Mark Schniepp

December 13, 2023

So the Nation and the State averted recession in 2023. Growth was above expectations for the year, the labor markets remained at full employment, wages continued to rise, people spent their earned incomes along with their savings, and nearly all the labor strikes got settled.

As we launch into 2024, here is why we don’t see any immediate vulnerability in the economy yet:

Black Friday apparently did not disappoint this year. Anecdotal accounts from major retailers allege a 7.5 percent increase in sales from last year.

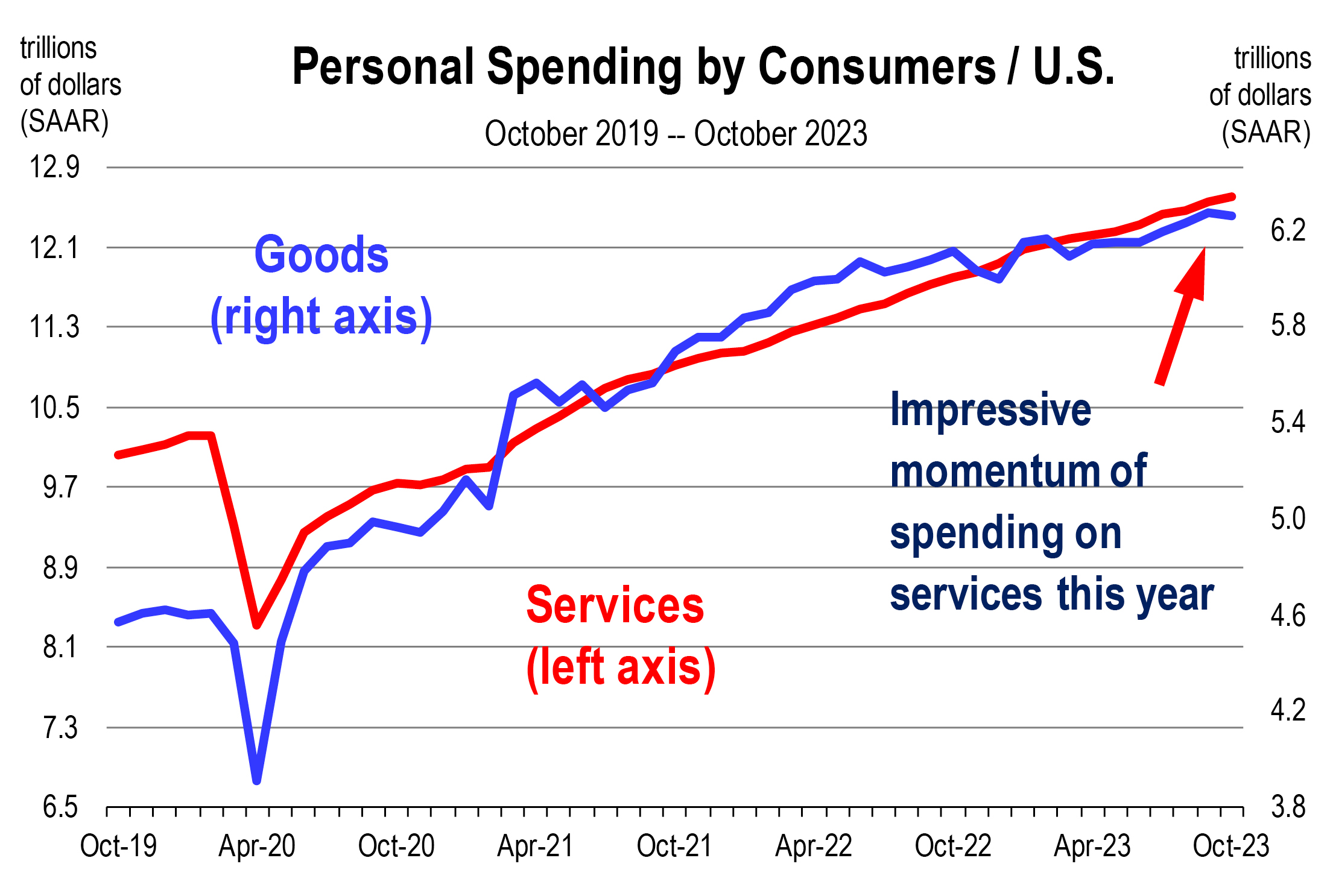

Personal spending by consumers has been slowing as of late, but it’s still running ahead of inflation which to date has softened to 3.1 percent nationally, and 2.8 percent in California.

Employment for November rose by 199,000 jobs and the unemployment rate fell to 3.7 percent. Both of these economic measures were a surprise to the upside. The rate of layoffs remains very low though we are seeing a short spurt here in December. The rate of workers filing for unemployment insurance remains very low. Wage increases remain slightly ahead of expectations.

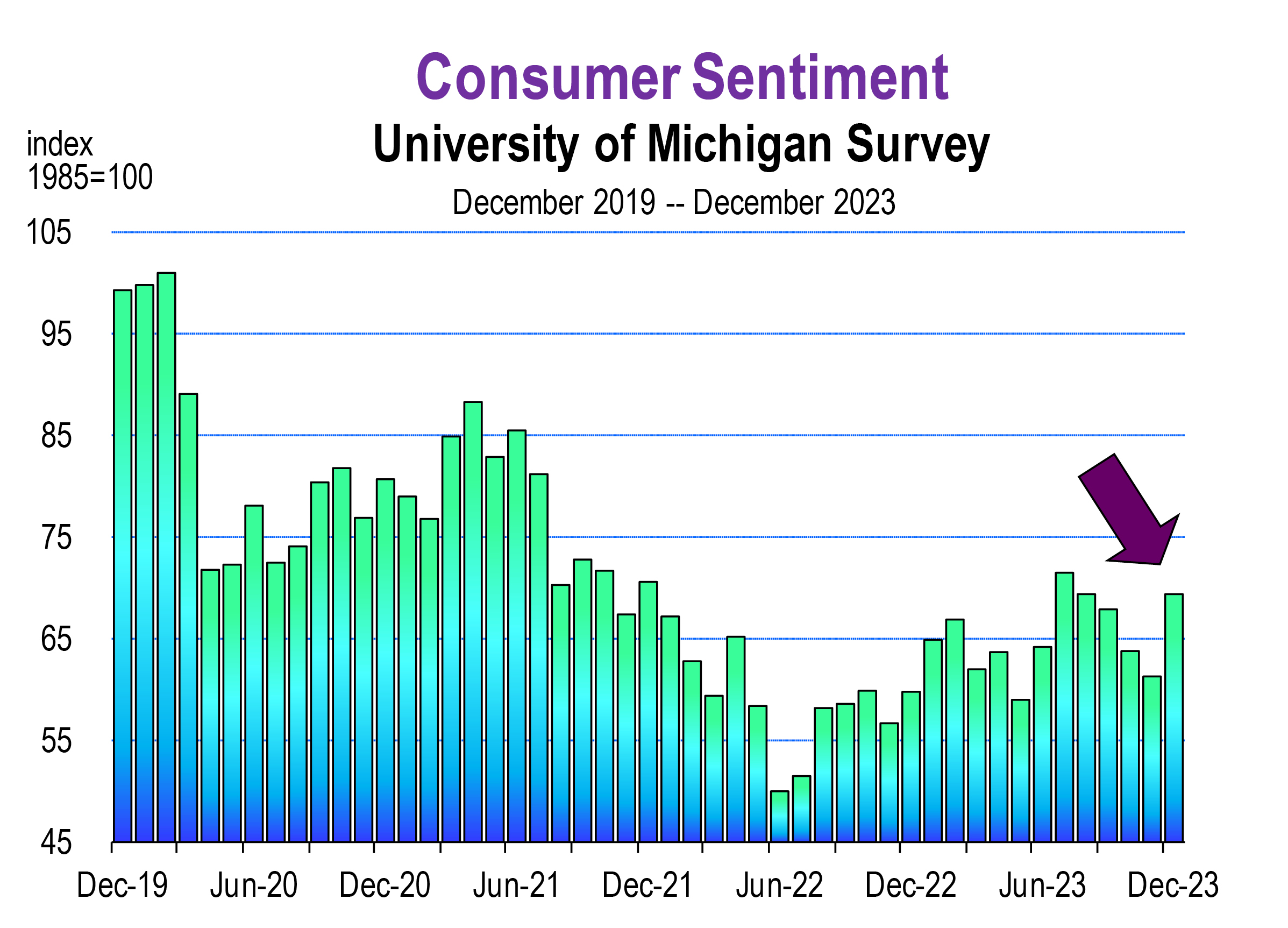

Despite the never-ending war in Ukraine, the new war in the Gaza Strip, the divisiveness in Congress, the divisiveness regarding university protests in favor of Hamas, consumer sentiment survey results from the University of Michigan showed a pronounced reversal in the persistent pessimism by consumers.

A rise in the index indicates optimism. The early December index rose to it’ highest level since July. Expectations regarding inflation improved dramatically. Attitudes

regarding current economic conditions also rose sharply.

California

The visitor industry has continued to generate vibrant activity in recreation, entertainment and leisure services all year. Whereas taxable sales of goods is lower this year in California compared to 2022, expenditures at restaurants, bars, and entertainment venues is higher in 2023.

Most sectors of the economy remain in some form of positive growth or are stable. The big contributor to the job market has been healthcare along with recreation and leisure services. In Southern California, professional services including technology services has also accounted for significant hiring, despite the layoff surge that dominated the news cycle earlier in 2023.

In fact, it’s been Southern California that has done the heavy lifting of the state’s economy during most of the year. The level of new housing and new commercial and industrial development has been impressive in view of current interest rates and inflation.

However, the state government has imitated the federal government and has been reluctant to rein in spending.

The California Legislative Analyst’s Office reported that the fiscal deficit for California will rise to a record $68 billion in 2024-2025, the second straight year of massive deficits for the state. California needs to cut spending and use the rainy-day funds to bring next year’s budget into balance.

Income tax collections which are the principal source of revenue for the California State Government fell 25 percent in 2022-23. They are projected to rise only marginally from those levels in the current year. State Government spending needs some restraint, but without it, look for policy makers to find some way to increase revenues.

Looking Forward

The long awaited recession that never came in 2023 is not necessarily postponed to 2024. There is no recession forecast, but much slower growth will characterize the economy along with a softening job market. The cooling off of labor market tightness is necessary for inflation to normalize to under 3 percent. Then the Fed will relax its restrictive policy and bond yields should ease some, helping out consumers.

This is what the stock market has presumed, and sure enough, the year is ending happy with all the major indexes at 2023 highs. This has boosted optimism and household perceptions of their wealth positions.

- With inflation falling, the Fed will keep rates steady with perhaps even a rate cut towards the end of 2024.

- That said, current mortgage rates and car loan rates will remain the same for much of next year. Housing inventory will remain low. Affordability of housing will remain low.

- A presidential election has the potential to create a lot of flux in the markets.

- International travel will remain strong, especially with a Summer Olympics in Paris. 89 percent of travel insurance purchases for trips, January 1 to December 31, 2024, are for trips abroad.

- Taylor Swift concert prices will continue to defy gravity. The lowest price for a single ticket to her Eras Tour through Japan in February is $782 on Stub Hub.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.