Mark Schniepp

February 2025

What the Indicators are Saying

GDP rose 2.3 percent in the fourth quarter of 2024, and 2.5 percent for the calendar year. GDP growth in the first quarter to date is estimated at 2.9 percent (February 7) by the Atlanta Federal Reserve’s GDPNOW model.

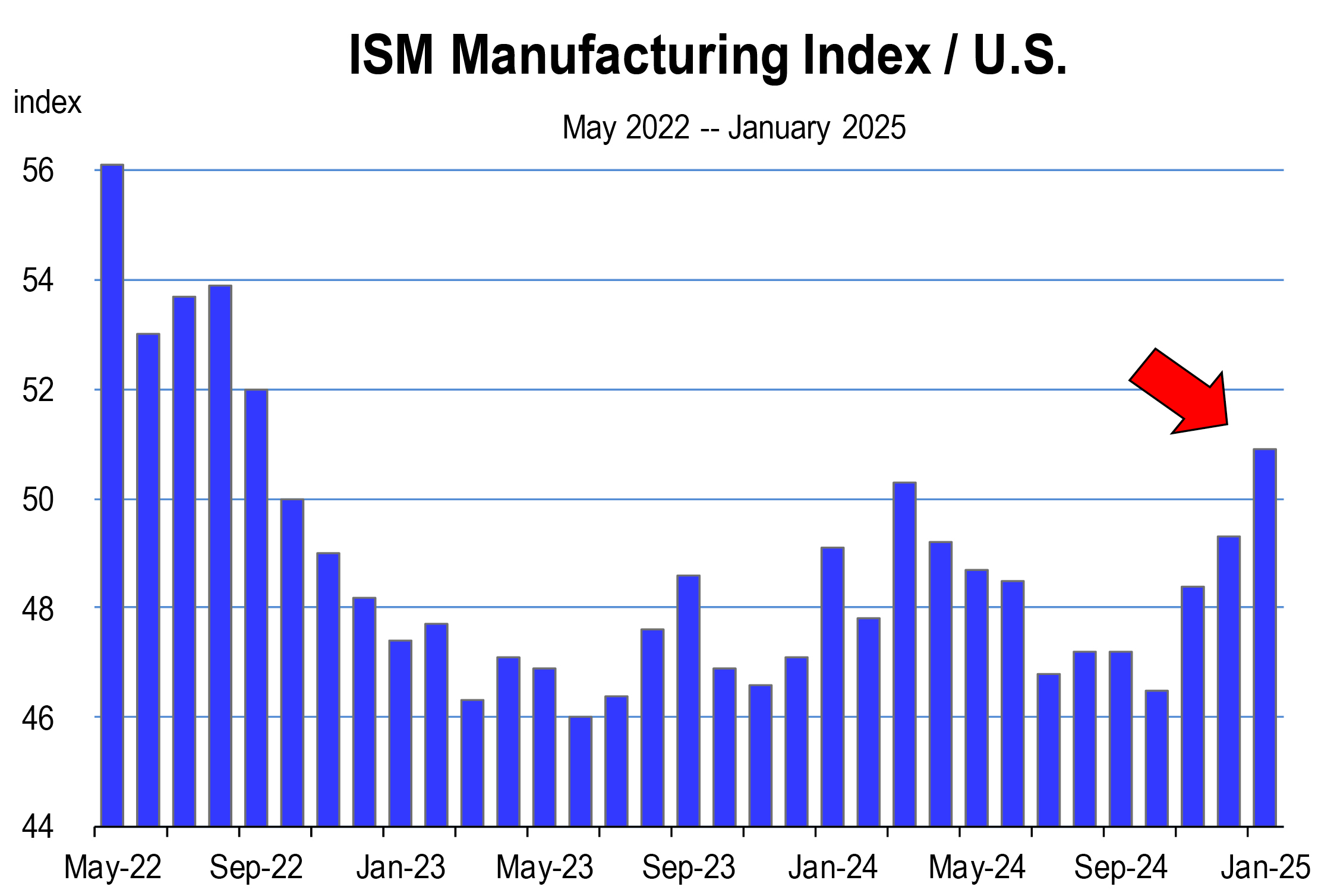

Manufacturing has now turned around and is expanding in the U.S. again

The Institute of Supply Management Purchasing Index pushed above 50, indicating positive growth in manufacturing orders during January.

Incomes are rising as expected. There is continued growth in wages. The outlook is bright for income growth looking forward, as the labor market remains on solid footing.

The Job Openings and Labor Turnover Survey remains steady regarding  hiring, quits and layoffs in the labor market. In December, hiring and separations through quits or layoffs both increased. Though still at a modest level, the slower pace of layoffs (which remain historically soft) continue to ensure job growth. The unemployment rate for January slipped further, to 4.0 percent.

hiring, quits and layoffs in the labor market. In December, hiring and separations through quits or layoffs both increased. Though still at a modest level, the slower pace of layoffs (which remain historically soft) continue to ensure job growth. The unemployment rate for January slipped further, to 4.0 percent.

Spending growth by consumers finished 2024 on a high note, rising as much as wages and contributing to a solid 4.1 percent year-over-year growth in retail sales during December.

New home sales were higher in December. As homebuyers contend with an increasingly limited supply of existing homes for sale, many are turning to the new-home market.

I expect a rate cut by the Fed in the first or second quarter, and perhaps a second cut in late summer. Lower rates will reduce builders’ costs of loans for capital and land development, reducing the cost of construction. This assumes no extraordinary increases in material costs. Over the last 9 months, construction cost

inflation has been unusually tame, averaging 1.9 percent in California.

Policy and the Economy in 2025

Fed cuts to the funds rate are unlikely to push mortgage rates down, but the progress being made toward balancing the federal budget by Elon Musk and DOGE would result in lower 10 year treasury bond yields and lower mortgage rates.

The Fed will remain concerned about rising inflation due to elevated wage growth. Consequently, after 100 basis points of federal funds rate reductions in 2024, the timing of further Fed cuts has become less certain, indicating a more gradual, data-driven approach in 2025.

Despite the volatility and seemingly lateral movement in prices since early December, the 3 major indices of the U.S. stock market are all higher to date in 2025.

The market is holding together relatively well despite the uncertainty that investors feel regarding tariff policy, the federal deficit, and interest rates. Whereas DOGE can and is identifying where government spending appears to be wasteful, it is up to Congress to do something about it. And there is nothing out of the House yet that would signal they are serious about cutting spending in a meaningful way.

Furthermore, any larger than expected government spending cuts would pose a downside risk to U.S. growth. But at the same time, this would likely push long term rates lower, offsetting less federal spending with higher levels of private investment and consumer spending.

The administration’s plan to renew the 2017 tax cuts and augment them with no taxes on tips, overtime, and social security would enhance growth prospects this year. Consequently, there is significant potential for higher-than-expected growth in 2025, providing the unknowns don’t slow the current momentum in the economy, which is now running at an above average pace. We are predicting that the economy will progress at a healthy clip near term, but the pace of growth will moderate.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.