by Mark Schniepp

December 2015

If you’ve been loyally following these monthly newsletters, then you’re pretty much aware that the U.S. and state had another year of better–than-expected economic growth. And the financial markets held up remarkably well despite the tumultuous stock market in China, the devaluation of the Yuan, and continued sluggish growth in the European communities.

There are a number of economic indicators that impact you directly that are making your life substantially better today:

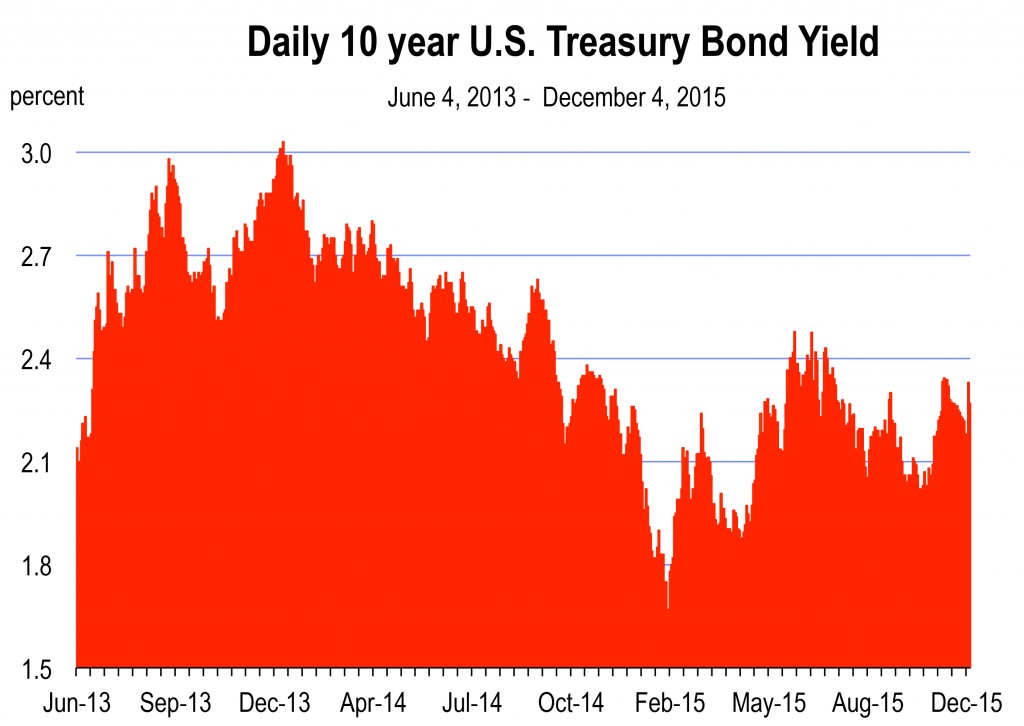

- Interest rates are at or near an all time low

- Oil prices remain low and gasoline prices are cheap, saving you a bundle every week

- Job opportunities continue to improve, especially if you have a skill or some experience

- Inflation is virtually non-existent and that’s the way it’s been for most of 2015

- Home prices continue to rise, increasing your equity and overall wealth position

There’s very little to worry about concerning the health of the economy as we close out 2015 and welcome in a new year. That said, here’s my annual review of the year.

Significant Events in 2015

A dubious play call by the Seahawks at the one yard line in the final moments of Superbowl XLVIIII resulted in a Patriot interception and victory. The final score was 28-24.

The 10 year U.S. Treasury Bond yield closed at 1.67 percent on February 2. This was the lowest level of the year and only 27 basis points from the all time record low of 1.40 percent set on July 24, 2012.

The 10 year U.S. Treasury Bond yield closed at 1.67 percent on February 2. This was the lowest level of the year and only 27 basis points from the all time record low of 1.40 percent set on July 24, 2012.

Leonard Nimoy, “Mr Spock” passed away in late February.

On April 25, a 7.8-magnitude earthquake struck Nepal, near Kathmandu, killing more than 8,000 people and injuring 17,866.

Apple hit an all time record high in stock price and market valuation on May 17. Its current market capitalization of $654 billion is greater than the GDP of Sweden, Poland, Argentina, Norway, Iran, Thailand, Denmark, Singapore, Hong Kong, or Isreal.

David Letterman called it quits after 33 years as a late-night TV show host. His last show was on May 20.

The Dow and S&P indices reached all time record highs in mid-May.

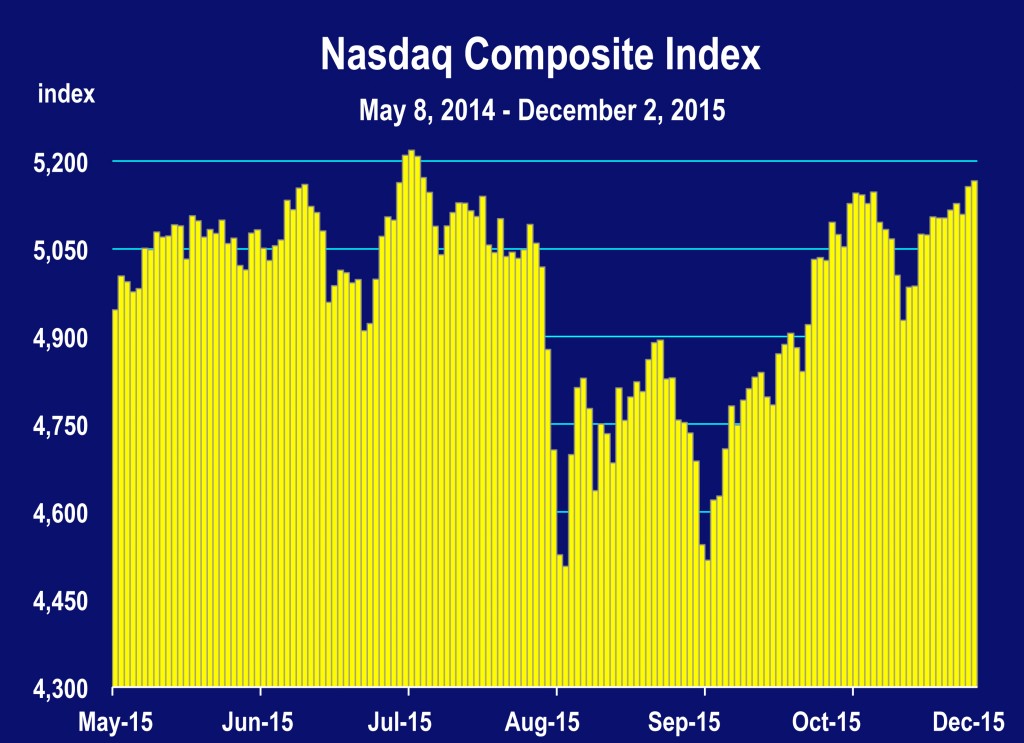

The Nasdaq Composite index set an all time record high close on July 20. It is not far from that level today.

The Nasdaq Composite index set an all time record high close on July 20. It is not far from that level today.

Domestic crude oil prices fell to $38.22 / bbl on August 24, the lowest level since January of 2009. Gasoline prices for regular grade are now well under $3/gallon for most areas of California.

The U.S. economy created 298,000 jobs in October and 211,000 jobs in November, and is now on pace to deliver more than 3 million new jobs during calendar 2015, the most since 1999.

On November 13, three teams of gun-wielding ISIS suicide bombers hit six locations around Paris, killing 130 people and wounding hundreds.

Kobe Bryant, playing in his 20th season as a Laker, announced on November 29 that he would retire after the 2015-2016 season.

Kobe Bryant, playing in his 20th season as a Laker, announced on November 29 that he would retire after the 2015-2016 season.

How Good a Year Was 2015?

The wealth of American households climbed to a new peak in 2015, as rising home prices and record level stock market valuations were the principal contributors.

The unemployment rate has fallen to 5.0 percent in the nation. In California, its 5.7 percent and falling. Wage and salary increases are now occurring more regularly and exceed the rate of general price inflation by a factor of 2 or 3.

Consumers are the engine of growth in the U.S. economy. It’s the same for the California economy but also toss in technology sector growth and a strong tourism sector.

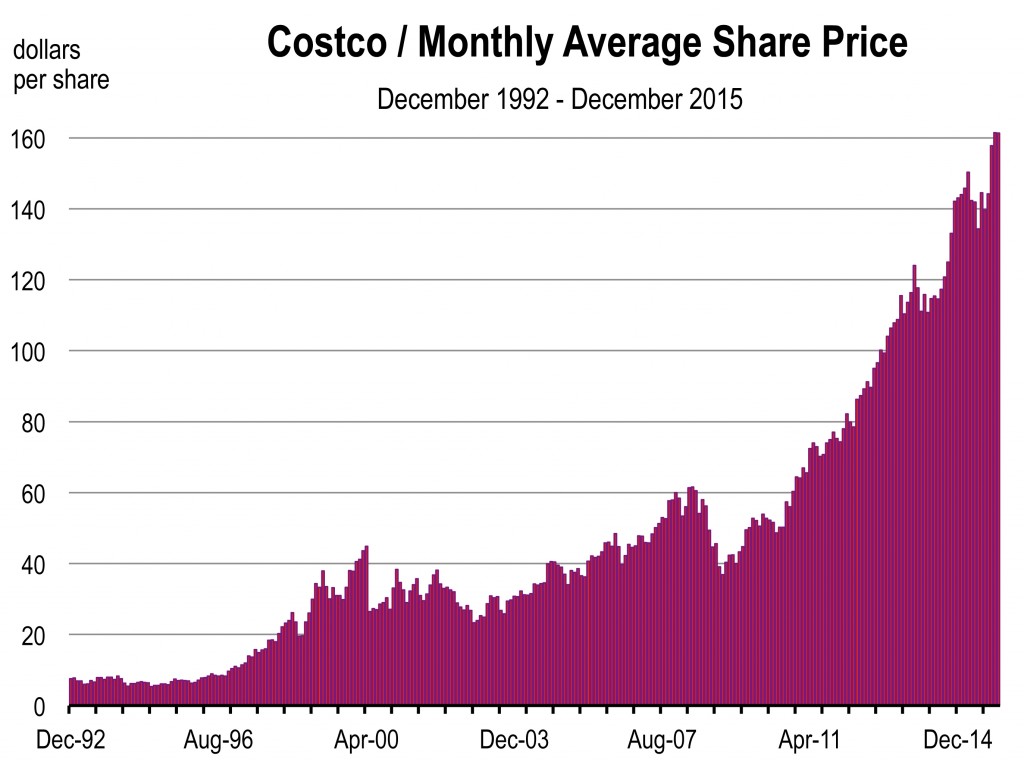

Consumer spending is being directed at Costco. Costco is currently at an all time record high in stock price. Wal-Mart however recently slipped to its lowest value per share since April of 2012.

Consumer spending is being directed at Costco. Costco is currently at an all time record high in stock price. Wal-Mart however recently slipped to its lowest value per share since April of 2012.

The U.S. dollar is strengthening again, meaning you should plan that trip to France or Italy soon. Since you’re fully employed and your salary is rising again, you’ll have additional disposable income to throw around Europe.

In general, momentum accelerated in 2015. For the current economic cycle, it’s been the best year to date for American households, employed Americans, retail businesses including online commerce, and the financial markets.

New Expectations for 2016

Expect more rain. The current (December) predictions still have a huge El Nino raging between January and March. Stock up on a few new umbrellas now.

Interest rate hikes by the Federal Reserve are coming. If not in December than certainly in February. Rate hikes mean the economy is doing well.

It’ll be an election year. Next November, expect the lowest unemployment rate since the 2000 election.

GDP growth is forecast at between 2.5 and 3.2 percent next year, with a consensus of 2.8 percent.

U.S. economic momentum is likely to accelerate, and that raises our expectations of a sound and stable economy in 2016.

__________________________________

New Publications by the California Economic Forecast

The latest edition of the Ventura County Economic Outlook is available. The 88 page publication that accompanied our update conference in September 2015 can be downloaded from our website at www.californiaforecast.com/publications.

Upcoming Economic Forecast Conferences in 2016

2016 Ventura County

February 5, 2016

Westlake Hyatt

Register Now

2016 Santa Clarita Valley

March 10, 2016

Valencia Hyatt

Register Now

2016 Orange County (In Partnership with the UCLA Anderson Forecast)

April 2016

UC Irvine

2016 San Diego County (In Partnership with the UCLA Anderson Forecast)

Date TBD

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.