by Ben Wright

July 2016

Many commentators have suggested that a British vote to leave the European Union would lead to global recession. They have drawn comparisons to the crisis in 2012 when large government deficits threatened to push Greece out of the EU. But Britain is not Greece for one important reason: Britain has its own currency.

Britain is not Greece

The Greek situation was dangerous because Greece uses the Euro, the currency it shares with 18 other nations. An exit from the EU would have forced it to abandon the Euro overnight and renegotiate its financial contracts, creating real problems for the banking system and threatening a replay of the crash of 2008.

But the United Kingdom uses the Great Britain Pound, one of the oldest currencies in the world, and no current geopolitical scenarios will alter this. The British national economy faces other issues, but the Pound will retain a prominent role in the global economy, and there is little risk that Brexit will mushroom into an international catastrophe.

The Short-Term Volatility is Over, But UK Growth Will Lag

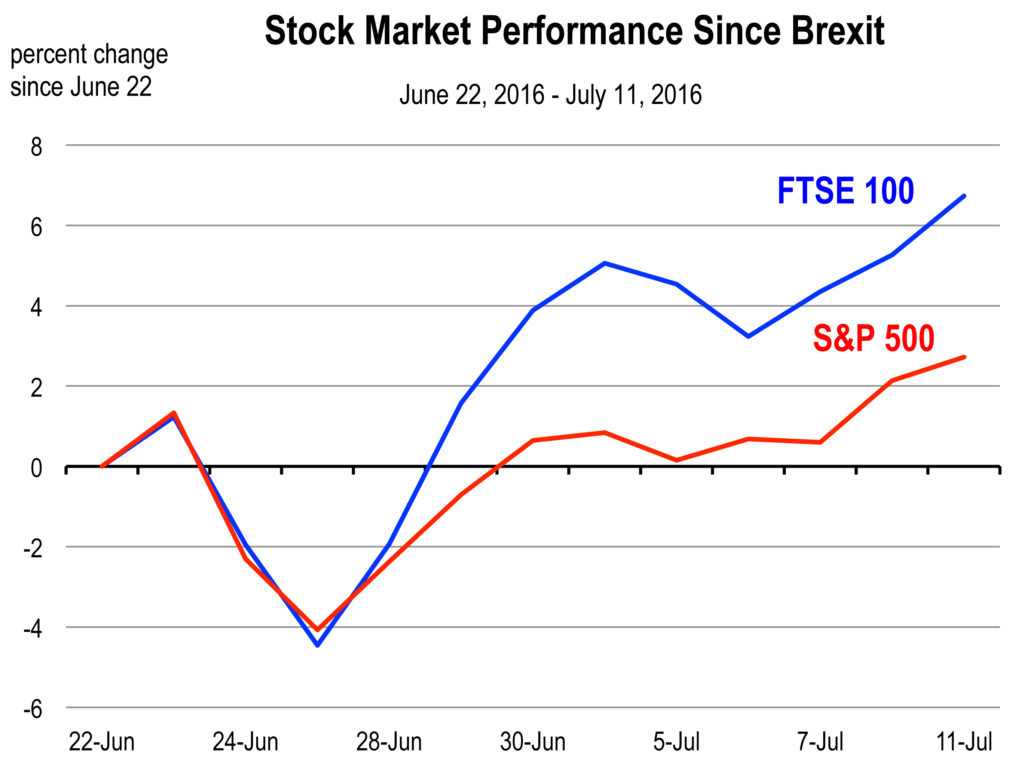

In the minutes and days after the vote, stock markets tumbled around the world. Bond yields fell and the Dollar strengthened as investors rushed to safe haven assets. This was a predictable reaction to a burst of uncertainty, but the turmoil has now subsided and markets have calmed. The S&P 500 has reached a new high, and the index of British blue chips has surpassed its pre-Brexit value by more than 6 percent.

In the minutes and days after the vote, stock markets tumbled around the world. Bond yields fell and the Dollar strengthened as investors rushed to safe haven assets. This was a predictable reaction to a burst of uncertainty, but the turmoil has now subsided and markets have calmed. The S&P 500 has reached a new high, and the index of British blue chips has surpassed its pre-Brexit value by more than 6 percent.

But the short-term effects were never the real danger, and new issues will unfold over the coming months and years. If English officials do not strike a new trade agreement in Brussels, their economy stands to lose substantial ground over the long term.

The UK is a large exporter of industrial machinery, aircraft, and other high-value goods. But so are Germany, France, Italy, Finland, and a number of other EU nations. Without a trade agreement, British goods would be subject to new tariffs, making them more expensive and less competitive in the global marketplace.

Over time, it’s likely that some of the UK’s trading partners would find new suppliers, which would slowly erode the manufacturing sector. Ironically, the industrial hubs that supported Brexit could be the biggest losers. It was developing nations like China and South Korea, not other European countries, that were their main source of competition.

Without free access to the European market, some firms would relocate to other parts of the EU, and others would delay investment into their UK operations. The most important may be the banking sector, which is arguably the preeminent hub of global finance. Some reports have estimated that London could lose 10,000 banking jobs over the coming years, relocating them to Frankfurt, Amsterdam, and other cities with existing financial infrastructure. Those first to leave may be at multinational firms that already have other EU offices.

| Company | Total Jobs in London | Jobs Likely to Leave London |

|---|---|---|

| Citigroup | 8,000 | 2,000 |

| Goldman Sachs | 6,410 | 1,603 |

| Bank of America | 5,545 | 1,386 |

| Morgan Stanley | 5,000 | 1,250 |

| J.P. Morgan Chase | 16,000 | 1,000 |

| Source: Keefe, Bruyette & Woods, Inc. |

Britain would almost certainly see lower levels of in-migration – their only current source of population growth. It’s very hard for an economy to grow without new additions to the workforce, and if migratory patterns reversed and the resident base began to decline, economic expansion would be considerably muted. Just look at what’s happening in Japan.

In total, economists estimate that the loss of trade, investment, and in-migration could reduce GDP growth by up to $260 billion over the next decade, and would place a drag on wages by upwards of 7 percent. UK households could lose $2,600 in annual purchasing power, and British exporters may lose 50 percent of their market share within the European Union. A recession is unlikely, but can’t be ruled out because the British economy was slated for slow growth even if the “Remain” campaign had prevailed.

Pain Will Be Concentrated In the UK

When growth slows in an economy as prominent as Great Britain – currently the 5th largest in the world – it tends to influence conditions elsewhere. But the global effects of this scenario are expected to be mild.

Economists estimate that the U.S. would have grown by 2.5 percent over the next year, but have downgraded their forecasts to 2.0 percent, largely due to the drag from less favorable exchange rates. The Fed was ready to raise interest rates in July or September, but will now almost certainly wait until December or later, and international interest rates will remain lower than if Brexit had never occurred. US companies that have operations in the UK will reassess their options, and may lose some of their EU business.

The British economy stands to lose a substantial amount of trade, but some of this activity may simply shift to their EU competitors. Some of the migrants heading to London or Manchester will instead choose Paris or Munich. Barriers to trade are usually contractionary, but in this case there will be a meaningful substitution effect.

In general, outside of Her Majesty’s Kingdom, most of the world will take this situation in stride.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.