell goods in person, healthcare procedures to return, workers to return to jobs, and consumers to shop, eat and drink away from home. Here’s a look at the economy as the gates open for the first time in about 40 to 45 days.

Manufacturing

U.S. Manufacturing is returning but it will struggle throughout 2020. Consider the following:

- Plants have been closed all over the U.S.

- Boeing decided to cease producing the 737 MAX at the beginning of the year

- The world is in recession

- The dollar is strong; U.S. prices are higher

- Worker safety is the top priority so new guidelines could interfere with productivity

Challenges include obtaining necessary raw materials and parts from suppliers that have been shut down. Manufacturing is starting up in a number of states now but there will be delays. Medical device manufacturing never shut down. We look for many plants to be up and running by next month.

Because it is highly automated, manufacturing could rebound quicker than other parts of the economy, pending the ability to restore supply chains.

Services

There are few if any visitors other than business visitors within the essential sectors. Therefore, hospitality is effectively shut down or lacking most business.

Other than food, drug, and home product stores, the retail business is shuttered. But in many states retail stores are opening with capacity limitations on shoppers.

Capacity limitations within restaurants, bars, cafeterias and within retail stores will reduce sales. Fewer tables to be served in a café requires fewer servers and fewer cooks. Fewer shoppers in a store requires fewer salespeople and fewer cashiers. The food and beverage away from home industry will be impacted in a meaningful way during the recovery.

There will be a reticence to travel due to (1) fear of crowded public gathering places, and (2) closed attractions of all types. Until national parks, amusement parks, recreation events, theaters, festivals, concerts, and other events are allowed to resume, tourism within California and other states will be muted.

There will be a reticence to travel due to (1) fear of crowded public gathering places, and (2) closed attractions of all types. Until national parks, amusement parks, recreation events, theaters, festivals, concerts, and other events are allowed to resume, tourism within California and other states will be muted.

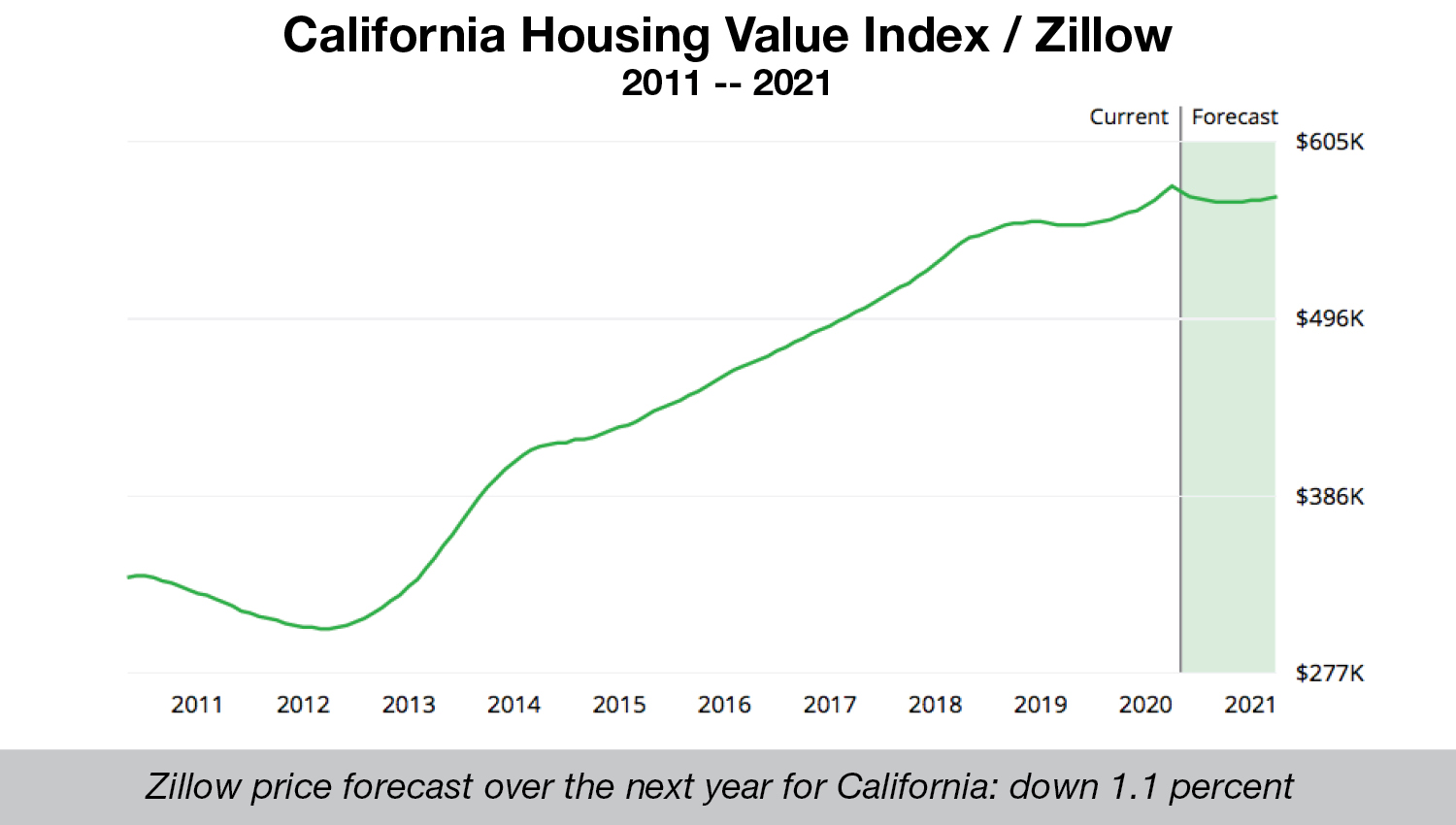

New housing demand has plunged. Existing home listings have dropped 40 percent, and sales are off sharply. But home prices are not. Through March, selling values were higher, year over year, than in February, and the Zillow forecast is for a decline this year of between 0 and 3 percent.

The housing market should be relatively unaffected once shopping can resume. Lower interest rates will help, but because lenders have tightened credit, obtaining mortgage money will limit the pool to higher credit score buyers.

Construction had largely stopped, though it is now starting again in many states, including California. Construction will face challenges because particular tasks or trades rely on two or four person squads. In general, however, projects will be able to move forward with thousands of workers resuming their jobs.

Car buying can occur online and at dealers in some states.

Auto sales should rebound since the absence of a car sale in March and April is generally a postponement until dealers are fully open again. Sales will be lower in 2020 because many potential buyers have become unemployed.

Schools have moved everything to online instruction for the remainder of the school year. That won’t change so economic activity associated with schools—dormitories, cafeterias and sporting events—is cancelled. Many staff won’t be recalled back to work until the next school year.

However, if child care centers can open, they will be busy as parents of younger children will be returning to work.

Healthcare has been impacted by PPE shortages and the mandate to defer non essential procedures. That is now changing. PPE production has ramped up and is being distributed to hospitals and clinics. Because the surge in COVID-19 patients never materialized, many hospital staff have little to do. States are now allowing hospitals to take more patients and gradually return to normal. We predict a sharp return of hospital workers as the year progresses.

Finance is the only sector to see an increase in business activity due to surging demand for small business loans. Finance and insurance should remain busy during the year.

May is the Month for Reopening the Economy

Restarts have now occurred in 20 states, and more are opening daily. Even curbside pickup from some retail stores will be allowed starting Friday in California.

Restaurants, malls, and movie theaters have opened at 25 percent capacity in Texas.

In South Carolina, parks, beaches, malls, hotels, and clothing stores have reopened.

Movie theaters and restaurants are open in Georgia.

Ditto for Montana. Even schools reopened on Thursday, May 7, though many districts have cancelled in person classes for the rest of the school year.

Restaurant dining rooms, bars, gyms and churches are open in Oklahoma. Restaurants and bars and retail stores have opened in Tennessee.

Many other states have opened construction projects, elective procedures within hospitals, retail stores and restaurants. By the end of the month, nearly all states will have restarted many sectors of their economies.

Re-opening does not occur without major unknowns. How many customers will be back? How many customers can be accommodated in a day? Will there be enough sales to justify the operating costs under stringent protocols that limit customers? How many workers can be hired and how can they be safely kept healthy?

Uncertainty is a corrosive influence on businesses, as it hampers planning and investment decisions. With so much uncertainty surrounding the opening of the economy, businesses will move cautiously over the next few months.

We can’t predict how the recovery will go yet, only that it has started. As we gain clarity on the distancing rules and protocols, we’ll be able to evaluate the speed at which the recovery might evolve, so stay tuned for updates.

We Could be Near the Bottom of the Recession

by Mark Schniepp and Ben Wright

April 30, 2020

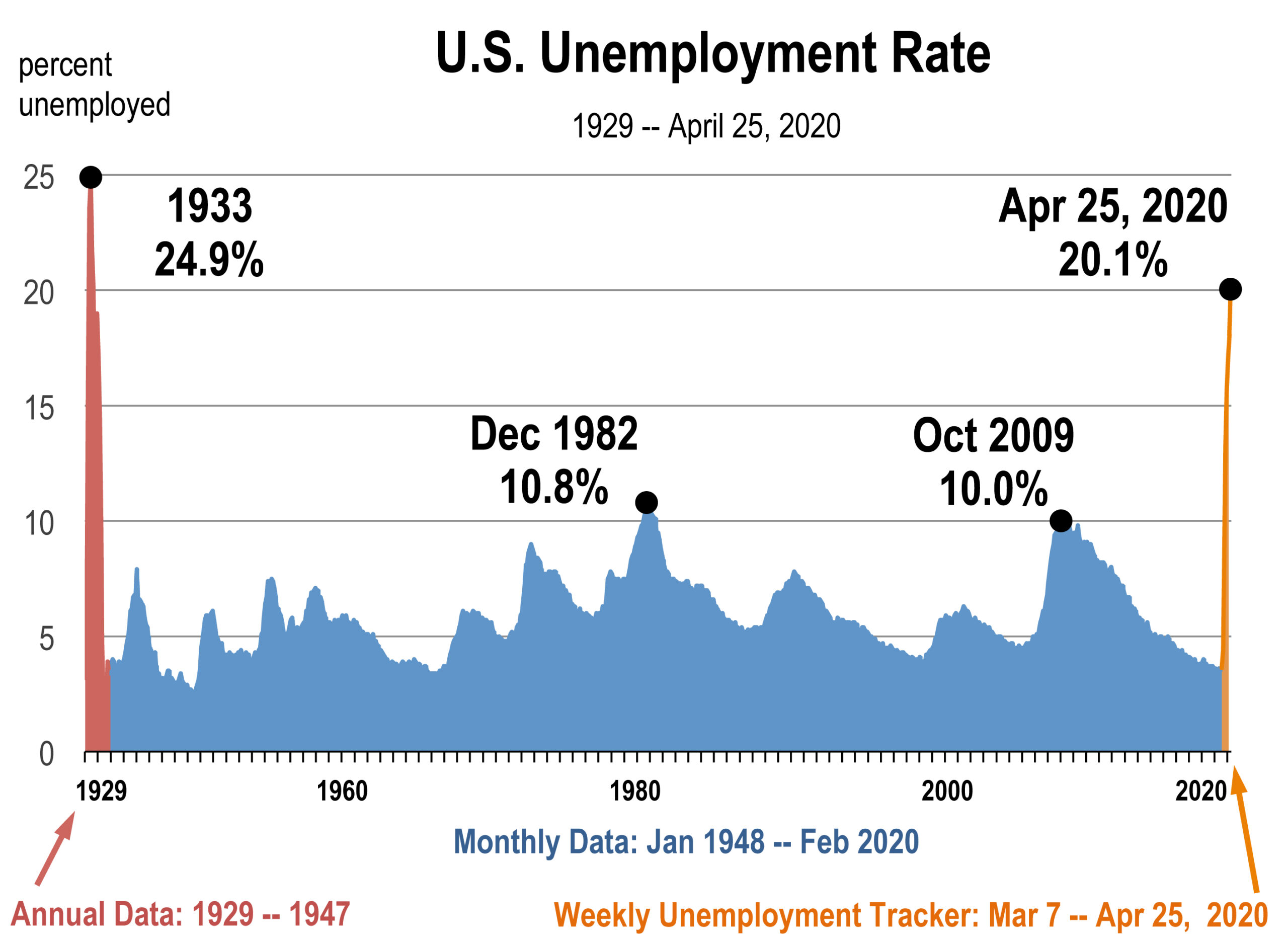

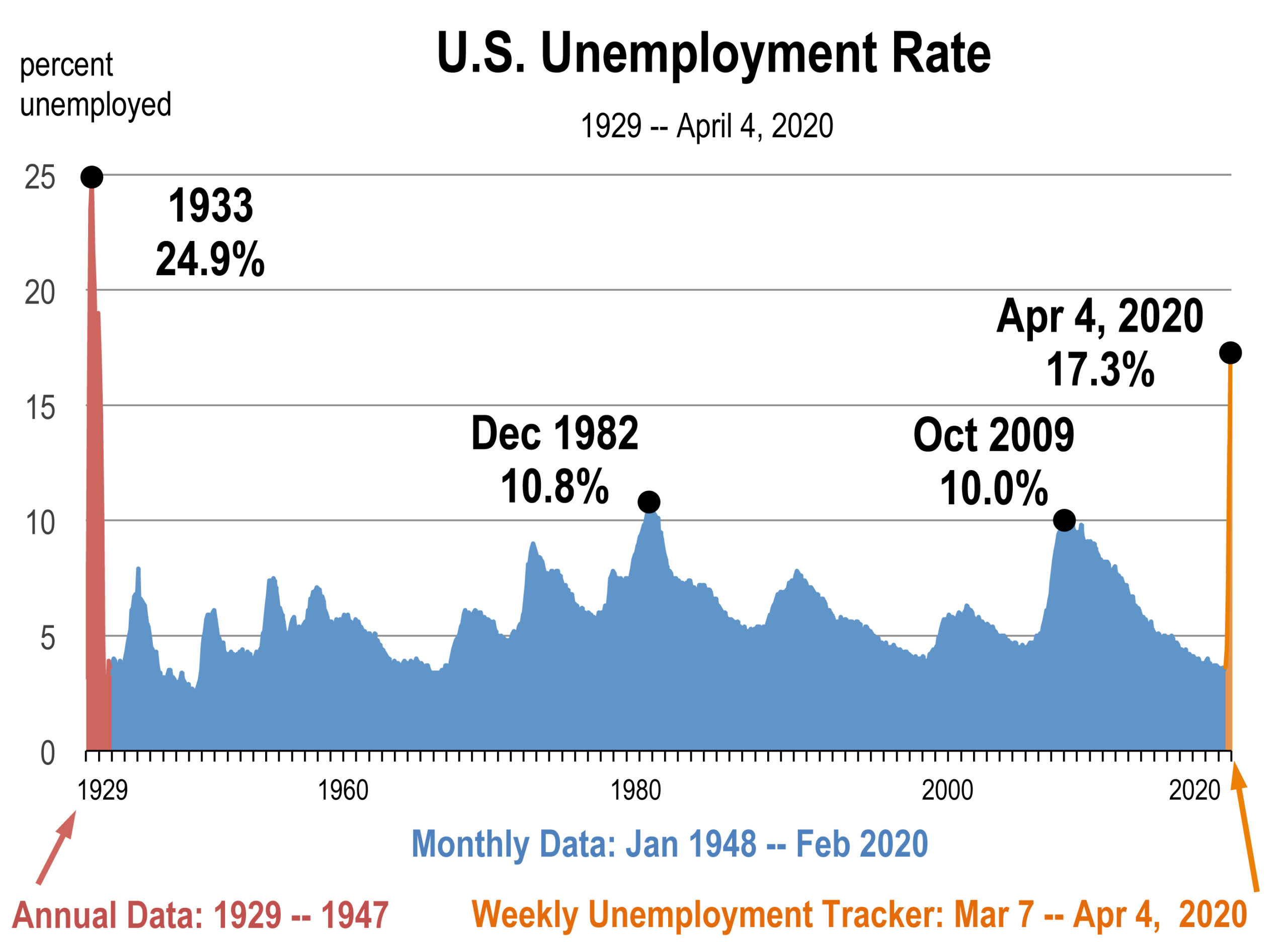

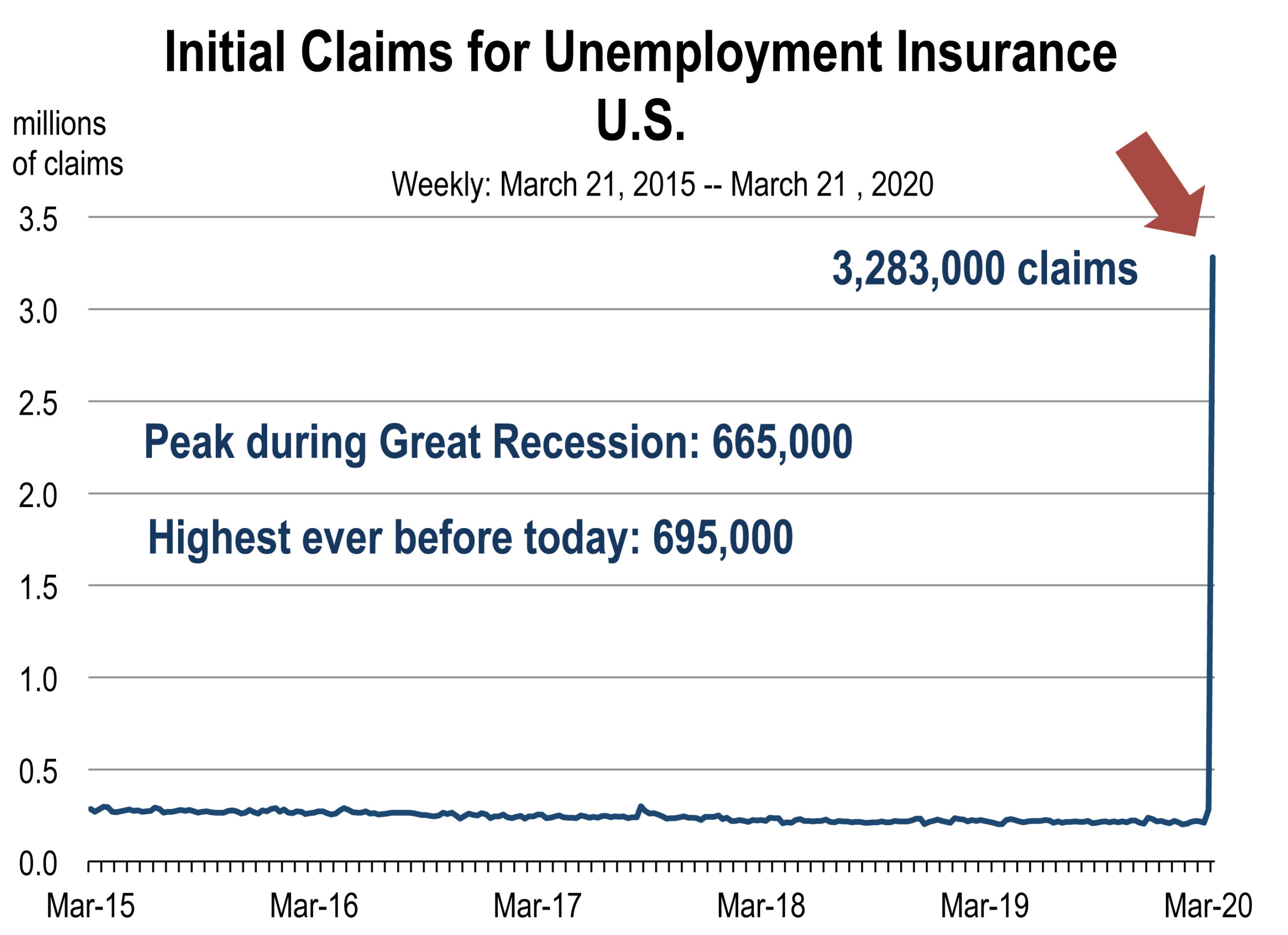

For only the second time in the last century, more than 20 percent of the U.S. labor force is effectively unable to find work. In California, nearly 24 percent of the workforce is unemployed.

The indicators measuring the extent of the economic contraction continue to be shocking, but over the next two weeks, the unemployment rate will likely decline as the fiscal rescue programs pick up speed and parts of the country reopen their economies.

It has been a month since Congress appropriated more than $2 trillion for relief efforts, but those funds are just beginning to trickle out.

As of April 21st, approximately $175 billion in loans had been distributed to small businesses through the Paycheck Protection Program, and another $174 billion should be on its way.

The Fed plans to lend several trillion dollars to businesses and government agencies, and most of this funding has yet to be released. Congress has already replenished the PPP program with an additional $310 billion and the House of Representatives is proposing up to $1 trillion in aid for state and local governments.

All said, the amount of stimulus that is about to hit the economy exceeds anything on record. And it will arrive just as more states begin to lift their lockdowns. Already, 15 states have partially eased their shelter-in-place orders, allowing some businesses to reopen.

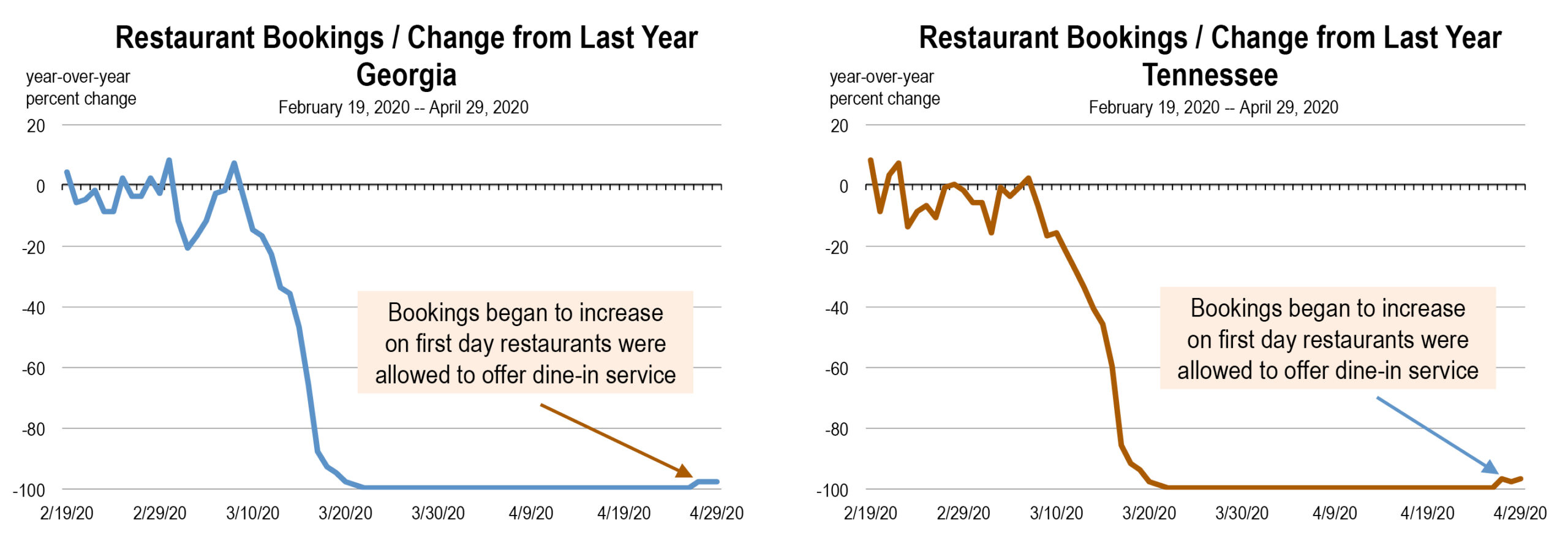

There is very early evidence that some industries that were completely frozen have begun to thaw. In Georgia and Tennessee, two of the first states to ease their lockdowns, restaurant bookings started to inch higher on the first day that dine-in service was permitted.

Macy’s plans to open 68 stores on May 4th, and the rest of its 775 locations within 8 weeks. One of the nation’s largest retail operators will start to open 49 shopping centers tomorrow.

Next week, there may be a new surge in claims for unemployment insurance, but it won’t necessarily indicate that the unemployment rate has deteriorated further. If there is a surge, it will almost certainly be the result of gig workers and contractors applying for unemployment benefits, a process that only began on April 28th in California.

There’s a good chance this will be a W-shaped recovery, with multiple up-and-down moves. So it’s possible that a future contraction could push the unemployment rate above its current level. But it is highly likely that we have reached a short-term bottom and conditions could begin to improve within weeks.

PPP Loans Could Fund 39 Million Jobs

by Mark Schniepp and Ben Wright

April 24, 2020

The nation’s unemployment rate is now at stratospheric levels, but where it goes from here is uncertain.

The first round of Paycheck Protection Program Loans has now been distributed and the dollar amount is significant. If firms elect to have these loans ultimately forgiven, effectively converting them into grants that won’t require payback, they must maintain their pre-recession staffing levels near pre-recession salaries.

Some firms will use PPP funds to re-hire workers that had been laid off. Other companies will use them to prevent layoffs in the future. Some organizations have undoubtedly applied for loans when they had no intention of laying anyone off at all. And other firms will allocate the funding to finance both payrolls and other perhaps larger expenses such as rent, equipment, materials, and utilities.

The details of these decisions will have large implications for the job market.

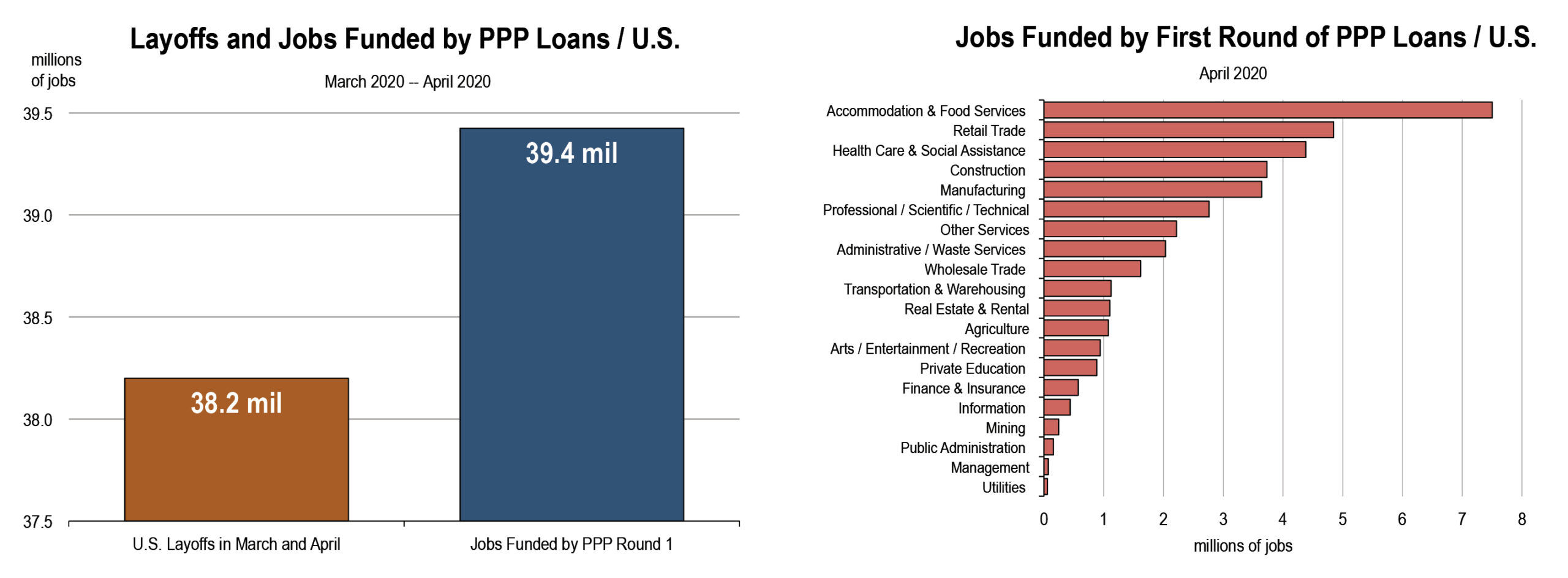

A high share of funding has gone to sectors hit hardest by the shutdowns, such as accommodation and food, retail, and construction, where layoffs have been substantial. But other sectors have received loans to fund more jobs than they have actually lost to date, indicating that the loans will be used to maintain existing payrolls. The most prominent are healthcare and professional, scientific, and technical firms.

The $349 billion comprising the first round of PPP loans could fund the salaries of 39.4 million jobs nationwide, exceeding the 38.2 million layoffs that have been recorded to date.

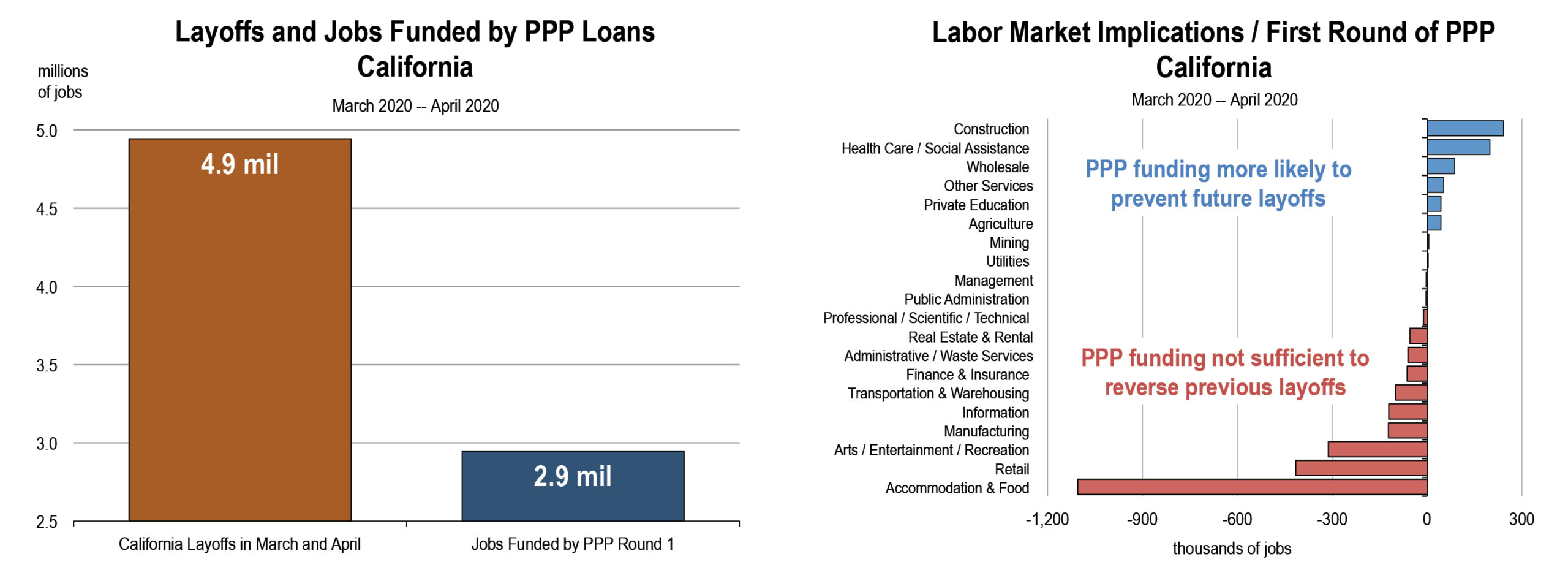

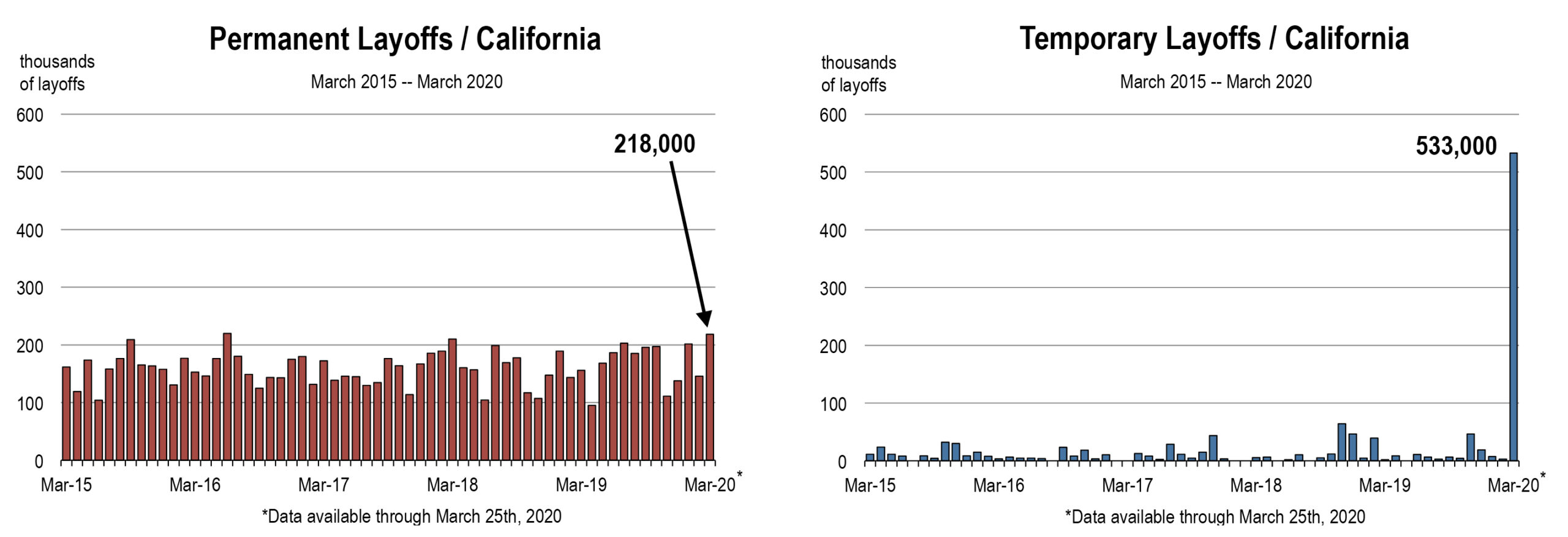

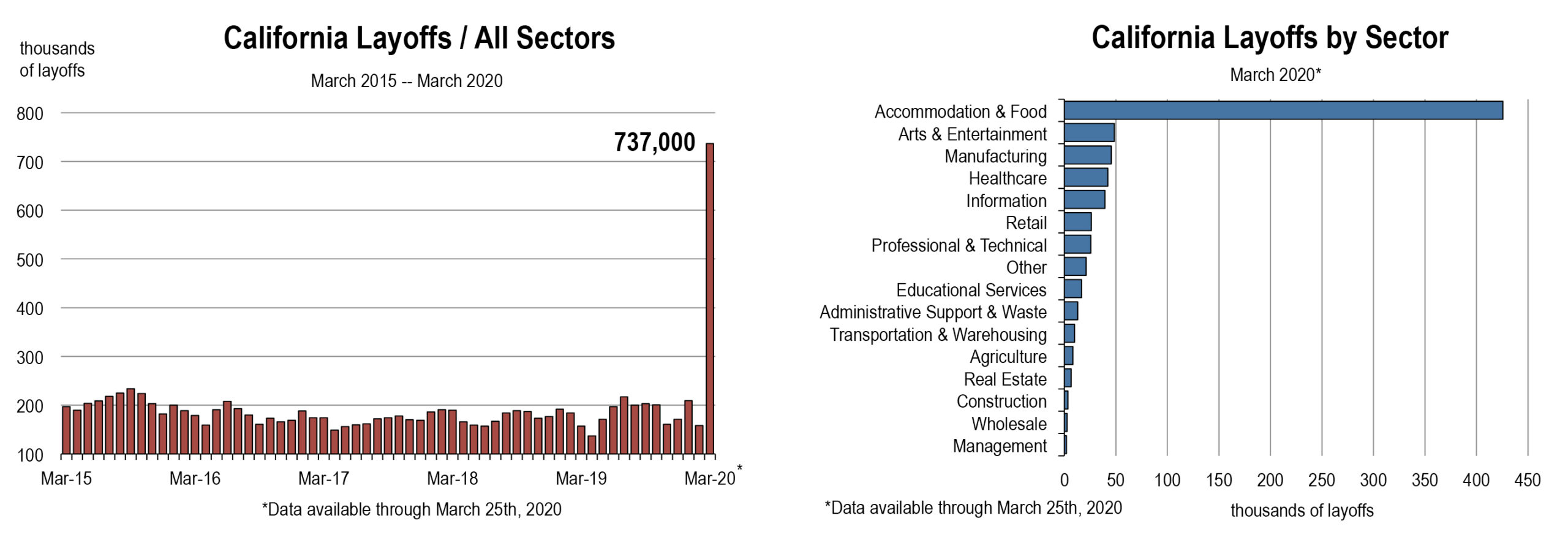

In California, the circumstances are strikingly different. There have been an estimated 4.9 million layoffs in March and April, but PPP loans issued to California firms will support only 2.9 million jobs.

The largest deficit is in the expansive accommodation and food service industry. Of the 1.7 million jobs lost, a maximum of 580,000 could be restored by the fist round of PPP activity – a shortfall of 1.1 million jobs. Prominent shortfalls can also be observed in retail (416,000 jobs), entertainment and recreation (312,000 jobs), and manufacturing (122,000 jobs).

Loans to the construction industry, on the other hand, could prevent more than 210,000 layoffs in addition to the jobs already lost. Loans to healthcare organizations indicate surplus funding for 199,000 jobs.

How will the first round of funding affect the labor market? It’s too early to tell, but there are ways to track the results in real time.

Initial unemployment claims are a barometer of layoffs, so a sharp drop in claims would imply that PPP loans were preventing layoffs that would have otherwise occurred.

Continuing unemployment claims are closely related to the number of people who have been unemployed for two weeks or more, so a decline in continuing claims would indicate that previously laid off workers were being re-hired.

All of this information is included in our weekly unemployment calculations, and there is a strong likelihood that the unemployment rate will be falling within the next few weeks. Congress and President Trump just authorized $310 billion for another round of PPP funding, which could fund millions of additional jobs, so stay tuned for updates.

Weekly Unemployment in California Hits 22.3 Percent

by Mark Schniepp and Ben Wright

April 23, 2020

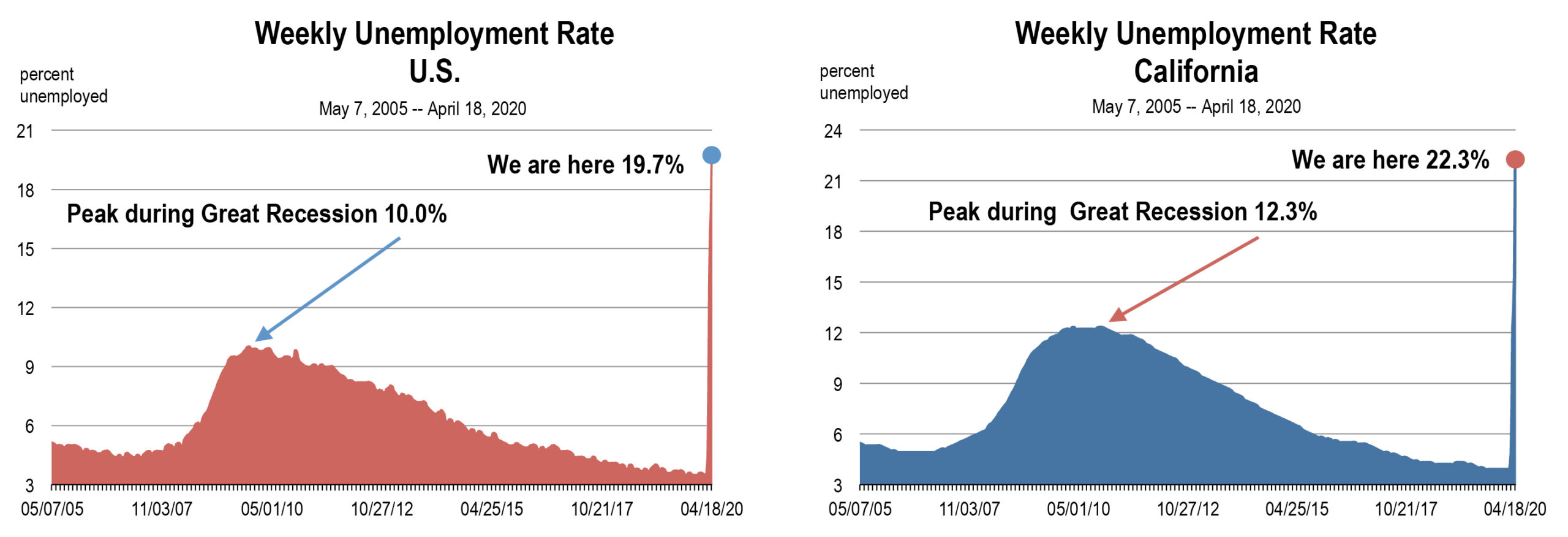

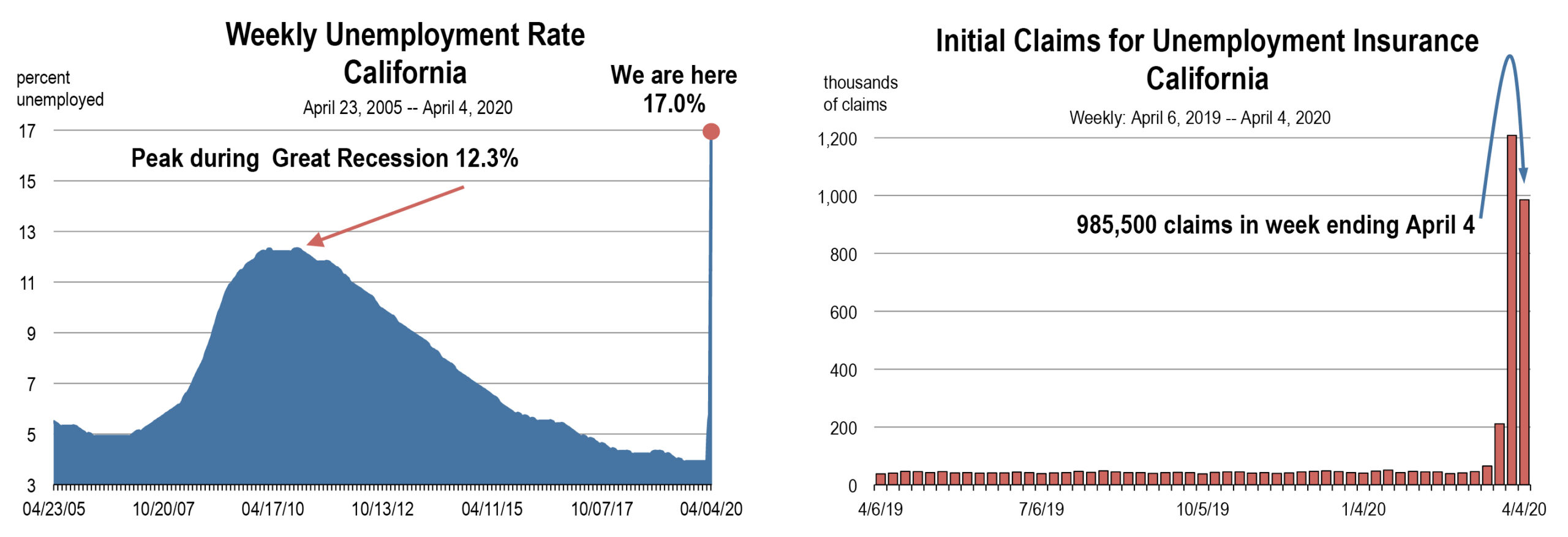

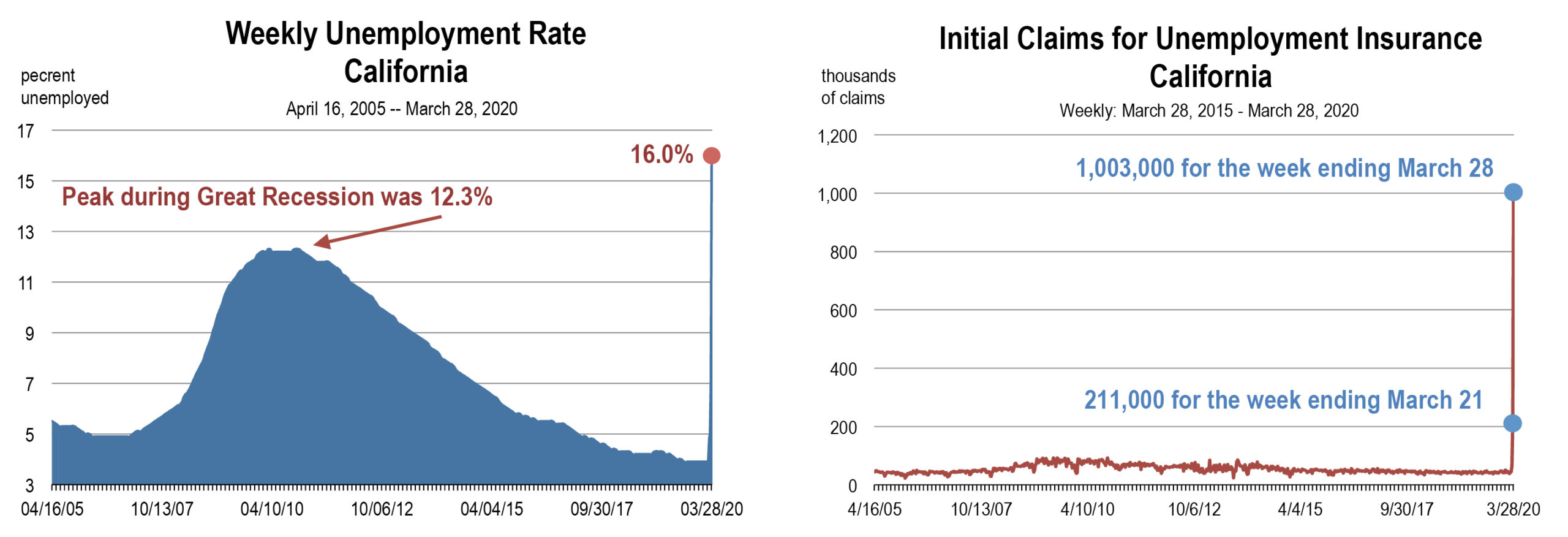

The unemployment rate for California soared to 22.3 percent last week when another 554,000 claims for unemployment insurance were filed by COVID-19 impacted workers. The unemployment rate for the U.S. jumped to 19.7 percent.

These rates are the highest ever recorded for either the U.S. or California since the Great Depression.

At this point in our real-time analysis of effective unemployment, the current rates may be the highest that we observe during this recession.

That’s because $349 billion in Paycheck Protection Program loans have now been funded, meaning that many workers will theoretically be “hired back” by their previous employers and paid their previous salaries.

Furthermore, next week, a number of U.S. states will be “opening” back up by easing off stay-at-home orders.

Colorado and Montana will be the first to open on April 26th (this upcoming Sunday). South Carolina and Mississippi open on Monday. Then the states of North Carolina, Arizona, Alabama, Georgia, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Maine, Louisiana, Wyoming, New Mexico, Nevada, Texas, Tennessee, and North Dakota will open on April 30th, a week from today.

There is no date set for lifting the shelter-in-place in California or Oregon.

Consequently, unemployment will continue to persist at horrific levels in California while declining throughout much of the rest of the nation, with many workers returning to work throughout the month of May.

Inventory is the Real Estate Indicator to Watch

by Mark Schniepp and Ben Wright

April 20, 2020

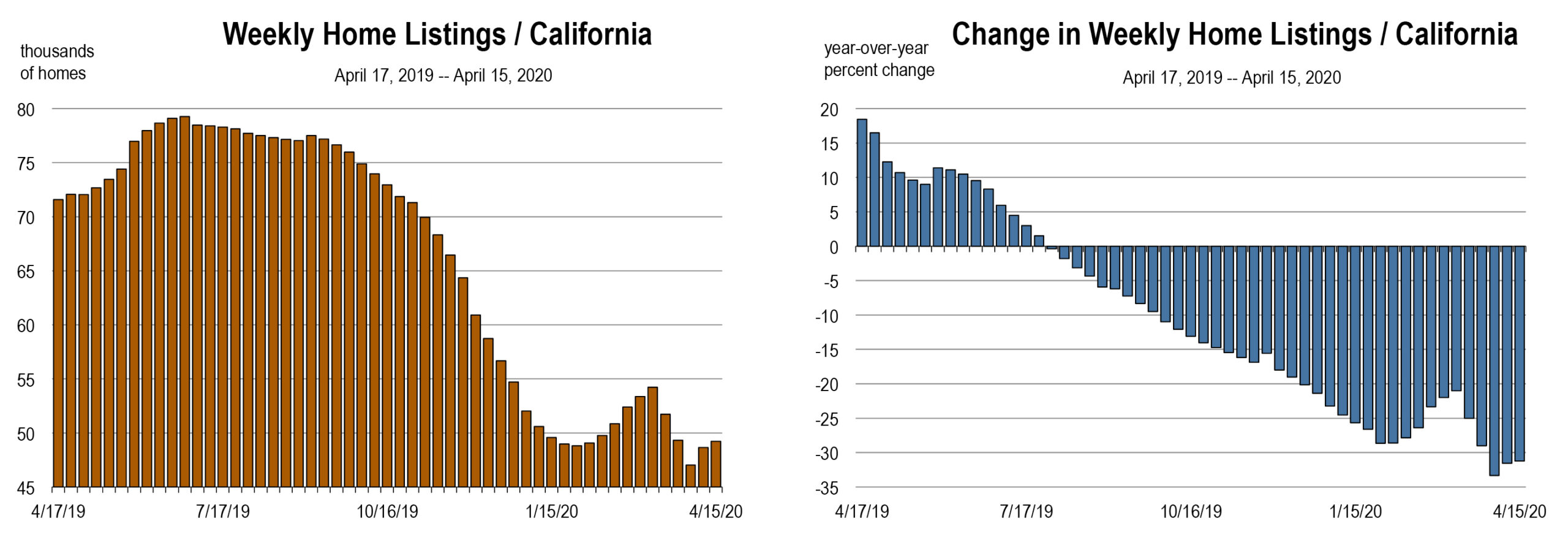

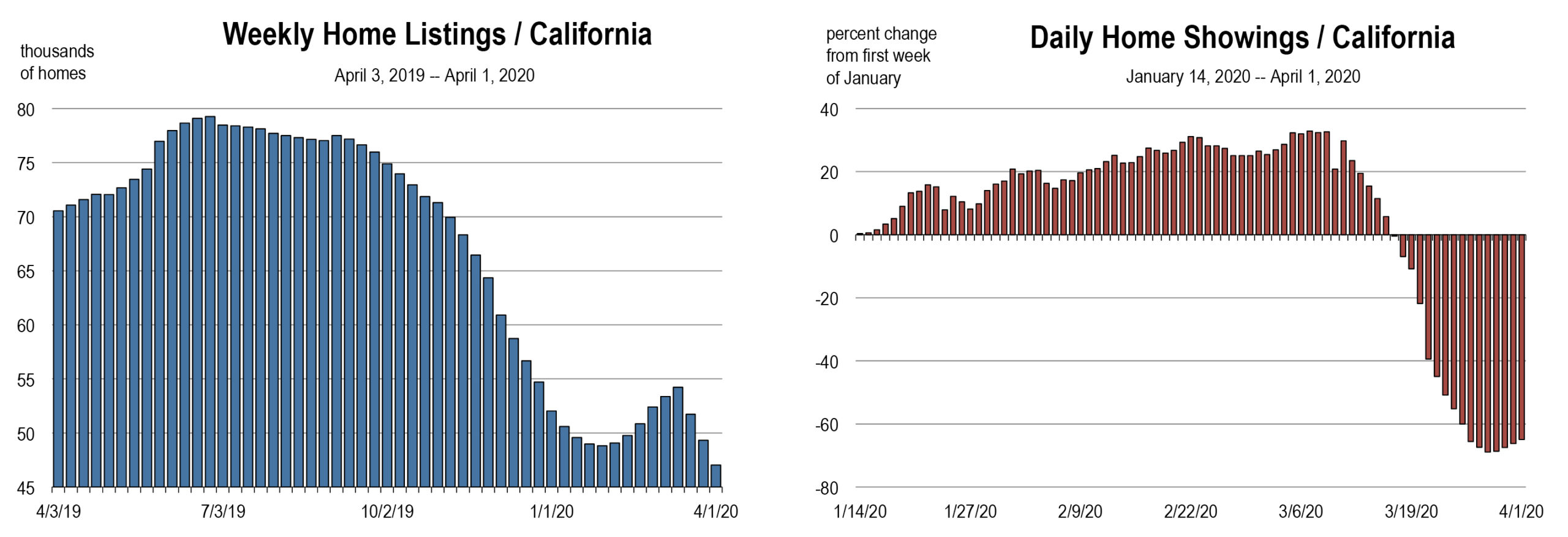

For-sale housing inventory has deteriorated faster than other components of the residential real estate market, but it appears to be stabilizing.

The number of home listings inched slightly higher during the last two weeks, and inventory now appears to be following the typical seasonal pattern of rising in the spring.

The home hunting season usually begins in March, with warmer weather bringing both buyers and sellers into the market in larger numbers. This year was no exception until President Trump declared a state of emergency, immediately leading sellers to delist properties and cancel open houses.

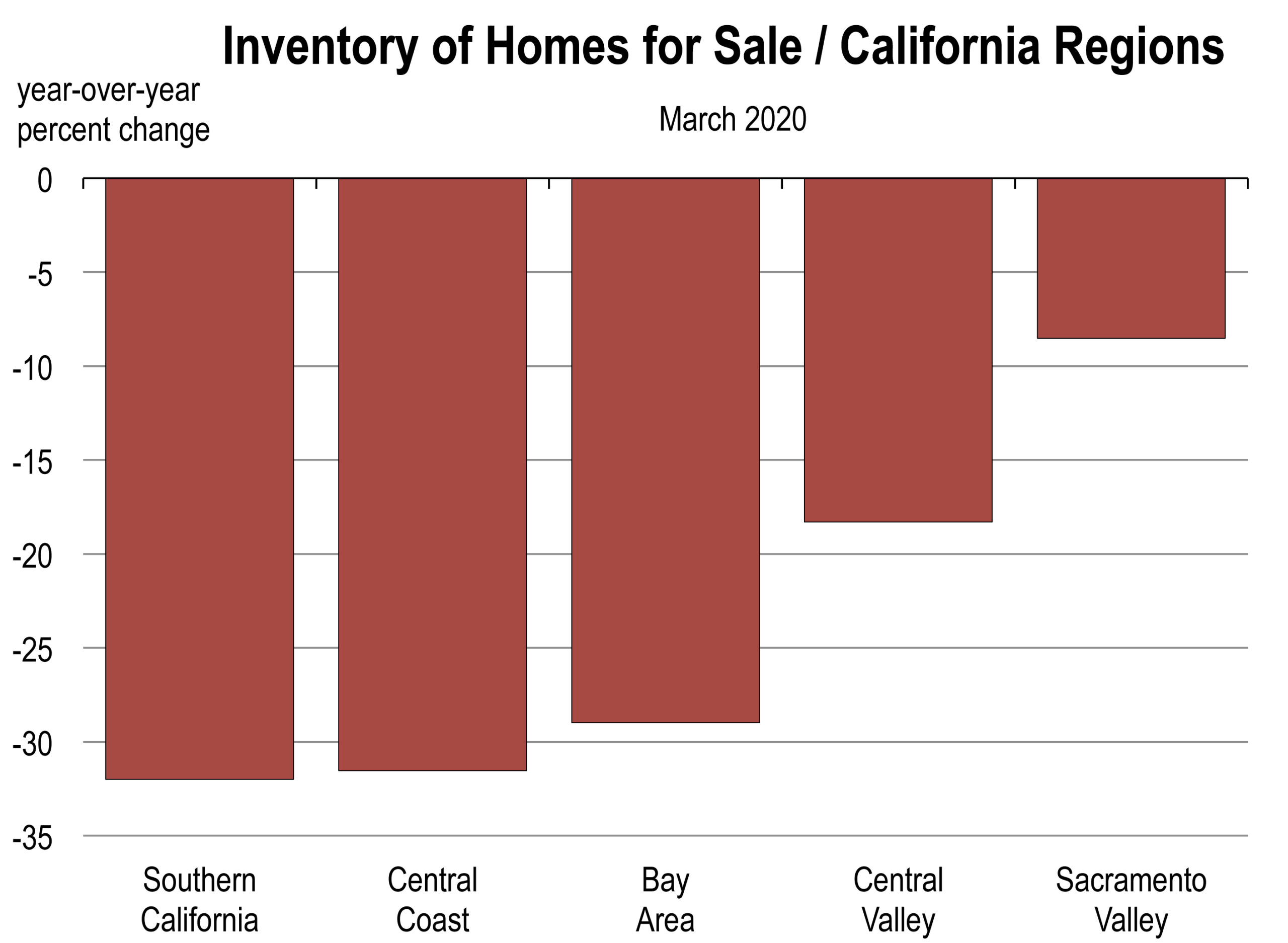

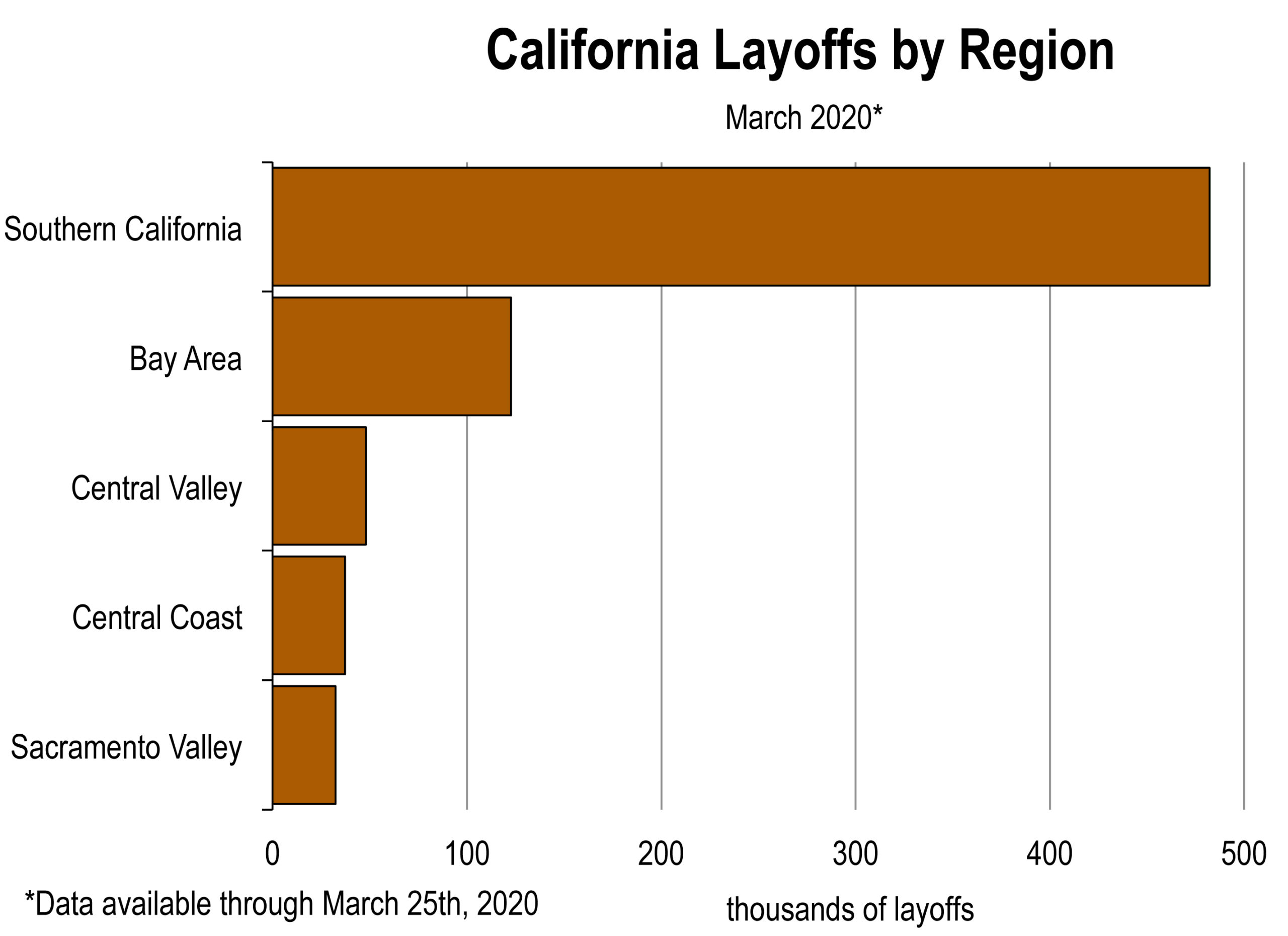

Not surprisingly, changes in housing inventory have moved in sync with California layoff data very closely. Regions with more than their fair share of layoffs, like Southern California and the Central Coast, had more homes pulled from the market than regions with lower layoff rates (scroll down to our April 14th post for more information about layoffs).

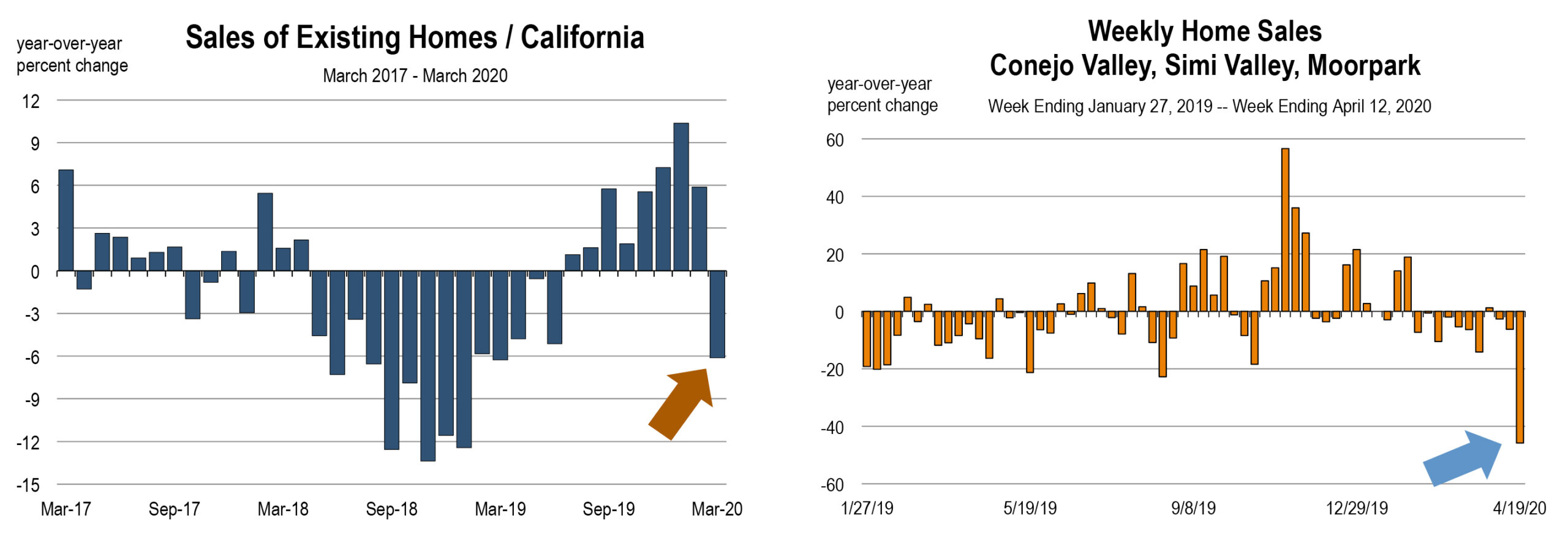

Home sales have declined as well, but so far the lockdowns have impacted sales much less severely than listings. Why? Because many contracts were signed in the first half of March, before the magnitude of the Conoravirus recession was apparent.

In this environment, sales appear to be following inventory trends with a one-month lag, and we expect April transactions to show strong declines.