Mark Schniepp

November 8, 2024

Long Term Rates Have Moved Higher

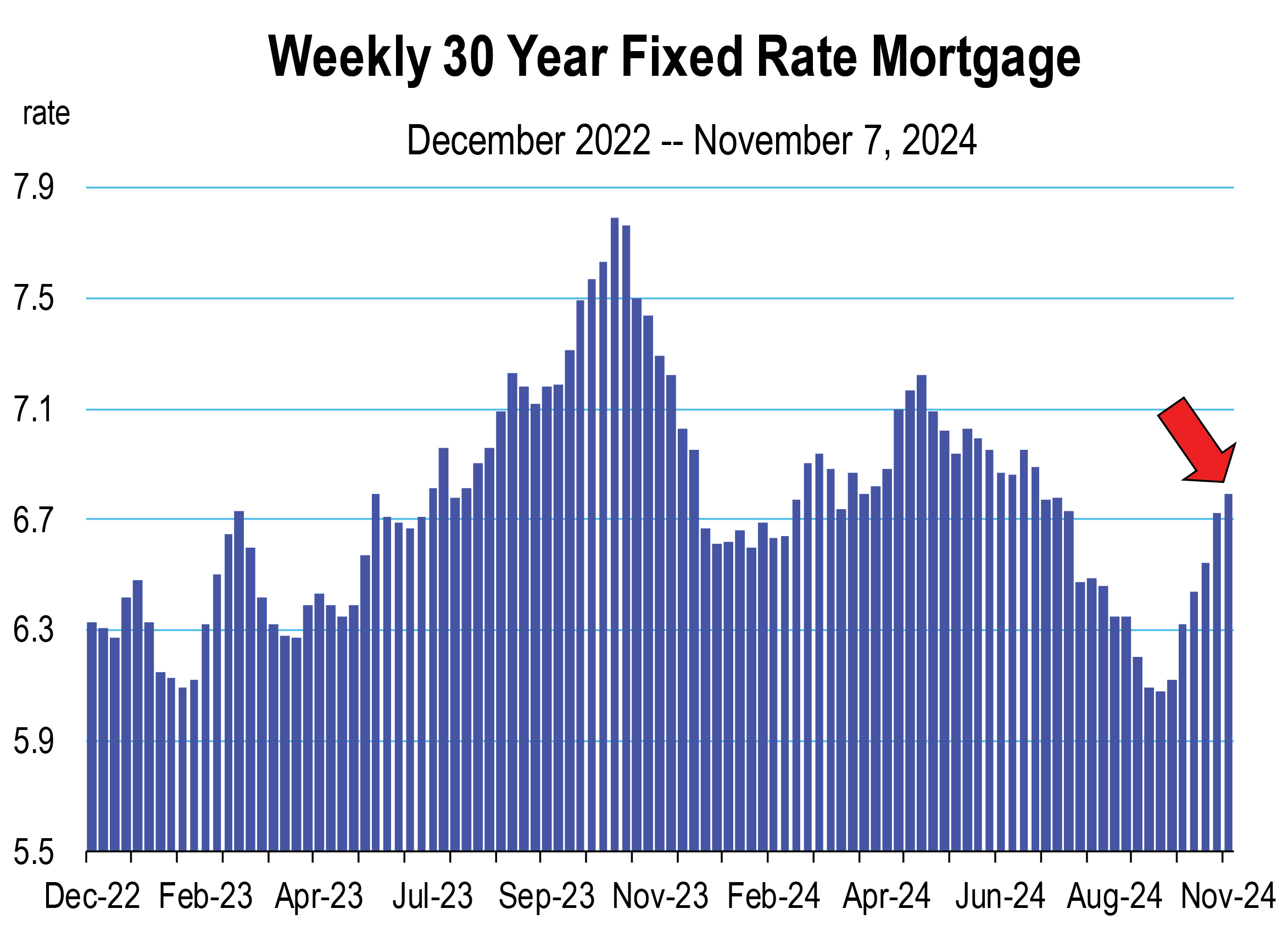

The 30 year fixed rate mortgage yield plunged 100 basis point between May and September 2024. The Fed cut short term rates in September, and again on Thursday November 6.

Paradoxically, longer-term interest rates have moved upward since, driving up mortgage rates and other consumer and business borrowing costs.

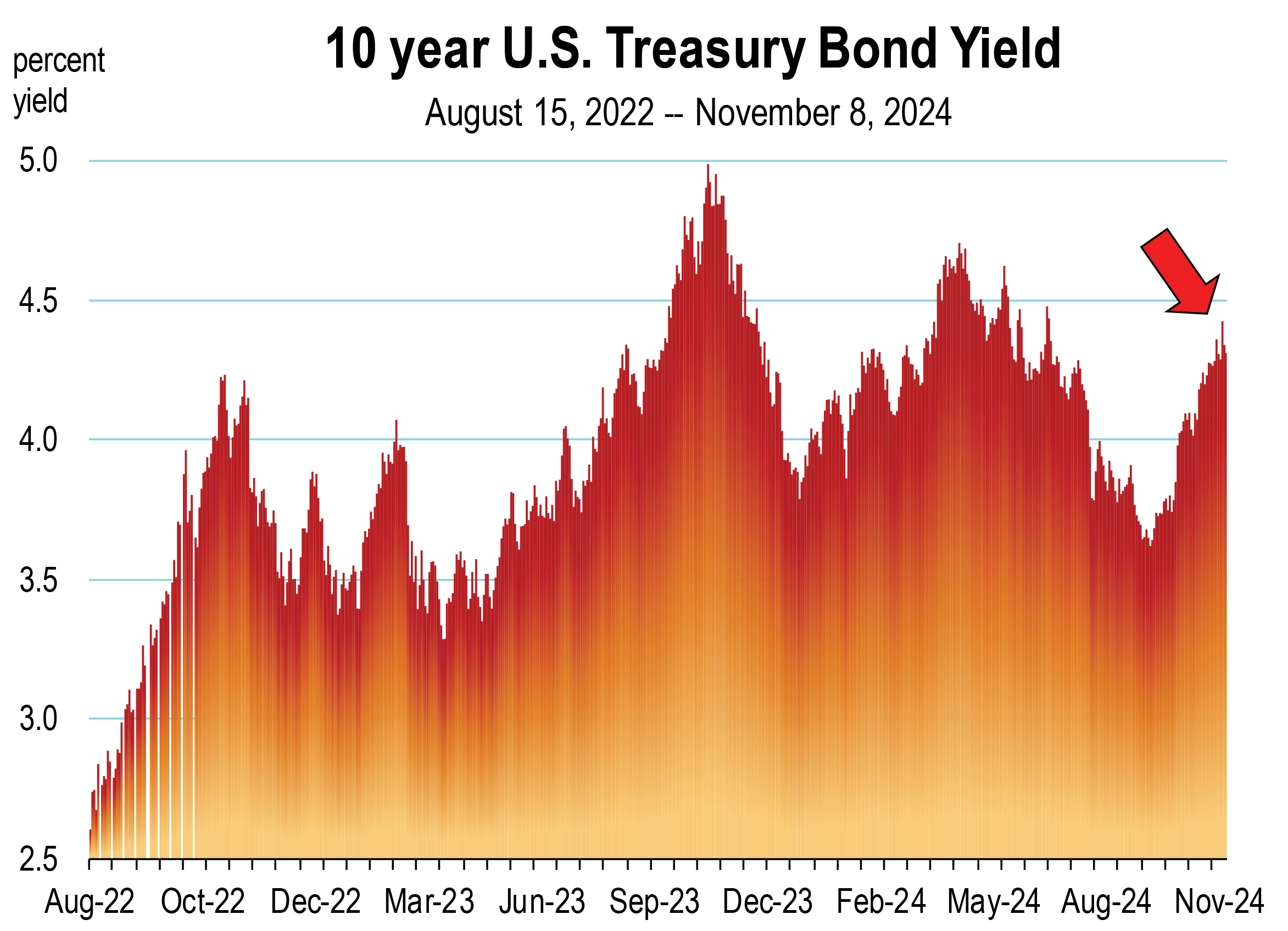

The 10-year U.S. Treasury yield reached a recent low of 3.64 percent on September 17, the day before the Fed announced its first rate cut. As of November 8, that rate was up to 4.32 percent, an increase of 70 basis points.

So we’re seeing a reversal in longer term rates. Why?

Growth

A vibrant economy that is generally firing on all cylinders will generate inflation. The investor belief is that there is significant confidence in the economy, soon to be impacted by Trump policies which were friendly the last time around. This is pushing the 10 and 30 year treasury bond yields higher as substitution from bonds to stocks continues.

Stock prices like a vibrant economy, and so the markets spiked the day after the election believing a conservative administration will ease government regulations which kneecap the private business sector.

I have long maintained that the ebullience in financial markets over the last couple of months manifesting the day after the election, signals to the Fed that it doesn’t need to cut rates that much more. The quarter point easing on Thursday, November 7 was not likely necessary. We risk igniting inflation with easing monetary policy.

Record stock prices reflect high expectations for the economy which already has increased household wealth and now makes the corporate borrowing environment more favorable. Hence our outlook for 2025 is one of steady growth and low unemployment.

Government Debt a Factor

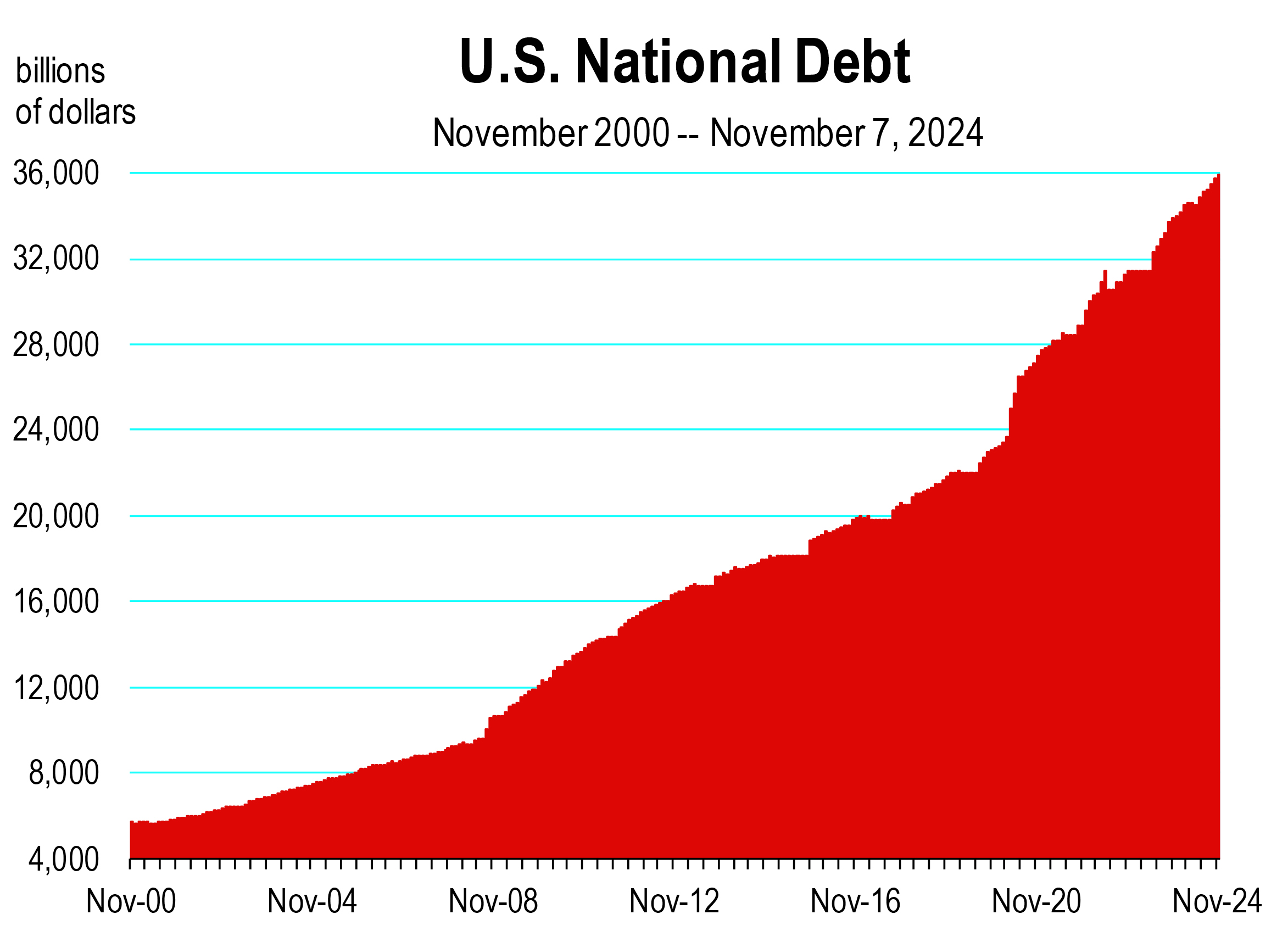

I’ve shown you over the last year how Federal debt has risen sharply, due to the inability of Congress to restrain itself from massive spending. The level of federal spending has never returned to the pre-pandemic trajectory. Here it is again, now at $35.9 trillion.

Government debt is financed through issuance of U.S. Treasury bills, notes and bonds. The U.S. Department of the Treasury has been required to issue increasing amounts of debt to fund government operations. The last 2 years of high interest rates means the cost of financing government debt is more expensive. The average interest rate paid today is more than double what it was in 2020.

One factor that is affecting Treasury bond yields (and therefore higher rates to you) going forward is the expectation of more government bonds coming to market, entirely due to the high federal government debt, the annual government deficit and the higher interest costs associated with today’s elevated interest rates. The supply of debt is therefore increasing, rapidly.

Consequences

Government Debt

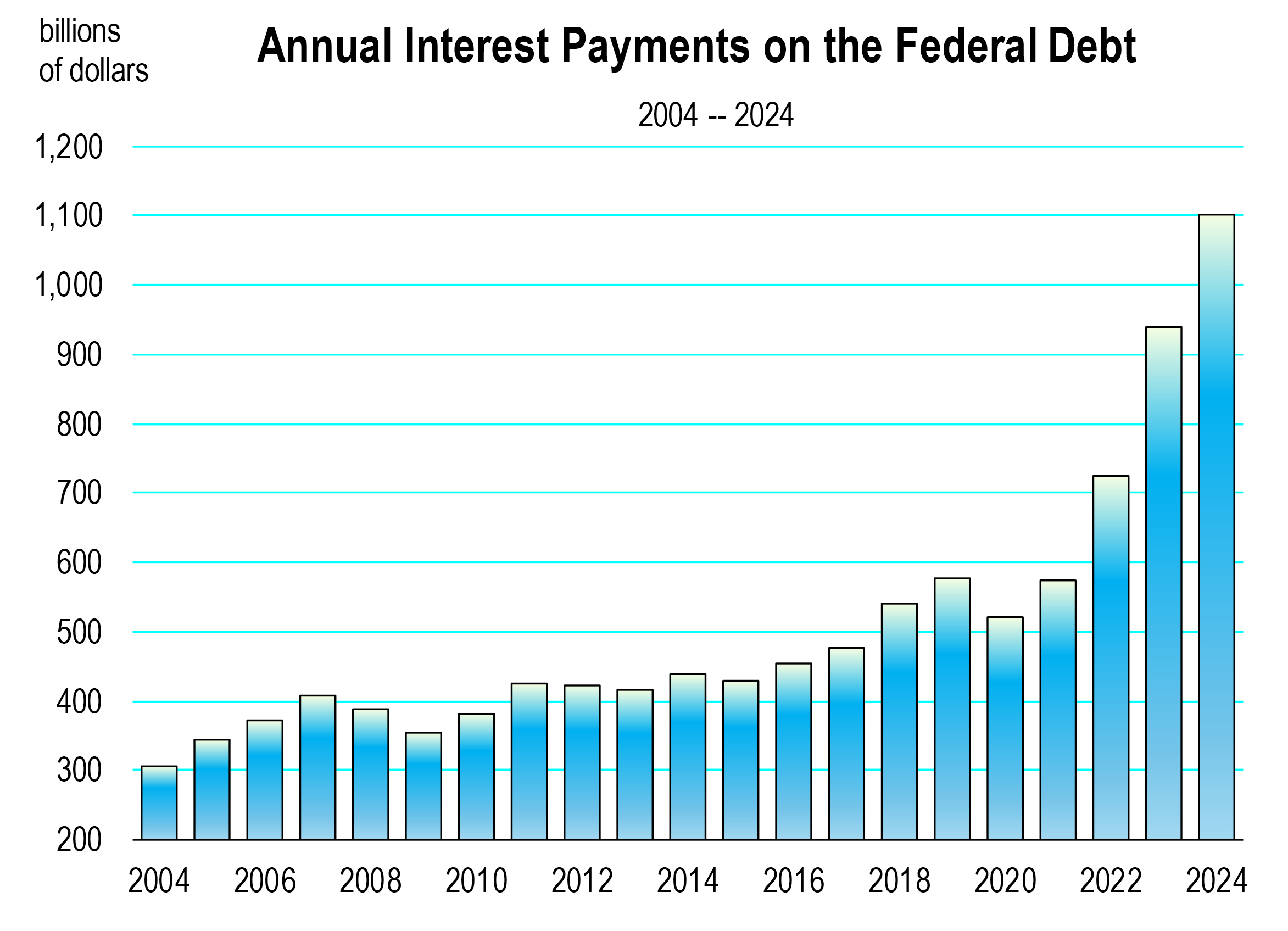

The demand for debt is weakening. The demand for 10 year treasury bonds remains low due to the expectation that more bond auctions will be coming. This increases the yield on all treasury term rates to entice buyers.

Higher interest costs, in turn, contribute to the growth of federal spending — continuing a vicious cycle of borrowing, interest, and higher debt. Currently, 22 percent of annual federal expenditures are debt payments. The 2024 payment will be $1.1 trillion. The federal government is on a path to spend more on interest costs than its combined spending on education, research, and infrastructure.

Housing

Higher long term treasury bond rates move mortgage rates in lockstep. Higher mortgage rates will not rescue the housing market from the recession it’s been in for the last 2 years. We don’t see a meaningful contribution by housing to overall economic growth in 2025, but it’s not likely to become a drag on growth either. Higher rates mean less inventory as would be sellers avoid having to finance their next home at current rates. Less inventory means no relief on the rise in selling values, because existing home supply will remain limited.

Delinquency rates

The average personal loan interest rate is 12.4 percent. American consumers owe $249 billion in personal loan debt, through quarter 3 of 2024. This is up $4 billion from quarter 1. 24 million Americans have a personal loan. The 60-day delinquency rate for personal loans is 3.4 percent, the highest rate since 2012.

is up $4 billion from quarter 1. 24 million Americans have a personal loan. The 60-day delinquency rate for personal loans is 3.4 percent, the highest rate since 2012.

Added to personal loan debt, Americans owe $1.14 trillion in credit card debt. The delinquency rate has moved to 3.3 percent, the highest rate since

2011.

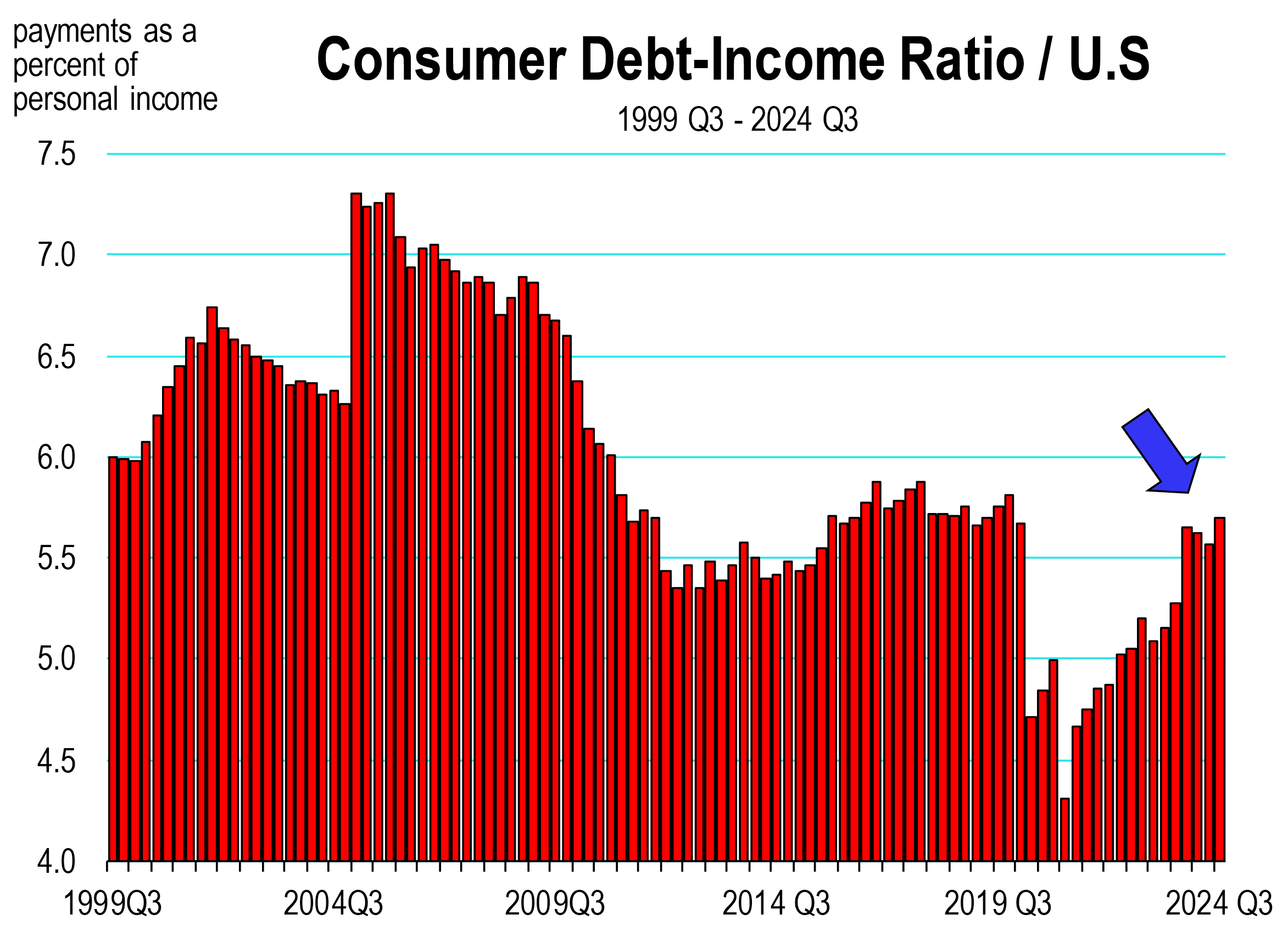

While consumer debt is still not that high relative to consumer personal income, it is a rising concern because of (1) its current direction, and (2) the current trajectory of interest rates.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.