Mark Schniepp

December 2, 2024

Far from great, 2024 was a good year

This year—2024—was a much better year than economists predicted. A year ago, there was more talk of a looming recession, or very slow growth predicted for 2024. The labor markets however, remained strong, consumers continued to spend, investor buying extended the bull market into its third year, and businesses generated profits.

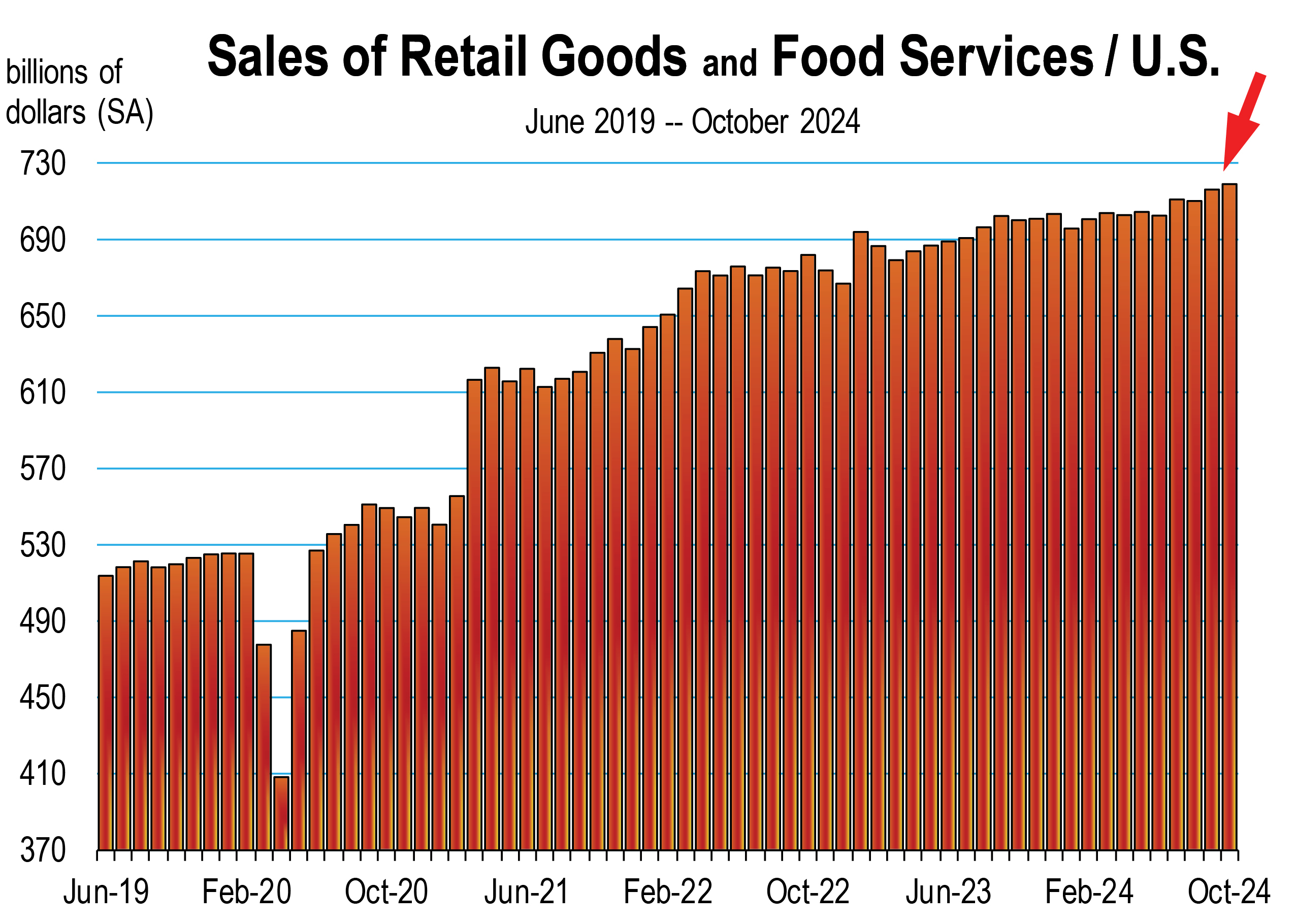

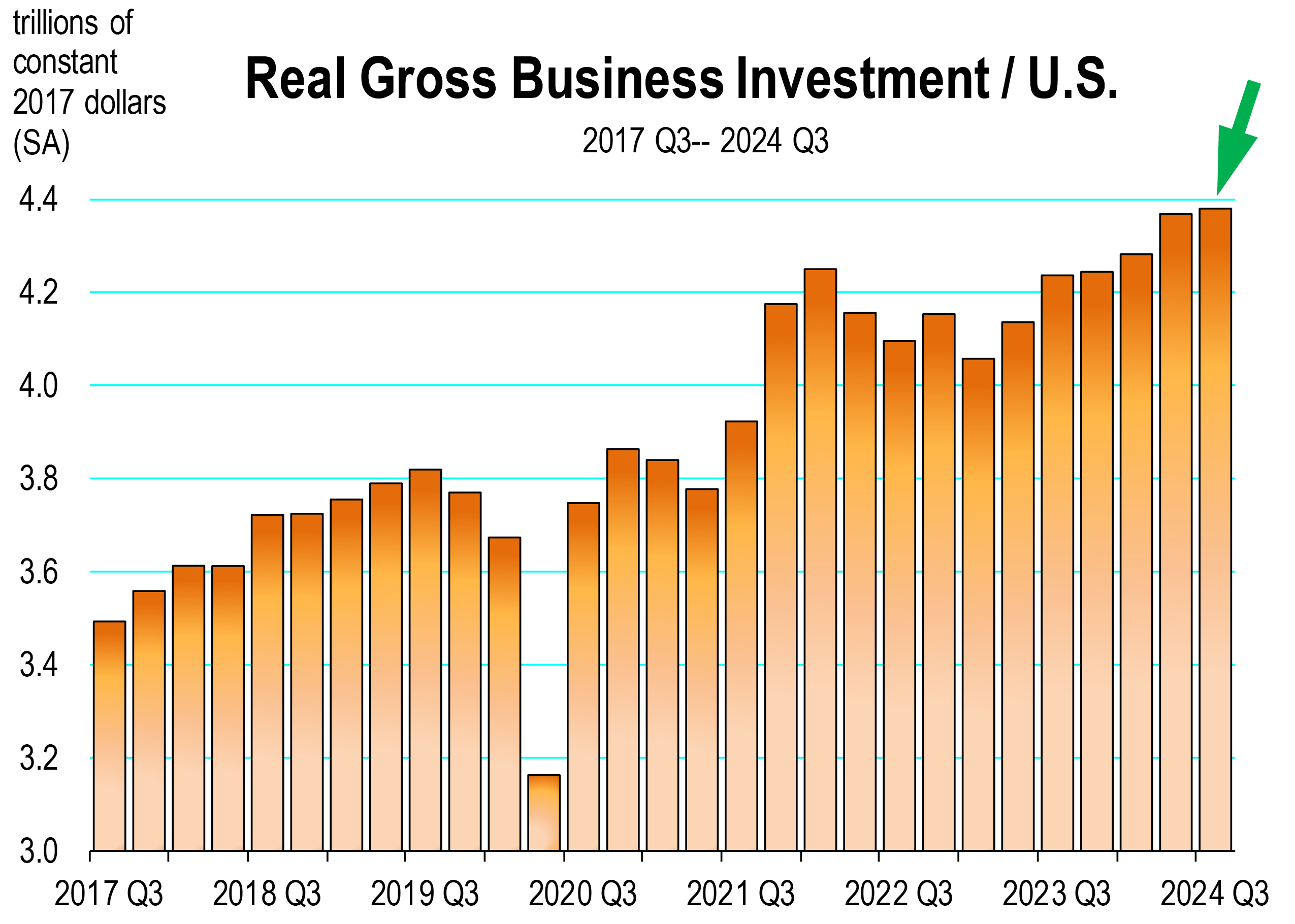

Moreover, consumer spending levels along with the stock market raced to all-time record highs and business investment also peaked in 2024.

But 2024 was also unsettled by wars in Ukraine and the Middle East, by assassination attempts, by unbridled immigration across the southern border, by high interest rates and the ongoing weakness in the housing market, high costs for healthcare, and record levels of U.S. debt.

Inflation fell below 3.0 percent for the first time since March 2021.

Mortgage rates sharply declined 100 basis points between early May and mid-September, but they rebounded in the fall and at their current level, 6.8 percent, they cannot rescue the housing market.

Federal debt is now over $36 trillion and it’s rising at a rate of nearly $2 trillion per year. These high debt levels will prevent interest rates from retracing the lows that prevailed before the pandemic.

Real wages are rising again with inflation in remission. The unemployment rate remains low at just 4.1 percent. The rate in California is higher, due in large part to the surge of international immigration diverted into the state this year.

The office market remains weak, but the trauma has not yet put banks collectively in trouble.

Though inflation is being contained, the leftover high prices have frustrated consumers. Furthermore, the high rates of interest are a drag on spending, especially lower-income consumers. This is why the confidence and sentiment indices are not reporting more convincing optimism about the current economy or its near-term outlook.

The GDPNOW estimate for the fourth quarter is running at 3.2 percent. And in view of actual growth for the first three quarters of the year, annual growth of the economy in 2024 will be above the historical trend.

California

In California, the technology sector was coming off a year in which thousands of layoffs occurred, principally in the Bay Area but also impacting the Los Angeles metro area. The layoff surge did not carry into 2024.

Though tech employment remained stable, tech companies reported strong earnings which pushed their stock valuations to record levels.

The dockworker strike that impacted Westcoast ports and longshoremen jobs in 2023 caused cargo ships with goods from Asia bound for the U.S. to divert through the Panama Canal.

divert through the Panama Canal.

In 2024, shippers came back to Los Angeles, Long Beach and Oakland and seaport container traffic soared. The logistics sector is no longer hemorrhaging jobs.

There was more stability in the labor markets this year, with the exception of TV, film, and sound recording. The labor disputes affecting actors and writers that were fully resolved by November 2023 have had lasting consequences for Hollywood jobs in California this year. The 40,000 jobs that were shed in 2023 have not yet been restored. Furthermore, most of the job creation is limited to the healthcare and public sectors.

A glaring issue for 2024 has been the immigration surge. Until this year, we did not actually know the extent of the immigration wave that has flowed through the southern border crossings into the U.S. CBO reports immigrant encounters at nearly 10 million since 2021.

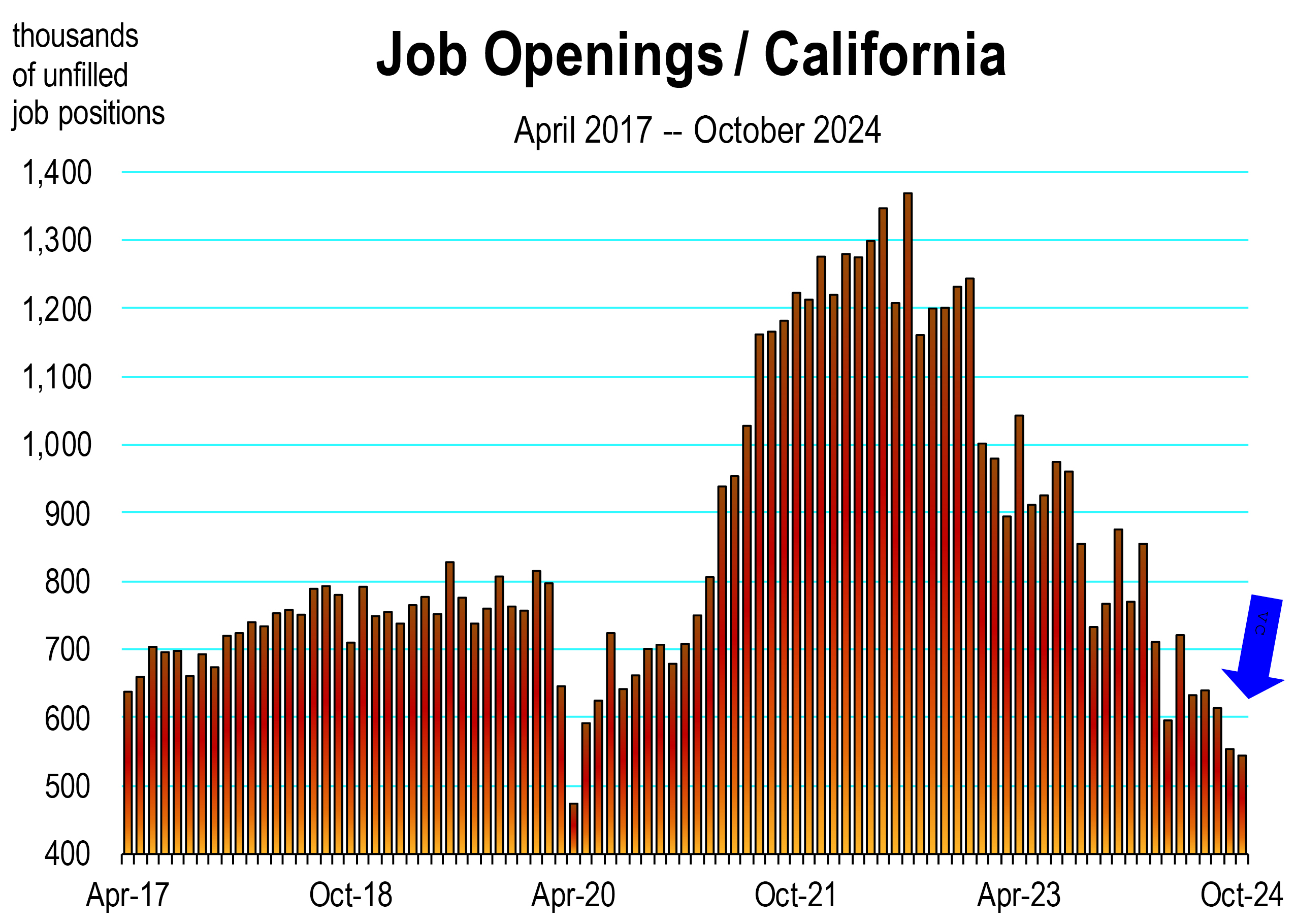

The flow of immigrants is a principal reason for rising unemployment and declining job openings, especially in California where a disproportionate share have been diverted to.

Tourism remained a steady engine of growth for the California economy in 2024. Even with the opening of thousands of new hotel rooms, the rate of transient lodging utilization remained high, indicating increased overnight visitors throughout the state. Furthermore, the number of airline passengers continued to increase at all principal airports in the state, and amusement park attendance will rival 2023 crowd counts which nearly eclipsed pre-pandemic levels. At Universal Studios Hollywood, attendance hit record levels thanks to Super Mario World.

New homebuilding has hung on despite unfriendly mortgage rates for all of 2024. The new home market has supplemented the existing home market where for-sale inventory dropped to all-time record lows.

Momentum carrying into 2025

Inflation reports that continue to move in the direction of the Fed target, together with modest growth that is not pushed higher by more FED interest rate cuts, will translate into lower long-term rates, including mortgage rates. A Congress that can present fiscally sound appropriation bills in 2025 will also rally the bond market, dropping yields lower.

The weight of the recent evidence, the momentum of tourism in California, and of commodity imports into the Los Angeles, Long Beach and Oakland seaports, will dominate the weakness in local Film and TV production.

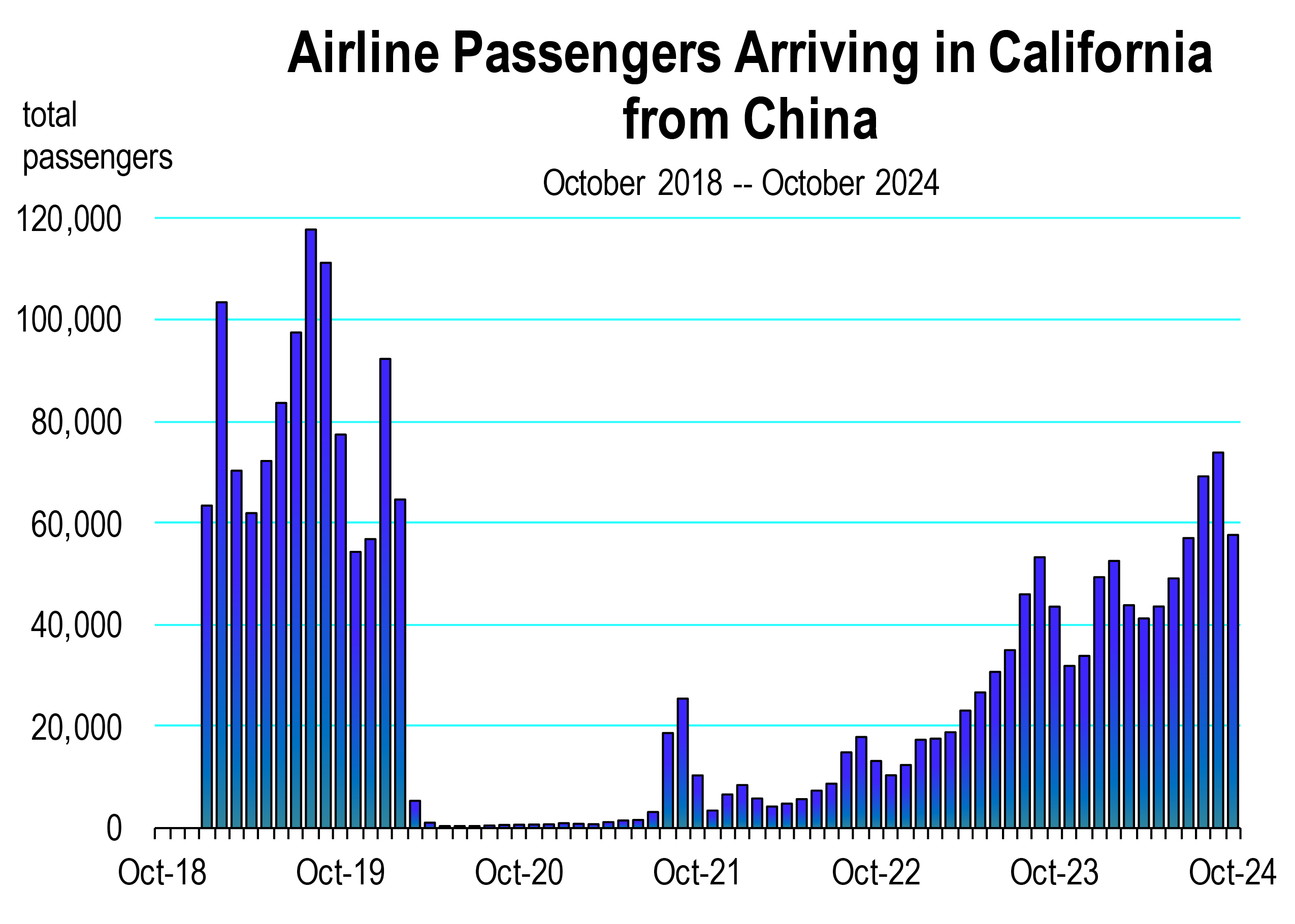

The continuing rebound of Chinese visitors into California will add meaningfully to international travel here. Plan your Disneyland trip in January and February when crowd counts are the lowest.

The implementation of AI, new technologies in autonomous systems, and medical devices will advantage the California economy where much of the innovation in these resources areas is occurring. This includes the Bay Area, Los Angeles and Orange Counties.

Southern California labor markets include a significant presence of workers in advanced manufacturing. Advanced manufacturing includes computer, semi-conductor and electronic components, medical devices and apparatus, and aerospace components and parts. These industries are expected to expand output to meet a growing worldwide demand.

Finally, new development of infrastructure, entertainment venues, medical center and healthcare facilities, and warehouse and distribution centers will remain a principal engine of growth in the region, keeping the construction workforce at peak levels.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.