by Mark Schniepp

February 2021

California

We can’t see it so much in California because of the severe restrictions on business and the fact that we’ve not been able to go anywhere or engage in much spending activity since Thanksgiving. But the growth of the economy has been positive due largely to distribution of goods, technology, and home sales.

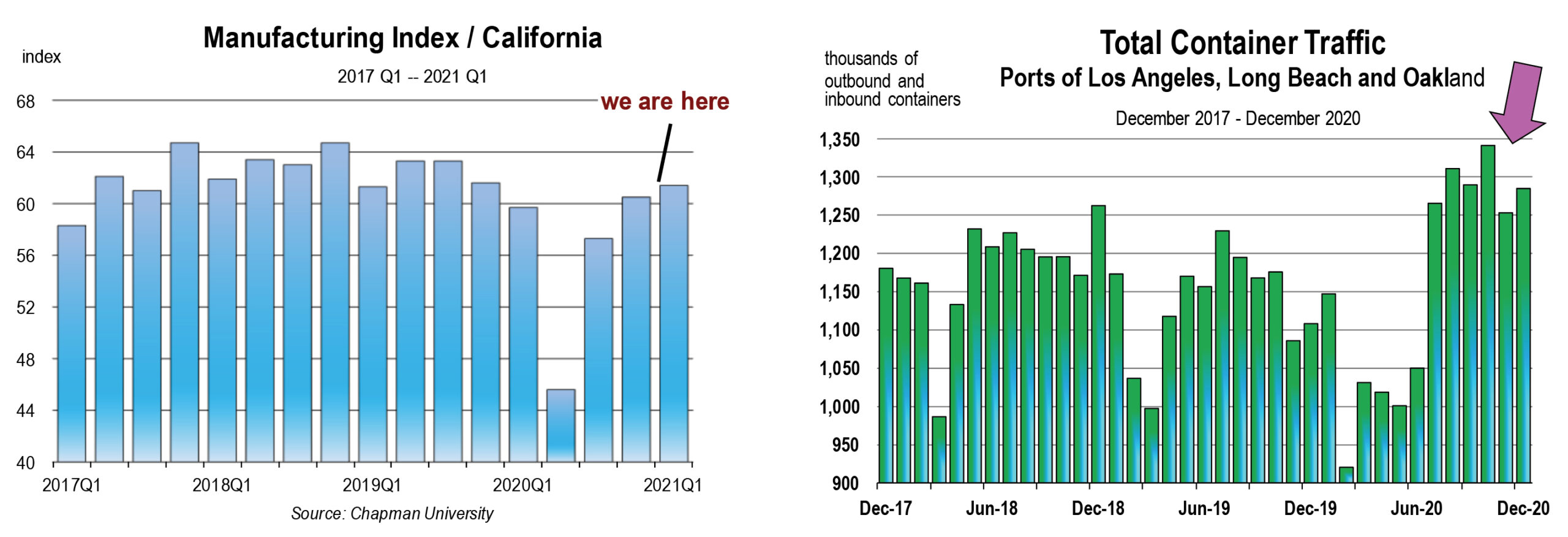

Homebuilding and Infrastructure projects are underway throughout the state, generating a rapid recovery in construction activity. By this month or next, construction employment will have completely recovered from the precipitous decline caused by the pandemic in April, May, and June. The state’s manufacturing sector has now completely recovered.

Imports and exports through the state’s ports of Oakland, Long Beach, and Los Angeles have also recovered sharply in the 2nd half of the year. There was surprisingly more container traffic in 2020 overall compared to pre-pandemic 2019, principally from stuff coming into the U.S. rather than going out.

The 2020 calendar year ended with 9.4 million fewer jobs in the entire U.S. compared to December 2019. California ended up with 1.4 million jobs fewer than in December 2019.

The December jobs report was negative for both the U.S. and California.

The victimized economic sectors that contributed to the downbeat report continue to be concentrated in leisure/hospitality and local government. The severe restrictions on food services, travel, and attractions produced the freefall in leisure, recreation and hospitality revenue and employment. This has contributed principally to City and County governments grappling with major declines in tax revenues.

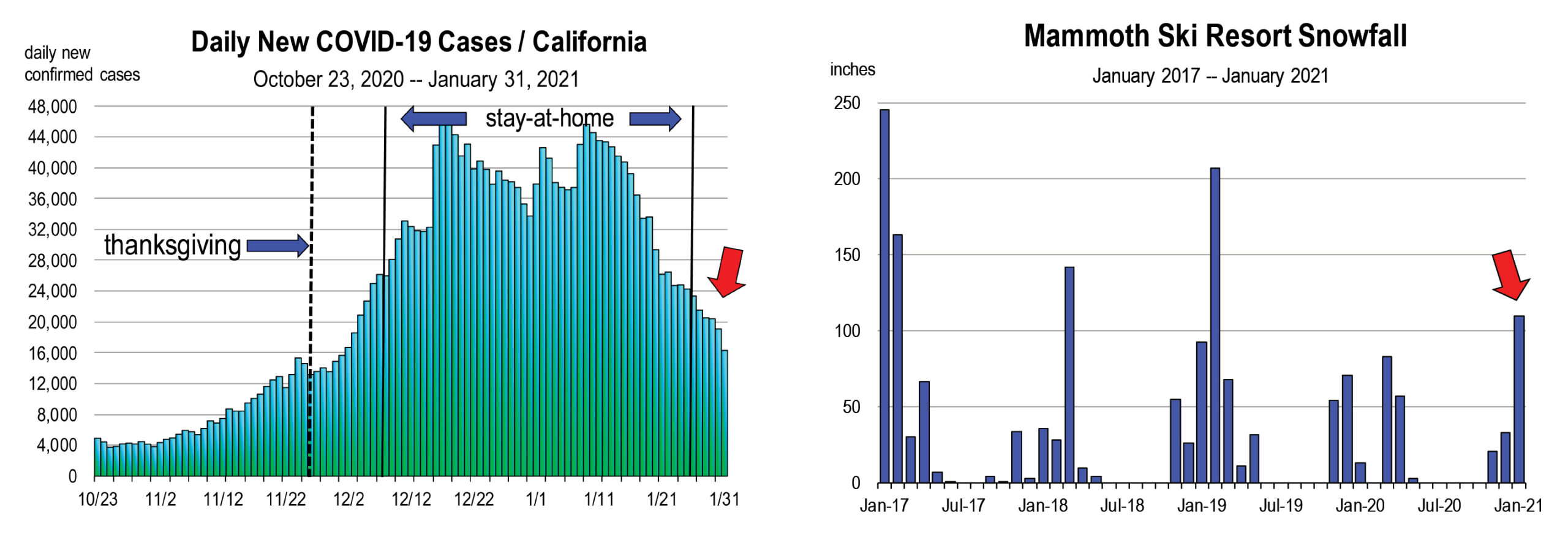

California suffered the most severe business restrictions in the nation during December and January, and generally for most of the 2020 calendar year. We are guessing that restrictions will be gradually eased as clear evidence of fewer cases emerges in California this year. All counties are now in the purple tier of business restrictions after the stay-at-home mandate was ended by the Governor’s office on January 25.

We would also hope that as the number of people receive vaccinations, the number of positive cases will decline. Though the level of daily cases is still high, we are finally seeing a clear abatement over the last two weeks. It’s unlikely however that this reversal of trend is due to vaccine distribution because fewer than 8 percent of the state’s population had received the first shot by the end of January.

In sync with the lifting of the stay-at-home order in California is the deluge of snowfall in the Sierra. Mammoth Mountain received 9 feet of new snow in the week ending January 30. With hotels now able to book reservations, thousands of visitors can inundate the ski resort, and all of the ski areas around Lake Tahoe. Hopefully the ski industry in California can now post a solid 2021 snow season.

The U.S. Economic Recovery is More Convincing

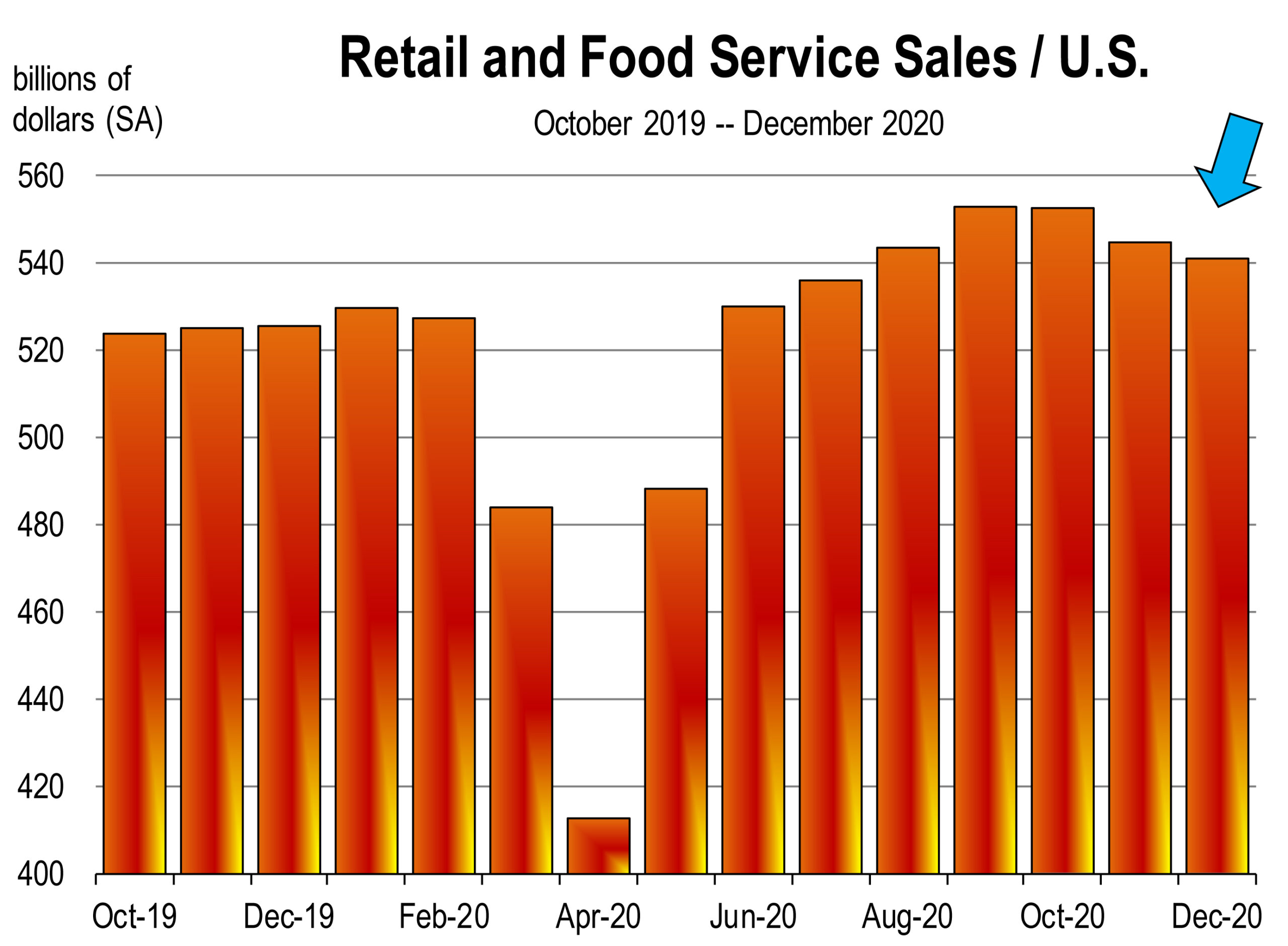

Because the limitations on economic activity in other states have been far less onerous than in California, positive growth measured by employment or sales or fewer unemployment claims per capita has been higher for the aggregate U.S.

GDP growth during the 4th quarter of 2020 weighed in a 4.0 percent, great by pre-pandemic standards but much slower than in the 3rd quarter because of the increased infection rates during the Fall, tighter restrictions to contain the spread of the virus, and the lack of fiscal stimulus which had contributed to the previous two quarters.

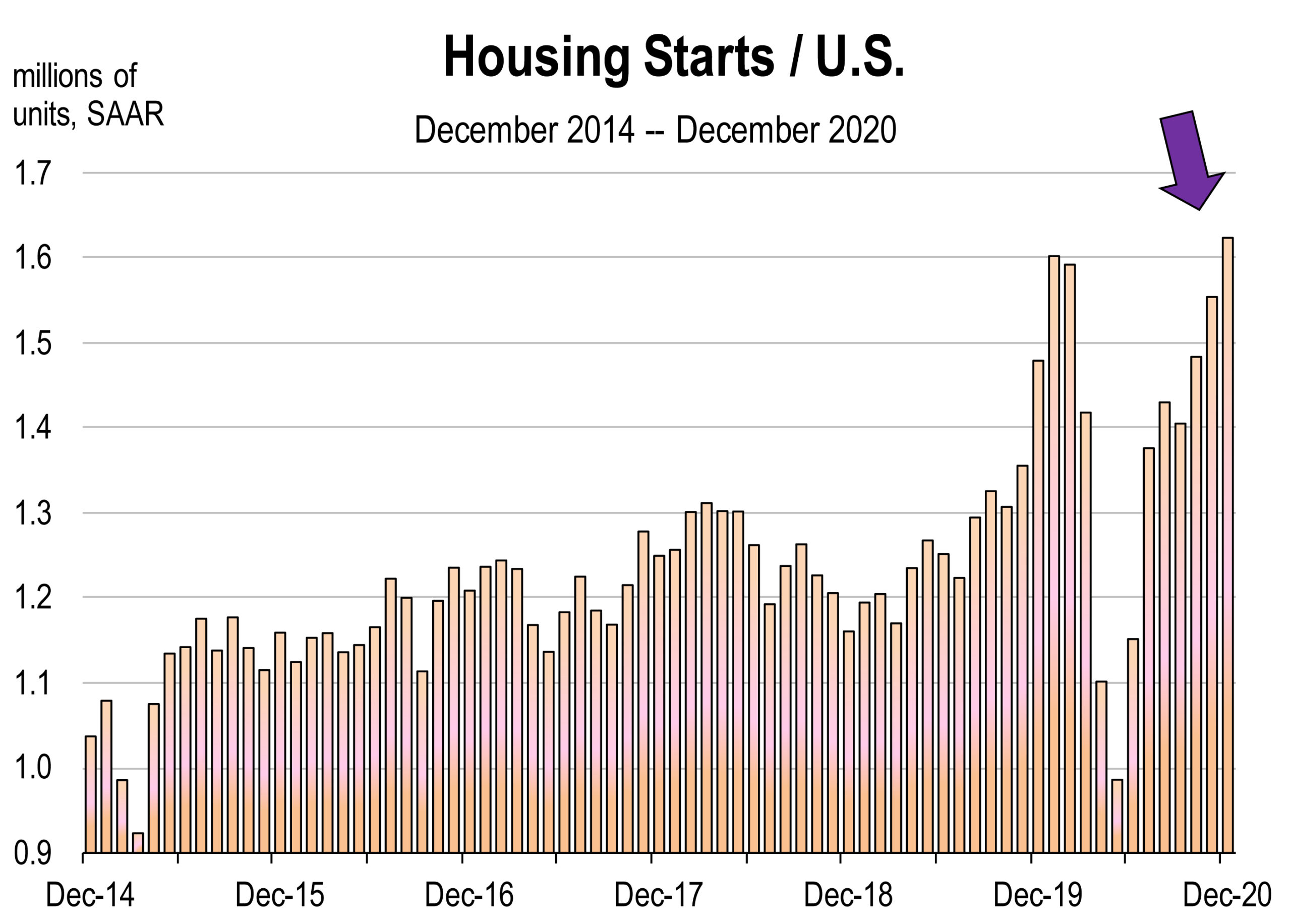

Housing is one particular indicator that is contributing largely to GDP improvement.

Housing is one particular indicator that is contributing largely to GDP improvement.

Homebuilder confidence is solid; both housing starts and new home sales have rebounded sharply to their highest levels since 2006.

Home refinance activity remains very strong and existing home sales have surged month after month since June. Total existing home sales during 2020 were also the most since 2006.

30 year fixed interest rates for conventional mortgages were 2.95 percent in late January, consistent with accommodative monetary conditions. At the January meeting of the Fed’s Open Market Committee, the target range for the fed funds rate was kept at 0% to 0.25%. This target is unlikely to change anytime soon.

The manufacturing economy continues to grow. Output has increased in 7 of the last 8 months.

The Moody’s back-to-normal index has been generally slipping the past 2 months, to the lowest level since June 2020. The index evaluates the extent to which the economy is back to pre-pandemic normality. The decline is mostly due to the surging case counts across the nation. Of the 15 states tracked for how the recovery is trending upward, California ranks next to last, just ahead of Illinois.

And consumer sentiment is not improving, remaining steadily lackluster. The positive news on the delivery and administration of the vaccines is being offset by increased or sustained restrictions on business activity and the general lack of improvement in the unemployment rate. Not surprising, retail sales have now declined for 3 straight months, under the weight of business restrictions and consumer fears from heightened positive case numbers in the U.S.

Automobile sales nevertheless continue to increase and the pace of sales has now recovered completely.

New claims for unemployment benefits have declined during the last two weeks of January. This is encouraging news although the level of claims is still extremely high. Too many American workers are still out of work. The unemployment rate is 6.7 percent. But add to that the four million people who were working a year ago but have dropped out of the labor force and are therefore not included as unemployed. Counting them would boost the nation’s unemployment rate to 9.0 percent.

New claims for unemployment benefits have declined during the last two weeks of January. This is encouraging news although the level of claims is still extremely high. Too many American workers are still out of work. The unemployment rate is 6.7 percent. But add to that the four million people who were working a year ago but have dropped out of the labor force and are therefore not included as unemployed. Counting them would boost the nation’s unemployment rate to 9.0 percent.

The US economy is clearly in recovery, but the start in 2021 is slow. The pace of growth is expected to accelerate in the second half because widespread vaccinations in the first 5 to 6 months of the year will enable the economy to recover more rapidly thereafter.

How strong the economy is later this year will depend on how the virus evolves and the effectiveness of the vaccines and mitigation efforts.

However, please read our January newsletter for my major concern about the outlook for general economic growth over the full calendar 2021 year. There are still too many big unknowns. Rapid recovery during the 2nd half of 2021 relies on an open economy. We can’t be sure the economy will be wide open in June.

Vaccine Update

There are two vaccines being administered in this country and many more worldwide at this time. Two additional vaccines—by Johnson and Johnson, and Novavax—are now completing clinical trials, with results and FDA approval expected this month.

The vaccine delivery of doses to individuals is the subject of criticism and frustration. Millions of doses are sitting unused in freezers. The original ambitious schedule of getting 20 million people inoculated by the end of 2020 was finally accomplished 22 days late on January 22nd. California has consistently ranked at the bottom of states in the percentage of distributed vaccines that have been administered. And because of its high daily positive caseload, California needs to vaccinate as quickly as possible.

Delays have been caused by the holidays, the tidal wave of new coronavirus hospitalizations which have interrupted vaccination campaigns, insufficient staff needed to administer shots, the challenges of the ultra cold storage requirement of the Pfizer vaccine, the wrong vaccine being used, fewer vaccines being delivered, and other delays.

The recovery period we are in might be called the vaccine phase. During this phase consumers remain reticent to engage in activities usually requiring high human contact and remain largely at home and/or isolated. This keeps a lid on spending and economic growth. Also during this time, business restrictions remain firmly in place in most states, constraining business openings, hiring, and opportunities for consumers to spend.

We are now looking forward to the post vaccine period of recovery when pent up demand for services is expected to surge. Therefore, we will be watching closely how restrictions are lifted and how consumer demand evolves as herd immunity from coronavirus is generated by a dominant share of the population receiving the vaccine. That is not expected however until the late Spring.

The Outlook for 2021

Presenting a credible outlook for the U.S. and California today requires knowledge of how the coronavirus will evolve in 2021. We’d like to think the pandemic will be called off by summer. That’s what we thought nearly a year ago, in March of 2020.

Right now, travel bans are still in effect. Rigorous testing for airline passengers entering the U.S. is now required. Effective January 26, the CDC now requires all air passengers including U.S. citizens to present a negative COVID-19 test, taken within three calendar days of departure.

Travel to most of Europe is still limited to essential workers only. The U.S. is still not on the welcome list. Travel from Europe to the U.S. is mostly prohibited. Ditto China, Brazil, and South Africa.

It is largely unknown when these conditions will change. Consequently visitor industry contribution to the U.S. and California economy is uncertain.

U.S. resident spending is expected to grow this year, for housing, food, clothing, autos, gasoline, furnishings, and healthcare. The unknowns include education, entertainment, recreation, and personal care.

When business restrictions are largely lifted, most consumers will return to pre-pandemic behaviors, though some reticence toward high human contact activity will still characterize some consumers. Consequently, we don’t anticipate airline, cruise ship, or tour bus travel to recover quickly.

The reticence will extend to live public gathering events, such as concerts, county fairs, or sporting events. These activities may remain social distanced anyway for most of the year, limiting audiences.

The outlook for the 2021 economy remains hazy. Most of us were glad when calendar 2020 ended. But so far, 2021 is looking a lot like 2020.

Have the Newsletter Sent to Your Inbox

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.