by Mark Schniepp

December 1, 2021

- Supply chain bottlenecks

- Inflation

- The labor force

- The pandemic

These are the four biggest issues that we, as consumers and businesses are facing in 2021. Moreover, these issues will not be resolved by year’s end. An escalation of at least two of these issues is likely, given that we’ve seen very little resolution to date.

These are the four biggest issues that we, as consumers and businesses are facing in 2021. Moreover, these issues will not be resolved by year’s end. An escalation of at least two of these issues is likely, given that we’ve seen very little resolution to date.

Supply Chain

Supply chain bottlenecks which have wreaked havoc on U.S. Ports and product inventories in U.S. stores appear to be modestly easing. Weekly container prices have been declining since mid-October, but the number of containerships anchored in the San Pedro Bay waiting to dock to unload cargos is still at or near record numbers.

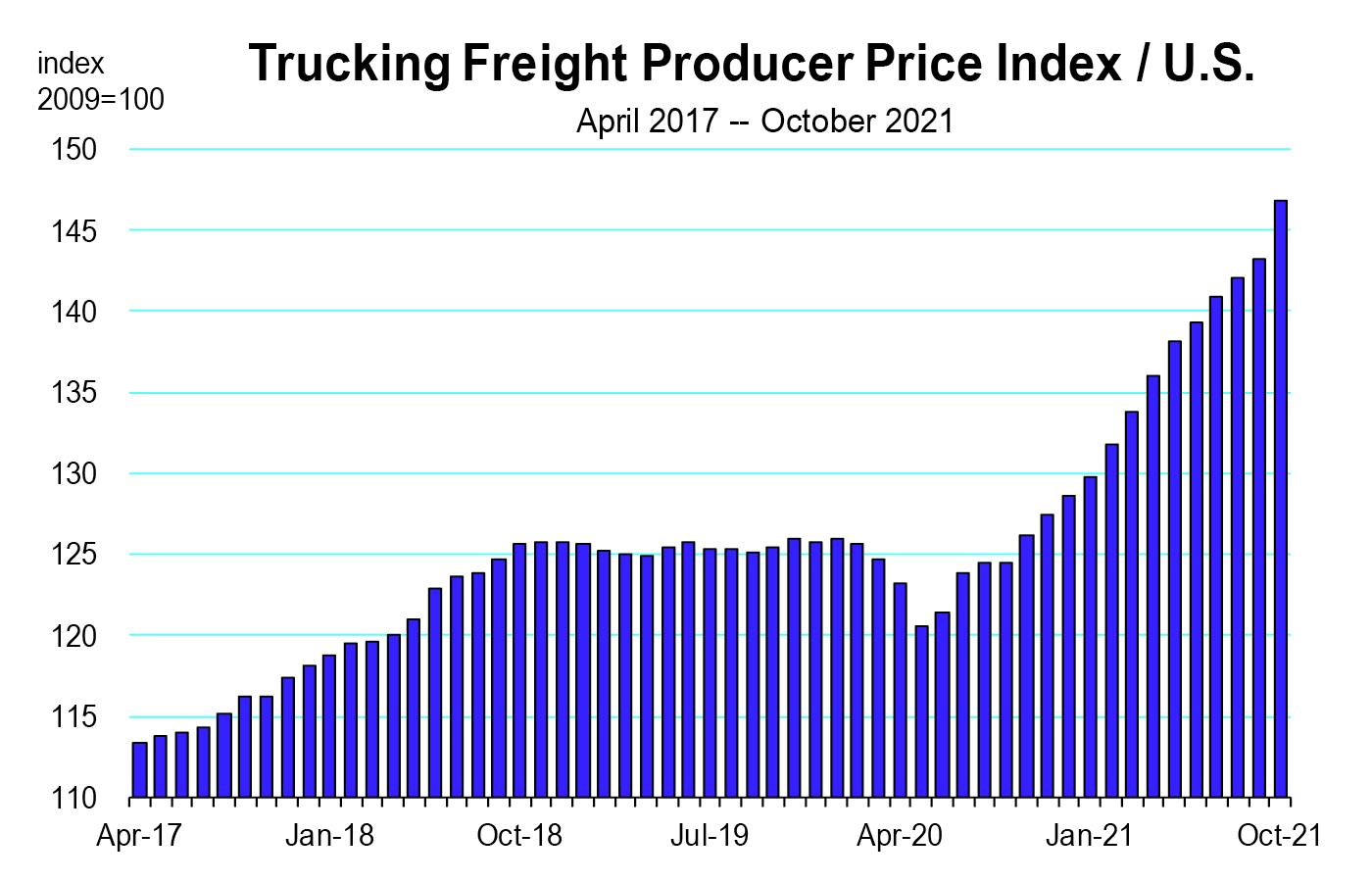

More goods are making their way into Ports and being unloaded, but containers are still stacking up in Port yards waiting for trucking and rail transportation to distribution centers. Trucking costs for transporting freight have soared, showing no signs of reversing. How long this container backlog will persist remains uncertain.

Inflation

Congress is trying to move forward on the $1.85 trillion climate and social spending bill. The legislation has stalled amid concerns from moderate Democrats over the price tag, and the latest inflation reports will only add to the reticence by legislators to vote for more massive fiscal policy.

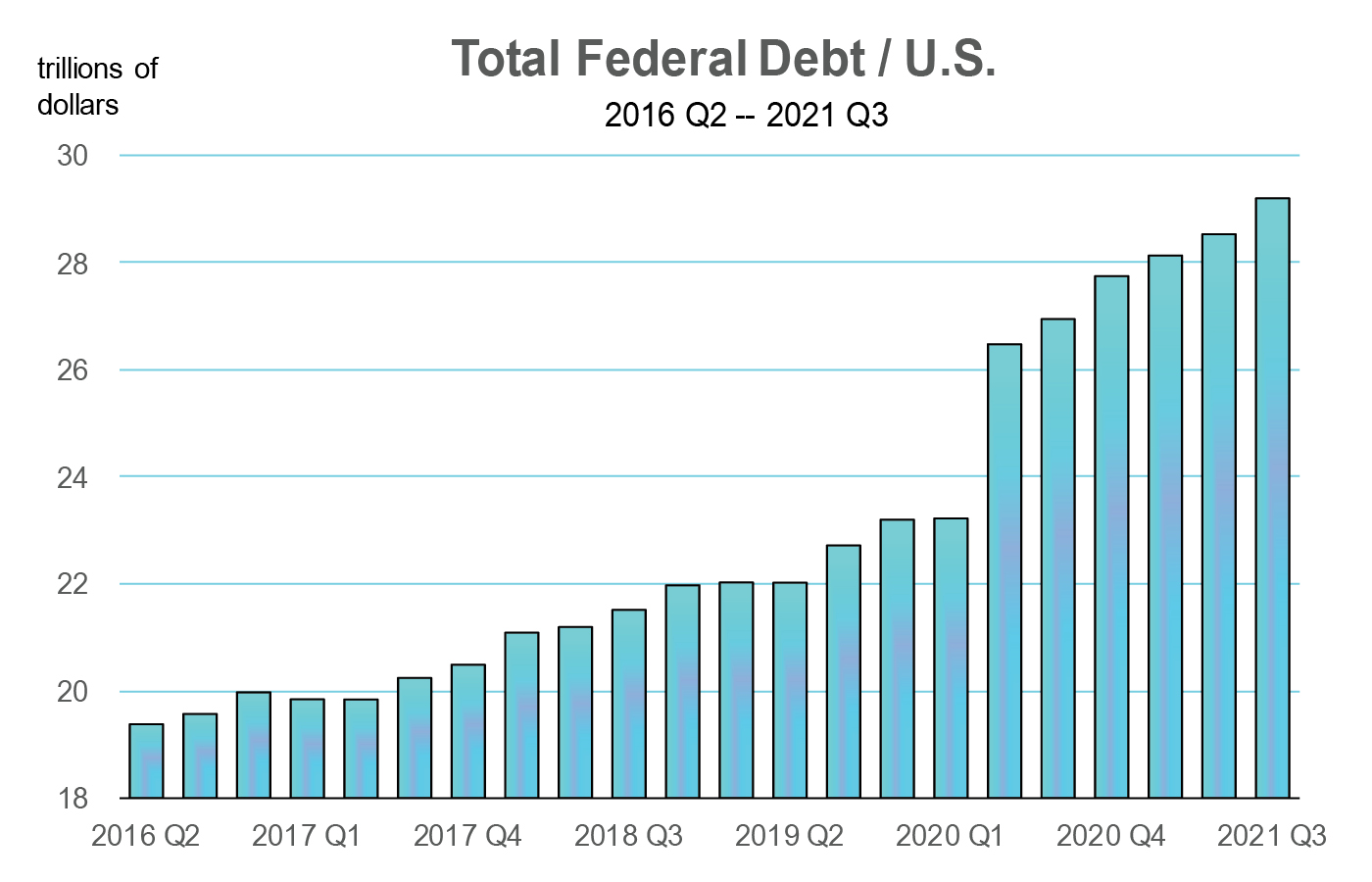

The current Congress has already passed $3.1 trillion in spending bills this year, creating not only a surge of federal debt, but a potential surge in government spending which is front loaded for 2022, 2023, and 2024.

The current Congress has already passed $3.1 trillion in spending bills this year, creating not only a surge of federal debt, but a potential surge in government spending which is front loaded for 2022, 2023, and 2024.

Over the next 10 years, the CBO estimates the total interest cost on the federal debt will rise to $5.4 trillion, becoming the fastest growing component of the federal budget.1

The latest report of 6.3 percent consumer price inflation was for the 12 month period ending October 2021. This is the highest rate of annualized inflation since 1990. The narrative from the FED is that current inflation is transitory, which means “not permanent.”

If not permanent, then how long before we see inflation abate? The FED has no answer because the next few months will not get any better.2 However, the bond market is not crashing, so that’s a good sign that investors are buying the transitory narrative.

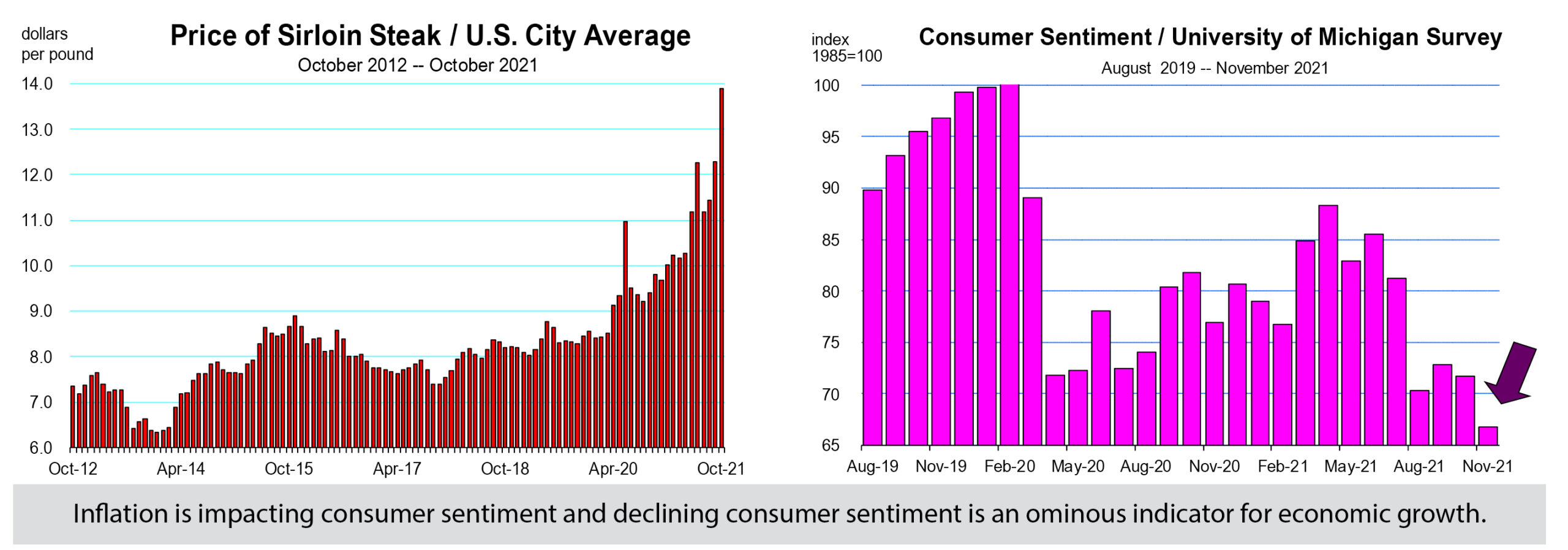

Calling “transitory” the threat of record inflation is not proving to be a calming message to Americans. Higher prices today subtract more from people’s incomes. Declaring that today’s inflation is temporary does not change today’s damage. When I go to the store and buy that $15 sirloin steak that was $8 a year ago, I’m still out the $7 today, even if that steak goes’ back to $8 next September. Ditto everything else I need to buy between now and September (or whenever the FED thinks inflation is supposed to subside).

Effectively, inflation reduces my real income, and when my real income is reduced, I spend less.

A new survey indicates that 88 percent of Americans are concerned about inflation, held across all age groups, racial groups, and income levels.3 The October survey found that 48 percent of adults plan to reduce their spending on restaurant meals and takeout, 30 percent on technology, 29 percent on clothing, and 20 percent on travel.

And speaking of surveys where consumers are threatening to spend less, comes the latest sentiment survey index by the University of Michigan. The November survey results show consumer confidence hitting new pandemic-era lows as pessimism about the economy rises.

What is weighing down sentiment? Inflation (especially in food and gasoline), the pandemic that never ends, and policy mistakes by Congress and the Administration including vaccine mandates and massive spending bills.4

Labor Force

Finding workers to staff positions in all sectors has become a principal problem for businesses trying to meet the voracious demand for goods and services by consumers. At historically record levels, there are over 10 million job openings that remain unfilled.

The slow return of the labor force is a principal reason (if not the dominant reason) why total employment has not fully recovered yet. In California, 400,000 people who were in the labor force when the pandemic hit, are not back at work nor are they looking for work. Where are they?

Surveys conducted by the Census Bureau in mid-October indicate that most of them have become caretakers for infected patients or their kids. Many have become stay-at-home parents and/or are now homeschooling their kids. Prime age workers who are without children have fully returned to the labor force.

Consequently, either as vaccinations increase for school age children, more of the general population is vaccinated, or the pandemic naturally burns out, the labor force is predicted to gradually be restored. The problem of finding workers now is going to persist into next year and keep pressure on wages which fuels inflation.

If you are recently retired, we need you to come back to work. You’ll make yourself and everyone happier.

The Pandemic That Never Ends

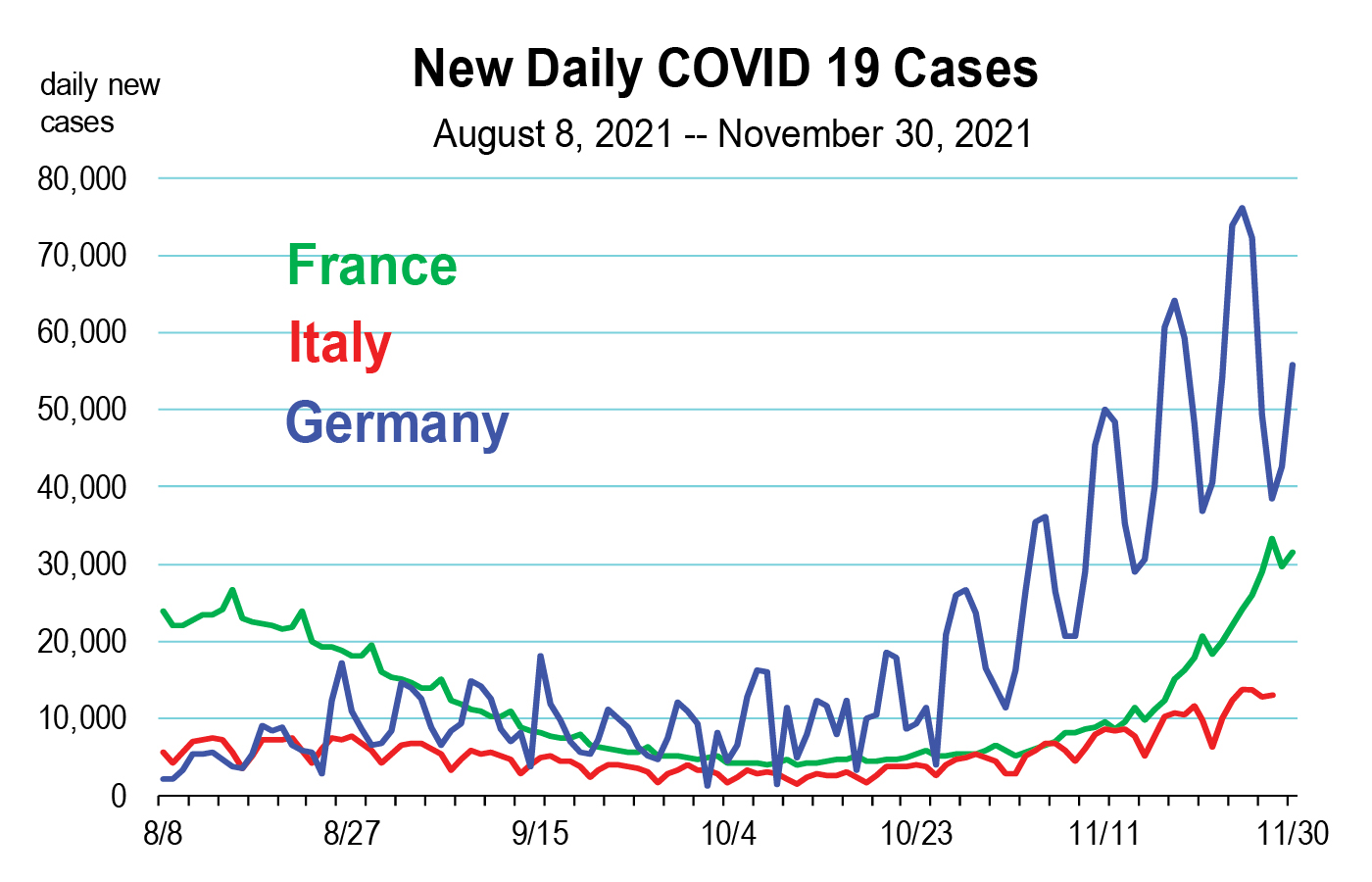

The global economic recovery remains tethered to the pandemic. And another wave is coming. We are seeing it in Europe, notably Germany and Austria. In Austria, a vaccine mandate and a national lockdown have now been imposed. In Germany, daily cases are now more than twice as high as they have ever been during the course of the entire pandemic.

The global economic recovery remains tethered to the pandemic. And another wave is coming. We are seeing it in Europe, notably Germany and Austria. In Austria, a vaccine mandate and a national lockdown have now been imposed. In Germany, daily cases are now more than twice as high as they have ever been during the course of the entire pandemic.

Now officials are worried that waning protection from the vaccines, combined with Americans spending more time indoors amid colder weather, will also send the United States into a fourth wave of spiking cases. Cases are already rising again, and we now face the onset of the new and unknown Omicron variant from South Africa. It has emerged in Europe and it is likely to become the dominant variant in the U.S. soon. However, much will depend on its speed of transmission, virulence, associated rates of hospitalization and death, and the effectiveness of vaccines and antiviral medications against it.

Public health officials including Anthony Fauci are calling for an immediate expansion of booster shots, as well as mandatory vaccine programs for children. California already became the first state to announce vaccine requirements for children in K-12 schools.

Parents that object to this are a threat to leave the labor force, while other reticent potential workers may remain out of the labor force until vaccines are mandated for all. In either case, the negative effect on a labor force that we need now is extended. Consequently, vaccine mandates could potentially impact the economy. Clearly, we desperately need the pandemic to end or an acceptance by all that the risks have largely abated and coronavirus is something we can now live with. The longer the pandemic is allowed to persist, the more lasting its impacts will be.

2 Even as the Fed begins tapering its bond buying program by $30 billion per month, this form of monetary tightening is unlikely to have much effect on consumer price movements next year, even as bond purchases go to zero by mid-2022.

4 In a recent November 23, 2021 Rasmussen Reports poll of 2,500 U.S. voters, 29 percent said that the country is heading in the “right direction.” This finding is confirmed by a November 9, 2021 USA Today/Suffolk University poll, and an October 31 NBC News poll. In the former, only 20 percent of respondents think the country is going in the “right direction,” and 66 percent answered the “wrong direction.” In the latter, 71 percent of Americans believe the U.S. is on the wrong track.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.