by Mark Schniepp

March 19, 2021

The COVID-19 crisis plunged the U.S. economy into its quickest and deepest economic recession in modern U.S. history. In the near-term, how and when the country gets out of the disaster will primarily be determined by its public health response and the efficacy of rolling out the vaccine.

Economic forecasts can be challenging under normal circumstances, but a global pandemic, the election of a new president, and emergency powers invoked by the states, have resulted in significant additional complications that economists must consider. The extent to which local economies are limited by restrictions on businesses and consumers is a major factor, if not the dominant factor in assessing how the economy evolves this year and next.

Opening Economies

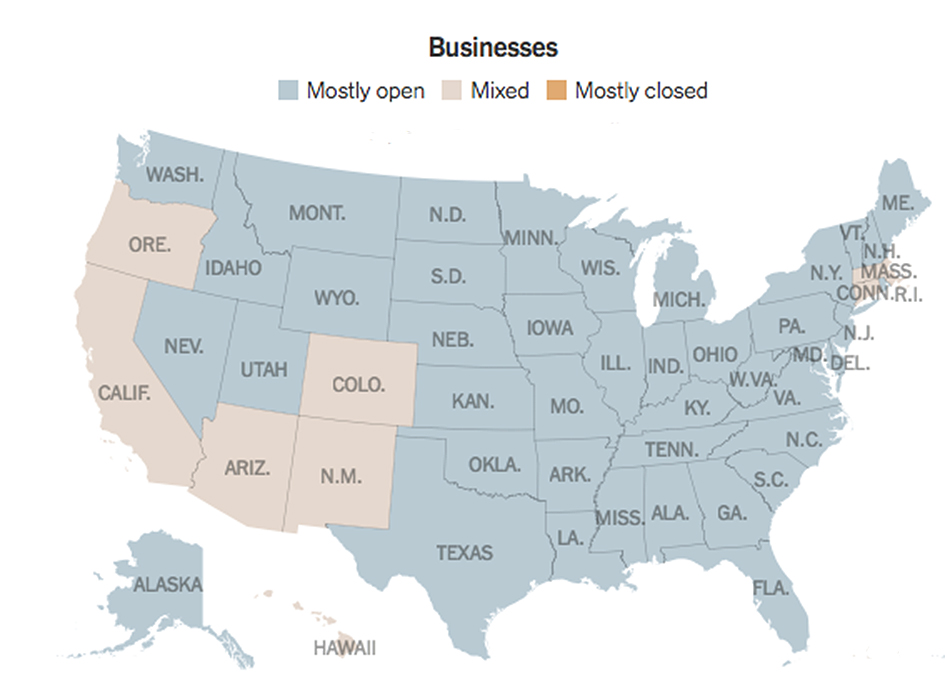

Easing economic restrictions are occurring throughout the nation, and at a snail’s pace in California where most economic activity in the state is still subject to some form of limitation. Restaurant customers are limited as are retail store and personal service customers. Office workers are largely remote, schools are either not open or operating on a hybrid schedule. Sporting events are capacity regulated as are business meetings. Large events are prohibited.

The path of the coronavirus and the effectiveness of the vaccine have the potential to be significant wild cards for the economic outlook this year. But the downside risk is less than the upside risk to the forecast. New, more infectious variants of the virus are racing against the vaccines, the latter of which is winning so far in California. The ultimate victor will influence the implementation of restrictions on various types of business activity.

The extent of the recovery in the public’s perception of economic conditions will remain limited until the labor market improves and the number of reported COVID-19 cases falls significantly, enabling the removal of restrictions and restoring the ability to move freely.

This has largely occurred in many other states but not in California.

An unrestricted economy would likely result in a surge of growth, led by consumer spending, job and income creation, business travel, leisure travel and tourism, and strong demand for public gathering events such as concerts, conferences and sporting events.

Consequently, with the clear abatement of the pandemic, we expect a sharp rebound in the economy, though a return to the normal we knew in 2019 will be delayed until mid 2022 or early 2023.

Source: New York Times, March 19, 2021

The Outlook

As restrictions are eased in California this year, more travel will be unleashed. Visitors should inundate all regions of California. The demand for amusement parks, festivals, fairs, parades, and large events will be prolific as Californians desperately seek a return to normal fun activity.

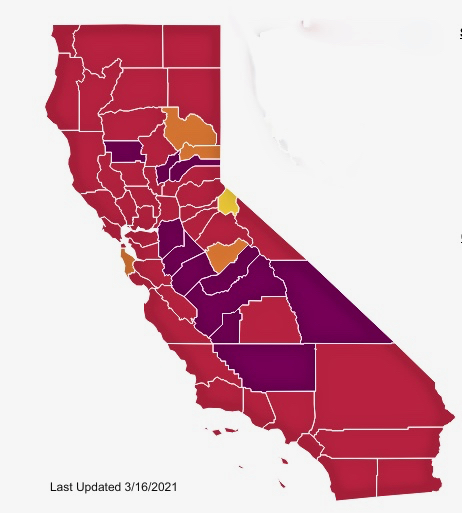

The outlook calls for improvement, though California will remain limited for much of the calendar year. Unless the office of the Governor changes course, the Blueprint for a Safe Economy will continue to limit the restoration of business in county economies throughout the state. With most counties now advancing to the Red tier on March 16, it will be another 3 weeks before any county can advance to the next best tier, and 6 weeks to move to the least restrictive tier which is still relatively restrictive. Then what?

If mask and distancing mandates are going to be required even after all adult Californians receive the vaccine, business restrictions will also be required, at least in terms of capacities. This takes us through the summer months and into the fourth quarter.

Without a fully open and functioning economy, California faces limits on growth, including hiring. A swell of spending activity by consumers restrained for well over a year cannot fully occur. Therefore the larger spending and jobs surge in California is unlikely until 2022 when we presume all restrictions will have been lifted.

California Tier Assessments

Another Surge?

A potential threat to all the counties moving into the Red Tier and having business restrictions eased is the possibility of another surge, pushing counties back into Purple.

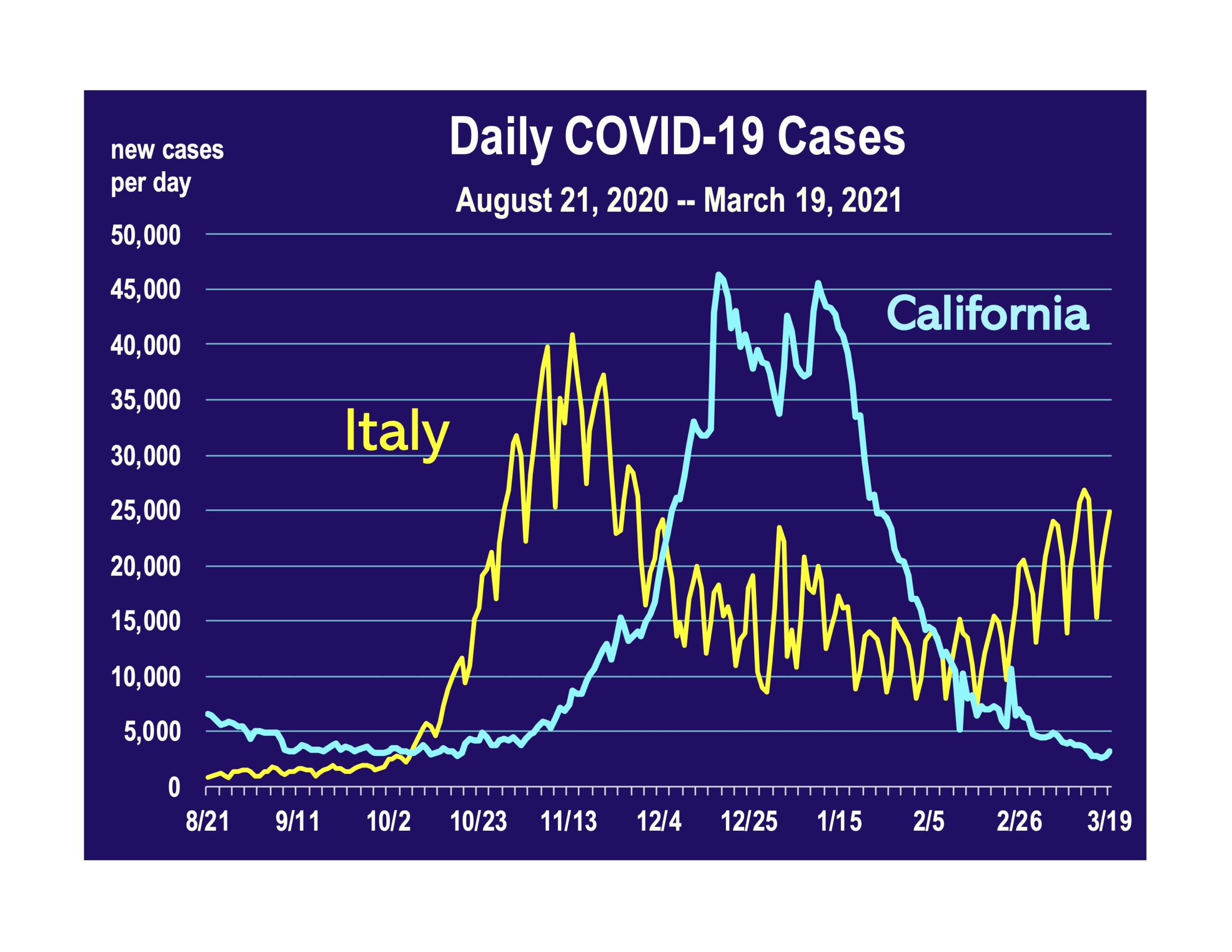

This possibility exists, and infectious disease experts from major universities in California are predicting the onset of another surge—at the end of March or beginning of April. If the European Union is a precursor to the path of the coronavirus in California, then another surge is likely, unless the vaccine can interrupt what has been a reliable predictor of past surges.

This possibility exists, and infectious disease experts from major universities in California are predicting the onset of another surge—at the end of March or beginning of April. If the European Union is a precursor to the path of the coronavirus in California, then another surge is likely, unless the vaccine can interrupt what has been a reliable predictor of past surges.

Going back to the beginning, infection rates in European countries rose first, in late February 2020. Italy peaked in late March. Cases in California and much of the rest of the U.S. followed in mid to late March, and peaked in early May.

Cases in Italy began rising last October, leading California by a month. Cases declined in December and January and California followed 3-4 weeks later. Cases in Italy have been rising again, since late February and early March of this year. Their cycle suggests that a rebound in infection rates will revisit California soon.

Germany, France and Italy have imposed new lockdown measures to slow down the third wave of the pandemic, now raging through Europe.

These fits and starts of the pandemic have and will continue to wreak havoc on public health, consumer confidence, the economy, and our ability to provide accurate forward-looking information regarding the economic recovery and when we can return to normal.

The Trevi Fountain in Rome was tourist-empty last week, in light of new lockdown measures imposed on March 15, 2021.

Have the Newsletter Sent to Your Inbox

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.