Mark Schniepp

August 10, 2024

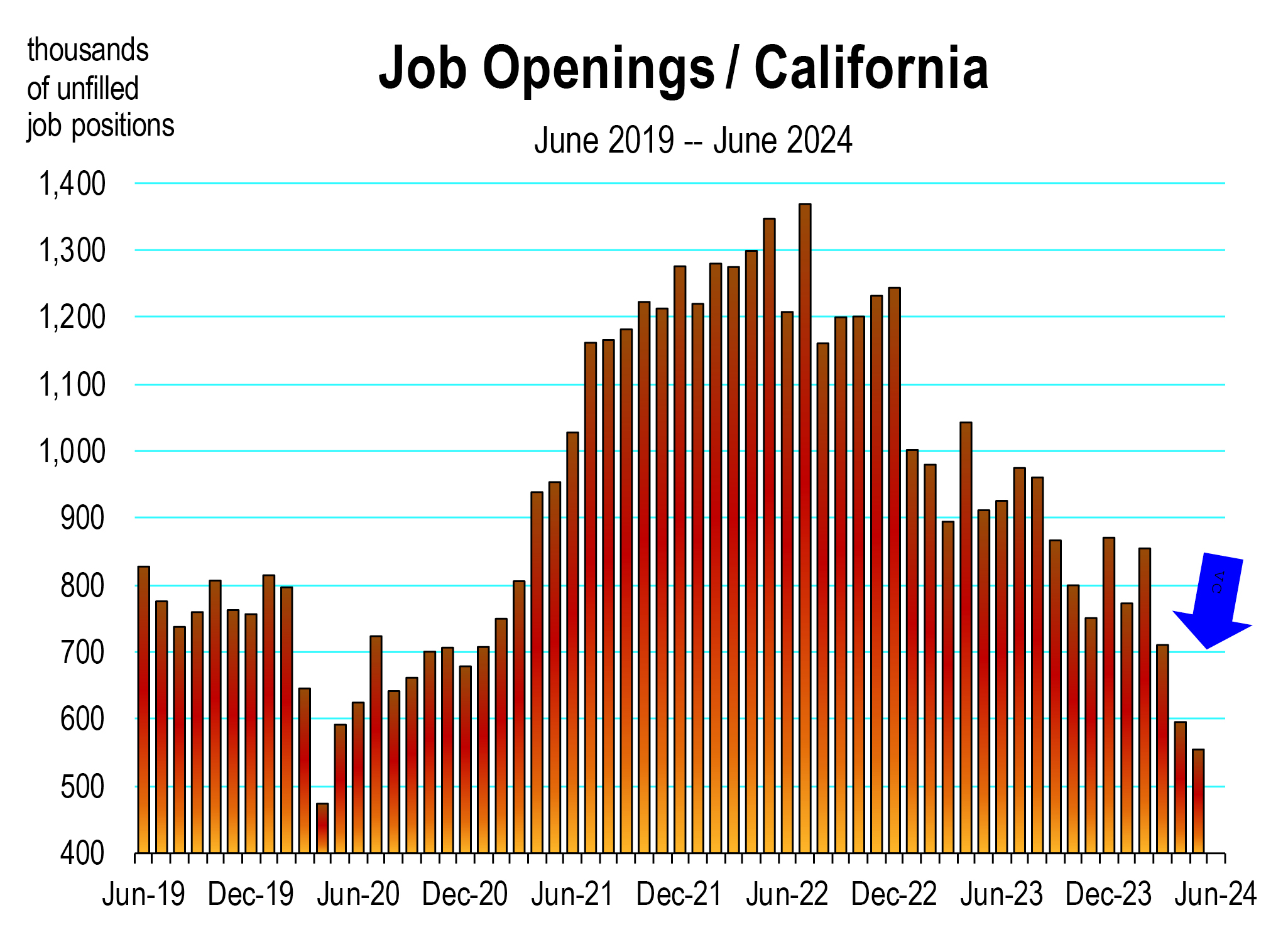

In the August 2023 newsletter, I wrote about the tight labor market. Unemployment at that time was below 4 percent, Unfilled job openings exceeded ten million and workers quitting their jobs (for a better job elsewhere) was still quite high.

A year has passed and the data show a clear change in the labor market.

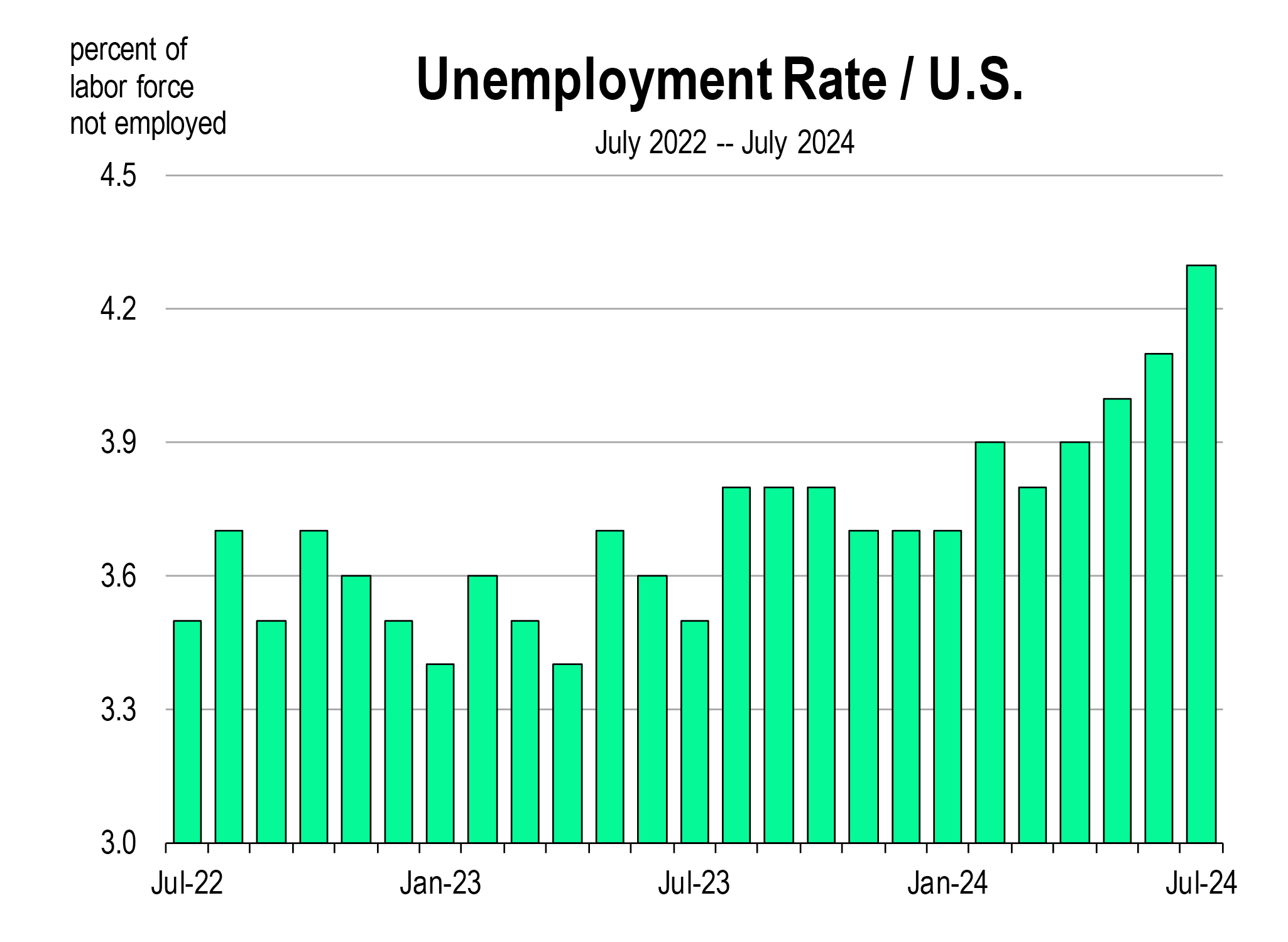

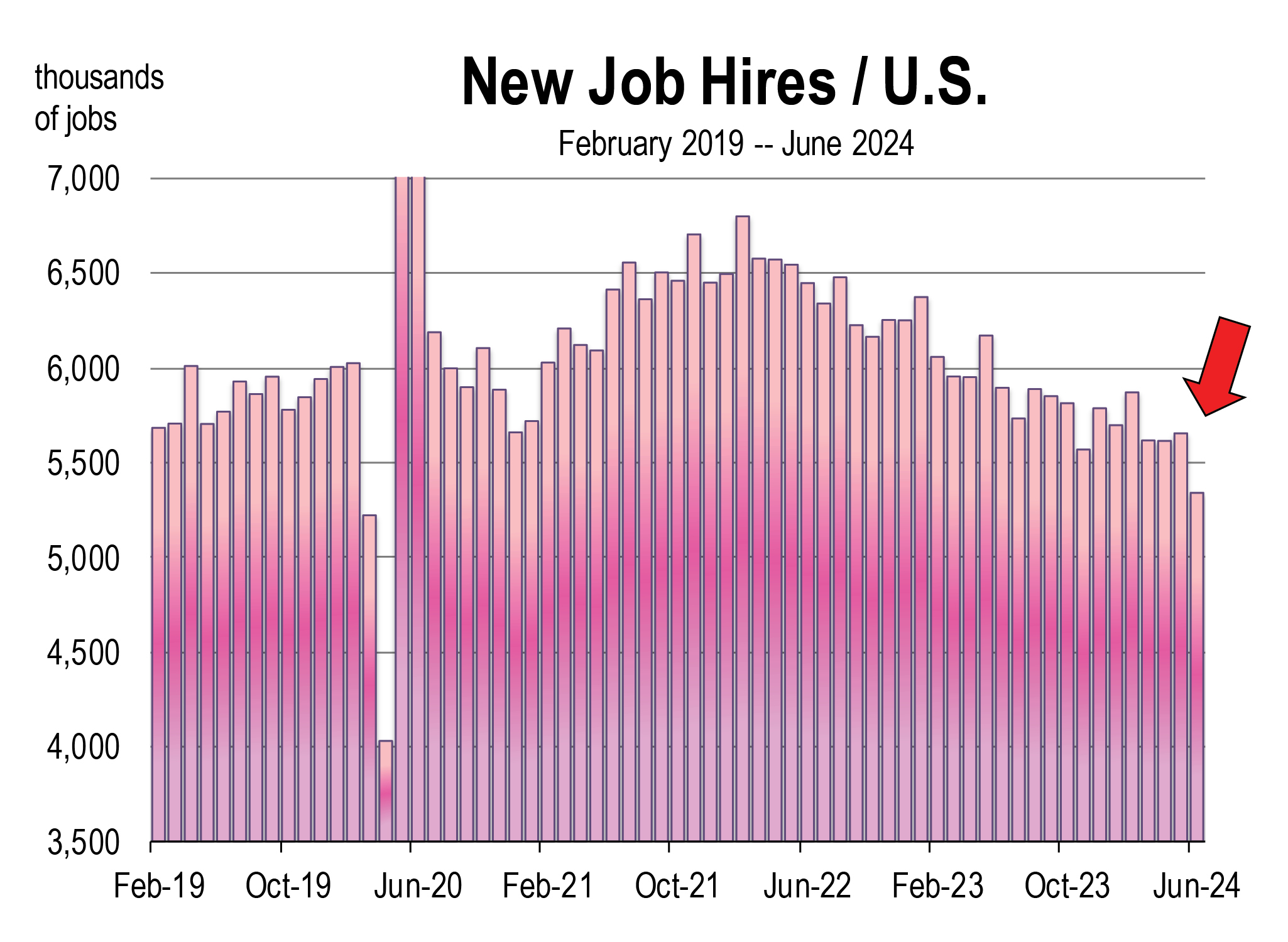

The unemployment rate has jumped to 4.3 percent. Job openings have declined 20 percent. New hires are now less than they were before the pandemic. How quickly the winds have changed.

The weaker July labor market data arrived just after the Federal Reserve voted to hold interest rates steady, the same level that was in place a year ago. There is some fear among investors that the Fed is waiting too long to make the long anticipated rate cuts in view of the stock market correction in recent weeks. The worry with the rising unemployment rate is that once it starts upward, it tends to keep rising.

However, GDPNOW, the Atlanta Fed’s real time estimate of economic growth has third quarter 3 GDP now running at a 2.9 percent clip. Furthermore, a 4.3 percent unemployment rate is still quite low, and it was caused in large part by rising labor force growth rather than a decline in employment.

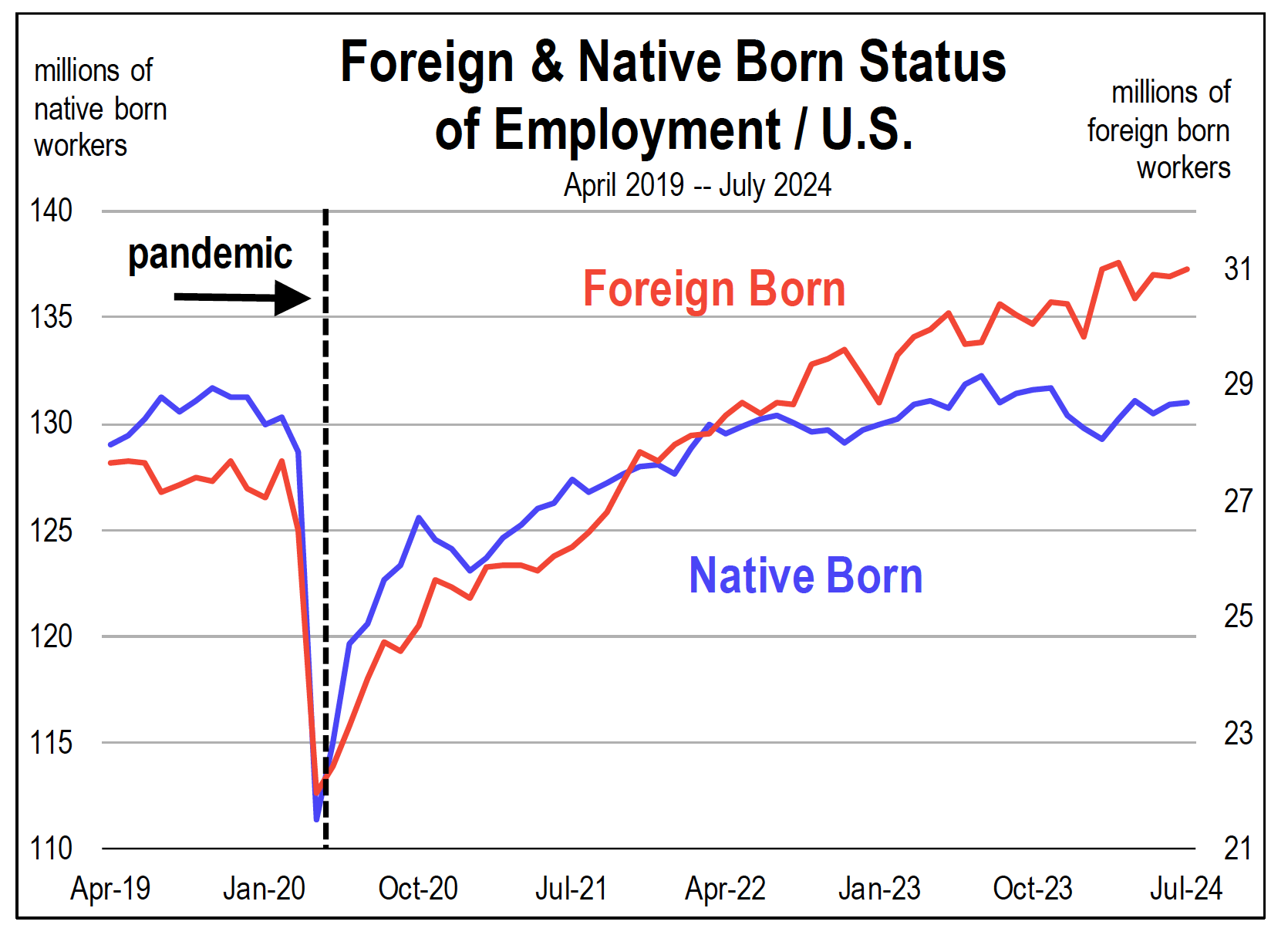

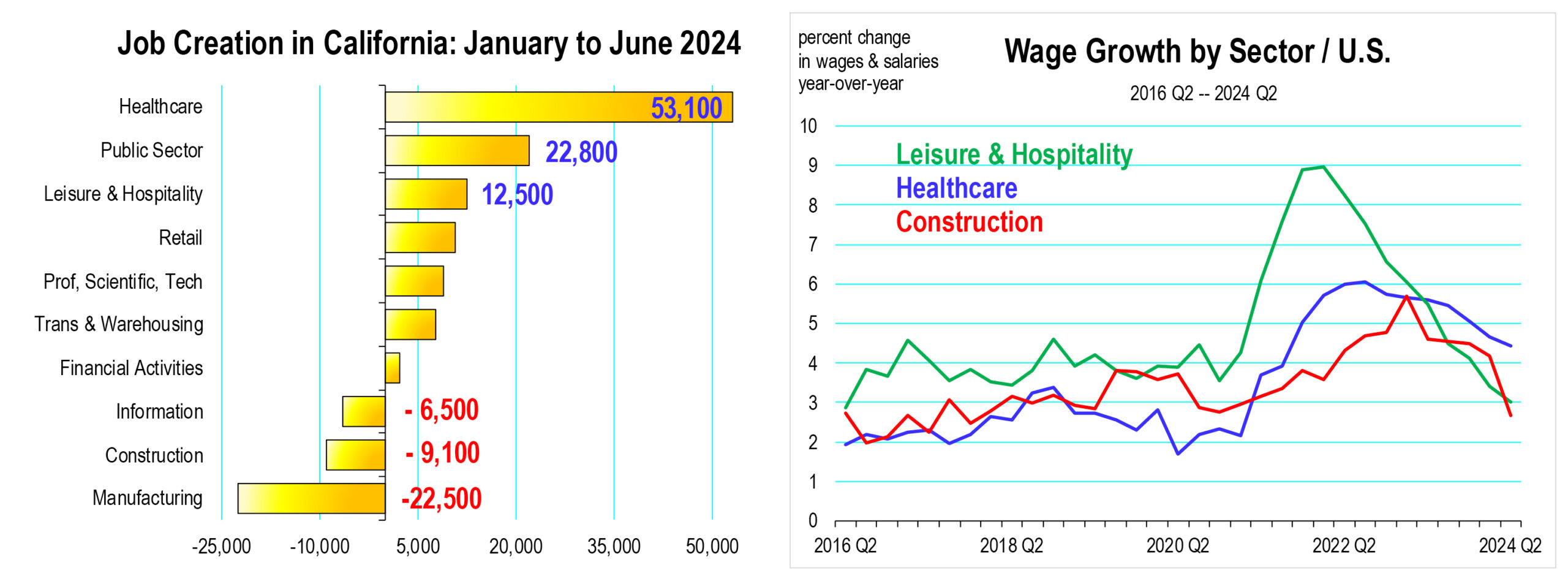

Rising labor force growth is likely due to the massive immigration surge that we’ve observed through the southern boarder over the last 3 years. Migrants have added significantly to the U.S. labor force and are taking jobs in the construction, healthcare, and leisure/food services industries. It is these sectors along with the public sector in California that is creating the lion’s share of all jobs now.

The growth of foreign born workers is now dominating total workforce growth. Foreign born workers which include undocumented immigrants have recently jumped to an all time record high in numbers. Over the last three years or since July of 2021, native born employment has increased 2.9 percent while employees of foreign born status have soared 18.3 percent. Foreign born employment has risen by 5.1 million workers during this time frame, and 1.2 million over the last year. Meanwhile, native born employment has declined by 1.2 million workers since July 2023.

The surge in potential workers from immigration would naturally push the unemployment rate higher as they entered the labor force more rapidly than they became employed. These workers have alleviated the severe staffing shortages in particular industries in the post pandemic period. They have contributed significantly to the decline in job openings, which have fallen sharply in California.

However, the same influx of immigrant workers that helped fill job openings also dampened wage growth across the affected industries in the state. Because of the tight labor markets in 2022, wage growth averaged 6-7 percent. Now it has moderated to between 3 and 4 percent.

In summary, the labor market then is simply not as weak as the a rising unemployment rate might imply. However, some concern has been heightened this year regarding the lack of broad based job creation in the California job market. Healthcare, the state and local public sector, and leisure and hospitality are responsible for creating most of the net jobs in the state during 2024, with little contribution from other sectors. And the technology sector which peaked in 2022 has not yet rebounded from the spat of layoffs that occurred from late 2022 to mid 2023.

A rate of unemployment in the state is 5.2 percent, having increased by the same amount over the last year as the national rate. This would normally be of concern had the increase not been attributed to a rising labor force due largely to immigration.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.