by Mark Schniepp

October 2015

The October Reputation

The title of this month’s newsletter is most appropriate because Octobers tend to be notorious bear months for the stock market. The “Stock Traders Almanac” has labeled October a jinx because of the frequency of market crashes that have occurred in the month. The worst October ever was in 1987, when the stock market declined more than 23 percent on Monday, the 19th. The DJIA fell 508 points.

When the stock market crash of 1929 occurred, it took investors by surprise on October 24. Just weeks before, the market had reached a new high for the year. Nearly 25 percent of the market’s value was lost in two days.

When the stock market crash of 1929 occurred, it took investors by surprise on October 24. Just weeks before, the market had reached a new high for the year. Nearly 25 percent of the market’s value was lost in two days.

The Panic of 1907 occurred during the last half of October when runs on banks culminated in a major sell-off on the New York Stock Exchange. By November 7, the DJIA had declined 50 percent from the previous year.

During the first 8 days of October 2008, the DJIA lost 2,380 points or 22 percent of its value. The actual decline in the market started in earnest in September of that year. September has, like October, been another especially weak month for stock market performance.

Investor emotions that turn negative when the calendar changes from summer to fall can influence stock market performance. In the fall months, after summer vacations are over and the sun sets earlier, investors get more gloomy. Consequently, any negative economic or market developments in these months can produce overreactions.

The Significance of a Decline

Consumer spending is vulnerable to swings in the stock market because stock holdings are concentrated among high-income households and these households are responsible for a disproportionate share of consumer spending.

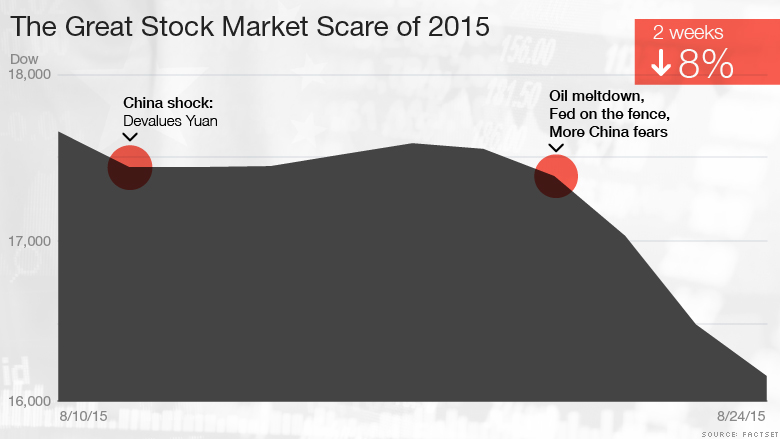

CNN Money, August 25, 2015

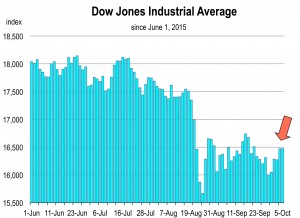

The Dow eroded 11 percent between August 10 and August 25, 2015. The recent market correction was allegedly precipitated by the devaluation of the Chinese Yuan and the plunge in the Shanghai Stock Index in July and August of this year. The low point for the Dow this year occurred on August 25. It has since gained over 1,000 points and is near 16,800.

Consequently, we watch the various stock and bond markets carefully as a precursor to spending behavior in the U.S. In the event of a sharp and unexpected downturn in the market, consumer spending during the fourth quarter would likely be impacted which would slow down the growth of production, employment, income, and GDP.

Are Consumers Showing any Signs of Pull-Back?

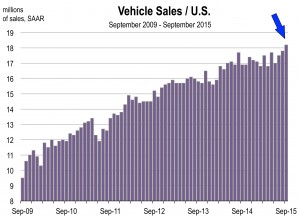

Core retail sales growth is positive though it has been lackluster during the summer months, likely influenced by concerns about increased market volatility. However, automobile and light truck sales soared during August and September.

Core retail sales growth is positive though it has been lackluster during the summer months, likely influenced by concerns about increased market volatility. However, automobile and light truck sales soared during August and September.

Existing home sales have been running strong all year and August new home sales are at their high point for the current business cycle. Mortgage rates remain at very low levels which are expected to persist for the remainder of the year.

Furthermore, e-commerce sales have strengthened this year and continue to outpace in-store retail sales by large margins.

Is Another Market Correction Imminent?

If you monitor this topic on the internet, there is no shortage of content that suggests, warns, or flatly states that the bear market has started and a decline, collapse or crash is imminent.

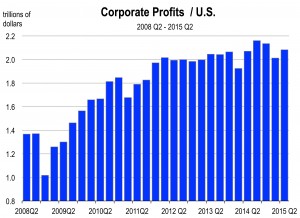

However, the relatively positive collection of economic indicators would imply that another correction is not necessarily imminent. There is little evidence to suggest that consumer spending behavior is being impacted by the correction to date. So I guess they don’t think so either. Corporate profit readings would suggest that the market could, fundamentally, still go higher.

However, the relatively positive collection of economic indicators would imply that another correction is not necessarily imminent. There is little evidence to suggest that consumer spending behavior is being impacted by the correction to date. So I guess they don’t think so either. Corporate profit readings would suggest that the market could, fundamentally, still go higher.

The October 2015 correction probably came early this year in August and lingered into September. From its high in May of this year, the market declined a total of 14 percent. Today, it’s currently off by 10 percent. Certainly any unexpected jolt to the economy or geopolitical setting could set off another bearish reaction. Consequently, we are not ready to forecast the stock market direction for the rest of the year. But there is no imminent decline foreseen in the market from my reading of the taro cards. And I don’t care if it’s October.

__________________________________

Upcoming Autumn Conference

Santa Barbara Technology and Industry Association

Economic Summit

November 5, 2015

Radisson Hotel, Santa Maria

8:00 am – 10:00 am

The California Economic Forecast is an economic consulting firm that produces commentary and analysis on the U.S. and California economies. The firm specializes in economic forecasts and economic impact studies, and is available to make timely, compelling, informative and entertaining economic presentations to large or small groups.