Mark Schniepp

April 2024

The U.S. Economy

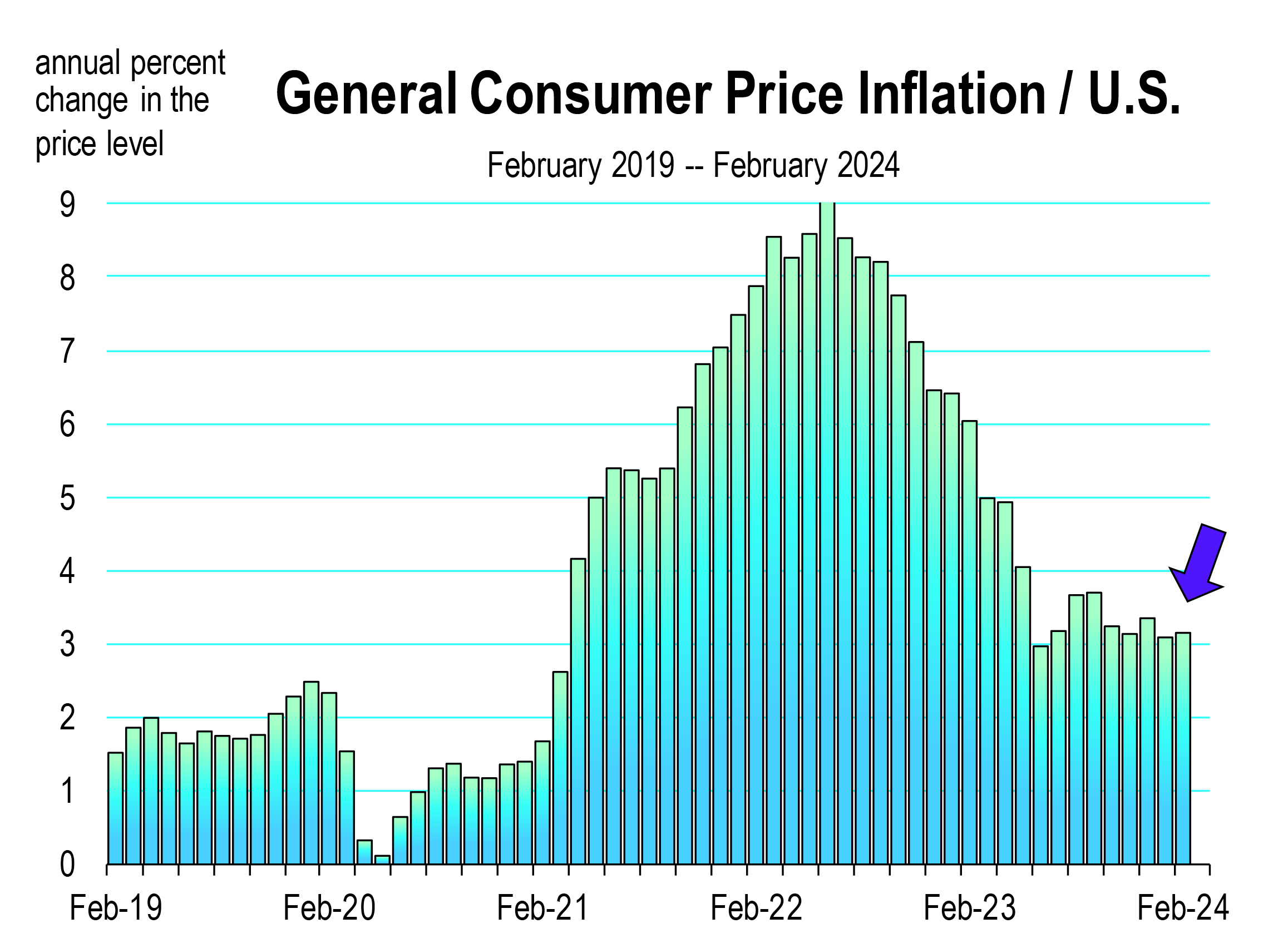

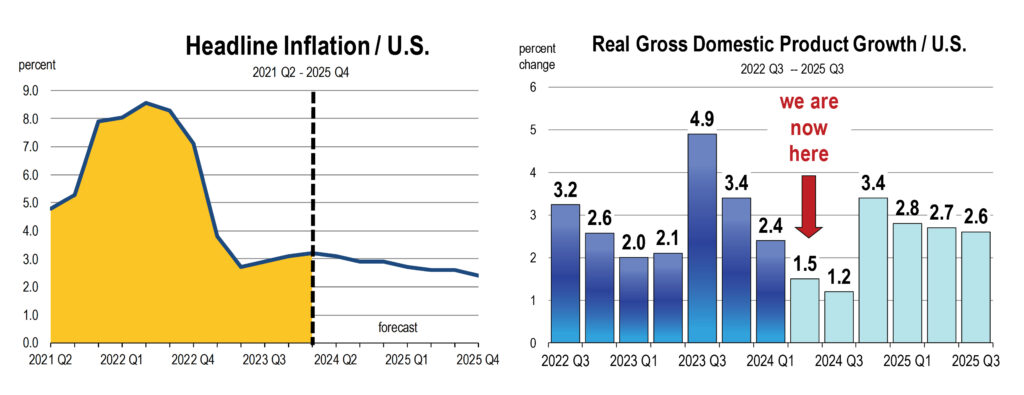

Inflation has receded meaningfully in the U.S. without the corresponding increase in joblessness historically observed when restrictive policy is needed to extinguish inflation. The progress on inflation over the last year has led policymakers within the Federal Reserve to become more upbeat that their interest rate tightening has worked, and the target of 2.0 percent will be met this year.

Furthermore however, the urgency to cut interest rates this year—up to 3 cuts proclaimed by the Fed last December—is unlikely in view of recent reports of higher-than-expected inflation.

The fully anticipated recession of 2023 never manifested, and the Fed and economists in general are now more upbeat about a soft landing than they were last fall. The “soft landing” refers to the continuous growth of the economy—with no recession—despite sharp interest rate hikes over the last 24 months.

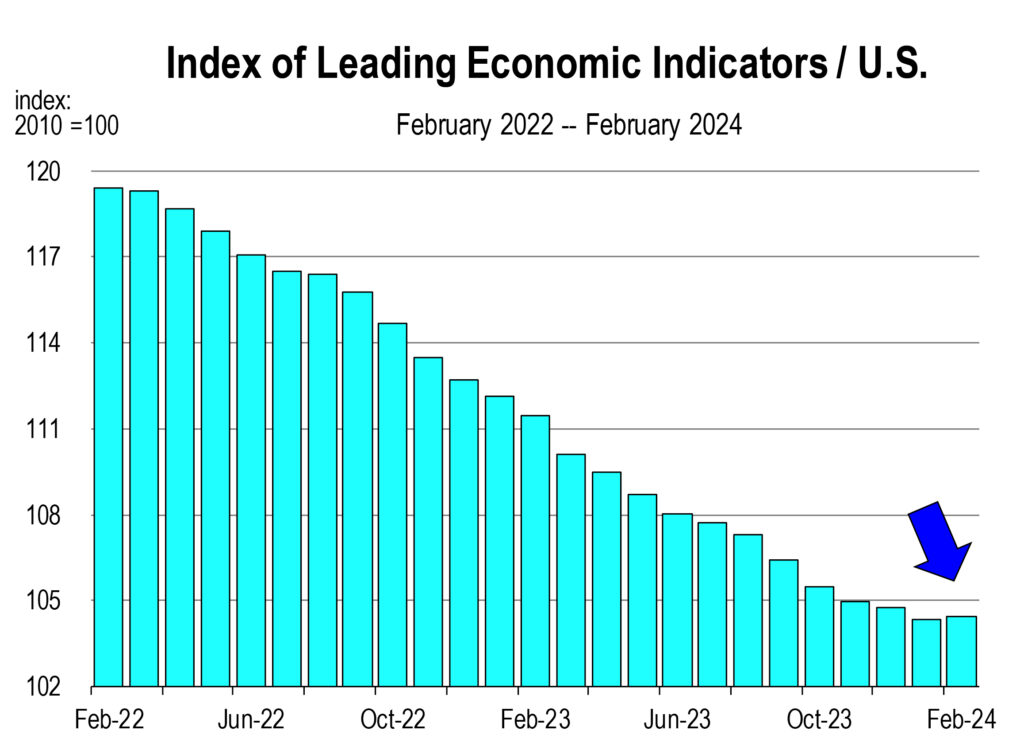

Incoming data for the nation have generally been positive. The key reports indicate that consumers are feeling more optimistic about this year’s economy, homebuilding jumped higher in February, and homebuilders are becoming more optimistic about sales this year. Stock market prices are at record highs, industrial production ticked higher in February, and the index of leading indicators also moved higher in February for the first time since February 2022.

The labor market remains surprisingly strong evidenced by a low 3.8 percent unemployment rate, low numbers of unemployment insurance claim filings, historically high levels of job openings, and general wage increases. The latter threatens to stall progress on inflation this year if the rate of unemployment continues to remain under 4.0 percent, which it has for the last 26 consecutive months.

We believe that the election year combined with not-so-consistent progress on lowering overall headline inflation will not necessarily induce further rate hikes, but will postpone any rate cuts during much of 2024.

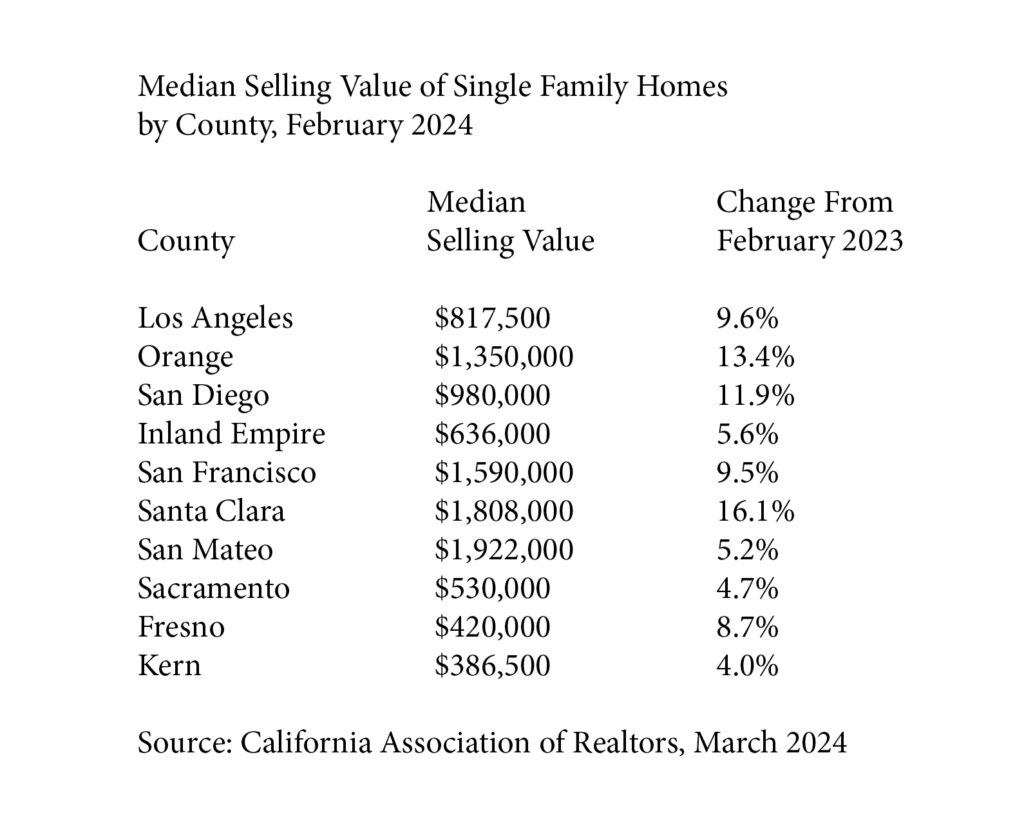

A meaningful part of the inflation problem rests with the housing component of the local CPI. The improvement in housing inflation has been only marginal, and the increase in housing prices and rents generally eclipsed headline inflation through much of 2023.

The Housing Market

There remains a strong disincentive for homeowners to sell because they have locked in low mortgage rates on the homes they live in now.

With little supply in the market or waiting on the sidelines, home prices are rising again, and moved nearly 6 percent higher in February 2024 than a year ago. In California, because the paltry inventory of for-sale homes is so much more severe, prices are rising in all major metro markets of the state.

The forecast for inflation is for slower improvement in 2024, with more progress occurring in 2025.

The UCLA Anderson GDP forecast for 2024 was revised upward from 2.1 percent to 2.5 percent. Subsequently, UCLA predicts 2.5 percent growth for 2025 and 2026, and lower rates of unemployment than previously forecast back in December.

The California Economy

Labor markets have been strong since the economic recovery began after the pandemic. Total jobs increased by 5.6 percent in 2022, 0.7 percent in 2023, and 1.5 percent growth is expected in 2024. The fact that 2023 is lower is more a function of running out of workers than an absence of jobs.

The slowdown in job creation suggests that out-migration and a reliance on hard-hit industries including technology and information are responsible factors. Population in California has been in decline now since 2019, and this has negatively impacted the growth of the labor force, defined as people wanting to work in California.

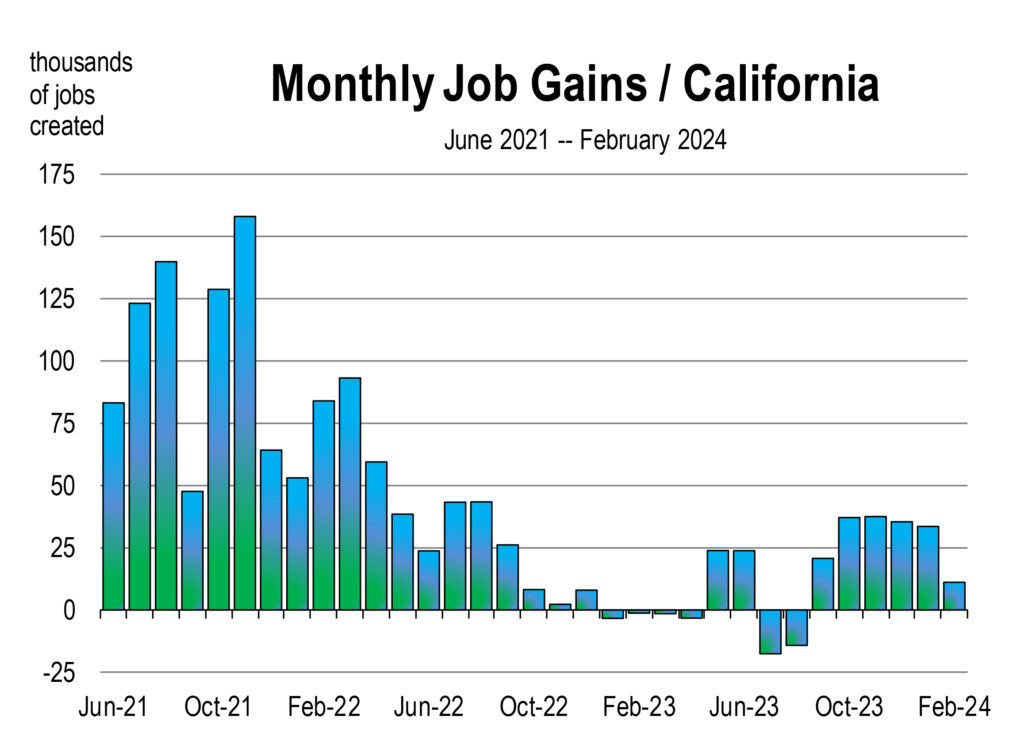

Recent revisions in the employment data by the State show that California struggled with job creation from late 2022 through May of 2023, the period when layoffs within the tech and retail sectors were the most prolific. Job creation now appears to have stabilized, averaging 28,000 new jobs filled per month.

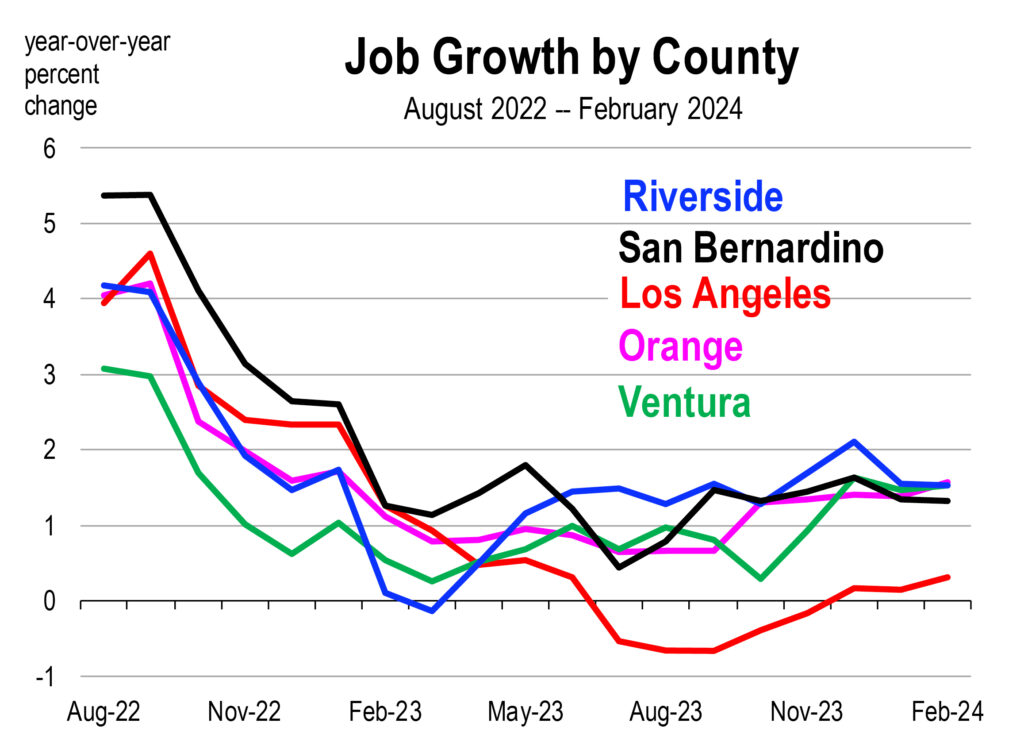

In the Southern California region, the growth of employment over the last 18 months has been similar across counties. Riverside, Ventura, and Orange Counties have all now converged at 1.5 percent year over year growth in February 2024.

Construction employment in California reached a record high in 2023 due to the volume of new construction projects—both residential and non-residential—continues to expand.

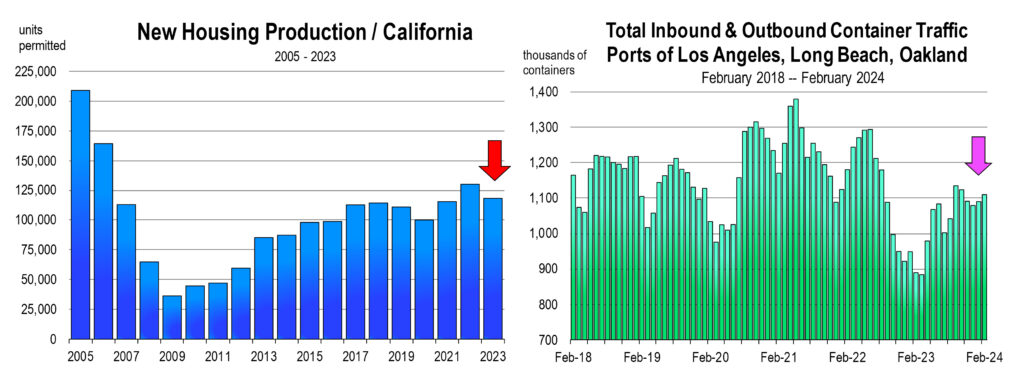

Except for last year—2022—the total of new housing starts in 2023 was the highest volume since 2006. Expansions in Southern California, Sacramento Valley and the Central Valley led the state in homebuilding.

California’s seaports are now returning to normal again. International exports are no longer in decline. Cargo volumes are recovering at the principal ports in the state—Los Angeles, Long Beach, and Oakland—where the dockworker’s strike interrupted significant container activity for approximate 14 months. The labor dispute ended in August 2023.

But the slowdown in China, Germany, and elsewhere in the Pacific suggests that a complete rebound to 2021 or even 2020 levels of cargo is still a year or more away.

Nevertheless, with higher volumes of goods now arriving into California’s west coast ports, the growing need for warehouse and distribution space, along with conveyance systems will increase moderately in 2024, accelerating in 2025.

The 2024 Outlook for California

The expectation of California economic growth exceeding the U.S. remains probable this year, because of

- The positive outlook for technology, especially AI development in the Bay Area

- More venture capital investment coming into San Francisco and Los Angeles

- The potential for expanded trade flows due to East Coast Port labor disputes and bottlenecks at the Panama Canal

- Positive homebuilder sentiment and continued homebuilding exceeding normal levels over the last 10 years

- The return of production in the TV, Movie and Sound Recording industries.

Real incomes are expected to rise in 2024, due to the containment of inflation. Consumer spending is forecast to slow but still contribute positively to the growth of gross state product over the year.

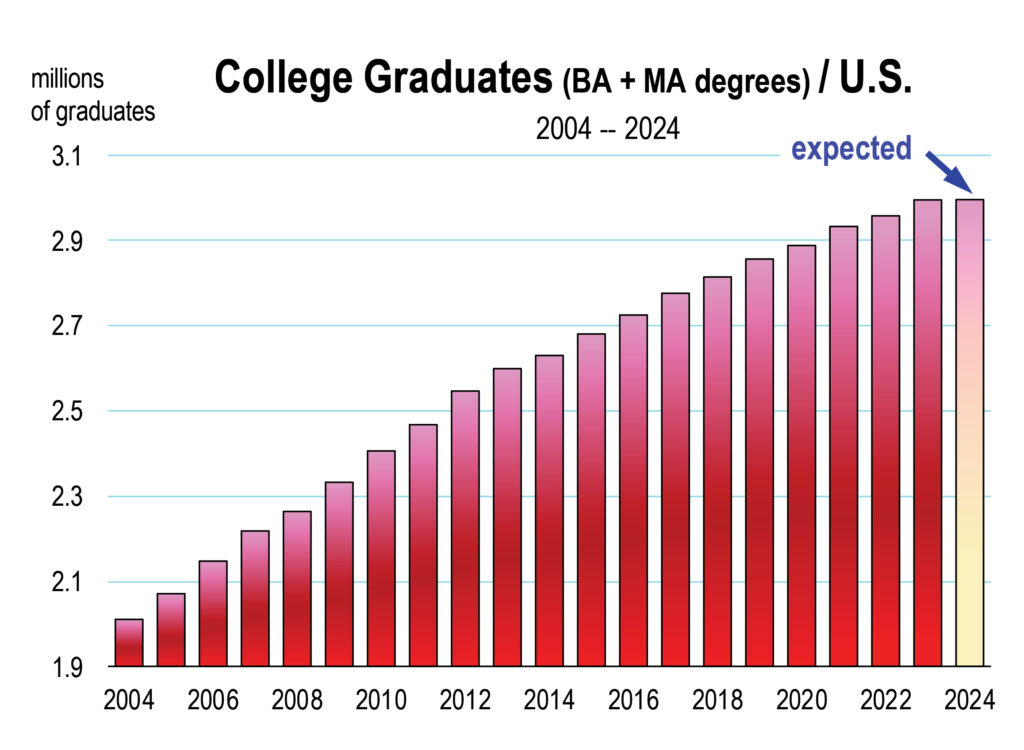

The unemployment rate will rise as open job positions fill and more workers are expected to enter the labor force, especially from the record college senior graduating class this June.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.