Mark Schniepp

March 2025

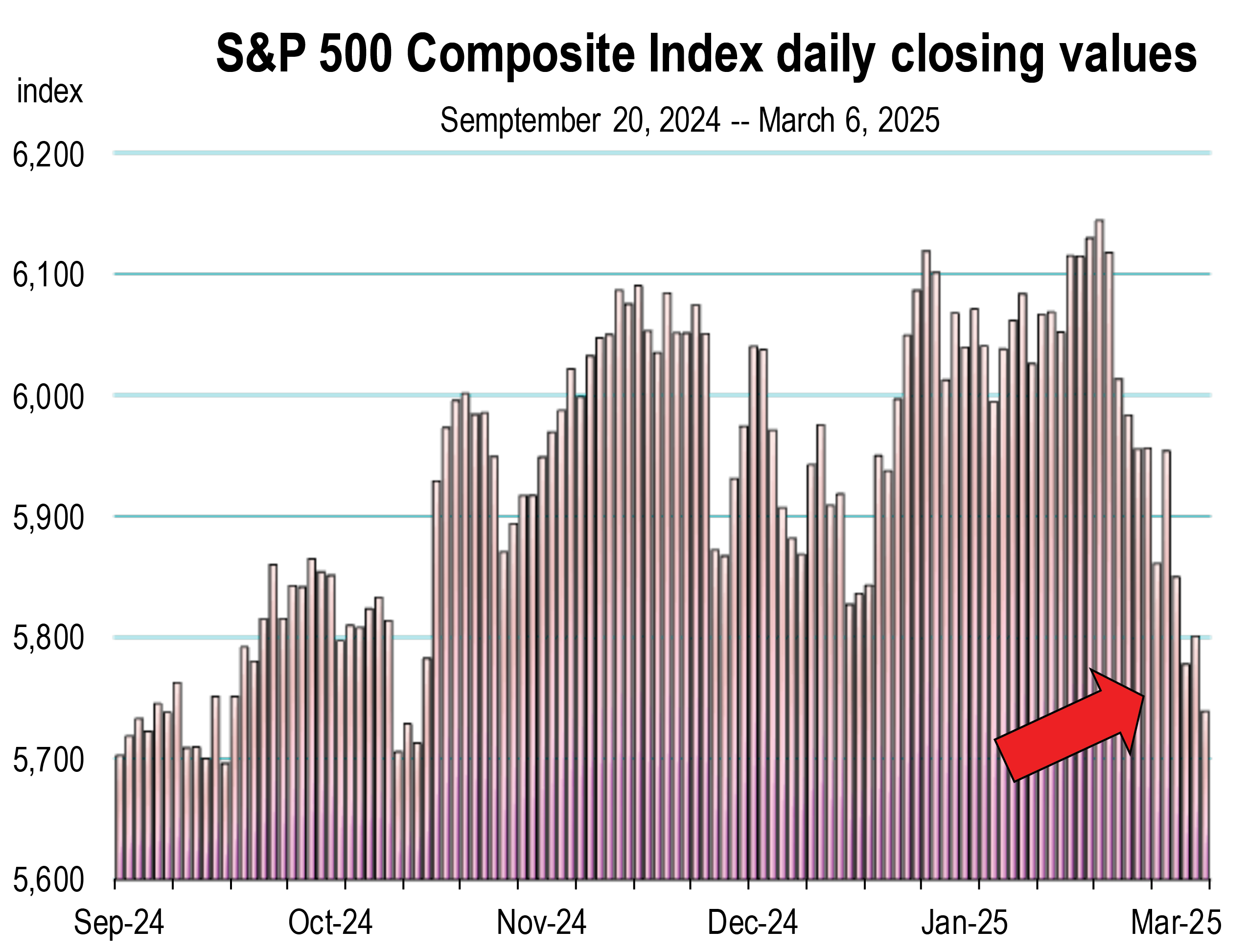

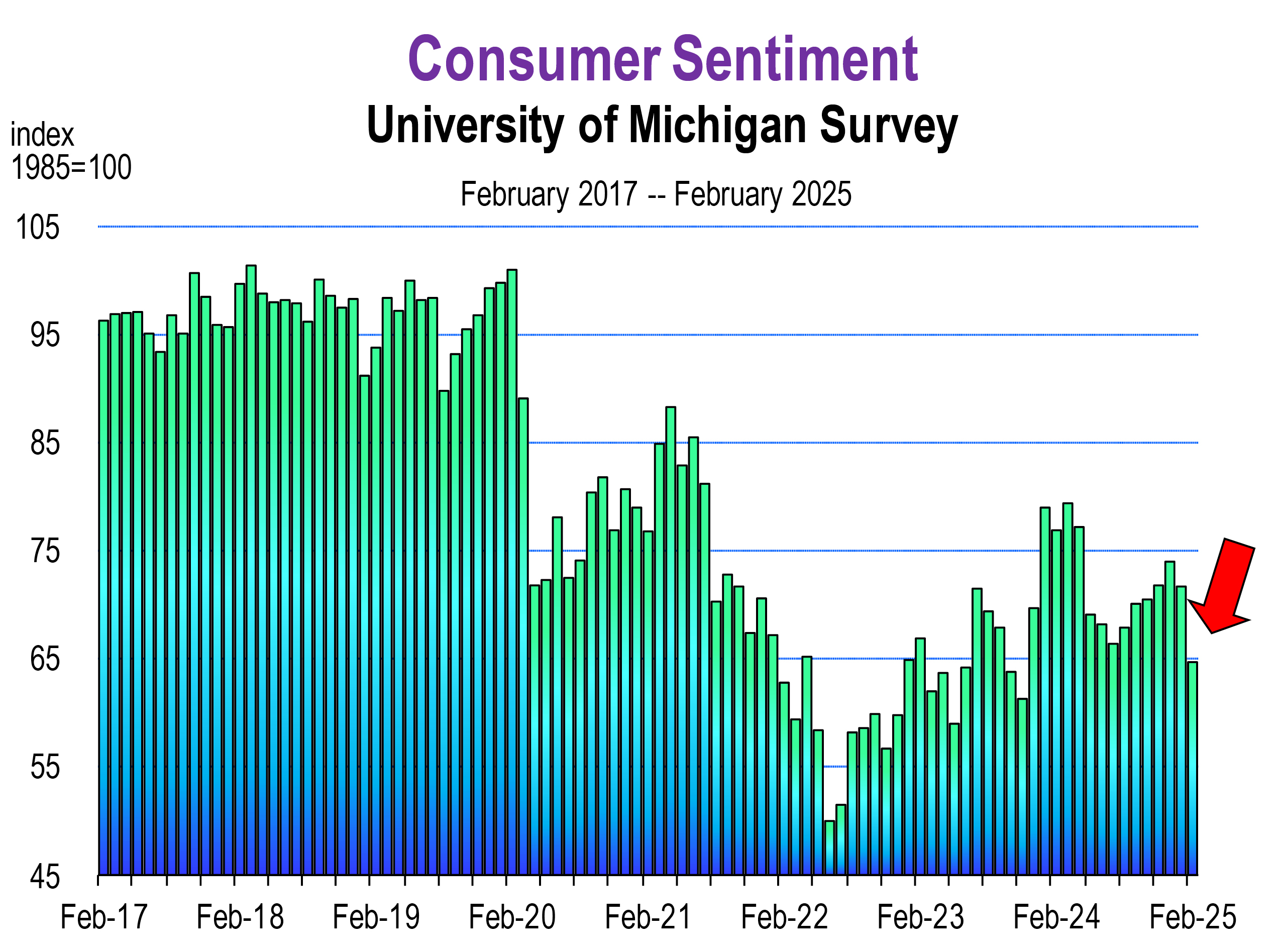

With the nation now amid an age of uncertainty, I hope the “age” lasts just a month or two. Markets loathe uncertainty, especially the capital markets.

The uncertainty comes from the post haste implementation of policies of the new administration. The uncertainty is supporting investor ambivalence in the stock market, consumer ambivalence regarding present and future opportunities for jobs, income and spending, and employer worry regarding the availability of an adequate labor force.

Policies

The principal policies of the new administration are as follows:

- Identify and terminate wasteful spending in government.

- Enforce immigration laws at the northern and southern borders, and deport illegal migrants who have entered the country over the last 4 years.

- Restructure international trade policy to focus on “America First” principles, prioritizing trade agreements that are advantageous to the U.S. This includes imposing tariffs on countries with unfair trade practices towards the United States.

DOGE has identified what it believes as obvious government waste in the form of bloated or nonsensical spending. Thousands of federal workers have been fired or asked to quit with a generous severance.

Border policies have now been enforced. Immigration has been reduced by over 90 percent. And deportations are well underway.

Tariffs were imposed on Canada, Mexico, and China. The tariff rate is 25 percent for the our neighbors and 10 percent on all Chinese imports. On March 6 however, tariffs were paused on imports from Canada and Mexico until April 2, prolonging uncertainty further.

While many people believe that these measures are both necessary and noble, and support the America First principals

that the Trump candidacy espoused throughout the campaign, they will also disrupt the status quo and create economic impacts that will result in some short term pain. That pain can manifest in the form of higher prices, perhaps leading to a spurt of inflation in coming months. Inflation might be impacted by higher prices for imported goods coming from tariffed countries. It might also be impacted by higher wages that must be paid to attract new and legal workers into those labor markets that employed illegal migrants who are now at risk of deportation. GDP growth in 2025 could also be impacted.

C + I + G + X – M

This is the equation for GDP, equal to the sum of consumption expenditures by consumers, investment spending by businesses, government spending, and export value minus import value.

G is on the chopping block, and even if you believe that many of the programs getting terminated and many federal employees being laid off are indeed wasteful and not in the best interest of Americans, reduced government spending will lower GDP this year, if the change is not offset by increased C, I, or X.

Trade policy will be characterized by reducing trade deficits, defined as X – M where M is greater than X. Policies using tariffs will try to boost X and reduce M, this policy would increase GDP providing there is no reduction in C or I as a result of the imposition of tariffs.

But C and I may ultimately be negatively impacted by higher prices on imported goods due to tariffs.

Unknown Economic Impacts = Uncertainty

Border policy and enforcing U.S. immigration policy will reduce migration into the U.S. and the labor force of potential workers needed to fill positions in leisure and hospitality, healthcare, and construction.

Consequently, the uncertainty today is due to changes in the status quo that will likely impact the economy, but that  are largely unknown. Just how high and for how long will tariffs will be implemented, and will there be adequate and affordable substitution effects for consumers as alternatives to tariffed goods.

are largely unknown. Just how high and for how long will tariffs will be implemented, and will there be adequate and affordable substitution effects for consumers as alternatives to tariffed goods.

Moreover, the uncertainty today will also persist regarding how many deportations will occur that would meaningfully impact the workforce, increasing labor costs for employers. How many federal government employees will be laid off, which would raise the unemployment rate in D.C. and Virginia if replacement jobs are not found in a timely manner. Jobless claims will be critical to watch in the coming weeks to determine the magnitude of potential labor market disruption.

Ending wasteful government programs and reducing the federal government workforce would reduce overall government expenditures which would shrink the federal budget deficit providing Congress acts to cut programs permanently out of the FY25 and FY26 appropriations. Successful budget cutting would rally the bond market, reducing longer term interest rates, which by itself, would increas consumption and investment.

The unknowns are generally unnerving to consumers, businesses and investors. And to date, consumer and business sentiment have declined, home builder confidence has declined, and stock prices are moving lower. In the aggregate their change since the beginning of the year is negative.

The next 3 months

Course correction is possible if current policies being pursued by the new administration lead to an erosion in economic growth, rising unemployment, or accelerating inflation. I don’t believe the economic impacts will be severe. Tariff policy may be short lived. Deportations may not be substantial enough this year to meaningfully affect the labor force and wage inflation. And large government expenditure reductions may not be embraced by a bold enough Congress willing to cut them out of this year’s budget, and the FY26 budget.

Over time, a reduction in government spending is imperative if federal debt is to be reckoned with, which is necessary to lower longer term interest rates. Hopefully current policies are a signal that the new administration is serious in finding redress for government programs or directions that appear disconnected to an American First agenda.

Our forecast is for the unemployment rate to rise slightly to 4.1 percent after dropping to 4 percent in January. We also predict that the threat of tariffs on Canada and Mexico are likely to be reduced or never implemented if concessions from the two countries are made to help secure the northern and southern borders.

While the current environment is chaotic, I believe it presents a significant long-term opportunity, based primarily on U.S. market’s ability to adapt to change. Just as certain policy developments in the 1980s and 1990s ultimately sparked an era of growth, the changes to the status quo that we are witnessing today could have a similar transformative effect.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.