Mark Schniepp

September 2, 2024

The U.S. Economic Expansion Remains Modest

The economy remains in an expansion through growth has moderated this year. It has been 52 months since the last recession and there is low probability that another one is in the forecast anytime soon. Some lingering issues still remain from the last recession amidst new issues that have emerged.

Most of the serious imbalances in the economy caused by the trauma of either totally or partially shutting down businesses from March 2020 to May 2021 have been resolved. However, we are not entirely back to normal yet. Impacts directly the result of the pandemic still haunt the economy today and remain unsettling. This includes inflation, the labor market and the office market.

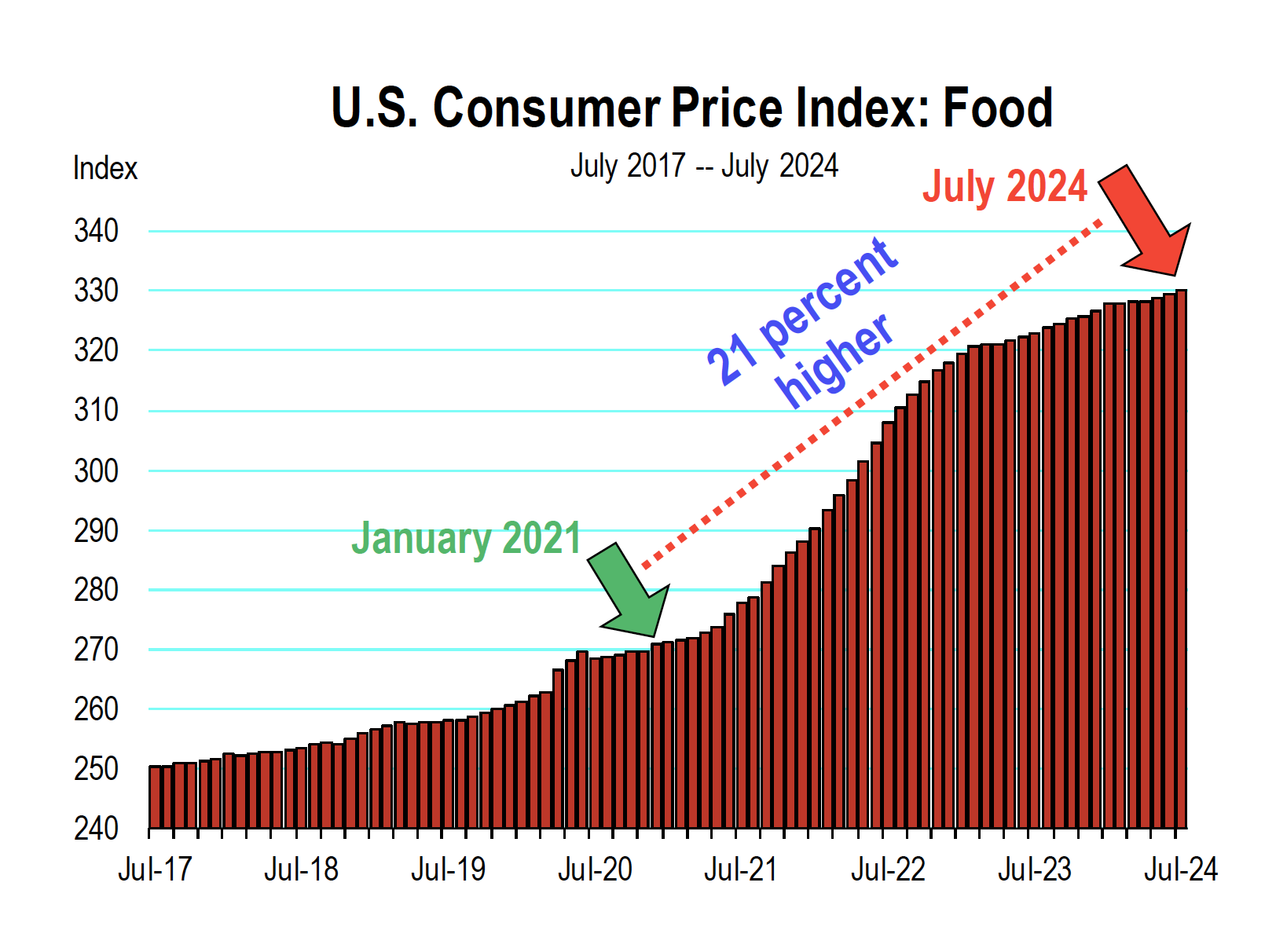

Inflation

The supply chain interruptions followed by the massive government spending bills were the causes of the highest surge of inflation in 40 years, peaking in the summer of 2022. Progress on inflation has been steady since, though with hiccups. This has led to a pessimistic American consumer kneecapped by general prices for goods and services that are 21 percent higher today then in early 2021.

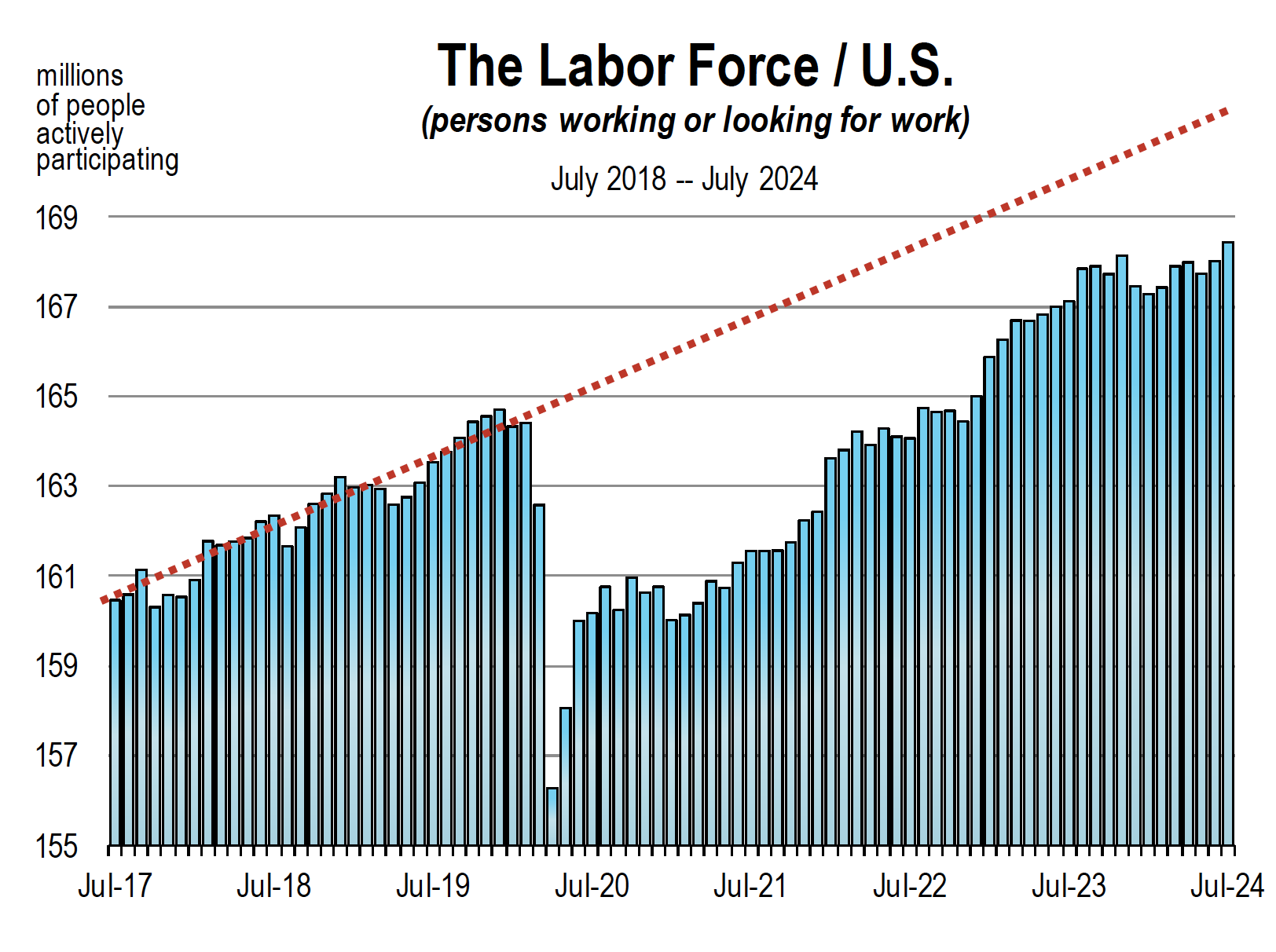

Tight labor markets

Closed schools and coronavirus infections generated a meaningful defection from the labor force by men but mostly women to care for children and the sick. This included accelerated retirements by the eldest baby boomer members of the work force. The net effect was a meaningful decline in the labor force. It took 2 full years for it to be restored to pre-pandemic levels. Growth of the labor force today is less than one percent—well below the trajectory of growth indicative of 2018 and 2019. In California the labor force has still not returned to pre-pandemic levels.

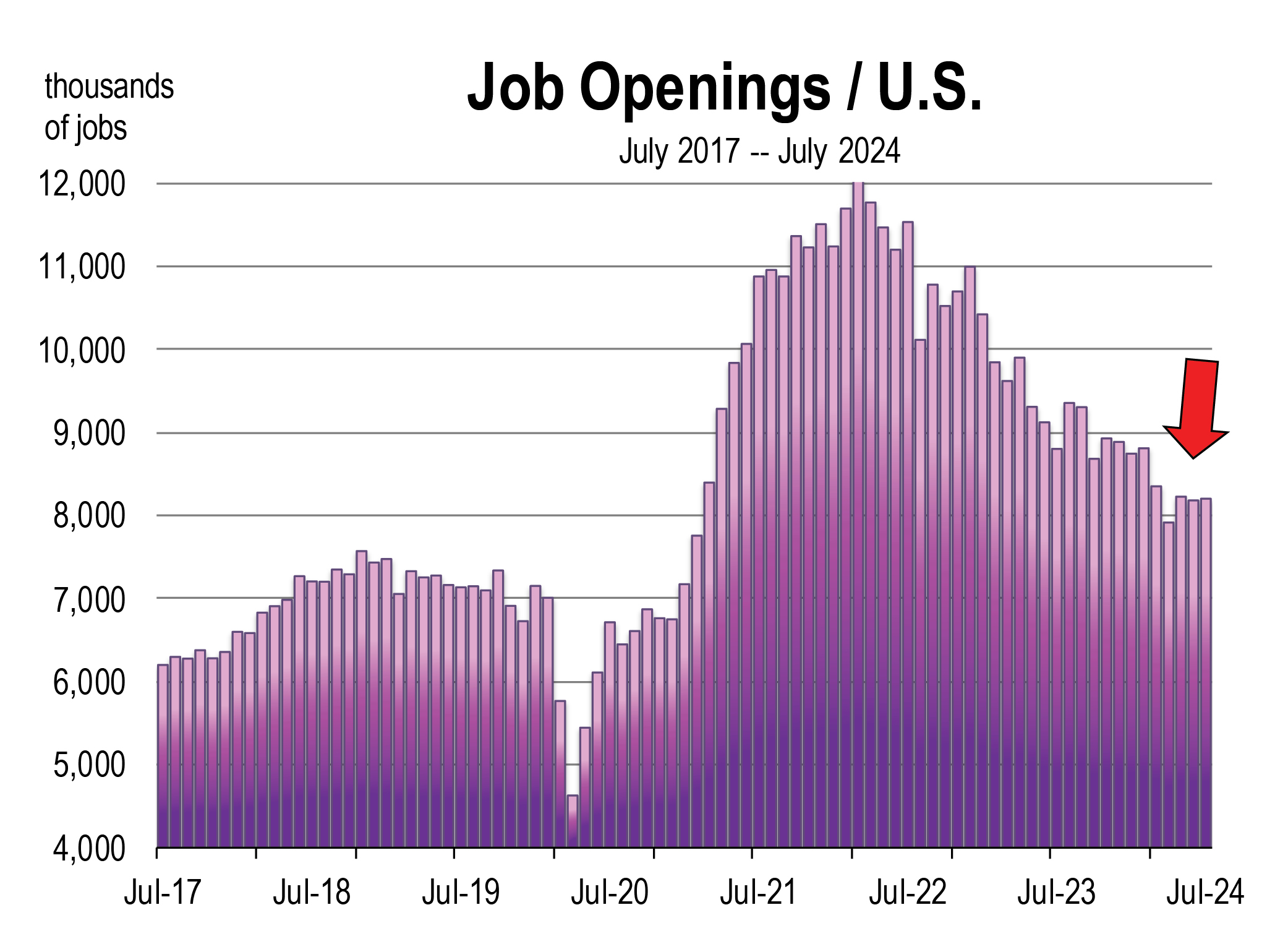

Consequently, with general economic growth largely normalized in 2022, 2023 and 2024, tight labor markets have persisted. This has driven up wages and caused perceived “shortages” of workers in many industries, including construction, healthcare, and leisure & hospitality. Inflation has been harder to extinguish due to soaring wages in these sectors.

Though labor markets are now softening with unemployment rising, unfilled job openings are still higher than they were than before the pandemic. And labor markets were tight at that time.

A normalizing labor market will result in lower wage inflation, fewer job openings, and the return of workers to the office. We don’t expect this normalization until well into 2025, or later.

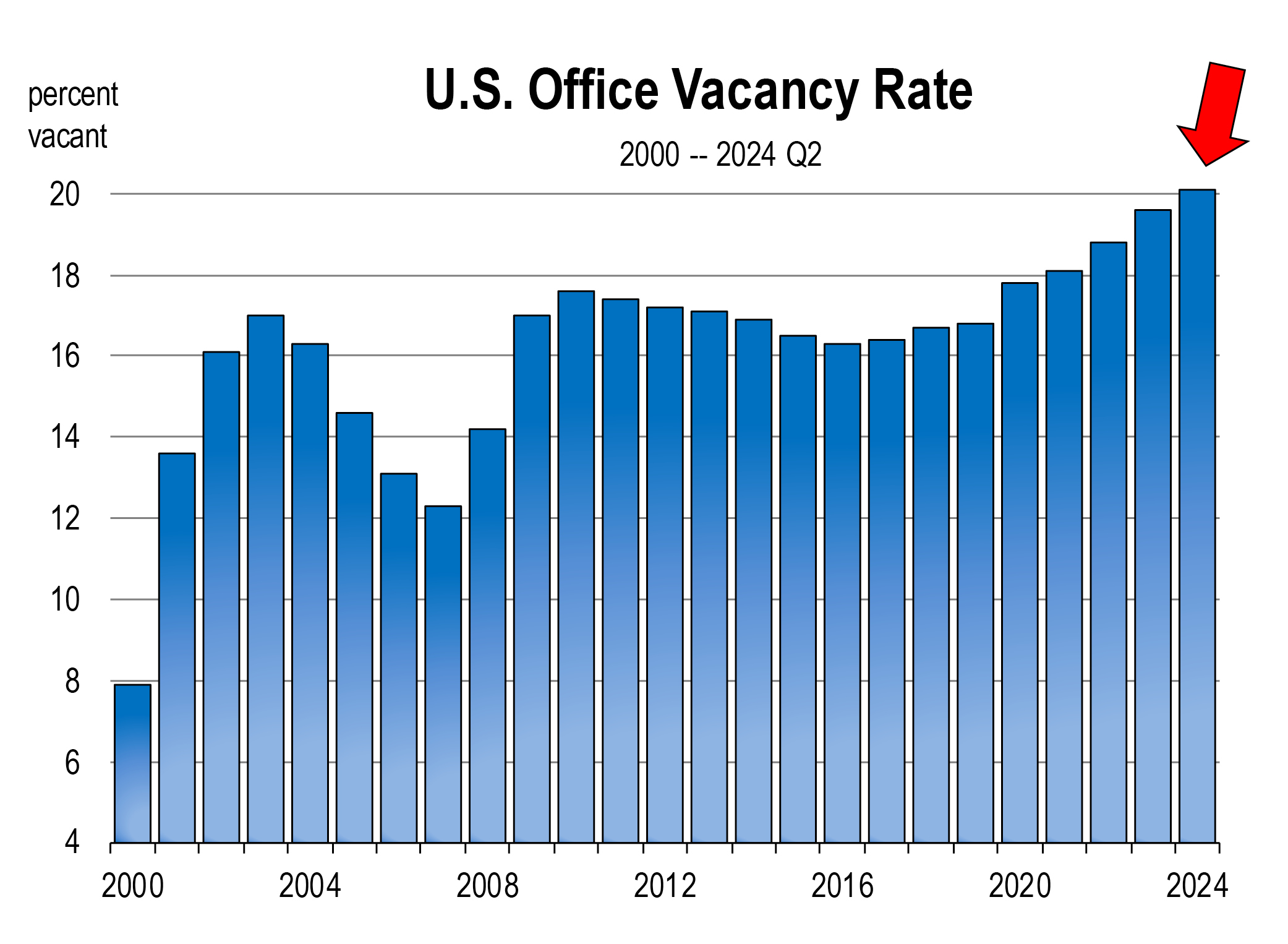

The Office Market

The social risks during the heat of the pandemic surge generated widespread adoption of work from home arrangements, particularly from office using companies who could virtually connect remote employees together for meetings and collaboration as a surrogate for in-office work.

When pandemic restrictions were entirely lifted in the spring of 2021, workers were hesitant to return to the office insisting on remote or at least hybrid arrangements. The prevailing tight labor market enabled employees to make demands they otherwise could not for fear of being replaced. Those replacements were now absent. Employers consented. Thirty to forty percent of office workers were remote in 2022 and 2023. Though work from home arrangements are now moving back toward in-office requirements, hybrid arrangements are still pervasive. Furthermore, companies found they could operate with less space with remote and/or hybrid workers. When leases required renewal, companies chose to downsize their space. More office space became available. Vacancy rates soared. This scenario persists today.

With high rates of vacancy, the value of office buildings has plunged 20 to 40 percent. Leveraged office building owners faced with renewing mature loans, now face higher financing costs, reduced loan values, and a less cash flow from fewer tenants. If lenders stop modifying loans and push towards remaking them, a potentially seismic foreclosure issue could ensue.

The office market will ultimately return to pre-pandemic status, but the timing is uncertain, and at least some carnage is inevitable.

New Issues

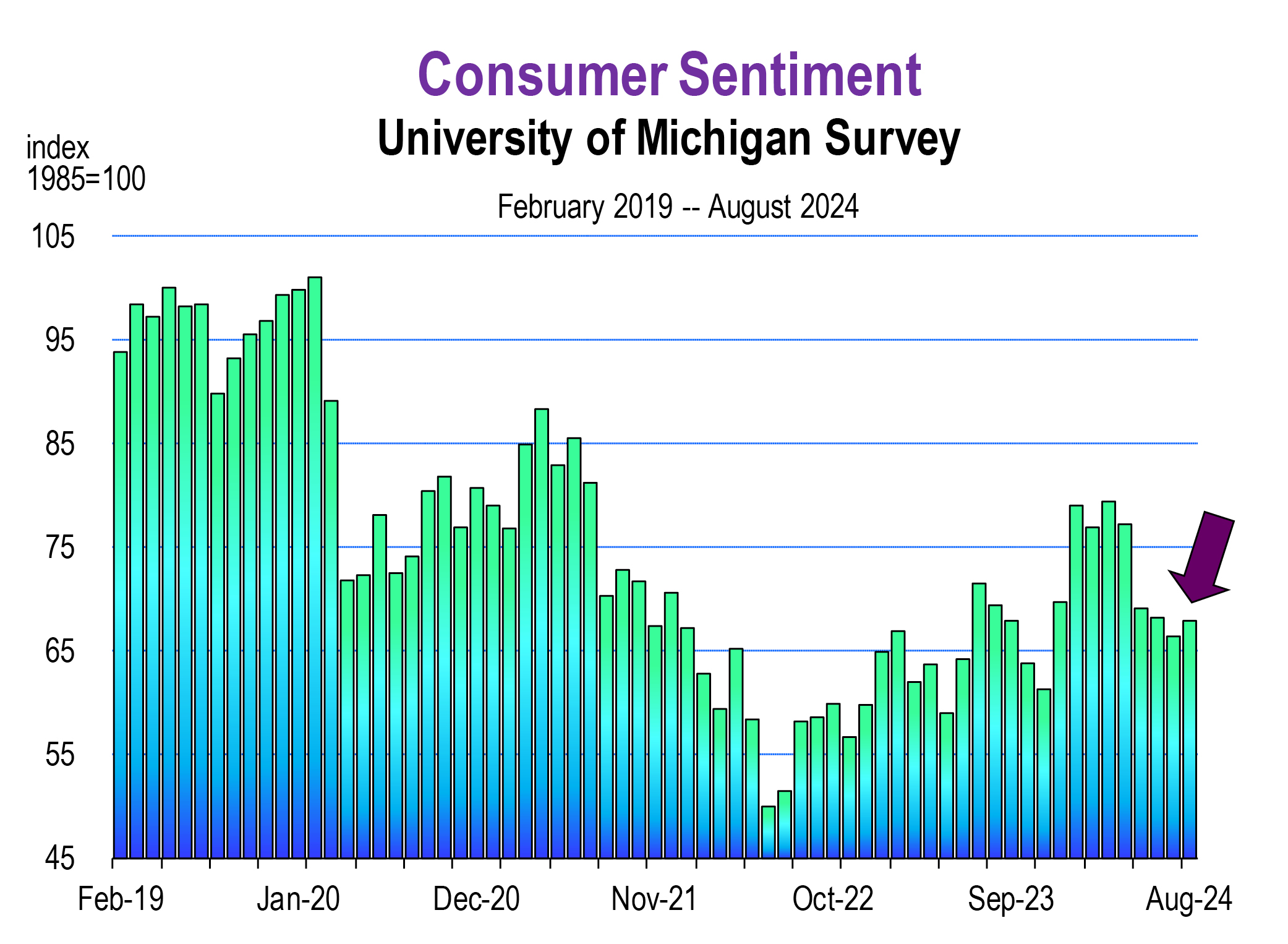

Spending behavior largely rests on the how consumers perceive economic conditions; how these conditions will impact their job opportunities, their incomes, housing, and prices of goods and services. General perceptions of the economy that are pessimistic or uncertain usually weigh down spending. Sentiment indices of the American consumer have been weak, due to consumer uncertainty.

General consumer sentiment reflects the unsettled post pandemic economy and newer issues including massive immigration at the southern border, low housing affordability and political uncertainties. Consumers’ assessments of the current labor situation, while still positive, have weakened, and assessments of the labor market going forward are more pessimistic. This has occurred in tandem with the rising rate of unemployment.

Consumers are also concerned about federal debt. Fifty-three percent of Americans view the debt as a very big problem.[1] They are right because its growth is a root cause—runaway government spending—of current inflation.

GDP

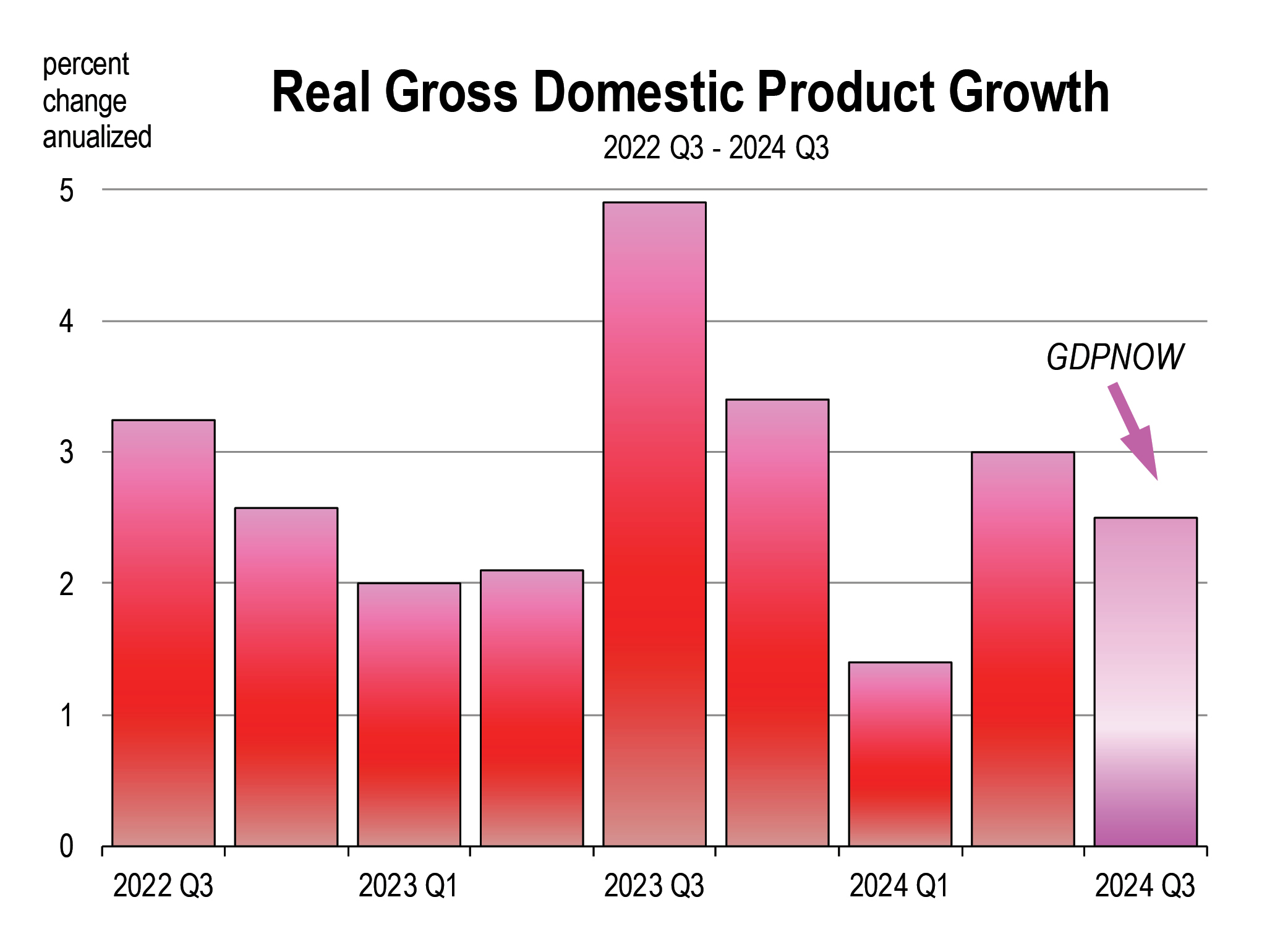

The growth of GDP has been positive all year, and for this quarter (July to September), the rate of growth is running at 2.5 percent. This follows on the heels of 3.0 percent growth in quarter 2.

The Federal Reserve now has the difficult task of driving inflation lower, while preventing the labor market from weakening further. Up to now, rate hikes have been largely successful. But in recent months, the rising unemployment rate has persuaded the Fed to begin cutting rates in September and very likely in November. In fact, these cuts are now presumed and embedded in stock and bond valuations today. The federal funds rate cuts should improve sentiment among home builders, financial market investors, and consumers seeking home and car loans. But it could stall recent progress made on inflation.

For the rest of the year, we see inflation remaining stubborn to tame, and GDP growth running at below trend.

Downside and Upside Risks

Though recession is the largest risk, the likelihood of a contraction in growth is low. The next biggest risk is rising unemployment because that will certainly lower growth but also inflation. The Fed’s forecast for inflation in June was 2.6 percent for 2024, and 2.3 percent in 2025. This forecast is possible providing spending by consumers subsides.

The odds of recession are less likely than they were a year ago, but not completely off the table, especially with unemployment rising, along with stock market volatility.

We are now less worried about escalating war in Ukraine, but other geo-political tensions, such as between Israel and Iran, or China and Taiwan or even the U.S. and China are or could become bigger threats, and any stress in these tensions could lead to an economic tipping point.

The upside risk is that (1) inflation is snuffed out this year, (2) unemployment rises but modestly enough to keep spending as an engine of positive economic growth, and (3) world economic growth resumes- –in Europe especially—which would maintain U.S. productive capacity and export growth.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.

[1] Pew Research Center, Top Problems facing the U.S. May 23, 2024