Mark Schniepp

June 2025

The key issues for the California economy in 2025 include the effect of new foreign trade policy, attempts to reduce federal government spending, and the onset of AI in most industries, especially technology and advanced manufacturing.

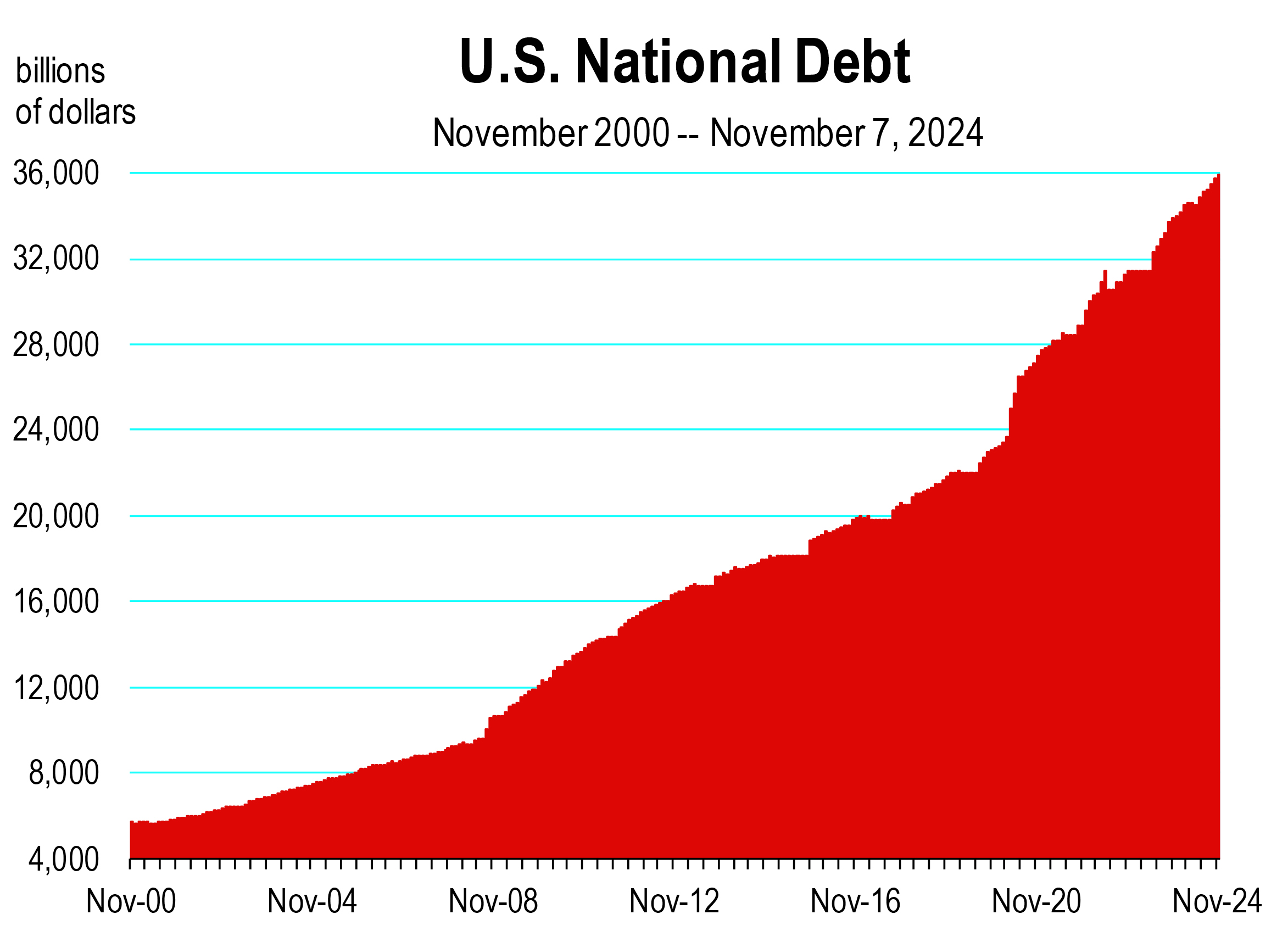

Reductions in federal spending could impact healthcare activity in California, namely Medi-Cal. The void in spending would have to be made up by State revenues. However, the State is currently in a horrific condition regarding its annual budget, for both fiscal 2024-2025 and 2025-2026.

Deficits of $45 billion in the current fiscal year and another $12 billion in 2025-2026 are facing the legislature.

It is likely that no cuts to Medi-Cal will occur, keeping the healthcare industry in California—one of only three labor market sectors to create jobs in 2024 and 2025—growing.

To date, the healthcare sector is not only the leading sector for job creation in the State, but the only private labor market that is creating jobs. Employment in all other industries is now consolidating, largely due to  the rapid onset of AI which has been the case since 2023.

the rapid onset of AI which has been the case since 2023.

California faces a shortfall in tax revenue that will likely result in some consolidation of state and local government employment this calendar year.

New Development in California

In February, the Associated General Contractors of  California survey of respondents was optimistic regarding construction business activity in 2025. Nearly 63 percent of those surveyed expect modest growth in overall business activity this year.

California survey of respondents was optimistic regarding construction business activity in 2025. Nearly 63 percent of those surveyed expect modest growth in overall business activity this year.

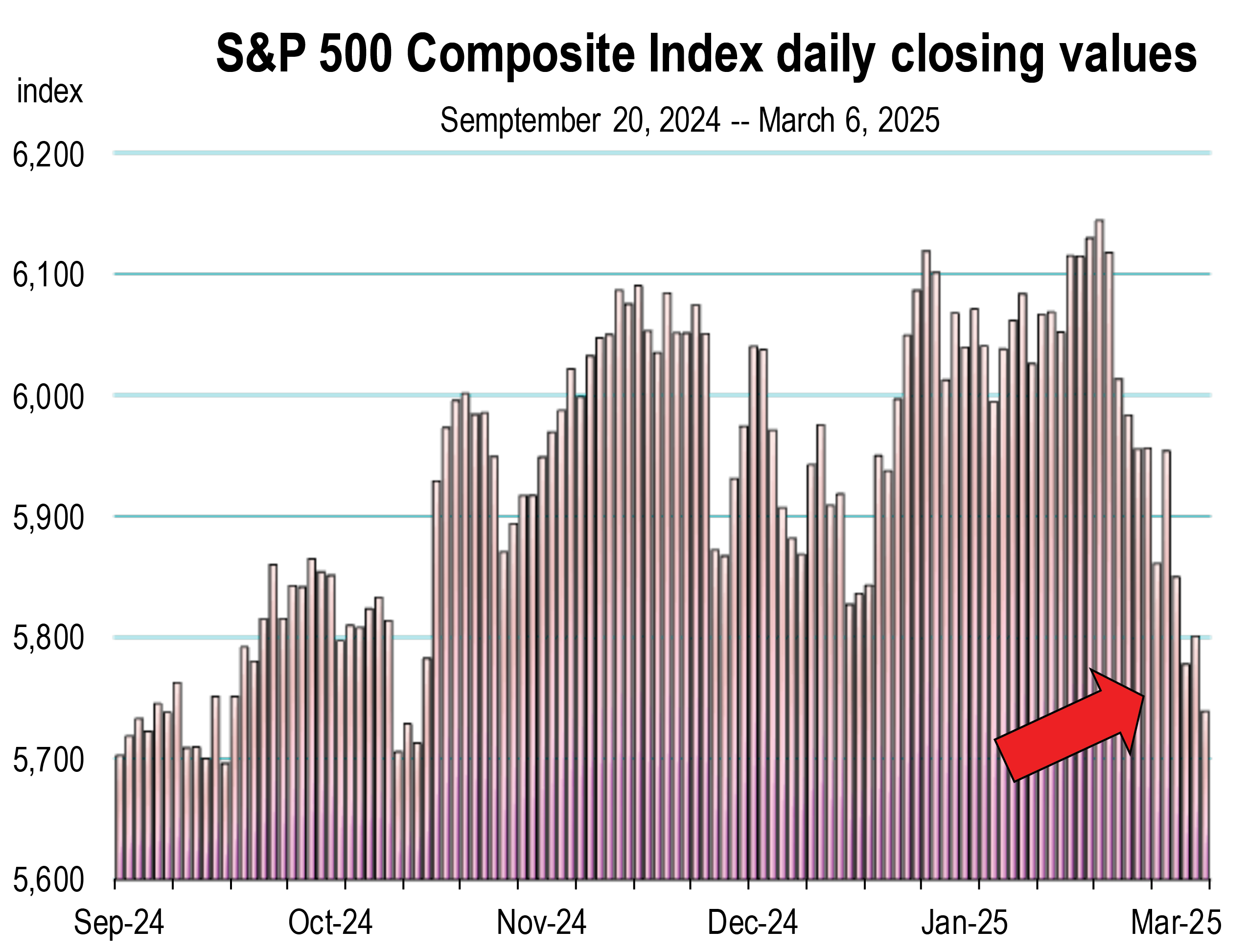

Beginning in February however, tough tariff talk shook the stock market, and caused delays among some of the nation’s largest employers in hiring. The uncertainty associated with how tariffs might interrupt supply chains  for construction materials along with unknown cost hikes due to tariffs has delayed project starts this year.

for construction materials along with unknown cost hikes due to tariffs has delayed project starts this year.

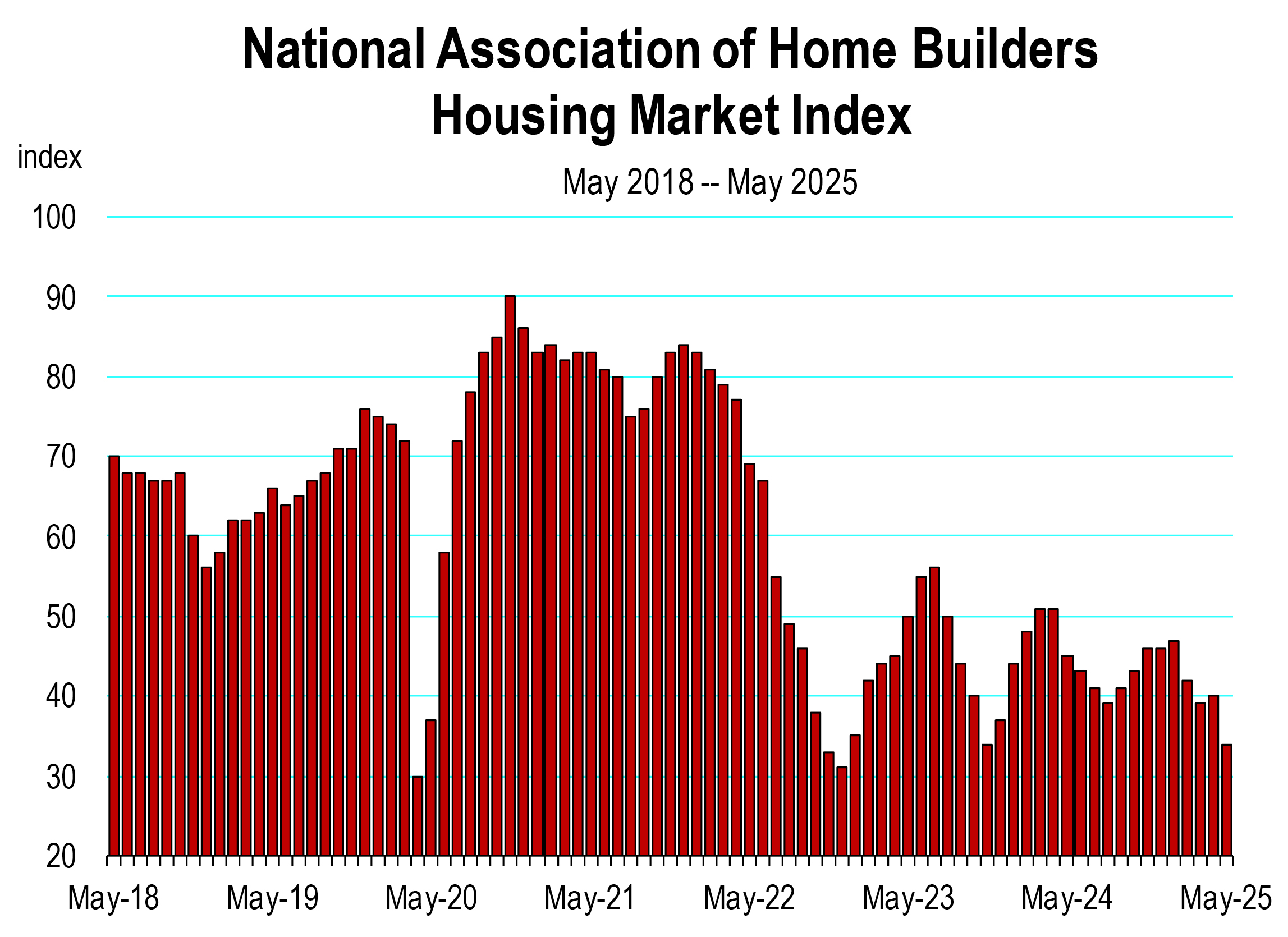

Building permits for housing are lower as builders grapple with the uncertainty. The NAHB Housing Market Index is a gauge of home builder sentiment and expectations regarding the single-family housing market tracking builders’ perceptions of current sales, sales expectations for the next six months, and traffic of prospective buyers. Those perceptions are relatively pessimistic. Consequently, the pace of new housing permits in 2025 is now at the lowest level since 2015.

Nevertheless, there are many large housing projects that are moving forward this year, in many of the larger markets of the state. The largest include the Southeast Development project in Fresno, with 45,000 residential units, the Brooklyn Basin in Oakland, Silverwood in Hesperia, Riverstone in Madera, Related Bristol in Santa Ana, Valencia in Santa Clarita, and Stonestown in San Francisco.

Infrastructure projects in California continue to dominate construction activity in 2025, including the

airport modernization projects at LAX and San Diego International, the California High Speed Rail, and  the BART Silicon Valley tunneling project.

the BART Silicon Valley tunneling project.

The Bullet train however, is now facing significant funding challenges in addition to ongoing cost overruns. Last week, the Federal Department of Transportation proposed cutting $4 billion in funding, along with another $2 billion from the Federal Railroad Administration unless the project can demonstrate compliance.

The largest dam removal project in U.S. history is underway in northern California, called the Klamath River project.

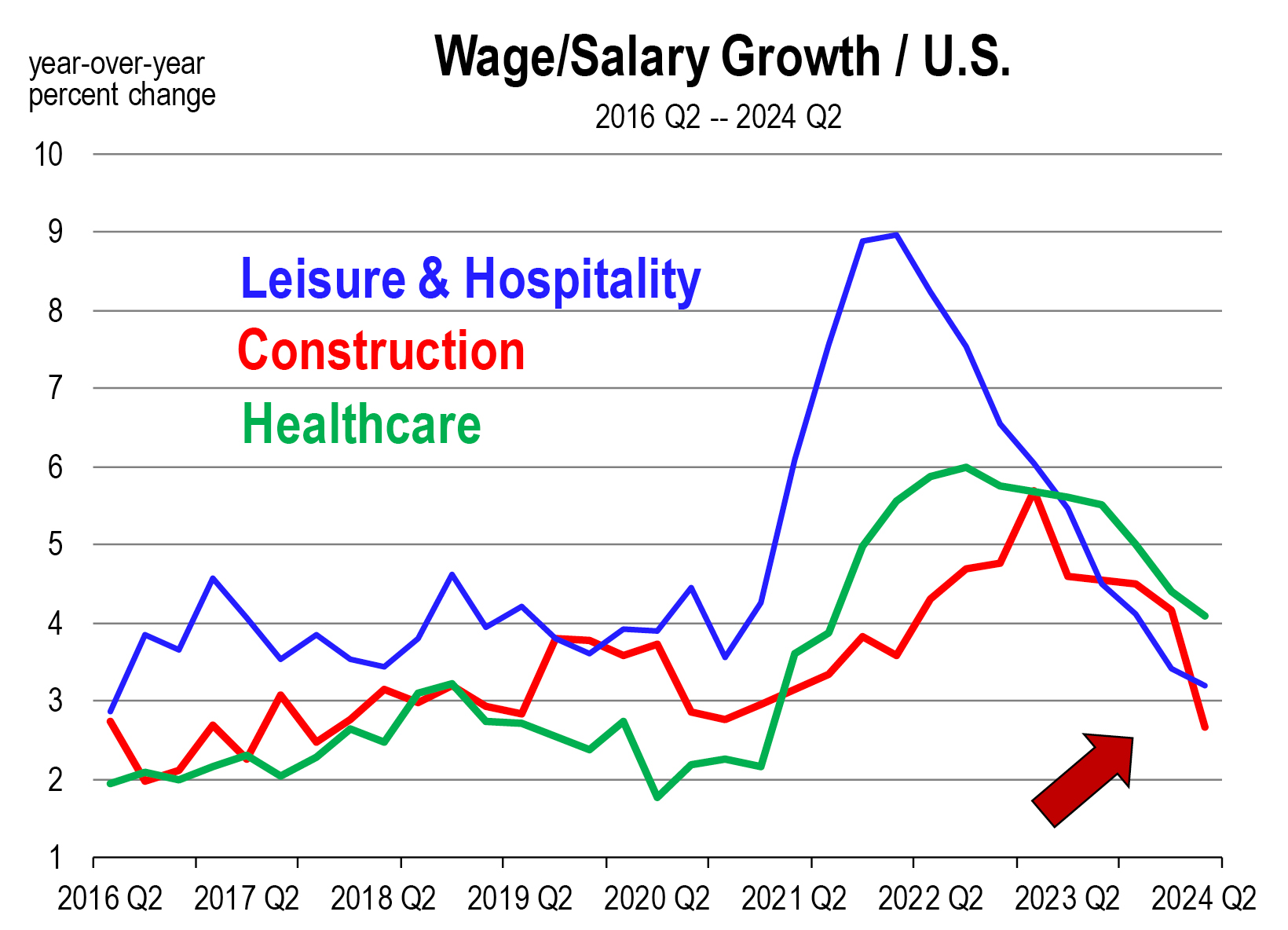

The concerns regarding California’s construction industry last year were principally the scarcity of skilled labor. The same concern is present this year.

Though prices for certain construction materials are still high, the worry over tariffs and how they might impact building material prices has generated uncertainty among builders. Consequently, a softening in the total construction workforce this year is due mainly to hesitancy in project starts.

More clarity regarding tariffs and building costs is unfolding as the year progresses. It appears that 10 percent tariffs will prevail, on most country’s products coming in. And a deal has been struck with China regarding rare earth minerals though the tariff rate is much higher on all goods. Construction products will be subject to a 55 percent tariff at this writing. It is my opinion that much of this tariff will be borne by the manufacturers.

Construction costs in general have pushed higher over the last two months due to recent upward movements in steel and cement.

Recent Economic Evidence

Tourism in California remains a key engine of growth. Though Canadian visitors have declined 14 percent this year, total international visitors are off about 1 percent compared to a year ago. And many tourist venues and attractions are still recording high levels of attendance largely from resident Californians. Hotel/motel utilization in 2025 is about the same as last year, though hotel prices are higher by three percent this year.

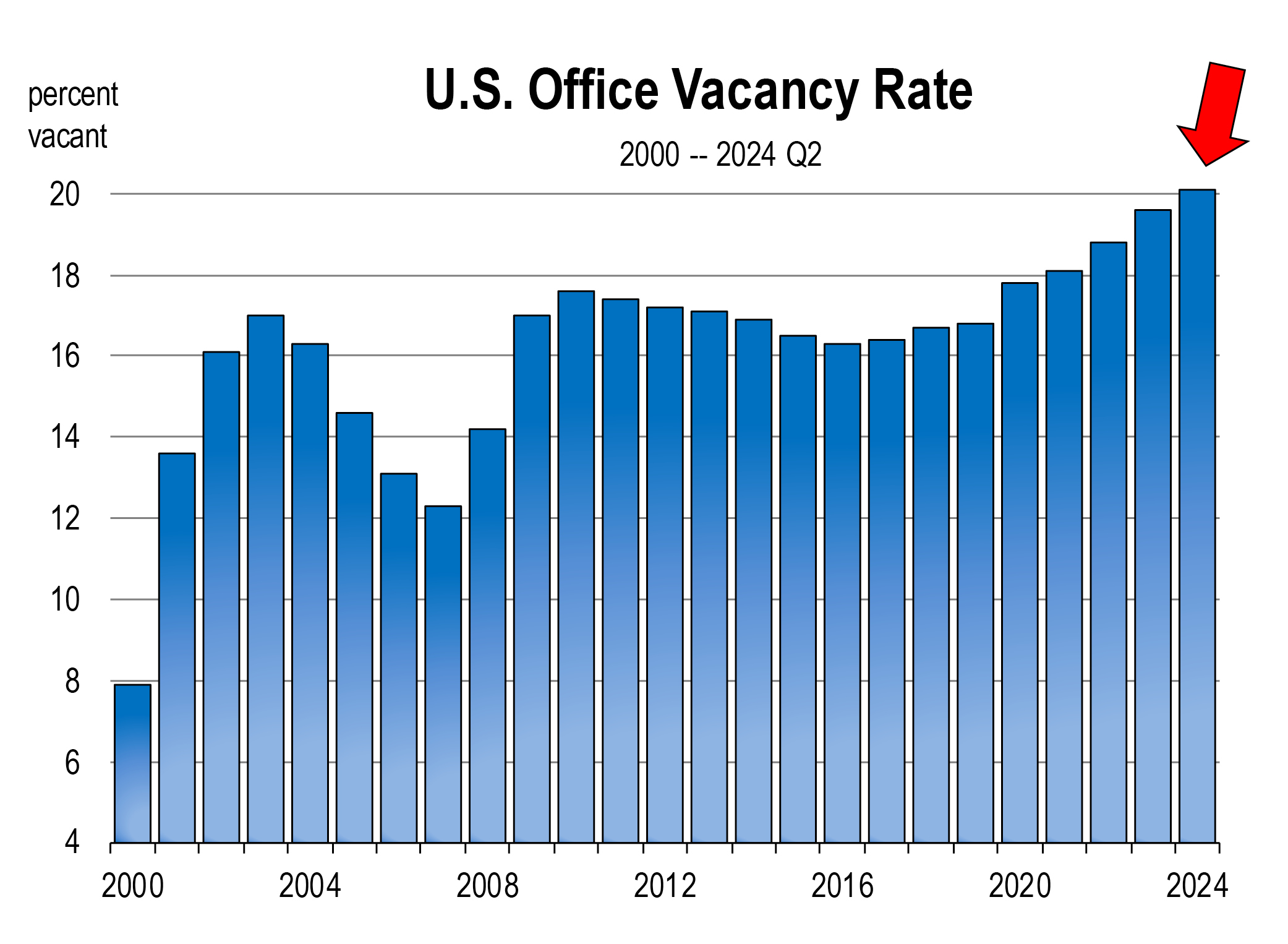

The Office market is still weak but turnarounds in office utilization are finally occurring in San Francisco, San Jose, Orange County, San Diego County, and the Inland Empire. Elsewhere in large metro areas, utilization continues to modestly decline.

The onset of AI has occurred rapidly, becoming adopted in a more widespread fashion by all sectors of the economy. AI has generated significant cost savings in technology, the financial sector, real estate, manufacturing, and professional services. A large part of these cost savings have come at the expense of jobs. In the technology services sector alone, AI has displaced an estimated 70,000 jobs since early 2023.

Foreign trade volumes at the Ports of Oakland, LA and Long Beach have faltered in recent months, due largely to the tough tariff talk that has reduced incoming container traffic and therefore goods flow into the states warehouses and distribution facilities. This situation is likely to change when tariff policy is sorted out with our largest trading partners, including China, Canada, Mexico, and Europe. For now, however, there has been a decline in logistics employment (truck drivers, warehouse workers, water transportation workers) which has further placed a meaningful drag on the labor market this year.

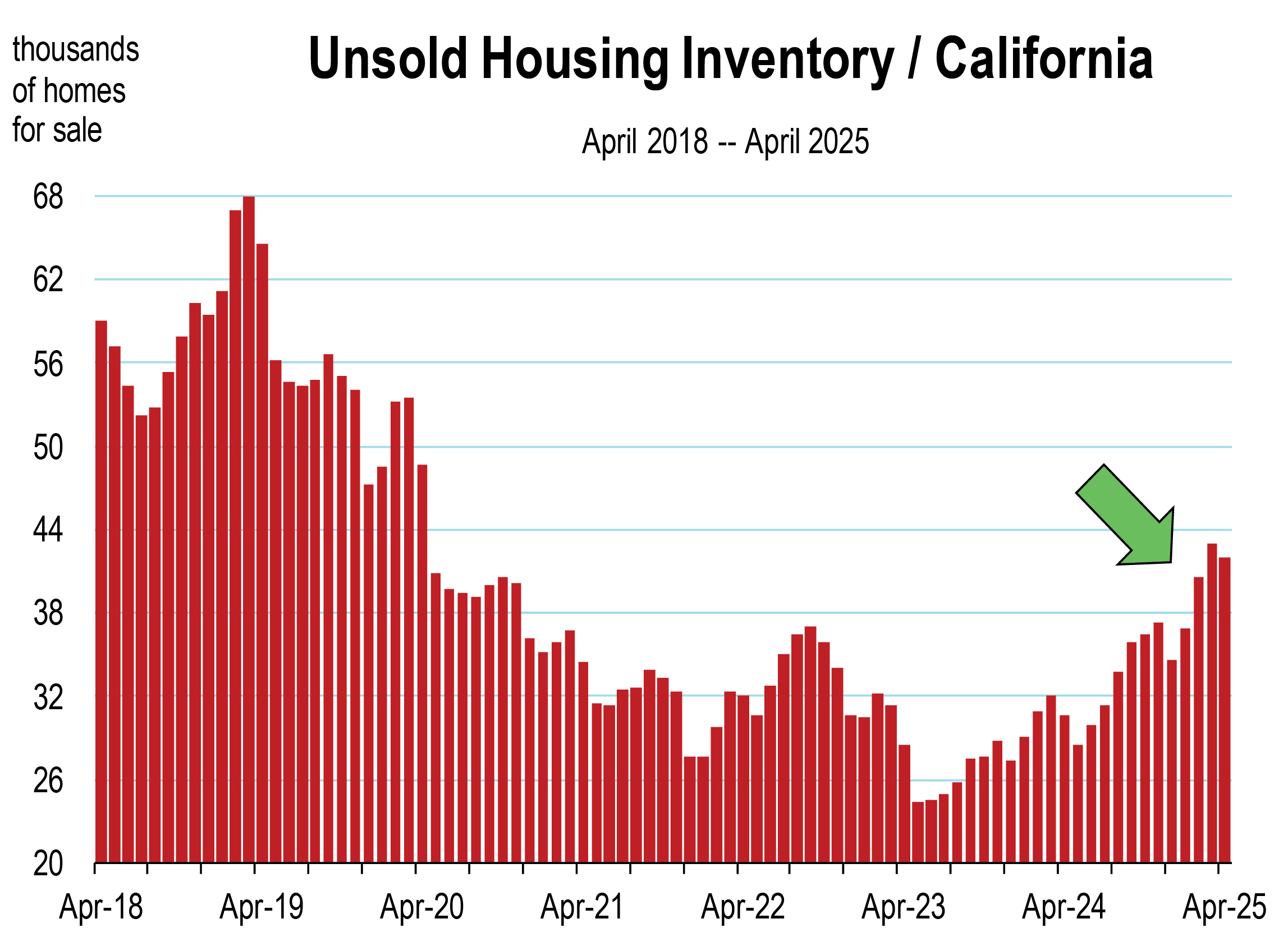

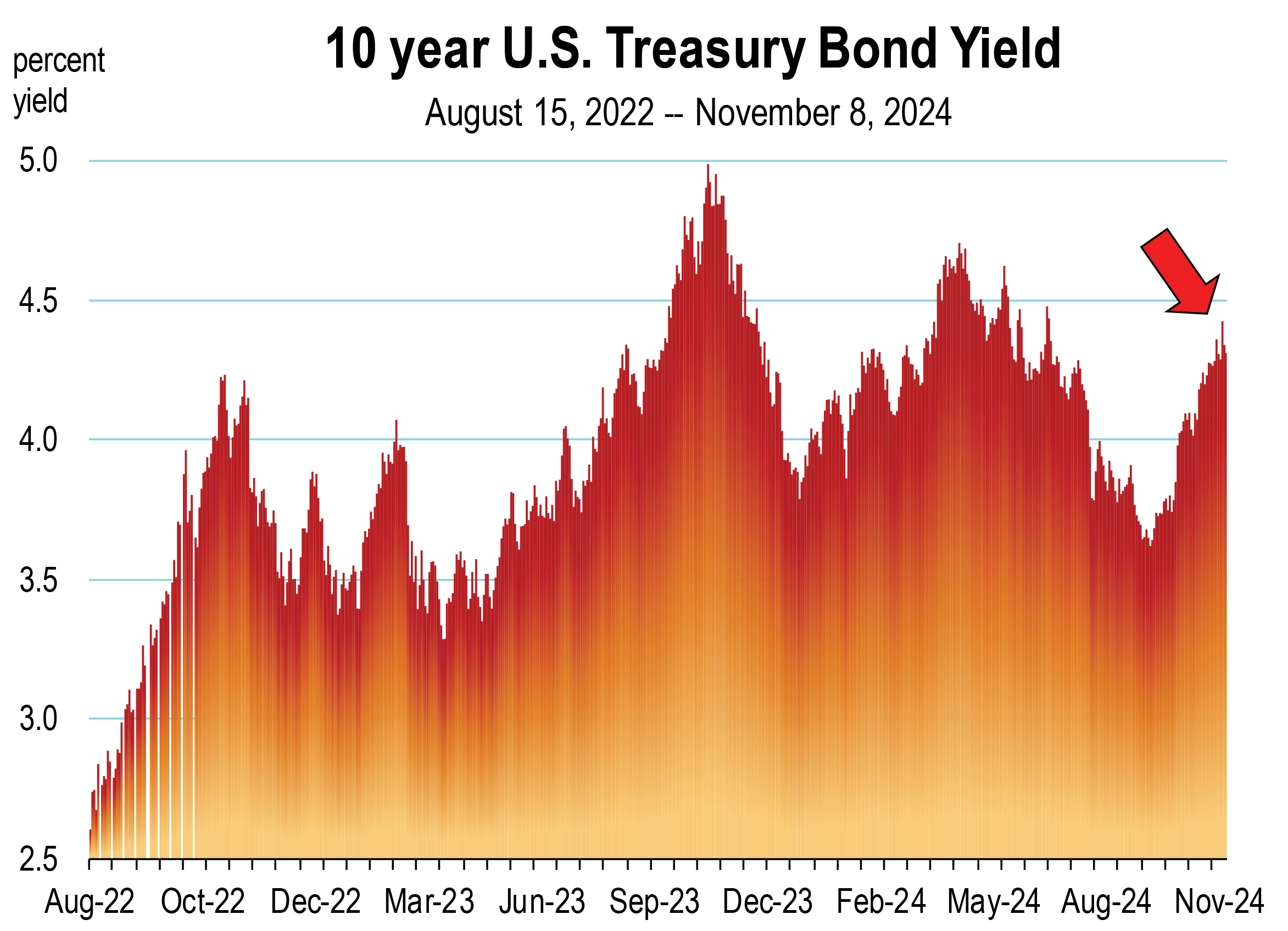

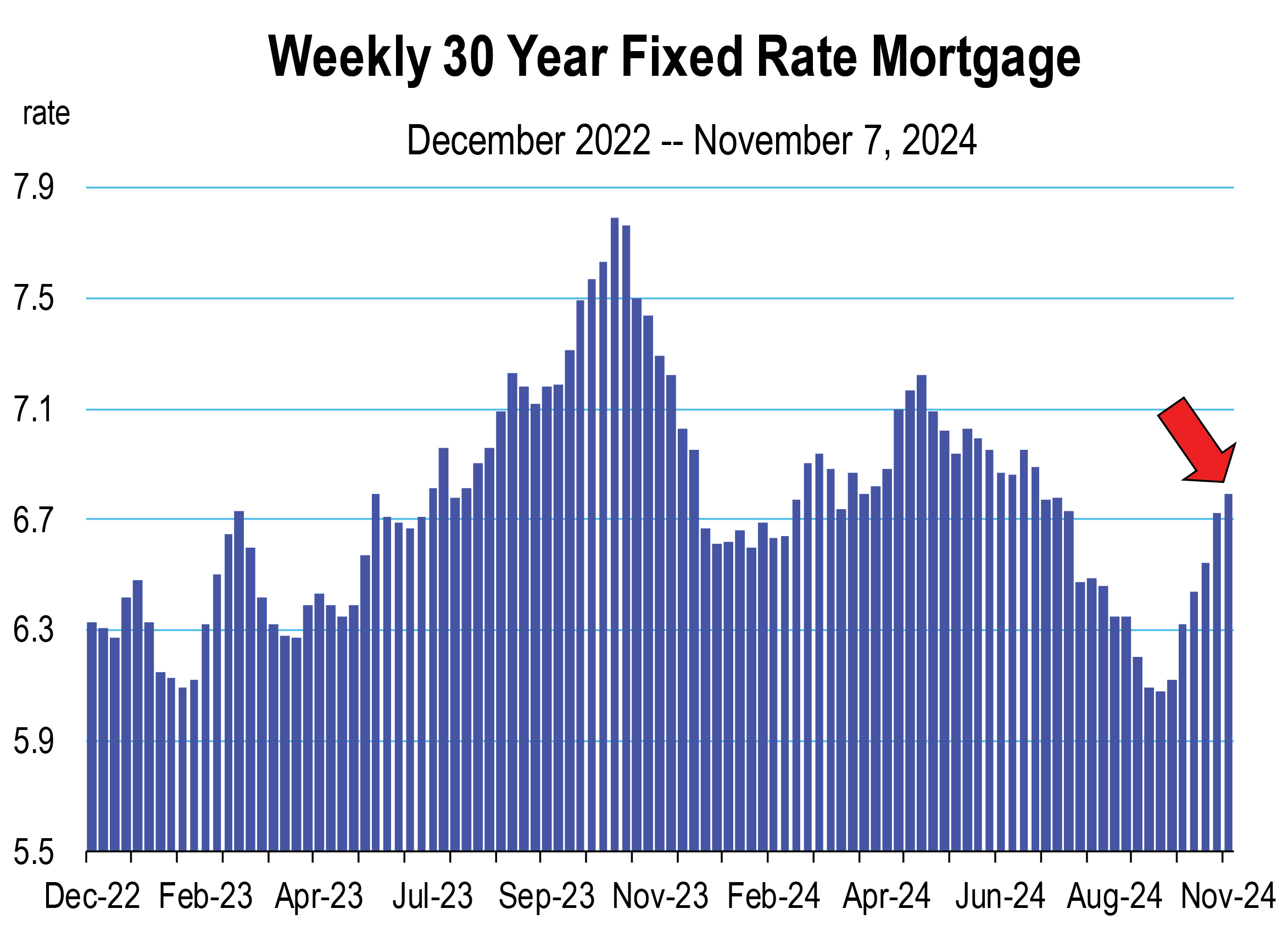

Existing home selling prices are now at all-time record highs in most counties of California. Though the existing home market remains weak, sales are higher this year as inventory rises for the first time in nearly a decade. With much of the uncertainty that bogged down new housing project starts in the first half of 2025 now dissipating, and with the likelihood of some mortgage rate relief over the next 6 months, the housing market should modestly improve going forward.

The Outlook for California in 2025

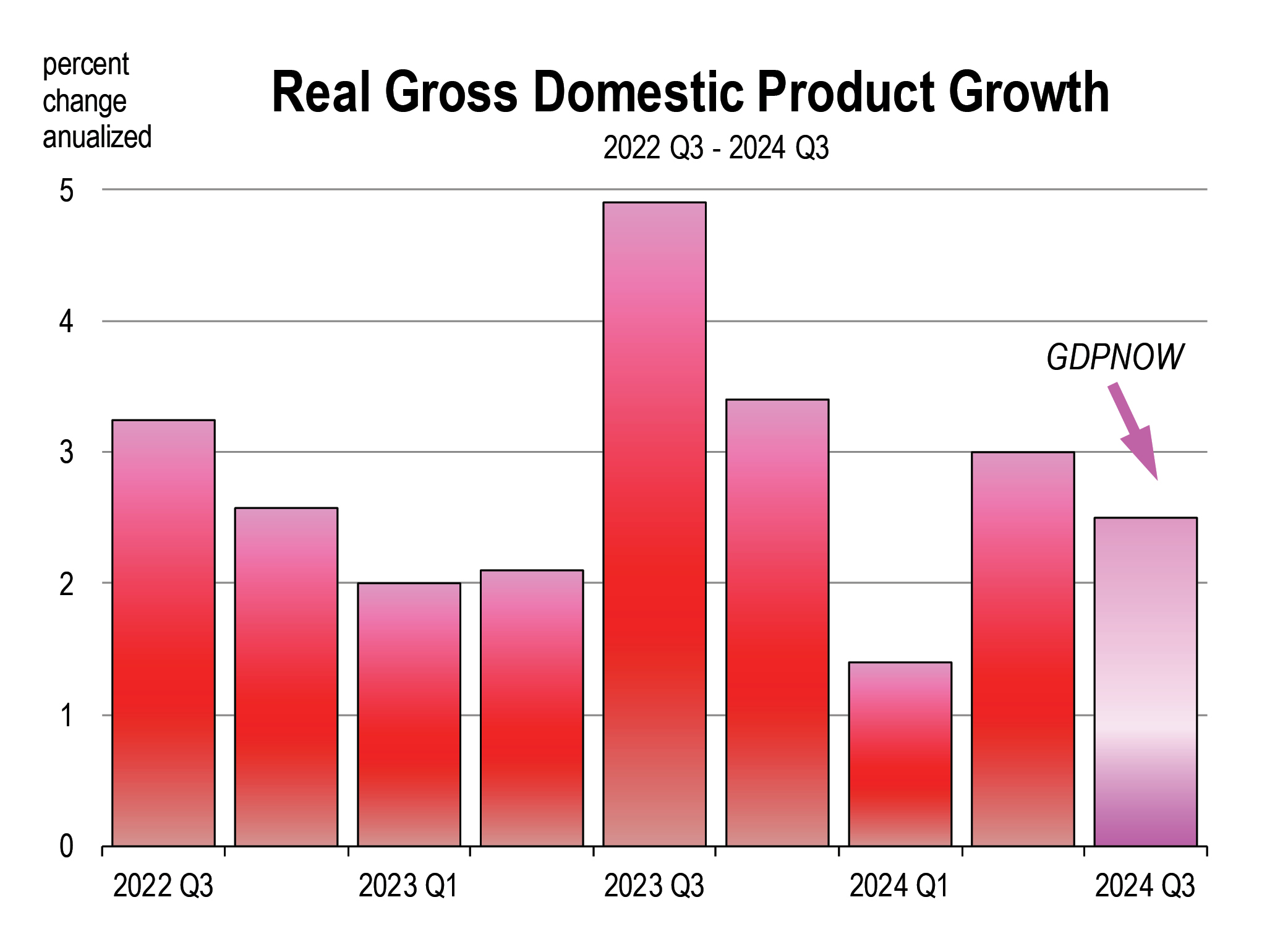

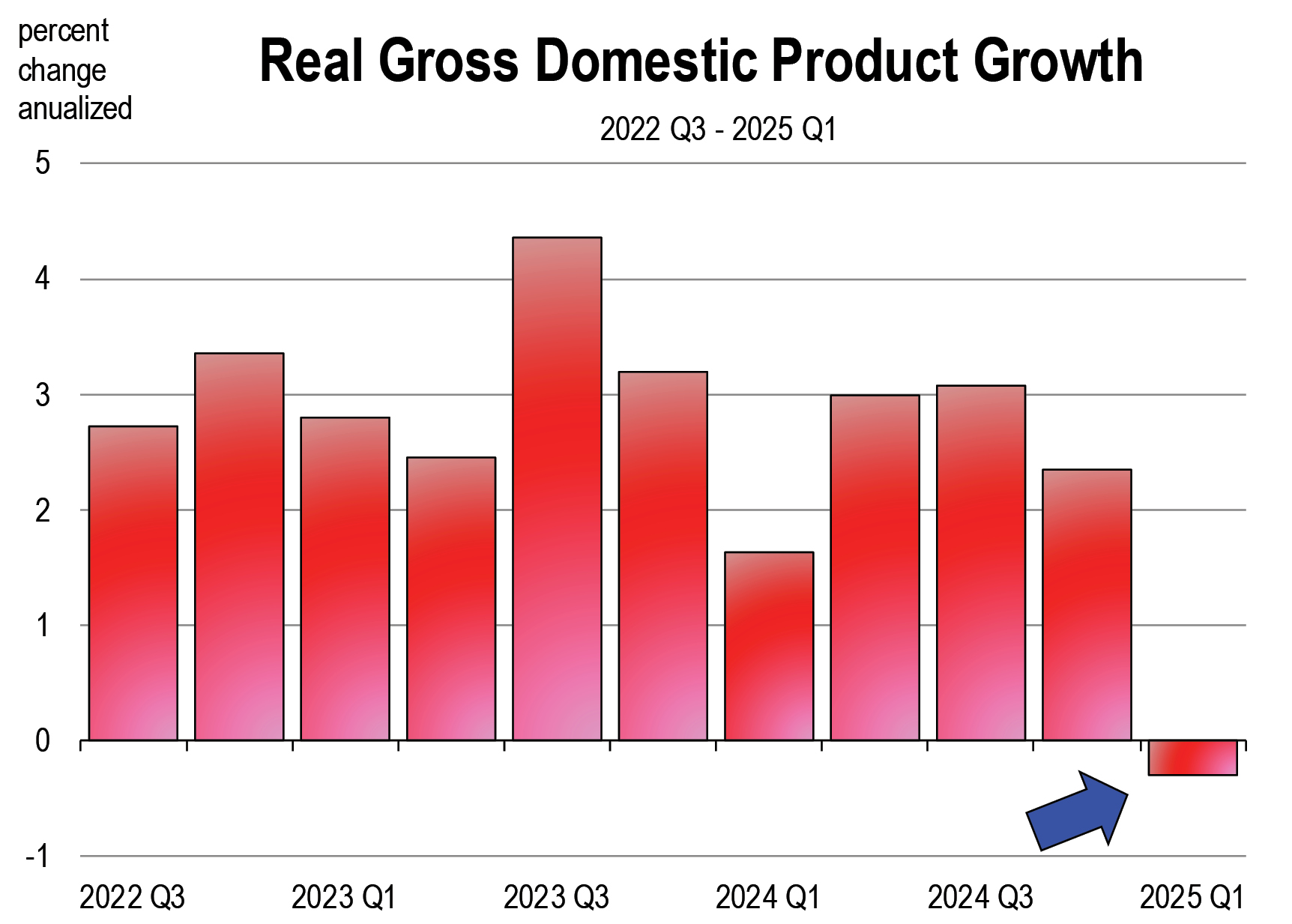

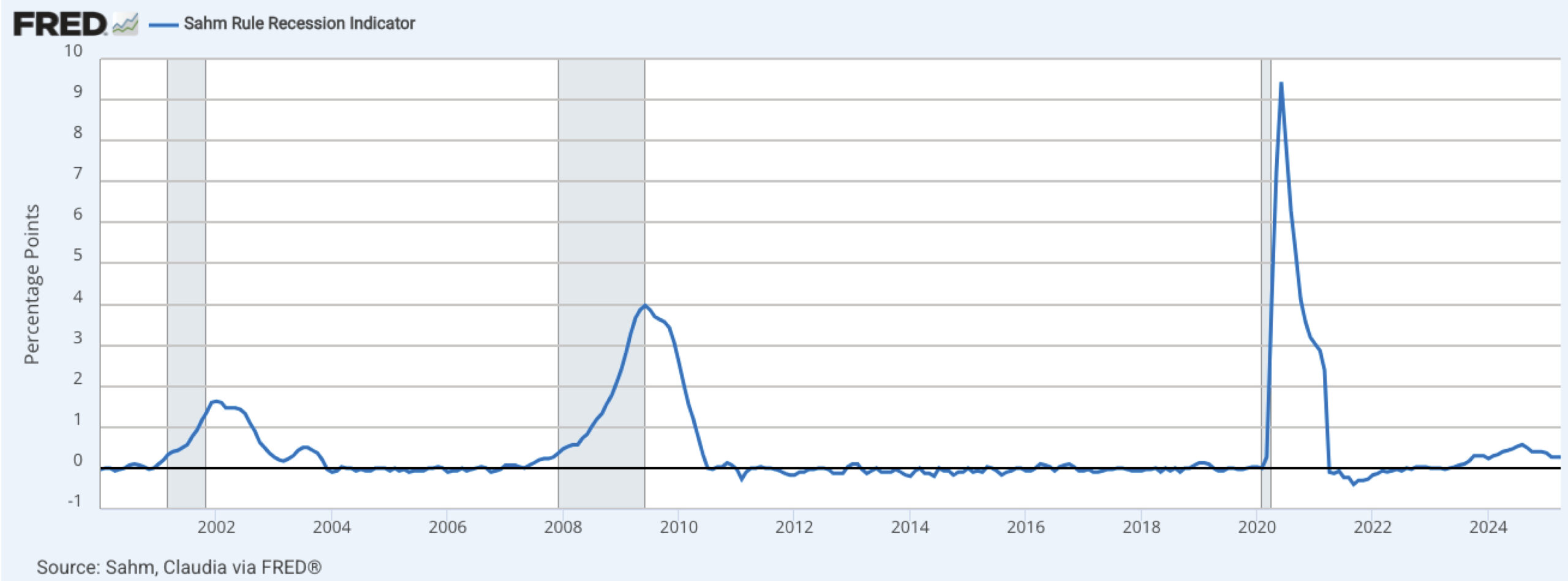

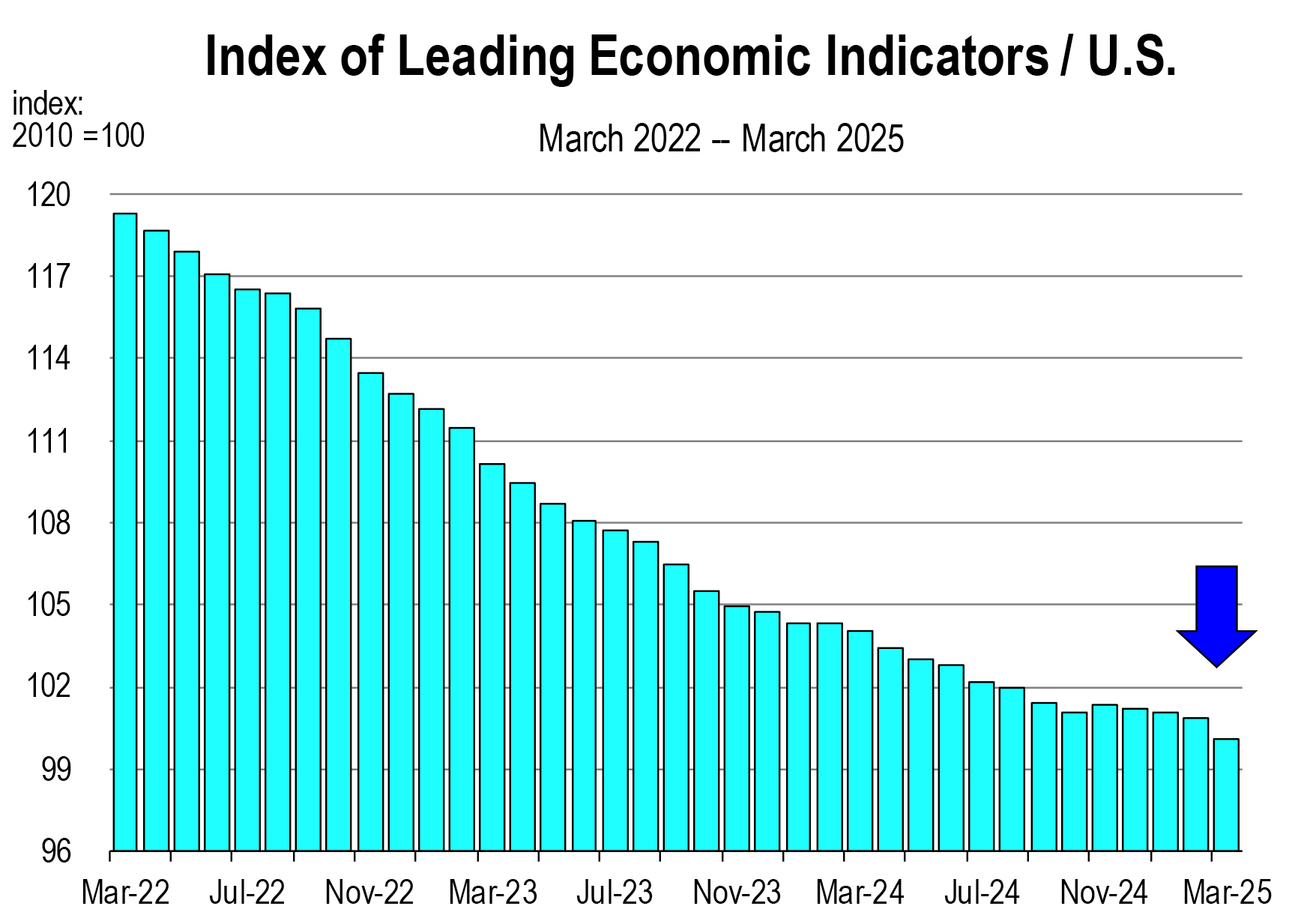

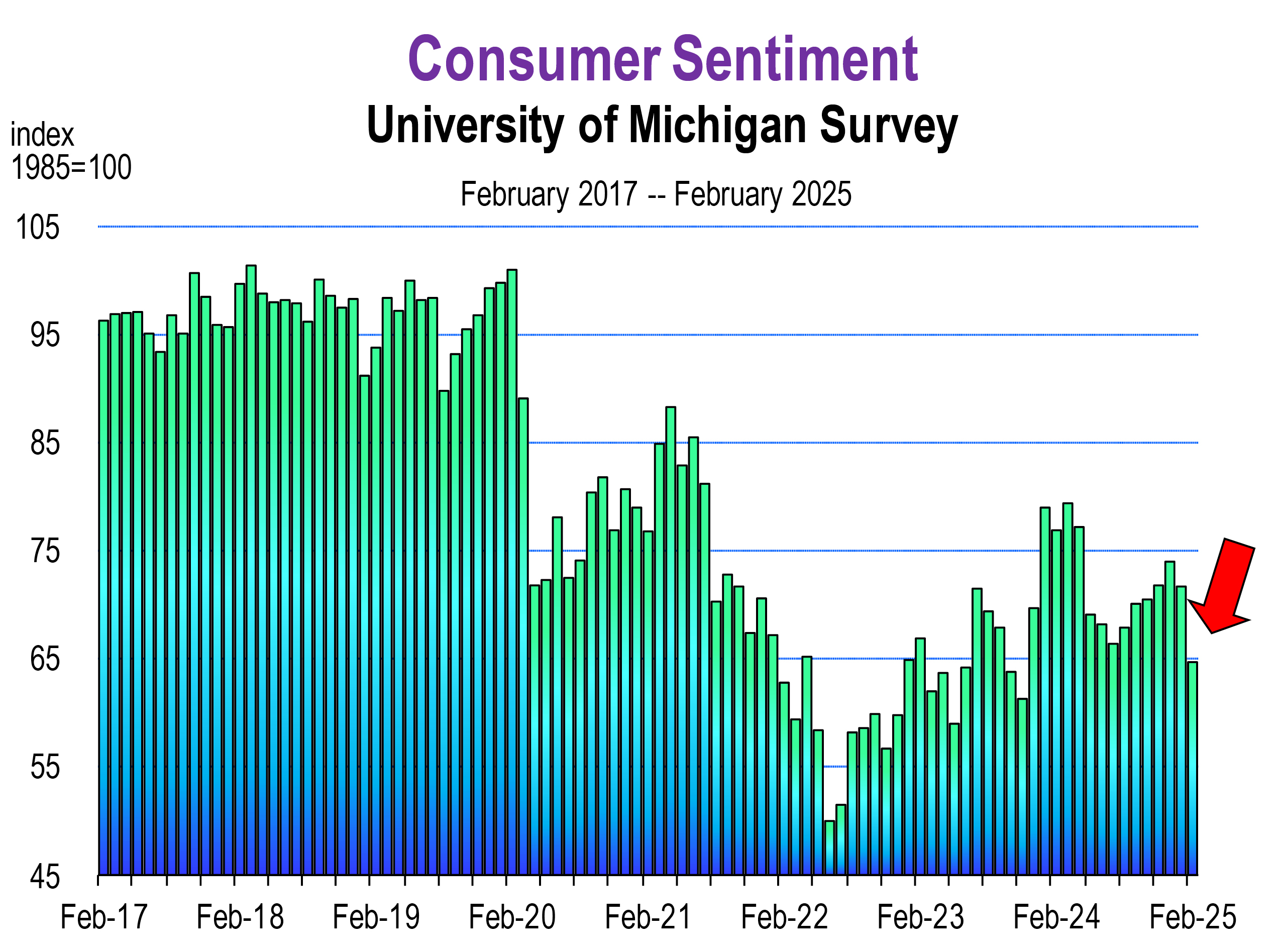

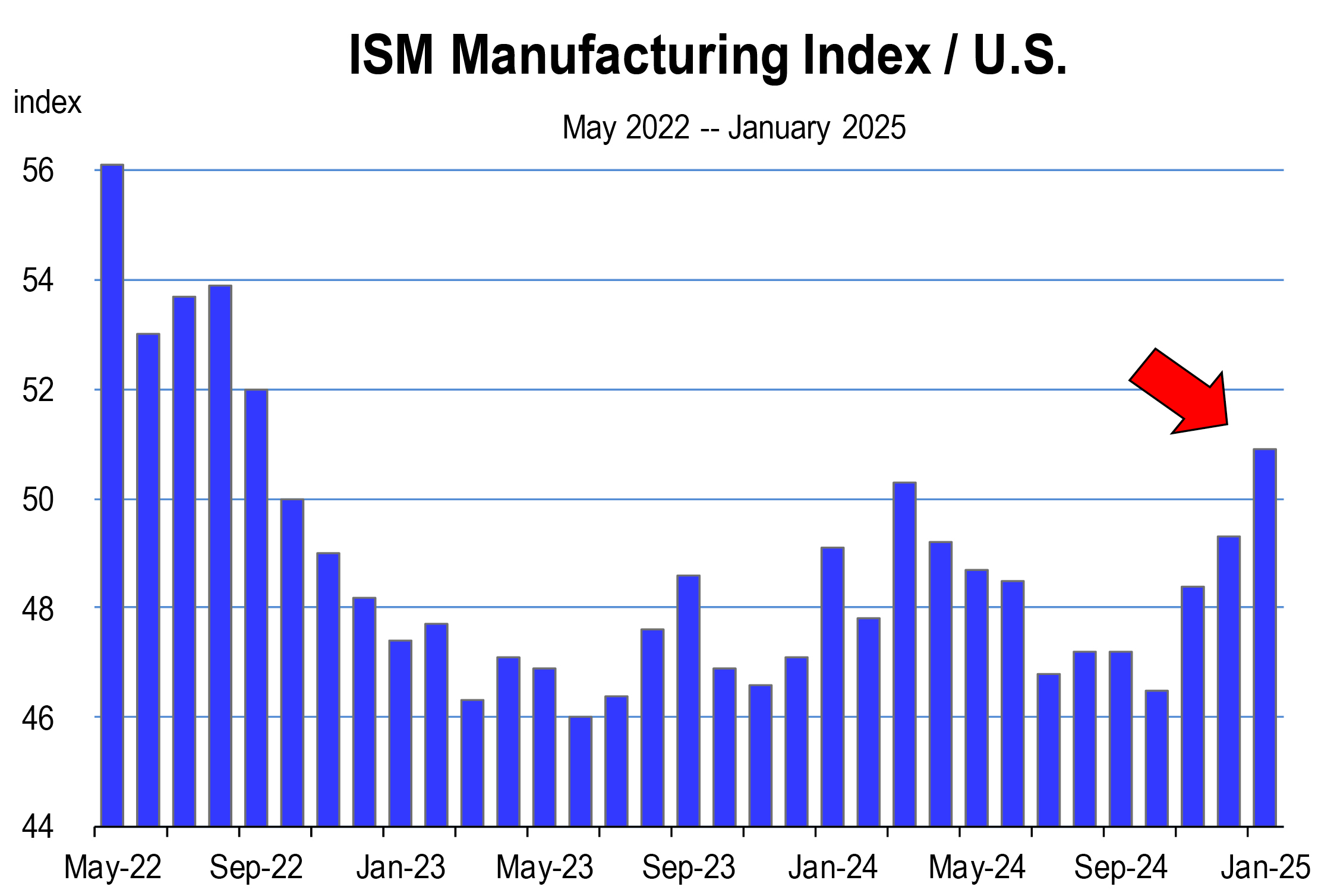

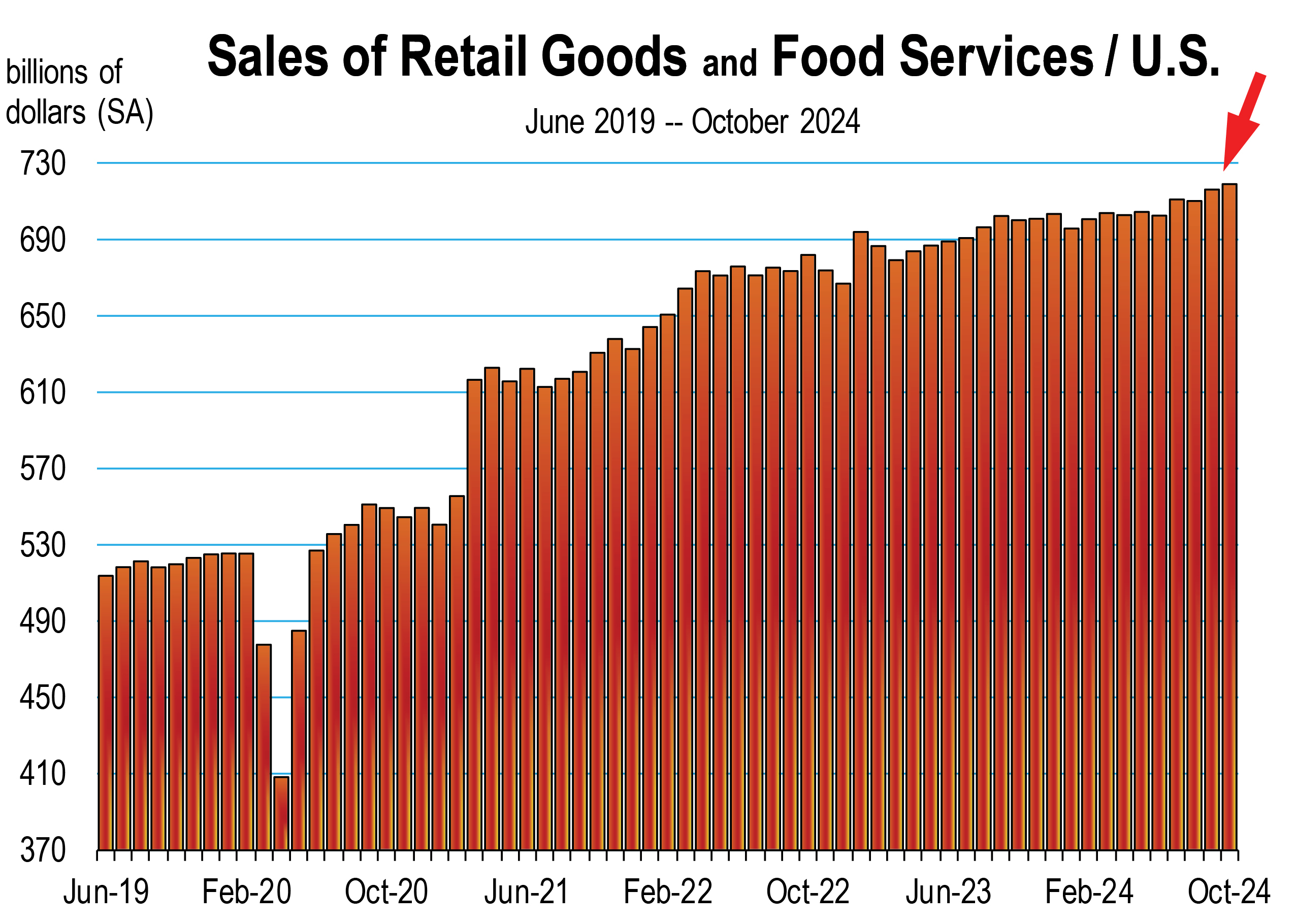

The resilience of consumer spending, amid contractions in (1) domestic investment due to prolonged uncertainty and (2) government spending from overdue government downsizing, a slight contraction in GDP growth occurred in the first quarter of 2025. Second quarter growth is much more stable and relatively strong. Recession will be avoided at the national and state level, despite the weakness of the California labor market in the first 4 months of the year.

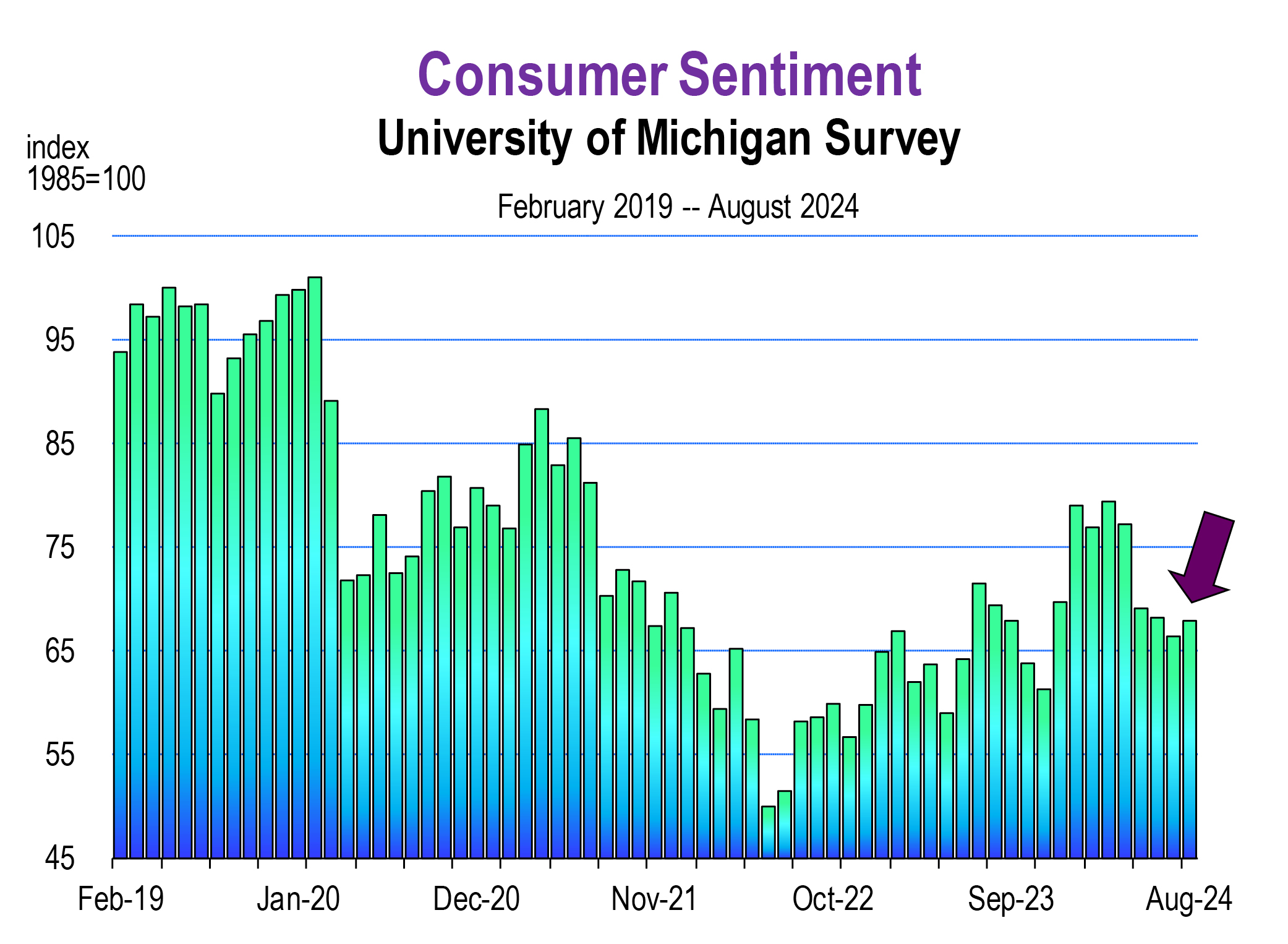

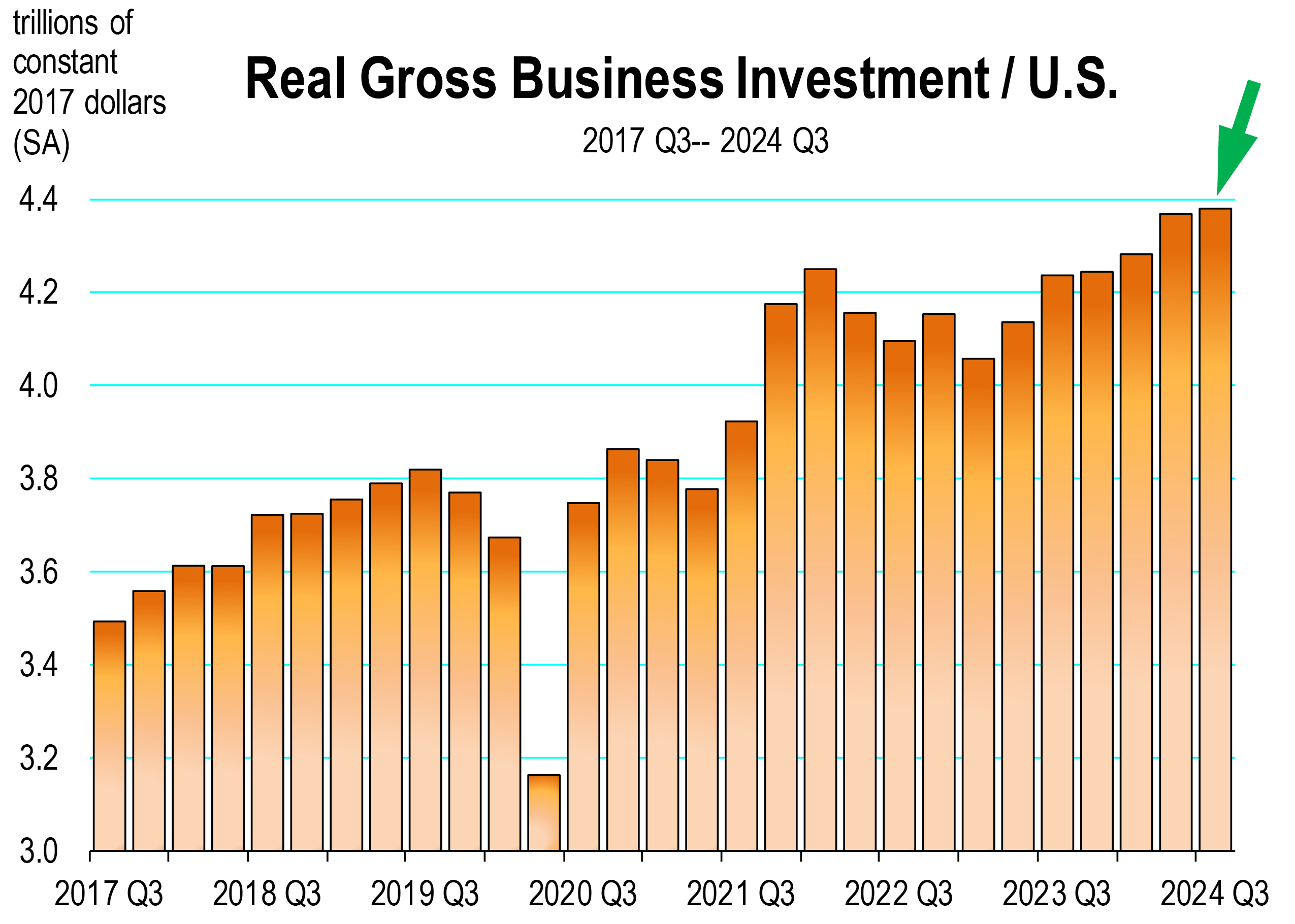

The most likely outlook for California is that the Trump administration’s economic policies will diminish economic activity but not derail it. The President has course corrected, and stock prices which were down 16 percent for the year on April 8, are now positive for the year at mid-June. Consumers continue to spend and business investment in AI and other software and equipment will strengthen over the second half of the year.

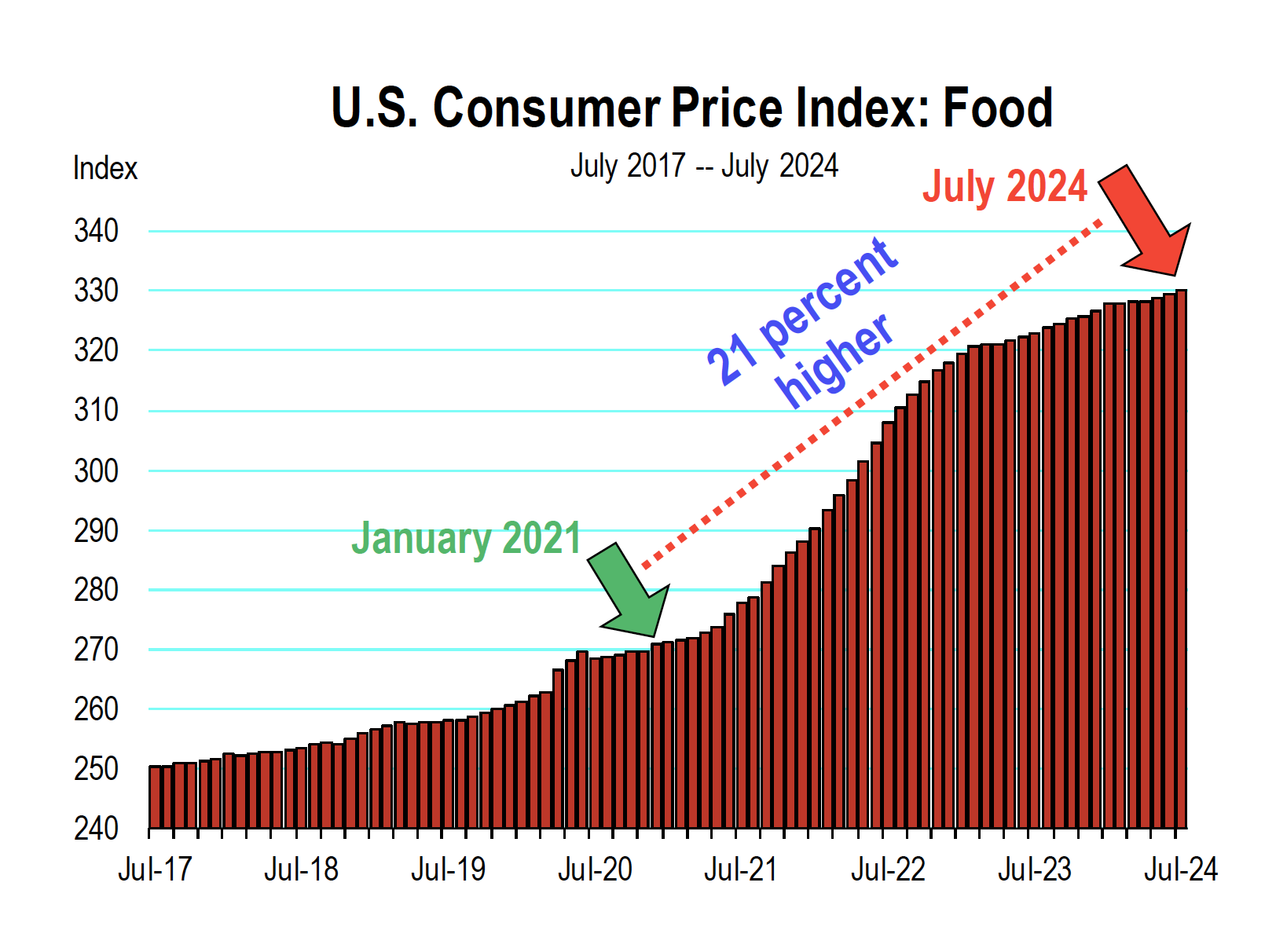

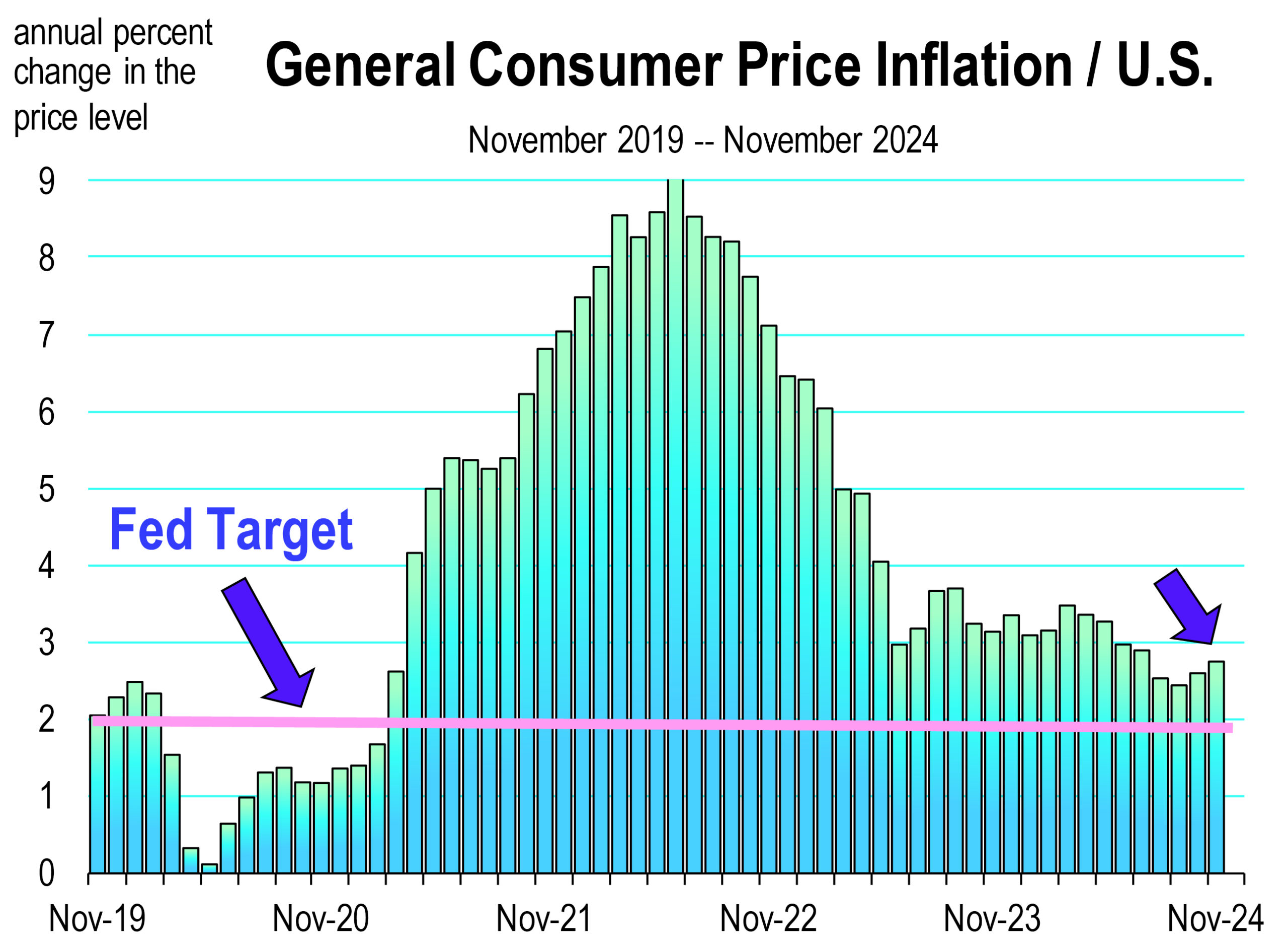

With inflation becoming contained, it is likely that another Federal Reserve rate cut or two will occur before the end of 2025, modestly helping both the new and existing housing sector.

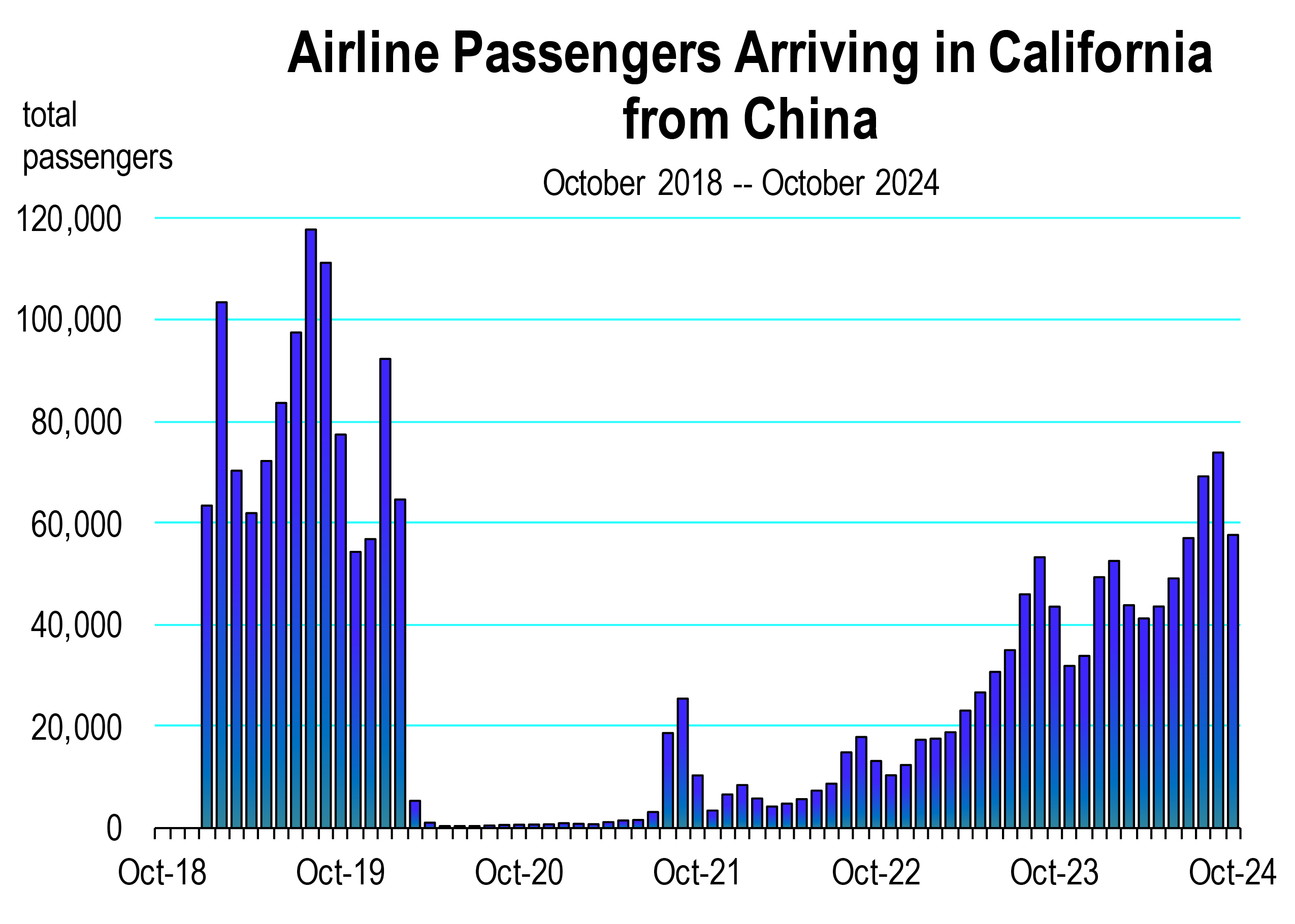

Growth in California is forecast to rise about 1.4 percent in 2025 and 2.2 percent in 2026. There will be fewer tourists from Canada, and China for that matter, but the visitor industry will still remain busy.

There will be superior growth in advanced manufacturing in California in aerospace products, computer boards and products, and medical devices, but AI will continue to replace jobs.

New development will remain the largest engine of growth this year, likely offsetting the weakness in the State’s economy from downsizing labor markets, a weak office market, and recovering international trade.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

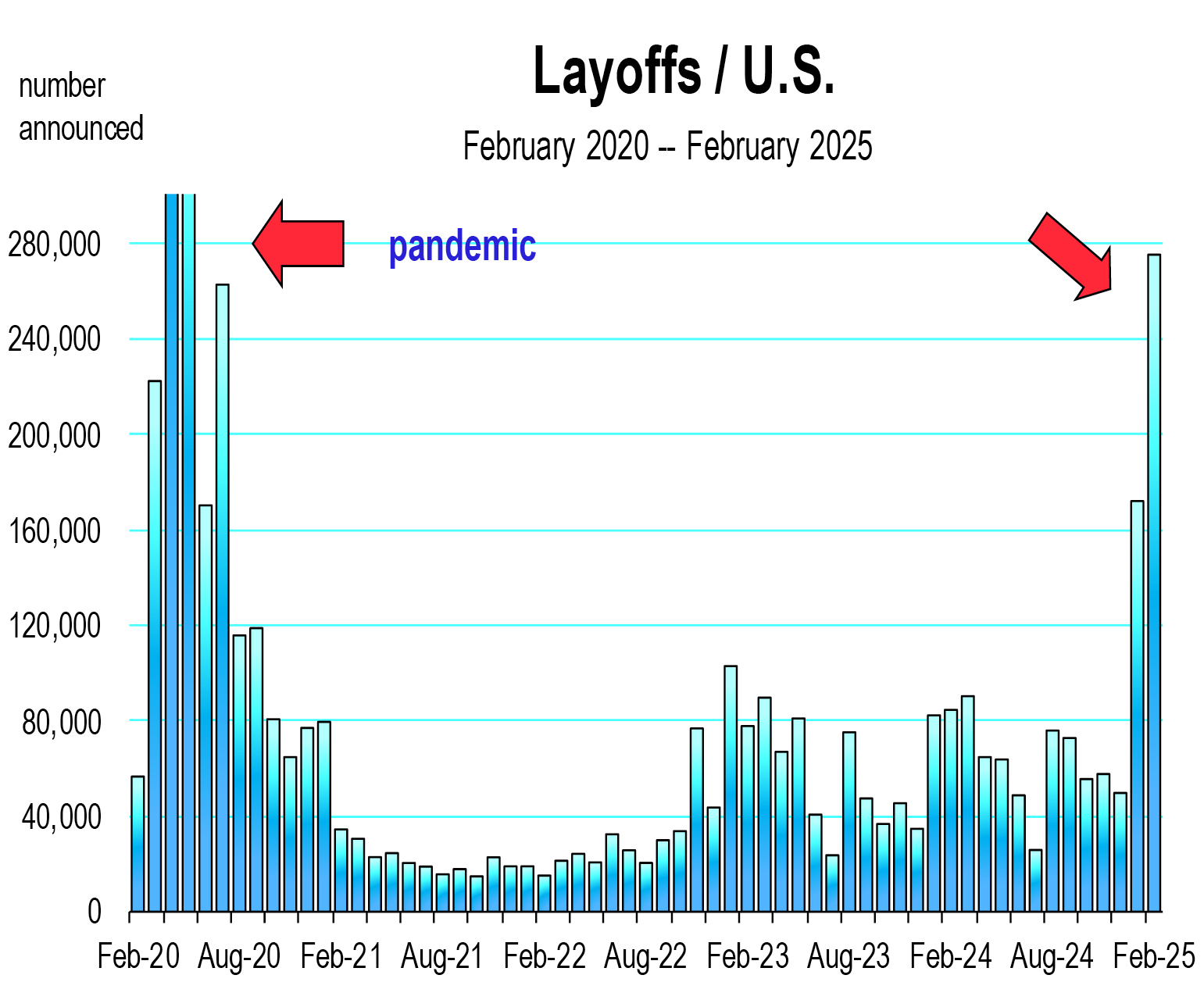

monthly Challenger Report on layoffs and the weekly unemployment insurance claim reports to monitor the possibility of higher rates of unemployment.

monthly Challenger Report on layoffs and the weekly unemployment insurance claim reports to monitor the possibility of higher rates of unemployment.

are largely unknown. Just how high and for how long will tariffs will be implemented, and will there be adequate and affordable substitution effects for consumers as alternatives to tariffed goods.

are largely unknown. Just how high and for how long will tariffs will be implemented, and will there be adequate and affordable substitution effects for consumers as alternatives to tariffed goods.

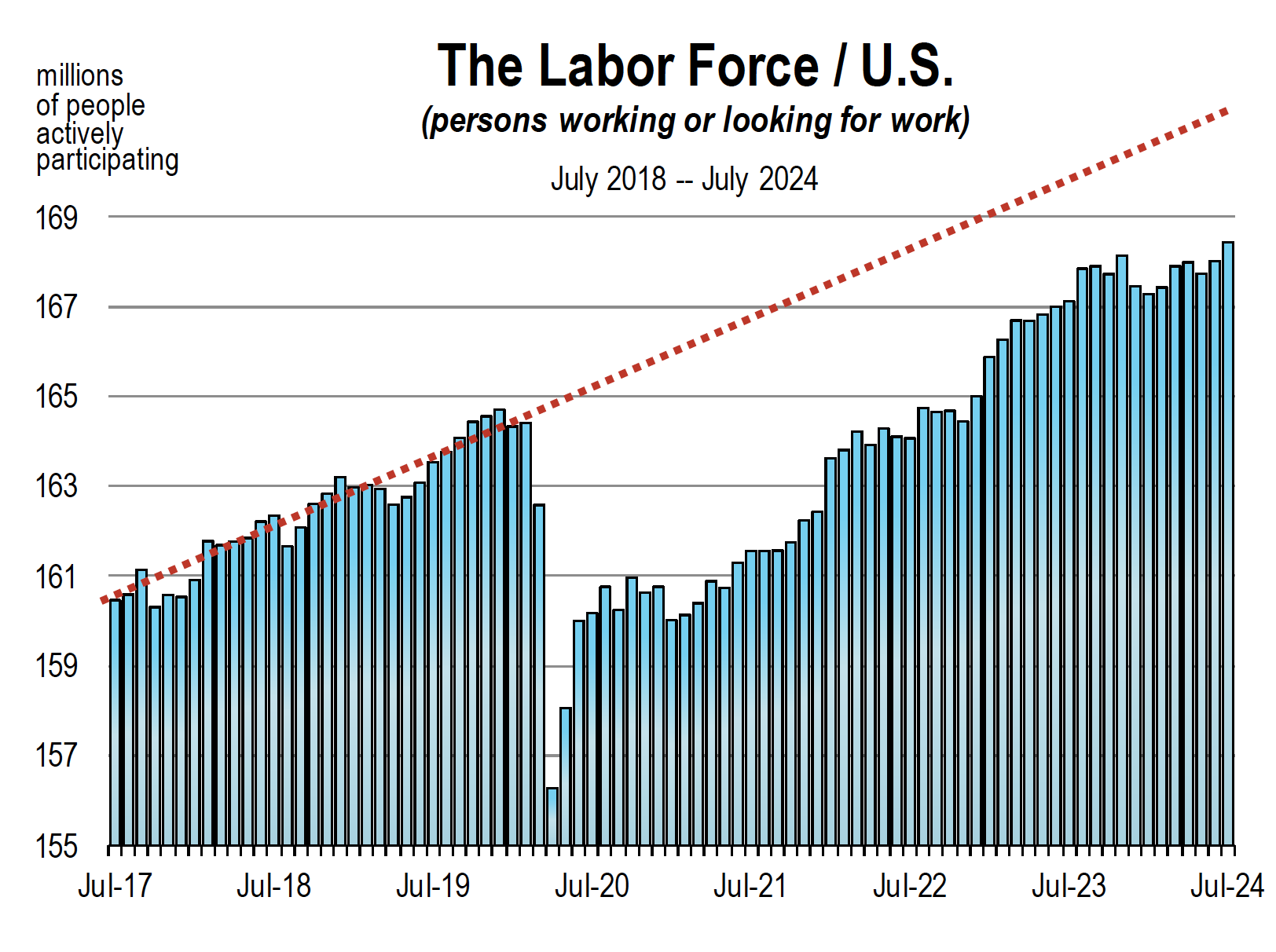

hiring, quits and layoffs in the labor market. In December, hiring and separations through quits or layoffs both increased. Though still at a modest level, the slower pace of layoffs (which remain historically soft) continue to ensure job growth. The unemployment rate for January slipped further, to 4.0 percent.

hiring, quits and layoffs in the labor market. In December, hiring and separations through quits or layoffs both increased. Though still at a modest level, the slower pace of layoffs (which remain historically soft) continue to ensure job growth. The unemployment rate for January slipped further, to 4.0 percent.

divert through the Panama Canal.

divert through the Panama Canal.

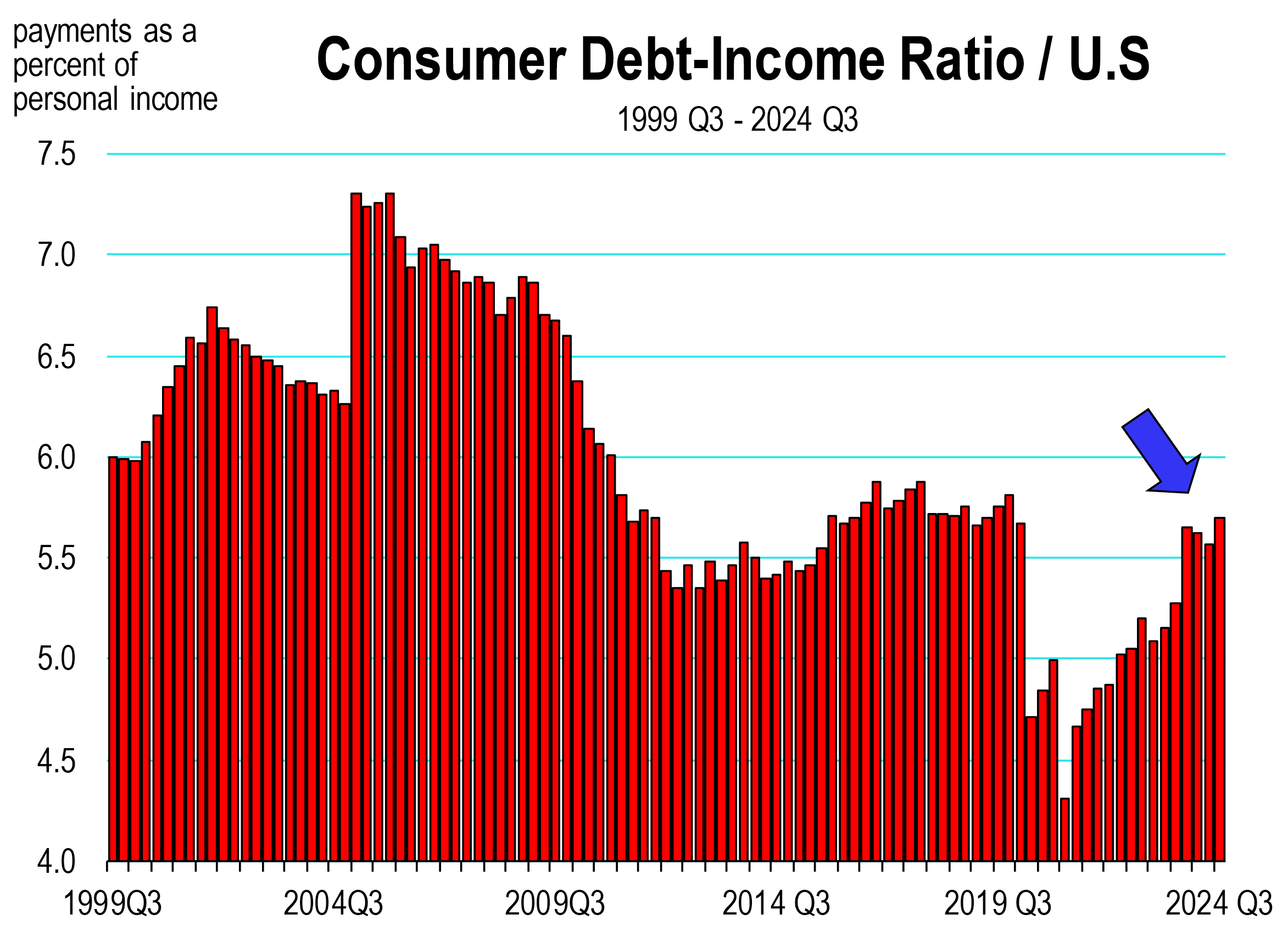

is up $4 billion from quarter 1. 24 million Americans have a personal loan. The 60-day delinquency rate for personal loans is 3.4 percent, the highest rate since 2012.

is up $4 billion from quarter 1. 24 million Americans have a personal loan. The 60-day delinquency rate for personal loans is 3.4 percent, the highest rate since 2012.

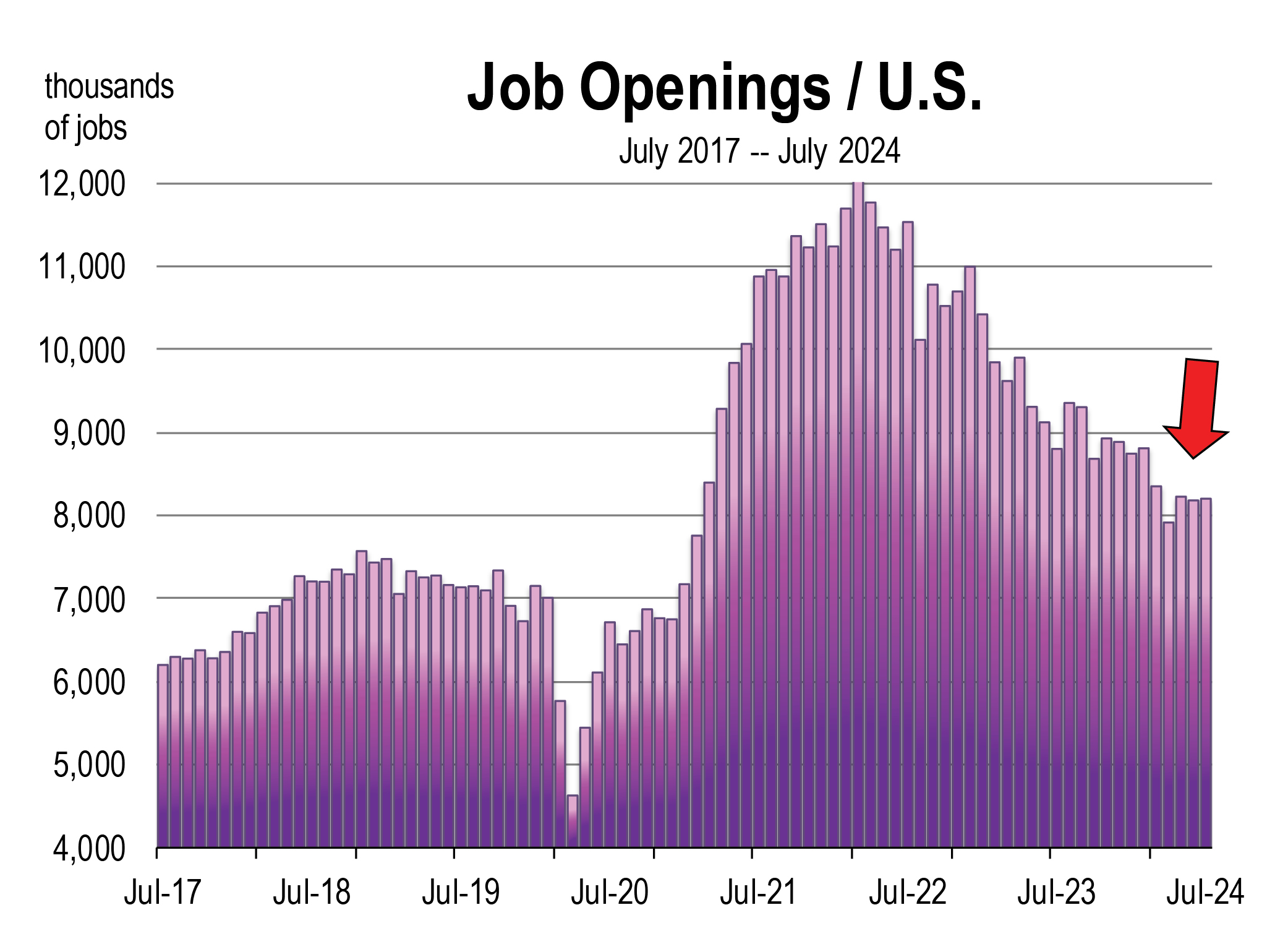

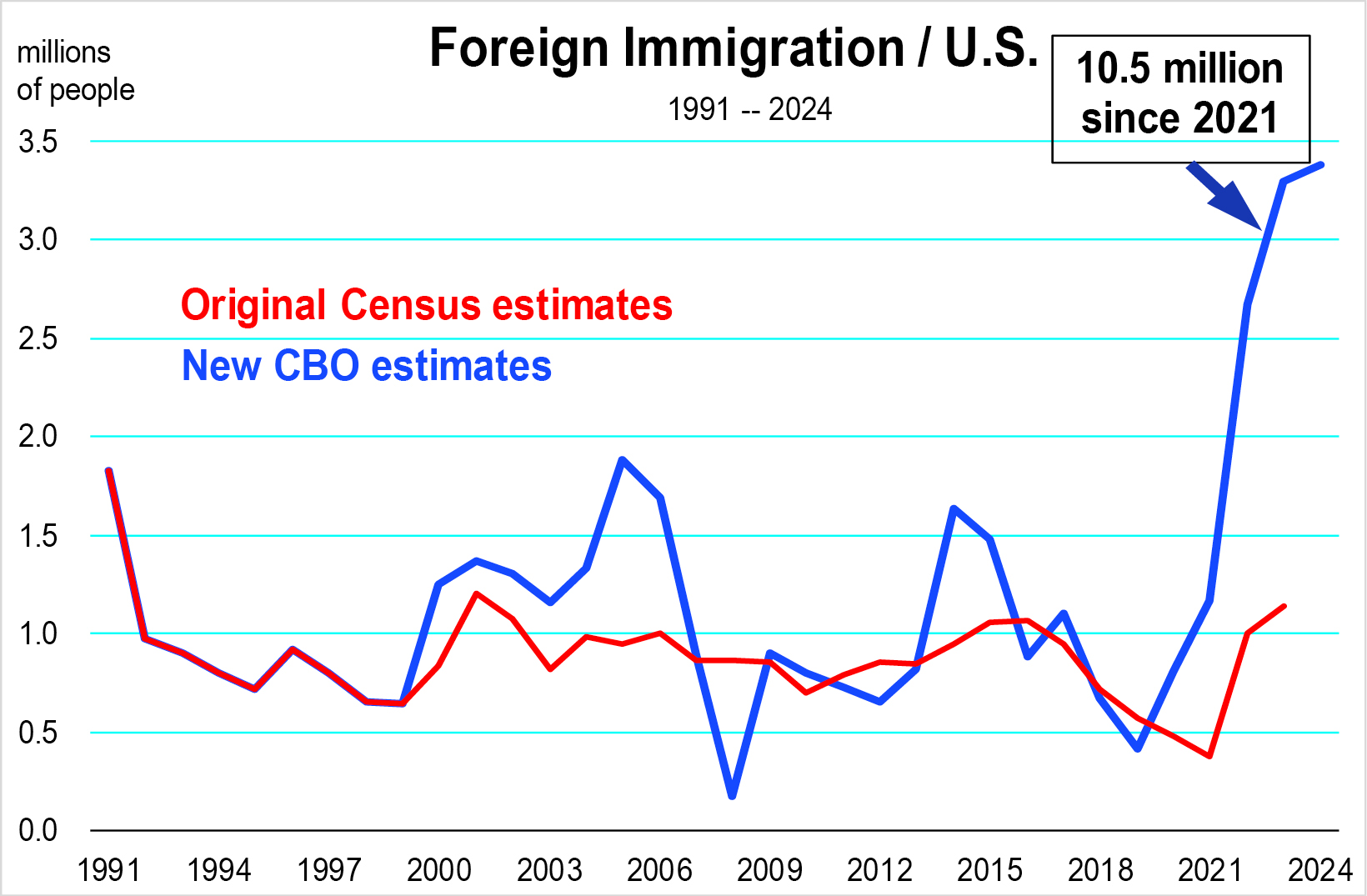

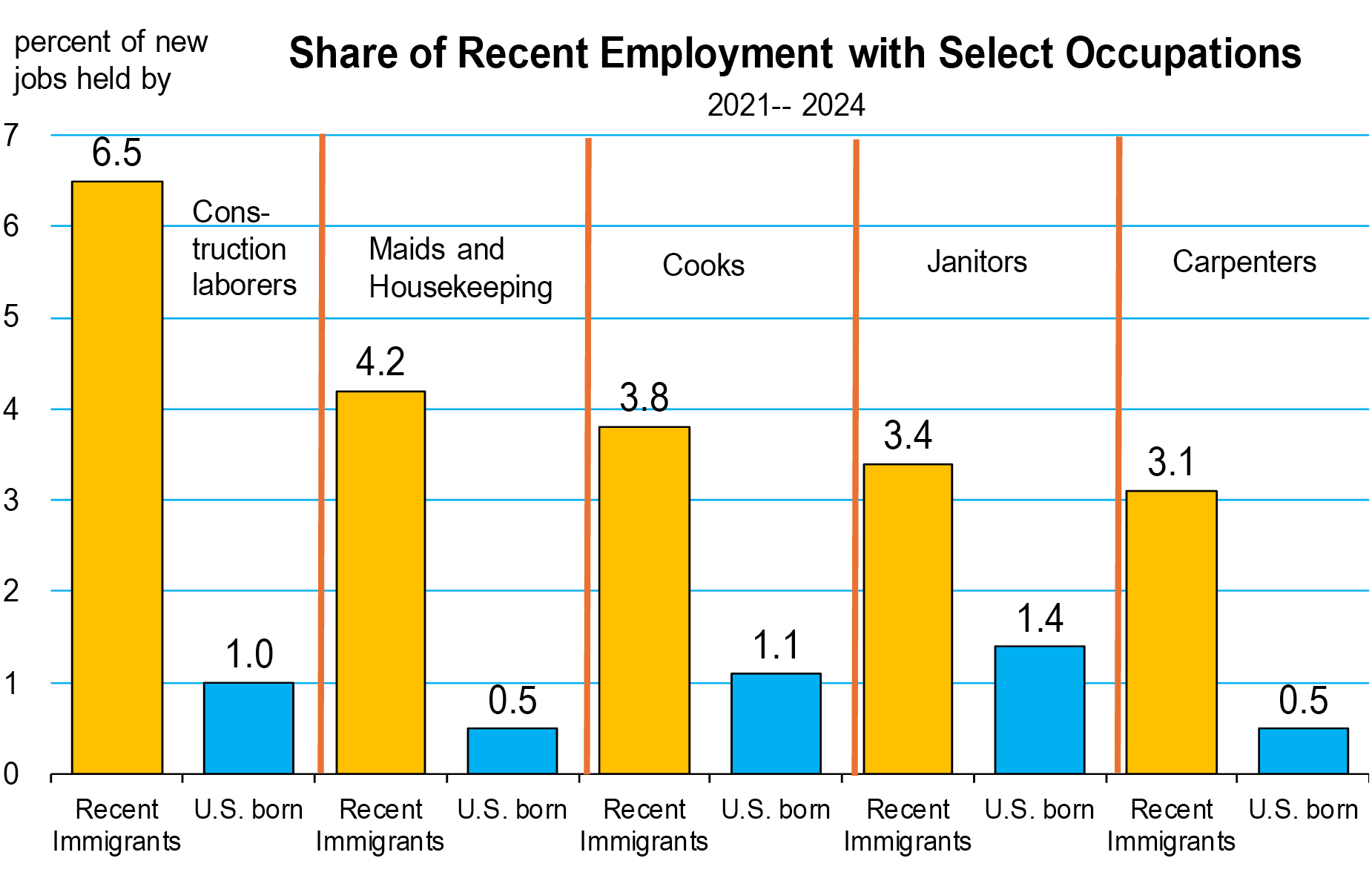

native born population is 37.

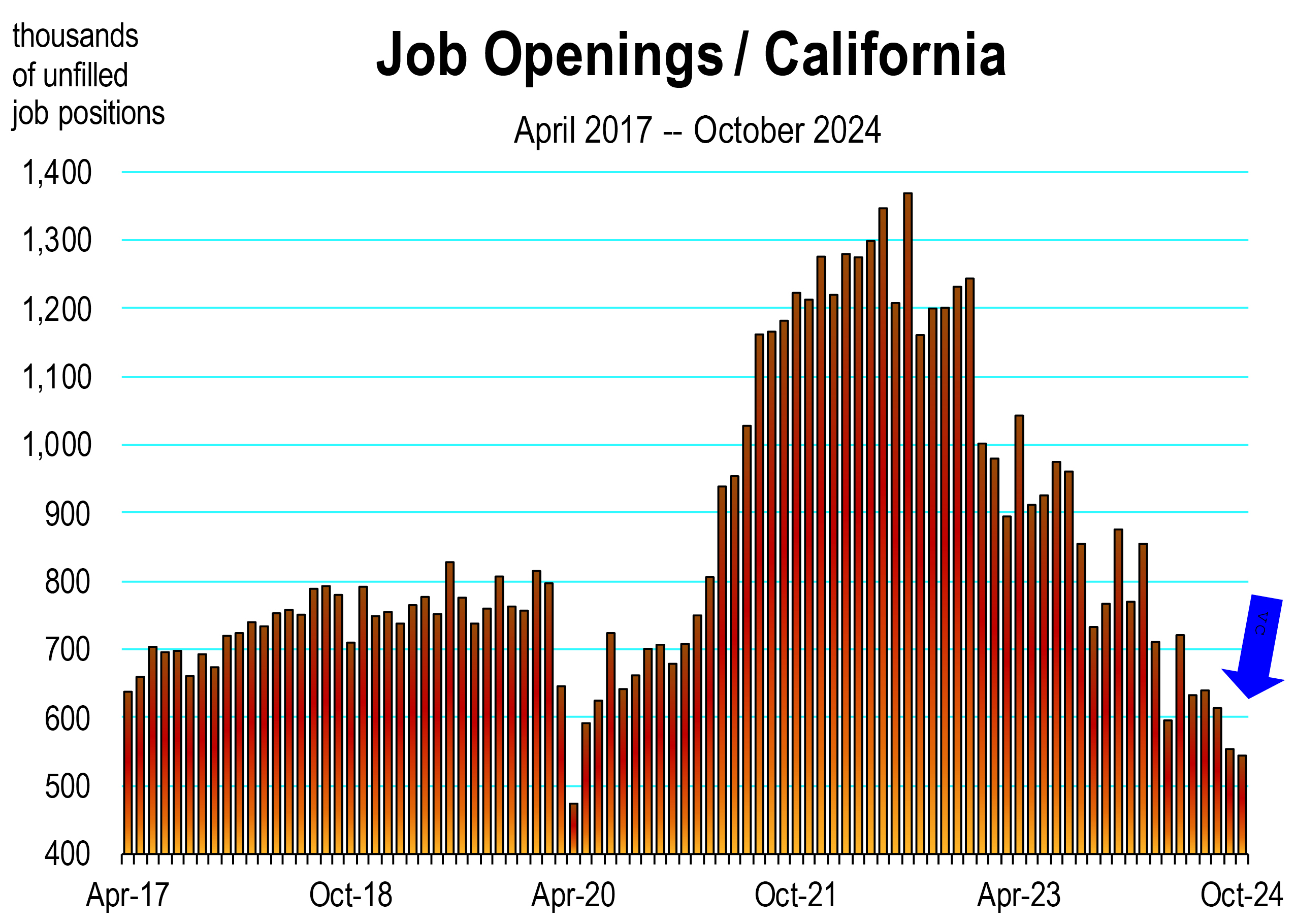

native born population is 37. period. They have contributed significantly to the decline in job openings, which have fallen sharply in California. However, the rate of unemployment in California has gradually moved higher since 2022, and among all 50 states, is

period. They have contributed significantly to the decline in job openings, which have fallen sharply in California. However, the rate of unemployment in California has gradually moved higher since 2022, and among all 50 states, is