by Mark Schniepp

January 4, 2021

2020 is now in the rear view mirror. For the economy and for most every living person, the year was horrific. If anyone was guessing, they’d likely say that the outlook for 2021 would be better if not infinitely better, especially now that the world is being vaccinated meaning the pandemic will soon be eradicated.

2020 is now in the rear view mirror. For the economy and for most every living person, the year was horrific. If anyone was guessing, they’d likely say that the outlook for 2021 would be better if not infinitely better, especially now that the world is being vaccinated meaning the pandemic will soon be eradicated.

Nevertheless I’m still concerned. And I hope I’m wrong about what I’m writing about in this month’s newsletter.

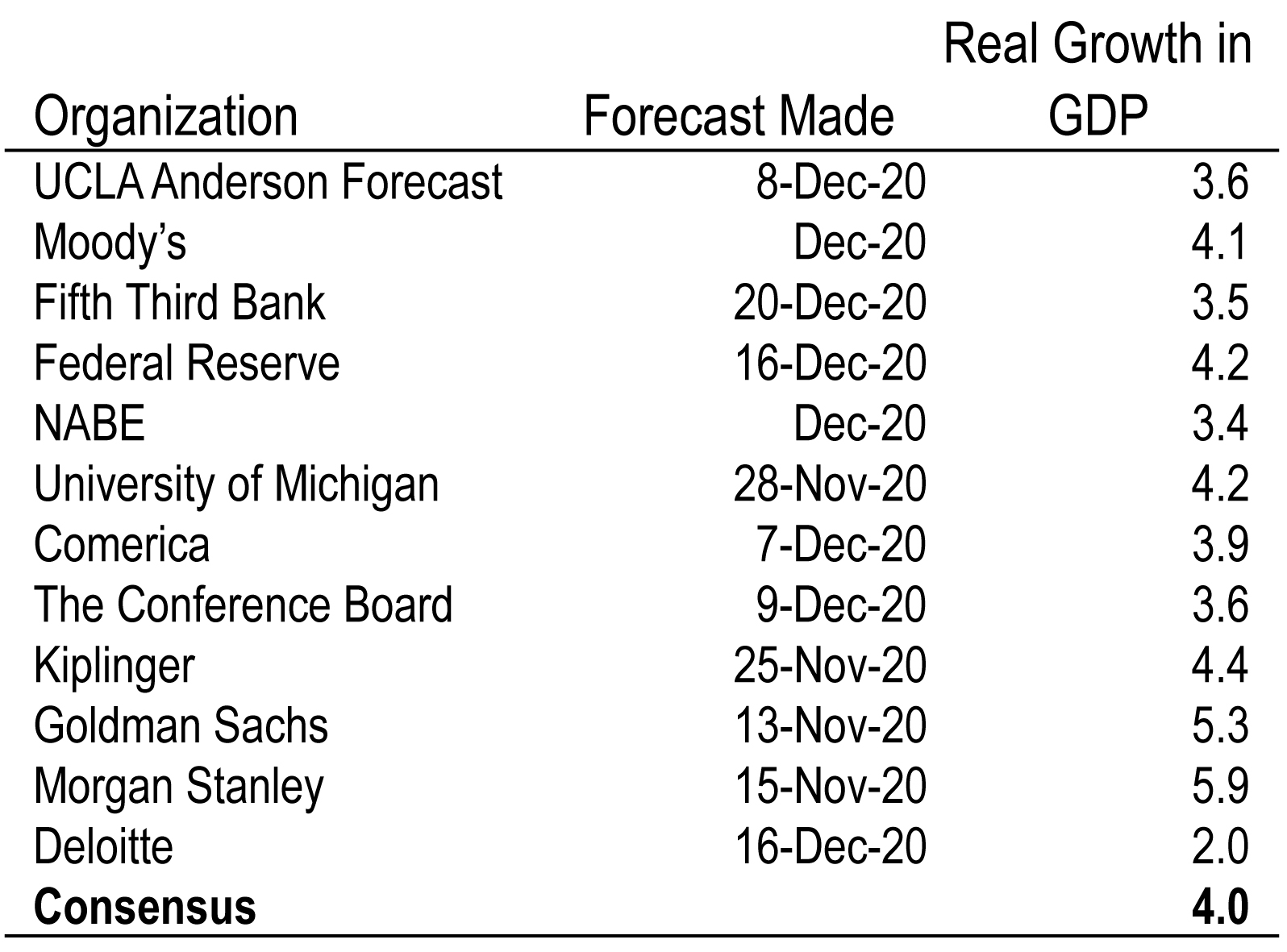

U.S. economic forecasts for real GDP in 20201 are shown here from a number of organizations.

Real GDP contracted 3.7 percent in 2020, and grew 2.2 percent in 2019. So a 4.0 percent consensus forecast for 2021 appears quite auspicious, and encouraging.

With a fair amount of growth, the Fed expects the unemployment rate to drop to 5.0 percent in 2021. That implies another million jobs created during the year and greater mobility of consumers as they buy goods, services, entertainment and recreation.

The outlook for 2021 should be easier to predict than what we just went through. But then, practically anything would be easier compared to 2020 when guessing when and how much businesses could operate was a game of musical chairs.

Today the in-person California economy is largely closed. There is still production and in-person sales of retail goods including food, clothing, home supplies and a few services. There is more online acquisition of products than ever before.

Many services are being provided in spite of the prohibitions, such as personal care services like manicures and haircuts. Gym recreation activities are relatively widespread, both legally outside and illegally inside.

Hotels are closed unless you are traveling in an official essential worker capacity. Short term rentals are also supposed to be prohibited.

Construction activity is busy in the state. Agricultural production continues though the industry’s workforce has sharply contracted because the restaurant industry is largely closed.

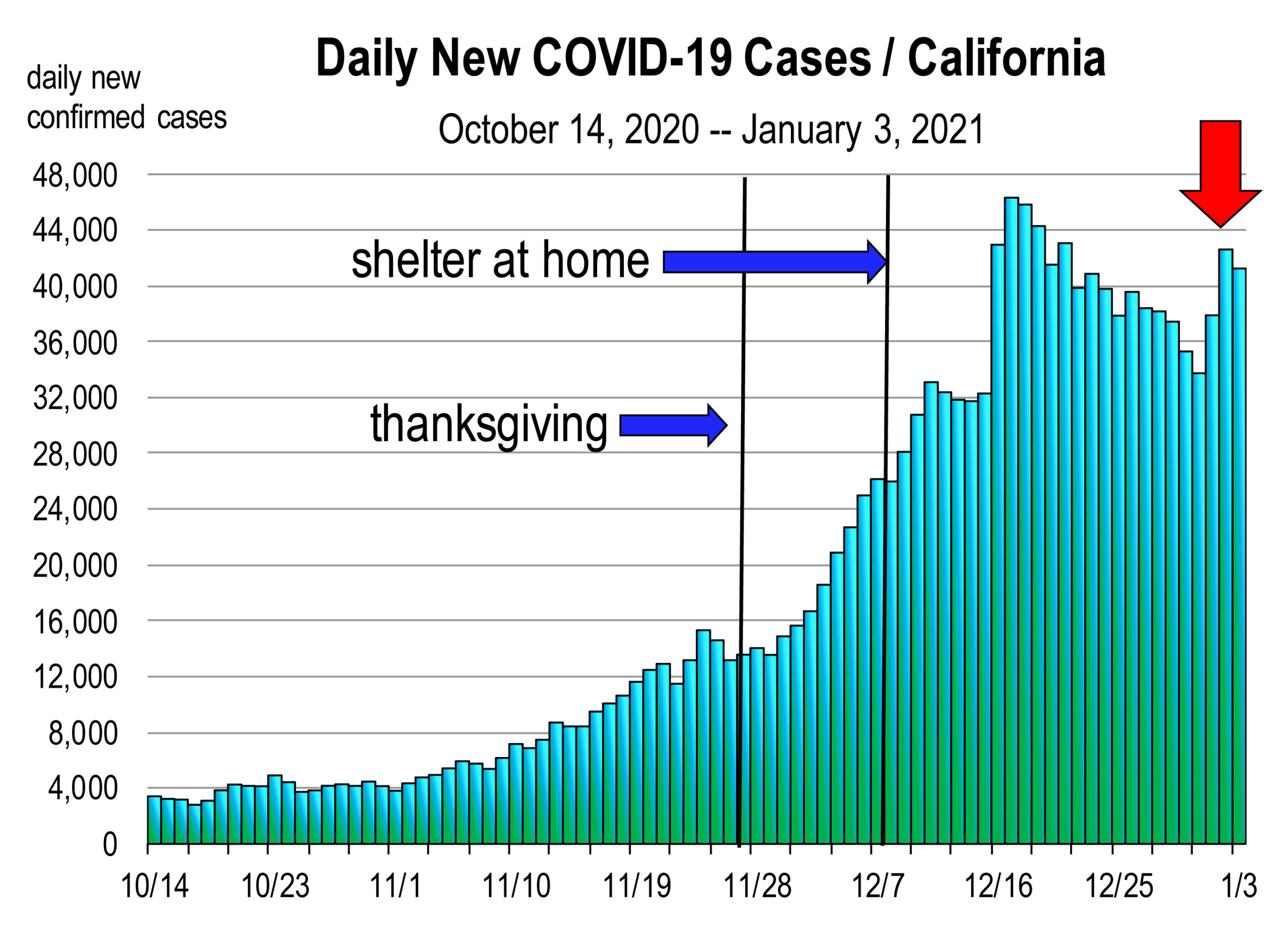

The case counts are not diminishing, despite the severe restraints on business, the mask mandate, the curfew, and the prohibition of gatherings. And unless case counts begin to meaningfully decline soon, an even larger pullback in business activity than expected might ensue.

A self-sustaining recovery will not occur until the vaccines are widely available, likely by the spring of 2021. Only then will many consumer-facing businesses begin to function more normally. Only then will businesses ranging from restaurants and hotels to public transit to entertainment venues begin to function more normally. Or will they?

Two vaccines are well underway, Pfizer and Moderna. Two additional vaccines are coming in January or February. Their delivery and implementation around the country is breeding new optimism. There is a strong belief that a return to normalcy is possible by mid year 2021. The stock market’s performance would suggest this as do the recent economic forecasts for the nation in 2021.

We all believe that the distribution of vaccines that started three weeks ago will begin to ease the medical necessity for restrictions.

But with the vaccine now being administered to thousands of recipients in California, there are still risks that the usefulness of the results of the vaccine will be delayed, causing economic growth to fall short of expectations.

This is because there is an emerging narrative that after receiving both vaccine doses, we will still need to wear masks and social distance. What?

“We don’t know if all the vaccines will be equally effective. We don’t know whether a vaccine prevents asymptomatic infections and if there’s still the possibility that a vaccinated person could transmit the virus without knowing it. Because there’s still a chance that you could be a silent carrier even after getting vaccinated, wearing a mask, practicing social distancing, and handwashing all remain important.”1

If this is true and mask and distancing policies are still widely enforced, it’s probable that restrictions on businesses will also remain largely in place even after much of the population is vaccinated.

I’m just guessing but in view of the very cautious approach we have observed in California since July regarding limited business openings, a continuation of a regime of restrictions for much of calendar 2021 would not be surprising.

Consequently, despite widespread participation of the population with the vaccines, if there are persistent restrictions on businesses during 2021, a robust recovery will not be possible. Or certainly not the kind of growth that is being forecast for the U.S. economy. We will see fits and starts, and generally positive growth, but no significant surge in overall economic activity.

I hope I am wrong, but be prepared for delays in reinstating the California economy to February 2020 conditions. Also be prepared for many schools, colleges and universities to remain closed for the remainder of the current 2020-2021 academic year. The loss of that activity alone produces a meaningful drag on the state’s economy.

The absence of large events, such as concerts, conventions, theatrical performances, and audience attended sporting events also dampen many options for consumer spending, and needless to say, job creation or restoration of thousands of these jobs which have been absent for 10 months now and counting.

Scenario A: Restrictions are removed with widespread dissemination of the vaccine

The outlook assuming conditions return largely to normal by mid year has California GDP rising 3.8 percent this year with strong gains in the 2nd half. Employment surges in construction, professional services, and healthcare. State and local government jobs will also start to recover in fiscal 2022 which starts in July.

People will begin to travel both domestically and abroad this summer as the world opens up. I would expect Disneyland to have opened, the Dodgers to be playing to live audiences, business meetings and large conventions to resume, and entertainment venues to ramp up again.

Largely, conditions are back to normal and the second half of 2021 would look quite vibrant.

Scenario B: Restrictions persist well into 2021 even after the majority of Americans are vaccinated

Here is what is closed now:

- Movie theaters

- Live audience sports

- Amusement parks

- Bars, breweries and distilleries

- Wineries

- Any indoor recreational facility

- Hair salons and barbershops

- Personal care services

- Museums, zoos, and aquariums

- Family entertainment centers

- Card rooms and satellite wagering

- Any indoor public gathering

For most of the state, restaurants are entirely closed for indoor or outdoor dining. And this has led to the further collapse of food service jobs during the month of December.

The December 2020 Stay-at-Home order was extended by 3 weeks into January by Governor Newsome on December 29, 2020. Consequently, most of the state’s hospitality economy is in for another empty month of growth.

Clearly, Stay-at-Home orders will be rescinded as positive case counts decline and ICU capacity loosens up. But the nightmare scenario going forward would extend many restrictions on the above list though the spring and into the summer months of 2021. That said, vacation travel will be as unlikely then as it is now. Schools will not open broadly until the fall of 2021.

In the meantime, rising unemployment and layoffs from accelerated restrictions will suppress demand for a variety of goods and services. This is why a second stimulus bill is desperately needed to circumvent the growing likelihood of declining growth this quarter.

The U.S. will not return to its pre-COVID-19 employment level until the end of 2023, and many industries face more long-lasting impacts. Risks to the outlook in 2021 are mostly negative. The increased spread of the virus across much of the country could result in an even larger pullback in business activity than expected.

Under either scenario, the housing market is forecast to generate an increase in sales and selling values. The California Association of Realtors’ forecast for 2021 has home sales rising 3.3 percent and the median price edging up between 1 and 2 percent (in the wake of an 8.1 percent increase in home values during calendar 2020).

1 https://www.inquirer.com/philly-tips/covid-vaccine-coronavirus-mask-vaccinated-efficacy-20201216.html

Have the Newsletter Sent to Your Inbox

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.