Mark Schniepp

June 11, 2024

A Looming Issue that Needs Resolution

The 2024 economy remains in an expansion. Recession is now off the table and it appears that modest growth is the likely scenario through the end of the year. Many of the economic indicators are positive, as is the direction of most of the capital markets.

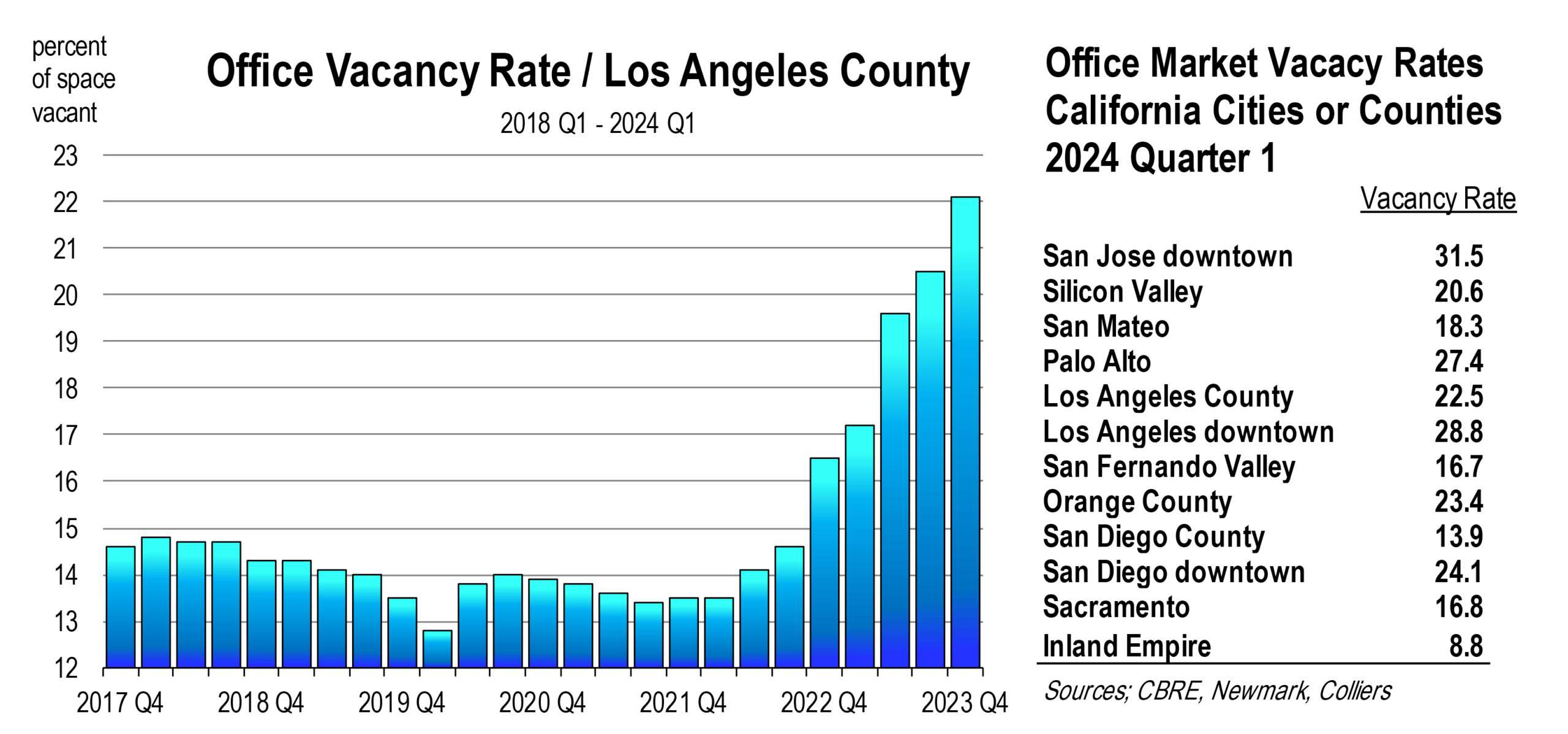

A market where conditions remain weak and are growing weaker is Commercial Real Estate, and in particular, the office market, especially in California. San Francisco has the highest rate of underutilization of office space for any metro area in the country. Not far behind is Downtown Los Angeles, San Jose, Palo Alto, and downtown San Diego. The issue for rising vacancy in the office market is typically that office using employment has contracted as part of a broader based employment decline. Consequently, companies cut back on space to cut costs and “weather the downturn”. That’s not the case this time. We have near record levels of employment in office using sectors. The problem is that many of these workers are not using the office, and are instead working from home.

The issue for rising vacancy in the office market is typically that office using employment has contracted as part of a broader based employment decline. Consequently, companies cut back on space to cut costs and “weather the downturn”. That’s not the case this time. We have near record levels of employment in office using sectors. The problem is that many of these workers are not using the office, and are instead working from home.

The work from home arrangement, made ubiquitous during the pandemic has materially impacted the office market today and this could lead to more serious problems later this year or next.

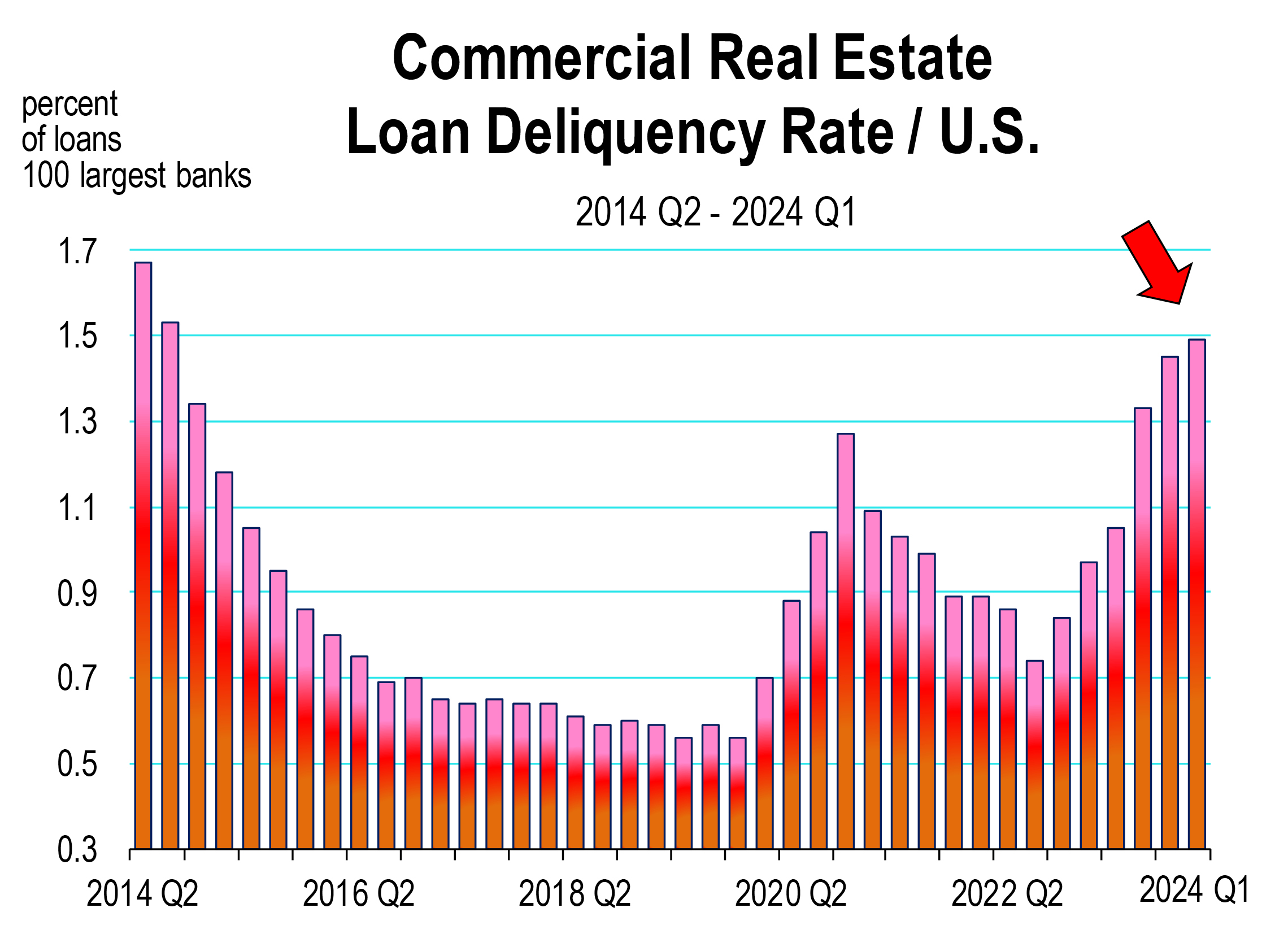

Vacant offices reduce cash flow for building owners. Reduced cash flow makes it difficult for owners to address their debt service, mainly the mortgage payment. Office loans that mature are at greater risk of distress and delinquency because of the difficulty of generating enough cash flow to cover debt obligations in the current environment. A substantial volume of office loans matured in 2023. Extensions on existing mortgage obligations granted by lenders in 2023 have pushed the looming problem into 2024 and/or into 2025.

This puts the bank at risk of having to foreclose on the office building owner-borrower and reduce the value of the asset on its books, possibly raising a flag for regulators. It’s a vicious circle, largely the result of pervasive work-from-home arrangements that became extended after the pandemic ended and remain in place today.

Where is the Office Market Distress?

The wave of office distress that has been anticipated has yet to occur. But the exposure to distress continues to broaden.

Delinquency rates are not rising that much or that fast yet because banks have chosen to extend maturing loans. Now, lenders in the office market space have adopted the mantras of “extend and pretend” and “survive until ‘25,” hoping for circumstances to improve in 2025. Those circumstances include lower interest rates and rising vacancy which would expand cash flow.

REIT commercial real estate values have not collapsed. There has been no major correction in valuations though a number of REITs are not rising in value, weighed down by the share of poorly performing office product in their portfolios.

Consequently, the indicators that would confirm a major problem is here are not signaling the true extent of the distress.

Return to the office (RTO)

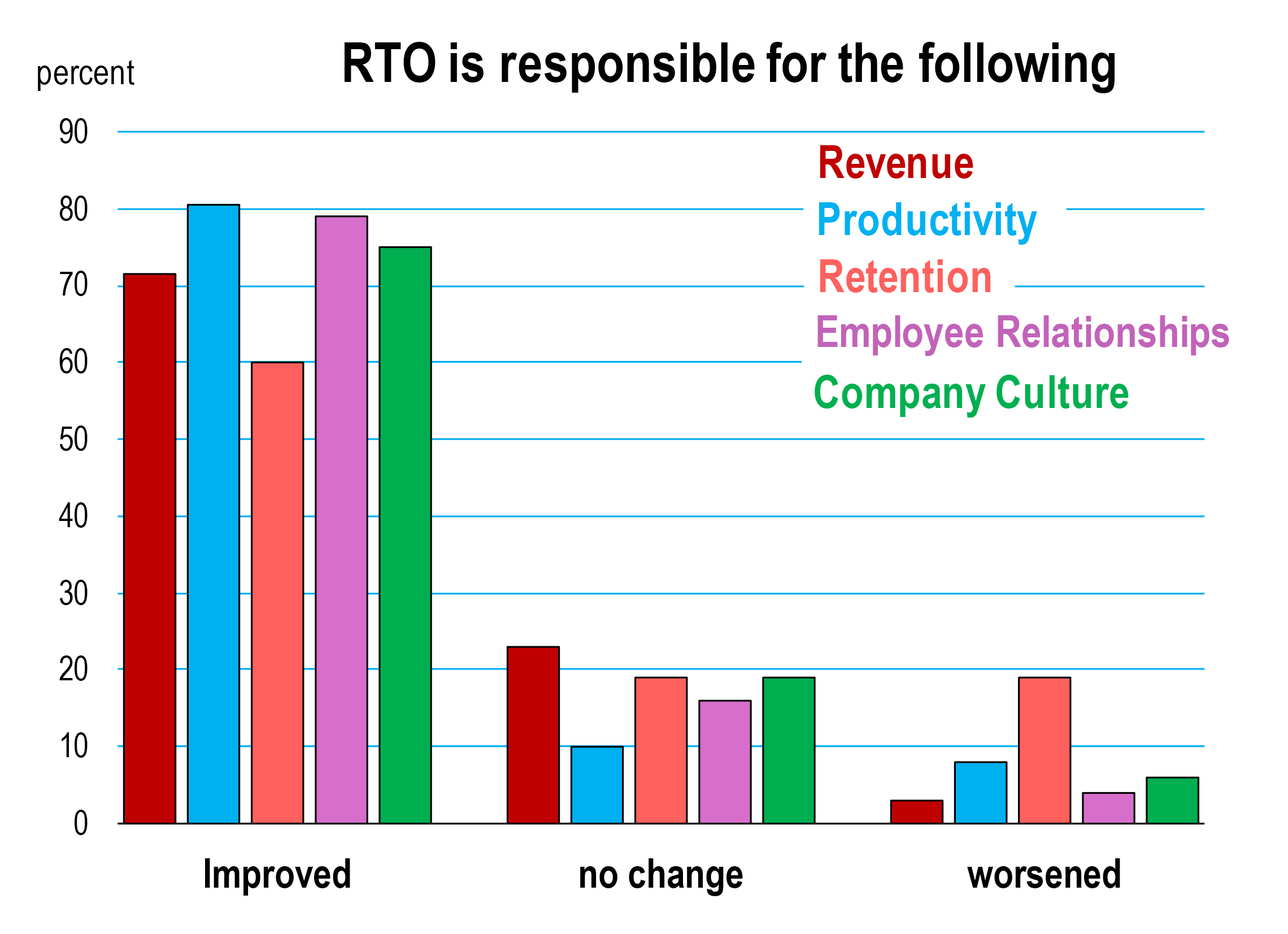

If workers willingly returned to the office, or employers mandated their workers to RTO, utilization would increase, cash flow would be restored to building owners, and the risk of delinquency would abate. Problem solved? Well yes, but it’s not working like that.

Source: Resume Builder, August 2023. “Do you believe RTO has improved or worsened the following conditions in the office?”

More workers are fact coming back to the office, cutting their work-from-home days from 5 to 3 or even less. Mandates by many employers have brought many workers back, but this is not the first choice for managers, nor always effective since a portion of workers will not comply. Companies including Google, JP Mortgage Chase, Zoom and Amazon, that have instituted stricter in-office policies have experienced tensions. In May 2024, Amazon began requiring that staffers work out of physical offices at least three days a week. This led to a walkout of employees at its Seattle headquarters. The company has found that having most of its employees in the office more frequently has led to greater energy, connection and collaboration. Other surveys of companies that have mandated a return to the office have found that productivity, employee relationships, and company culture have improved. Meta also is sticking to its RTO policy, announced in June 2024, where people assigned to an office are expected to be there three days a week.

Generally, because we are still in a tight labor market, employers are afraid of losing their best workers, or want to provide their employers the opportunity of choosing work from home at least in a partial or “hybrid” fashion. Many jobs can be performed remotely from the workplace, and these workers will likely never return to the office. Companies that take a hard stance on returning to the office understand that it may not work for everyone, and it’s a chance they are willing to take because of the strategic value being placed on in-office collaboration.

The decision to require workers to RTO only part of the time, shows us today that there will be limits on how many workdays employees will be on-site in the office. Rather than return to a traditional work-in-the-office schedule, many white-collar employers have settled into a mix of both in-office and remote work.

It appears that even if fully remote working employees are converted to hybrid experiences, there will still be 10 percent of the office workforce that will participate in hybrid arrangements of 1 to 2 days at home, and 3 days in the office. Even this arrangement where more employees have returned to the office will enable employers to reduce their workplace space, and/or modify it so that it will more efficiently accommodate a hybrid arrangement.

The Office is Not Dead

Over time, we believe that even hybrid working arrangements will be reduced for the majority of workers, though not all, especially senior workers that do not manage employees day to day or other occupations or functions where there is less interaction with employees.

That said, office vacancy is expected to increase as many workers return and employment grows over time. A gradual resolution of the office dilemma is expected with vacancies beginning to turn around probably by next year.

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.