Mark Schniepp

May 6, 2024

“Businesses remain especially upbeat regarding their payrolls. Almost no businesses say they are laying off workers. Businesses understand that they will have a perennial problem filling open job positions as baby boomers age out of the workforce and foreign immigration is diminished. It is also encouraging that businesses’ equipment and software investment intentions are holding up well.”

— April 29, 2024 Economic Roundup by Moody’s Analytics

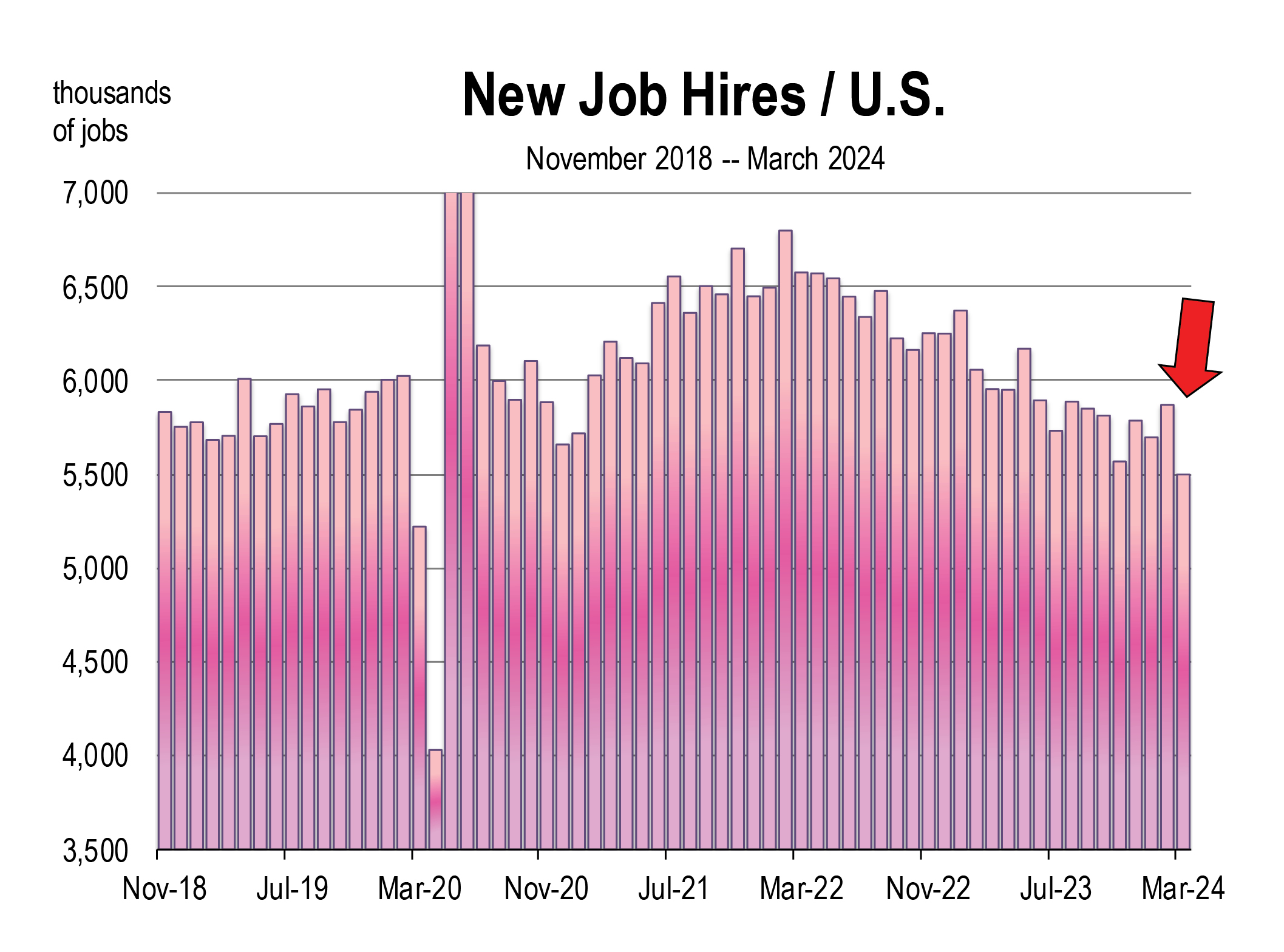

The labor markets remain in a full employment condition. But the rate of new hiring has now fallen below the pre-coronavirus levels of 2018 and 2019. Hasn’t Moody’s been watching the surge of migrants at the southern borders of the United States on TV? The inflow of migrants will eventually lead to a softening labor market, rather than a perennial problem filling job positions. In the most recent JOLTs report (job openings and labor turnover survey), the number of openings is shrinking and the rate of hiring as slowed.

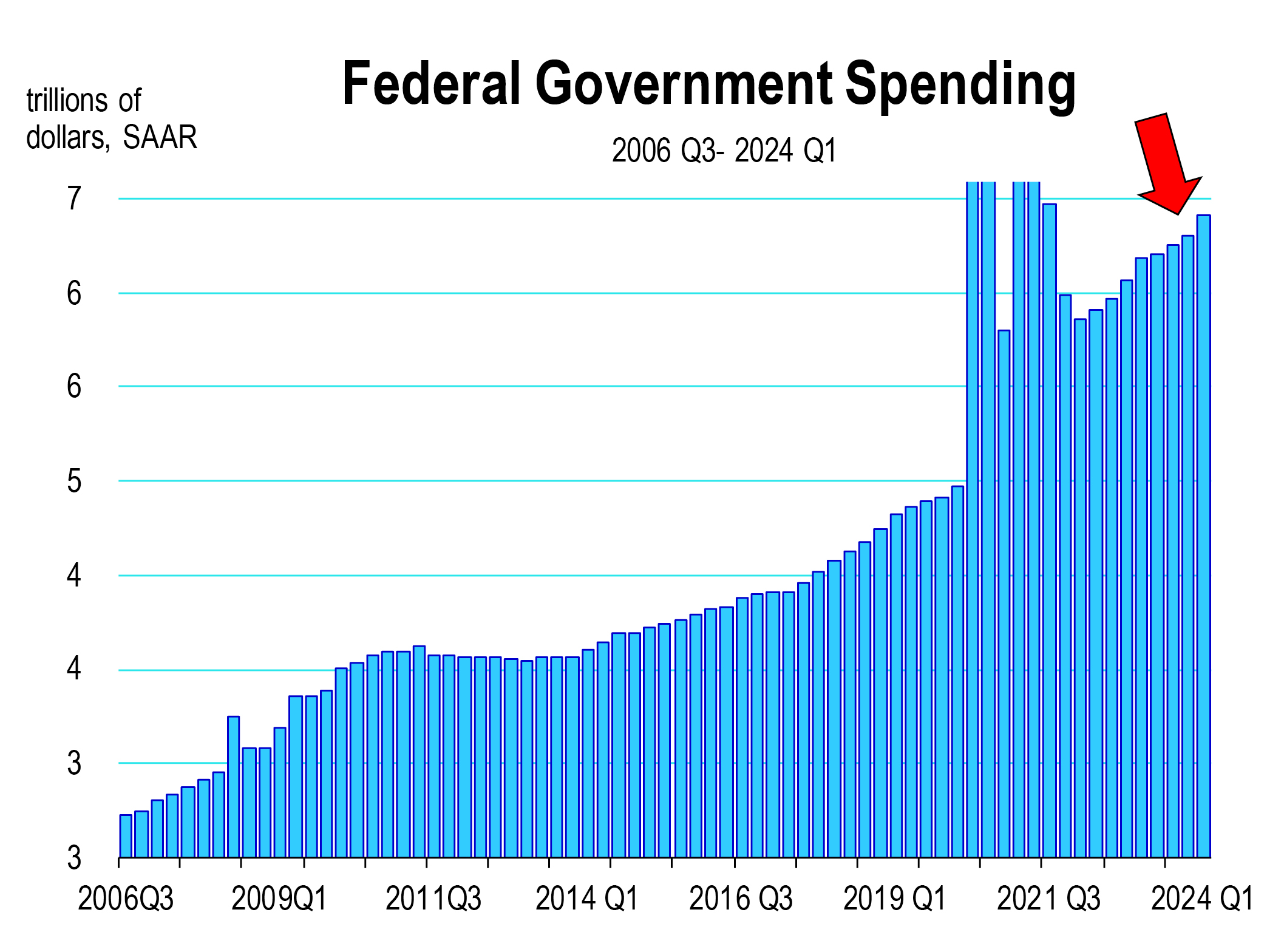

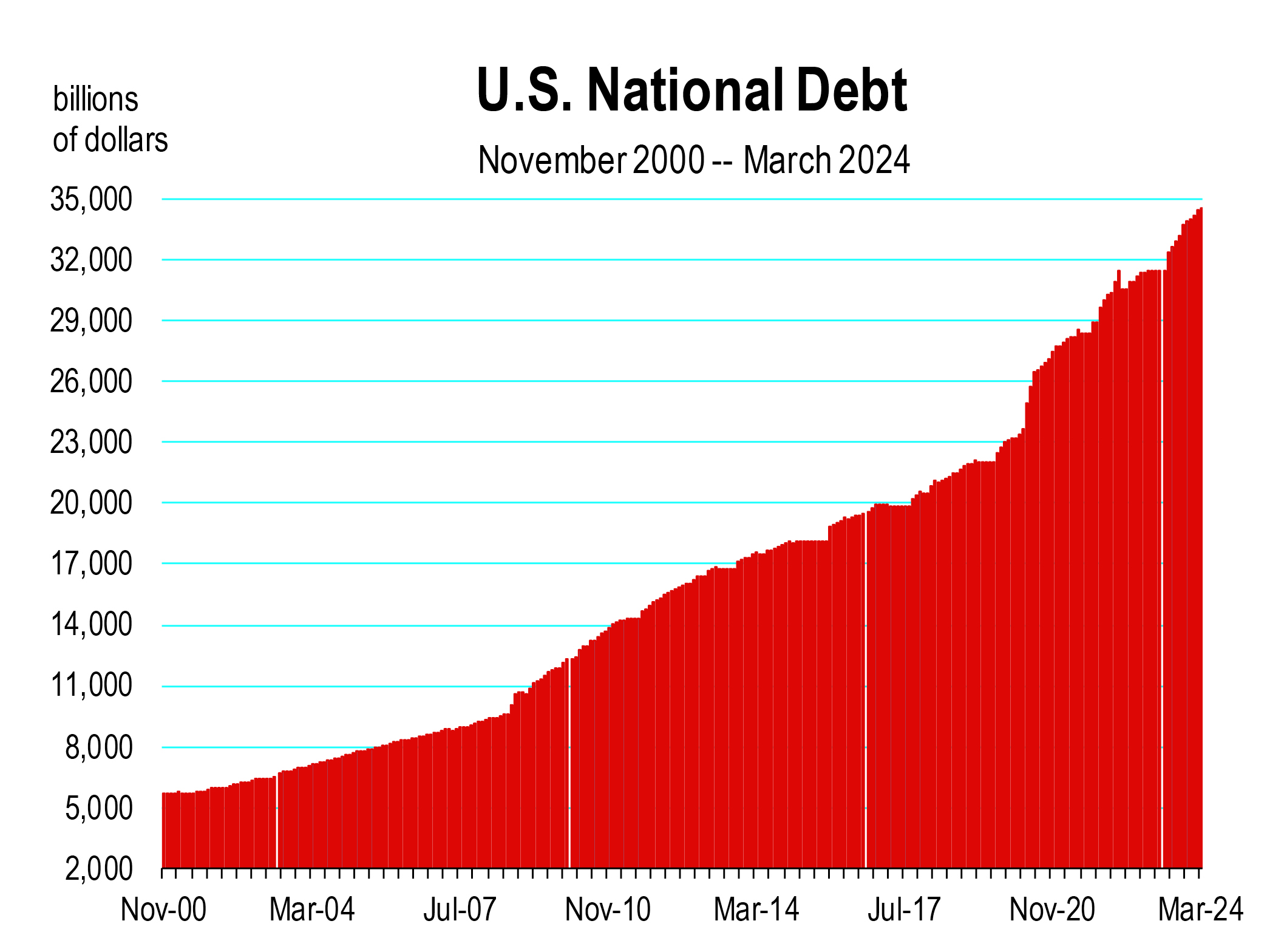

Investment in equipment and software has been stellar the last two quarters. And consumer spending has not slowed down. But even stronger growth in spending has occurred by the federal government. And this spending spree has continued to drive up the federal debt, and is hindering progress on extinguishing inflation.

Moody’s continued to report the following day that

Moody’s continued to report the following day that

“… businesses remain cautious about their sales and pricing. Financing conditions are also tight. They have much to worry about, including the Russian war in Ukraine, high global inflation and aggressive monetary tightening by global central banks, the U.S. banking crisis earlier last year, and the ongoing political drama in Washington DC. The recent geopolitical events in the Middle East and the volatility in long-term interest rates around the world aren’t helping either.”

I don’t know how many businesses other than the industrial war complex that are worrying about the Ukraine war, other than hoping it won’t end. The two schools of thought on this are (1) the war is largely a border dispute which Russia is determined to settle by acquisition of eastern provinces, and (2) Russia considers Ukraine as the first conquest in an inevitable strike on other counties within their sphere of influence.

If you side with the latter, you are more likely to support the Congressional appropriations to Ukraine. I’m not aligned with this opinion, and more aid to Ukraine is simply expanding federal debt, increasing expectations of higher rates of inflation, and losing the support and confidence of Americans. In the most recent April 2024 poll, Gallup reported:

“The majority of Americans, 65%, continue to think the war in Ukraine is at a stalemate, and are more likely now (23%) than they were in October of 2023 (14%) to say Russia is winning.”[1]

In a February 2024 survey by The Harris Poll, more than two-thirds of Americans support urgent U.S. diplomacy to end the Ukraine war.[2]

Inflation is a worry for not only businesses but consumers. And the largest concerns are in the banking system, especially regional banks holding commercial real estate debt. The ongoing political drama in Washington DC is not merely drama. It is a fight by the Freedom Caucus to limit runaway government spending and stabilize the dollar principally to reverse its vulnerable displacement as the world’s reserve currency.

What the mainstream economic news does not mention enough is the rapidly increasing federal debt, how it is interfering with the Fed’s fight against inflation, and how this is jeopardizing confidence in the U.S. dollar. This is why we have the BRICs alliance today along with the threat of transacting oil in other currencies, and generally undermining the global status of the dollar.

“In April, the Conference Board’s consumer confidence index fell to its lowest level since July 2022, dipping below the long-run average of 100. Deterioration in consumers’ expectations for future economic conditions led the decline in sentiment as the component retreated further below 80 . . .”

— Moody’s Economic Roundup, April 30, 2024

Written comments in the Conference Board’s survey also indicated that consumers are worrying more about politics and geopolitics, and this includes the prolonging of the Ukraine War and the Middle East conflict between Israel and Gaza, and now Iran.

However, Americans are more concerned with the southern border, with inflation, with the general economy, and mostly with U.S. government leadership, according to the monthly Gallup polls, including the most recent edition conducted in March.[3]

The slide in consumer confidence has not manifested into any noticeable pullback by consumers yet, but clearly they are growing pessimistic again due to the lack of new progress regarding immigration, inflation, and poor government leadership. Congress needs to start becoming more serious about the federal deficit by messaging they are resolute in shrinking it. To date, they are not.

[1] https://news.gallup.com/poll/643601/americans-say-not-helping-ukraine- enough.aspx#:~:text=As%20has%20been%20the%20case,quick%20end%20to%20the%20war.

Both Republicans (62%) and independents (44%) increasingly see the U.S. as doing too much to support Ukraine compared with when Gallup began asking this question in August 2022. Democrats are at 14 percent.

[2] https://quincyinst.org/2024/02/16/new-poll-more-than-two-thirds-of-americans-support-urgent-u-s-diplomacy-to-end-ukraine-war/

[3] https://news.gallup.com/poll/1675/most-important-problem.aspx

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.