Mark Schniepp

February 7, 2023

Arguably, the current U.S. labor market is the tightest it has ever been. The rate of unemployment has been under 4.0 for the last 12 months, and it continues to drift lower. It’s now at a 54 year low.

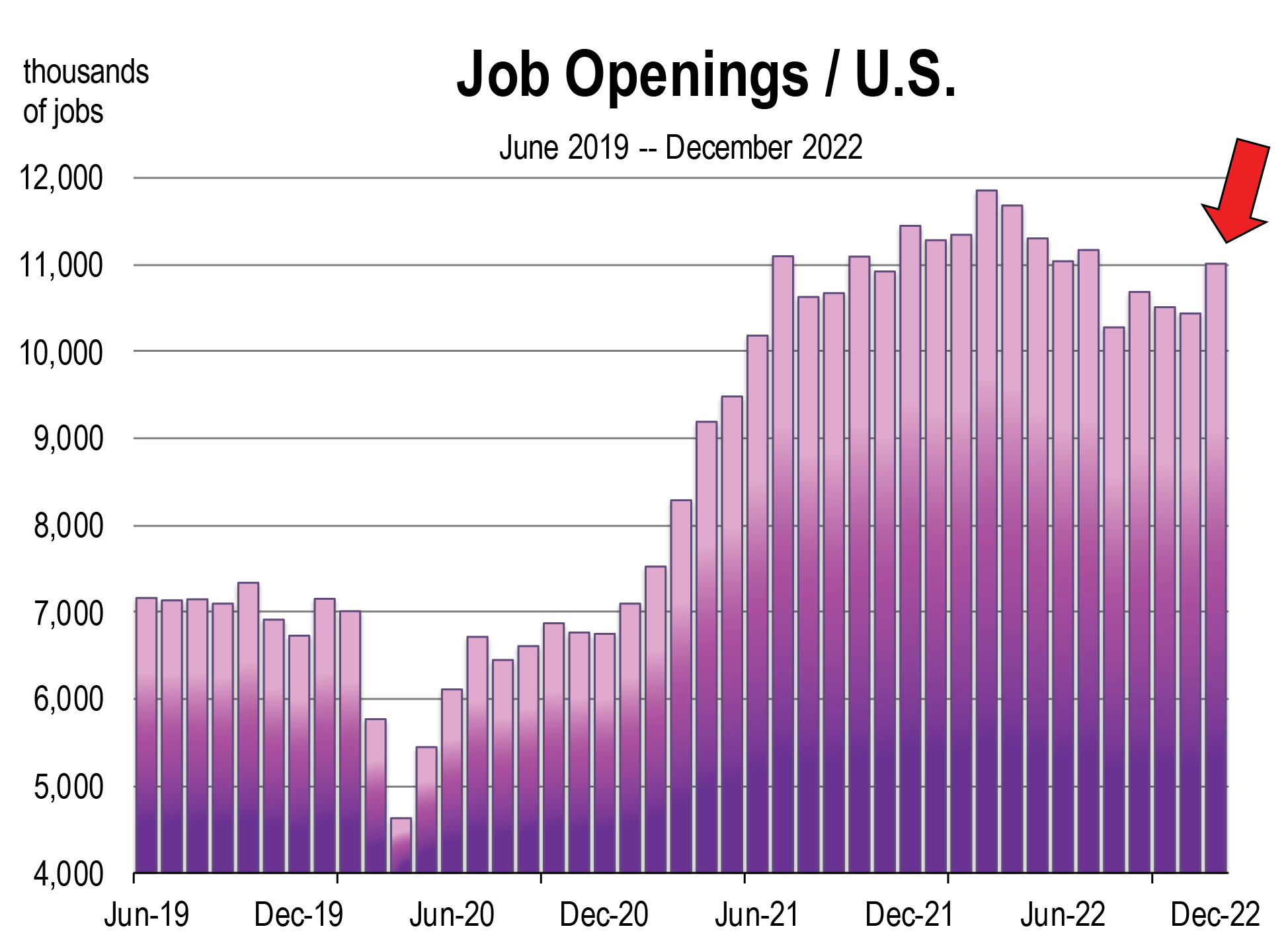

We had a notion that the labor market might be slowing, and that job openings were starting to abate. Instead, they are rising again. There are nearly two unfilled positions for every person unemployed.

The number of job openings remains a problem for employers trying to fill positions and provide a seamless flow of goods and services. So far into 2023, there is nothing seamless about that flow. Project shortages abound, and we are all annoyed while trying to get accustomed to waiting longer for services.

The lack of available workers is the issue. We thought by now the labor market would soften and job openings would largely fill or be withdrawn as a result of a slowing economy.

Six months ago, in the August 2022 newsletter, I wrote:

To be clear, the economy is not in a recession, but the likelihood of recession during the current business cycle is virtually certain. How severe and miserable the recession will be cannot yet be predicted, although there is no absence of opinions about this.

What Recession Usually Means

-

- Substantial job losses and even mass layoffs

- Businesses shutting down

- Private sector activity showing considerable weakness

- Household budgets under severe strain

- Broad-based weakening of the economy

Today, I’m not so sure that recession is virtually certain. That checklist is still valid, and we still don’t see any evidence of (A) or (B), or (D). We do see evidence of (C) and a broad-based weakening of the economy is the subject of everyday debate, because, well, the signals are quite mixed.

The Ugly

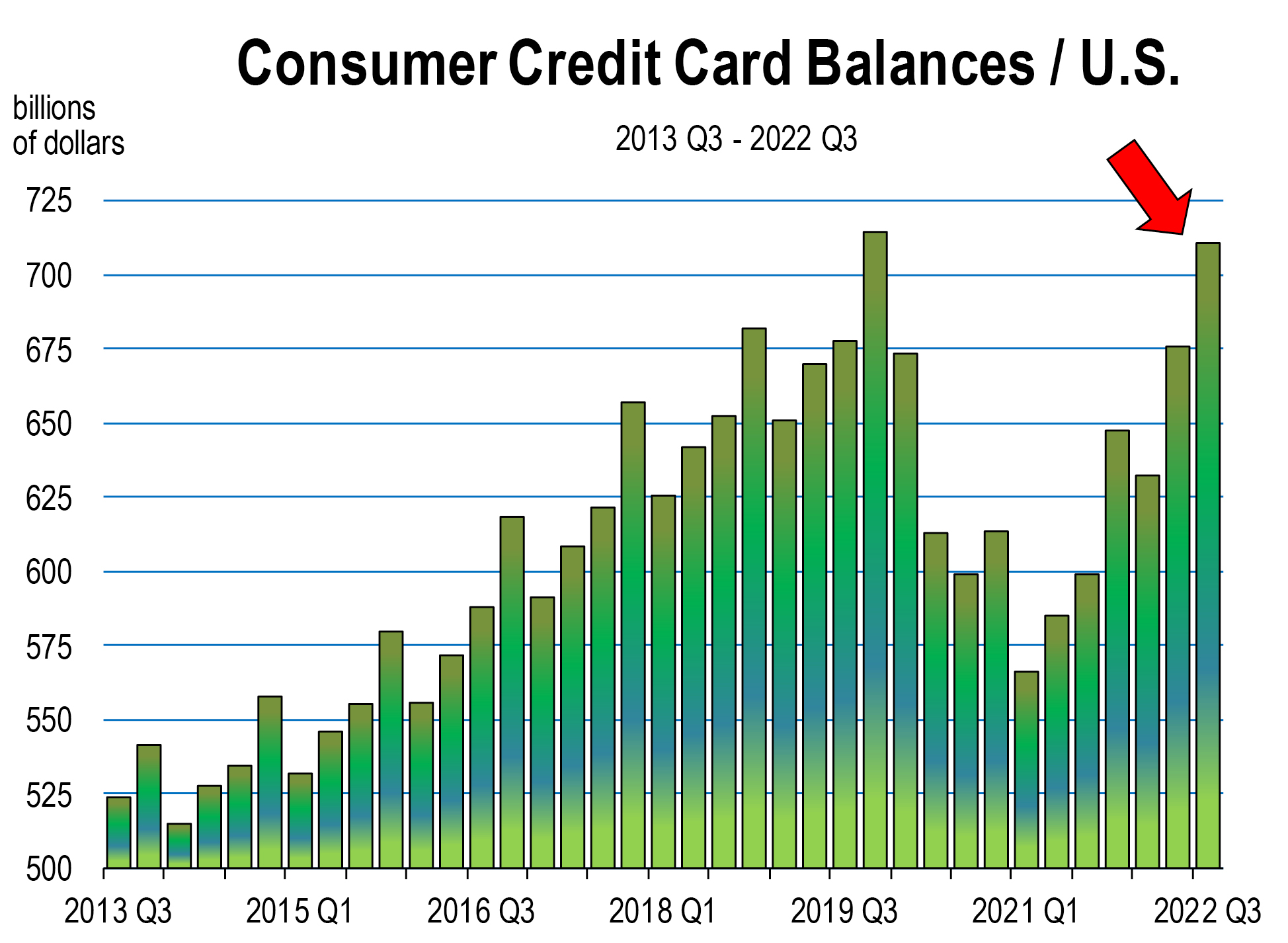

While household debt is still low, rising credit card balances are growing more worrisome, which could ultimately strain household budgets that don’t have much room for error. The personal savings rate has plummeted to the 2nd lowest level in 50 years.

Everyone is working, but everyone seems to be spending the same or more, due principally to the inflated prices we all face today.

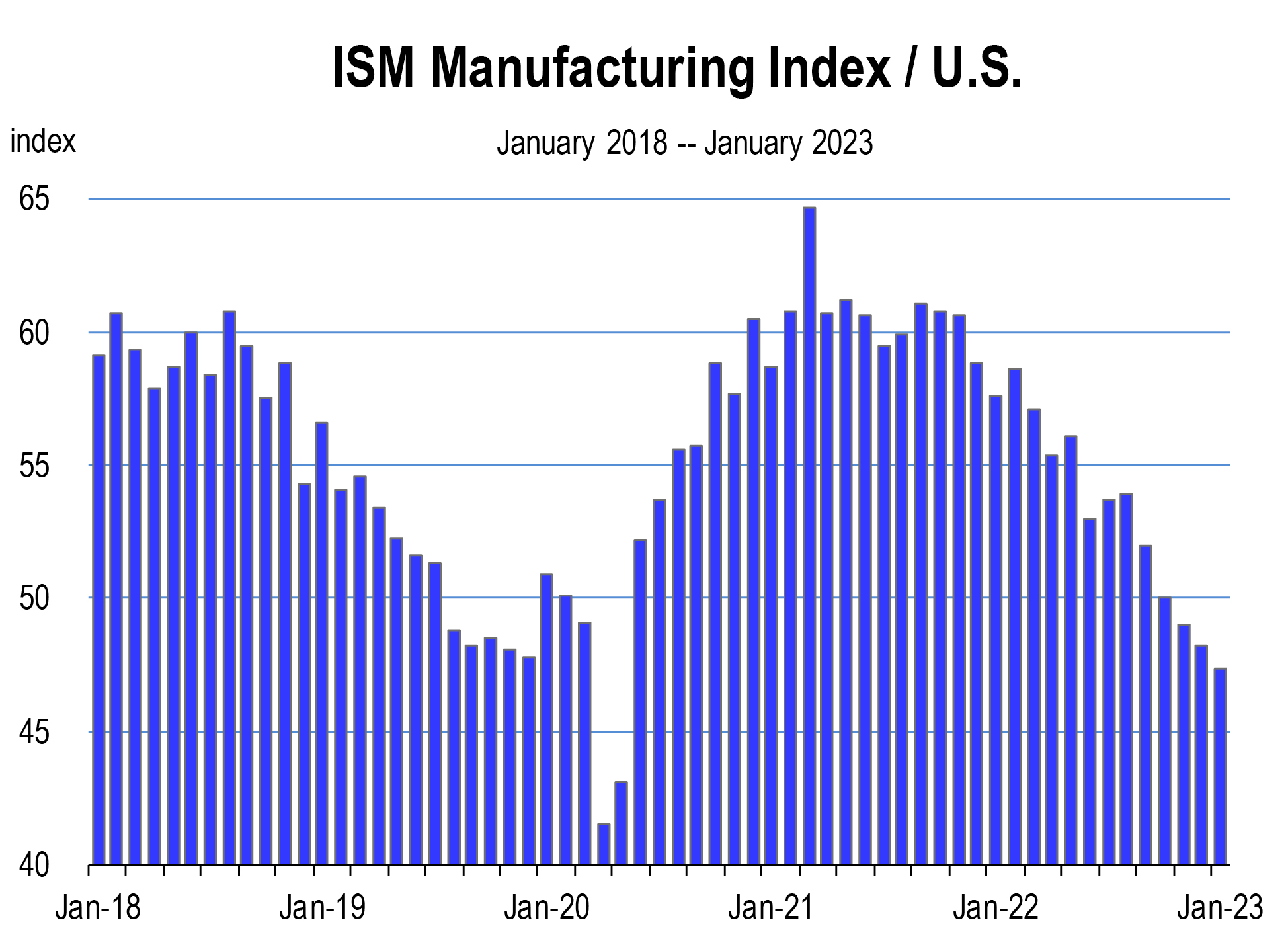

Considerable weakness can be seen in the ISM Manufacturer’s Index which monitors the demand for U.S. manufacturing products. It has generally been in decline for the last 14 months. The recent movement below 50 indicates contraction and trouble for the industry.

Consumer sentiment remains pessimistic, and is not getting much better. Most Americans believe the direction of the country is abysmal. The index of leading indicators has recorded 10 consecutive months of decline.

And of course, the housing market is already in a recession.

On The Other Hand

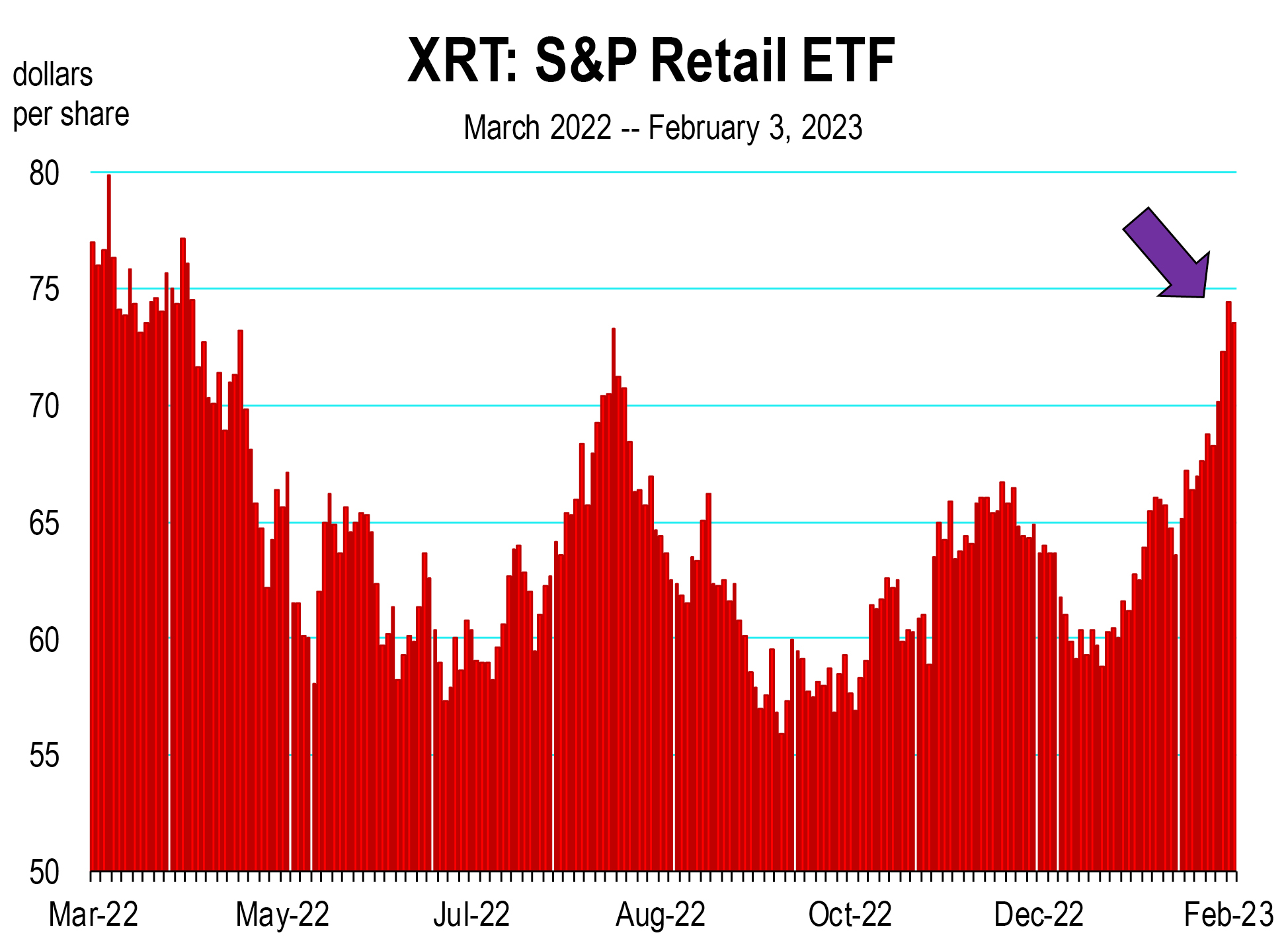

The XRT index has soared year-to-date, the inflation reports are showing improvement, the Nasdaq composite index is up 15 percent year-to-date, the non-manufacturing index rebounded sharply in January as new orders surged.

The XRT fund tracks the performance of the S&P Retail Select Industry Index. From January 1, 2023 to February 3, 2023, the fund is up 21.7 percent.

The certainty of recession is fading because the labor markets are not weakening, and consumers continue to spend despite a decline in their real incomes. Their savings are depleted but their debt levels while rising on revolving credit cards, are not increasing much otherwise, largely because their mortgage payments are contained by low fixed rate loans they refinanced into over the last decade. Though revolving credit is elevated and rising, it is not raising any major red flags by itself.

Stock Market

Is what we are seeing from the stock market year-to-date a dead cat bounce? We can’t say. The Nasdaq lost 33 percent last year, the S&P was off 19 percent, and bond prices tumbled 17 percent, generating one of the worst years for investors on record.

History does tend to show that stock market rebounds follow big stock market drops. Investors may be anticipating this until the earnings reports suggest otherwise. Earnings rise when profits rise. Profits rise with economic growth. It’s the growth issue that we are debating here. Sorry, but we don’t know yet because, well, the signals are all mixed up.

Verdict: Recession in 2023?

Recession in quarter 2 is what we had anticipated. Because of the strong labor market, a weakening there will probably not occur until the 2nd half of 2023, delaying the likelihood of recession to later in the year. There is also a rising probability that the nation might skirt past a bona fide recession this year, depending largely on what happens in Europe and China.

The projection for economic growth in 2023 is still weak, but recession is less certain because of improvements on the inflation front, and the recent decline in mortgage rates despite the FED’s stance that further interest rate hikes this year are appropriate.

I will keep you posted every month on how conditions are changing, for good or bad. So stay tuned.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.