Mark Schniepp

January 2025

The big three campaign issues of the new administration that allegedly resonated with the electorate were:

- Improving the economy and restoring low inflation

- Securing the southern (and northern) border of the country

- Resolving the Ukraine-Russia conflict and restoring peace in general

Paying off federal debt

A meaningful reduction in government spending recommended by DOGE and sanctioned by Congress could actually balance the annual federal budget and make inroads on debt reduction. This would be the first time since the 1990s. However, we all know there are inefficiencies in government program spending. Identifying them and pressuring the House to develop appropriation bills to nix federal programs, grants, transfers, and general spending is needed to reduce the debt.

Debt reduction would help to keep interest rates lower and spending limitations would help to keep inflation at bay.

Expand Oil Drilling

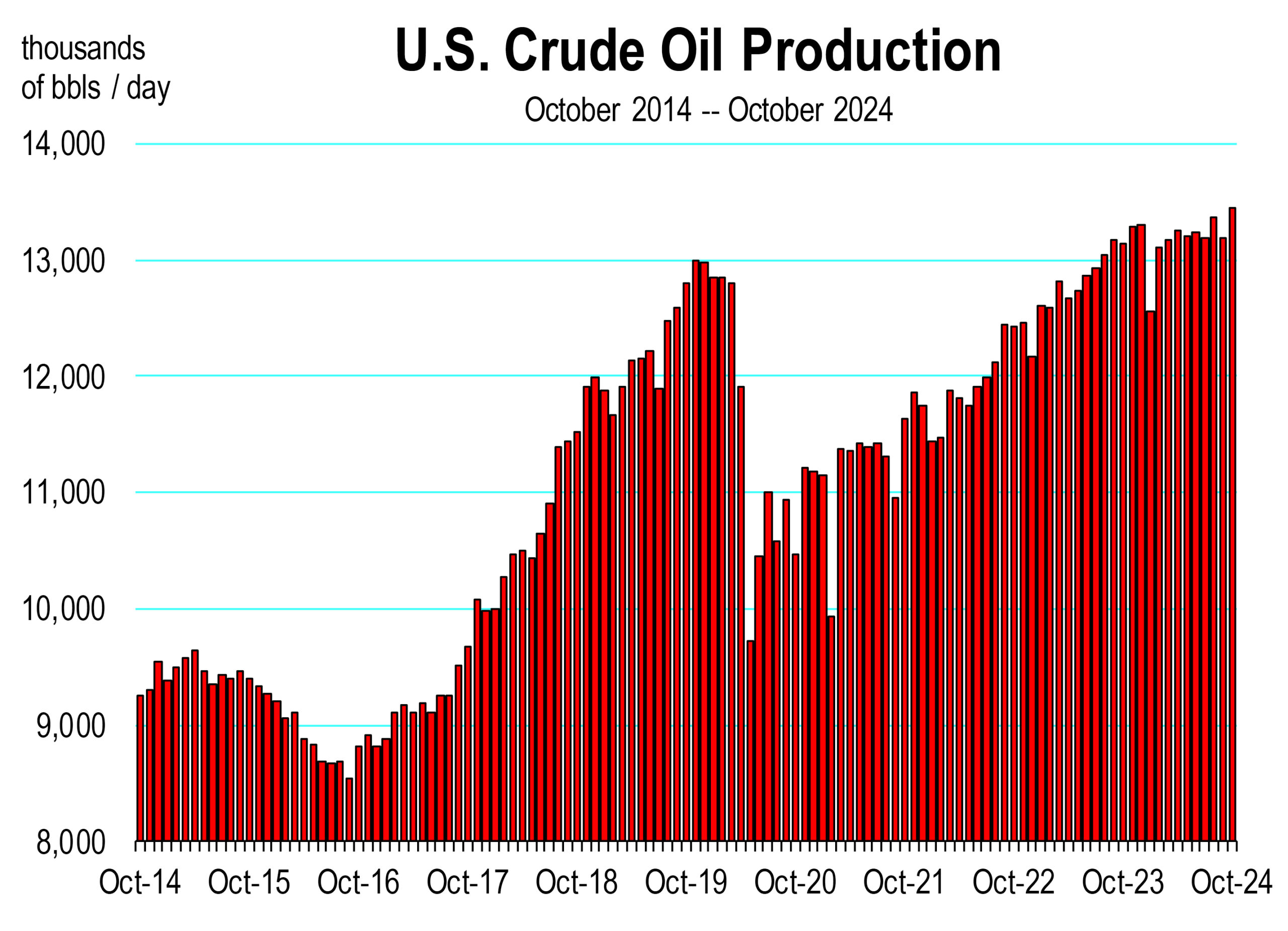

Oil production is already at record levels but is still subject to high royalty rates when conducted on federal lands.

Also, there are significant regulatory obstacles including local discretionary approvals that could be eliminated to enable expanded drilling, lower operating costs and incentivize more production in the Permian basin (Texas and New Mexico), the Williston Basin (North Dakota), and the Gulf of Mexico.

More domestic energy production would increase world supply providing OPEC does not restrain member production in response. Crude oil prices would decline.

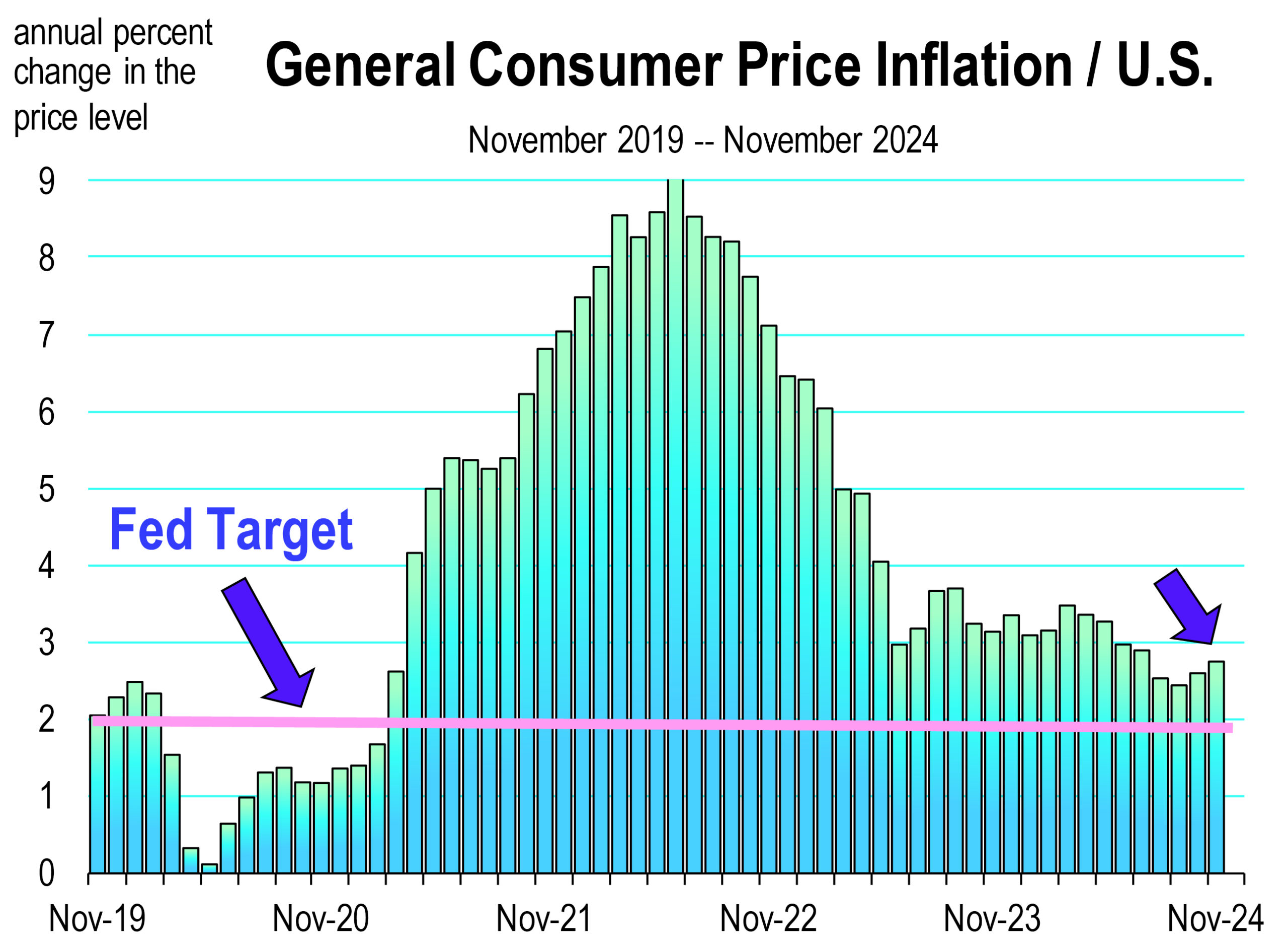

Taming Inflation

Inflation is already moving in the direction of being tamed, meaning that the rate of general price increases is returning to the inflation environment that prevailed during the Trump 1.0 years. However, rate cuts by the Fed are an economic growth stimulus that we don’t need. According to GDPNOW, fourth quarter growth was 3.1 percent, a level that could compromise continuing progress on inflation.

Furthermore, inflation reduction will be more likely (1) at lower levels of government spending, (2) with progress on the Federal debt, and (3) enabling expansive energy production from all sources.

Extend the tax cuts

The tax cuts are already in place from 2017. They expire on December 31, 2025. This gives Congress a sufficient window of opportunity to reconsider how to structure tax policies to balance so that spending does not exceed revenue. If Congress chooses not to extend the 2017 Tax Cuts and Jobs Act, an effective and meaningful tax hike will occur. The tax hike will impact middle and higher income American families. The corporate tax rate of 21 percent does not expire, but it could be raised back to 35 percent if lawmakers choose to reopen the tax code. Maximum tax rates will revert back to 39.6 percent (from 37 percent now). The standard deductions which usually impacts lower income households will be cut in half, and child tax credits will deflate from $2,000 per child to $1,000. Households with $400,000 in income would realize diminishing value of the mortgage interest deduction and charitable deductions.

Sole Proprietorships and S corporations will no longer be able to deduct up to 20 percent of business income when calculating annual taxes. Consequently, small businesses and gig employees will face a stiffer tax burden.

Gift and Estate taxes will revert back to the $5 million exemption level, from $13.6 million under the Trump tax cuts that have been in place since 2017.

By extending the tax act of 2017, Trump also wants to eliminate taxes on tipped wages, overtime, and Social Security payments. These programs would increase disposable income for lower wage earners and for seniors which would enable more household spending and in theory, accelerated growth of the economy.

Tariffs on China and other countries

The initial round of tariffs imposed in 2018 and 2019 are still in effect on China and were even increased under the Biden administration last spring. Tariffs may result in marginally higher costs to consumers but not much impact was detected as a result of the first round of tariffs.[1] It appears that much of the tariff burden was eaten by Chinese manufacturers and not passed on in the form of higher prices to American consumers.

What the new administration is thinking regarding actual implementation of tariffs has not been articulated. Only general saber-rattling statements by Trump, probably in the spirit of preparing for negotiations with our key trading partners, has been reported.

For Mexico and Canada, their hope appears to be that Trump’s threats are mere negotiation ploys to which concessions can be made even before he takes office. The threat of tariffs against Mexico has already cajoled Mexican President Claudia Sheinbaum to agree to stem illegal migration across the border into the U.S.

While tariffs would increase federal revenues, the totality of collections would unlikely be meaningful. Furthermore, we don’t believe a new round of tariffs in 2025 will be either substantial or pervasive because this could counter Trumps bigger pledge to reduce inflation and increase economic growth.

End the Ukraine Russia war

Concessions will have to be made by Ukraine to end the conflict with Russia, but ending the war will result in substantial economic benefits for the European economy. It will free up and enable expanded Ukrainian agricultural production—especially corn and wheat—which is highly coveted by China, Spain, Turkey, Italy, the Netherlands, and Egypt. Ukraine is the world’s top producer of Sunflower oil, much of it exported to EU countries first, China second, and India third.

The Russian economy has been significantly impacted, largely by the exit of 1,200 major multinational firms that fled the country in protest. This resulted in a major shutdown of the economy. Some sectors are off 60 to 90 percent in total production. Energy exports have been cut in half, especially natural gas which lost a major delivery pipeline (the Nord Stream) into Germany when a series of underwater explosions rendered it inoperable in 2022.

Ending the war would remove any need by Congress to continue financing it, and therefore reduce one large area of government spending.

Trumponomics 2.0 Summary

The principal parts of the new plan are to reassert the Trump 1.0 tax cuts, extend them further, significantly cut government spending, impound previously appropriated Congressional funding, onshore more U.S. company production, deport illegal aliens, and threaten tariffs on, and the withdrawal of economic aid, to countries whose behavior unequivocally harms U.S. interests and/or policies.

The reaction of the stock market and the broader economy will represent a real check on Trump trade policies. Progress on inflation poses a further check.

This is why there is rising probability that inflation could remain a problem in 2025 and stay above the Fed’s 2 percent target. As of November, the core measures of CPI and the Personal Consumption Expenditure Price Deflator together averaged 3.0 percent. The hope that inflation will come down in 2025 will remain an issue and depend on trade strategies and getting control of federal spending.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

1 Associated Press, “Trump’s tariffs did little to alter the economy, but this time could be different,” November 28, 2024,